Demo Accounts

Demo accounts are trading simulators that allow you to practice dealing in financial securities without putting your cash on the line. They’re an essential starting point for beginners but also a valuable tool for experienced investors looking to test strategies.

Explore our selection of the best demo trading accounts, tested by our British experts who have used dozens of trading simulators over the years and placed countless paper trades.

Top Demo Trading Accounts

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

How Did We Choose The Best Demo Accounts?

To list the best brokers with demo trading accounts, we:

- Leveraged our directory of around 300 brokers (all accepting traders from the UK)

- Pinpointed all those providing a free demo account (verified during our testing process)

- Ranked them by their rating (blending 100+ data points with our direct experiences)

What Is A Demo Trading Account?

A demo account is a free, interactive market simulator that online brokers offer to introduce their trading services to potential customers.

These virtual accounts replicate real market conditions, allowing you to experience financial markets and to road-test platforms and apps before setting up a real-money trading account.

Practice accounts are bankrolled with virtual cash, the amount of which varies from broker to broker, though typically ranges from £10,000 to £100,000 in our experience.

Some demo accounts can be used indefinitely, though the majority expire after a fixed period, normally 30 days to 90 days.

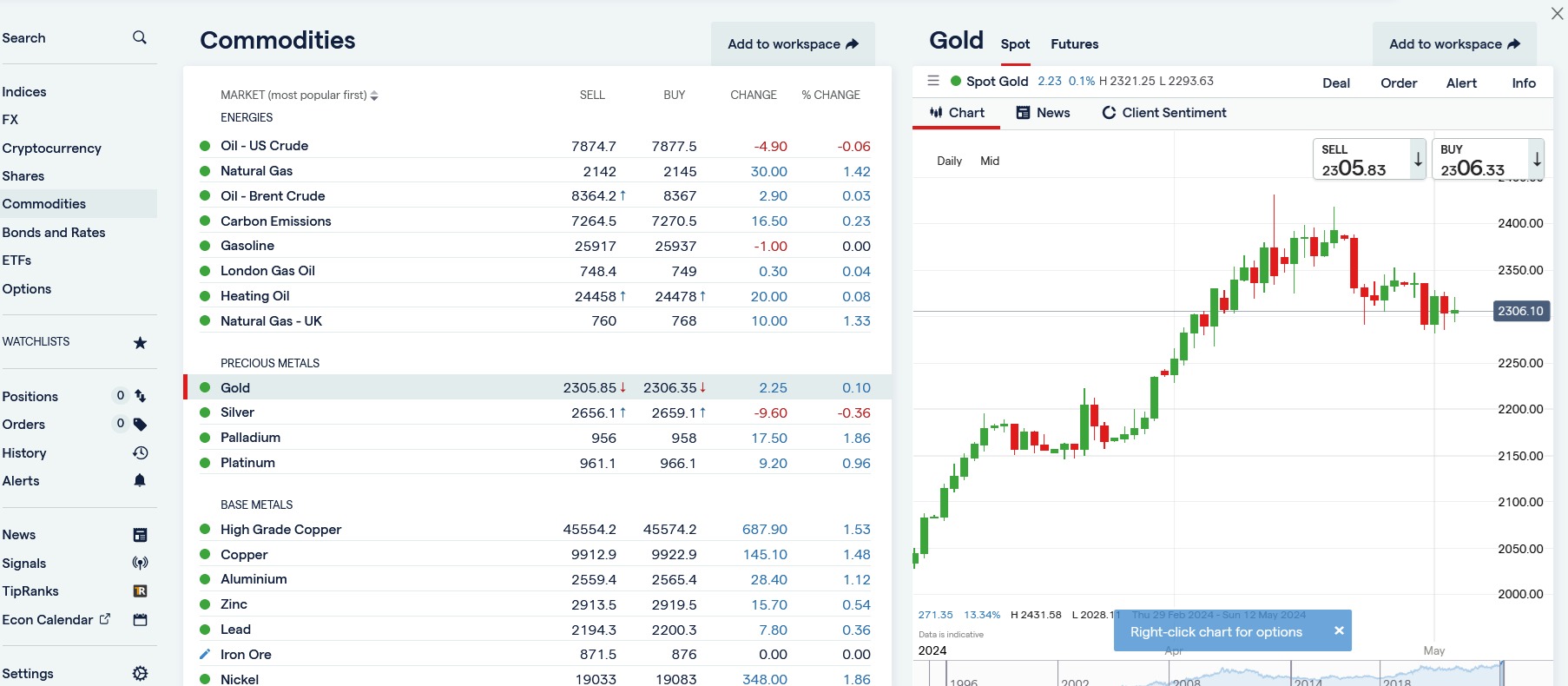

IG Demo Account

These simulators allow you to acquire a better understanding of market dynamics – including price movements, volatility, and liquidity – than a book, presentation or investing blog can provide. By providing direct exposure to the cut and thrust of trading, they help novice traders, in particular, get up to speed.

Trading simulators are especially useful for investors who plan to use a high-risk, leverage-based trading strategy. Utilising borrowed funds can magnify losses as well as gains, so practising with fictional money at the outset can help traders avoid thumping setbacks.

Even though I’m not dealing with real money, it’s important I treat my demo account as if it is real. That way I can more effectively replicate the day-to-day requirements and psychological challenges of online trading.

Steps To Open A Demo Account

In recent years, we’ve seen companies invest heavily in areas like technology, education and promotional offers to entice traders. However, demo accounts remain one of the most popular tools they also use to draw in customers. Yet after using dozens of demo accounts, we’ve found not all trading simulators are the same.

Here are the 5 key steps you need to follow to open a demo trading account, alongside the key considerations:

1. Decide What To Trade

The first thing you’ll need to decide is what asset class or classes you wish to trade. This is because some brokers only allow certain securities to be traded, either in their demo or real-life accounts.

OKX, for example, specialises in cryptocurrency dealing. In contrast, other brokers offer a much broader range of asset classes. eToro, for instance, allows you to trade stocks, commodities, indices, exchange-traded funds (ETFs), plus traditional currencies and digital currencies.

2. Bankroll Size

Next, consider how much simulated cash the broker allows you to trade with. The bigger the pot, the longer you can potentially trade for before running out of funds. More cash also allows you to place larger trading positions, and thus better replicates real-life conditions.

The size of the virtual bankroll can differ greatly across brokers. City Index and FOREX.com both offer a £10,000 kitty. Plus500 offers £40,000; XTB provides £100,000; while IC Markets stands out by providing unlimited funds.

XTB Demo Account

Certain brokerages also allow you to increase or decrease the amount of virtual currency in your accounts upon request. At eToro, for instance, I’ve found you can double your initial credit of $100,000 by dropping a message to customer service.

The amount of virtual funds available may also vary depending on the type of financial product you plan to use. For example, IG gives you a virtual £20,000 to trade with: £10,000 in a spread betting demo account, and £10,000 in a CFD trading simulator.

3. Trading Timeframe

Think about how long you plan to trade with virtual funds – beginners in particular may need an extensive testing period.

After using countless demo trading accounts, we’ve found most brokers only allow demo accounts to remain open for a limited time. Once the period expires, access to the trading simulator may be lost, unless you open a live trading account with the brokerage.

Once again, the lifespan for demo accounts can differ greatly across the industry. For XTB this stands at 30 days, while AvaTrade it’s 6o days. easyMarkets, meanwhile, allows unlimited use of its trading simulators.

Selecting demo accounts with longer lifespans can be an excellent idea. This allows for more extensive testing of trading strategies, risk management techniques, and familiarisation with the trading platform, including alongside a real-money account.

Importantly, demo accounts can also be suspended if they are not used for a certain period. For example, with IC Markets, virtual accounts expire following 20 days of inactivity, though it still has one of the best demo accounts I’ve seen, especially for active traders who seek greater flexibility. It offers zero restrictions on the life of the demo account, along with unlimited funds.

4. Trading Platform

Trading simulators also give you a chance to experience a broker’s services before opening a real-life account, including the quality of the platform – one of the key reasons we use demo trading accounts.

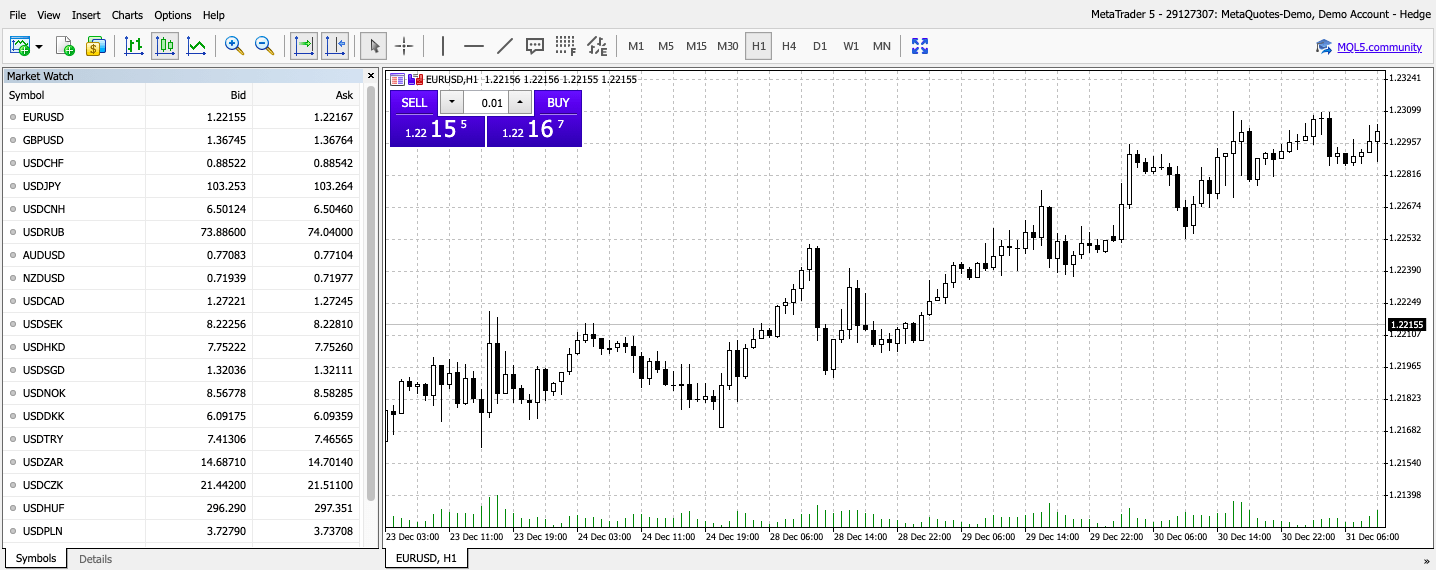

The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available with most demo accounts where brokers support these industry-leading third-party solutions.

OANDA traders, for example, can use the company’s own browser-based platform, or they can choose to download MT4 and trade that way.

Some brokers only allow demo users to trade with MT4 or MT5. This may not be desirable for those who don’t wish to download extra software or do not like the increasingly outdated platform, which is geared towards experienced traders.

MetaTrader Demo Account

Other limitations to be aware of include brokers imposing limits on the number of open positions that can be held in demo accounts. With FxPro, for instance, this is capped at 70 for MetaTrader accounts.

Brokers also increasingly make their demo accounts available for use on mobile devices. This can be a dealmaker for traders who like to do business on the move, with FinTech Global reporting that downloads of retail trading apps in the UK have more than doubled in recent years.

5. Time To Sign Up

Once you’ve decided which brokerage to go with, it usually takes only a few minutes to sign up, set up the platform, and start paper trading. The vast majority of companies we’ve opened demo trading accounts with require only basic information at this stage.

With CMC Markets, for example, I simply had to select the UK as my region, input my email address, and choose a password. I didn’t even have to disclose my name. After this, I punched a verification code the company emailed to me into the webpage, and the trading platform opened before me.

This process took less than five minutes from start to finish.

Other brokerages we’ve used may ask for more details though. FxPro requires your date of birth, nationality, employment status and trading knowledge.

RoboForex goes still further. It requires you to verify your address and provide identity documentation like a passport, ID card or residence permit. In this respect, the requirements of opening a demo account are the same as with a live account, which is fine if you plan to trade real money with the broker, but it’s time-consuming and frankly irritating if you just want to use the free simulator.

Pros and Cons Of Using Demo Accounts

Pros

- Risk-free trading – You can test and refine your trading strategies in real market conditions without putting your cash in peril.

- Experience building – Unlike books or seminars, trading simulators allow you to develop first-hand knowledge of how markets operate and in real time.

- Confidence building – Demo accounts can provide a bridge for risk-averse investors who otherwise would lack the confidence to begin online trading.

- Broker evaluation – Demo accounts allow you to assess a broker’s trading platform, customer service and asset coverage before depositing cash with them.

Cons

- Unrealistic expectations – You may not experience the same emotions and psychological challenges that you would in live trading, leading to unreasonable objectives and overconfidence.

- Real-life differences – Real-world phenomena like trade execution delays, slippage, and liquidity are not present in demo accounts, which in turn can create unrealistic results.

- A substandard experience – Some brokers offer a threadbare trading platform for their demo accounts, while certain simulators also don’t offer exposure to the full range of asset classes.

Bottom Line

Demo accounts can be an invaluable tool for investors. As well as teaching new traders how to navigate financial markets in a risk-free way, they can help both novice and experienced investors understand whether a certain broker is right for them.

However, no two trading simulators are exactly the same, so find the one that best meets your needs from our list of top-rated demo trading accounts for 2025.

FAQ

Which Is The Best Demo Trading Account In The UK?

This will depend on the markets you want to trade, which platform you want to use, how much paper money you want to test strategies, how long you would like access to the trading simulator, and how quickly you want to get started.

Use our ranking of the best demo accounts for UK investors to find the right simulator for you.

Which Brokers Offer Unlimited Demo Trading Accounts?

CMC Markets, IG and IC Markets are all highly-rated brokers offering unlimited demo trading accounts.

What Is The Difference Between A Demo And Live Trading Account?

The key difference between a demo account and a real or live account is that a demo account is a simulation. The conditions of a demo account reflect live markets but there is no exchange of real money, meaning zero risk and zero cash profits.

Demo accounts also normally have limitations that live accounts do not. There is usually a set period for which they can be used, whereas a live account offers unlimited use.