Scalping Trading

Scalping trading is a fast-paced strategy that takes advantage of market volatility by repeatedly buying and selling. The intraday trading technique aims to take on less risk in return for smaller profits, which can accumulate over time into larger gains. In this tutorial, we cover the definition of scalping trading, how to get started and the best scalping strategies for beginners.

Best Scalping Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

Established in 2024 and headquartered in Seychelles, Bullwaves is a MetaTrader-only broker offering access to a modest collection of 250+ assets including forex, metals and indices. Traders can choose from three accounts; Classic, VIP and Elite, catering to different experience levels and budgets.

-

Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

-

Launched in 2020, Cyprus-based RedMars offers competitive spreads on more than 300 instruments and leverage up to 1:500. Three accounts are available - Standard, Pro and VIP - serving a range of budgets and experience levels, with a fast and fully digital account opening process.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

EagleFX is an ECN/STP broker that offers spot forex and CFD trading on a small collection of 170+ assets to active traders worldwide. The catch is that it’s registered in the weakly regulated jurisdiction of the Commonwealth of Dominica, providing limited safeguards.

-

Tradeview is an offshore forex and CFD broker based in the Cayman Islands and regulated by CIMA. Traders can access over 5000 instruments with a minimum deposit of $100. There are several third-party platforms on offer, including MetaTrader 4 (MT4) and cTrader.

-

Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from four accounts (Classic, Silver, Gold, VIP) with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees, though these don’t compensate for the weak oversight from the IFSA and paltry education and research.

-

Founded in 2010, ThinkMarkets is a reputable CFD and forex broker with regulation from several top-tier bodies including the FCA and ASIC. The broker provides services to over 450,000 accounts from 11 global offices. Traders can use a bespoke platform, MT4 or MT5 to access a wide variety of assets including 3500+ stocks and ETFs, 46 forex pairs and over 20 cryptocurrencies.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Amega is an offshore STP broker offering CFD trading fon forex, stocks, indices and commodities with very high leverage up to 1:1000 and a zero-commission pricing structure. Traders access markets through the MT5 platform and can test the broker's services through a demo account.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

Ingot Brokers is a multi-regulated brokerage established in 2006. The broker offers CFD trading opportunities on 1000+ instruments including forex, stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers both raw spreads and commission-free account options.

-

SageFX is an offshore, unregulated CFD broker that offers highly leveraged trading on forex, stocks, commodities, indices and crypto via the TradeLocker platform. Traders can access commission-free trading or an ECN account with tight spreads. While the broker's regulatory status is weak, it does provide segregated accounts and two-factor authentication.

-

FinPros is an offshore broker that provides CFD trading on 400+ instruments with high leverage up to 1:500. This is a reliable bet for traders seeking offshore options, with strong security measures, negative balance protection and segregated client funds. The extra features including trading tools and commission-free stocks make this a good choice for beginners, and experienced traders will appreciate tight spreads.

-

xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

-

Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

-

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits.

-

Coinexx is an unregulated broker that provides leverage up to 1:500 on forex, commodities, indices and cryptocurrencies with deep liquidity, pure ECN spreads and negative balance protection. The broker uses crypto as base currencies and has low minimum deposit requirements of 0.001 BTC.

-

AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on trading strategies.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

SimpleFX is an online broker specializing in CFD and cryptocurrency trading, with multi-currency accounts, STP execution, low pricing and no minimum deposit. Bringing innovation and gaining recognition at numerous industry events since 2014, SimpleFX now caters to retail traders from over 190 countries, boasting a client base exceeding 200,000 active users.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

What Is Scalping Trading?

Scalping trading is a technique that chases small returns by trading across short timescales of minutes or even seconds. Each trade aims to scalp just five or ten pips, based on the theory that the trader is exposed to less risk in these reduced time periods. However, high leverage is often used to enable adequate returns from this intraday trading style. The aim is to generate substantial returns through a high number of smaller wins.

Scalping is possible because of price fluctuations, though volatile markets come with heightened risk. It is a strategy that can be applied to sideways markets, making it a great solution for day traders who aren’t willing to wait for a trending market.

Scalping Trading vs Day Trading

The main difference between scalping and day trading is the time period used. Scalping timeframes may be only minutes or seconds, whereas a day trader may look to hold a position for several hours at a time. Either way, scalpers and day traders avoid holding positions overnight, unlike swing traders who may hold positions from a few days up to a few months.

Markets

Scalping trading can be applied to all markets including forex, cryptos, stocks, binary options and CFDs. However, derivatives such as CFDs are particularly suited to scalping trading because they can be traded with leverage. The lack of leverage and high fees associated with trading stocks makes them less suitable for scalping trading. The same applies to indices such as the FTSE100, NIFTY BANK, DAX and ASX.

Pros & Cons Of Scalping Trading

Here, we review the benefits and drawbacks of scalping trading.

Pros

- Versatility – scalping can be used across a range of asset types and during flat markets, meaning positions can be opened at any point.

- Risk level – assuming that traders execute strict exit strategies, scalping can be less risky due to the short timeframe of each trade.

- No requirement for in-depth research – unlike in news trading, scalpers don’t need to carry out in-depth research of the particular market, currency pair or company they are trading. However, traders should still be aware of any scheduled news releases that will have an impact on asset price. Market Profile is a good way to keep on top of the overall market context when scalping trading.

Cons

- Leverage risks – high leverage is required to generate decent returns when scalping. The use of leverage multiplies losses as well as gains, making it a riskier trading strategy overall.

- Discipline – scalpers must not be tempted to deviate from their strategy in an attempt to profit from an extra few pips. This can rapidly result in losses that will wipe out any scalping trading wins.

- Fees – scalping involves the execution of a high number of trades meaning fees can quickly eradicate profits, especially if commission is charged per trade.

- High pressured environment – scalping is an intense trading strategy that requires focus for long periods of time and is therefore not suited to all traders.

How To Start Scalping Trading

Choosing A Broker

A broker is essential for anyone looking to start scalping trading. However, with some brokers banning scalping trading – usually market makers who are not guaranteed to profit off the trade – the first thing to check is whether they permit scalping trading.

No dealing desk brokers are recommended for scalping trading, as they enable faster market access through Electronic Communication Networks (ECN) or Straight Through Processing (STP). These are digital systems that automatically match buyers and sellers for fast execution. ECN offers better spreads but high fixed commission fees and higher minimum trading volumes. STP has lower trading volume requirements, but brokers can trade against clients.

Next, check if the broker is regulated. The Financial Conduct Authority (FCA) in the UK ensures that clients funds are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS). However, regulations enforced by these authorities may limit your trading strategy, with the FCA limiting leverage to 1:30.

Check the broker’s spreads and fees are sufficiently low for your scalping trading strategy. High one-off fees per trade (which are usually charged when trading stocks) will make it almost impossible to carry out profitable scalping. Large spreads will also make it more difficult to generate a profit as the price has to move by a larger amount.

Finally, check which tools and systems the broker has available. Their trading platform should be easy to navigate and offer the chart and indicator types required by your trading strategy. Opening a demo account is a great way to trial their trading platform, and will also allow you to practise your scalping strategies using virtual funds. A live news feed will help you react more quickly to unexpected price swings caused by financial reporting, and access to Level II quotes will enable you to see the full order book to better predict future prices.

Overall, Binance is a recommended broker for scalping trading Bitcoin and other cryptocurrencies, with a great desktop app offering. Forex.com and Pepperstone’s Razor account are other good options for scalping trading in the UK. Unfortunately, scalping trading is forbidden on Trading 212, eToro and Plus500.

Derive A Plan

A plan of action is key to carrying out successful scalping trading. Here, we list the essentials to consider when deriving a plan.

- Select a market – scalping trading is best suited to assets with high liquidity, to enter and exit positions easily. Some of the best forex scalping trading strategies are based on major and minor currency pairs, because they have the highest liquidity and lowest spreads which makes them a safer trade. Exotic pairs can be more volatile which may reap more profit but at a greater risk. When putting together a crypto trading strategy, try a less volatile altcoin such as Bitcoin first.

- Choose a time to trade – the best time to trade is when the markets are most liquid. For forex scalp trading, this is 12-4pm GMT, as the New York and London exchanges are both open.

- Select your target – a common strategy is the 50 pips a day forex trading strategy, where traders aim to make 50 pips profit from price movements of a single currency pair. For this, the currency pair must have at least a 100 pip per day range, making GBP/USD and EUR/USD viable options.

- Pick a strategy – this is likely to involve the use of technical indicators to enhance your trading strategy. In the next section, we give examples of how you can use technical analysis to better predict price movements.

- Implement risk management – decide your risk-reward ratio and implement a stop loss accordingly. The risk-reward ratio is the amount of capital you could lose versus the amount of profit you’re aiming to achieve. There is no fixed rule for which ratio should be used, as this depends on factors such as fees and the volatility of the market, though 1:2 is common.

- Keep a trading journal – this will guarantee you keep on top of your scalping trades throughout the day and can help you learn from previous mistakes. Just make sure your attention isn’t diverted from executing trades.

- Focus on one trade at a time – one of the most important rules when scalping trading is to ensure you aren’t distracted. Holding more than one position is difficult and may cause you to lose focus.

Scalping Trading Strategies

To ensure scalping trading is profitable, traders need an edge. Scalping trading can be enhanced through the use of technical indicators, to better predict future price movements. Here, we explain how to use popular indicators to carry out some of the best scalping trading techniques, which can be used across multiple systems including MetaTrader 4.

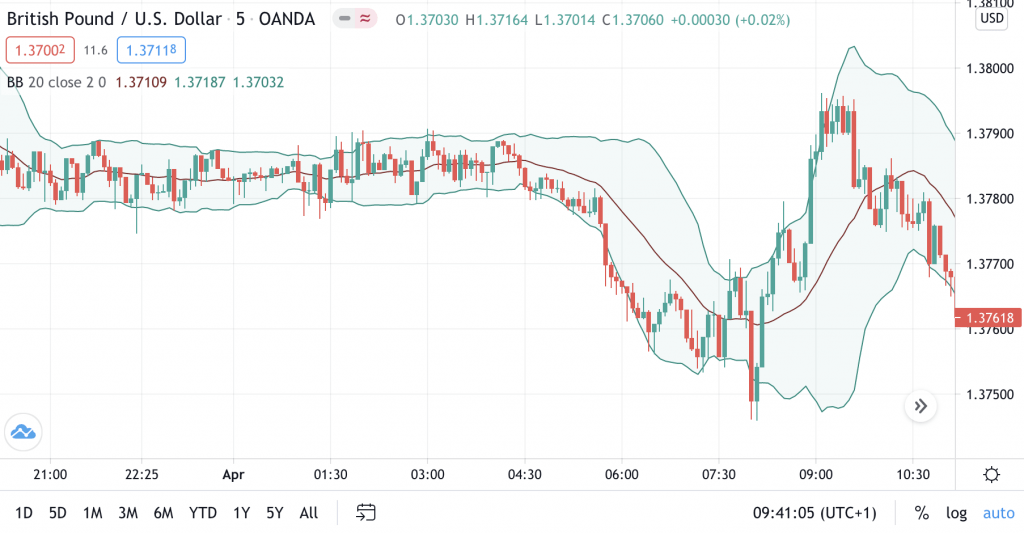

Bollinger Bands

Bollinger bands indicate the volatility of an asset using a middle, lower and upper band. The middle band is a moving average (often a 20 day period) which indicates the price trend. The lower and upper bands are positioned either one or two standard deviations above and below the middle band. A tightening of the upper and lower bands indicates a reduction in volatility, whilst a separation shows the opposite.

The Expansion of Bollinger Bands shows an Increase in Market Volatility

First, use the distance between the Bollinger Bands to determine whether to open a position based on the current market volatility. When scalping trading, a 1 minute or 5 minute timeframe is most suitable. Higher volatility comes with increased risk as the price can quickly jump even in short timescales. For a safer scalping strategy, only buy and sell when the Bollinger Bands are flat, which signals a trading range (observed from 21:00 to 04:30 in the above chart).

With the 1 or 5 minute scalping trading system still setup, use the position of the bands to determine when to buy or sell the forex pair. If the price touches the lower Bollinger Band, this indicates an underbought region and is a buy signal. If the price touches the upper Bollinger Band, the asset is considered overbought and this is an indication to sell.

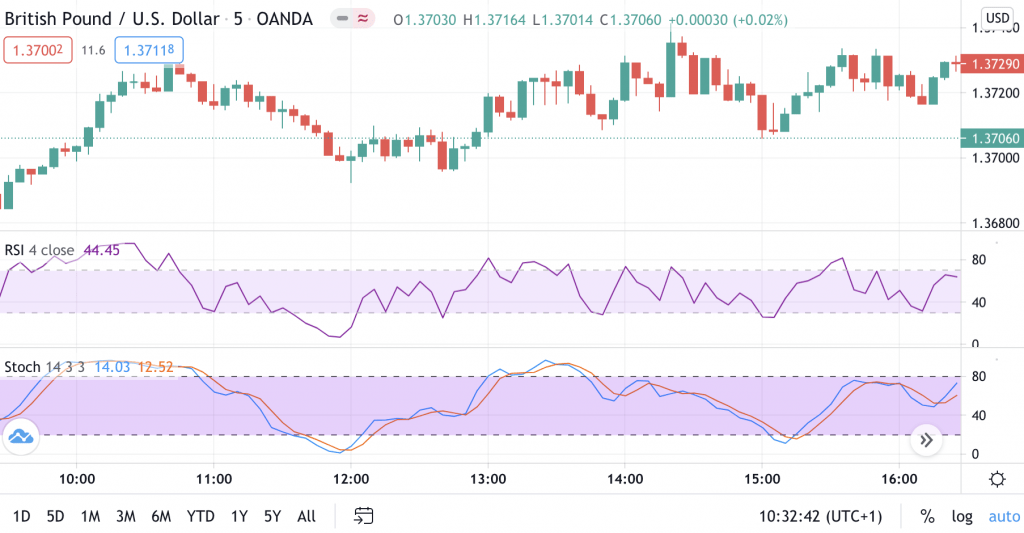

Stochastic Oscillator & RSI

The Stochastic Oscillator and Relative Strength Index (RSI) can provide further insights when scalping trading, especially when used together. While the RSI indicates oversold and overbought conditions, the Stochastic Oscillator can be used to detect trend reversals.

The RSI calculation is based on previous trading prices, usually the 14 days prior. The index is a scale of 0-100, with 30 typically quoted as the threshold under which an asset is underbought. A reading over 70 is considered to be overbought.

The stochastic oscillator also uses a scale from 0 to 100 to highlight changes in trend. It works by calculating the acceleration of price changes (called momentum), based on the theory that the momentum of an asset will often change before the price itself. Recognising reverses is important in scalping trading, where every pip counts.

The RSI and the Stochastic Oscillator can be used in combination to determine entry and exit points:

- If the RSI is showing as overbought (above 70) and the stochastic indicator is showing a trend reversal from a bullish market, sell

- If the RSI is showing as underbought (below 30) and the stochastic indicator is showing a trend reversal from a bearish market, buy

By using the stochastic oscillator in combination with the RSI, buying an underbought asset that doesn’t observe a trend reversal and therefore continues to see a price drop is avoided (and vice versa).

Using the RSI in Combination with the Stochastic Indicator

Scalping Algo Trading

Robots can add significant value when it comes to scalping trading, due to the quick and precise nature in which trades need to be enacted.

Algorithmic bots can be used for automated scalping trading by buying or selling at a specified price, which is also known as system trading. However, robots are not foolproof and their effectiveness is determined by the trader’s inputs, which should reflect a planned trading strategy with sufficient risk management in place.

Some trading platforms offer a codebase where users can download free or paid for bot software that has been developed by programmers. For example, the popular MetaTrader platforms have a library of bots called ‘Expert Advisors’ (EAs), that are created using the MQL programming language. Examples include the hamster scalping trading robot EA which uses the RSI and ATR indicators and the 1 tick scalping strategy bot.

Traders may also want to program their own bot or commission a programmer to develop a bespoke scalping bot for them. Outside of MetaTrader, other platforms offer equivalent automated trading, some of which is based on more popular programming languages such as Python.

Further Research

Understanding the fundamentals is crucial before entering the fast-paced world of scalping trading. There are numerous online courses available for beginners who want to learn more about how scalping trading works. YouTube is a great source of strategy training content, including videos of traders scalping in real-time. Live scalping trading rooms are also a great way to see strategies first hand.

Once the basics are covered, there are many books, eBooks and online forums to pick up scalping trading tips. While TradingView offers scalping trading analysis from a range of sources, traders can also take advantage of free online downloads such as the ‘Top 5 Scalping Trading Strategies’ PDF or articles such as ‘Scalping for Profits as a Day Trading Strategy for Dummies’.

Wrapping Up Scalping Trading

Scalping trading is an intense strategy that relies on focused execution of short timeframe trades. Though not an easy technique to master, it can lead to substantial returns if executed correctly. While scalping can be applied to all markets, it works best with low fees, high liquidity and leverage, making major forex pairs highly suited to scalping trading methods.

Preparation is key, so following our step-by-step guide to finding a broker and creating a plan is the best way to execute a successful scalping trading strategy.

FAQ

What Is A Scalp In Trading?

A scalp aims to make a small profit of just a few pips by trading for very short timescales of just minutes or even seconds. It is based on the theory that the trader is exposed to less risk when trading in these shorter periods.

Is Scalping Trading Illegal In The UK?

Scalping trading is legal in the UK though some brokers do not permit it. Make sure to check the broker’s T&Cs and rules before starting scalping trading.

What Is The Best Scalping Strategy?

Some of the best scalping strategies are based on simple techniques, to ensure the trader can remain focused. Using the RSI and Stochastic Oscillator in combination is a great way to predict the price trend and identify oversold and underbought regions in parallel.

How Do I Scalp Gold In Forex?

XAU/USD is a gold forex pair that can be traded using scalping strategies. Its stability means it is more predictable than other assets but may not provide as high returns. FXTM is a broker that permits scalping and offers XAU/USD.

Does Scalp Trading Work?

It is possible to generate good returns from scalping trading if the trader is disciplined and focused. As with all trading, scalping is not risk-free and traders should ensure they have appropriate stop losses in place.