Momentum Trading

The momentum trading strategy allows individuals to capitalise on accelerating prices of securities, including forex and stocks. If you’re keen to learn how to day trade using momentum, this article explores some key trading strategies for beginners and experts, as well as top software, indicators and tools. We also discuss some comparisons between momentum trading vs swing trading, trend following, and other popular methods.

Momentum Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

What Is Momentum Trading?

The definition of momentum trading is the process of buying and selling an asset based on the strength of its price movement. Investors will follow others in the intraday market who are also capitalising on short-term upwards trends. This is known as herding.

When an asset hits a high, more traders will look to exploit the opportunity, which then pushes the market price even higher. Once a large volume of sellers has entered the market, the momentum will typically change direction and force the price down again.

Investors will therefore buy when an asset is rising and then sell once it is expected to start coming down. As such, rather than following the concept of ‘buy low, sell high’, momentum trading seeks to ‘buy high, sell higher’. We’ll cover how to day trade using these momentum strategies later.

The strategy is hugely popular among individuals looking to trade in any market, including forex, penny stocks, shares, options, futures, ETFs and even cryptos. It’s also worth noting that momentum trading relies more heavily on the technical analysis of short-term price movement, rather than long-term fundamentals.

Momentum trading can sometimes be confused with other similar trading strategies. Let’s break down the terminology briefly below:

- Day trading – A broad term describing a short-term strategy that primarily uses technical analysis to open and close multiple positions within one trading day. Day traders will also use scalping or momentum strategies.

- Swing trading – Swing trading also focuses on short-term technical analysis and aims to trade within the ranges of support and resistance. Swing traders hold on to trades for days or weeks.

- Trend following – A long-term strategy that aims to buy on upswings and sell on downswings. Trend traders are more concerned with what the price is doing over the long-term, as well as the size of trades.

- Position trading – Commonly compared to buy-and-hold investing, position trading is a long-term strategy where participants enter the market in the hope that the value will increase over time. Position trading is also considered to be a form of trend following.

Pros Of Momentum Trading

When used correctly, momentum trading can offer some attractive benefits:

- Profit potential – Momentum traders rely on liquidity in the market, meaning there is a high volume of buyers and sellers in the market. This creates more competitive pricing and the potential to generate high returns within short time periods.

- Accessibility – Compared to high-frequency scalping or day trading, momentum strategies are less demanding and can therefore work well for beginners. Furthermore, since the strategy relies on volatile and liquid markets, you will be trading popular assets such as gold, crude oil, EUR/USD, or even cryptocurrencies such as Bitcoin.

- Volatility – Whilst it can involve risk, traders can use volatility to their advantage when momentum trading. The aim is to capitalise on price swings and ride volatility in the market during the early stages of an uptrend.

Cons Of Momentum Trading

However, traders should bear in the mind the following drawbacks:

- Emphasis on short-term moves – Due to the nature of momentum trading, traders will notice a greater emphasis on technicals and short-term price action. As such, the strategy might not be ideal for long-term fundamental traders.

- Not ideal for bearish markets – Momentum trading works best in bullish markets where investors can herd towards an uptrend. Bearish markets, on the other hand, are riskier and present fewer opportunities to profit.

- Time-consuming – Momentum trading is considered by some as more time-intensive than other styles of trading. This is because traders will need to focus on pursuing a trend when it starts, which may last for minutes or hours.

Momentum Trading Indicators

In order to develop your strategy, you’ll need to familiarise yourself with technical indicators and oscillators within your live charts. These, if used properly, can help you to analyse price action and uncover new trends. There is a variety of indicators you can use, but we’ve explained how to do momentum trading with a few popular options below.

With any strategy, always ensure that appropriate risk management rules are in place in order to protect your earnings against disaster. Even using the most polished strategy cannot guarantee a winning streak, so it’s worth learning how to calculate your risk profile before you start.

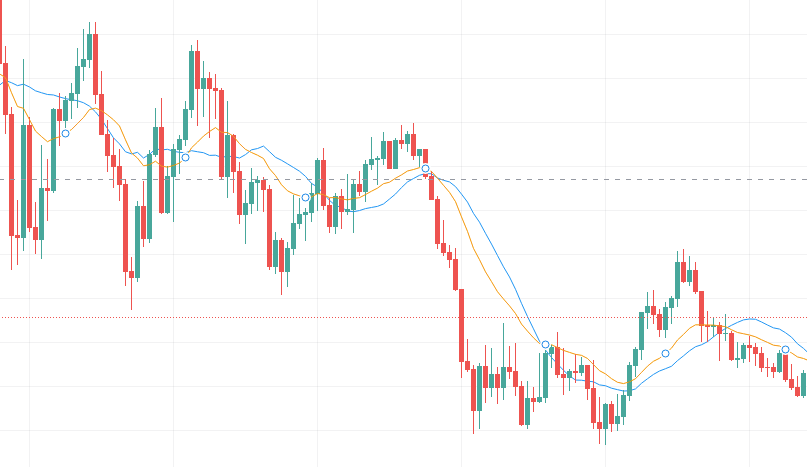

Momentum Indicator

The momentum indicator is technically an oscillator, as it fluctuates between extreme high and low values, relative to a central line. The indicator is a key tool for determining the entry and exit signals within a momentum trading strategy.

The indicator measures the strength of an upward or downward trend by comparing the most recent closing prices with others within a particular time frame. It can therefore determine how overbought or oversold the market is.

When the indicator crosses through the centre line, this indicates that momentum is either increasing or decreasing. Traders will therefore use this indicator to determine whether to buy or sell.

Momentum trading indicator

Typically, the momentum indicator works best when combined with others, including the MACD, RSI, Stochastics and Moving Averages. We’ve covered a few of these examples below.

Moving Averages (SMA & EMA)

Widely used across all methods of trading, moving averages help to identify trends by blurring out market noise in both short-term and long-term trends. Momentum traders will use moving averages to determine whether a trend is accelerating.

The simple moving average (SMA) shows the average price of an asset over a given period of time. The exponential moving average (EMA) places a higher weighting on more recent quantitative data.

Trading with EMAs therefore tends to be more responsive to the latest price changes than with SMAs. As a result, EMAs can be better are smoothing out spikes in an asset’s historical price.

Moving averages

Moving Average Convergence Divergence (MACD)

The MACD indicator shows the relationship between two moving averages of an asset’s price. Specifically, the calculation for MACD is to subtract the 26-month EMA from the 12-month EMA. This formula creates the MACD line as well as a 9-day ‘signal line’.

The momentum trading line will trigger buy and sell signals depending on where the MACD crosses. The idea is that a short-term MA will indicate current price action, whilst a long-term MA looks at current and past prices.

If the separation between the lines widens, this could indicate a new trend, where a convergence of the MACD with price action confirms the strength of an upward trend.

MACD

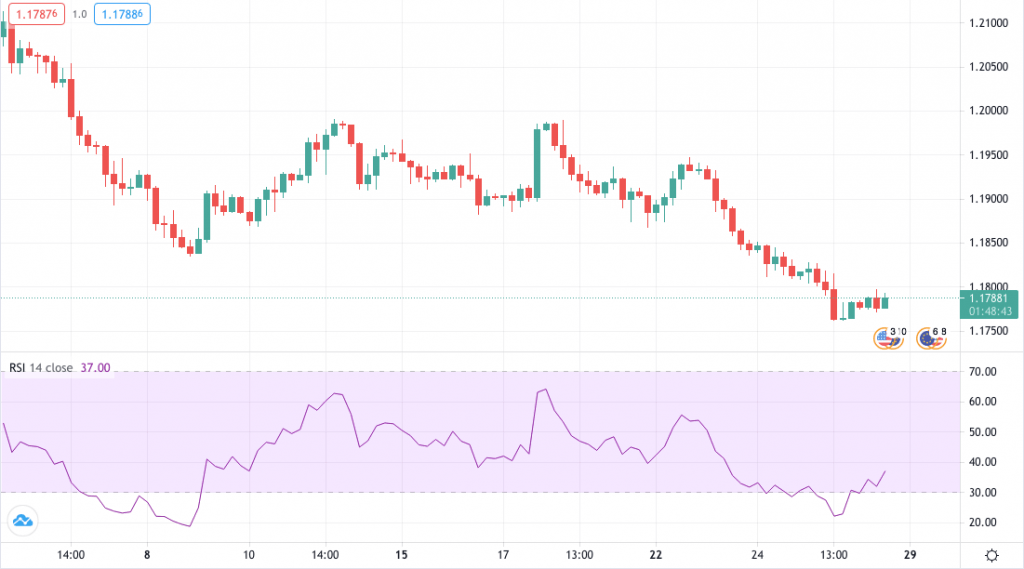

Relative Strength Index (RSI)

Trading with the RSI indicator allows you to see the average gains and losses over 14 periods. The RSI oscillates between 0 and 100, indicating the overbought or oversold conditions of the asset’s price. If the price hits 70 or above, the market is thought to be overbought, whilst values below 30 suggest oversold conditions.

Relative Strength Indicator

The idea behind RSI is that clear trends will usually come from retracements between the price levels. Divergence will therefore occur when momentum and price are moving in different directions. Traders will look to open and close positions in the middle of these trends.

Momentum Trading Top Tips

Now that we’ve covered some key technical analysis indicators for your strategy, there are some other useful tools that you could add to your momentum trading checklist. Most of these can be found in an online trading platform or app, some of the best ones being MetaTrader 4, cTrader or Thinkorswim.

It’s not compulsory to trade using all of the options below, but depending on individual preferences, they can help to boost certain methods of trading. You can check out some of our top broker reviews here. You can also check out this list of forex brokers if you only want to focus on forex trading.

Use A Demo Account

No matter the experience level, a demo account or trading tutorial can benefit traders in various ways. If you’ve signed up to a new broker, a demo account allows you to try out the features of the platform and practice placing risk-free trades using virtual money.

You can also use a demo account to test out a new strategy in real-time. Conveniently, many top brokers also offer demo accounts without a time restriction, so you can use them alongside your live account whenever needed.

Automate Your Strategy Using Bots & Signals

Although they aren’t everyone’s cup of tea, automated tools such as trading robots or forex signals can help to determine optimum entry and exit points. Momentum day trading strategies can work well with these tools, though not all of them will be suitable.

Trading bots are essentially automated market scanners that can be programmed to suit any desired strategy. Once the bots have identified an opportunity, they can automatically submit a trade order for you.

Similarly, signals will follow specific criteria set by the trader and will make a suggestion on buy and sell moves once these have been satisfied. Signals are often generated by a trading bot but they can also be managed manually by another trader.

You may also get access to a backtesting feature that allows you to create and run bots or strategy indicators using a custom algorithm. This can be particularly useful for traders who know how to code within a programming language such as Python.

Use A Variety Of Learning Materials

Momentum trading requires a solid understanding of trending markets and how to use technical indicators to take advantage of them. The best education you can give yourself is through a variety of different materials, both within your broker’s platform and through third-party resources.

This could include trading guides, a strategies course, published research papers, podcasts, blogs, videos or newsletters. Some brokers can also recommend forex trading books or even supply PDF copies of e-books.

Take Advantage Of Platform Tools

Most good platforms will offer additional features that can help you to learn and trade seamlessly. An economic calendar and news feed will likely be at the top of your list. These can keep you abreast of the latest market news and economic developments that can determine a new trend or price direction.

If you’re a social trader, you may also want to utilise any trading forums, chat rooms or discussion groups within the platform. These can be excellent tools if you need to seek quick advice from more experienced traders.

You could also look into trading alerts which are notifications that automatically trigger if conditions change within the market. These can be customised to suit certain criteria and can cater for different requirements, for example, if a certain news event hits the market you wish to trade.

Final Word On Momentum Trading

In this article, we’ve covered an explanation of how momentum trading works, as well as the basics of trading using various indicators.

Whilst the strategy can be time-consuming, many traders view momentum trading as a good opportunity to exploit strong uptrends. Furthermore, traders can take advantage of popular volatile and liquid markets.

However, momentum trading does require strong technical analysis skills on short-term time frames, so it’s unlikely to suit traders who prefer long-term buy-and-hold strategies. If you think momentum trading could work well for you, we recommend utilising a practice account and other platform tools to model your own trading system.

FAQ

What Is Momentum Trading?

Momentum trading aims to exploit strong upwards trends by buying when the market starts to pick up and selling when the trend appears to have peaked. The strategy follows the idea of buying high and selling higher.

Is Momentum Trading A Profitable Strategy?

Momentum trading can be profitable with the proper use of technical indicators and good knowledge of the markets. Remember that the markets can be unpredictable, so always take measures to protect your funds and use appropriate risk management.

What Is The Best Momentum Trading Broker In The UK?

There are numerous brokers offering momentum trading for UK clients. For a wide range of markets and top-class education, you could try IG or Admiral Markets. eToro is an excellent choice for low fees and beginner-friendly trading, whilst Interactive Brokers is a top performer for professionals.

What Is The Difference Between Momentum Trading Vs Position Trading?

Both setups are very similar but work on different timescales. Momentum trading involves opening a trade in the middle of a trend and then waiting until it appears to have peaked. Position trading focuses more on opening a position before the market starts to move and then increasing the position over time.

Is Momentum Trading Good For Beginners?

Beginners can certainly learn how to trade using momentum strategies. Note that momentum trading does require a good level of time commitment and thorough research. Whether you’re tracking overbought and oversold conditions or playing trend breakouts, new traders should always practice within a demo account first.