CFD Trading

Online CFD trading in the UK is a way for traders to diversify trading portfolios and strategies. If you’re unfamiliar with how to trade CFDs, we’ve provided a detailed explanation of how it all works, plus some useful tips and tricks to help you get started. This article also covers the pros and cons of CFD trading in the UK, including how to set up an online account and make money. In addition, we’ll look at other features, including trading platforms, UK tax rules, CFD margin and rollover, plus an introduction to the best brokers with full reviews.

Top 3 CFD Brokers

-

Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

-

XTB offers a huge selection of more than 2,100 CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependant). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

-

CMC lets you trade CFDs on 12,000+ assets across currencies, indices, commodities, shares, ETFs and treasuries with new equities spanning quantum computing, AI learning, and digital car sales in 2025. Spreads are tight, there are no hidden fees and the industry-leading MetaTrader 4 platform is also supported for leveraged trading. Year after year, CMC shines as one of the best CFD brokers in the market.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What Is CFD Trading?

Definition

CFD stands for ‘contract for difference’. They’re an agreement between two parties to exchange the difference between the opening and closing price of a financial instrument. CFDs are a derivative product, meaning traders do not own the underlying asset. This differs from traditional trading. If you compare CFD trading in the UK vs investing in spot forex or stocks, for example, you’d own the stock traded with the latter.

How Do CFDs Work?

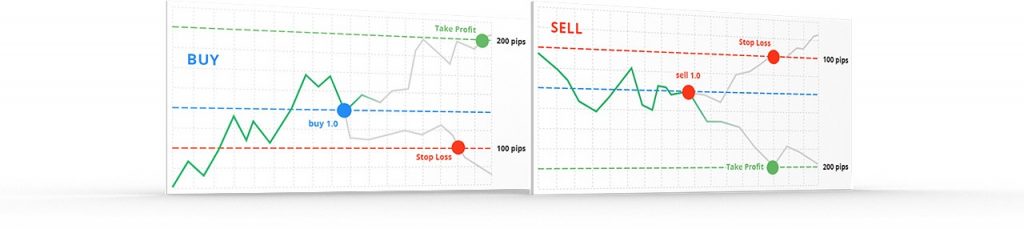

The concept of CFD trading in the UK is simple enough to define. The extent of the profit or loss is determined by speculating on the price direction of an asset, either by going long or short. Price rise predictions mean a trader will go long. If they think the price will fall, they’ll open a short position. CFD contracts are also impacted by margin and leverage, which will also be explained later.

CFD trading in the UK is available on a number of markets, including forex pairs, UK, US and other global stocks, options, plus commodities like gold and oil. In the UK, the FTSE 100 index is particularly popular with CFD traders.

CFD Video Tutorial

An Example Of A CFD Trading In the UK

Here is a walkthrough of a contract for difference trade:

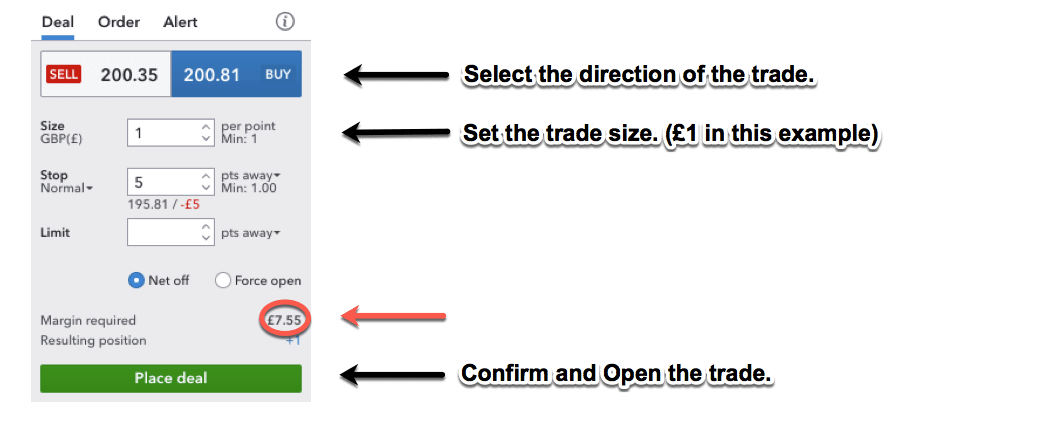

In our example, we are going to open a trade on Vodafone. The specific screens and layout will differ between providers, but the fundamental elements will remain:

- Notice the ‘Sell’ and ‘Buy’ values differ. The gap between values is known as the “spread”. This small percentage is how the broker will derive a profit.

- In the example, we have selected ‘Buy’, and set the trade size to £1. This means for each whole unit the asset price moves, our position will go up by £1 or down by £1.

- We have also entered a figure in the ‘Stop loss’ box. This is a risk management tool. In the example, our stop loss is set 5 points away from the opening price. This should limit our potential loss to just £5. Stop losses however, are not always guaranteed.

- The ‘margin required’ (highlighted in red) is the amount of funds needed in the account to open the position.

- Lastly, click the ‘Place Deal’ button to confirm the trade. We now have an ‘open position’ on Vodafone, for £1 per point.

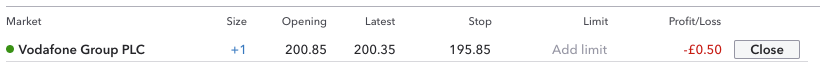

Open Positions

In a similar way to the trading screens, providers will display open positions in a variety of styles – but always show the same details:

The opening price shows our ‘strike’ price, and the latest price is just that – the current market value. Our stop loss value is shown – as is the current profit/loss. As our trade has only just been opened, we have to ‘make up the spread’. So the position is currently 50p down.

As the spread needs to be covered, almost every trade will open at a small loss – just as it has above. Any fees or trading costs are built into this spread. Where a trade is held open overnight, a very small charge will be applied. Even with a trade held open for months, this fee remains tiny, relative to the investment itself.

When we decide to end the trade, we simply click the ‘Close’ button. Alternatively, we can open a new trade, and ‘Sell’ Vodafone for £1 per point. But using the ‘Close’ button is far easier.

There is no time limit or expiry on a CFD.

Our £1 CFD effectively exposed us to £200.85 worth of investment. This is important to remember. While the brokerage only requires you have £7.55 in the trading account, you are still exposed to risk beyond that. If the Vodafone share price collapsed for any reason, the trade could lose way more than £7 or £8. When CFD trading in the UK, losses can exceed deposits. For this reason, the stop loss is a vital tool in risk management.

The Result

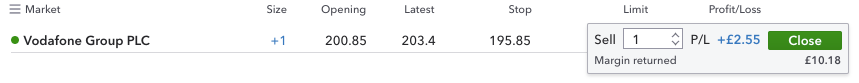

After opening the trade above, we now have an open position – What happens now?

Our trade will now mirror the fortunes of the Vodafone share price. For each penny the stock price rises or falls, our positions will gain, or lose, one pound respectively. So here are some scenarios:

If The Share Price Rises

Assume the spread on Vodafone shares reaches 205.85-206.35. To close our ‘Buy’ position opened above, we need to ‘Sell’ the same value of assets. So we will be taking the lower side of the spread – in this case, 205.85.

Our original ‘strike’ price was 200.85. If we close the trade at 205.85, the CFD has closed 5 points higher. This means we are due 5 times our trade size – in our example £1 – so:

5 x £1 = £5.

In our example above, we opened at 200.85. Below, you can see the value rose to 203.4 – our profit or loss shows £2.55 profit on this trade as we close it:

If The Share Price Falls

Assume the spread has dropped to 195.85-196.35. We still need to ‘Sell’ (and take the lower side of the spread). So the trade now settles at 195.85. The value has dropped 5 points, meaning we lose 5 times our trade size:

5 x -£1 = -£5.

Notice our stop loss was set at 195.85 above. This means our position would automatically close if the spread reaches that point. This is why the stop loss setting shows -£5 in red. That is the amount the trade will lose if the stop loss is triggered. If the price continues to go down, your trade will not lose any further funds. The caveat to this is that in extreme market conditions, stop losses may not be guaranteed and may slip.

Remember, the point at which you close the deal is down to you.

Summary

In our CFD trading example above, we opened a position that gave us access to a trade value of £200.85 – equivalent to buying 100 Vodafone shares. The same process can be used to trade gold, the price of oil or foreign currency.

Our example used a very small trade size, but factoring it up is a simple process. You can see then, how leverage can give CFD traders a large portfolio of investments, for a fraction of the outlay of traditional methods. With leverage comes risk however. Traders should note how much they are exposed to, and manage it correctly. Money management is a key element of CFD trading for a living in the UK.

Key Features Of CFD Trading In The UK

Before you begin CFD trading in the UK, it’s vital you get to grips with the following concepts.

Spreads & Commission

When CFD trading in the UK, CFDs are quoted in buy and sell prices, also known as the offer and bid prices. The difference between the two is known as the spread.

Usually, the cost to open a CFD trade is included in the spread price with no commission, however some providers might charge the commission separately.

Trading on the lowest spread will mean you need less price movement in your favour to make a profit. You can of course make a loss too, if the price moves against you.

There may be some other charges, including overnight holding costs if you hold a position overnight, or market data fees. In some cases there may also be dividends on equities.

Trade Size

A CFD asset is usually traded in lots, which is the standardised contract volume. A contract can vary depending on the underlying asset traded. Gold, for example, has a contract for difference value of 100 troy ounces, which is 1 lot. One share CFD contract size usually has the same value as buying one share. For example, buying 100 Barclays CFD contracts will mimic buying 100 shares of Barclays.

Duration

Generally, CFDs do not have a fixed expiry because you are paying an interest charge (overnight rollover) which can allow you to keep positions open for as long as you want. Most traders, however, will not use CFDs as a long-term trading strategy.

Note that futures CFD contracts do expire, usually on a monthly basis, though this can vary. This means that unless closed by the trader, the futures contract will be rolled over into the next month.

Leverage & Margin

One of the benefits of CFD trading in the UK is the use of leverage. Leverage lets you deposit a small percentage of the full position value to gain more market exposure. This can be both good or bad – whilst leveraged trading can be profitable, it can also increase your losses.

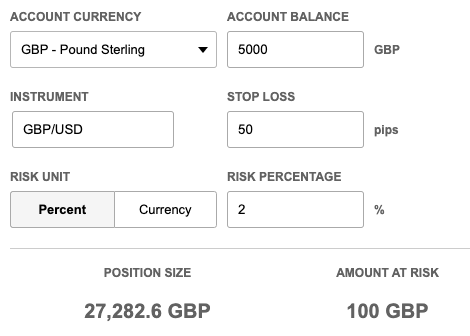

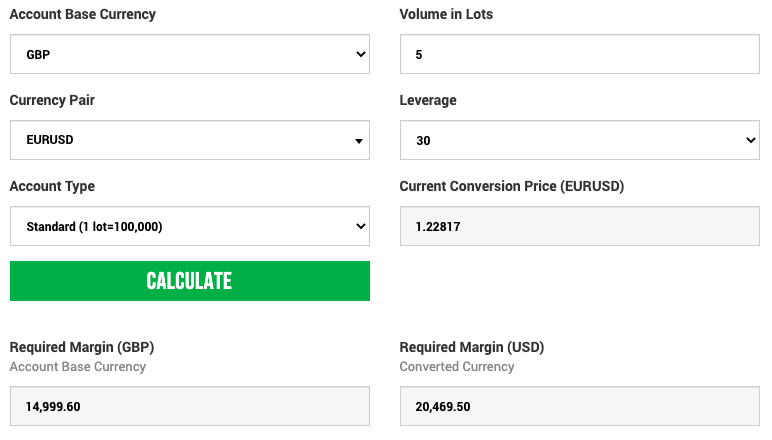

The margin level is the amount needed to open and maintain the leveraged position. Deposit margin is the initial opening requirement, whilst a maintenance margin is what is required to keep the position open before it begins incurring losses. Most companies will offer a margin calculator which can help you manage your margin levels efficiently.

It is possible to trade CFDs with high leverage up to 1:500 and to trade CFDs without leverage at all. However, CFD trading in the UK and some other jurisdictions is limited by regulations to ratios of 1:30 for retail traders. Professional clients can leverage more if they meet certain requirements.

Advantages Of CFD Trading In The UK

- Leverage – CFDs are leveraged instruments, so you only need to deposit a fraction of the full value of the trade to gain exposure to the market. In the EU and UK, trader protections in the form of restricted leverage limits (capped at 1:30) apply. Regulated firms offering CFD trading in the UK are also required to include a risk disclaimer on their website.

- Tax Efficiency – CFD trading in the UK is exempt from stamp duty tax, as you don’t own the underlying asset. This means that overall transaction costs when trading CFDs are generally lower than traditional shares trading.

- Trade All Market Conditions – CFD trading in the UK allows traders to take advantage of price declines as well as rises. Also, as you don’t take any ownership, this form of trading is generally more flexible if you compare CFD trading vs stock or share trading. You can therefore buy and sell as easily as each other.

- Hedging – Similarly, CFD trading in the UK can be used to hedge existing positions. For example, if you’re holding a large stock holding of Tesla but are concerned about a decrease in share value, a short CFD position will help you offset any losses.

- Out Of Hours Trading – Some companies allow you to trade for extended times or out of hours at weekends. Be aware though, that prices can significantly fluctuate outside of typical trading hours, which can lead to losses if you don’t know what you’re doing. Make sure to check the market opening hours before CFD trading in the UK.

Disadvantages Of CFD Trading In The UK

- Leverage – Although this is one of the biggest benefits, leverage can be a significant disadvantage. Having a large exposure can increase your losses as much as it can increase your profits. Make sure to put stops and limits in place to mitigate your risk.

- Trading Scams – As with all online trading, scammers can operate within unregulated or unregistered brokerages, where traders will be promised big returns after a hefty initial minimum deposit. Some will also tempt new clients with attractive trading promotions, such as a no deposit bonus or ‘free gift’. When CFD trading in the UK, these offers are not available through regulated providers since they’re strictly prohibited by the FCA and other top regulators.

- Overnight Financing fees – Traders have to pay interest fees on leveraged positions held overnight, which can increase significantly the longer you hold that position open.

- Crypto-derivatives ban – As of 6th January 2021, the FCA has imposed a ban in the UK on the sale of crypto-derivative products for retail investors. This includes contracts for difference on popular instruments, such as Bitcoin and Ethereum.

Is CFD Trading In the UK Halal or Haram?

With online trading companies and CFD providers keen to expand their user base, many now offer websites boasting ‘halal’ accounts. However, Muslim traders should tread carefully before CFD trading in the UK. While these accounts are legal and ensure that no interest or “Riba” is used on the account – they may still be haram.

Much depends on the traders themselves. In Islam, gambling is haram. If an investor is using a trading account to purely speculate, then that would be forbidden. Only the trader can know if they are investing responsibly.

This site is not qualified to answer this question categorically, but there are useful forums regarding Halal investing. If you’re still unsure about CFD trading in the UK, consult your local religious leader for advice.

How To Start CFD Trading

1. Choose A Broker

Before you start, it’s important to find the best CFD broker who can offer a competitive trading account and facilitate your specific investment requirements. The quality of the trading platforms or apps you use will also have a huge impact on your CFD trading experience.

Most companies offer the MetaTrader suite, which offers excellent fundamental and technical analysis features, automated trading and risk management tools. Some companies also offer CFD trading in the UK on impressive proprietary platforms, including eToro, Trading 212, IG, Plus500 and Oanda.

Traders should also consider what options are available to them if urgent support is needed with funds, fees or in the trading platform. Good providers offer 24/7 customer support via either a live chat service or a telephone hotline. You can take a look at some of our 2025 UK broker reviews for guidance, or check out some customer feedback online. All of our providers below offer straightforward online account registration and 24/5 trading hours.

MT4 Mobile App

2. Practice and Educate

CFD trading in the UK is high risk, so education is key to keeping your profits in the black. Most accounts provide access to a free demo account or tutorial, where you can test out CFD trading strategies without risking real capital. They’re also a great way to trial a new trading platform to ensure you’re comfortable with the layout and capabilities. Even the most experienced CFD traders will practice using a new platform before investing, so this step should be a crucial part of your platform comparison.

It’s also important to continually learn and progress. Well-established and reliable platforms can often act as a trading mentor by offering a range of training resources for beginners. These might include perhaps a starter guide in PDF format, online courses and e-books, YouTube video lessons, trading tips, or advice on a forum or community page.

For example, the XTB UK site offers a comprehensive trading academy catering to all trader levels, whilst Trading 212 offers a good selection of 101 tutorial videos. For those who prefer non-online learning, there are also plenty of useful and digestible books available, including the forex and CFD ‘Trading for Dummies’ collection.

Plus, those looking to learn CFD trading through a game can try out the various of apps on the market. These are essentially demo accounts with simulated markets. They’ll help you to learn strategies and practice in a friendly environment. One of the most popular is Forex Game, available to download on iOS and Android.

3. Take A Position

When deciding whether to take a long (buy) position or a short (sell) position, you will need to employ effective strategies, indicators, charts and signals to help you determine which way the price will move.

The trading platform you use will have a significant impact on how you do this, so make sure you become familiar with the platform tools in a demo account.

4. Trade Size

Determining your position size should also take into consideration the amount of risk you are willing to take. CFDs are leveraged products, which means what you put down as an initial deposit may only be a small fraction of the total position size. Thus, it is possible to lose more than you initially commit.

5. Risk Management

Managing your risk is a key element to ensuring safe CFD trading. These usually include guaranteed stop loss and take profit limits, which are instructions to your provider to close your trade when it hits less than favourable levels. These can help prevent your account from triggering a margin call and incurring losses.

6. Monitor Positions

It’s always important to get into the habit of monitoring your positions regularly, even if you have risk management tools in place. This allows you to stay on top of any opportunities or problems. Most good platforms also offer a mobile app, where you can login and monitor your positions from anywhere.

CFD Trading Strategies

Whether you’re day trading, swing trading or scalping, it’s important to understand the different investing styles and strategies used for CFD trading in the UK. Traders should also be aware of if or when a strategy works, and how you can mitigate risk if it’s not working.

Consider whether your skillset is best suited to fundamental or technical analysis – or even both. Fundamental analysis involves reading market news to understand the economic and political changes that could impact asset value. On the other hand, technical analysis prioritises the use of indicators and charting techniques to look for trends in the data.

CFDs vs Spread Betting

On the surface, CFDs and spread betting appear the same. Both allow traders to go long or short and use leverage. Both are forms of derivative, so the underlying asset is not owned – therefore no stamp duty is applicable.

However, there are subtle differences that are worth knowing:

- Deal Size – CFDs are normally based on the asset price, so a £10 per point contract on Vodafone for example, will cost less to open than a £1o per point position on the FTSE. The deal size for a CFD will depend on the asset price. With a spread bet, the trader chooses the size of the bet and the asset price is not relevant.

- Capital Gains Tax – CFDs are liable for Capital Gains Tax (once over a certain size) as they’re counted as a financial asset. This also means that CFDs losses can be claimed back in any tax return. This can make CFDs more attractive when using them to hedge, for example. Spread betting is not subject to taxation.

- Commission – CFDs on shares are often charged via commission. With spread bets, the cost is absorbed in the spread. This makes spread betting more attractive when buying smaller amounts of stock.

- Direct Market Access – CFDs often offer traders direct access to markets and order books for shares and forex. This is not the case with spread bets.

- Expiry – CFDs do not generally have an expiry. Spread bets, on the other hand, will have a fixed expiry or ‘settled’ date. This might be the end of the day, end of the week or months away – but there is always a fixed point at which the bet ends.

Given these differences, it is worth considering which investment is the best tool, each and every time you open a position. What is “best”, will often depend on the aim of each trade and its size.

CFD Trading Tips

- Risk Appetite – A CFD is a linearly leveraged financial product, meaning profits and losses are directly correlated to market performance. Therefore, your losses can exceed your initial investment. However, regulated CFD accounts in the UK will offer negative balance protection. This means traders should receive a margin call if the market moves against their trade, helping to manage the risk of losing more than they can afford.

- Overnight Fees – A CFD does not have a fixed maturity date. The trader will dictate when the contract expires. When you judge that it’s the right time for you to close a position, this is done by placing a trade of the same value in the opposite direction. Most CFD platforms in the UK will, however, take a very small charge for positions held overnight. Each charge is minuscule relative to the trade size – but is repeated each night.

Taxes

CFD trading in the UK comes with some tax benefits, namely the exemption from stamp duty. This is because traders do not own the underlying asset.

However, traders do still need to pay capital gains tax, which should also be included along with any losses in a tax return to HMRC. There is an annual exemption, after which it’s useful to keep a journal on an Excel spreadsheet of your taxable earnings.

Note that tax treatment may vary in a jurisdiction other than the UK. For example, in Australia, CFDs are taxed by the Australian Taxation Office (ATO) on the basis of revenue account, not capital.

Find out more about CFD trading in the UK and investing taxes.

Final Word On CFD Trading

It is possible to make money when CFD trading in the UK, however, using leverage can also lead to significant losses. Traders need to practice be disciplined and patient in order to be successful. This guide provides the basics of CFD trading in the UK for beginners, including the pros and cons, and the details you need to get started.

FAQ

What's CFD Trading?

A CFD is a contract between two parties, whereby the difference between the opening and closing price is exchanged. CFD traders do not own the underlying asset and positions are leveraged. CFDs are one of the most commonly traded derivatives.

What Is A CFD Trading Account?

A CFD trading account allows you to buy CFDs on various assets and therefore speculate on rising and falling prices within global markets. You can practice trading in a risk-free demo account with most good providers.

Is CFD Trading Halal Or Haram?

CFD trading involves leveraging a stock value to earn a profit without taking any ownership of the product. This is known as a Riba and is prohibited in Islam. However, it is possible to trade CFDs Riba-free using a swap-free account.

Is CFD Trading In The UK Safe?

CFD trading in the UK is safe as long as you are using a regulated and trustworthy provider. UK-regulated platforms offer good levels of trader safety, including financial compensation and negative balance protection. However, safe trading does not mean risk-free. It is also vital that you do thorough research into the risks around leveraged trading.

Is CFD Trading Legal In The UK?

CFD trading is currently legal in the UK. Make sure you choose a regulated and licensed CFD broker offering regulated leverage limits. Note that as of January 2021, crypto-derivative retail CFDs are banned in the UK.

Is CFD Trading Taxable In The UK?

CFD trading in the UK is exempt from stamp duty tax because you do not own the asset. Note that CFDs are still subject to capital gains tax. You can find out more from the HMRC website or our guide here.

CFD Trading In The UK: Is it Legit?

CFDs are a legitimate form of trading on a range of global markets. Note that whilst most providers you find will offer CFD trading, not all of them are regulated companies. It’s important to thoroughly research your platform before committing money.

Is CFD Trading The Same As Spread Betting?

CFDs and spread bets are both leveraged products, with no ownership of the underlying asset. The main difference between CFD trading vs spread betting, is the way they are taxed. CFD trading is subject to capital gains tax, whilst spread bets are not. Spread betting also involves staking money per point of price movement. Whether you choose CFDs or spread betting, it’s important to understand their subtle differences.

Is CFD Trading In The UK The Same As Binary Options Trading?

Both CFD trading and Binary options are a type of financial derivative. However, they operate slightly differently. The main difference between CFD trading vs binary options is that CFDs involve exchanging the price difference of an asset, from open to close, whilst binary options allow you to buy or sell the right (but not the obligation) to trade at a fixed price, for a set period of time.

Is CFD Trading In The UK Profitable?

It is possible to make money with CFDs, however, leveraged trading can also lead to significant losses. Traders will need to practice, be disciplined and be patient in order to be successful at CFD trading in the UK.

What Are The Advantages of CFD Trading In The UK?

CFD trading allows your capital to stretch further by using leverage to put down a fraction of the full trade value. It is more flexible than other types of trading and comes with some tax benefits. But crucially, CFDs allow traders to profit in both bullish and bearish markets.

What Is A CFD Trading Platform And How Does It Work?

A CFD trading platform provides access to the online financial markets, where you can open, manage and monitor positions from your desktop or smartphone device. Trading platforms vary in terms of the specific features they offer, but many include automated trading capabilities and risk management tools.

CFD Trading: What Does It Mean?

CFD trading involves speculating on a price difference of an asset, such as a forex pair, without buying and selling the underlying asset. It’s offered by top online companies such as Trading 212.

Is CFD Trading In The UK Worth It?

Determining whether online CFD trading is worth it is entirely down to the trader’s preferences and experience. Once you have honed your skills and strategies, CFD trading can be profitable, but they are high-risk instruments that can lead to losses.