Plexytrade Review 2025

|

|

Plexytrade is #59 in our rankings of CFD brokers. |

| Top 3 alternatives to Plexytrade |

| Plexytrade Facts & Figures |

|---|

Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Trading App |

Rather than developing its own app, Plexytrade offers its 100+ instruments on the MT4 and MT5 mobile platforms. While MetaTrader is favored by experienced traders, the absence of a proprietary trading app results in a steep learning curve for beginners. It also means deposits, withdrawals and account management have to be completed through the Plexytrade website, leading to a less complete mobile trading experience. |

| iOS App Rating | |

| Android App Rating | |

| Min. Trade | 0.01 |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Plexytrade offers a modest selection of CFDs, providing opportunities to speculate on upward/downward price movements across 15 indices, 48 US stocks, 3 commodities, 4 metals, and 5 cryptos. The free margin calculator allows you to work out how much you need to put down to open and maintain leveraged positions. |

| Leverage | 1:2000 |

| FTSE Spread | 0.8 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 5 |

| Stocks Spread | 5 |

| Forex | Plexytrade presents major, minor, and exotic forex pairs for trading, with leverage reaching 1:2000 and raw spreads starting from 0.0 - an enticing proposition for advanced traders seeking gains from minor price shifts. However, the downside lies in the limited selection, with only 41 currency pairs available, significantly fewer than the 100+ forex assets at IG. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.1 |

| Assets | 40+ |

| Stocks | Plexytrade's range of 48 US stock CFDs trails most competitors, though the selection of 15 popular global indices (including S&P 500, Nasdaq 100, and Dow Jones) is reasonable. Still, the lack of stock market research tools like stock screeners and the minimum deposit requirement to access the economic calendar (a typically free feature at other stock brokers) is disappointing. |

| Cryptocurrency | Plexytrade lets traders capitalize on the inherent volatility of the cryptocurrency market by offering leveraged trading on 5 popular cryptocurrencies, including Bitcoin. However, the threadbare offering of digital tokens seriously trails leading brokers like Eightcap with its 100+ crypto derivatives. |

| Coins |

|

| Spreads | 1.1 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Plexytrade operates as an offshore trading platform, providing access to a range of CFDs across various asset classes, including forex, commodities, global stock indices, stocks and cryptocurrencies.

Our team of experienced UK-based traders and financial analysts has conducted a comprehensive and hands-on evaluation of Plexytrade, focusing on its key features, dependability, and trading environment to determine how well it meets the needs of investors in the United Kingdom.

Our Take

- Plexytrade operates offshore (registered in Saint Lucia) and is not licensed by the Financial Conduct Authority (FCA). That means no FSCS protection, no strict compliance standards, and fewer legal protections if anything goes wrong—something UK traders should weigh carefully.

- Plexytrade offers extremely high leverage—up to 1:2000 on its Micro account. That’s way above the FCA’s 1:30 cap for retail traders in the UK. While high leverage can boost profits, it also magnifies losses, so it’s best suited for seasoned traders who know how to manage risk.

- All funding and withdrawals are made via cryptocurrencies like Bitcoin, Ethereum, USDT, Ripple, and more. Traditional methods like bank transfers, debit cards, or e-wallets are not available. This can be great if you’re comfortable with crypto but a barrier if you’re not.

- You can only hold your account in USD or EUR. Any crypto deposits are automatically converted to one of those currencies, which could mean exchange rate fees or poor conversion rates for traders dealing in GBP.

- You can trade using the well-known MT4 and MT5 platforms, which offer advanced charting, expert advisors (EAs), and many tools for technical traders, as well as the TradingView-based Tradelocker.

Is Plexytrade Regulated In The UK?

Plexytrade presents itself as a global CFD trading platform, but for UK investors, there are critical considerations—particularly regarding its regulatory standing and operational transparency.

While Plexytrade maintains a registered address in Rodney Bay, Saint Lucia, and reports having a physical presence in Podgorica, Montenegro, it operates without oversight from any recognised financial regulatory authority.

Although the company states that its trading servers are based in the UK, this alone does not compensate for the absence of formal regulation—a concern for many British investors accustomed to the protections provided by the Financial Conduct Authority (FCA).

Regulatory oversight is not just a formality—it plays a crucial role in ensuring the security of client funds, enforcing ethical conduct, and holding brokers accountable through routine audits and compliance checks.

FCA-regulated brokers, for instance, are required to participate in the Financial Services Compensation Scheme (FSCS), which can reimburse you up to £85,000 in the event of broker insolvency. Plexytrade, operating without such regulation, cannot offer these safeguards.

Plexytrade also claims to hold client funds in segregated accounts and offer negative balance protection to limit trading losses—standard features among reputable brokers. However, the lack of independent verification, public financial reporting, or regulatory scrutiny raises questions about the reliability of these assurances.

Unlike well-established brokers such as IG or Plus500—both FCA-regulated and publicly listed—Plexytrade does not provide the same level of transparency or investor protection.

Accounts

Live Accounts

Plexytrade offers four distinct account types, all compatible with the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

While the platform choice remains consistent across all accounts, differences arise in spreads, commission structures, high leverage limits and additional features.

For UK traders familiar with FCA-regulated brokers, it’s worth noting that Plexytrade’s account structure reflects more of an offshore flexibility model—offering high leverage and relatively low entry barriers, but lacking the investor protections and constraints imposed by UK regulators:

- Micro: Targeted toward beginners and traders with limited capital, the Micro account requires a minimum deposit of $50. It offers high leverage of up to 1:2000, variable spreads starting from 0.7 pips, and supports a maximum trade size of 5 lots per order. This account does not charge trading commissions, which may appeal to newer traders, but it does not include a dedicated account manager.

- Silver: The Silver account is a middle ground between entry-level and advanced trading. It increases the maximum lot size per order to 50 and reduces leverage to 1:500. The minimum deposit rises to $300, but trading remains commission-free. This may suit intermediate traders seeking more flexibility without transitioning to a commission-based model.

- Gold Raw: Geared toward experienced traders, particularly scalpers and high-frequency traders, the Gold Raw account offers raw spreads starting from 0.0 pips. Instead of relying on spreads, Plexytrade charges a commission of $2 per lot (or $4 round turn). Leverage remains capped at 1:500, and the minimum deposit is $300 again. For UK traders who are used to paying tighter spreads and commissions with FCA-regulated brokers, this account mimics a competitive ECN-style model, albeit without regulation to back client protection.

- Platinum VIP: Positioned as the premium offering, the Platinum VIP account reduces commissions to $1 per lot ($2 round turn), increases the maximum order size to 80 lots, and includes extra perks such as a dedicated account manager and free annual VPS access. Leverage is reduced to 1:400, and a steep minimum deposit of $10,000 is required.

All accounts support advanced trading strategies such as Expert Advisors (EAs), scalping, and hedging and offer VPS hosting for algorithmic and uninterrupted trading.

Notably, the stop-out level across all accounts is 20%—significantly lower than the 50% often enforced by FCA-regulated brokers, which are designed to limit client losses and maintain account equity.

While this may appeal to risk-tolerant traders, it does expose you to more significant downside potential.

Islamic (swap-free) accounts are also available if you seek Sharia-compliant trading options, and PAMM accounts let fund managers trade for multiple investors.

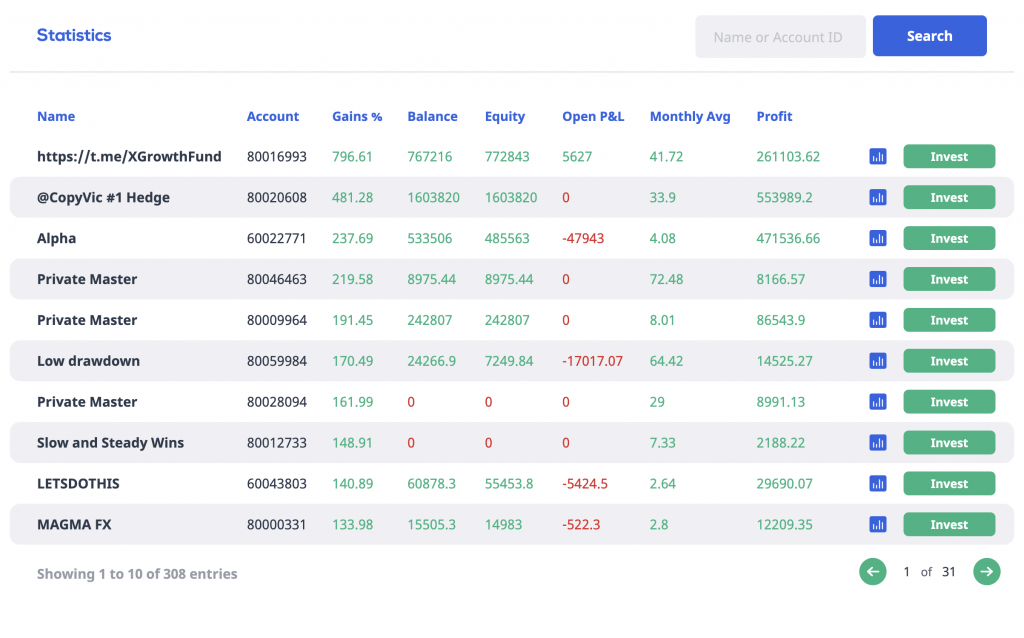

PAMM Offering

Demo Account

Plexytrade offers a demo account feature that enables you to explore the platform and test trading strategies in a risk-free environment.

This can be especially valuable for newer traders or those transitioning from other brokers, as it allows you to become familiar with the available platforms and refine strategies without risking actual capital.

A notable advantage of Plexytrade’s demo account is that it does not have a fixed expiration date, allowing you to practise at your own pace. This flexibility stands out compared to some other UK brokers that impose time limits—typically 30 days—on demo access.

That said, there is a catch worth noting: demo accounts that remain inactive for over a month are automatically archived. However, active users who log in regularly are unlikely to be affected.

Funding Options

Deposits

Plexytrade’s funding options are notably limited compared to those of more established brokers, particularly for UK-based traders accustomed to a wider range of deposit and withdrawal methods.

The platform only supports cryptocurrency transactions, accepting coins such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Cardano (ADA), and Tether (USDT).

Traditional payment channels—including debit card, credit card, bank wire transfer, and widely used e-wallets like PayPal or Skrill—are not available.

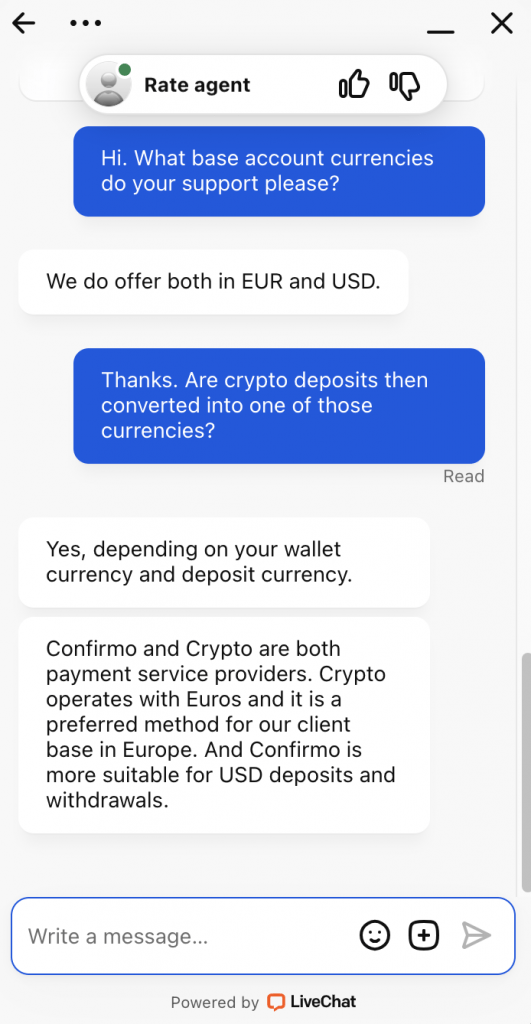

Plexytrade uses two third-party processing partners—Crypto and Confirmo. Crypto operates in euros, which is a preferred method for clients based in Europe. Confirmo is more suitable for USD deposits and withdrawals.

Transactions are processed almost instantly, and Plexytrade absorbs any associated network fees or commissions, making the process cost-effective. This could be particularly advantageous if you’re an active trader who values fast account funding and minimal overhead.

However, for many UK traders—especially those new to online trading or unfamiliar with handling crypto wallets—this could represent a significant barrier to entry. The lack of support for FCA-regulated payment systems may raise concerns about consumer protection, chargeback rights, and transaction traceability.

In terms of accessibility, Plexytrade does maintain relatively low deposit thresholds. The minimum deposit is $200 via the Confirmo payment processor and $30 for Crypto transfers, making it more inclusive for traders with modest capital.

That said, UK traders should know that all deposits are converted into USD or EUR, as Plexytrade does not operate in GBP. This means currency conversion fees may apply, depending on how the crypto is purchased or held before deposit.

Withdrawals

Regarding withdrawing funds, Plexytrade maintains the same crypto-focused approach as it does with deposits.

The minimum withdrawal amount varies depending on the method used. For crypto withdrawals, the minimum is $75, which could be restrictive for traders with smaller balances or those who prefer to withdraw in smaller increments. In contrast, Confirmo offers a lower threshold of just $15, making it more accessible for low-volume or frequent withdrawals.

On the upside, withdrawal processing times are generally quick, particularly for crypto transactions, which benefit from blockchain efficiency. Plexytrade also states that it covers any withdrawal-related fees, which can help reduce overall trading costs.

Such minimum withdrawal requirements might seem limiting, especially compared to platforms like FP Markets, where there are no minimum withdrawal amounts—making it easier to access smaller profits more frequently and flexibly.

Market Access

Plexytrade focuses on forex and CFD trading, but its range of tradable instruments is relatively narrow compared to more comprehensive offerings from major brokers.

While it covers the essentials—including forex pairs, indices, commodities, metals, and cryptocurrencies—it notably excludes asset classes like real stocks, ETFs, or options, which may limit its appeal to more diversified traders.

Plexytrade provides access to 41 currency pairs, alongside CFDs on 15 global indices (including the S&P 500, Nasdaq-100 and FTSE 100), 48 US-listed stocks such as Apple, Tesla and Alibaba, as well as three commodities (Brent oil, crude oil and natural gas) and four precious metals (gold, silver, platinum and palladium).

Additionally, it offers leveraged CFD trading on five major cryptocurrencies—Bitcoin, Ethereum, Ripple, Litecoin, and Solana—allowing you to speculate on crypto price movements without owning the underlying digital assets.

For UK traders accustomed to a broader market selection, Plexytrade’s product lineup may feel restrictive. For instance, CMC Markets offers access to over 300 forex pairs and more than 10,000 total instruments, while IG provides upwards of 100 currency pairs and 17,000+ markets, including real stocks, ETFs and options.

Regarding additional features, Plexytrade does not currently support passive income tools, such as interest on unused cash—an offering available on platforms like eToro, which provides annual returns on uninvested cash.

Furthermore, copy trading and social investing features are absent, limiting the platform’s appeal to beginners or passive investors who might prefer to mirror the strategies of experienced traders.

Leverage

Plexytrade offers varying high-leverage options depending on the account type, with the highest available at 1:2000 for the Micro account.

This high leverage is appealing if you want to control more prominent positions with smaller investments, but it comes with increased risk. The Silver and Gold Raw accounts offer leverage up to 1:500, and the Platinum VIP account provides a more ‘conservative’ leverage of 1:400.

Although these leverage levels are higher than UK traders typically experience with FCA-regulated brokers (where the maximum is capped at 1:30), they can lead to significant losses if not carefully managed.

For UK traders, the lack of regulatory oversight and the potential for rapid losses make it crucial to approach high leverage cautiously. Plexytrade’s leverage options may suit more experienced traders, but new traders should be aware of the risks associated with trading without the protections offered by FCA regulation.

Pricing

Plexytrade is attractive if you prioritise competitive pricing, offering tight spreads and low fees based on our analysis.

The spreads vary depending on the account type. The Gold Raw account offers spreads as low as 0.0 pips for major currency pairs like EUR/USD and USD/JPY, though it charges a commission of $2 per lot ($4 round turn).

If you opt for the Platinum VIP account, the commission is even lower at $1 per lot ($2 round turn), making it appealing for high-frequency trading. By comparison, most brokers typically charge around $7 round turn commission.

A notable advantage of Plexytrade is its zero deposit and withdrawal fees, which are rare among many brokers. Additionally, the platform covers the costs of crypto conversion fees during deposits and withdrawals.

Plexytrade also does not charge commissions on stocks, metals, or indices, making it affordable for those who want to diversify their portfolios.

To further enhance its offering, Plexytrade provides a 120% cash welcome bonus for up to three accounts per client. While this can significantly boost your trading capital, the bonus is subject to conditions, such as a minimum deposit of $200 and a minimum trading volume of 100,000 units round turn on forex and metals.

Trading Platform

Plexytrade doesn’t offer a proprietary trading platform, which may raise concerns for traders who are used to brokers with custom-built interfaces and exclusive features.

That said, it provides access to two of the industry’s most trusted and widely used platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are both available on desktop, web, and mobile.

This is a reassuring feature for UK traders. Thanks to its clean interface and a built-in library of technical indicators, MT4 is a solid starting point for beginners. It’s mainly geared toward forex and CFD trading, which aligns with Plexytrade’s core product offering.

Meanwhile, MT5 is more robust, supporting a wider range of tradable assets like stocks and cryptocurrencies and offering more advanced charting features, deeper market depth, and faster execution speeds. However, its interface and scripting language are a bit more complex, which could pose a learning curve for newer users.

Plexytrade also supports a newer platform called TradeLocker, which may appeal to traders looking for a more modern alternative.

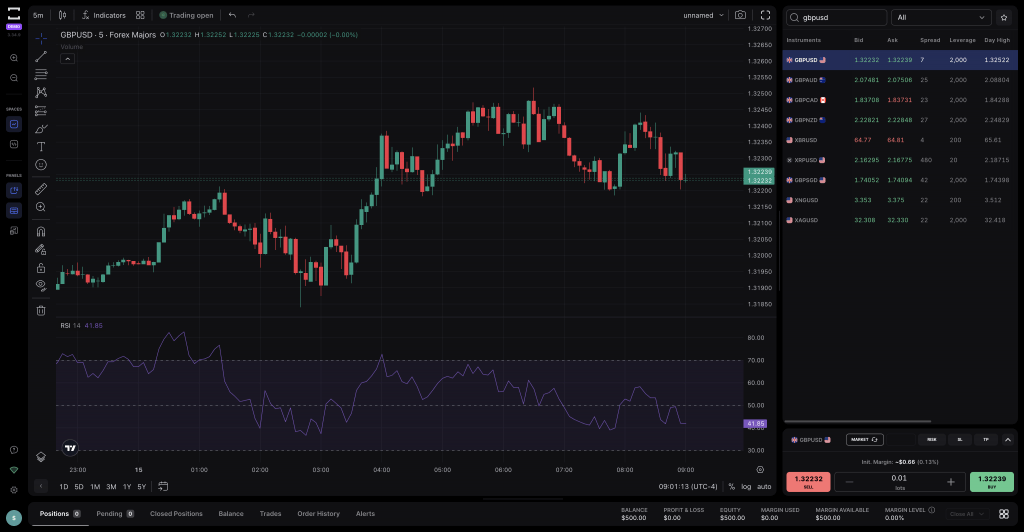

During hands-on tests, I found TradeLocker sports an intuitive TradingView-based layout and smooth execution, combining simplicity with more advanced charting tools.However, it lacks the widespread familiarity, community support, and third-party integrations that MT4 and MT5 enjoy.

TradeLocker

Extra Tools

Plexytrade offers additional trading tools, though the range is limited and primarily geared toward more experienced traders who meet specific deposit requirements.

One of the key extras is access to Trading Central, a respected third-party provider of technical analysis tools. These include trend insights, price targets, and trade setups, but there’s a catch: you’ll need to deposit at least $5,000 to unlock them.

For many UK retail traders, that threshold may be too high to justify, especially when other brokers provide similar tools for free.

Plexytrade also maintains a market blog with occasional updates on trading strategies, market commentary, and broker news. While this content can be helpful, it lacks the consistency and depth more established brokers offer. The platform does not provide structured educational materials, video explainers, podcasts, or in-depth training courses.

The gap becomes clear when you compare this to top FCA-regulated brokers like IG, CMC Markets, or eToro. These brokers typically offer a comprehensive education suite, including live webinars, video tutorials, trading academies, and daily market analysis produced by in-house experts.

Some, like eToro, also include copy trading and community-driven features, allowing less experienced traders to follow the strategies of successful investors.

Customer Service

During our evaluation of Plexytrade, customer support emerged as an area with room for improvement—particularly for UK traders who value responsive and accessible assistance.

Plexytrade provides several help channels, including live chat, email, and a global support hotline. However, support is only available 24 hours a day, five days a week, which may not be ideal for those trading on weekends or across multiple time zones.

By contrast, some brokers—such as IC Markets—offer 24/7 customer support, ensuring round-the-clock access regardless of the trading schedule.

Another limitation is the lack of localised support for UK clients. There’s no UK-based phone number or multilingual service, meaning urgent issues must be directed to the broker’s office in Montenegro, which could pose delays or communication challenges.

Setting up a demo account in hands-on testing proved more complicated than expected. Although the live chat team was generally quick to respond and courteous, they couldn’t resolve an email verification issue, forcing us to escalate the matter via email.

Unfortunately, the email response time was around 48 hours, which can be frustrating if you’re trying to get started or need urgent access to your account.

To their credit, the support team eventually resolved the issue. But for UK traders used to high-touch service and fast resolutions—especially from FCA-regulated brokers—Plexytrade’s current customer support framework might fall short of expectations.

Bottom Line

Plexytrade is an offshore broker that may appeal to experienced UK traders looking for high leverage, crypto funding, and access to forex and CFD markets. It supports MT4/MT5, offers low spreads, no deposit or withdrawal fees, and a 120% welcome bonus.

However, it’s not FCA-regulated, so UK clients don’t get key protections like FSCS coverage or leverage limits. Limited asset variety, lack of GBP accounts, and slower support may also be drawbacks.

It may suit high-risk traders who are comfortable with offshore platforms, but those seeking safety and regulation may prefer FCA-authorised brokers.

FAQ

Can You Invest In GBP With Plexytrade?

Plexytrade does not support GBP as a base currency, which may be a drawback for UK traders looking to deposit, withdraw, or manage their accounts in British pounds.

Plexytrade operates in USD and EUR. If you fund your account with GBP via crypto or a third-party service like Confirmo, your funds will be automatically converted into USD or EUR upon deposit.

This conversion process exposes you to currency exchange fees and fluctuations, which could eat into your trading capital over time.

While it’s still possible to invest as a UK trader, the lack of direct GBP support may add a layer of cost and complexity compared to FCA-regulated brokers offering multi-currency accounts, including GBP.

Is Plexytrade Safe For UK Traders?

Plexytrade is not considered an entirely safe or secure option for UK traders. The platform is unregulated, meaning it does not fall under the oversight of the UK’s FCA or any other top-tier financial regulator.

For instance, regulated brokers in the UK must follow strict rules around fund segregation, negative balance protection, transparency, and dispute resolution—none of which are legally guaranteed with Plexytrade. There’s also no investor compensation scheme should the company become insolvent.

Does Plexytrade Offer A Mobile Trading App?

Plexytrade does not offer a proprietary mobile trading app. However, traders can still access the markets on the go through the MT4, MT5 and TradeLocker mobile apps, which the broker supports.

All platforms are available for iOS and Android devices and offer a full suite of trading tools, including real-time charts, technical indicators, one-click trading, and order management.

Once you open a Plexytrade account, you simply log into a platform using the broker’s credentials.

Can You Invest In Cryptocurrency With Plexytrade In The UK?

UK traders can access cryptocurrency markets with Plexytrade via CFDs, which allow speculation on the price movements of coins like Bitcoin, Ethereum and Ripple without owning them. While crypto CFDs are banned for UK retail traders under FCA rules, Plexytrade—an unregulated offshore broker—still offers them.

All transactions are done through cryptocurrencies, with no support for GBP accounts. Deposits are converted to USD or EUR, which may involve exchange fees. This setup may appeal to experienced crypto users but could be less suitable for beginners or traditional investors.

Article Sources

Top 3 Plexytrade Alternatives

These brokers are the most similar to Plexytrade:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Plexytrade Feature Comparison

| Plexytrade | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4.8 | 4 | 4 |

| Markets | CFDs, Forex, Indices, Stocks, Commodities, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $50 | $0 | $1,000 | $40 |

| Minimum Trade | 0.01 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Plexytrade Review |

Pepperstone Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| Plexytrade | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Plexytrade vs Other Brokers

Compare Plexytrade with any other broker by selecting the other broker below.