TradingView

TradingView provides a wide range of charts, alerts, tools and customisation options to help clients plan trades. Using the proprietary Pine Script programming language, traders have turned their investment ideas into more than eight million strategies and indicators that are shared amongst the community. This review will explain how to use TradingView, the tools and features available, plus the platform’s pros and cons. We have also compiled a list of the top UK TradingView brokers in 2025.

TradingView Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

IQCent is an offshore binary options and CFD broker based in the Marshall Islands. The brand continues to offer a range of unique account types with bonuses and perks, including payout boosts, TradeBacks and free rollovers. With 100+ assets, around-the-clock trading and 98% payouts, the firm is popular with aspiring short-term traders.

-

BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange.

-

FXCM is a respected forex and CFD broker, established since 1999. The British-headquartered broker has won multiple awards and operates in various jurisdictions, including the UK and Australia. With zero commissions, over 400 assets, and a range of analysis tools, FXCM remains a popular choice for traders. The broker is also regulated by top-tier authorities including the FCA, ASIC, CySEC, FSCA, BaFin.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC.

-

Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

-

RaceOption is a binary options broker operating from the Marshall Islands. With over 1,500 clients, the broker aims to offer fast funding, low fees and a secure trading environment. Traders can access over 100 binary options and CFDs, plus copy trading and weekly prizes.

-

Focus Option is an offshore broker that specializes in binary options as well as CFDs. Binary options trading on forex, cryptos and three commodities is done through the broker's simple web-based platform with average payouts between 70% and 95%. The broker also offers a mobile app for trading CFDs, with 300+ tradeable instruments.

-

TMGM is an ASIC-regulated forex and CFD broker with a vast range of tradeable assets covering forex, stock, index, crypto and commodity markets. The account types on offer provide a flexible choice between no commission or zero spreads, with competitive pricing all-round.

-

RoboMarkets is a Cyprus-based forex, CFD and stock broker aimed at traders from Europe. The broker offers thousands of instruments across six asset classes and provides access to four leading platforms, including MetaTrader 4. With ECN pricing, Cent accounts and algorithmic trading tools, RoboMarkets caters to a range of trading strategies and investing styles.

-

Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

-

Global Prime is a multi-regulated trading broker offering 150+ markets. Traders can get started with a $200 minimum deposit and trade with leverage up to 1:100. The firm also has a high trust score and a good reputation with a license from the ASIC.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

-

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

About TradingView

TradingView is a technical and fundamental analysis platform created in 2011. Since its launch, it has grown in popularity and now boasts a user base of more than 30 million investors. As a result, it is one of the most popular trading websites in the world.

The platform is offered by many leading trading brokers but can also be accessed independently. The main TradingView headquarters are based in the USA but there is an additional office for TradingView UK Ltd in London, UK.

Markets & Assets

TradingView provides data across a range of financial markets, including:

- Stocks – 50 stocks and ETFs such as Invesco QQQ, Tesla (TSLA), GameStop (GME), AMC Entertainment (AMC), Robinhood (HOOD), Bitcoin ETFs (BTCC.U and BTCC.B), L’Oreal (OR), L&T Infotech (LTTS) and Finance (L_TFH), Rolls Royce (RR.L), P&G

(PG), Berkshire Hathaway (BRK.A and BRK.B) and Bombardier (BBD.B) - Cryptos – 56 cryptocurrencies such as Cardano (ADA), Ethereum (ETH), Tether (USDT), Quant (QNT), Bitcoin (BTC), 1INCH (1INCH), Shiba Inu (SHIB) and Ripple (XRP)

- Forex – An extensive list of major, minor and exotic currency pairs with cross rates, strategy ideas, currency indices and an economic calendar

- Indices – 47 indices such as the S&P 500 VIX volatility 75 and S&P Futures, Dow Jones US30, DXY, and E-Mini NASDAQ

- Bonds – 50 types of government bonds, for example, 2-year, 10-year and 30-year government treasury bonds

- Futures – 50 assets such as crude oil, natural gas and metals including gold (XAUUSD)

- Economies – 50 economic parameters such as the US inflation rate year on year

TradingView provides real-time data for some markets for free, for example, the National Stock Exchange (NSE) of India and the London Stock Exchange (LSE) in the UK. Users with Pro, Pro+ and Premium accounts can also pay for real-time data on certain exchanges via a monthly subscription. The New York Stock Exchange is $2/month and the NASDAQ is $2/month.

Products & Tools

Charts

TradingView provides a high-quality, customisable charting platform where clients can view historical data for each market and asset. Time frames along the x-axis range from one second up to one month, accommodating both short-term day trading strategies and longer-term swing trades.

The are 14 types of charts including bars, Japanese candlesticks, hollow candlesticks, lines, Kagi and area charts, amongst others. The charting software comes with many in-built tools to help analyse data, such as the replay tool, short and long position tool and the risk-reward tool. If you need help understanding how to use these tools, there are tutorials hosted on the TradingView website.

For traders who want a simple dashboard, there is a lightweight charts library available for download from the TradingView GitHub.

Clients with basic accounts can only view one chart at a time, however, paid accounts can integrate multiple graphs into a single window. For instance, the Premium account allows users to view up to eight charts at once. These layouts can then be saved so that you have easy access when you login for the day.

The example below shows a EUR/USD chart with a 4-day exponential moving average (EMA) indicator overlaid. This EMA can be customised to a range of time frames in line with your trading strategy. For short-term trading, you may want to use 3-day, one-week, 8-day or 9-day views. For longer-term trading, you may find 20-day, 44-day, 50-day and even 200-day EMAs helpful.

EUR/USD Chart With EMA

The example above uses a chart in light mode but there is also a night/dark mode.

Screeners

The screener service can be used to compare stocks, forex and cryptos. For each market, TradingView provides information such as trade volume, the volume multiplied by price and market cap.

Additionally, each asset has a technical rating for trading sentiment using a five-point scale of strong sell, sell, neutral, buy and strong buy. This is an easy way to search for different assets and view vital information at a glance to support trade research and shortlist potential assets. For example, you can filter the screener to view the top gainers by percentage or magnitude to find stocks, forex or cryptocurrencies with a 52-week high or low.

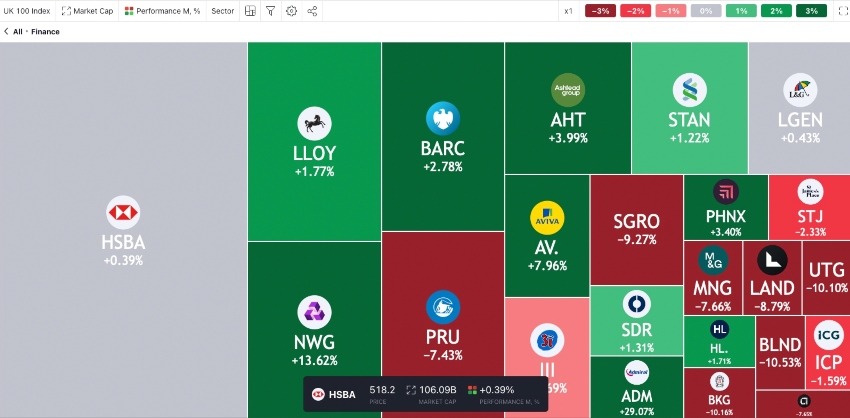

Heatmaps

TradingView has created a visual representation of how popular securities have performed over a certain time frame. Each heatmap can be customised the show the best-performing assets either by total market cap or traded volume. The colour is indicative of performance over the chosen time frame where green is growth and red is decline.

The example below is a heatmap of financial companies in the FTSE 100 index scaled by market cap showing each stock’s performance compared to one month ago. The available time frames include a one-hour change, 24-hour change and a change over 365 days, amongst others.

UK Stocks Heatmap

Indicators

Indicators are incorporated alongside market knowledge to help investors make predictions on future price performance. For instance, when an asset’s price reaches a pivot point, it is likely to reverse its trending direction and can be used as an indicator for triggering both buy and sell orders.

On TradingView, there are hundreds of established indicators to overlay onto charts. For example, volume and market profile, relative strength index (RSI) and profit and loss (P&L) can all be added to the chart at the click of a button. These are common indicators that you can expect to find from other brokers and trading platforms, such as MetaTrader 4 (MT4). But what sets TradingView apart from other platforms is the breadth of community-created indicators. On the TradingView community tab, you can find thousands of scripts made by other traders to support technical analysis. Popular examples include the M-oscillator, order flow, volume profile visible range (VPVR), Super Z, Cipher B, yield curve and the Hex Risk Metric.

If you cannot find indicators that suit your needs, you can also create your own. Investors can design scripts using TradingView’s proprietary programming language, Pine Script. There is plenty of support available in the online user manual. Here, you can find guides on writing with the script, debugging advice and definitions of error messages. Once you have finished writing the script, you can use the backtesting service to see how accurate the indicator is.

Alerts

TradingView users can set up asset alerts. Traders can also use the service to create a watchlist to monitor many different instruments at once. There are several options for alert conditions, for example, increasing or decreasing past a certain valuation, moving outside of or within a given range and crossing a strike price. You can set also when the notification expires down to a minute or just leave it running indefinitely.

Additionally, TradingView allows clients to choose if they wish to receive an alert each time the condition is met or just the first time. Finally, you can select the method used to receive the signal, including app notifications, email, or Webhook URL.

Social Network

A big part of the TradingView platform is the community aspect. The website hosts a large social network that all members can contribute to.

Whether you are a beginner or an experienced trader, there is something to enhance the trading experience. For example, you can watch live streams to follow trading sessions, read market insights and trade ideas, learn about different risk management techniques and download other users’ watchlists.

Accounts

There are four different types of TradingView accounts. For the full breakdown and comparison between each, see the official website. A refund is only available for auto-renewals of a yearly subscription. A refund is not available for monthly subscriptions or first-time purchases.

Note that all features included in a lower-tier account are available in subsequent accounts:

Basic

- Free account

- One saved layout

- One alert at one time

- One chart per tab or window

- Real-time, contextualised news

- Only seven years of annual financial data. All other accounts have 20 years

Pro

- Two charts per tab

- Five saved layouts

- Five indicators per chart

- Regular customer support

- A maximum of 20 alerts at one time

- The price of a Pro monthly subscription is $14.95. An annual subscription is $155.40, representing a saving of $24

Pro+

- 10 saved layouts

- 10 indicators per chart

- Four charts in one layout

- Priority customer support

- Two devices at the same time

- Premarket data for intraday charts

- A maximum of 100 alerts at one time

- Opportunity to export TradingView data

- A Pro+ subscription incurs a monthly cost of $29.95. Purchasing an annual subscription costs $299.40 which would save $60

Premium

- 25 indicators per chart

- Eight charts per layout

- Unlimited saved layouts

- Four devices at the same time

- First priority customer support

- Time frames as low as one second

- A maximum of 400 alerts at one time

- A monthly subscription is $59.95 whereas a yearly subscription is $599.40, which would save you $120

Free Trial

TradingView offers all new users a 30-day free trial for the Pro, Pro+ and Premium accounts. This is a good way to see which features are worthwhile and you can weigh up what is most important to ensure you only pay for the services you need.

Note, to qualify for the one-month free trial, you must be a new user.

Payment

You can pay for your TradingView account subscription through four different methods. This includes debit/credit cards, Google Pay, PayPal and cryptocurrency.

TradingView accepts cryptos such as Bitcoin (BTC), Litecoin (LTC) and several ERC20 network tokens such as USD Coin (USDC) and Ethereum (ETH).

Customer Support

TradingView offers multiple support channels to answer common queries. This includes issues such as TradingView not working or loading on the Binance app, the platform keeps freezing, keeps refreshing or you can’t access or connect to your broker. If you require help, you can use any of the following channels:

- A help centre with FAQs, guides and tutorials helping users understand aspects of analysis such as portfolio tracking, importing Quandl data and what Z score is.

- Live customer support with tickets is only available to users with paid accounts. Contactable between 4 AM (EST) and 3 PM (EST) on weekdays.

- Social media such as Twitter, Facebook, YouTube, Instagram, Telegram, Discord, LinkedIn and TikTok channels. There is also a forum on Reddit where members of the TradingView support team offer help and advice.

- If you are experiencing outages then check the status monitor on the TradingView website which shows when services such as alerts, data feeds and embedded widgets are operational.

TradingView Promotions

TradingView runs a referral scheme where customers can earn up to $30 off of a plan upgrade. Each user is allocated a unique link they can send to family, friends and colleagues.

For each person that uses your link to sign up, you receive a discount on your next subscription purchase. If the person you refer purchases a monthly subscription, you receive a discount of $10. If instead, they purchase a one-year subscription, you receive a $30 discount.

Getting Started

How To Create A TradingView Account

- Go to the TradingView website, click on ‘Get started’ and then the ‘Sign up’ button

- Input your desired username, email and password

- Select the account type and input your payment details if you select the Pro, Pro+ or Premium version

- For added protection, you may want to configure 2-factor authentication. This can be done in profile settings

Apps & Accessibility

You can access TradingView via a mobile app, desktop application or through your web browser. For Android mobiles and iPhones, you can find Google Play Store and Apple App Store download links on the website.

The desktop app can be downloaded regardless of the operating system used as long as you meet the requirements. For macOS, you must be running at least Catalina 10.15, Windows computers need Windows 10 64-bit or above and any Linux distro is supported as long as Snap package manager is installed.

If your computer does not meet these requirements, for example, if you run Windows 7 or 8, you can use your web browser as an alternative. The web browser is a viable option and still allows charting across two screens.

For clients who wish to download TradingView on iPads or Android tablets, you may be able to find third-party Python API versions on websites such as GitHub.

Comparing Brokers That Offer TradingView

There are several factors to consider when weighing up the TradingView broker you should use. Several brokerages are already partnered with TradingView, including OANDA, Pepperstone and Eightcap.

If your broker is not yet supported, for example KuCoin and Kraken, you can request integration via the TradingView data API. Traders interested in viewing an order book must connect with a broker that supports level 2 data.

To help find the right broker, consider the following:

- Regulation – Find brokers licensed by a recognised authority such as the FCA in the UK. Regulators enforce measures to help keep clients safe, for example, mandating the broker apply negative balance protection and separate customer and brokerage funds.

- Fees – Any fees such as monthly subscription costs, deposit and withdrawal charges or trade commissions can chip away at profits. Keep in mind that this could be on top of the fees charged by TradingView. It is worthwhile keeping a journal and taking note of expenses so you can plan out your budget and strategy accordingly.

- Customer Reviews – It can be hard to tell how good or bad a broker is before you start using it. Therefore, reading ratings and reviews from current and past users can be helpful. See our list of recommended brands to get started. Our seasoned traders test and try a broker’s products and services.

- Markets – Before you sign up with a broker, check which markets are available. For example, if you want to trade major, minor and exotic forex pairs, you probably don’t want a broker that specialises in crypto trading.

- Deposits & Withdrawals – The best brokers will support popular low-cost and secure payments. The majority of firms will offer bank transfers but also look for debit/credit cards and e-wallets such as PayPal and Neteller. Many brokers today also come with low minimum deposit limits and quick transfer times.

- Demo Account – For beginners, find a broker that offers a free paper trading account. These accounts use simulated funds so you can test out new strategies and indicators you have found on TradingView. This is especially important if you want to trial and backtest an expert advisor such as 3Commas.

TradingView Verdict

TradingView is a high-quality trading platform that is popular with investors in the UK and around the world. Whether you wish to trade BTC and ETH or XAUUSD and the S&P 500, there are thousands of ideas and recommendations spanning indicators and strategies. The opportunity to start with a free account or register for the one-month free trial means it is also easy to become a part of the investing community.

Check out our list of online brokers that support TradingView to get started.

FAQ

Is TradingView A Broker Or Trading Platform?

TradingView is a platform used to analyse markets through technical and fundamental research. If you want to execute trades using the charting software, you will need to connect your brokerage account with TradingView.

Should I Use TradingView?

This is something you will need to decide upon yourself having weighed up the cost of a subscription vs how much you could benefit from the services. If you are wondering if TradingView is a good platform, then reading customer reviews and ratings can prove useful. You can find reviews on websites such as Reddit, Discord, Telegram, Facebook and Trustpilot. Our experts also tested the platform for this review.

Is There A TradingView App For Windows PC?

Yes, there is a TradingView app for Windows PCs. But note that you need to be running Windows 10 64-bit or above – the TradingView app will not work with older versions of Windows. Alternatively, you can use TradingView through a web browser.

What Time Frames Are Available In TradingView Charts?

The shortest time frames in TradingView charts are one and five seconds, which are only available to users with Pro+ and Premium accounts. All users have access to 1 minute, 5 minute, 1 hour, 4 hours, 1 day, 2 day and 2-month charts. Time frames such as 2 minutes, 6 hours, 8 hours, 12 hours, 3 days and yearly charts are only available to Pro, Pro+ and Premium accounts with custom time intervals.

How Do I Use Keyboard Shortcuts In TradingView?

You can use hotkeys in TradingView charts for quick navigation. For instance, you can set up quick keys to jump to a certain date, zoom out, zoom vertically and invert the chart along the y-axis. To view all the keyboard shortcuts in TradingView, go to the chart and click on the three horizontal lines button in the top-left of your screen. Select the ‘Keyboard Shortcuts’ option and the pop-up will show all the hotkeys.