LQDFX Review 2025

See the top 3 alternatives to LQDFX or the best UK brokers list for options.

|

|

LQDFX is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to LQDFX |

| LQDFX Facts & Figures |

|---|

LQDFX is a straight-through processing (STP) broker based in the Marshall Islands. The offshore trading firm offers competitive spreads from 0.0 pips, free deposits, 24/5 support and access to the hugely popular MetaTrader 4 platform. LQDFX also runs a competitive bonus program for short-term traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities, Crypto |

| Demo Account | Yes |

| Min. Deposit | $20 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | LQDFX offers a modest collection of CFDs covering currencies, metals, stocks, indices, commodities and cryptos. The 50+ technical indicators and drawing tools pre-included in MT4 will facilitate both short-term and long-term strategies. |

| Leverage | 1:1000 |

| FTSE Spread | 0.90 |

| GBPUSD Spread | 0.1 |

| Oil Spread | 0.05 |

| Stocks Spread | 0.05 (Apple Inc) |

| Forex | LQDFX offers an extensive list of 70+ currency pairs, more than most alternatives. Spreads are low, coming in at 0.2 pips for EUR/GBP during peak market hours and the low/no commission models will suit beginners and high-volume forex traders. |

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.5 |

| Assets | 71 |

| Stocks | Alongside 11 global indices, you can trade 35+ of the biggest names in stocks and shares like Google, Microsoft and Netflix. This range won't suit seasoned stock investors, although there is some chart analysis and a decent economic calendar. |

| Cryptocurrency | You can trade 16 well-known cryptos including Bitcoin, the majority paired with USD or EUR. Spreads are low, starting from 1.02 pips. You can also deposit instantly via crypto with minimum deposits from $20 and no fees. |

| Coins |

|

| Spreads | 1.02 - 28.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

LQDFX is an STP and NDD brokerage that offers UK investing in a range of forex, equity, commodity and crypto instruments. The firm boasts access to the MetaTrader 4 platform and a huge collection of educational resources, making this a good platform for new traders. In this 2025 review, we will cover who LQDFX is, what account types it offers, how to place trades, its fees, market access and more.

LQDFX is a competitive STP broker that boasts a solid range of CFD assets, access to MT4, a 100% deposit bonus and extensive education materials. However, UK clients may be put off by the lack of regulation and support for GBP-based accounts.

Company Details & Overview

LQDFX is an online brokerage founded in 2015, owned and operated by LQD LLC and based in Saint Vincent and the Grenadines (SVG).

The firm offers straight-through processing (STP) trade execution with a no-dealing desk (NDD) model, giving clients direct access to markets with no requotes.

The brokerage is currently unregulated.

Markets & Instruments

LQDFX offers a wide range of tradable assets:

- Indices – 11+ global stock indices, including UK 100 (FTSE 100), US 100 (NASDAQ 100) & Aus 200 (ASX 200)

- Forex – 71+ pairs: 7 majors, 21 minors, 43 exotics, including GBP/USD, CHF/JPY & EUR/SEK

- Commodities – 4+ agricultural and energy commodities, including cocoa, coffee & natural gas

- Cryptos – 16+ coins and tokens, including BTC/USD, ETH/EUR & Ripple (XRP)

- Stocks – 37+ stocks & shares, including Apple, Google & Tesla

- Metals – 7+ metals, including gold, platinum, silver

This totals almost 150 instruments with which UK clients can speculate on global and local markets, currencies and cryptos. This provides ample opportunities for those looking to invest in popular assets. However, those looking to trade in more exotic instruments may need to look elsewhere.

Platforms

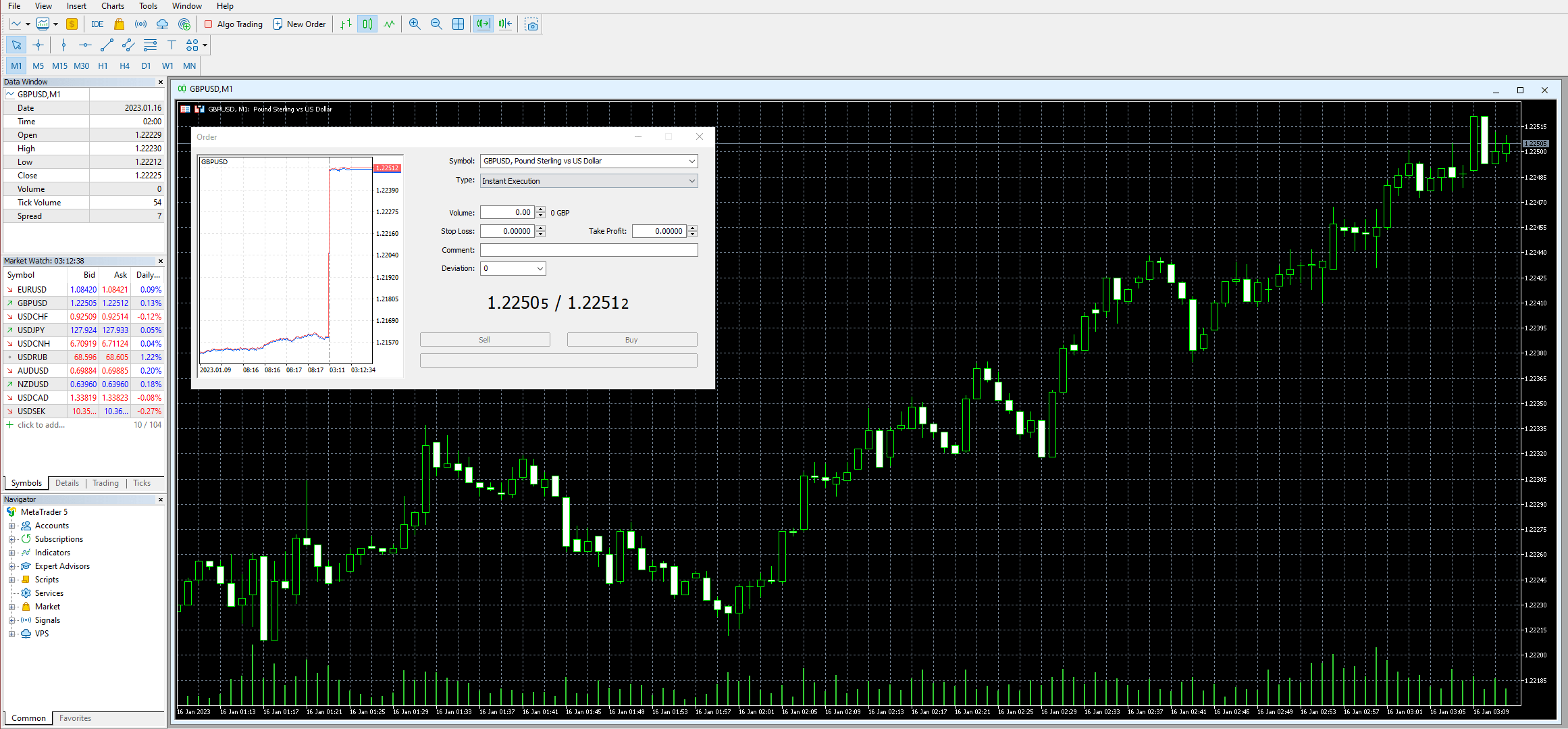

While using the broker, we found that LQDFX clients can make use of the highly popular MetaTrader 4 (MT4) platform. This is one of the most popular available and is used across the globe by retail and professional investors.

MT4 offers access to over 30 built-in technical indicators, customisable charting options, one-click trading, Expert Advisors automated trading, nine timeframes and much more.

You can download the MetaTrader 4 terminal for both Windows and Mac or use the browser-based WebTrader. A download link is available on LQDFX’s website.

How To Place A Trade On MT4

- Log into the client portal and download the MT4 terminal or click on the MT4 Web Terminal button

- Sign into your account within MT4 using the server and details provided by LQDFX

- Choose the asset you would like to invest in from the top left of the window

- Click New Order

- Enter the trade parameters (e.g. volume, stop loss & take profit)

- Choose Sell by market or Buy by market to place your trade

MetaTrader 4

Fees & Charges

Trading fees and commissions with LQDFX vary by account type, instrument and market conditions.

Typical Spreads & Commissions

- Micro: 1 pip, no commission on FX

- Gold: 0.7 pips, no commission on FX

- VIP: 0.1 pips, £2.50 per 100,000 on FX

- ECN: 0.1 pips, £3.50 per 100,000 on FX

- Islamic: 0.7 pips, no commission on FX

Payment Fees

Deposit and withdrawal fees vary with the payment method used. LQDFX does not charge deposit fees when transferring through Visa, Mastercard, Confirmo, crypto or PayRedeem. Nor does the broker charge withdrawal fees with Confirmo, crypto or PayRedeem. However, there is a fee of £10 when withdrawing via Visa or Mastercard payment cards.

MT4 Mobile App

LQDFX allows clients to manage their trading accounts through the MetaTrader 4 mobile app, available on both the Apple iOS App Store and the Android Google Play Store.

The mobile app comes with the standard features of the desktop and WebTrader MT4 terminals, allowing traders to open and close positions, check live prices, view charts and use indicators. However, many of the more advanced functions, such as algorithm creation, are not supported on a mobile device.

Payment Methods

There are a limited number of payment methods available when transferring funds to and from your LQDFX trading account. Clients can deposit and withdraw funds through debit/credit card transfers (Visa and Mastercard), PayRedeem and cryptocurrency transfers. Withdrawals are available through Fasapay.

While free deposits and withdrawals (or low fees) are a boon to this company, the lack of other, more popular, payment methods like Neteller, Skrill or PayPal hinders the firm.

Deposits

- Crypto – £250,000 max deposit on all coins, £30 min deposit, instant processing

- Visa – £2,000 max deposit per transaction, £20 min deposit, processed within 30 minutes

- Mastercard – £2,000 max deposit per transaction, £20 min deposit, processed within 30 minutes

- PayRedeem – Max deposit dependent on your PayRedeem tier, £20 min deposit, instant processing

- Confirmo –£350,000 max deposit for BTC, LTC, USDT, USDC, ETH & SOL, 0,02 BTC max deposit for LBTC, £20 min deposit, instant processing

Withdrawals

- Visa – £10,000 max withdrawal, £20 min withdrawal, 1-2 business day processing time

- Mastercard – £10,000 max withdrawal, £20 min withdrawal, 1-2 business day processing time

- Crypto – £50,000 max withdrawal on all coins, £75 min withdrawal, 1-2 business day processing time

- PayRedeem –Max withdrawal dependent on your PayRedeem tier, £10 min withdrawal, 1-2 business day processing time

- Confirmo – £50,000 max withdrawal for BTC, LTC, USDT & USDC, £15 min withdrawal, 1-2 business day processing time

Account Types

LQDFX offers five account types: Micro, Gold, ECN, VIP and Islamic. All accounts support USD and EUR base currencies, offering STP market execution, an account manager, no requotes, the same instruments, MT4 access and all educational material. The key differences between each account are provided below.

The key downside for UK traders is that GBP accounts are not provided.

Micro Account

- No commission

- Variable swap fees

- 1:500 max leverage

- Spreads from 1.0 pips

- £20 minimum deposit

- 5 lots max position size

- 0.01 lots min position size

Gold Account

- No commission

- Variable swap fees

- 1:300 max leverage

- Spreads from 0.7 pips

- £500 minimum deposit

- 40 lots max position size

- 0.01 lots min position size

ECN Account

- Variable swap fees

- £3.50 commission

- 1:300 max leverage

- Spreads from 0.1 pips

- £500 minimum deposit

- 40 lots max position size

- 0.01 lots min position size

VIP Account

- Variable swap fees

- £2.50 commission

- 1:100 max leverage

- No max position size

- Spreads from 0.1 pips

- 0.1 lots min position size

- £25,000 minimum deposit

Islamic Account

- No swap fees

- No commission

- 1:300 max leverage

- Spreads from 0.7 pips

- £20 minimum deposit

- 40 lots max position size

- 0.01 lots min position size

Demo Account

When we used LQDFX, our experts found that all UK clients can open a free demo paper trading account on the MT4 trading platform. The broker allows you to open as many accounts as you desire, straight from the client portal. You can choose the parameters of the demo account, including starting fund size and available maximum leverage rate.

This is a competitive demo account offering, many companies impose time limits and usage fees or restrict the number of accounts you can open.

How To Sign Up For A Demo Account

- Click the Open Demo Account button at the top of the broker’s website

- Fill in your personal details (name, email address and phone number if you do not already have a live account)

- Select your desired currency (USD or EUR), account type, leverage limit and starting balance

- Create the account by clicking Complete

- Use the MT4 credentials emailed to you to login to the WebTrader, mobile app or desktop client

Bonuses & Promos

LQDFX offers a 100% deposit bonus to new and existing clients. When depositing over £250 into your account, you are eligible for a 100% bonus to be added on top. The maximum bonus limit is £20,000. However, those wishing to take advantage of this deal must meet predefined volume requirements at a rate of £5 released per round turn lot (100,000 units) on forex and metals.

While the 100% rate is quite high, this is quite a steep wagering requirement, so carefully review whether you would like to lock up your funds in such a manner.

UK Regulation

LQDFX is an unlicensed and unregulated firm, holding no authorisation by the UK Financial Conduct Authority (FCA) or any other regulator.

While the broker provides transparency on its website through a range of legal documents and states to comply with anti-money laundering (AML) and segregated client fund protocols, there is limited guarantee that the broker truly has these in place.

Leverage Rates

As the firm is unregulated, it can provide high-margin investing opportunities. Most of the account types offer up to 1:300 in leverage, while the Micro account boasts up to 1:500 and the VIP up to 1:100.

Extra Tools & Features

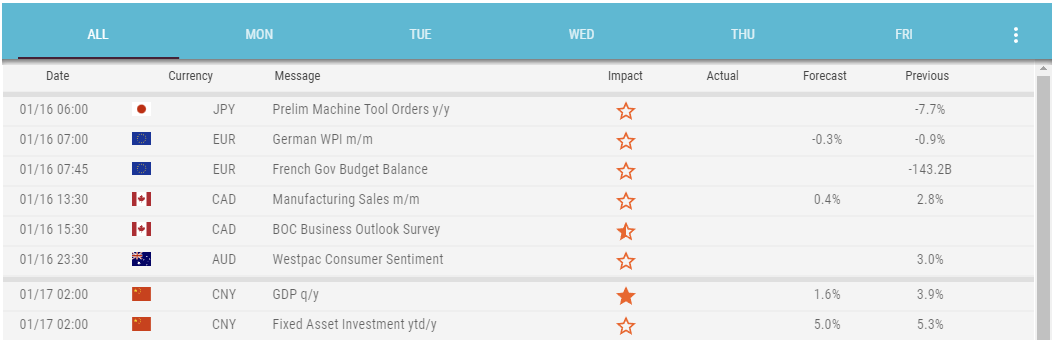

LQDFX offers several additional features, including an economic calendar, educational resources, chart analysis and pivot, Fibonacci and deal size calculators.

The educational resources cover a range of topics, though predominantly targeting novice traders. These include tutorials on how to use MetaTrader 4, getting to grips with basic forex terms, how to perform different trading strategies, an introduction to ECN and more.

The firm also offers an ebook focused on forex, teaching newer traders essential concepts and terms.

LQDFX Economic Calendar

LQDFX Trading Hours

The broker’s trading hours vary depending on the asset in question. Some assets, like cryptocurrencies, are available 24/7 due to their decentralised nature. However, others will only be available when their respective markets are open.

The LQDFX terminal runs in the GMT+1 time zone and supports all asset trading times.

Customer Service

There are several customer support avenues that clients can use to contact the broker if a problem arises. The firm operates a 24/5 customer support service and can be contacted via:

- Live Chat – On the site’s the “Contact” page

- Customer Support Email – support@lqdfx.com

- Enquiries Telephone Number – +357 2403 0362

- Account Support Telephone Number – +44 20 8064 1038

Client Security

LQDFX employs optional two-factor authentication (2FA) and one-time passwords (OTP) to protect clients’ accounts. This applies to both desktop and mobile trading platforms.

Should You Trade With LQDFX?

LQDFX gives investors the basic services required to speculate upon popular forex pairs, stocks, commodities, cryptocurrencies and indices. The broker provides many account options, allowing you to tailor your trading experience to suit your needs, including a halal, Islamic account. Those new to financial speculation will find the educational resources to be beneficial when starting out, particularly when compared to the offerings from competitors. However, the inherent risk associated with unregulated brokers is a notable drawback.

FAQ

Is LQDFX A Good Broker?

LQDFX provides traders with plenty of tools to get into trading some of the most popular instruments available. This is coupled with one of the most well-regarded trading platforms available and a plethora of educational resources. However, the unregulated nature of the firm introduces personal risk.

Can I Practise Trading On A LQDFX Demo Account?

Yes, LQDFX allows clients to make as many demo accounts as they desire to practise trading, learn the platform or build strategies. This includes being able to set personal parameters, such as starting funds and maximum leverage rates.

Is LQDFX A Safe Broker?

LQDFX claims to protect client funds through segregated accounts, as well as stating to follow anti-money laundering protocols. However, the firm is unregulated so there is no guarantee that the firm will protect traders’ funds.

Does LQDFX Offer Good Trading Platform Choices?

LQDFX only offers one trading platform, MetaTrader 4. However, this is one of the most popular platforms for online traders. It comes with a range of tools and analysis options and can be customised through plugins and coding to tailor to each trader’s needs.

How Much Do I Need To Deposit To Start Trading With LQDFX?

Minimum deposits with LQDFX depend on the account type, but are competitive for beginners. The lowest deposit required is £20 for both the Micro and Islamic accounts. The highest minimum deposit is £25,000 for the VIP account.

Top 3 LQDFX Alternatives

These brokers are the most similar to LQDFX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

LQDFX Feature Comparison

| LQDFX | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.5 | 4.8 | 4.8 | 4.7 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $20 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | LQDFX Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| LQDFX | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

LQDFX vs Other Brokers

Compare LQDFX with any other broker by selecting the other broker below.

Popular LQDFX comparisons: