eToro Review 2026

eToro (specifically eToro UK Ltd in the UK) are an established online broker. The original creators of ‘social trading‘ – the strategy of sharing trading knowledge and giving people the option to follow other traders – and copy their trades. This is also known as Copy Trading.

This review is not relevant for US readers and does not reflect the services offered in the US.

“eToro make investing accessible. Whether you want to trade Apple, or the price of Gold – eToro enable retail investors to trade the financial markets with minimum fuss.”

eToro have always been an adaptive brand, looking for the markets that traders will want. They were quick to add cryptocurrency trading (as still offer huge depth in those markets), and the latest bio-tech advances.

They also developed cutting edge portfolio tools and copy trading options. This style of product development enabled them to grow rapidly, and expand the social trading offer.

Social trading requires volume of traders, there must be people to copy. eToro currently well over 5 million traders, meaning there is huge depth of trading knowledge and an active trading community.

The firm is regulated by the Financial Conduct Authority (reference 583263), which offers UK consumers peace of mind in terms of safety and security.

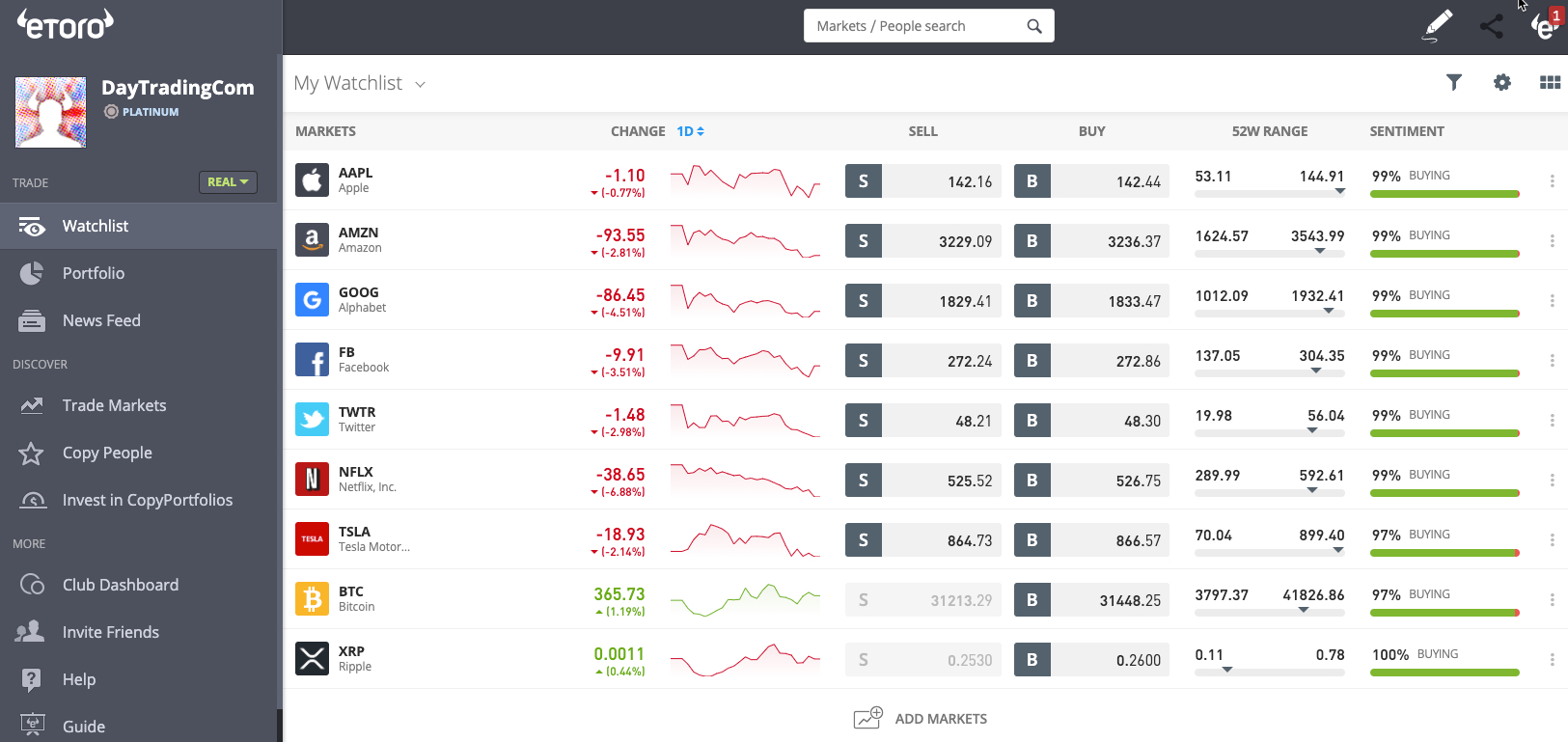

Trading Platform

The virtual portfolio (demo account) can be opened without any KYC checks or deposits. This provides quick access for traders to take a look at the platform risk-free, and see if it works for them.

The new trading platform has replaced the ‘Webtrader’ version which is no longer available.

The eToro trading platform is laid out with simplicity in mind. The windows are clear and uncluttered, but functionality is retained. No other platform removes the complexity of trading the same way eToro manage to.

There are various ways to open a trading window. The left hand menu gives users access to account details, watchlists and both the ‘Real’ and ‘Demo’ accounts. Trades can be made by choosing an asset from any of the visible lists.

Traders can also choose the ‘Markets‘ menu option. This grants access to the full range of assets available at eToro.

Asset choices can be filtered by category: –

- Stocks

- Commodities

- Currencies

- Indices

Further filters can then also be applied – by ‘Sector’ for example.

Choosing a specific asset (by clicking) will open up a new information window, including current trader sentiment, news and related options.

The ‘Trade‘ button opens a trading window where trade details such as size, stops and limits and the direction (buy or sell) are set.

This ‘trade’ window contains a lot of data and options, but the design ensures everything is clear.

The Buy and Sell buttons are at the top, followed by the market and finally the current value.

The daily price changes are also listed. On the right is a drop down list, from here traders can place an ‘order‘ for a certain price, or when the market is closed.

The default setting is ‘trade‘ and this is where the trade is placed immediately.

The trade amount field can be amended via the -/+ buttons, or overtyped. The information below the ‘amount’ field will update as that figure is changed;

Stop Loss

The Stop Loss field – the price where the trade will close if reached. This is an important risk management tool for limiting losses.

Leverage

The leverage field. Leverage will magnify both profit and loss so traders should make sure they fully understand the implications. European regulation currently limits the leverage offered on certain markets.

Units

This field shows the number of units the trade will open based on the amount, and the leverage

Take Profit

Take Profit – Is the price level at which the trader is happy for the trade to be closed, and the profit banked. This is useful when certain price targets form part of the trading strategy.

Stop loss and take profit points are not guaranteed.

When a user first opens an account, a platform ‘wizard’ runs traders through the trading platform and guides them through making a ‘virtual money’ trade.

This can be helpful to watch, just to learn the process.

How To Use Copy Trader

The most important aspect of the eToro offering however, is the copy feature.

If traders do not have the time of knowledge of certain markets, they can follow another trader who does. This is the key attraction of eToro.

A large group of people using eToro will not actually trade directly. They will set their account to invest in the same trades that other traders make. If a trader shows great ability trading forex pairs, then you can follow their trades and make all the same calls.

Choosing who to copy is the hardest part.

To find a trader, open the ‘People‘ menu option. This provides a huge database of all the traders on eToro.

A series of filters can then be applied to narrow down the choice.

Filtered by:

- Location – Where are they based?

- Assets – Which markets do they trade?

- Performance – Have they been profitable, and for how long?

- Recent activity – Are they active?

- Risk – eToro provide a unique risk rating for each trader.

- Trading Size – How much do they invest?

So if a user wants a UK based forex trader, making 20% profit annually – eToro can find any traders that match – in seconds.

Any traders on the shortlist can then be investigated further. Message boards, monthly trading performance and the current portfolio can be scrutinised.

If a suitable trader is found, the ‘Copy’ button opens up a new trading area.

This copy screen is clear and uncomplicated. A trader needs to enter the amount they wish to invest, plus a stop loss figure.

They need to decide whether to open all the trades that the trader being copied already has open – or none of them. Choosing none means waiting until new trades are opened.

Those are the only choices the copier needs to make. Selecting the ‘Copy‘ button commits that amount to copy that trader.

From that point, whenever the copied trader opens a new trade, the copier will also open the same trade, at the same prices.

The trade size will be relative to the amount the copier specified. So even if the expert trader is investing millions, someone with £100 can still copy them.

Traders who get copied , earn additional commission from the broker.

This is a crucial point, as it explains the attraction of eToro to seasoned traders too. A trader earns additional money based on how many traders ‘follow’ them. Win-win.

eToro also benefits from increased trading volume. They know winning players will trade more often – generating them higher income – so they want to see players making a profit.

Asset Choice

eToro boast a huge choice in assets. Stocks are a clear strength.

There are almost 300 companies from markets all over the world to trade.

In terms of forex, there are over 40 currency pairs, including all of the major Forex currencies.

Indices and commodities can also be traded, including the FTSE, Oil prices and Gold

Cryptocurrency trading via CFDs was halted by the UK regulator at the start of 2021 and is not available to retail investors in the United Kingdom.

eToro Fees

eToro make a small charge for leveraged positions held overnight, or over the weekend. This is standard practice for CFD brokers.

Brokers incur their own costs in keeping positions open. The larger the trade (once leverage is considered) the larger the fee will be.

For example a £1,000 position with no additional leverage will not incur a nightly charge.

Where the same trade had X5 leverage (so the exposure totals £5,000) then a nightly fee of £0.84 would apply.

The overnight fees are small, but are worth noting when traders plan leverage longer term trades.

Deposits are free, but withdrawals incur a £5 charge. There is also an inactivity charge if an account is dormant for 12 months. No positions will be closed due to inactivity however.

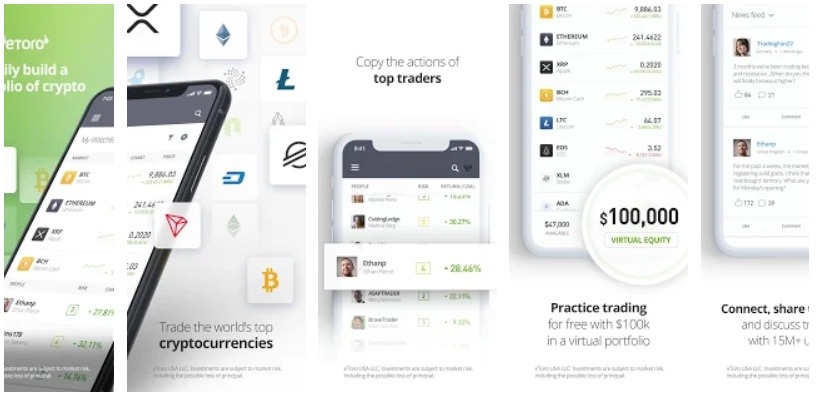

Mobile App

eToro deliver a free mobile application and developed it to maximise the operating platform, so the user experience is optimised for each device. The eToro iphone (iOS) version requires version 10.0 or above, while android needs version 5.1 and up.

The application mimics the look and feel of the etoro platform. The navigation is simple, and viewing areas large. All the assets and markets available of the full site are also on the app.

Full trading history is available, plus live prices. Full search options for assets or traders are included, so copy trading is still possible.

Deposits and withdrawals can be requested via the app, and research and charting features are also there.

The trading app makes managing a portfolio on the go no hassle.

Regular updates ensure the app is getting quicker and smaller (in terms of memory use) – these regular improvements, coupled with a focus on mobile trading, mean eToro deliver one of the best mobile trading experiences.

Deposit And Withdrawal Methods

There are a wide range of options to fund a trading account at eToro. Supported methods include:

- Credit / Debit card deposits (VISA, Mastercard etc).

- eWallets (PayPal, Skrill, WebMoney and Neteller )

- Wire bank transfer

There is a minimum withdrawal of $30, which is fairly typical.

A withdrawal can take up to 3 days. eToro do make withdrawal fee of $5 for each withdrawal made. This is expensive, and not a charge made by other providers.

Converting currency can also be expensive with charges ranging from 50 to 250 pips.

Withdrawals need to be made back to the same method as the initial deposit. This is to comply with Anti-money laundering laws. For the same reason, eToro also request certain ID documents before processing a withdrawal:

- Colour copy of passport, including signature

- Copy of a recent utility bill or bank statement (as proof of address)

- If paying with Credit card, a copy of front and back, with CVV covered along with final 8 digits of the main number.

Complaints

eToro does not generate many complaints. On occasion, traders are disappointed with the performance of a trader they have copied, but eToro are not responsible for that.

Delays with withdrawal can cause some issues, but new traders who complete the verification steps will ease the process when they do make a withdrawal.

Platform up-time and reliability is very strong.

Intro Video

Here is a brief video introducing eToro and Social trading;

Trader Benefits

eToro offer traders additional benefits:

- Charting– Advanced charts can be opened from any asset.

- Learn More – The trading community and educational tools can help a trader improve rapidly.

- News Feed – Buzz feeds on each asset ensures traders can stay up to date on events that might effect prices.

For those starting out, the ability to learn from others – and copy their trades – is a great selling point for eToro.

For experienced traders, the platform could perhaps be improved. While the platform is concise and clear, is does lack the features and research tools available on more advanced platforms.

CopyTrader™ System

eToro’s CopyTrader™ system is how the brand defines their copy trading features. It enables those who lack the experience or confidence to allocate funds to more profitable trades, and copy those trades in real time.

Popular Investor Program

The popular investor program allows eligible traders to rise up the eToro levels from Cadet to Elite and gain extra perks along the way:

- Monthly payments

- 1.5% Based on average AUC.

This is a great option for profitable traders to boost performance without risking additional capital.

CopyPortfolios™: Exclusively At eToro

CopyPortfolios™ have been pioneered by eToro.

There are two types of CopyPortfolios™:

- Top Trader CopyPortfolios – These grant access to a group of leading eToro investors in one go.

- Market CopyPortfolios – These bring together several assets based on a particular trading strategy

Top Trader Portfolio

Each fund is controlled by an algorithm to ensure the fund is balanced and optimal. Diversification and risk management are improved when investing via a portfolio.

The Copy portfolio provides the ability to follow a range of the best traders, based on performance and assets traded.

The fund allocates monies to each trader or asset based on performance. This allows those investing via the portfolio to relax, knowing the investments are being actively managed.

Market Copy Portfolios

A different portfolio is made up of a range of assets within one asset class, sector or category. So the portfolio might cover retail, pharma or banking for example. The portfolios can include ETFs, and will also cover different regions, so an investor can gain exposure to Japanese, European and US assets using a variety of portfolios.

These portfolios provide an excellent shortcut for time-short traders. The range of sectors, regions and indices is huge, so a trader can build a diverse investment package quickly, or gain exposure to exactly the area of the global market they want to.

The portfolios have proved very popular for this reason, and are being constantly expanded with more choices.

Crypto Copy Portfolios

There are also specific portfolios to get exposure to Crypto currencies. These invest in the major cryptos like Bitcoin and Ethereum but also Ripple, Litecoin, DASH and many others. It is a broad basket of alt-coins ensuring an accurate reflection of the sector.

The portfolio offers anyone bullish (or bearish) on blockchain technology, to take a view on the long term trajectory of alt-coins, without having to choose exactly which one will see widespread adoption (or collapse).

The portfolio is frequently analysed and auto-rebalanced by committee. The weighting is adjusted based on market cap size.

Yoni Assia, CEO and co-founder of eToro had this to say on the new release:

“This CopyPortfolio is the first of its kind globally providing investors access to the world’s biggest digital currencies in one innovative portfolio. For those who believe in the technology’s potential, this is an opportunity to invest in a straightforward and simple way.”

Cryptocurrency Wallet

eToro deliver their own cryptocurrency wallet. The wallet allows new and existing customers to buy and sell a range of cryptos, or to trade them and convert them into other alt-coins.

This innovation means that traders can buy the underlying asset, and not just speculate on the price via a CFD. This is an important difference, particularly in the UK, where trading crypto via leverage is not available to retail investors.

The app is available from both Google Play and the Apple App store.

Security is delivered via multi-layer protection. Users can see their historic blockchain transactions, but the private key (security algorithm) is kept hidden.

eToro have been at the forefront of crypto trading since the very start, and continue to lead the way in 2026.

eToro “How to” Guides and Further Details:

Do I pay tax on profits?

The general answer is “no”.

Traders should however, be aware of the position HMRC takes. If you consider trading as a full time occupation, then HMRC may view profits as a taxable source of income.

If you think you may reach a professional level of trader, then seeking professional clarification is your best option.

Regulation

eToro offer contracts for difference (CFDs). These financial products are regulated by the FCA (Financial Conduct Authority), so UK consumers get a strong level of protection when trading at eToro.

eToro (UK) Ltd represent the UK based arm of the firm. They are registered at Companies House.

Being regulated by the FCA ensures UK consumers are protected from negative balances, risk of default by the broker, and have suitable routes for dispute resolution.

Consumers can raise problems with the Financial Ombudsman Service, (in the case of a dispute which has not been resolved via the broker directly) or the Financial Services Compensation Scheme (If eToro UK Ltd cease trading for any reason).

An account holder can apply to be considered as a professional trader. This can mean increased levels of leverage and different access to trading products. It also means however, that the protections offered above are removed. A professional trader is acknowledging they know the risks they are taking, and do not need regulatory protection.

Trading hours

Assets can only be traded when the markets they are traded on is open. eToro operates 24 hours a day, but if a market is closed, then certain assets will not be available.

For example, assets traded on the London Stock Exchange will be available during UK trading hours – but not when the market closes.

Forex markets operate 24/5, but trading volume differs considerably throughout the day, so get to know the markets you want to trade.

When markets are closed, it is still possible to open ‘orders’ which will then be fulfilled when the market is next available – if the price hits the level you set.

How To Copy Traders

Finding traders is a key process in the eToro offering. Time and effort spent on research is crucial. Copying the wrong traders will end badly.

So how do novices find the best traders?

On the Copy Trader screen, there are an array of filters to start the process. These include:

- Location

- Risk Level

- Market

- Profit / Performance

- Timeframe

- Trending

- Most Copied / Top Investors

The ‘Most Copied’ list is an obvious one. These traders became popular for a reason – but recent activity still needs to be checked.

Risk profile is a metric that eToro calculate based on the markets traded, and the size of trade relative to portfolio size, among other things. This ‘Risk Score’ is covered in detail later in the article.

Short term profits are enticing, but dangerous to use in isolation. A single trade recently may hide significant losses previously. To find the consistent traders, set the ‘timeframe’ filter for a longer term period.

With a few filters applied, it is now possible to shortlist some potential traders to copy. Each trader can be researched in detail, including individual trades and profit per month. This is a good method for spotting reliable performance.

There is no clear cut answer on which traders to copy. Appetite for risk is important. Some traders might deliver small, consistent monthly profits, others may be very volatile but end up being more profitable long term. Each trader must decide how much risk they are content to take.

Research and diligence at this stage will pay-off in the long term.

The confirmation screen is where a user enters the amount they want to commit to copying a particular trader. Investments will then be ‘scaled’ based on this budget, and that of the copied trader. So a small investor can still copy someone trading millions!

Step by step guide to Copying traders at eToro

- Open the ‘Copy People’ menu option.

- Use the filters to narrow the search.

- Review the shortlist, and the lists provided by eToro.

- Research individual traders. Look for consistent profits.

- Select the ‘Copy’ icon.

- Enter the amount to invest copying this trader.

- Confirm and check the details within the Portfolio

How to trade on the eToro platform

The platform is clear and not intimidating, and opening a trade will quickly become routine.

There are just three elements to each trade:

- Identify your asset or market.

- Click ‘Buy’ or ‘Sell’ to open a trade ticket (Or use ‘Trade’).

- Review the trade details, and confirm with the ‘Open trade’ button.

To find a market, us the personal watchlist, or start a new search:

Click on ‘Trade Markets’. This shows popular, or most traded, assets. Filter by category such as ‘Stock’, ‘Indices’ etc. The refine the search further by ‘Sector’ or any other filter.

Once you have your asset, open the trade ticket. Set the amount and any stop loss or take profit price levels. You can also amend the leverage applied. Any overnight or weekend fees are listed below the ‘Open Trade’ button.

Confirm via the ‘Open Trade’ button. You position will then display in your portfolio area. It will always open with a slight loss, as the spread must be made up. A trader buys at the higher end, and closes at the lower.

Risk Scores At Etoro?

The eToro risk score is a rating that eToro allocate to each trader. It ranges between 1 and 10, with 1 as very low risk, and 10 very high risk.

The rating is made based on a range of things including:

- Diversification (More diverse or negatively correlated trades = less risk)

- Volatility of markets traded

- Leverage used

- Trade size relative to portfolio. (A low % risked on each trade is low risk, a trader putting everything they have on 1 trade is high risk!)

For example, if a trader has used all their equity on 4 trades, and all four use the maximum leverage and are based on GBP rising in value, they will a high eToro risk score.

If another trader only ever has 50% of equity used in trades, has a diverse portfolio and does not use leverage, they will get an ultra low risk score.

These values offer a trader a quick way to compare risk profiles of other traders, but each person will know their own tolerance for risk.

Fees

eToro fees vary based on the market. Different forex pairs will attract different spreads. They will also change based on volatility or events.

Overnight fees only apply where leverage is used, but knowing the fee in advance is difficult, particularly if the timescales for holding the position are not known. Ultimately, they will not have a large bearing on the success or failure of the trade.

eToro charge a withdrawal fee. This is a flat $5 on all withdrawals. This is a clear negative for eToro, it is rare for brokers to make charges for withdrawals.

eToro also levy a charge on dormant accounts. An account is ‘dormant’ if no activity takes place for 12 months. The fee is $10 per month. eToro will not close trades in order to pay this fee.

__

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational pur poses only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Top 3 eToro Alternatives

These brokers are the most similar to eToro:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- XTB - Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

eToro Feature Comparison

| eToro | IG | Pepperstone | XTB | |

|---|---|---|---|---|

| Rating | 4 | 4.5 | 4.8 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | $10 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5, cTrader | - |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | 61% of retail CFD accounts lose money. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. |

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

72% of retail investor accounts lose money when trading CFDs |

70% of accounts lose money when trading CFDs with this provider. |

| Review | eToro Review |

IG Review |

Pepperstone Review |

XTB Review |

Trading Instruments Comparison

| eToro | IG | Pepperstone | XTB | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

eToro vs Other Brokers

Compare eToro with any other broker by selecting the other broker below.

Popular eToro comparisons:

|

|

eToro is #12 in our rankings of CFD brokers. |

| Top 3 alternatives to eToro |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs |

| Demo Account | Yes |

| Minimum Deposit | $50 |

| Minimum Trade | $10 |

| Regulated By | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Debit Card, Klarna, Neteller, Rapid Transfer, Skrill, Sofort, Swift, Trustly, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Aluminium, Cannabis, Cattle, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Iron, Lead, Lean Hogs, Lithium, Livestock, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc |

| CFD FTSE Spread | 1.5 |

| CFD GBPUSD Spread | 1.9 |

| CFD Oil Spread | 0.05 |

| CFD Stocks Spread | 0.57 (Apple) |

| GBPUSD Spread | 1.9 |

| EURUSD Spread | 0.9 |

| GBPEUR Spread | 1.3 |

| Assets | 55 |

| Currency Indices | USD |