Scalping Trading Strategy

A scalping trading strategy involves executing fast-paced trades with extreme accuracy. The aim is to get in and out of a trade quickly, making just a few pips on each position. Over time the pips accumulate, creating larger profits. In this article, we dive into the best 5 scalping strategies that work across multiple assets, including forex, stocks, gold, futures and options.

Scalping Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

Established in 2024 and headquartered in Seychelles, Bullwaves is a MetaTrader-only broker offering access to a modest collection of 250+ assets including forex, metals, indices, and newer additions like stocks and ETFs. Traders can choose from three accounts; Classic, VIP and Elite, catering to different experience levels and budgets.

-

Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

-

Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

EagleFX is an ECN/STP broker that offers spot forex and CFD trading on a small collection of 170+ assets to active traders worldwide. The catch is that it’s registered in the weakly regulated jurisdiction of the Commonwealth of Dominica, providing limited safeguards.

-

Tradeview is an offshore forex and CFD broker based in the Cayman Islands and regulated by CIMA. Traders can access over 5000 instruments with a minimum deposit of $100. There are several third-party platforms on offer, including MetaTrader 4 (MT4) and cTrader.

-

Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from four accounts (Classic, Silver, Gold, VIP) with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees, though these don’t compensate for the weak oversight from the IFSA and paltry education and research.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Amega is an offshore STP broker offering CFD trading fon forex, stocks, indices and commodities with very high leverage up to 1:1000 and a zero-commission pricing structure. Traders access markets through the MT5 platform and can test the broker's services through a demo account.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

Ingot Brokers is a multi-regulated brokerage established in 2006. The broker offers CFD trading opportunities on 1000+ instruments including forex, stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers both raw spreads and commission-free account options.

-

SageFX is an offshore, unregulated CFD broker that offers highly leveraged trading on forex, stocks, commodities, indices and crypto via the TradeLocker platform. Traders can access commission-free trading or an ECN account with tight spreads. While the broker's regulatory status is weak, it does provide segregated accounts and two-factor authentication.

-

FinPros is an offshore broker that provides CFD trading on 400+ instruments with high leverage up to 1:500. This is a reliable bet for traders seeking offshore options, with strong security measures, negative balance protection and segregated client funds. The extra features including trading tools and commission-free stocks make this a good choice for beginners, and experienced traders will appreciate tight spreads.

-

xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

-

Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

-

Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

-

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits.

-

Coinexx is an unregulated broker that provides leverage up to 1:500 on forex, commodities, indices and cryptocurrencies with deep liquidity, pure ECN spreads and negative balance protection. The broker uses crypto as base currencies and has low minimum deposit requirements of 0.001 BTC.

-

AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on trading strategies.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

SimpleFX is an online broker specializing in CFD and cryptocurrency trading, with multi-currency accounts, STP execution, low pricing and no minimum deposit. Bringing innovation and gaining recognition at numerous industry events since 2014, SimpleFX now caters to retail traders from over 190 countries, boasting a client base exceeding 200,000 active users.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

How To Use A Scalping Trading Strategy

A scalping trading strategy works by holding positions over a very short time frame, typically around 1 – 5 minutes. The system is a type of day trading strategy as no position is ever held overnight. Traders aim to close a position once they are in profit, making only a few pips each time. These short, sharp trades are made frequently enough so that one or two pips can turn into 50+ pips per day.

Manual Or Automated

Scalping can be executed manually or using an automated trading robot. Robots, or Expert Advisors (EAs) as they are known, are often preferred because they can open and close a position much quicker than a manual trader can.

Speed of execution is vital in scalping as the profits per trade are relatively low. Just as profits can rack up quickly, losses can too – so accuracy is crucial. EAs are based on an algorithm written in a coding language such as C+ or Python. They look at data points and are programmed to execute a trade based on logic, rather than human emotion or feeling – another key factor in the success of a scalping trading strategy.

Liquidity Of The Asset

A scalping trading strategy can be used with any tradable asset, such as cryptos, stocks or commodities like gold. But it is most popular in forex. This is due to the liquidity of the FX market. Scalpers usually trade only the most liquid currency pairs, such as the USD/EUR or JPY/USD.

They’ll also be aware of the best time frame for each asset. For example, the EUR/USD is generally traded between 7 am and 8 pm GMT Monday to Friday, but it is most liquid between 1 pm and 4 pm GMT when volumes pick up dramatically, making this the ideal time of day to scalp.

Tight Spreads

Scalping is profitable for those who can hold their nerve and execute positions quickly. But it also relies on brokers having the tightest spreads. There are some scalping trading strategies that will not work with spreads above 2 pips as this leaves limited room for profit. As a result, traders should shop around for the best rates.

Best Scalping Trading Strategies

When considering how to create your own scalping day trading strategy, it’s important to consider your options. We’ve listed 5 of the best strategies below to help you find one that works for you.

Relative Strength Index (RSI)

The RSI is an oscillating indicator often used in scalping trading strategies. It tells a trader when the market is overbought or oversold. When the RSI value is over 70, this suggests the market is overbought. This means the price is higher than it should be and traders may want to sell before it drops back down to its expected value. When the RSI value is under 30, this suggests the market is oversold and the price is lower than it should be. Some analysts choose to operate on more extreme RSI values of 80 or 20.

RSI

The RSI Index has been known to extend way beyond the 70/30 limits, and so it is advised that traders supplement this indicator with other momentum or trend indicators to avoid errors. Traders should also set a stop loss to cover against positions that could wipe out profits from previous scalping trades. For example, an SL of -6 pips is a good place to start but should be regularly reassessed and increased or reduced as necessary.

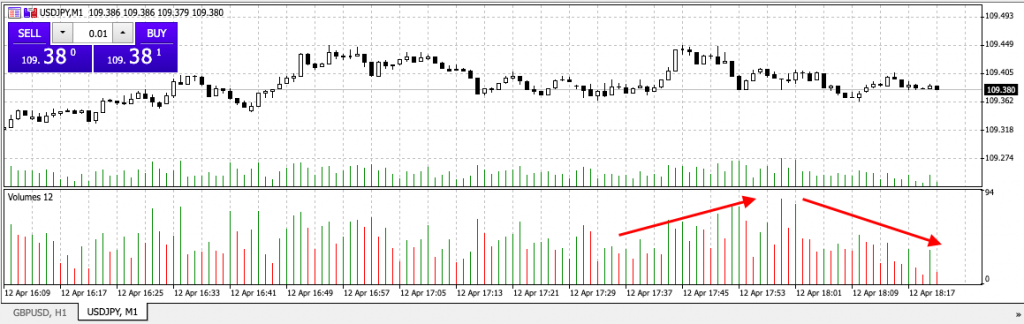

Volume & Price Action

Price action trading and scalping go hand in hand due to the short, sharp decision making required. A volume indicator can tell you which way the market is heading and so volume and price action can be paired together to form a scalping trading strategy.

Volume

If the volume traded in an asset is reducing, the market is slowing. This could indicate an imminent trend reversal, or it could mean a short break before it continues to move again. Price action involves reading the market for these changes, making a prediction based on the movements and trading accordingly.

Moving Averages

A moving averages (MA) scalping trading strategy is another good option. Add the MA indicator to a short timeframe chart. Compare the moving average for a shorter and a longer time period (EMA-5 and EMA-20 will work). Once the EMA-5 crosses the EMA-20, you have an idea of which direction the trend will move in and can take a position in this direction.

Moving averages

Be sure to close your position within the 20 minute time frame and have stop losses set up in case the trend doesn’t emerge.

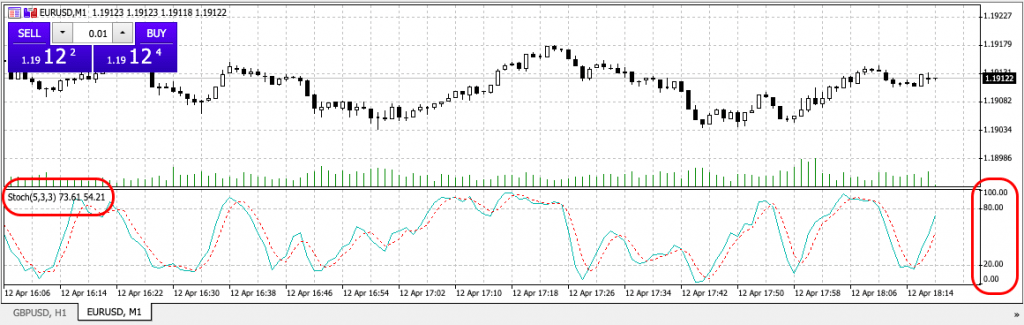

Stochastic Oscillator

The stochastic oscillator is a type of momentum indicator that assesses the random probability distribution. This means it looks at the current price in relation to its range over a period of time. Just like the RSI indicator above, it will give a number between 0 and 100 which will indicate the likelihood that an asset is overbought or oversold.

Stochastic Oscillator

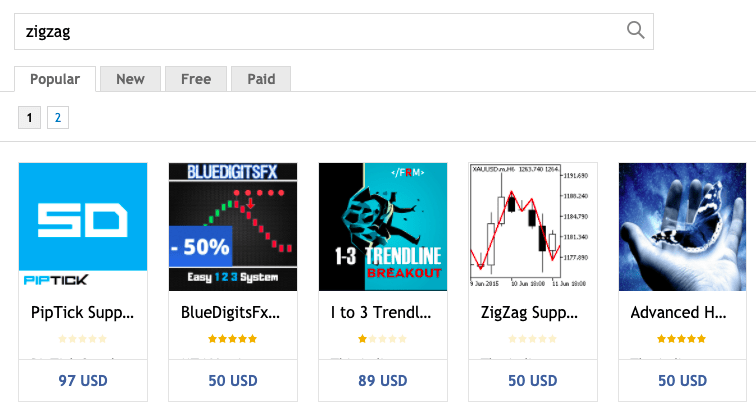

ZigZag Strategy

The ZigZag indicator helps traders to identify trends. When the forex price moves more than a certain percentage from your pre-chosen amount, the indicator will plot points and create a straight line on the chart. These lines indicate a swing high or low greater than 5%.

ZigZag

In this way, it removes minor price movements to make trends more easily visible. It is usually combined with another indicator, like the Elliot Wave, as it helps traders identify where each wave is positioned within the overall cycle. The ZigZag indicator is not provided by default on MT4 and so it will need to be downloaded from the MetaTrader Market.

Tips For Implementing A Scalping Trading Strategy

Check Your Broker Is Suitable

Brokers that are prone to slippage are not suitable for scalping trading strategies. Slippage is when a trade is executed a few pips away from the intended buy or sell price. For a scalping trader operating at such minute profits, this could be the difference between a trade concluding in the red or black. Look for brokers that can guarantee execution prices. Also note that some brokers do not allow scalping trading systems on their platforms.

The Right Environment

It’s vital that your trading operation is suitable for a scalping trading strategy. This means having the basics in place, such as a fast internet connection and no interruptions. It may seem overly simple, but there’s no room for error when scalping trading.

The Correct Charting Time Frame

Scalping trading strategies involve very small time frames. Some traders prefer to use tick charts, but one and two-minute charts are also popular. For beginners, it’s recommended that you start with a 5-minute chart until you’ve built enough practice to progress to shorter time frames.

Final Word On Scalping Trading Strategies

The best scalping system will minimise the likelihood of error by ensuring their broker and operations are capable of fast-paced execution. It will utilise indicators where appropriate, ideally using one of the 5 simple scalping trading strategies above. Also, it will leave emotional or knee-jerk reactions at the door.

Now you’re armed with the basics, you can start to build your own forex or stock trading strategy for scalping. Plus, if you’re interested in learning more, there are plenty of scalping trading strategy books and pdf guides available for download which will help you curate more advanced techniques. They’ll take you beyond the top 5 listed above to help you find a scalping trading strategy option that works for you.

FAQ

Is Scalping A Day Trading Strategy?

Yes, all scalping is day trading as it involves opening and closing a position within a very small time frame – usually a matter of minutes. Trades are short and sharp, just like a scalpel, with the aim of generating a few pips profit per position. However, not all day trading is scalping, there are many other day trading strategies out there and scalping is just one of them.

What Is The Best Scalping Trading Strategy?

This depends on your experience, risk appetite and market conditions. Not all scalping strategies work for every trader so there is no ‘best’ strategy. Practice on a demo account and find out which works for you. Once you’re happy that you’re making a profit, you can have a go with real funds.

Is Scalping A Good Trading Strategy?

Scalping can be a hugely successful trading strategy for the right trader in the right conditions. Those undertaking a scalping trading strategy should maintain a laser focus on accuracy and limit exposure where possible. They should choose a broker with guaranteed execution prices and an asset with sufficient liquidity. Implementing these will increase the likelihood of a successful scalping trading strategy.

Is Scalping Suitable For Beginners?

Yes, scalping is a great strategy for beginners because its main premise involves limiting exposure to loss. Trades are only open for a few minutes, so the likelihood of large losses is very low. This means beginners can practice creating profitable trades, while steadily building both profits and expertise.

How Does Scalping Trading Work?

The scalping trading strategy uses short, sharp and frequent trades to generate a couple of pips with each position. Traders use indicators to identify trends in an asset’s price movement and buy/sell based on this. Over time, the pips can accumulate, resulting in large scale profits.