Oanda Review 2025

|

|

Oanda is #15 in our rankings of CFD brokers. |

| Top 3 alternatives to Oanda |

| Oanda Facts & Figures |

|---|

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, ETFs, Spread Betting |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | OANDA Trade, MT4 |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, KNF, MAS, CIRO, FFAJ, BVI, CIRO |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader and OANDA API |

| Islamic Account | No |

| Commodities |

|

| CFDs | You can speculate on popular financial assets covering forex, commodities, indices, metals and bonds. You can get started with $0 minimum deposit, making the broker a good pick for beginners. There’s also over 130 technical indicators available collectively in the MT4 and OANDA Trade platforms. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 1.4 |

| Oil Spread | 3.0 |

| Stocks Spread | 12 (Apple Inc) |

| Forex | OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds. |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 0.9 |

| Assets | 68 |

| Stocks | OANDA expanded its suite of stocks in 2024 with more than 2,200 shares now available from leading stock exchanges, including blue chip firms like Apple and Meta. There are also no commissions on US stocks and traders benefit from free insights and market reports from Dow Jones and Oanda’s MarketPulse research tool. |

| Cryptocurrency | OANDA offers trading on leading cryptocurrencies, including Bitcoin. You can place trades in the app hassle-free and practice in the unlimited demo account. The broker offers guaranteed stop-loss orders to help protect you against crypto market volatility. |

| Coins |

|

| Spreads | $100 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Spreadbetting | OANDA offers spread betting via OANDA Europe Ltd to UK and Ireland residents only. You can trade over 100 assets with no commission and no minimum trade size. Spreads are also competitive. The FTSE 100, for example, is available from just 1 point and the GBP/EUR from 0.8 pips. |

OANDA is a global broker that accepts UK investors for trading on forex and CFDs. The brokerage offers trading via their own platform or MetaTrader 4 (MT4), plus demo accounts and spread betting. It also has a variety of deposit and withdrawal options and mobile apps. Our OANDA review will help you decide whether the forex broker is right for you.

About OANDA

The OANDA Corporation is based in the US but caters to traders in almost 200 countries worldwide. The firm was founded in 1996 and has provided online access to the financial markets since 2001. The OANDA Europe Ltd branch is registered at a London office location and is regulated by the Financial Conduct Authority (FCA).

Trading Platforms

OANDA clients can choose between three types of platforms to execute an FX day trading strategy. Review forums often point to the platform choice as a primary reason for joining this broker. Traders can access the live markets after registration and login using their account ID. The firm is a market maker, as opposed to an ECN or no dealing desk broker.

OANDA Trade Desktop

OANDA Trade is this broker’s own brand online platform. It is available to download from the firm’s website for Windows, Mac and Linux and offers a sophisticated suite of technologies to enhance your strategy.

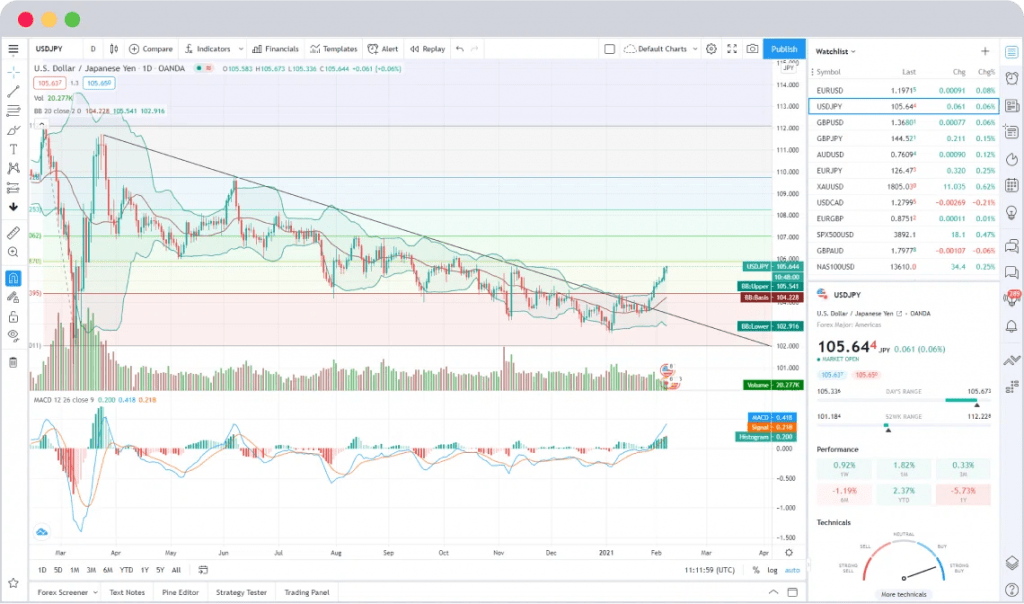

Advanced charting:

- Charting tools powered by TradingView

- More than ten chart types and layouts

- Place orders directly from charts

- 65+ technical indicators

- 50+ drawing tools

Technical analysis:

- Web-based application powered by AutoChartist

- Automatic pattern recognition and quality indicators

- Continuous intraday scanning and volatility analysis

Personalised layouts:

- Up to eight charts in one layout

- Set up defaults for certain trades

- Choose your most frequently used tools to display

OANDA Trade Desktop

OANDA traders should note that although hedging is not prohibited on the platform, an additional sub-account is required to use this strategy.

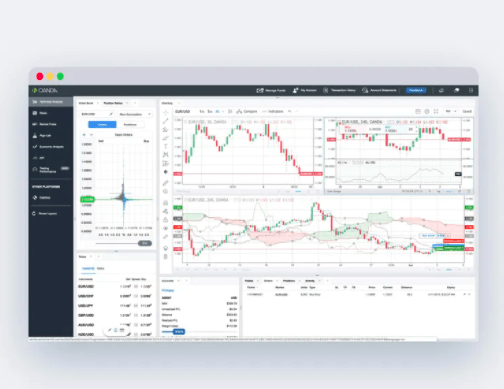

OANDA Trade Web

The OANDA Trade web service is an award-winning platform that clients can access through any browser, after broker login. The platform offers rapid execution and an intuitive interface, alongside a range of useful trading tools:

- Innovative design to view pending orders and current positions

- Risk management orders to protect your trades from volatile markets

- Advanced technical analysis with order book overlays and a news aggregator

- Unbiased trading behaviour pattern analysis to identify strengths and weaknesses

OANDA Trade Web

Clients can also access the forex order book, a 24 hour summary of open orders and positions held by OANDA customers. Many traders use this as an indicator, as it may correlate with depth of market and sentiment. Traders can also utilise open, long-short, and historical position ratios for a similar purpose.

Users can apply one-click trading and a range of order types, though the broker does not offer guaranteed stop-loss orders to UK traders.

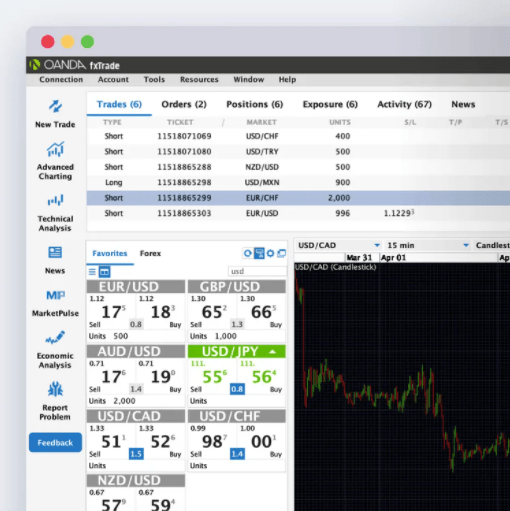

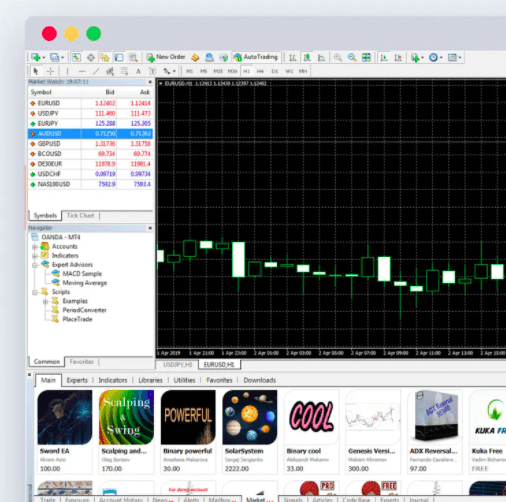

MetaTrader 4

OANDA customers can also opt to trade through MetaTrader 4 (MT4), a program that clients can download to Windows, Mac and Linux PCs. MT4 is a market-leading trading platform trusted by millions of forex investors worldwide. The platform has the following features:

- Over 50 built-in indicators

- 11 drawing tools and nine chart types

- Nine timeframes and multiple displays

- Clear support and resistance levels on charts (using OANDA plugin)

- Open order book indicator to capture market sentiment (using OANDA plugin)

MT4

MT4 users can also use Expert Advisors (EAs), known as trading bots. These support automated trading and allow backtesting of strategies.

OANDA investors can get premium upgrades for MT4, such as an alarm manager to trigger trades, an increased open order refresh rate of five minutes, and 28 new tools and indicators. Traders can also access depth of market pricing using the plugin to gain tighter spreads.

Note that MetaTrader 5 (MT5) integration is not currently offered by OANDA to UK clients.

TradingView

Investors can also opt to execute positions using the TradingView platform. The platform includes social community features, a customisable alert system, strategy identification and testing, plus powerful technical analysis. It contains useful tools for OANDA traders such as the volume indicator alongside scalping and hedging analysis.

TradingView

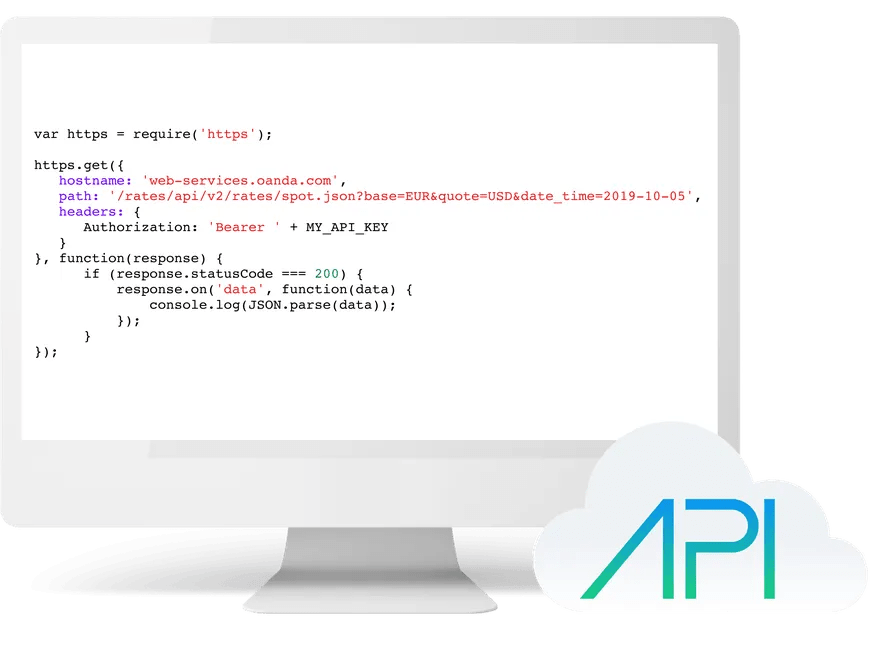

API

OANDA provides a trading API in their Developer section that allows clients to make requests directly to the platform, using a supported language like Python. Investors can use this to trade instruments and download historical tick data back to 2005. Many tutorial videos are available online to get started.

OANDA API

Markets

OANDA offers a wide range of markets and instruments to its UK clients:

- Forex – 70+ currency pairs

- Indices – 16 indices including NASDAQ 100

- Metals – 20+ products including gold and silver

- Commodities – Oil, gas and softs

- Bonds – Six government bonds

Our review of OANDA was pleased to see the extensive instrument list available to traders. The broker also offers spread betting, and investors can take a position on over 100 instruments.

OANDA does not offer Bitcoin (BTC), Ethereum (ETH) or any cryptocurrency trading. Adding the ability to trade Bitcoin CFDs or other crypto assets may appeal to customers but such retail products are currently banned by the FCA. Binary options and futures trading would also bolster this firm’s asset range.

Trading Fees

Forex spreads are competitive and start from 1 pip on EUR/USD. Live spreads on this pair were around 2.4 pips at the time of writing. Trading fees for this broker include financing charges (also known as rollover, swap rates or overnight fees), which are debited/credited if you have an open position on your account as of 5 pm ET.

OANDA clients are also charged an inactivity fee of up to £10 per month if their account sees no trades for over 12 months. Users who restart trading can request a rebate of up to three months of these charges.

This broker does not exact commission on trades, as its profit is built into the pricing of its spreads.

Leverage

OANDA offers leverage to its traders, though clients should note that margin levels are set by the FCA and cannot exceed 1:30 for retail investing. The broker offers a margin call calculator, which can determine whether a position will require more collateral or trigger a closeout. OANDA also runs a lot size or unit calculator to work out the maximum number of units that can be traded with your available margin.

Leverage limits are as follows:

- Forex – Between 1:30 and 1:10

- Indices – Between 1:20 and 1:10

- Metals – 1:20 for gold and 1:10 for others

- Commodities – 1:10

- Bonds – 1:5

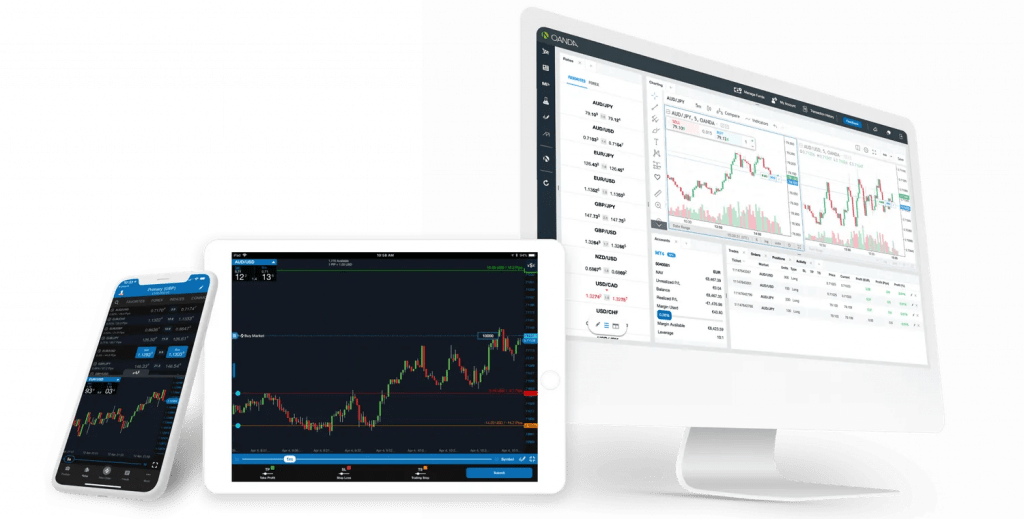

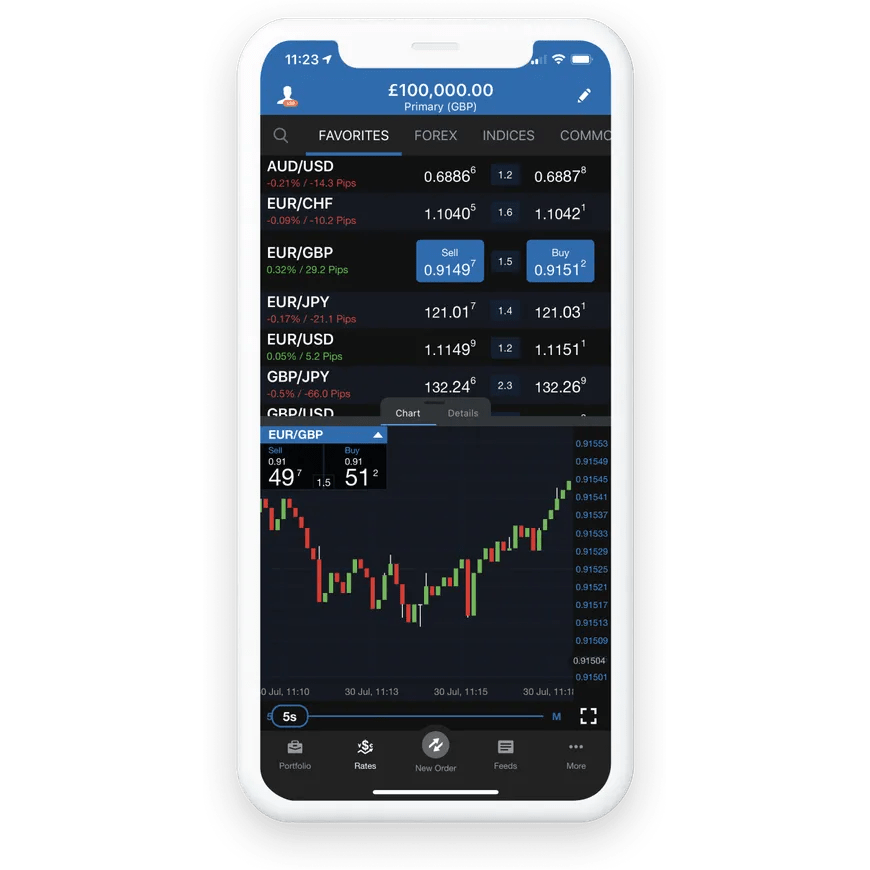

Mobile Apps

The OANDA fxTrade mobile app is available for Android, iPhone, and tablet devices like iPad. User review comments are very positive and clients can enjoy trading on OANDA’s full range of CFD markets. Features of the app include:

- Alerts and price signal push notifications

- Sophisticated mobile charting with 50+ technical tools

- Trader performance analytics to track behaviour and history

- Customisable interface including preferred financial instruments and unit size

OANDA app

The MT4 smartphone app is also fully-featured and contains all the key tools for efficient operations on the financial markets. Investors can engage with one-click trading and a full set of order types, plus useful indicators and technical analysis.

Payments

OANDA clients can add money to their account through the ‘My Funds’ section, which is accessible after the sign-in page. Traders can choose between credit and debit cards, PayPal, and bank wire transfers for deposits and withdrawals. Our review found that there are no minimum deposit requirements and adding funds is fee-free. Traders can generally expect clearance times of one business day, though this may vary for bank transfers.

Withdrawal times are quoted as up to six business days for card, one business day for PayPal and two business days for bank transfer. Fees are only charged for bank transfers and are £10 for the first withdrawal each month and £20 thereafter.

Demo Account

Potential OANDA customers can sign up for a demo account for a free trial of the platform. The practice account allows traders to login and download the software, giving them access to the financial markets. OANDA clients can also switch to a MetaTrader 4 demo account to get experience on both platforms.

Regulation Review

OANDA is a major broker that attracts excellent ratings and reviews. The firm has regulation from the UK’s Financial Conduct Authority and offers negative balance protection to retail clients. In comparison to other brokers, like OANDA vs FXCM or IG, the firm offers excellent execution and a broad range of assets.

Additional Features

OANDA clients can access news from providers like Dow Jones FX Select and a full economic calendar for market updates. The broker also hosts tutorial videos and guide pages, alongside a series of educational webinars.

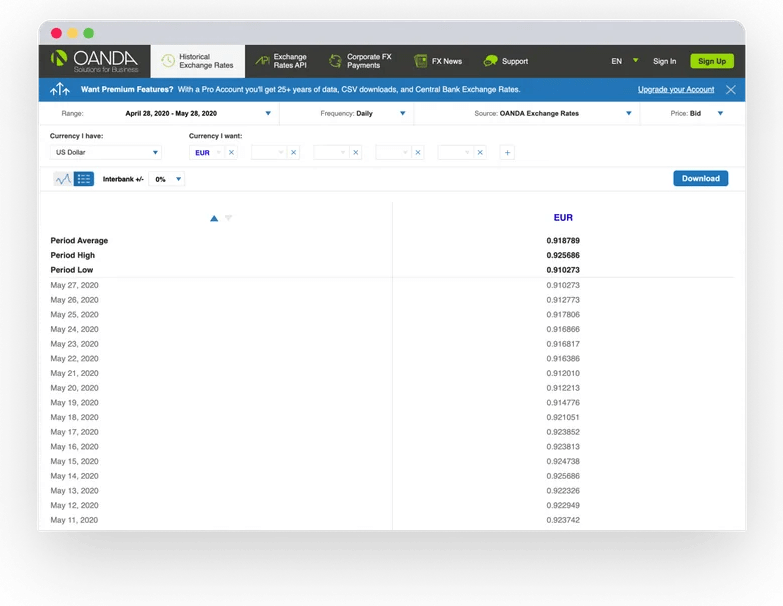

OANDA offers the Historical Exchange Rates tool, previously called FX History. This allows users to compare the average exchange rate chart of up to five different currencies using historical data back to 1990. The currency data feed includes monthly and yearly average rates.

OANDA FX rates

The broker also hosts the OANDA Live Exchange Rates page. This section provides average live (spot) FX rates for currency pairs. Corporate clients interested in forward rates can use OANDA’s Exchange Rates API to obtain this and other useful data.

OANDA also publishes its own historical and recent spreads and quotes in an easy-to-use tool. Traders can check the spread history of a wide range of instruments to help them speculate on price direction.

Finally, OANDA also operates extensive money transfer services, separate from its brokerage operations.

OANDA Accounts

Traders can open two different live account types, termed Standard and Premium. Both types allow users to open a spread bet sub-account for tax-free trading and have a minimum lot size of 1 unit (also known as nano lots). Standard account members enjoy institutional-grade execution speeds and the full suite of trading platforms.

Premium accounts require a minimum balance of £20,000 and have the following advantages:

- Priority service queues

- Unlimited free wire transfers

- Dedicated relationship manager

- Faster MT4 open order indicator refresh rate

Note both Standard and Premium solutions can be used as business or joint accounts.

Benefits

Choosing to trade with OANDA has several benefits:

- FCA regulation

- Currency heat maps

- No minimum deposit

- Spread betting on over 100 instruments

- Choice of three advanced platform types

- Easily accessible historical spread and exchange rate data

Drawbacks

Clients can also expect some disadvantages:

- No welcome deposit bonuses

- No cryptocurrency or binary options trading

- Wider spreads than some other major brokers

Trading Hours

The OANDA website is open 24/7 for research and information. Trading and market hours depend on the asset of interest and time zone, though the forex market usually operates 24/7. OANDA may also have server downtimes during certain holiday trading hours and maintenance periods.

Customer Support

Traders can contact customer service for help and support with issues like withdrawal problems or to close an account. Contact details are as follows:

- Phone number – +44 20 3151 2050

- Email – frontdesk@oanda.com

In addition to the hotline, traders can use the live online chat to get in touch from 4 pm Sunday to 6 pm Friday ET.

Client Security

OANDA stores all personal information on secure servers and uses strict security procedures to prevent unauthorised access. The broker does not offer two-factor authentication for account access, which may be a valuable addition to improve client protection.

OANDA Verdict

OANDA is a large forex and CFD broker that offers an excellent trading experience through a choice of MT4, TradingView and the OANDA Trade platforms. Clients can enjoy spread betting, demo accounts and fee-free funding. Beginners will be interested in the zero minimum deposit requirements while advanced traders can utilise historical data to inform their strategy.

FAQ

Is OANDA A Market Maker?

OANDA is a market maker and not an ECN broker. Market makers play an important role in creating liquidity in the financial markets.

Is OANDA A Good Forex Broker?

OANDA is regulated by the Financial Conduct Authority (FCA), a reputable body and holds several other foreign licenses. This regulatory oversight contributes to OANDA being a reliable and trustworthy broker with negative reviews rare.

What Is The Minimum Deposit At OANDA?

There is no minimum funding amount to open a Standard account, though high net worth clients with a £20,000 balance can access Premium features. Customers can also practise on a demo account and use the trading platforms with virtual funds.

What Assets Are Available At OANDA?

OANDA customers can trade a wide range of instruments including forex, gold, oil, and bonds. Traders can also place spread bets. At present, UK clients cannot access cryptocurrency markets.

What Platforms Can I Use At OANDA?

Customers have the choice of three platforms – OANDA Trade, MT4, and TradingView. OANDA Trade and MT4 can be accessed as desktop solutions, on a browser, or via mobile app.

Top 3 Oanda Alternatives

These brokers are the most similar to Oanda:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Oanda Feature Comparison

| Oanda | IG Index | Pepperstone | Swissquote | |

|---|---|---|---|---|

| Rating | 4.3 | 4.7 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, ETFs, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $0 | $0 | $0 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, KNF, MAS, CIRO, FFAJ, BVI, CIRO | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Oanda Review |

IG Index Review |

Pepperstone Review |

Swissquote Review |

Trading Instruments Comparison

| Oanda | IG Index | Pepperstone | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | Yes | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Oanda vs Other Brokers

Compare Oanda with any other broker by selecting the other broker below.

Popular Oanda comparisons: