Scalping Forex

Scalping the forex market is a lucrative trading strategy that requires dedication and time. By making many quick, large trades over the course of a day, scalpers steadily accumulate significant profits. This guide will discuss the benefits and drawbacks of scalping forex, how you can become a scalper, plus other key tips and definitions.

Best Scalping Forex Brokers

-

Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

-

XTB provides access to 70+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

-

Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

-

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

-

FxPro offers 70+ currency pairs but no minors and stands out with its ultra-fast execution speeds and tight spreads averaging 0.45 pips on EUR/USD. Forex traders can also build test and deploy short-term trading strategies on the industry-leading MT4 software, with expert advisors (EAs) for algo trading.

-

IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

-

FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

-

Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

-

City Index is one of the most trusted forex brokers, providing an above-average selection of 80+ currency pairs alongside tight spreads from 0.7 pips, trading alerts, and terrific insights into FX markets, with 99.99% of trades successfully executed.

-

Axi’s 70+ currency pairs is its strongest market offering and beats out rivals like AvaTrade, which offers only 50+. Combine this with an elevated MT4 offering through the NextGen add-on, and Axi remains an excellent broker for forex traders.

-

IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

-

Plexytrade presents major, minor, and exotic forex pairs for trading, with leverage reaching 1:2000 and raw spreads starting from 0.0 - an enticing proposition for advanced traders seeking gains from minor price shifts. However, the downside lies in the limited selection, with only 41 currency pairs available, significantly fewer than the 100+ forex assets at IG.

-

Bullwaves has expanded its forex offering, now providing more than 100 major, minor and exotic currency pairs on the advanced MetaTrader 5 platform, which is home to a sophisticated charting package and backtesting capabilities.

-

RedMars strongest investment category is forex with more than 50 currency pairs, from majors to minors and exotics. Spreads start from 0.0 pips, catering to active currency traders, and leverage can reach 1:500. However, there are no forex heatmaps or research tools to support aspiring forex traders.

-

UnitedPips supports trading on over 40 major, minor and exotic currency pairs. To help inform trading decisions, it offers daily market analysis with fundamental and technical insights into prominent currency pairs like AUD/USD and EUR/USD.

-

Capitalcore offers a modest selection of around 35 currency pairs, which is very limited compared to CMC Markets' 300+ pairs. Spreads are lowest on the VIP account (0.4 pips on EUR/USD), but become less competitive in Classic and Silver accounts (1.5 pips on EUR/USD), and there aren't any zero spreads.

-

OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad for fresh insights.

-

Amega offers an unusually large selection of currency pairs for an unregulated broker with 70+ forex CFDs, alongside up to 1:1000 leverage, zero commissions and competitive spreads from 0.8 pips. FX traders also have access to MT5 – the faster, more advanced version of MT4.

-

Coinexx offers an excellent selection of 70+ major, minor and exotics currency pairs, presenting diverse opportunities with a forex calculator to aid trading decisions. It’s also one of a select few brokers to support forex trading on the ActTrader platform, alongside MT4 and MT5.

-

Ingot Brokers offers forex trading on a modest suite of 30+ currency pairs with raw spreads on the MT5 platform. There are also no restrictions on short-term trading strategies, including hedging, scalping and the use of Expert Advisors (EAs).

-

FinPros offers 80+ forex pairs, which is one of the more diverse offerings available. Traders benefit from ultra-low latency, MT5 support and very tight spreads and low commissions on the RAW+ account.

-

xChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies.

-

AdroFx's strongest offering is its 60+ currency pairs, which can be traded with very high leverage up to 1:500. The broker also offers competitive forex spreads starting from 0.4 pips and charges no commission. Additionally, traders have access to MetaTrader 4, which was built for forex trading and offers excellent support for technical analysis and algo trading.

-

Trade 7 major, 21 minor and 29 exotic forex pairs with high leverage and a choice between STP or ECN accounts. Support is available around the clock and the TradeLocker forex software is provided.

-

I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading.

-

Trade Nation offers over 30 of the most popular forex pairs with variable spreads. Traders can access a slick proprietary platform or MetaTrader 4, with real-time forex market updates and insights via 'Smart News'.

-

Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders.

-

ActivTrades offers its lowest fees in the forex department, with excellent spreads on majors like the EUR/USD from 0.5 pips and zero commissions, keeping pricing simple. Improvements to the ActivTrades platform, alongside access to the industry-leading MetaTrader 4, also give traders the tools they need to navigate the FX market confidently.

-

BlackBull offers 64 currency pairs with excellent pricing through its ECN accounts, with the Standard commission-free spread starting from 0.8 pips. BlackBull also ensures its rapid execution carries through to MT4, which still stands as the industry’s most popular platform with active forex traders.

-

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

-

Swissquote offers compelling conditions for active forex traders, with an extensive range of 80+ currency pairs, plus ultra-fast execution speeds averaging 9ms and access to the industry’s favorite MT4 software.

-

SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online.

-

EagleFX facilitates short-term trading on over 50 major, minor and exotic currency pairs with competitive spreads as low as 0.1 pips, plus the industry-leading MT4 platform, which delivers a host of charting tools for traders, including 9 timeframes and over 30 indicators.

-

Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service.

-

Trade 50+ forex pairs via the MetaTrader 4 and MetaTrader 5 platforms with leverage up to 1:500, immediate execution, deep liquidity and tight spreads.

-

FP Markets stands out as an excellent option for forex traders, boasting a selection of over 70 currency pairs covering a wide range of currencies, especially since expanding its choice of exotics. With average spreads of just 0.1 on the EUR/USD in its Raw account, the broker provides competitive pricing for traders.

-

IronFX continues to offer a strong selection of 80 currency pairs. You can trade through the market-leading MT4 platform with a range of forex market research tools. That said, commission charges in the zero-spread accounts are high, starting from $13.50 per lot.

-

Trade 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from, and traders will benefit from fast execution and support from extra features including a pip calculator. The MetaTrader 4 software was also designed for online forex trading.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies.

-

Speculate on popular currency pairs with flexible leverage up to 1:500 and zero-pip spreads in the GO Plus account. Commission-free trading is available with micro, mini and standard forex contract sizes.

-

Trade on 60+ forex pairs with no commission and competitively tight spreads from 0.6 on major pairs such as EUR/USD. This is a good selection of forex pairs and excellent pricing for commission-free trading, well below the industry average.

-

ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours. Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators - ideal for complex forex strategies.

-

OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds.

-

CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

-

FXTM stands out with a strong selection of over 60 currency pairs, surpassing many competitors like AvaTrade. It also stands out with its six currency indices for traders aiming to diversify their forex portfolios, while the ECN account offers ultra-competitive spreads starting at 0 pips on majors, along with low commissions of just $3.50 per lot.

-

easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty.

-

Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

-

Trade around 50 major, minor and exotic currency pairs with ECN pricing that’s geared towards active traders or fixed spreads with no dealing desk intervention and a low starting deposit of just $1.

What Is Scalping Forex?

Scalping is a long-standing trading strategy that takes advantage of constant, minor price movements to skim lots of small profits. A big difference between scalping forex vs other day trading strategies like swing trading is the timeframes over which the systems are implemented. Scalpers enter and exit several trades in a few minutes or seconds, accumulating returns over the course of the day. Other investors tend to complete a few trades each day or week, looking at longer-term price movements.

Scalping forex is an exciting approach to trading, with lots of trades and analysis occurring in high frequency. Most scalpers aim for between 5 and 10 pips from each trade. While price movements tend to be very low, profits are increased by trading with very large volumes, often requiring the maximum leverage levels that brokers offer.

Strategies For Scalping Forex

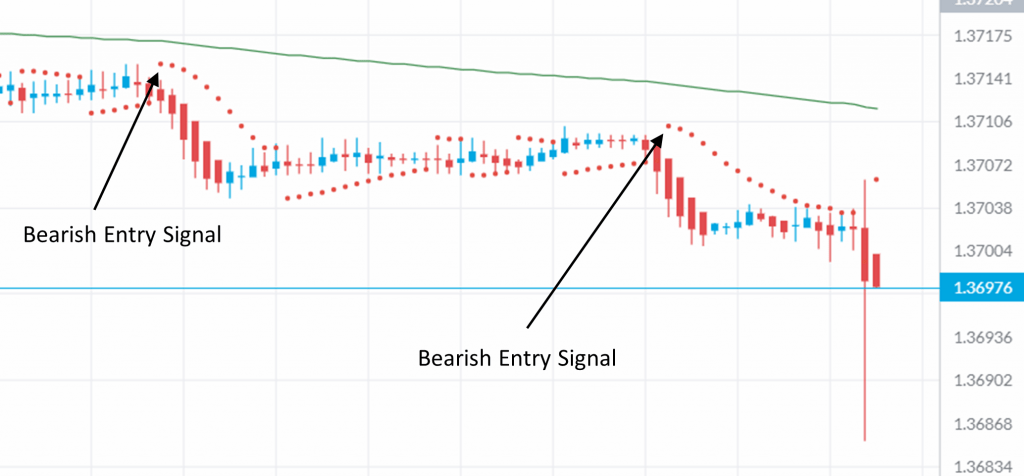

Parabolic SAR

The parabolic SAR indicator, which stands for stop and reversal, aims to identify entry and exit points for forex traders that follow the general market movement. A long-period SMA or EMA line will identify the general trends, leaving specific signals to the SAR indicator.

The indicator itself forms dots either above or below the closing price at each time step. The dots appear above the price bars for bearish movements and below for bullish. The algorithm behind the dots is complex but it generally provides an early indication of a new short-term trend forming.

Parabolic SAR

The changeover of the dots from bullish to bearish indicate the forex trend is changing. When the dots fall below the price levels, open a long position to capitalise on a new uptrend. If the dots cross below the price, short the pair as a downtrend is likely on its way. The exit signal is the dots crossing back in the opposite direction. Stop losses should be placed in line with the SAR dots.

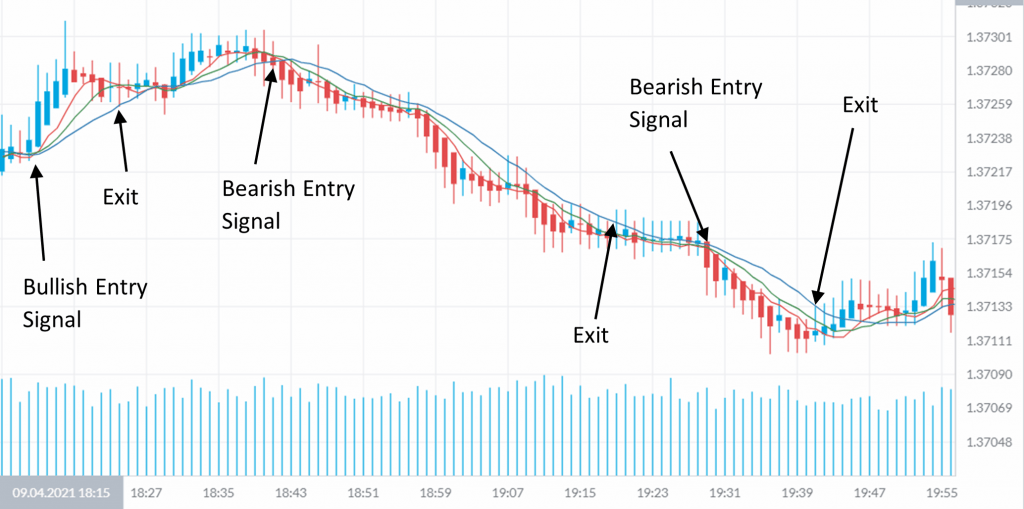

Moving Average Ribbon Entry

Using this scalping forex trading strategy groups three different simple moving averages (SMAs) onto a two-minute chart. The periods are usually 5, 8 and 13 and help identify strong trends for scalpers to take advantage of. When a signal is produced, scalpers can either capture the later section of the trend or wait for a loss of momentum and trade its reversal.

The alignment of the three SMAs points towards a change in the trend, with the 5-bar SMA closely following the price and the others tracking longer-term movements. If the price level penetrates the 13-bar SMA, the momentum is beginning to fall away, and forex scalpers should exit the trade.

Moving Average Ribbon

It is often useful to combine this scalping strategy with Bollinger Bands in forex markets, which can signal exit points for trades.

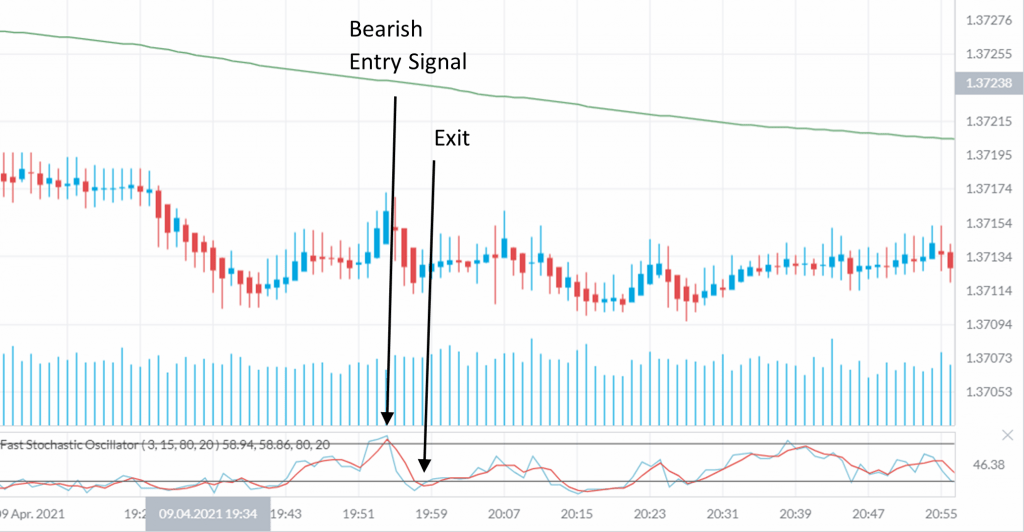

Stochastic Oscillator

Stochastic refers to statistical analysis of difficult-to-predict phenomena with a semi-random distribution, such as price quotes for a scalping forex pair. The stochastic oscillator compares the current price of the instrument with its previous price range to determine turning points in trends.

The indicator appears as a second chart with two lines oscillating roughly between the 20% and 80% marks. The two lines follow the same algorithm but over different time periods. The black solid line is the fast stochastic indicator referred to as %K while the red dotted line is the slow indicator, called %D.

The two lines, %K and %D, are used similarly to a moving average convergence-divergence (MACD) strategy, with crossovers indicating a buy or sell signal. A bullish signal occurs when the lines drop low and the %K line crosses above the %D line. An exit is then signalled by the lines reaching the 80% mark or crossing back over.

Stochastic Oscillator

A bearish signal is the opposite, occurring when the %K line crosses below the %D line while both are at a high percentage. The trade should then be exited when a bullish crossover is seen and the lines close below the 20% mark.

For effective use of the stochastic oscillator, combine it with a long-period SMA, which will capture the long-term trend of the forex market. With this information, you should then only enter trades that follow the general direction of the market movements.

Scalping Forex Tools

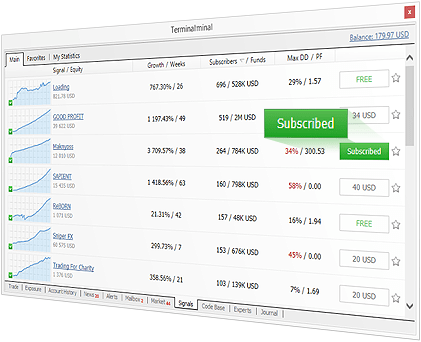

Scalping Forex Signals

Trading signals are widely used amongst scalpers, day traders and short-term investors. Produced by other traders using statistical, graphical or technical analysis, scalping forex signals can be sent by email or platform notifications. Some well-known signals providers are Telegram, Scalp King Forex, MyFXBook and Forex Factory.

Not all forex signals are reliable, however, and none of them are 100% effective. Given their origin, you should be careful how much faith you put in signals and, if possible, identify when and how often they are successful, how they work and what criteria they follow.

MetaTrader FX signals

Unfortunately, many traders want to try and increase their profits by providing signals, offering services like ‘best forex scalping strategy, 90% winners’. A good rule of thumb is to only follow signals provided by professionals and experienced forex traders.

Scalping Forex Charts

The biggest and most important tool in your toolbox for scalping forex, or any day trading, is charting. Live charts provide price information in a visual format that is easy to read and analyse.

Given the short timeframes over which scalping forex is carried out, picking the right charts is vital for success. FX scalpers typically operate with charts no larger than 15-minutes (M15), although most scalping strategies are best implemented on one or two-minute charts.

It is important that you fully understand the basic types of charts, graphical tools and indicators. From basic line charts tracking the closing price to candlewick and Heiken-Ashi plots, different charts are useful for different approaches to scalping forex trading. There are also lots of helpful tools and indicators available, such as Bollinger Bands, cycle indicators and Fibonacci retracements.

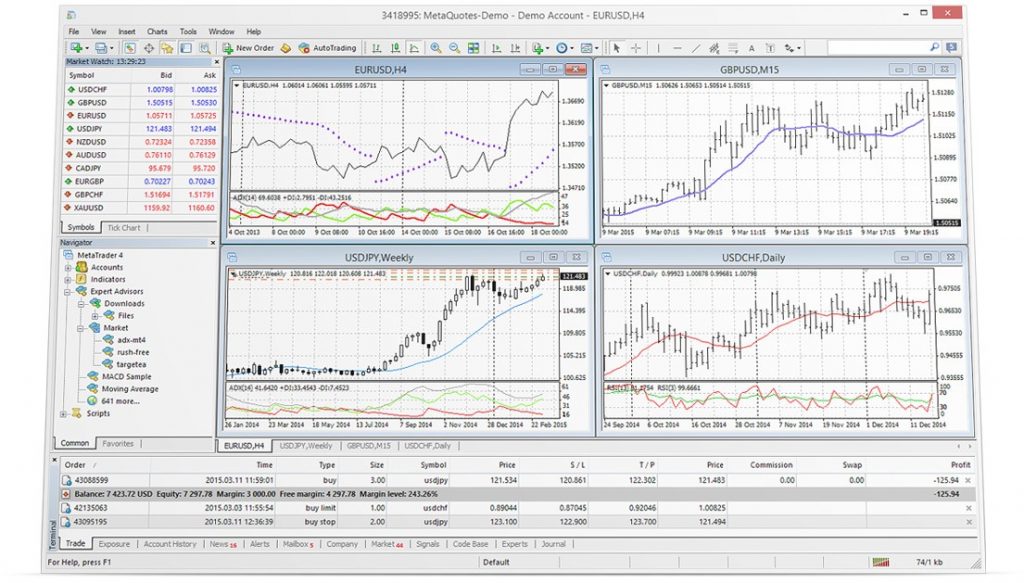

MetaTrader 4

The trading platform you use can also have a big impact on the chart types and indicators available to you. Big, commonly used platforms like MetaTrader 4 (MT4) have a wide range of indicators and visual tools that can help make scalping forex easier, while others provide tools to create custom indicators to follow your own strategies. Many websites also provide free downloadable indicators, such as Forex Factory.

Scalping Forex Robots

Scalping is a trading strategy that stands to gain a lot from the application of automated trading systems. Given the large number of rapid trades that follow a clear set of rules, algorithms can be written with strict criteria to follow a scalping forex strategy. Automated trading can combine a wide range of indicators with a complex algorithm in a way that could be difficult to track and execute manually.

Automated scalping forex can be done in two ways. The first, and easiest, involves finding a suitable electronic advisor (EA) online that follows a strategy you like, which can be downloaded free and implemented with the platform you use. Some platforms even provide stock bots themselves, following a range of strategies including scalping forex, such as MT4. Some of the best big bot providers are Forex Scalper Zone, MyFXBook and Forex Factory EAs.

MetaTrader bots

Reviews of EAs and bots are very useful as not all bots will be as effective as you may hope. There are plenty of review websites that can help you clarify whether a bot is trustworthy. Similarly, lots of trading forums will discuss scalping forex strategies, bots and platforms.

Alternatively, you can write your own strategy into a bot to scalp forex on your own terms. This requires a brokerage platform that supports a suitable API.

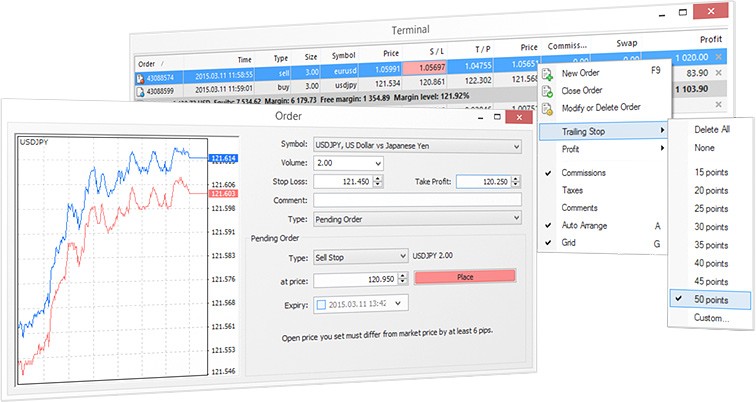

Scalping Forex Stops

Trading stops are an important aspect of any successful investor’s strategy, whether for scalping forex or spread-betting cryptocurrencies. These stops, also called stop-losses, embed a particular exit point into a trade if the price swings in the wrong direction. Once the price hits the specified point, the trade will be exited, mitigating trading losses.

Stop-losses are a simple risk management strategy but should not be underestimated. The chance of a losing trade significantly damaging profits disappears, as the trader can set the maximum level of loss before entering a trade. This helps ensure that winning trades will outweigh losses in the long run, maximising forex profits.

FX trading stops

While most scalping forex strategies will specify where stop-losses should be placed for each trade, it is worth noting that a stop placed too close to the price of the forex pair you are scalping may cause you to leave the trade too early.

Pros Of Scalping Forex

Scalping forex pairs comes with a range of benefits that are attractive to beginner and experienced traders alike:

- Profitable – Despite the low profit-per-share, scalpers leverage massive volumes and high frequencies to produce meaningful profits.

- Opportunity-rich – There are huge numbers of profitable opportunities every day for scalping the forex market.

- Low risk exposure – The short timeframes over which forex scalpers trade means that the likelihood of a trade hitting a big price reversal is lower. Scalpers generally trade at a risk to reward ratio of 1:1.

- Easily automated – The heavy attention requirements and strict rules of scalping forex lend themselves nicely to automated trading.

- Less knowledge depth – Most scalping forex strategies focus on statistical and visual patterns, generally requiring less in-depth knowledge of specific markets than other trading approaches.

Cons Of Scalping Forex

Scalping is not a perfect trading approach, however, and there are certain disadvantages that investors should be aware of:

- Focus – Traders wishing to scalp forex require quick reactions and constant focus to analyse the instrument’s price movements over long periods of time.

- Leverage – Scalpers must make use of leverage to extract significant profits from each trade. This can increase the risk of loss if the market reverses.

- Capital – To best take advantage of rapid price changes, forex scalpers require a constant stream of capital to trade with.

Getting Started Scalping Forex Trading

Choosing A Broker

The first step to kicking off a forex scalping career is to find the right broker. Not all brokers are built with scalpers in mind, and some even ban scalping altogether, analysing the length of time each position is open for. The first step then is to eliminate all these brokers.

In general, scalping brokers follow an STP (straight-through processing) or ECN (electronic communication network) system, rather than dealing desk structures. These brokers offer the quickest execution times and most efficient trades.

The choice is not an easy one, however, as there are many considerations to take into account. You should investigate the quality of the forex demo account offered (length, capital limit), the commission and fee structure, which trading platforms are offered, whether EAs and APIs are supported to facilitate automated scalping forex, plus whether the broker is regulated by the FCA. You may also look for a forex broker that supports mobile trading with good platform apps (both iOS and APK) and support.

Choosing A Forex Pair

Once you have a shortlist of respectable brokers with tight spreads and quality services, you need to consider which instruments you may want to scalp. Forex pairs have three classifications: major, minor and exotic. Major pairs are the USD coupled with any of the six next biggest currencies, while minor pairs are combinations within those six and exotic pairs are any other combinations.

Different pairs will all have their own characteristics, from liquidity and volatility to the time of day with the most volume or its responsiveness to news events. Generally, the best scalping forex pairs are the majors, as they demonstrate the most liquidity and volume, providing the optimum conditions for scalping very short-term trends.

The liquidity of major forex pairs is not constant throughout the day, though, as they vary with the different global trading sessions. Some pairs will be more liquid during some sessions than others. For example, the JPY/AUD minor pair is more liquid during the Asian-Pacific session, while the GBP/USD major pair is most liquid during the crossover between the London and North America sessions.

Education & Training

Before forex scalpers login to their shiny new account and start trading, make sure to take advantage of the helpful guides and resources that are available.

Good brokers often provide their own range of useful trading resources, including how-to 101 guides and helpful tips. There are lots of other online resources, from discussion forums and blogs to YouTube videos, training courses, academies and dedicated books and e-books. There are also myriad PDFs with 1-minute (M1) trading strategies, 5-minute (M5) indicator notes, rules, cheat sheets, guides for dummies and 24/5 scalping methods; almost anything to do with scalping forex can be found on a PDF you can download for free.

Combining these resources throughout your forex scalping career, not just at the start, with practice on your broker’s demo account will make you a much more successful trader. Demo accounts will not only get you to grips with the broker and platform, but they will give you experience and understanding of forex pairs, scalping strategies and the change in characteristics throughout the day. Make the most of the opportunity and practice implementing your strategies on these demo accounts before risking real capital.

Determine Entry & Exit Points

With an account set up and a solid foundation of understanding, you can begin scalping your selected forex pair. You can open charts and begin technical analysis on your real account, applying indicators and graphical objects to identify both long and short-term trends for scalping opportunities.

You should stay disciplined when scalping forex; it is not a trading approach that has room for emotion or greed. The rules of your strategy will likely be based on lots of research and statistical analysis, so letting emotion or whim guide your hand is dangerous.

Control Risk

As mentioned before, stop losses are vital in the production and maintenance of scalping forex profits. These trading stops will automatically back out of a trade if the price swings the wrong way, limiting any single loss to a precalculated, acceptable quantity.

Another important money management strategy lies in the calculation of position sizes for any one trade using the 1% rule. Savvy traders will only risk around 1% of the net capital in their account on any single trade.

For the 1% scalping forex rule, you should place stop-losses wherever the strategy dictates, which will allow you to calculate the maximum position size. First find the difference between the entry price and the stop-loss, giving you the risk-per-share. Then divide 1% of your capital by this risk-per-share to find the maximum position size that would lose no more than 1% if the stop-loss is hit.

For example, if you have £1,000 in your account, 1% of this capital would be £10, the maximum quantity you would risk on a trade. If you are entering a long position for the GBP/EUR at 1.15, with a stop-loss placement at 1.13, the risk-per-share is the difference between the two, or 0.02. The maximum position size is then simply £10 divided by the 0.02 risk-per-share, giving a position size of £500.

Scalping Forex Tips

Timing

Timing is important for scalping forex in two different ways. Most obviously, the timing of each individual trade will affect the possible profits, as if a trade is entered or exited too early or too late, profitability can drop.

Also important is the time of the day that you attempt to scalp, even though forex markets are open 24 hours a day, trading over the night is unwise. There are three key trading sessions each day: the London session, the North American session based in New York and the Asia-Pacific session based in Sydney and Tokyo.

The highest levels of liquidity are seen during the crossover of the London and North American sessions, especially for all major pairs. Some minor pairs, like JPY/AUD, may have larger trading volumes or liquidity during the Asia-Pacific session, but the liquidity will still be plenty sufficient during the London and North American sessions.

It is also wise, particularly for beginners, to avoid the first and last 45 minutes of the trading day. These two time slots often see disproportionately high levels of volatility that catch traders off-guard. This is often because the impacts of extended-hours trading are being consolidated or negated, commonly resulting in high volatility and low liquidity for a short period of time.

Account For Spreads

Spreads are a vital consideration when scalping forex trading, as they can easily turn a profitable trade into a loss. Tight spreads will allow much smaller price movements to be scalped successfully, increasing the frequency and size of winning trades. Spreads should be considered carefully in the selection of the broker and instrument you wish to use.

You should always pre-calculate the effects of spreads in a trade, taking them into account before opening a position. A good rule of thumb to follow is that targets should be at least double the spreads.

Practice Makes Perfect

As with all things, scalping forex requires practice to master. Most brokers offer demo accounts that allow you to practice trades with live price movements but without any capital being risked.

Beyond simply familiarising yourself with the broker and platform, demo accounts offer useful training and experience. Any new strategies or refinements can be tested on a demo account to assess their efficacy and profitability risk-free.

Similarly, you can learn the ins and outs of different scenarios, instruments and market movements, giving you vital experience before scalping forex with real money.

Liquidity

Scalping forex has very little profit-per-share when compared to other strategies. This, coupled with the very high volumes that scalpers use to gain meaningful profits, makes traders vulnerable to slippage.

Slippage occurs at times of low liquidity in the market when a trade isn’t met at the other end at the price you entered it. This can be avoided by forex trading only when the market is most liquid, which will ensure your trades are met at the quoted price. Liquidity will also help by narrowing spreads at busy times, further increasing your profit margins.

Start Small

Learn to walk before you can run. The adage continues to ring true in many modern scenarios, including when learning to scalp forex markets. Scalping is intense, requiring focus, concentration and constant analysis, which can be difficult to maintain for just one forex pair, let alone several.

Begin with just one pair at a time, giving it all your attention so you can open and close positions at the optimal times, without profits starting to slip from a lack of attention. Once you are more experienced, you may be able to successfully split across more instruments, but a beginner should stick to just one.

Final Word On Scalping Forex

Scalping forex can be a profitable enterprise, combining a large number of small profits every day. Some of the most important factors for ensuring the success of scalping strategies are ensuring high levels of liquidity, fast broker execution times, discipline and tight spreads.

Beginners should start slow and focus on practicing strategies and following the rules of their system to the letter. Scalping the forex market is effective both as a primary strategy, or to supplement other approaches.

FAQ

Can I Make A Living From Forex Scalping?

Scalping for a living is definitely viable, as there are many profitable opportunities daily for forex scalpers, and those who strictly follow the rules of their strategies will tend to win more than they lose. Discipline and focus are important, along with a robust strategy and informed instrument selection.

What Is The Best Scalping Forex System?

While many strategy guides, signal providers and bot writers will claim they have the best strategy or the bot with the best win rates, there is no defined best. There are many scalping forex strategies, 1-minute (1M) to 5-minute (5M), gamma scalping, envelope scalping or scalp hedging, each of which will have varied results across instruments, times of the day and long-term market characteristics.

Can You Scalp Forex Without Indicators?

While most strategies will make use of different graphical or technical indicators, some only follow the price levels. These price action strategies can be harder, though still effective.

What Forex Instruments Can You Scalp?

Scalping forex is most common with standard currency pairs, particularly major and minor pairs. However, other forex instruments can be used for scalping, such as forex futures and commodity systems like gold (XAUUSD). Beyond forex, scalping can be applied to any tradeable instruments, like stocks and indices.

Is Scalping The Forex Market Legal?

Scalping is perfectly legal in the UK; it is commonly thought to be illegal because the US markets do not allow it. In the UK, anyone that has an account with a broker that supports scalping, such as IQ Option, can scalp forex markets.