HotForex Review 2025

See the top 3 alternatives to HotForex or the best UK brokers list for options.

|

|

HotForex is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to HotForex |

| HotForex Facts & Figures |

|---|

HotForex, now HF Markets, is a hugely popular broker with millions clients and authorization from several trusted regulators, including the FCA and CySEC. Leveraged CFDs are available on popular asset classes alongside industry-leading software, flexible account types and an accessible minimum deposit. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, ETFs, Commodities |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, DFSA, FSCA, CySEC, FSC, CMA, JFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | HotForex supports automated trading through access to MetaTrader 4 and MetaTrader 5, both of which have extensive expert advisor integration systems. |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | HotForex has CFD trading in stocks and shares, indices, ETFs, metals, energies, agricultural commodities and forex. Leverage is in line with the relevant regulatory jurisdictions and spreads are tight with no hidden charges. |

| Leverage | 1:30 |

| FTSE Spread | 1.16 |

| GBPUSD Spread | 1.8 |

| Oil Spread | 0.05 |

| Stocks Spread | Variable |

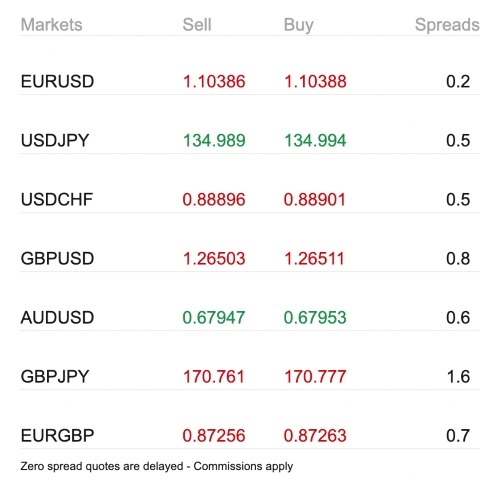

| Forex | HotForex has CFD trading on over 50 major, minor and exotic currency pairs with MT4 and MT5 accounts. This is a strong selection of currencies with advanced analysis software available to plan and execute trades. |

| GBPUSD Spread | 1.8 |

| EURUSD Spread | 1.3 |

| GBPEUR Spread | 1.5 |

| Assets | 50 |

| Stocks | HotForex provides both spot and CFD stocks, indices and ETF trading opportunities with two of the world's most popular trading platforms, MT4 and MT5. The choice of equity instruments will suit various trading styles and risk appetites. |

HotForex, now HF Markets, is a multi-asset CFD broker that offers three types of live accounts with different price structures and fast order execution. Retail investors can trade forex, commodities, indices, stocks, bonds, futures and ETFs on the MetaTrader 4 and MetaTrader 5 platforms. This HotForex review will cover all the broker’s most important features, with information on how to open an account and login to the client area, trading fees, payment methods, and more.

Our team rated the strong regulatory oversight from the Financial Conduct Authority. We also liked that there is access to powerful trading platforms and mobile apps. However, our experts were disappointed to see that the HotForex copy trading tool isn’t available to UK traders. Fees are also fairly high on some accounts and trading instruments.

Market Access

We did not have any major complaints about HotForex’s instrument list, which with 200+ CFD products is competitive and provides you with enough options to create a diverse portfolio. We were happy to see the presence – albeit limited – of bonds and soft commodities, which are sometimes neglected by rival brokers.

The main offering, forex, covers all the standard pairs and a good range of minors and exotics, but is not as broad as some competitors who offer 60 or 70+. Likewise, there is a good selection of shares available to trade, but other options on the market outcompete HotForex on this front too – sometimes offering thousands of stocks.

All in all, we felt the product range was good, but not outstanding.

- Bonds – Three government bonds including UK Gilt

- Indices – 12 global indices including the FTSE 100, NASDAQ 100, and US 30

- Forex – 50+ major, minor, and exotic currency pairs including EUR/GBP, GBP/USD, and GBP/JPY

- Stocks – 95+ company shares including Barclays Bank, BP, Google, and Walmart

- Commodities – Four precious metals, two energies, and five soft commodities such as sugar, UK Brent oil, gold, and silver

- ETFs – 34 exchange-traded funds covering several industries such as information technology, telecommunications, pharmaceuticals, and energy

We were also offered futures trading on various assets including commodities.

Accounts

We were pleased to see HotForex customers offered a choice between a tight spread with a commission and commission-free trading with a wider spread.

UK traders have the option of three live account types: Premium, Zero Spread, or Premium Pro. We found the conditions of the accounts are similar, including a minimum trade size of 0.01 lots, access to all instruments, market execution, a maximum trade size of 60 lots per position, and GBP as the base currency of all accounts.

I was also happy to see a Premium Pro account aimed at professional traders, who are free from UK restrictions on leverage offered to retail clients and can thus access leverage of up to 1:400. To qualify for this account type, traders will need to prove they have adequate experience; they will also need to fork out a much higher initial deposit of £5000.

Note that professional clients are not covered by negative balance protection or any similar measures enjoyed by retail traders.

Premium Account

- £100 minimum deposit

- Floating spreads from 1 pip

- No commission to trade forex pairs

- Maximum 500 simultaneous orders

Zero Spread Account

- £200 minimum deposit

- Floating spreads from zero pips

- Commission applies on forex pairs

- Maximum 500 simultaneous orders

Premium Pro Account

- £5000 minimum deposit

- Floating spreads from 1 pip

- No commission to trade forex pairs

- Maximum 300 simultaneous orders

Our experts were pleased to see an Islamic trading account with no swap or rollover fees for positions held overnight. Additionally, HotForex does accept joint account applications.

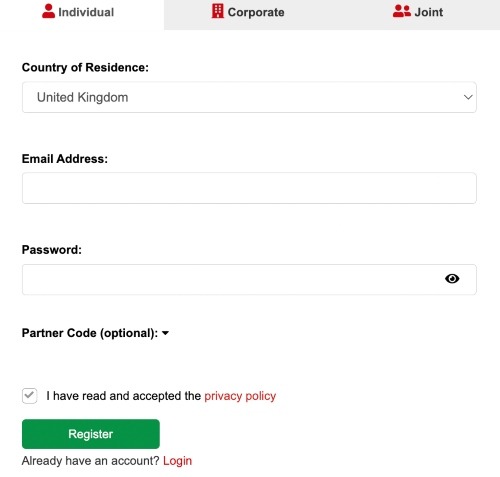

How To Open A HotForex Account

- Select the ‘Open Live Account’ logo from the HotForex website

- Complete the online registration form by providing your country of residence, name, phone number, email, and date of birth

- Create a password and select ‘Register’

- Activate your sign-up attempt by clicking the ‘Activate Account’ link sent to your registered email address

- Choose ‘Open Trading Account’ from the dashboard interface

- Select an account and platform

- Make a deposit and start trading

We were satisfied by the simplicity of HotForex’s quick and straightforward upload process for identity documents to comply with the FCA’s know-your-customer (KYC) requirements.

Fees

HotForex’s transparent pricing structure impressed our experts. My personal preference would be the Zero Spread account, thanks to its tight spreads and low commission charges. They start as low as £0.03 per 1k traded on major forex pairs, which is competitive.

I was slightly less impressed by the Premium and Premium Pro accounts, which do not charge any commission but instead have fairly broad bid-ask spreads compared to other brands, including a typical spread of 2.1 pips on the GBP/USD pair and 1.7 pips on the EUR/GBP. We were offered a gold spread of 0.27 points.

When we reviewed HotForex’s terms and conditions, we did not come across any inactivity charges, which is advantageous compared to brokers like XM and matches the offerings from brokers like Exness.

Payment Methods

Deposits

Even if it is more or less an industry standard, we were still glad to find that HotForex does not charge any deposit fees. It is also good to see the broker processes payments 24/5, with most methods providing fund clearance within ten minutes.

We were not so impressed, however, at the lack of alternative e-wallet solutions such as PayPal, Google Pay, or Apple Pay, or cryptocurrency payments such as Bitcoin. Fortunately, GBP is accepted as the account base currency.

The minimum deposit requirements vary by account type, though you can start trading on the Premium account with an initial payment of £100 (£200 for Zero Spread), which is competitive. We should also point out minimum deposits do apply to all payment methods:

- Skrill – Minimum deposit £50, £10,000 maximum and ten-minute processing time

- Neteller – Minimum deposit £50, £5000 maximum and ten-minute processing time

- Bank Wire Transfer – Minimum deposit £250, no maximum and two-to-seven-day processing time

- Credit/Debit Card (Visa & MasterCard) – Minimum deposit £5-£50, £10,000 maximum and ten-minute processing time

How To Make A Deposit

You can deposit to your live trading account in just a few minutes:

- Sign in to the HotForex client area

- Select ‘Deposit’ from the side menu

- Choose a payment method from the interface

- Add funds to deposit

- Complete the payment details on the following screen and select ‘Deposit’

Account verification documents must be submitted before deposits and withdrawals will be accepted. To upload documents, select ‘Complete Registration’ from the top of the menu on the left in the dashboard interface.

Withdrawals

HotForex does not charge any withdrawal fee, a fact that impressed us and stacks up well against competitors like eToro with its £5 fee per withdrawal. Funds must be processed back to the original payment method.

We are satisfied with the speed of withdrawals, which are processed on the same day if submitted before 10 AM. Minimum withdrawal limits apply:

- Skrill – Minimum withdrawal £5, instant processing

- Neteller – Minimum withdrawal £5, instant processing

- Bank Wire Transfer – Minimum withdrawal £100, two to ten day processing time

- Credit/Debit Card (Visa & MasterCard) – Minimum withdrawal £5, two to ten day processing time

You should reach out to the HotForex customer support team for any questions or problems.

HotForex Leverage

As an FCA-regulated broker, HotForex restricts the leverage offered to retail traders – the maximum amount available is 1:30 for major forex pairs.

We think this is still a decent amount of borrowing to boost position sizes, though traders seeking more trading power will have to look at offshore alternatives.

- Minor Forex Pairs – 1:20

- Metals – 1:20

- Energies – 1:10

- Soft Commodities – 1:10

- Indices – 1:20

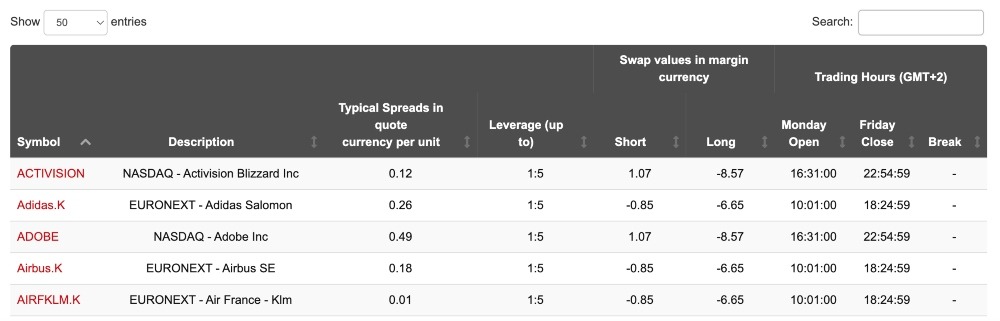

- Stocks – 1:5

- Bonds – 1:5

- ETFs – 1:5

The Premium and Zero Spread accounts have an 80% margin call and 50% stop out. The Premium Pro offers a 50% margin call and a 20% stop-out level.

UK Regulation

We were pleased to see that HotForex’s UK entity, HF Markets (UK) Ltd, runs a tight ship with oversight from an excellent regulator. This entity is authorised and regulated by the UK’s Financial Conduct Authority (FCA), registration number 801701.

When we searched the registration list, we came across some clone firms using the HotForex details. Though this is no wrongdoing of the brand, always be cautious of scams and hackers pretending to have references with HotForex.

HotForex is not permitted to offer deposit bonus schemes or alternative financial incentives such as a welcome or no-deposit bonus to UK traders due to ESMA regulations.

The FCA is a reputable financial authorisation, with top-tier compliance with financial safeguarding and customer protection. This includes negative balance protection and segregated client money. You are also entitled to up to £85,000 compensation from the FSCS in the case of business insolvency. We were also reassured to see the broker has Civil Liability insurance up to €5,000,000, protecting traders against financial loss from fraud and negligence.

Ultimately, our review confirms HotForex is a relatively secure brokerage. All payment processing is completed with level 1 PCI-DSS certification. The trading terminals also offer secure login and all data transactions are encrypted.

Trading Platforms

HotForex lacked a proprietary desktop platform, which we feel is at a disadvantage compared to some competitors. Instead, the broker offers the very popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are available for download to PC devices including Mac, Linux, and Windows, or can be used as web-based platforms. Both also provide iOS and Android (APK) mobile app compatibility.

We found that these third-party platforms are suitable for beginner and experienced traders and include some of the best features on the market, particularly for automated trading. However, some view MT4 and MT5 as somewhat dated, and we feel casual traders might prefer one of the sleeker, more intuitive proprietary platforms offered by some of HotForex’s competitors.

The main features of the platforms include:

MetaTrader 4

- Nine timeframes

- Hedging allowed

- Three chart types

- 32-bit platform speed

- Four pending order types

- Single-thread strategy tester

- 30 in-built technical indicators

- 31 drawing tools/analytical objects

MetaTrader 5

- 21 timeframes

- Hedging allowed

- Three chart types

- 64-bit platform speed

- Six pending order types

- Multi-thread strategy tester

- 38 in-built technical indicators

- 44 drawing tools/analytical objects

How To Place A Trade

The MetaTrader terminals accept various order methods, all of which we found easy and fast. This includes direct from charts, via the one-click trading function or the Market Watch window.

- Double-click on the instrument you want to trade

- In the ’New Order’ window, choose the transaction volume in lots

- Add a stop loss or take profit risk level (optional)

- Add a comment (optional)

- Select an order type from the dropdown menu (instant or pending)

- Choose ’Buy’ or ’Sell’ to confirm the position

Note, open positions will be visible in the ‘Trade’ tab.

Demo Account

We are always pleased to see brokers offering demo accounts and HotForex doesn’t disappoint. We were also glad to see HotForex’s paper trading profile offer simulated real market conditions and no maximum time limit. This allows traders to practise their strategies risk-free with £100,000 in paper funds, and both existing and prospective HotForex members can access it.

You can choose a demo account that simulates either the ‘Premium’ or ‘Zero’ account during the registration process.

How To Open A Demo Account

- Select the ‘Demo’ icon from the top right of the broker’s website

- Choose ‘New Clients’

- Complete the online registration form by providing your country of residence, name, phone number, email, and date of birth

- Create a password and select ‘Register’

- Activate your demo account by clicking the ‘Activate Account’ link sent to your registered email address

- Choose ‘Demo Premium’ or ‘Demo Zero’ conditions

- Choose a trading platform by pressing ‘Select’ from the relevant terminal

- Select a virtual balance from the dropdown and select ‘Open Demo Account’

- Account login details will be displayed on the following screen

Extra Tools

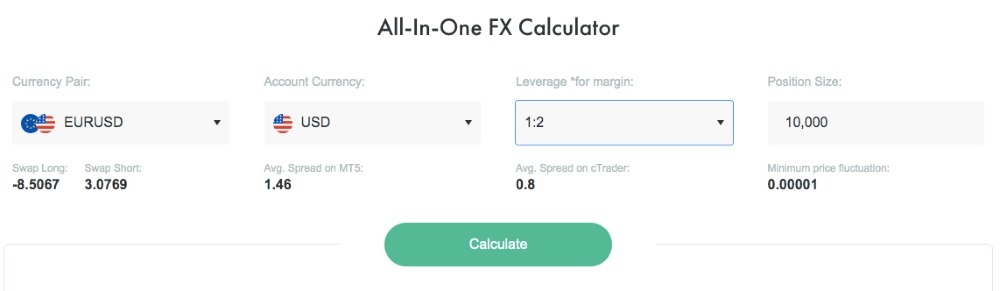

We appreciated the range of trading tools available to HotForex retail investors including calculators, insights, and VPS hosting. We unpack some of our favourites below.

VPS

HotForex VSP server, hosted by third-party brand Beeks Financial Cloud, provides 24/7 market connectivity with reduced latency and no downtime. The server is also compatible with expert advisors (EAs), which will appeal to traders who take advantage of MT4 and MT5’s powerful automated trading tools.

The three membership plans, Bronze, Silver and Gold, are available free of charge to traders who meet minimum deposit requirements. However, at £4000 for the lowest tier Bronze package with 1300 MB Ram and 25 GB disk space, this might be a little high for many retail traders’ budgets.

Fortunately, the membership plans can also be accessed without the minimum deposit for a monthly fee, starting at £25 for Bronze membership and rising to £40 for silver and £60 for gold. We think these options will be more realistic for many retail traders.

Autochartist

The Autochartist tool, offered to HotForex clients for no fee, is a great feature that many traders will find useful.

The powerful service works in MT4 and MT5 terminals to provide automated market scanning to determine patterns and trends based on support and resistance levels. Alerts can be set to signify trade opportunities or risks. The tool also works 24/7, so you don’t have to constantly watch out for price movements.

Other Tools

Altogether, HotForex has an impressive set of tools and features that we feel will be more than enough for a great many traders. As well as those we have already covered, several trading calculators are available to aid with investment and position sizes including a pip calculator, position size calculator, and a swap fee calculator.

There are also analysis and insights available, including forex news from FXStreet, an economic calendar, and exclusive volatility and sentiment insights from Big Data AI.

For experienced traders, we would recommend using the ‘Premium Trader Tools’ catalogue. Available tools include a trade session map, correlation matrix, and personal alarm manager.

We were disappointed, however, to find that the broker’s proprietary copy trading service, HFcopy, is not available to UK traders.

Education

When we used HotForex, our experts found a range of educational materials to suit both beginners and experienced traders. These include online webinars, e-books, and tutorial videos covering a wide range of topics including trading psychology, implementing strategies, and fundamental/technical analysis.

We recommend that beginners take advantage of the company’s MetaTrader 4 tutorial, which provides a step-by-step terminal walk-through.

Customer Service

HotForex’s customer support, available 24/5, impressed us with its speed and responsiveness. Contact methods include a telephone number and postal address as well as a live chat service, which responded to our enquiry in less than three minutes.

We also found a basic FAQ section on the broker’s website, but it was a shame to find no step-by-step user guides.

Contact details:

- Email Address – support@hfmarkets.co.uk

- Telephone – +442035199898 or 0800 920 2432

- Live Chat – Bottom right of the broker’s website

- Enquiry Form – On the ’Contact Us’ webpage

- Office Address – HF Markets (UK) Ltd, Bloomsbury Building, 10 Bloomsbury Way Holborn, London, WC1A 2SL

Company Details

HotForex was established in 2010 by founder and owner George Koumandaris. The group operates six global entities with relevant regulations including the Financial Conduct Authority (FCA). Today the broker has 3.5 million registered accounts.

HotForex has headquarters in London, UK as well as office locations in Cyprus and St Vincent and the Grenadines.

The brokerage has a successful history, recognised with 60+ global accolades including the Best Forex Broker 2022 at The European Awards and the Best CFD Trading Conditions 2021 from the World Economic Magazine.

Additionally, the brand contributes to sustainable practises and social initiatives including donations and charitable work with the Red Cross and the Rotary Club.

Trading Hours

Trading hours vary between instruments, but we were pleased to see the broker offering the maximum coverage available for most assets. Forex trading, for example, opens Monday at 00:00:51 and closes on Friday at 23:59:59. The server operates on GMT+2 time (GMT+3 DST).

Contract specifications including trading hours can be found on the relevant instrument page. Select ’Products’ and then the applicable asset class.

Should You Trade With HotForex?

We think HotForex can be a decent contender on many traders’ broker shortlists. The brand is overseen by a reputable regulator in the FCA and provides some excellent educational content and trading tools including VPS, and MT4/MT5 trading terminals. We were also reassured by this broker’s security measures, and UK traders can be assured of a reliable customer support team.

We were less impressed by the floating spreads, and if you open an account with these you should check to ensure you are not paying above the market rates.

FAQ

Is HotForex A Trustworthy Broker?

HotForex is a legitimate and regulated brokerage. The UK entity is authorised and regulated by the Financial Conduct Authority (FCA), a reputable financial watchdog that is recognised globally for its stringent compliance requirements.

Is HotForex A Dealing Desk Broker?

HotForex is classified as an STP/ECN broker with no dealing desk. HotForex is not a market marker broker as live price quotes are provided by liquidity providers.

Is HotForex A Good Broker For Beginners?

We are confident HotForex would work well for beginners, with a demo account service, low minimum deposit requirement, and access to numerous trading tools. The educational content is also a positive, integrating YouTube videos, step-by-step tutorials, and user guides.

Does HotForex Offer Low Trading Fees?

HotForex trading fees are relatively competitive, though we have found better rates at other brands. Retail investors can trade with forex commissions but minimal spreads on the Zero Spread profile. Alternatively, the Premium and Premium Pro accounts provide commission-free trading and floating spreads from 1 pip.

Does HotForex Offer A Choice Of Trading Platforms?

Yes, HotForex clients can trade on the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) terminals. These can be downloaded to PC devices, used as a WebTrader, or available as a mobile app. The broker also offers its own user-friendly app.

Article Sources

Top 3 HotForex Alternatives

These brokers are the most similar to HotForex:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

HotForex Feature Comparison

| HotForex | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, ETFs, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $100 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, DFSA, FSCA, CySEC, FSC, CMA, JFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4 |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | HotForex Review |

Swissquote Review |

Pepperstone Review |

IG Index Review |

Trading Instruments Comparison

| HotForex | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

HotForex vs Other Brokers

Compare HotForex with any other broker by selecting the other broker below.

Popular HotForex comparisons: