HF Markets Review 2025

|

|

HF Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to HF Markets |

| HF Markets Facts & Figures |

|---|

HF Markets is an established CFD broker with over 3 million clients and more than 60 industry awards. The trustworthy firm is authorized by several leading regulators, including the CySEC and FCA. New traders get a choice of accounts to suit different strategies and experience levels while the firm stands out for its impressive range of trading tools, from the MetaTrader software to Autochartist and the bespoke copy trading app, HFCopy. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Metals, Energies, Stocks, Indices, Commodities, Bonds, ETFs |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, FCA, DFSA, FSCA, FSA, CMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | HF Markets offers over 1000 CFDs spanning forex, stocks, indices, commodities, bonds and ETFs. Traders can speculate on rising and falling prices with flexible leverage. Fees are also transparent with no hidden charges. |

| Leverage | 1:30 (EU), 1:1000 (Global) |

| FTSE Spread | 1.7 |

| GBPUSD Spread | 2.0 |

| Oil Spread | 0.05 |

| Stocks Spread | Variable |

| Forex | HF Markets offers trading on over 50 currency pairs including all majors. The no dealing desk model ensures fast execution speeds with tight spreads from 0.1 pips. HFM also offers excellent research and analysis in the currency markets. |

| GBPUSD Spread | 2.0 |

| EURUSD Spread | 1.2 |

| GBPEUR Spread | 1.7 |

| Assets | 50+ |

| Currency Indices |

|

| Stocks | Clients can go long or short on popular stocks with leveraged CFDs, including major US tech firms. HFM also offers more than 2000 physical stocks for direct purchase with zero commissions and fractional shares from just $5. |

HF Markets is a forex and CFD broker with support for the ever-popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. With free deposits and withdrawals, strong customer support and FCA regulation, this broker is an established and competitive trading firm for UK investors. This review of HF Markets will assess the firm’s instruments, trading fees, funding options, customer service, safety measures, and more.

Our Take

- HF Markets is regulated by the UK’s Financial Conduct Authority, a top-tier authority

- The firm boasts an impressive 1200+ financial instruments spanning major asset classes

- Spreads are higher than some other firms of a similar size and quality

- HF Markets is great for UK-based traders willing to overlook higher fees for a diverse portfolio

Market Access

We found that HF Markets has an excellent range of instruments with over 1200 individual investment products. Our team was also pleased that bonds and ETFs are included, allowing investors to diversify their portfolios. UK traders will also appreciate the suite of British stocks and decent range of currency pairs.

Supported instruments:

- Six Metal Derivatives including gold and silver

- 47 Forex Pairs including majors, minors and exotics

- Five Commodity Futures including coffee and US cocoa

- Three Bonds including UK Gilts and US 10-year Treasury Notes

- 96 Stocks including UK-listed companies like Rolls-Royce and Rio Tinto

- 11 Spot Indices and 12 Futures Indices including the FTSE 100 and S&P 500

- Two Energies consisting of UK Brent and US Crude Oil (spot and futures markets)

- 34 ETFs

Fees

Although fees at HF Markets vary depending on the account type, we found them to be relatively competitive, particularly with the Zero account.

The Zero account has the lowest spreads, starting from 0.0 pips on forex and gold, and the commission is just £0.03 per 1k lot. Spreads on the zero-commission Premium account are higher, starting from 1.4 pips.

The typical spread for EUR/GBP is 1.7 pips and for GBP/USD is 2.1 pips, which is slightly higher than we would like. Advanced traders may prefer either the Premium Pro or Zero accounts to benefit from tighter spreads.

We found that overnight fees may apply at HF Markets if you hold a position across more than one day, although interest may be earned, depending on the instrument and position. Carry charges may also apply instead of overnight fees on swap-free (Islamic) accounts.

HF Markets Accounts

Our team ranks HF Markets as decent in terms of accounts, offering the typical range of STP and ECN execution options, including the zero commission Premium account and the raw spread Zero account. Professional traders can also opt for the Premium Pro account, although strict eligibility criteria are used to define such an investor.

All accounts provide access to MT4, MT5, WebTrader and mobile trading. However, only the Premium account offers access to the proprietary HFM platform. The minimum trade size is 0.01 lots on all account types and spreads are variable.

We were pleased to see that GBP is a designated base currency for UK traders.

Our team have highlighted the key features and differences between the accounts:

Premium

- Zero commission

- No minimum deposit

- Spreads from 1.4 pips

- 1:30 maximum leverage

- No ETFs, bonds or index futures

- Swap-free trading supported on some instruments

Premium Pro

- All instruments

- Zero commission

- Spreads from 1.0 pips

- 1:400 maximum leverage

- £5000 minimum deposit

- Designed for professional traders

Zero

- All instruments

- £0 minimum deposit

- 1:30 maximum leverage

- Spreads from 0.0 pips on forex and gold

- Commission from less than £0.03 per 1k lot

- Swap-free trading on particular instruments

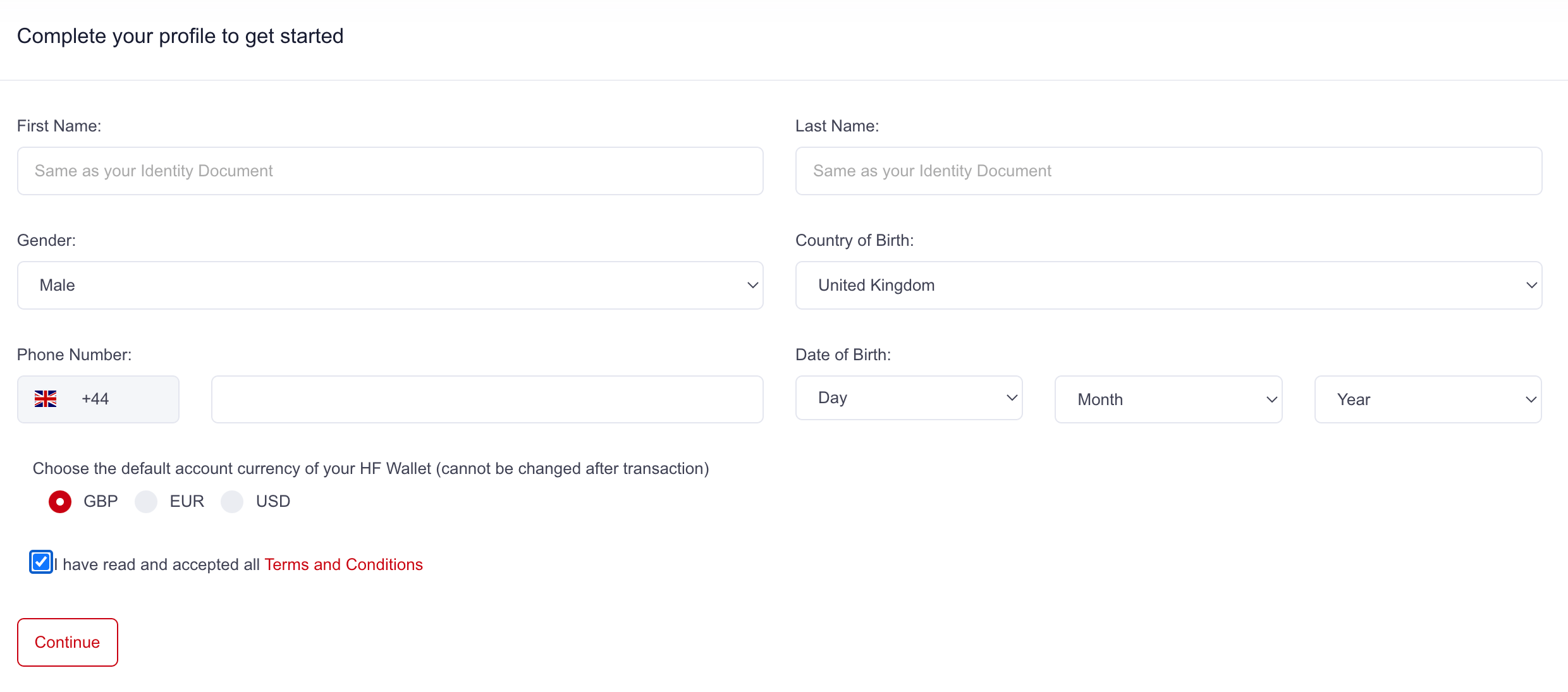

How To Sign Up For An Account With HF Markets

Our experts found the HF Markets registration process to be much longer and more involved than is the case with competitors like eToro.

However, we do think that the trading knowledge test is a prudent measure that will reduce the number of unqualified beginners losing money due to a lack of understanding.

- Fill in initial details, including country of residence

- Verify your email address

- Complete the registration form and select Continue

- Add investment projections and employment status

- Click Save and Continue

- Complete the trading experience and knowledge test

- Upload your ID documents and proof of residency

HF Markets Account Signup Form

Funding Methods

Deposits

We were pleased to see that there are generally no deposit fees at HF Markets, although this is now fairly standard amongst the best brokers, such as XTB.

Unfortunately, the minimum deposit is £40 on all deposit methods apart from wire transfer, which is £200. This essentially makes the zero minimum deposit claims on the Premium and Zero accounts redundant.

The processing time for deposits is up to 10 minutes apart from wire transfer, which takes 2-7 business days. The list of deposit options, shown below, is fairly limited but does include the most popular and convenient options for UK retail investors.

- Skrill

- Neteller

- Wire Transfer

- Credit/Debit Cards

How To Deposit

I didn’t have any issues navigating the funding process:

- Log in to myHF area (client area)

- Click on Deposits

- Select the payment method

- Follow the on-screen instructions

- Submit the payment

Withdrawals

Our team were pleased that there are no withdrawal fees at HF Markets as this is not the case with all brokers. However, charges may be applied for withdrawals that do not meet the minimum requirements of £4 or £80 for wire transfers. Investors should also note that banks may charge their own fees for transactions.

Withdrawals are processed within 24 hours of the withdrawal request, between Monday and Friday (except for public holidays). Neteller and Skrill are instant once processed, whereas the time taken for other methods is 2-10 business days.

The same methods that are available for deposits are available for withdrawals. However, investors should note that the maximum debit card withdrawal cannot exceed the amount of the initial deposit for anti-money laundering (AML) purposes.

UK Regulation

Our experts were reassured to find that HF Markets (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA). A robust regulatory authority imposes strict capital requirements on brokers and places them under greater scrutiny, which is why we recommend choosing a firm regulated by the FCA.

The brokerage is also a member of the Financial Services Compensation Scheme (FSCS), which may protect an individual investor’s deposit for up to £85,000 if the broker becomes insolvent.

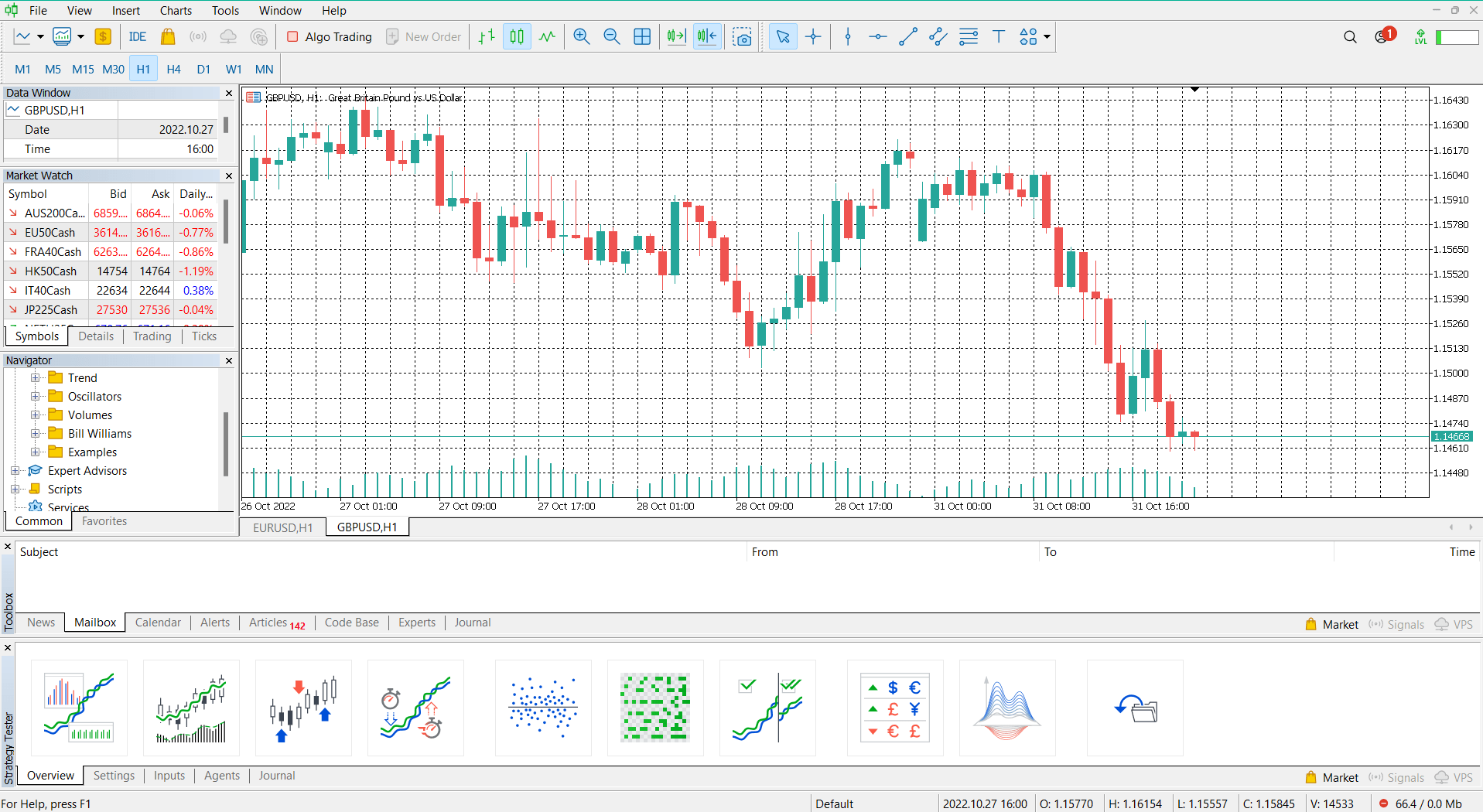

Trading Platforms

I think HF Markets has an excellent choice of trading platforms, including the industry-leading MetaTrader 4 and MetaTrader 5 platforms. There is also a proprietary mobile app, which we cover in more detail further below.

MT4 and its successor, MT5, have built up reputations for being reliable platforms that are rich with features and tools for technical and fundamental analysis. Both platforms can be used effectively by beginners and seasoned traders for sophisticated market analysis.

We have listed some of the main features of each platform below. Note that the server name, depending on the trading platform used, will likely be listed as ‘HFMarketsUK-Live Server 2’.

MT4

- Nine timeframes

- One-click trading

- 31 analytical objects

- Expert Advisors (EAs)

- 30 technical indicators

- Copy trading capabilities

- Four pending order types

- MQL4 algorithmic trading

MetaTrader 4

MT5

- 21 timeframes

- One-click trading

- 44 analytical objects

- Expert Advisors (EAs)

- 38 technical indicators

- Six pending order types

- Copy trading capabilities

- MQL5 algorithmic trading

- Built-in economic calendar

MetaTrader 5

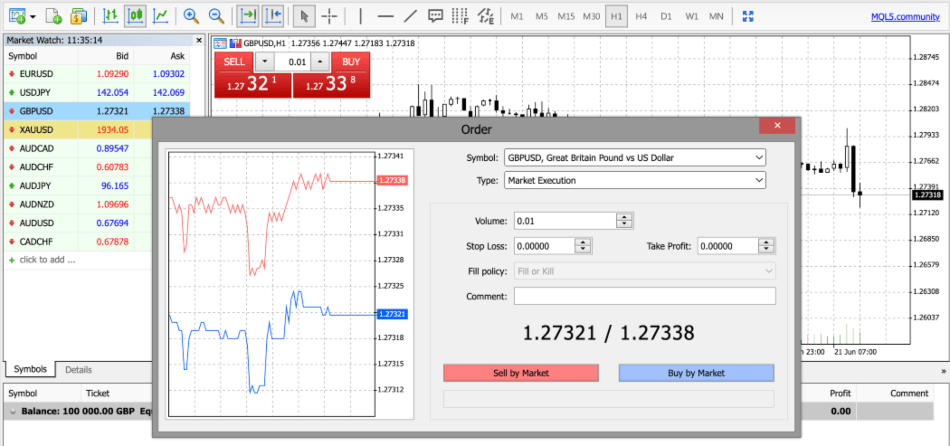

How To Place An Order On MT5

- Right-click on the instrument’s symbol (the list of instruments is on the left)

- Click New Order

- Complete the details including volume and, if necessary, stop loss/take profit

- Press Buy or Sell to complete the order

MetaTrader 5 Order Window

One-click trading can also be turned on from within the platform’s preferences to allow rapid order placement directly from the price charts.

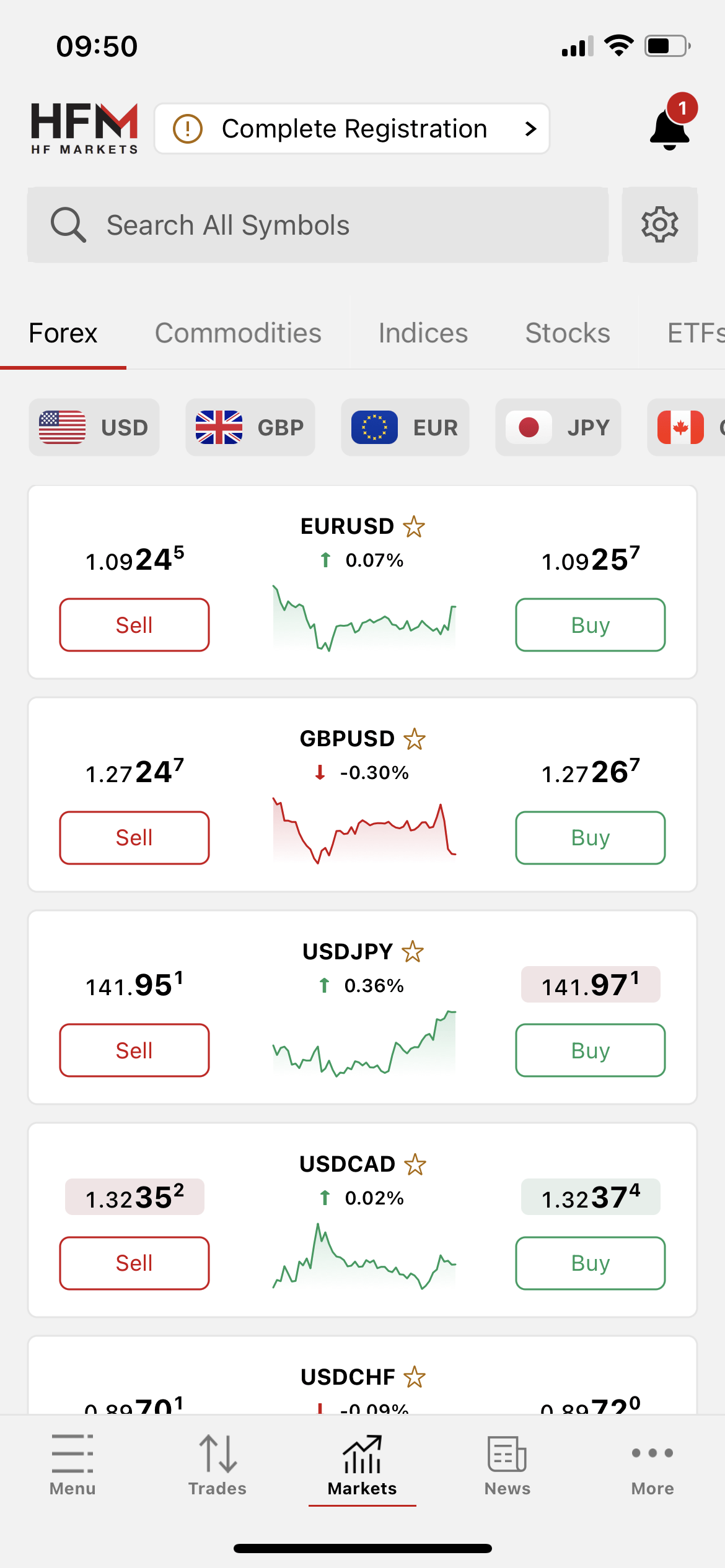

Mobile App

HFM Platform

The proprietary HFM platform runs on the HFM app, which can be downloaded from the Apple App Store and Google Play Store.

We tested the app and found it to be user-friendly with all the features conveniently located for accessible and effective investing. Our experts found it simple to navigate between different sections and were impressed by the range of functionality on offer for a mobile application.

The HF Markets application has all the features a trader would expect, including the ability to make trades quickly, access real-time quotes and add instruments to a list of Favourites.

HFM Mobile App

MT4 & MT5 Mobile Apps

Investors can also use the MT4 and MT5 mobile apps, which are available to download on iOS and Android (APK) devices.

These applications have many of the same features that are available on the desktop version, though some of the advanced technical analysis and algorithmic capabilities are not supported.

Experienced traders may find that these MetaQuotes apps offer more technical features than the proprietary HFM mobile app, whereas beginners may find the latter more intuitive and, therefore, the better one to download.

Leverage

In line with FCA regulations and many other brokers in Europe, HF Markets limits leverage rates to 1:30, except for professional traders on the Premium Pro account, who can trade with leverage rates up to 1:400.

Maximum leverage ratios vary depending on the market and instrument. Whilst forex majors have leverage up to 1:30, forex minors are limited to 1:20 and stocks offer no more than 1:5.

Prospective clients should note that HF Markets provides negative balance protection, which helps prevent traders from owing money to the broker if their leveraged positions suddenly decrease in value.

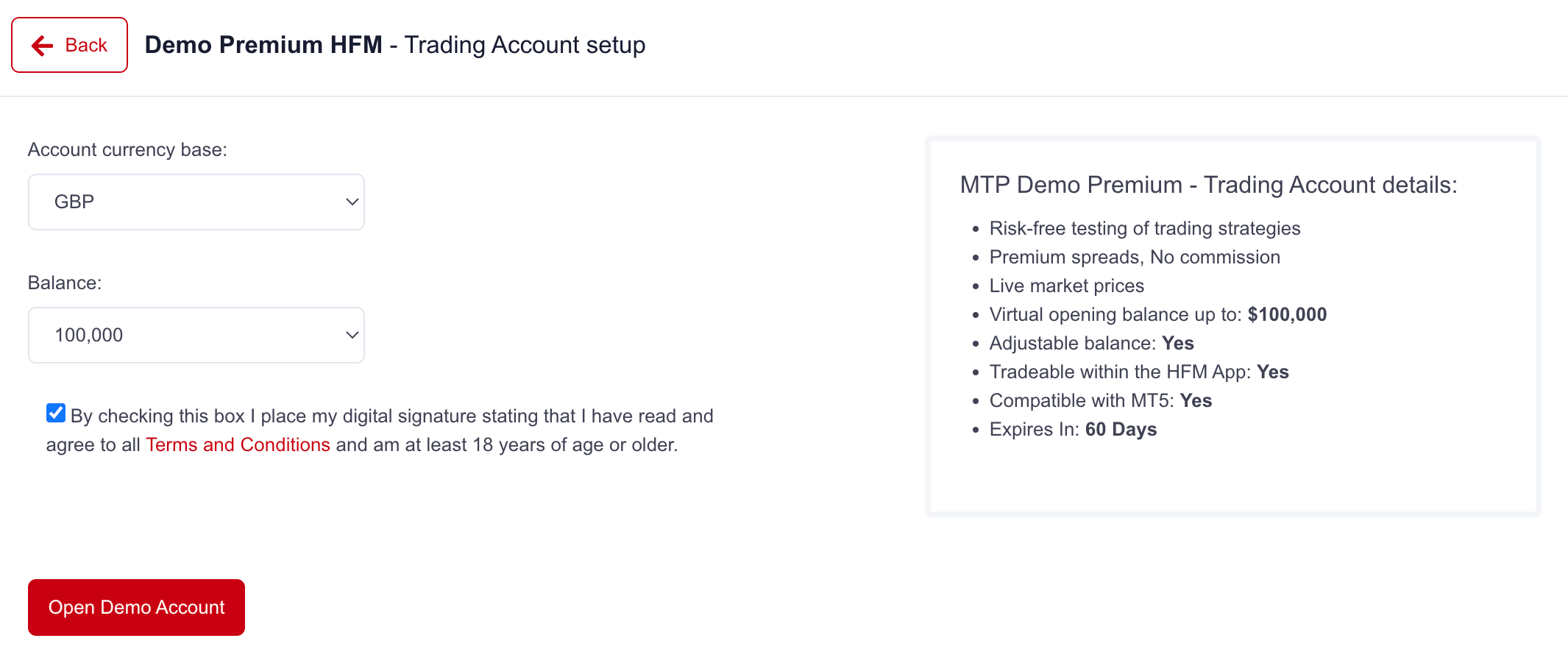

Demo Account

Our team was pleased to see that HF Markets provides users with access to a demo account with a virtual opening balance of up to £80,000, though this can be adjusted.

Demo accounts are very useful for beginners to understand how to make trades and learn more about the way markets move. They also bring benefits to more experienced traders as they provide a risk-free environment to test new strategies and explore different markets.

How To Open A Demo Account

- Log in to myHF

- Click the CFD Trading Accounts dropdown and select Open Demo Account

- Choose either Demo Premium or Demo Zero

- Select your preferred platform

- Enter the account currency and balance and read the terms and conditions

- Click Open Demo Account

- Note your login details

HF Markets Demo Registration Form

HFM Bonus Deals

Our team was unable to find any bonuses or promotions, such as a no-deposit welcome bonus, at HF Markets. This is to be expected given the broker is regulated by the FCA, which imposes restrictions on the use of financial promotions and deals designed to entice new traders.

Extra Tools & Features

Education & Market Analysis

We found that HF Markets offers a wealth of educational material, meaning that beginners, in particular, can gain a broader understanding of the forex and CFD markets while investing with the firm.

The broker provides tutorial videos, eBooks and free weekly forex webinars that feature live analysis of the markets as a means of demonstration and inspiration.

The educational resources are supported by a strong market analysis section, which features daily articles on current economic and market news. We were pleased to see that the analysis includes both fundamental and technical factors, thereby appealing to a range of traders and investors.

Trading Support

When we used HF Markets, there were a large number of tools not offered by many other firms that can be used to supplement a traditional strategy. These tools can be used in addition to the features available on the underlying platform, creating a rich trading experience.

Features include:

- Market insights powered by AI

- Free access to Autochartist, which can automatically scan for patterns

- Correlation matrix to identify the strength of correlation between symbols

- Traders’ Board featuring useful forex information including charts and forecasts

In addition, traders have access to more standard features like an economic and earnings calendar, as well as several trading calculators.

VPS hosting is also available for 24-hour investment and reduced latency. This service is free if certain (undisclosed) deposit and trading requirements are met.

Company Details & History

The HF Markets Group was established in 2010. It includes multiple entities across the world, including HF Markets (UK) Limited, whose registered address is in London, and others like HF Markets (DIFC) Ltd, regulated in Dubai, HF Markets (Europe) Limited, regulated by CySEC in Cyprus, and HF Markets (Seychelles) Ltd.

The company has over 200 employees globally in various offices, from Larnaca in Cyprus to Nairobi in Kenya, and more than 3.5 million live accounts have been opened.

HF Markets Group has products available in over 180 countries. Therefore, the broker is an established outfit with a sizeable customer base. It was formerly known as ‘HotForex’.

HF Markets has also won over 60 industry awards, including Best Forex Trading App by Capital Finance.

Customer Service

HF Markets has good, 24/5 customer support, including a UK-dedicated phone number and a live chat that was reliable upon testing. The contact options include:

- Live Chat – available in corner of website

- Phone Number – +44 2035199898

- Email Address – support@hfmarkets.co.uk

The FAQs section can also assist with more standard queries.

Trading Hours

Trading hours at HF Markets vary depending on the market. Forex has a large window within which to trade, between Monday at 00:00:51 and Friday at 23:59:59, although there may be more liquidity at certain times. The broker’s server time is GMT+2 in winter and GMT+3 in summer.

Other markets will have their own opening hours, which are displayed on the broker’s website. The hours that stocks trade are generally restricted to the hours of their underlying exchange.

Safety

HF Markets has implemented a range of security measures, going further than other brokers in many cases. The broker has a Civil Liability Insurance programme of up to £5 million to protect against potential loss caused by negligence, fraud and certain other factors.

In addition, segregated bank accounts with major global banks ensure that client money is not mixed with money belonging to the company. The broker is also subject to an annual audit by independent third parties.

The firm states that no credit card or payment information is stored and that payment transactions are protected by Level 1 PCI-DSS Certified Independent International Payment Gateways.

Should You Trade With HF Markets?

Our expert review has unearthed that HF Markets offers an excellent range of 1,200 instruments and plenty of additional resources to supplement your strategy. Moreover, we were reassured to see the firm regulated by the FCA, making it a good option for UK traders.

FAQ

Is HF Markets Legit?

HF Markets Group is a large global company that was established in 2010. It holds regulatory licenses around the world, including with the FCA in the UK.

Is HF Markets Good For UK Investors?

HF Markets performs strongly in multiple areas. It has over 1,200 instruments available, free deposits and withdrawals, and integration with the MT4 and MT5 platforms. It is also regulated by the FCA, a top-tier financial authority with strict regulations.

Does HF Markets Have A Low Minimum Deposit?

There is no minimum deposit on the Premium and Zero accounts. However, all deposit methods do have minimum limits, with the lowest being £40.

What Is HF Markets?

Previously HotForex, HF Markets is a global forex and CFD broker with a UK entity. The company has offices and employees around the world, offering a variety of trading platforms, account types and financial products.

Is HF Markets Trustworthy?

Yes. Our team of experts has confirmed that HF Markets is regulated by the Financial Conduct Authority (FCA) in the UK and is also a member of the Financial Services Compensation Scheme (FSCS).

Article Sources

Top 3 HF Markets Alternatives

These brokers are the most similar to HF Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

HF Markets Feature Comparison

| HF Markets | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 4 | 4 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Metals, Energies, Stocks, Indices, Commodities, Bonds, ETFs | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, FCA, DFSA, FSCA, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (EU), 1:1000 (Global) | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | HF Markets Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| HF Markets | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

HF Markets vs Other Brokers

Compare HF Markets with any other broker by selecting the other broker below.

Popular HF Markets comparisons: