Eightcap Review 2025

|

|

Eightcap is #9 in our rankings of CFD brokers. |

| Top 3 alternatives to Eightcap |

| Eightcap Facts & Figures |

|---|

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities |

| Demo Account | Yes |

| Min. Deposit | £100 |

| Mobile Apps | iOS & Android |

| Trading App |

Eightcap supports the MT4, MT5 and TradingView apps (the only FCA regulated broker offering TradingView), catering to mobile traders looking for advanced charting tools. While we don’t love the increasingly outdated design of the MetaTrader suite, its dozens of technical indicators and drawing tools, multiple charting styles, and straightforward overlays in horizontal mode are excellent. The push notifications and active social network on the TradingView app are also valuable additions for aspiring traders and Eightcap has published helpful videos on connecting TradingView accounts to iOS and Android devices. |

| iOS App Rating | |

| Android App Rating | |

| Payments | Credit and Debit card, wire transfer, Neteller, Skrill, Paypal, Fasapay, Bitcoin and more. Payment method options vary by country. |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, FCA, CySEC, SCB |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | TradingView Bots |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area. |

| Leverage | 1:30 |

| FTSE Spread | 1.2 |

| GBPUSD Spread | 0.1 |

| Oil Spread | 0.03 |

| Stocks Spread | 0.03 (Apple Inc) |

| Forex | Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market. |

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.0 |

| GBPEUR Spread | 0.1 |

| Assets | 50+ |

| Currency Indices |

|

| Stocks | Eightcap offers 590+ US, Australian, and European shares as well as a modest range of indices, including the Dow Jones and FTSE. Its Labs offer excellent educational tools, notably the ‘Navigating Stock Market Volatility’ guide, while Capitalise.ai lets you automate stock trading strategies in plain English. On the downside, Eightcap still doesn’t offer fractional shares for budget traders, which are available at brokers like XTB. |

Eightcap is an online broker that specialises in crypto derivatives and stock CFDs. This 2025 broker review will examine the Australia-based company’s offering, including instruments, leverage, deposit and withdrawal methods, regulatory licences, trading platforms and demo account support. Read on to discover the pros and cons of Eightcap for UK investors.

About Eightcap

Founded in 2009 in Melbourne, Australia, the Eightcap Group is split into a domestic, ASIC regulated broker and an international company licensed by the Securities Commission of The Bahamas (SCB). The latter serves UK clients under the name Eightcap Global Ltd. Overseen by CEO Joel Murphy, the international brokerage has an office in London as well as other key locations worldwide.

High-profile sponsorship deals with the Ferrari F1 team and Australian driver Daniel Ricciardo have helped cement Eightcap as a prominent financial services firm, both in its native Australia and on the global stage. The broker’s positive trading reviews back up the image of a customer-focused service with helpful support staff, a substantial selection of assets and top quality tools. As such, the broker has partnered with some globally recognised brands.

Markets

Eightcap provides trading instruments in several markets, including forex, index, crypto and commodity CFDs.

Forex

Eightcap provides over 40 currency pairs with a solid range of major, minor and exotic pairs. In addition, the website offers helpful summaries of the six most traded pairs and their significant price determinants, as well as general forex FAQs.

Spreads on FX markets start from as little as 0.0 pips on the seven major pairs through the ECN account or upwards of 1.0 pips on the commission-free STP account.

Indices

Eightcap supports a relatively modest selection of eight global indices, though these offerings span exchanges from four continents. The US S&P 500, Nasdaq and Dow Jones are available for speculation, as are the UK FTSE 100 and AUS 200. Unfortunately, no e-mini indices or futures markets like the VIX are supported, which may limit some traders.

Spreads start at 0.0 pips on indices for the Raw ECN and standard STP account alike, though the lowest typical spread is on the S&P 500 and stands at $0.55.

Share CFDs

Investors can trade more than 350 equities from US, UK, EU and Australian exchanges on Eightcap. However, share CFDs are only supported on the MT5 platform, so MT4 exclusive traders will be unable to speculate on these assets.

Spreads start at 1.0 pips on Australian shares, while stocks from other regions are subject to additional commissions of 0.1% per lot.

Commodity CFDs

Eightcap is disappointingly deficient in its commodity CFD instruments, with only four assets supported: gold, silver, UK Brent crude oil and US crude oil. With no soft commodities like cotton and wheat represented and a meagre selection of precious metals and energies, commodities are the broker’s weakest offering.

On both the standard STP and Raw ECN accounts, spreads start at 1.0 pips on silver and 0.1 pips on gold.

Cryptocurrency CFDs

Investors that wish to take advantage of the highly volatile cryptocurrency markets will be pleased to learn that Eightcap supports over 250 crypto derivatives markets. These feature crypto cross pairs, several non-USD pairs and five crypto indices.

In addition to providing a far greater range of markets than many competitors, the broker also boasts lower spreads than most starting at 12 pips for Bitcoin and 0.45 pips on Ethereum.

Leverage

The domestic arm of the broker is regulated by ASIC and is therefore restricted to modest margin capabilities. However, UK clients may be pleased to discover that the global Eightcap offering has far greater leverage rates available.

Up to 1:500 leverage is supported, though trades utilising leverage rates of over 1:100 will have to meet minimum and maximum account equity requirements to help clients minimise risk. Furthermore, the maximum account equity level of $5,000 when using 1:500 leverage is unusually restrictive and may put some prospective users off.

Account Types

Whether you are an investor that favours the tightest spreads or someone that prefers commission-free speculation, Eightcap can fulfil your needs with its ECN and STP accounts.

The Raw account utilises the ECN execution type to deliver the most competitive spreads from a range of liquidity providers in exchange for a commission fee of $3.50 per side per lot ($7 per round lot). The Standard account offers an STP execution style for zero-commission trading, though spreads are often significantly higher.

The live accounts are otherwise identical, with margin call levels at 80% and stop-outs at 50%, while trade sizes are between 0.01 and 100 lots. In addition, UK clients will be pleased to know that both account types support GBP as a base currency, as well as USD and EUR.

Unfortunately for those who cannot pay interest charges due to their religious beliefs, Eightcap does not provide a swap-free Islamic account.

Demo Account

Many investors like to trial a new brokerage before opening a live account through a risk-free demo account. To this end, Eightcap offers a demo account for both the MT4 and MT5 platforms for prospective users to practise new trading strategies or gain experience in a new market.

Trading Platforms

Eightcap offers three trading platforms to its live and demo users: MetaTrader 4, MetaTrader 5 and TradingView.

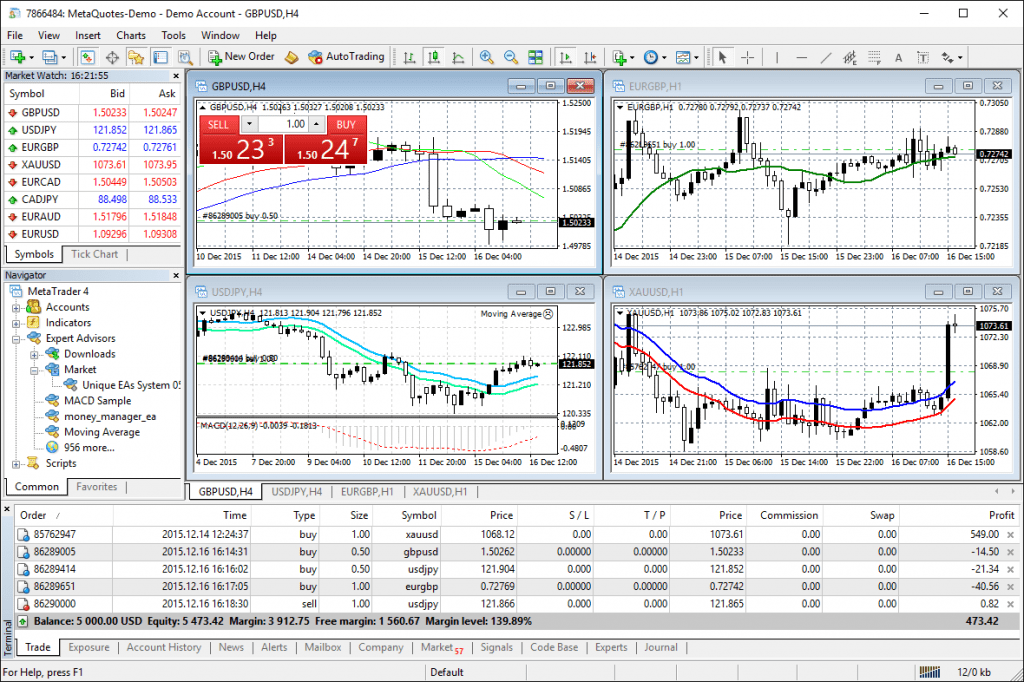

MetaTrader 4

The first of these is MetaTrader 4, or MT4. This platform has been very popular amongst forex and CFD traders for over a decade. Many users swear by its customisable but straightforward layout, seamless automated integration via expert advisors (EAs) and active MQL4 marketplace. MT4 offers nine timeframes and 30 technical indicators as standard and is available as a free download on Windows, Mac and Linux.

MetaTrader 4

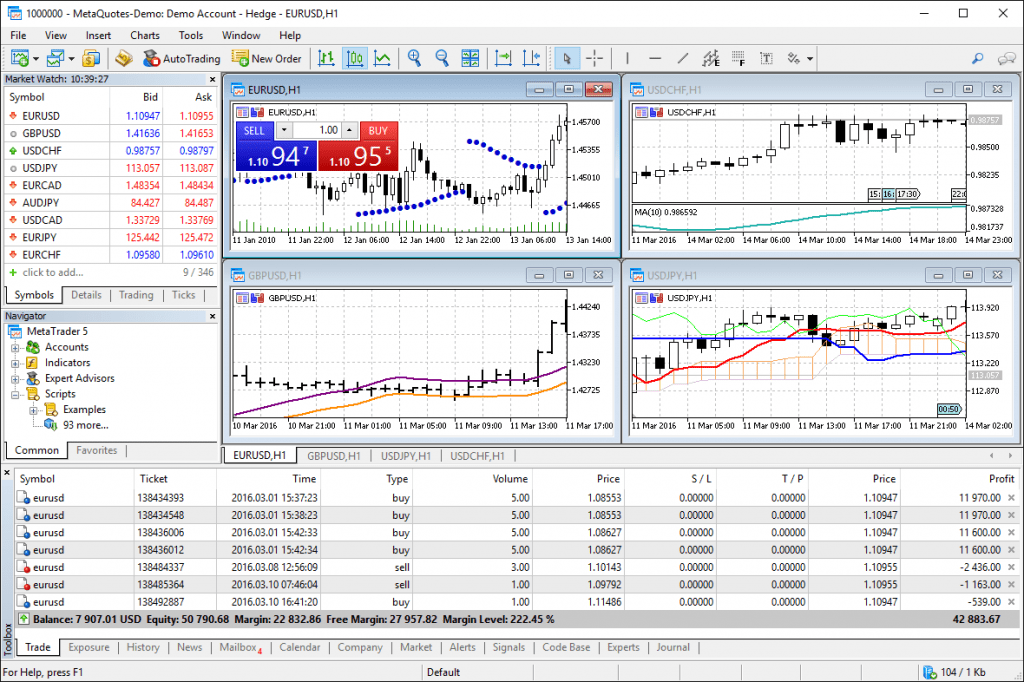

MetaTrader 5

MT5 is the newest release from MetaQuotes. While not a direct replacement for MT4, it offers improved facilities and compatibility for new markets. This platform features an additional twelve timeframes and eight indicators, an updated MQL5 coding language and equities CFD support.

MetaTrader 5

MT5 is available as a free download on Windows, Mac and Linux OS computers or through a browser-based web trader.

TradingView

Most experienced investors will be familiar with TradingView as a resource for researching the historical price data of an extensive range of assets. However, through Eightcap API integration, clients can open and close positions directly from the TradingView interface.

TradingView

This platform is browser-based and supports over 10,000 community-made custom indicators and charting tools.

Mobile Apps

All three supported platforms are available in mobile app form on Android (APK) and iOS devices. However, the TradingView app does not currently support trading, only chart analysis. The MT4 and MT5 mobile versions retain all the standard indicators and charting tools of the desktop-based equivalents.

There is no proprietary Eightcap app, so account management is limited to the client portal on the broker’s website.

Payment Methods

Eightcap provides UK clients with several options to safely deposit or withdraw funds from their accounts: credit and debit card payments, bank wire, Skrill, Neteller, PayPal, Worldpay and crypto wallet transfers.

Bank wire deposits take up to three business days to clear, while all other methods are quoted as up to instant. Eightcap does not offer a withdrawal time for each payment option but, for most brokers, this will take up to 24 hours. A minimum deposit and withdrawal limit of £100 or equivalent is enforced on all payment methods, excluding crypto and bank wire transfers.

Investors can make transactions in more than five prominent global currencies, including GBP, USD and EUR, as well as crypto tokens USDT and BTC.

Deposit & Withdrawal Fees

Eightcap does not levy any fees for transactions. However, bank wire transfers and crypto transactions may be subject to fees outside of the broker’s control.

Trading Fees

While some brokers charge inactivity or account management fees, Eightcap remains a fee-free broker. Trading commissions on the Raw account are competitive and transparent at $3.50 per side per lot, while users can find overnight swap fees for each asset via the MT4 and MT5 trading platforms.

Security & Regulation

While the broker boasts the highly respectable regulation of ASIC in Australia, UK operations are instead overseen by the Securities Commission of The Bahamas (SCB). Many online reviews report that the regulatory body is the Vanuatu Financial Services Commission but this information is outdated.

While by no means indicating that Eightcap is a scam, safety-conscious traders may favour the stronger protection measures of a regulatory body like the FCA or ASIC.

Client funds are held in segregated bank accounts, though there is no mention of protection schemes such as the Financial Services Compensation Scheme operated by the FCA.

Additionally, there is no two-factor authentication (2FA) to provide top-level security to the client portal.

Customer Support

Whether you have login issues, withdrawal problems or just a general enquiry, Eightcap offers several methods to contact its customer service department. Support is friendly, knowledgeable and available in a host of languages. The English speaking live chat operates 24/7 through the website.

There is a dedicated support email address but no UK phone number; an international call is required to reach customer service.

- Phone Number (Australia): +61 385922375

- Phone Number (Vanuatu): +678 35382

- Email Address: global@eightcap.com

Educational Content

An area in which Eightcap excels is its market analysis and educational content. Daily analysis articles look at developments in the forex, commodity and crypto markets, while weekly live YouTube webinars detail upcoming trading events in the week ahead.

In addition, the broker’s ‘Labs’ section is packed with educational content on market fundamentals, platform guides, e-books, potential trading strategies and deep dives on popular assets like Bitcoin or gold.

Eightcap Labs

Advantages Of Eightcap

- Reputable

- Crypto trading

- High leverage rates

- No transaction fees

- STP & ECN accounts

- Crypto deposits & withdrawals

- Solid education & analysis content

- MT4, MT5 and TradingView access

- Beginner automated trading software

Disadvantages Of Eightcap

- Low-tier regulation

- No UK phone number

- No promotions or bonuses

- Limited commodities & indices

- Large minimum deposit and withdrawal limits

Promotions

Many brokers use promotions such as a no deposit bonus or commission rebate to entice new clients to their company. However, Eightcap offers no such incentives to new or existing users. That being said, this is often a sign of greater reputability.

Additional Features

Eightcap provides its clients with several additional features to enhance their trading experience. As with many forex and CFD providers, the broker offers a free VPS service for 24/7 automated orders to those who have traded over five lots per month.

Less common is the provision of Capitalise.ai, a beginner-friendly automated trading service that allows its users to create conditional orders with no coding knowledge required.

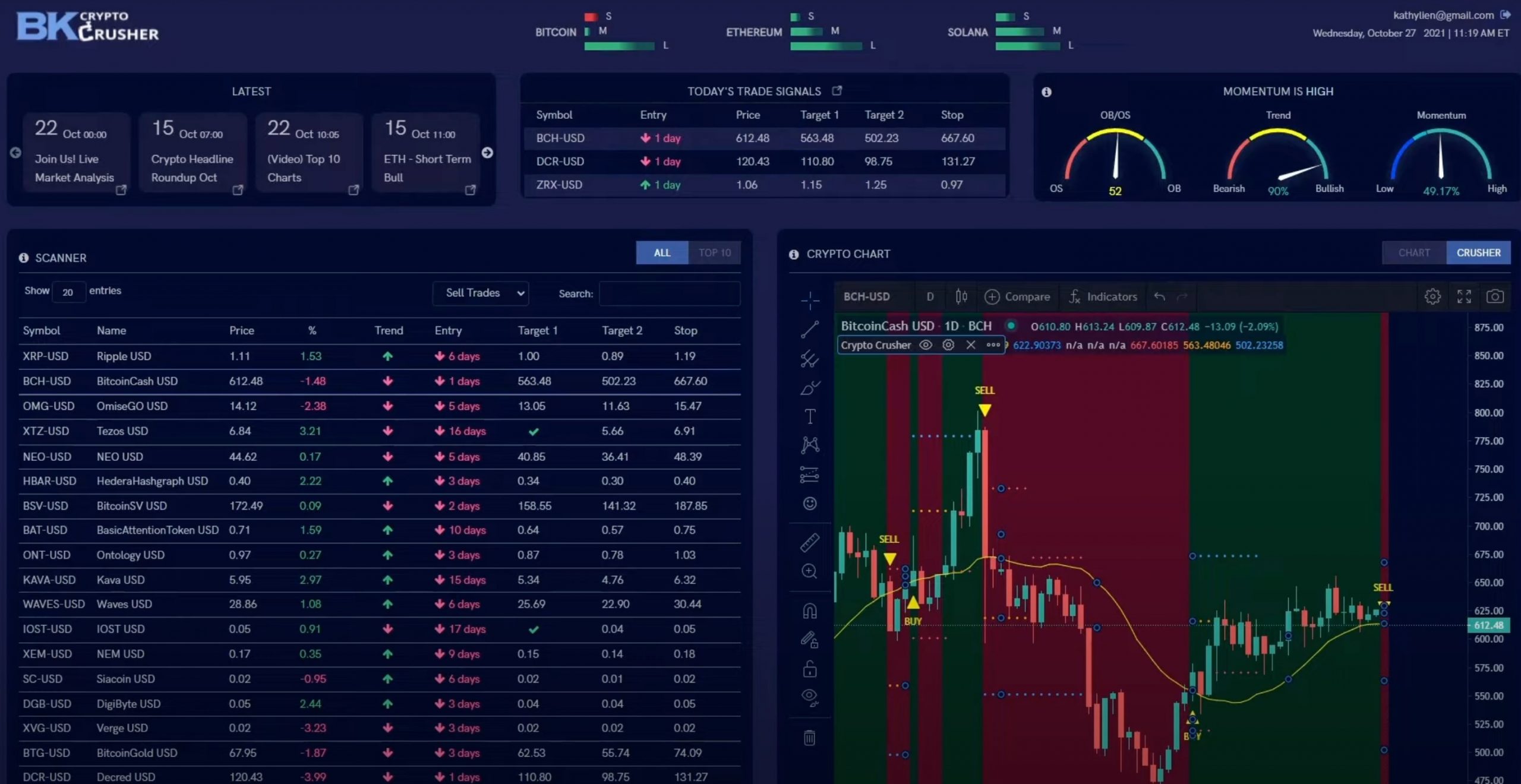

Additionally, those who desire extra data and indicators when trading on the firm’s 250+ crypto markets can take advantage of access to the CryptoCrusher platform when they maintain an active account with over $500 in account balance.

CryptoCrusher

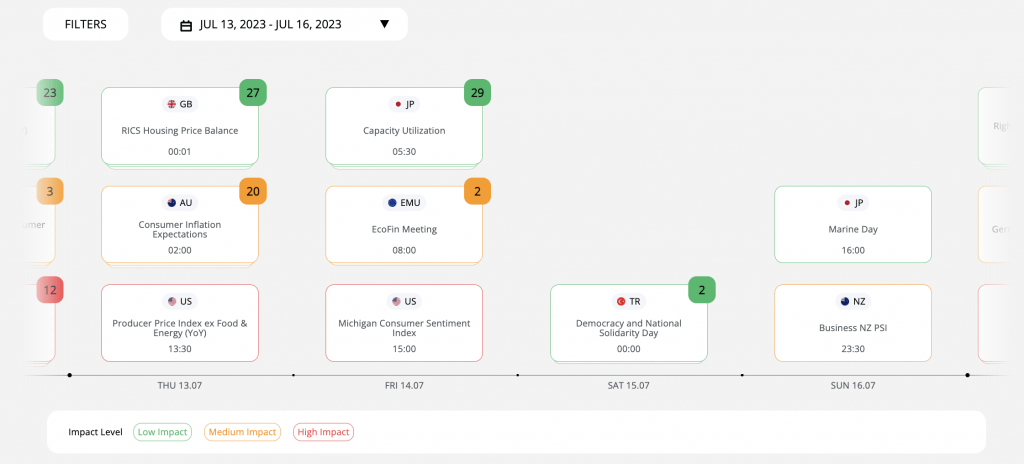

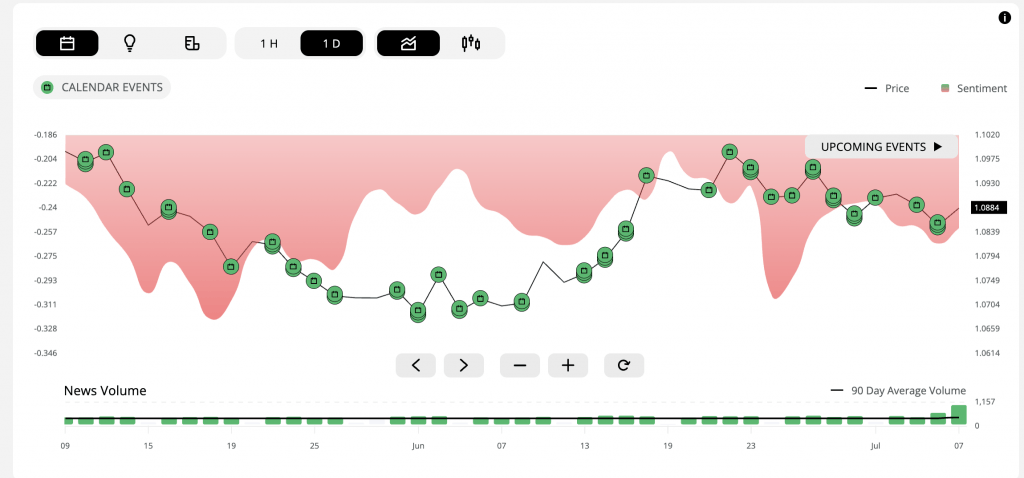

The broker also offers an excellent AI-powered economic calendar powered by Acuity. The user-friendly and interactive calendar makes it easy to filter and refine the events that matter the most to traders. Each event comes with detailed sentiment and forecast data to help traders locate trade ideas. You can also launch the calendar as an EA tab in the MT4/MT5 terminals, facilitating a seamless research and trading experience.

Interactive Economic Calendar

Economic Calendar Chart Overlay

Trading Hours

The Eightcap brokerage is available for trading 24/5, though markets such as share CFDs and indices may follow their local exchange hours. However, unlike many other companies, the platform offers 24/7 crypto derivatives trading, mirroring the constant uptime of the cryptocurrency markets.

Moreover, clients can login to the client portal at any time to change account settings or make deposits and withdrawals.

Eightcap Verdict

Eightcap is a competitive choice for forex and CFD trading alike due to its STP and ECN account options, lack of trading or transaction fees, significant cryptocurrency support and choice of top trading platforms. While some UK traders may prefer an FCA regulated broker or more commodity assets, Eightcap is a reputable broker with high leverage rates on offer.

FAQ

Does Eightcap Provide A Demo Account?

Yes, prospective Eightcap users can open a risk-free demo account on either the MT4 or MT5 platform to trial the brokerage before committing to a live account.

Is Eightcap an ECN broker?

Yes, Eightcap is an ECN broker. The broker offer both ECN accounts and commission-free market maker accounts. Make sure you open an ECN account if you want to engage in ECN/NDD trading.

What Is The Difference Between Eightcap Global Ltd & Eightcap Pty Ltd?

While Eightcap Pty Ltd serves residents of Australia and is regulated by ASIC, Eightcap Global Ltd provides brokerage services to clients from other jurisdictions, including the UK. The global arm is regulated by the Bahamas-based SCB.

Does Eightcap Offer A No Deposit Bonus?

No, Eightcap does not offer a welcome bonus to new clients.

What Does Eightcap Do?

Eightcap provides forex and CFD brokerage services to investors in its local Australia and abroad.

Is Eightcap A Scam?

Our opinion of Eightcap is that the brokerage is likely legitimate. This is based on the broker’s multi-jurisdiction regulation, wealth of positive user reviews and global reputation for fair dealing.

Top 3 Eightcap Alternatives

These brokers are the most similar to Eightcap:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Eightcap Feature Comparison

| Eightcap | Pepperstone | Vantage FX | IG Index | |

|---|---|---|---|---|

| Rating | 4.6 | 4.8 | 4.7 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | £100 | $0 | $50 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FCA, CySEC, SCB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4 |

| Leverage | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 71% of retail traders lose money when trading CFDs |

75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|

| Review | Eightcap Review |

Pepperstone Review |

Vantage FX Review |

IG Index Review |

Trading Instruments Comparison

| Eightcap | Pepperstone | Vantage FX | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Eightcap vs Other Brokers

Compare Eightcap with any other broker by selecting the other broker below.

Popular Eightcap comparisons: