Forex.com Review 2025

|

|

Forex.com is #10 in our rankings of CFD brokers. |

| Top 3 alternatives to Forex.com |

| Forex.com Facts & Figures |

|---|

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Trading App |

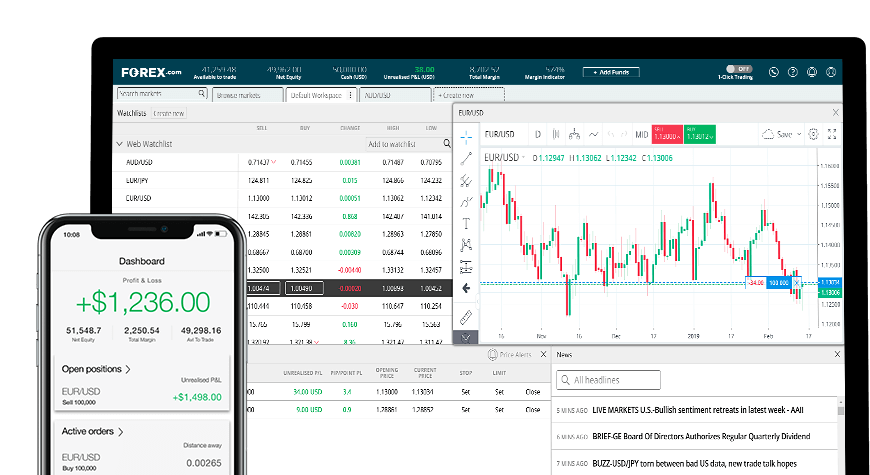

Running alongside the MT4 and Web Trader platforms, the FOREX.com app offers full trading capabilities on a user-friendly, compact platform. Integrated news and analysis, plus real time trade alerts, are two mobile specific features that set this app above the crowd. Additionally, it beats out MT4 when it comes to mobile charting tools, with over 80 indicators and 11 chart types, not to mention a slicker design that we love. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | With the ability to take both long and short positions on 5,500+ CFDs across forex, stocks, indices, commodities, and cryptocurrencies, FOREX.com excels. Its exclusive Web Trader platform offers an excellent trading experience, equipped with over 80 technical indicators and average execution speeds of just 20 milliseconds, ensuring an optimal environment for serious traders. |

| Leverage | 1:30 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 1.3 |

| Oil Spread | 2.5 |

| Stocks Spread | 0.14 |

| Forex | FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets. |

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 1.2 |

| GBPEUR Spread | 1.4 |

| Assets | 80+ |

| Stocks | FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share. |

Forex.com is an online market leader and the largest broker that offers MetaTrader 4 (MT4) platform integration. Its UK clients can trade over 300 products including forex, shares, gold and oil. Our review assesses the quality of Forex.com, including its mobile app, spreads, leverage and minimum deposit requirements. Get the platform download and login to start trading.

About Forex.com

Forex.com was founded in 2001 and is owned by StoneX Financial Ltd. The firm acquired GAIN Capital, the broker’s previous operator, in 2020. In the same year, the broker had an average daily trading volume of over $15 billion.

Forex.com is subject to Financial Conduct Authority (FCA) regulation in the UK and caters to both retail and professional clients.

Trading Platforms

Forex.com offers two main trading platforms, with features for beginners and experienced investors alike. Clients can begin executing orders as soon as they open an account and login.

Advanced Trading Platform

Forex.com has its own-brand desktop platform software, which is available to download from the website. This high-performance solution attracts positive reviews and ratings for its focus on flexibility and speed. The Forex.com software offers the following features:

- Fully integrated strategies from Trading System with more than 100 templates plus real-time FX signals provided by Recognia

- Range of order options including trailing stop and stop loss, plus partial close and hedging tools

- Trading directly from the chart with over 100 predefined indicators and 15 timeframes

- Completely customisable window layout with multiple watch lists

Advanced platform

Users of the Forex.com platform can also connect via the broker’s open API to execute orders and have the option of algorithmic trading.

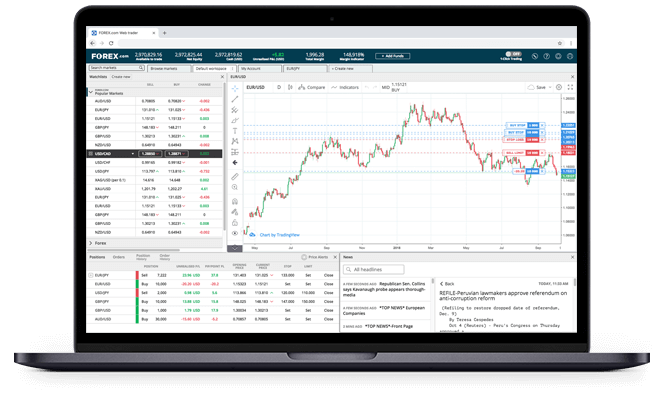

Web Trading

Clients can login to trade from any browser or operating system using the firm’s online platform. A tutorial for the web trading solution is available on the broker’s website and includes the following features:

- Smart risk management allowing investors to set up orders considering P&L, price, or pips

- Personalisation through layouts that can be saved for future use

- Sophisticated charting with one-click execution

Web platform

Both Forex.com platforms come equipped with powerful analytical capabilities that traders can utilise to improve their strategy:

- Advanced live charts from TradingView – Extensive drawing instruments and over 50 indicators on 10 chart types

- Performance analytics – Available on desktop and mobile, this tool examines an investor’s trading history including P&L, win ratio, and more to optimise efficiency

Note, the broker does not have rules against scalping, which may be useful for traders who opt for this strategy.

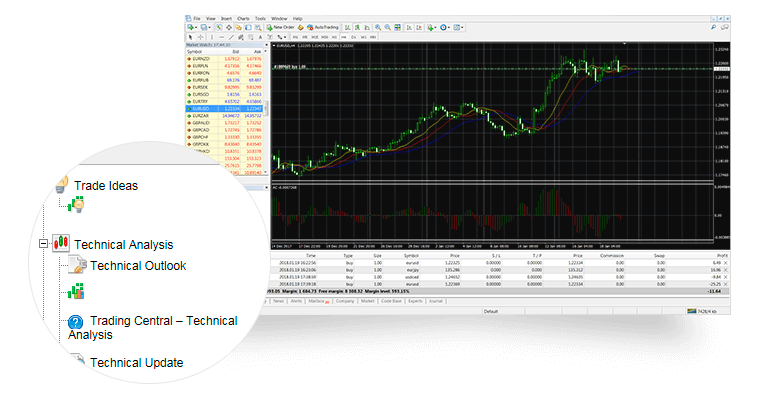

MetaTrader 4

Forex.com includes integration with MetaTrader 4 (MT4), a widely popular download platform that offers industry-leading order systems and technical analysis. Investors interested in the MetaTrader 4 service can use their broker credentials to login to the program and start executing orders. MT4 offers the following functionalities:

- Access to Reuters news, Forex.com research and Trading Central technical analytics

- 30 built-in indicators and over 2,000 more that can be customised for free

- Development and use of Expert Advisors (trading robots) for automation

- Market, pending and stop order types including trailing stops

- Nine timeframes and an unlimited number of charts

MetaTrader 4

Note Forex.com does not offer MetaTrader 5 (MT5).

MetaTrader 4 Web

The MT4 web platform offers a fully-featured trading experience with no software download required. The platform is compatible with all operating systems and provides many of the useful features of the desktop version:

- 30 technical indicators plus graphical objects

- One-click trading and complete execution history

- Full suite of trading order operations and real-time quotes

Clients should note that although live quotes are executable most of the time, slippage may occur in rapidly changing markets.

Markets

Forex.com traders can sign in to the platform to get live rates on over 300 global markets:

- Forex – Over 80 currency pairs

- Metals – Gold and silver (not available on MT4)

- Indices – Over 15 offered, including the DAX 30 index

- Shares – More than 220 major companies (not available on MT4)

- Commodities – Futures for softs and natural gas, spot commodities for softs and oil, metals including platinum and palladium (fewer offered on MT4)

Although Forex.com does provide a wealth of forex pairs and instruments like futures for oil trading, our review would like to see a broader range of assets. For example, cryptocurrency like Bitcoin (BTC/USD), binary options and spread betting are not available to UK traders.

Trading Fees

Forex.com offers competitive pricing, with typical spreads around 1.2 pips for EUR/USD on the standard account. This pair can reach as low as 0.8 pips with live spreads depending on volatility and liquidity. On the DMA account, the EUR/USD spread is listed as 0.6 pips while spreads vary with the MetaTrader account.

Forex.com charges rollover rates on positions held open overnight. These fees depend on several factors including whether your position is short or long at the rollover time (5 pm in New York). Interest rates do not apply to intraday trades.

Commissions are not charged on the Forex.com and MetaTrader accounts, and the broker profits only through pip spreads. The DMA account has a tiered structure for trading fees, where the commission per million USD reduces with higher monthly order volumes.

Forex.com also charges an inactivity fee of £12 per month on accounts that have been dormant for one year.

Leverage Review

Margin requirements vary widely depending on the platform type and asset class. For forex pairs, the following apply:

- Majors – 1:30 (except AUD/USD at 1:20)

- Minors – Between 1:30 and 1:10

- Exotics – Between 1:20 and 1:5

Traders with Forex.com can find the maximum leverage offered for any instrument by using their account login details on the desktop platform and accessing the Market Information Sheet.

Clients can determine the required margin on various contract sizes using the Forex.com margin pip calculator and the asset leverage ratio. Traders can apply to change their account leverage using the Margin Change Request form available online.

Mobile Trading

Forex.com App

The Forex.com mobile app provides rapid execution and one-swipe trading on the move. It is available for Android, plus iPhone and iPad devices running iOS. The fully-featured app includes:

- Advanced TradingView charting and market analytics

- Customisable execution style and watchlists

- Real-time price and order alerts

- Complete account management

Forex.com mobile app

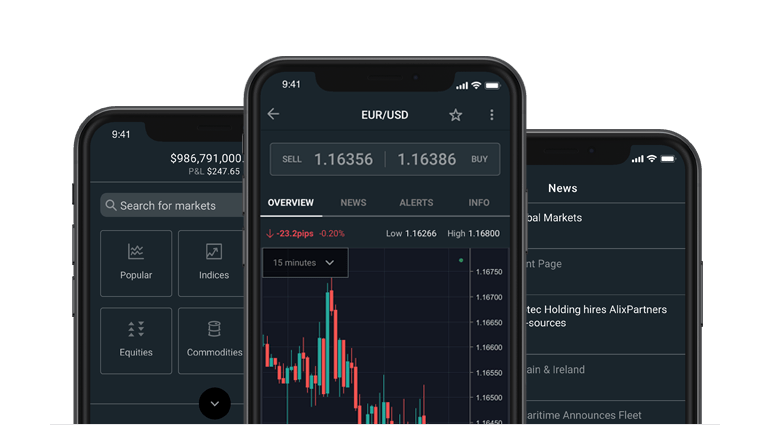

MT4 App

Forex.com clients using the MetaTrader platform can access the markets using their Android or iOS device via the MT4 app. Traders can utilise the following:

- 50+ technical analysis tools

- One-click buy and sell functionality

- Interactive quote charts and full set of orders

- Most popular indicators from the desktop solution

MT4 mobile app

Payments

How To Deposit

At Forex.com, all deposits take place via MyAccount on the broker’s website. Traders can fund their account by credit card, debit card, PayPal, and bank transfer. The minimum initial deposit is £100 and the broker does not charge fees for any incoming payments. Clients can typically expect card deposits to be processed within 24 hours, PayPal funds to clear immediately, and bank transfers to take up to 2 business days.

How To Withdraw

Traders can request withdrawals via MyAccount and these are usually processed within 48 hours. The withdrawal options depend on how clients initially made the deposit and how much was funded. The maximum amount that can be withdrawn on card in 24 hours is £100,000 or the amount originally deposited (whichever is lower). With PayPal, this is £20,000 per transaction, or the amount initially deposited if lower. There are no limits associated with bank transfer.

Forex.com traders can see customer statements and all funding in the Reports tab on the broker’s platform.

Demo Account

Potential investors can learn to trade using either the own-brand platform or the MT4 demo account option. Clients can login to the practice account and use the platform for up to thirty days, trading with £10,000 in virtual funds.

Forex.com Bonuses

Forex.com is unable to offer no deposit bonus schemes or other promotions due to UK regulatory conditions.

Regulation Review

Forex.com is regulated by the Financial Conduct Authority (FCA). As such, it participates in the Financial Services Compensation Scheme, which compensates traders with up to £85,000 if the firm becomes insolvent. Retail clients also enjoy negative balance protection.

The broker is often favourably compared to other major firms vs Oanda, FXCM or Nadex. Forex.com arguably offers a better platform trading experience with more currency pairs and CFD options.

Overall, customer reviews are positive and traders can be assured that their funds are safe with oversight from a major financial authority.

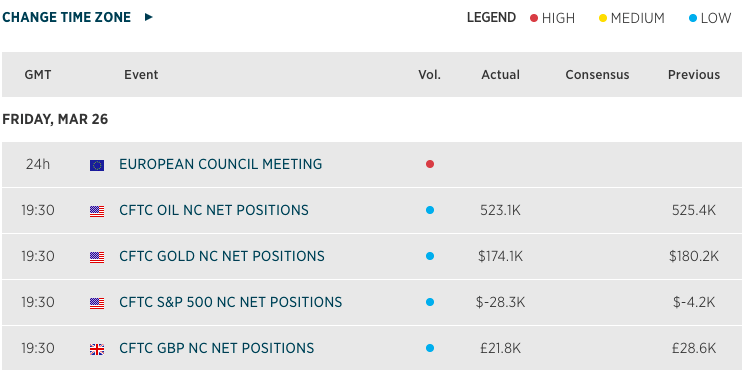

Additional Features

Forex.com offers an extensive trading news and research section, which includes an economic calendar and webinar series. The broker hosts a large educational resources library containing informational videos, a trading guide series, a glossary, and more. The website offers a decent selection of trading tools compared to other major providers.

Economic calendar

Trading Accounts

Forex.com traders can sign up for three different account types. The Forex.com and MetaTrader accounts are commission-free and both have a minimum lot size of 1,000 units. They operate on the Forex.com and MetaTrader 4 platforms respectively under a market maker model – the broker does not use an ECN solution.

The MetaTrader account allows free EA hosting on a dedicated VPS for clients with a minimum balance of £5,000 and 10 round trip mini lot trades per month.

The premium Direct Market Access (DMA) account exposes investors to higher liquidity and spreads as low as 0.1 pips, but requires a 100K minimum trade size.

Forex.com also offers sharia/Islamic accounts under certain circumstances.

Benefits

Trading with Forex.com has several advantages:

- FCA regulation & negative balance protection

- Choice of two fully-featured platforms

- No fees for deposits or withdrawals

- Commission-free trading accounts

- Wealth of educational resources

Drawbacks

This broker has the following drawbacks:

- Inactivity fee charged after 12 months

- Crypto asset trading not offered

Trading Hours

Forex.com trading hours depend on the market of interest, time zone, and any holiday breaks like Christmas. Opening hours for forex specifically are noted as 24 hours from 9 pm Sunday – 9 pm Friday GMT. Full details for each asset can be found on the broker’s website.

Customer Support

UK clients can contact customer service for support, for example to close an account, make complaints, or for withdrawal problems. Support can be reached via:

- Phone number – 08000567928

- Email – UKinfo@forex.com

Traders can also use the English-speaking live chat or the FAQ section to get information quickly.

Client Safety

Forex.com is committed to the secure storage of personal information received by its traders. The firm follows robust security procedures to prevent unauthorised disclosure and uses industry-standard encryption for data transmission. The MT4 platform, in particular, is secure with dual-factor authentication.

Forex.com Verdict

Forex.com is a global market leader in leveraged forex and CFD trading, with MT4 integration and competitive spreads. The broker offers a fully featured mobile app alongside its own brand trading platform and demo account. With FCA regulation and a £100 minimum deposit, investors at all experience levels would be comfortable joining Forex.com.

FAQ

Is Forex.com A Good Broker?

Forex.com is a safe and legitimate broker. It is regulated by the Financial Conduct Authority in the UK, and this oversight is encouraging to traders worried about scams or bad practices.

What Trading Platforms Are Offered By Forex.com?

Clients can choose between the Forex.com own brand platform and the MetaTrader 4 terminal, though more asset classes are available on the proprietary solution. Traders can download the software from the broker’s website.

What Is The Minimum Account Deposit At Forex.com?

In the UK, the minimum deposit is £100. Traders can fund their account by bank card, PayPal, or wire transfer and in most cases, the deposit will reach the brokerage within two business days.

Does Forex.com Have A Demo Account?

Potential investors can open a demo account risk-free, and login to practice trading on either platform with £10,000 in virtual funds. The demo account is available for thirty days, after which clients must deposit to continue accessing the platform.

What Assets Can I Trade At Forex.com?

The broker offers over 80 currency pairs plus CFDs in shares, gold, oil, and more. Forex.com does not provide access to cryptocurrency trading markets in the UK.

Top 3 Forex.com Alternatives

These brokers are the most similar to Forex.com:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Forex.com Feature Comparison

| Forex.com | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 4.5 | 4.7 | 4.8 | 4.8 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $100 | $0 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | Forex.com Review |

IG Index Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| Forex.com | IG Index | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Forex.com vs Other Brokers

Compare Forex.com with any other broker by selecting the other broker below.

Popular Forex.com comparisons: