Position Trading

Position trading is a favoured strategy amongst investors of all experience levels and can be adopted across asset classes. This technique requires less maintenance and time commitment than other forms of cash and market investing, however, there are other pros and cons to consider, which we explore below. We also provide a position trading definition, a comparison to other investing styles, key steps to follow and, an explanation of specific position trading strategies.

Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Position Trading Defined

This strategy involves holding a position over a period of time expecting a change in value that will generate profits. Holding an asset in the hope its price rises is called a long position, holding an asset in the hope it falls is called a short position. Both are held in the long-term and less importance is placed on short-term indicators, information and fundamentals.

Position trading is a popular strategy in all asset classes including forex, company stocks, futures, commodities, and cryptocurrency like Bitcoin. It is a good starting point for beginners but may also play an important part of an experienced trader’s portfolio.

Position Trading Vs Other Strategies

It is worth understanding the key differences and effects of position trading vs other investing styles:

- Position Trading vs Day Trading – Day traders tend to buy and sell assets on the same day, whereas position traders hold assets for longer periods.

- Position Trading vs Swing Trading – Similar to day trading, swing traders try to earn profits by realising gains in a short period, though often longer than a single day.

- Position Trading Vs Trend Following – Position traders tend to take a limited number of large positions while trend followers typically take a select number of smaller positions.

- Position Trading vs Buy and Hold – Buy and hold investing refers to positions held for longer periods, for example, into retirement.

Steps To Start Position Trading

Below is a guide for aspiring position traders.

Choose A Broker

There are a number of important broker qualities to consider when beginning position trading. These include the platform options, the range of assets on offer, the fees charged, and the level of business regulation.

A UK-licensed broker is bound to provide some degree of market security by segregating retail trading funds and offering negative balance protection, meaning if your trade enters a negative net position, there will be a limit to potential losses. If trading with no zero-balance protection then there are no limits to potential losses.

Choose A Market

Brokers offer a range of assets for position trading. Most provide a number of forex pairs, stocks and commodities, noting crypto CFDs are now banned in the UK. If you don’t know what asset you want to invest in, you can make use of a demo account first.

Fund Your Position

Once you have chosen your broker, you need to add funds to your account to start position trading. Most reputable brokers offer a range of finance methods but take note of any minimum deposit and withdrawal amounts. Typically, this is a fair amount but ensure you are aware of the limits before signing up.

Execute A Strategy

There are several specific position trading strategies that investors can implement; these are discussed in the next section. To support these setups, traders should make use of any fundamental and technical analysis tools provided, often integrated into platforms.

Position trading tools can help users develop charting skills, determine when to open a position and understand where to set stop losses. Most tools are available on desktop or via mobile trading apps.

Some position traders may wish to use algorithm-based strategies. These are available on platforms such as MetaTrader 5 via APIs.

Utilise Resources

Some brokers offer additional resources to support their customers when position trading. These include public forums and training course videos. Forums are a great resource for building knowledge by discussing topics from how to close a short position to how to analyse a business’s accounting statements. Trading 212 and eToro both have forums that are popular amongst position traders.

Traders can purchase strategy management books online or download PDFs to increase their knowledge. A good example of this is Trading for Dummies. Alternatively, there are extensive resources available on third-party websites to help develop investors’ core position trading strategies. Sites including YouTube and TradingView offer valuable insights for strategy development too.

Use Risk Management

Regardless of whether you are entering a long or short position, risk management is a key aspect of position trading. Financial markets can be unpredictable, traders should make use of position size calculators and implement their own trading rules to ensure strategies are aligned to their risk appetite.

Position Trading Strategy

There are a number of specific position trading strategy setups that can be adopted. It’s also useful for traders to understand the basics of other techniques such as moving averages on weekly, monthly and yearly charts.

Support & Resistance

Support and resistance (S&R) is the most common position trading strategy, often used in forex. Traders analyse price charts and patterns to determine the direction of the market along with entry and exit points.

The support line refers to the point that the price shouldn’t fall beyond while the resistance line indicates the level that price is unlikely to rise beyond. S&R lines, therefore, are key for determining where to set opening and closing positions.

Support and resistance

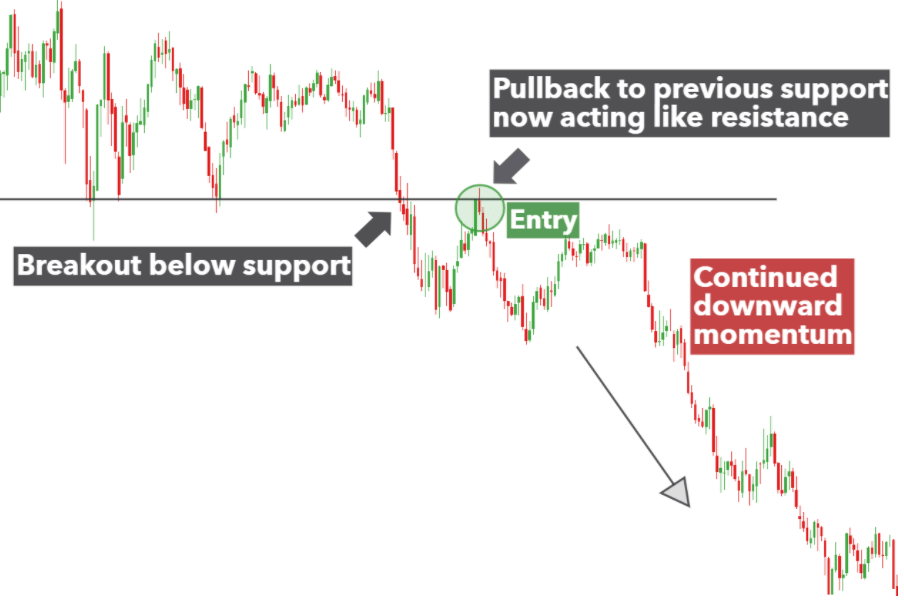

Breakouts

New price trends are often referred to as breakouts. If the price breaks the support line, traders can open a short position. If the price breaks the resistance line, traders can open a long position.

Breakouts provide traders with the opportunity to capitalise on market volatility and begin position trading at the start of a new trend. Chart analysis using support and resistance lines can form a triangle shape, if this occurs traders should expect a breakout and therefore the start of a new trend.

One of the risks of this strategy is if the breakout only has a temporary effect and the momentum isn’t strong enough to start a new trend. This is called a false breakout and patient traders wait for a pullback towards the support or resistance line before beginning to trade. An example of this is demonstrated below.

Breakouts

Trendlines

Traders can analyse the trend on a chart by identifying the peaks and troughs of an asset’s price over a period of time. By connecting the lows in an upward trend or the highs in a downward trend, traders can set support and resistance lines respectively.

In a strong trend, the price will fluctuate back to the trendline and move in the direction of an asset. The trader then enters the market when the price hits either trendline.

Note: a trendline strategy is subject to the volatility of the asset. A stable asset may not demonstrate peaks and troughs but a highly volatile asset may not travel in a consistent direction.

Benefits Of Position Trading

- Less maintenance and stress – Position trading does not require daily monitoring and is arguably, therefore, a less stressful form of trading.

- Easy to understand – Position trading is relatively straightforward and popular with both beginners and experienced investors.

- Potential returns – A patient trader may reap the benefits if they can act on a long-term market trend that moves in the desired direction.

- Relatively low risk – Some individuals use position trading strategies to diversify their risk while utilising other investing techniques. Position traders often tend to have a lower risk appetite.

- Educational resources available – Due to its popularity, there is a selection of position trading strategy books available to buy or download to PDF.

Drawbacks Of Position Trading

- High swap fees – Some brokers charge fees for positions held overnight on certain asset classes. Costs can accumulate and erode margins.

- Fast-changing trends – If the trend changes quickly, or if the trader goes against the trend, the value of the trade may promptly turn to a loss.

- Fewer wins – Position trading refers to holding a position over a longer time frame; therefore, the number of wins is lower vs other types of trading such as day trading or swing trading.

- More suitable for bull markets – Holding a trading position in a bull market can be more effective than a bear market. The former is where the market is on the rise, the latter where the market is on the decline.

Position Trading Terminology

When starting out in the financial markets, some of the terminology used can be confusing. Fortunately, we have compiled a list of key definitions.

- Position parking trading – An illegal form of trading where the owner of a stock is concealed by buying and selling a share between two parties in quick succession.

- Delta – A ratio measuring the change in price of an underlying asset compared to the change in price of the derivative or option. The rate of change in delta is known as gamma.

- Call option – A contract that gives the trader the option (but not the right) to buy an asset within a specific time frame and at a certain price.

- ROI (return on investment) – Simply the expected profit from an investment. This is calculated by dividing the return expected by the initial investment.

- Episodic pivots – Significant events throughout a stock’s life. Position trading using episodic pivots works particularly well with support and resistance or breakout strategies.

Final Word On Position Trading

We’ve looked at what position trading means and explained that it is relatively easy to understand and implement compared to other investing systems. Traders should have a good understanding of the market, utilise technical analysis tools, and make use of demo accounts.

Investors new to position trading can use our guide to understand the pros and cons of position trading, along with how to get started.

FAQ

What Is Position Trading?

By definition, position trading is when investors open and hold a position over a long period of time with the expectation that the asset will move in the desired direction. If the trader expects the price to fall, they will enter a short position while if the trader expects the price to rise, they will enter a long position.

What Is A Position Trading Firm?

A position trading firm is a broker or business which provides tradeable assets on the financial markets. The assets available to trade, platforms offered, and fees incurred vary from broker-to-broker so consult the provider’s website before signing up.

How Can I Learn To Position Trade?

There are a number of position trading books, company forums, tips, and information on broker websites. Some brokerages also offer position trading courses; however, this is subject to availability.

What Is The Best Position Trading Strategy?

Investors must develop their strategy based on risk appetite and personal trading preference. It is important to utilise demo accounts to test position trading strategies before putting capital at risk. Most top brokers offer demo accounts and additional features to support clients.

Is Position Trading Suitable For Beginners?

Yes, position trading is suitable for beginners. It can demand less time vs other trading methods such as day trading and users do not have to stress over short-term fluctuations. However, all trading comes with risk and it is important to ensure each trading position is supplemented with risk management tools.