CFD Trading Software

The best CFD trading software helps users make informed investment decisions. In this review, we have rounded up the top software for budding traders, from copy trading and automated bots to sophisticated charting and analysis tools. We also explain how to compare various trading platforms, from usability and compatibility to cost and security. Find out which CFD trading software you should download in 2025.

Top CFD Trading Software

-

Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

-

XTB offers a huge selection of more than 2,100 CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependant). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

-

CMC lets you trade CFDs on 12,000+ assets across currencies, indices, commodities, shares, ETFs and treasuries with new equities spanning quantum computing, AI learning, and digital car sales in 2025. Spreads are tight, there are no hidden fees and the industry-leading MetaTrader 4 platform is also supported for leveraged trading. Year after year, CMC shines as one of the best CFD brokers in the market.

-

FXCC offers a narrow range of CFDs beyond forex with a limited selection of metals, energies, indices and cryptos. However, it stands out with its high leverage up to 1:500, which will serve experienced traders looking to maximize their buying power while speculating on rising and falling prices.

-

You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

-

RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

-

FxPro offers thousands of CFDs on forex, commodities, indices, shares and futures, expanded over the years. The broker's analysis and charting capabilities continue to stand as some of the best in the industry, with Trading Central integration, advanced order types and access to custom indicators.

-

IG offers a huge selection of 17,000+ CFDs, providing more trading opportunities than most CFD brokers. Traders can go long or short on popular markets like stocks, currencies, commodities and cryptos, while custom price alerts and the IG Academy continue to enhance the trading experience.

-

Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

-

With the ability to take both long and short positions on 5,500+ CFDs across forex, stocks, indices, commodities, and cryptocurrencies, FOREX.com excels. Its exclusive Web Trader platform offers an excellent trading experience, equipped with over 80 technical indicators and average execution speeds of just 20 milliseconds, ensuring an optimal environment for serious traders.

-

You can go long or short on a range of CFDs covering forex, commodities, shares, indices and cryptos. High leverage up to 1:500 is available for experienced traders in some locations, whilst beginners will appreciate access to micro-lots. There are no restrictions on short-term trading strategies using CFDs.

-

You can trade CFDs on over 3,000 assets and access rich market data through the integrated TradingView charts. There are also comprehensive free learning tools available for beginners via the eToro Academy, including dedicated CFD trading courses and guides. 2025 also saw eToro introduce greater flexibility for UK clients, allowing users to trade US-based CFDs directly with GBP.

-

Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

-

BlackBull is an obvious choice for CFD traders, providing leveraged trading up to 1:500, low spreads from 0.0 pips, and 24/7 support that performed excellently during testing, providing a sense of confidence for active traders operating in fast-moving markets.

-

You can speculate on popular financial assets covering forex, commodities, indices, metals and bonds. You can get started with $0 minimum deposit, making the broker a good pick for beginners. There’s also over 130 technical indicators available collectively in the MT4 and OANDA Trade platforms.

-

While the growing selection of 275+ CFDs still trails category leaders like BlackBull with its 26,000+ underlying assets, easyMarkets shines for its proprietary risk management tools. These include easyTrade which caps your risk to dealCancellation that provides a 1, 3, or 6-hour margin to cancel your order if the market moves against you.

-

Traders can speculate on 1000+ financial markets with high leverage up to 1:500. You can bet on rising and falling prices in currencies, commodities, indices, shares, and more without owning the underlying asset. With the comprehensive choice of CFD trading platforms, users can also switch between desktop, web and mobile for a seamless trading experience.

-

Plus500 presents commission-free CFDs encompassing a vast array of markets, spanning currencies, stocks, indices, and commodities. You can engage in long or short positions on popular assets, benefiting from adaptable leverage without encountering any concealed fees.

-

City Index has one of the most extensive suite of CFDs we’ve seen, providing short-term trading opportunities on diverse assets, sectors and regions. Its ‘Trade Ideas’ also excel for active traders looking for information to inform decisions while the Web Trader boasts extensive charting capabilities with 90+ technical indicators.

-

Bullwaves offers CFDs with leverage up to 1:500, providing short-term trading opportunities on upward/downward price movements. However, the selection of CFDs is fairly narrow, with 100 currency pairs, six indices and two metals. Notably, there are no cryptos, although stocks and soft commodities have been added.

-

UnitedPips supports CFD trading on a narrow selection of currencies, metals and cryptos. It somewhat compensates for the meagre asset range with high leverage up to 1:1000, seriously amplifying potential profits or losses, and spreads that don’t change with market conditions.

-

RedMars caters to various short-term trading styles across popular asset classes, including 7 commodities, 14 indices, and 120+ stocks. Leverage is available up to 1:30 (retail) and 1:500 (pro), amplifying results. However, there is no calculator to help with understanding margin requirements and the depth of investments is limited.

-

Access highly leveraged CFDs across forex, commodities, indices, stocks and bonds with 24/5 customer support. Build a diverse portfolio with hundreds of CFD assets.

-

CFDs are available on forex, stocks, indices, metals, oil and cryptos, with support on MT4 and MT5. Execution speeds are also decent, averaging 0.5 seconds, though there is also a VPS service facilitating 24/7 connectivity for algo strategies.

-

CFDs are available on forex, indices, commodities and cryptos, although the range of 100+ instruments is limited compared to alternatives such as Quotex with 400+. Leverage is available up to 1:500 but the $250 minimum deposit is noticeably higher than competitors.

-

Markets.com offers a strong variety of CFD products, not only covering popular asset classes but also more interesting markets such as IPOs and Bonds. The low fees and educational resources will appeal to beginners, whilst seasoned CFD traders will appreciate the feature-rich charting platforms.

-

You can trade a range of CFD instruments across forex, shares, indices and commodities. There’s an excellent selection of platforms for traders, including TradingView and MT4, plus additional tools for experienced algo traders including API solutions.

-

Trade CFDs on Spreadex's diverse list of instruments with leverage up to 1:30 and highly competitive spreads. While this broker's USP is spread betting, the excellent trading terms and range of markets makes it an equally good choice for CFD trading.

-

Axi offers a growing suite of CFDs covering currencies, shares, indices, commodities and crypto (location dependent). It’s clearly built with active traders in mind with zero restrictions on scalping or algo trading, extensive leverage opportunities, and fast execution with latency under 100ms.

-

EagleFX offers just 100+ CFD instruments, but it stands out with its high leverage up to 1:500, round turn commissions coming in at $6 alongside competitive spreads, and support for trading strategies like scalping.

-

VT Markets offers over 1000+ CFDs spanning currencies, stocks, indices, ETFs and commodities. The MetaTrader charting platforms provide dozens of technical tools alongside integrated market analysis resources and zero restrictions on short-term trading strategies.

-

My tests uncovered around 100 CFD products covering forex, indices, commodities and cryptos. Leverage is available up to 1:400 and it’s good to see that scalping, hedging and EA strategies are permitted.

-

The range of CFDs at Capitalcore is narrow, with 6 precious metals, 6 indices, and a slim suite of stocks. Notably, there are no commodities such as oil or gas and spreads vary greatly. Tiered leverage is available depending on the account, from 1:100 to 1:2000.

-

PrimeXBT offers CFDs across four asset classes with very high leverage up to 1:1000. Beginners can also take advantage of the broker’s useful technical analysis guides and CFD education, plus 24/7 in-platform support via live chat.

-

Traders can access CFDs across forex, indices, commodities and stocks. There are no restrictions on short-term strategies, which is good news for scalpers and algo traders. There’s also an excellent range of free tools on offer, including a custom price ticker.

-

FXTrading offers CFDs on a wide range of assets, including forex, stocks, commodities, indices and cryptocurrencies. Commodities include a selection of softs as well as metals and energies, and the eight indices offered include the US30, US500 and UK100. Flexible leverage is available with excellent risk management tools.

-

M4Markets offers CFD trading across forex, stocks, indices, commodities and cryptocurrencies. Traders can access powerful charting platforms with multiple order types and built-in indicators. There’s also a good selection of data-driven analysis tools supplied by reputable provider, Acuity.

-

ThinkMarkets continues to offer an excellent range of around 3500 CFD instruments covering forex, indices, stocks and commodities. Leverage is available up to 1:30 in the EU and UK, while global clients can access up to 1:500.

-

Over 8,000 CFDs are offered on a vast array of instruments, encompassing stocks, indices, forex, and commodities. Moreover, the TWS platform lends itself to seasoned traders, offering a comprehensive selection of over 100 order types and algorithms, alongside premium market data sourced from reputable sources such as Reuters and Dow Jones.

-

Access over 2,000 CFDs across diverse markets including indices, commodities and bonds. There is also premium daily analysis and strategy resources for savvy traders.

-

Trade CFDs on 100+ instruments from popular asset classes. Leverage up to 1:200 is available on precious metals, while stocks, indices and energies can access 1:20 max leverage and 1:10 for commodities. On the negative side, the depth of assets is limited vs other CFD brokers.

-

Videforex CFDs are available on forex, indices, cryptocurrencies and commodities with up to 1:500 leverage and tight spreads from near zero. CFDs incur a commission fee of 1%–2.5% and up to 5% for leveraged trades.

-

Trade 400+ CFDs on forex, stocks, commodities, indices and cryptocurrencies with the choice of commission-free or raw-spread accounts with transparent fees. Speculate on rising and falling prices with no hidden charges.

-

IronFX’s asset list of 300+ instruments covers forex, stocks, commodities and index CFDs. Maximum leverage from 1:30 to 1:1000 is available depending on account location. Traders can access superb technical analysis features, including 30 pre-integrated indicators and 9 charting time frames.

-

Ingot Brokers offers CFD trading on 1000+ instruments including stocks, commodities and cryptocurrencies. The MT4 and MT5 platforms offer comprehensive features for active CFD traders, including multiple order types and pre-integrated technical tools.

-

Trade CFDs on forex, stocks, metals, energies, indices, cryptos and dollar futures. Sage FX offers tight spreads and high leverage on all instruments from 1:100 to 1:500.

-

You can trade CFDs across a range of diverse markets with flexible account types and leverage up to 1:1000. With access to both MT4 and MT5, traders can execute multiple short-term CFD trading strategies using the dozens of pre-integrated technical indicators and graphical objects.

-

Trade CFDs on forex, stocks, indices, commodities and cryptos with high leverage up to 1:500 on the no-commission ClassiQ account. The raw spread account options have low commissions from $4 round-turn and offer lower maximum of leverage of 1:200 or 1:400, which is still competitive.

-

You can trade hundreds of CFDs on major asset classes including currencies, shares and futures. Spreads are not overly competitive starting at 0.9 pips, although the $50 minimum deposit and zero commissions will allow active traders to keep their costs down.

-

Trade CFDs on forex, indices, metals, oil and cryptocurrencies with high leverage up to 1:500 and competitive spreads, with the choice between zero commission or raw spreads.

-

The 300+ instruments offered by FXGiants span seven asset classes, including indices, equities, futures and commodities. In particular, our team was impressed by the breadth of commodities, covering hard, soft and energy products.

-

Rock Global offers low-price CFDs on forex, shares, indices and commodities. The broker charges zero-commission trading on commodities and indices, and zero-spread, commission-only trading on shares. Leverage varies by instrument with 1:200 available on indices and 1:10 on blue-chip stocks.

-

You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget.

-

Trade CFDs on forex, indices, stocks, commodities and cryptocurrencies with leverage up to 1:3000. Swap-free trading is available, and all account types trade with competitive spreads and are commission-free except the Go Pro account, which charges a $7 round-turn commission.

-

Access a modest range of CFD instruments across key markets, including indices and commodities. Clients can trade directly from charts with high leverage up to 1:500 and customisable time intervals.

-

Focus Option offers CFD trading through an intuitive mobile app, with 300+ tradeable instruments spanning forex, cryptocurrencies, commodities, shares and indices. Leverage ranges from 1:20 to 1:50 and spreads are variable, starting from 1 pip, with no commission.

-

Trade over 200 CFDs with high leverage up to 1:1000 on a user-friendly if not basic proprietary platform. Underlying assets include stocks, forex and cryptos with ECN execution, though annoyingly market analysis isn’t provided consistently to inform trading decisions.

-

Plexytrade offers a modest selection of CFDs, providing opportunities to speculate on upward/downward price movements across 15 indices, 48 US stocks, 3 commodities, 4 metals, and 5 cryptos. The free margin calculator allows you to work out how much you need to put down to open and maintain leveraged positions.

-

OspreyFX offers leveraged CFDs on forex, commodities, stocks, cryptos and indices. Deep liquidity is available from 50+ providers with a competitive ECN account that will suit active trading strategies, including scalping.

-

Errante customers can trade stocks, indices, commodities and cryptocurrencies with leveraged CFDs. The level of leverage available depends on regulatory oversight, with 1:30 the maximum allowed in the EU though this varies by asset.

-

Trade flexible CFDs on forex, commodities, indices and cryptos with tight spreads, fast execution, micro-lot trading and leverage up to 1:500. There are also no restrictions on trading strategies.

-

Trade a decent range of markets via CFDs, with commissions of $6 per lot. There is also a reasonable $10 minimum deposit and 24/7 customer support for new traders.

-

Trade CFDs on a broad range of asset classes including forex, energies, precious metals, company shares, indices and cryptos. The excellent trade execution and opportunity to trade with direct market access pricing sets this broker apart from rivals.

-

Anzo Capital clients can use MetaTrader 4 and MetaTrader 5 to trade CFDs on stocks, equity indices, crude oil and precious metals with competitive price levels.

-

Switch Markets offers 180+ CFD instruments with 1:500 leverage and fast order execution speeds of <76 ms. I find commissions are also fairly competitive, coming in at $7 per round turn for Pro account holders.

-

PU Prime offers CFD trading on hundreds of shares, as well as indices, commodities, bonds and cryptocurrencies. The leverage available varies by asset, and spreads also vary greatly between instruments and account types with the tightest near zero and the widest in the hundreds of pips. Stock, index, commodity and bond CFDs are traded on the leading MT4 platform.

-

AdroFx offers a most selection of around 100 CFDs on stocks, cryptos, indices and commodities. Its appeal lies in the high leverage up to 1:500 which you can't find in heavily regulated jurisdictions and the commission-free pricing model which will serve beginners. You can speculate on both rising and falling prices from the same product with CFDs.

-

Trade all markets via CFDs, with retail leverage up to 1:30. With the RStocks Trader account, clients can access over 12,000 CFDs with algorithmic analysis tools and intuitive charts.

-

Access thousands of CFDs with competitive pricing and leverage up to 1:500. A range of asset classes are available, including currencies, shares, indices, metals and commodities. CFDs can be traded on the market-leading MetaTrader platforms.

-

Global Prime offers CFD trading opportunities on 150+ global markets including forex, indices, commodities, cryptocurrencies and bonds. Spreads are tight with a raw ECN account available starting from zero.

-

ActivTrades specializes in CFD trading, offering over 1000 instruments spanning currencies, shares, indices, commodities, and more. The broker has picked up industry awards for its CFD trading environment, delivering fast and reliable order execution with transparent margin requirements for traders.

-

Swissquote has emerged as a dependable CFD broker, providing short-term trading opportunities on an extensive selection of global markets with fast execution, its intuitive CFXD platform alongside MetaTrader, plus insights from trusted third parties like Autochartist and Trading Central.

-

SimpleFX stands out with highly leveraged trading options up to 1:1000 covering popular asset classes, including stocks, indices, currencies and commodities. Additionally, the social community serves as an excellent resource for gathering CFD strategy tips and short-term trading ideas.

-

EZ Invest offers leveraged CFDs on popular asset classes, including forex, stocks, indices and commodities. Execution speeds are decent but a large deposit is needed for the best pricing conditions.

-

Fortrade's list of leveraged CFDs covers a wide range of asset classes including forex, stocks, bonds, indices, commodities and cryptocurrencies. Traders can access leverage up to 1:30 and will trade with zero commission, fast execution and low latency on MetaTrader 4 or the bespoke platform.

-

FP Markets offers CFD trading on a first-rate selection of financial markets, spanning stocks, major global indices, commodities, metals, cryptocurrencies, and bonds. With tight spreads, fast execution speeds, leverage up to 1:500 and top-tier liquidity, short-term traders get an efficient and seamless trading experience.

-

HYCM traders can access CFDs on a range of stocks, indices, commodities and ETFs with floating spreads and maximum leverage varying by instrument. Clients also have a choice between two industry-leading platforms.

-

FXOpen has a compelling CFD offering, complete with 700+ underlying assets, from shares and indices to currencies, commodities, cryptos, and an expanded range of ETFs. With access to top-tier tools, especially since adding TradingView in 2022 and improving its TickTrader platform, FXOpen provides a complete CFD trading experience.

-

Trade CFDs on forex, stocks, commodities and indices with tight spreads and leverage limited to the FCA-sanctioned maximum of 1:30. Infinox traders benefit from lightning-fast execution speeds and a choice between STP and ECN pricing, making this a flexible option for beginner and serious traders.

-

Traders have the opportunity to engage in CFD trading across a broad spectrum of assets, including currency pairs, stocks, commodities, bullion (gold and silver), indices, and cryptocurrencies. Experienced traders can access high leverage up to 1:1000 in certain jurisdictions. However, a notable downside is the restriction of scalping strategies which may deter experienced traders.

-

Trade 8,900+ CFDs spanning forex, stocks, indices, commodities, options and bonds with powerful tools and signals.

-

SuperForex offers CFDs on a good range of assets, though it only really shines when it comes to forex, thanks to its very diverse list. On the other hand, the significant leverage available on most assets increases profit potential, though traders will need to watch out for spreads, which compare poorly to some competitors.

-

Trade CFDs on forex, stocks, indices, commodities, ETFs, bonds and cryptocurrencies with variable leverage up to 1:30. The broker provides great value to traders with six free trades per day on US, UK and European stocks, tight spreads on forex and low commissions on ETFs.

-

With CFDs on 20+ Polish and 30+ US stocks, as well as energies and seven global stock indices covering US, UK, European, Australian and Japanese markets, Just2Trade offers a superb selection of global assets.

-

You can take positions on a range of popular trading markets including forex, stocks, energies and metals. Leverage is high at 1:500 and live spreads can be viewed in the web-accessible platform and app.

-

World Forex's leveraged CFDs are available on a modest suite of 100+ instruments, including stocks, commodities and forex. Very high leverage up to 1:1000 is available for account balances up to $1000, with lower levels available to accounts with higher balances.

-

Trade CFDs on forex, stocks, metals, energies, cryptos and indices with high leverage up to 1:1000 on major currency pairs, 1:200 on metals, 1:100 on indices, 1:33 on stocks and energies, and 1:5 on cryptocurrencies. The range of 200+ instruments is not the biggest on the market, but the variety of asset classes provides flexible trading options for most traders.

-

Trade commission-free CFDs on 3000+ instruments from forex, stock and commodities markets with volumes starting from 0.1 lots, a low minimum deposit of $10 and tight floating spreads. The selection of CFDs beats most competitors.

-

Trade CFDs on forex, commodities, indices and crypto assets. With spreads from 0 pips and generous incentives and bonus offers setting Vault Markets apart from competitors, this Namibian broker will appeal to aspiring traders.

-

Trade CFDs on forex, stocks, indices, energies and metals with fast execution and variable leverage. Spreads are tight and commission-free trading is available on some assets.

-

FXTM’s CFD offering spans 600+ forex, stocks, commodities and indices, plus crypto (location dependent), with spreads lowered in recent years. Advanced traders can also get industry-topping leverage up to 1:3000 through Exinity Ltd, amplifying results but necessitating strict risk management.

-

Trade CFDs on an array of assets with ultra-low spreads

-

Engage in leveraged CFD trading across a wide array of instruments, encompassing forex, stocks, commodities, and indices. Yet while the selection of asset classes is satisfactory, the charting software and floating spreads for short-term traders fall behind that of competitors.

-

Trade leveraged CFDs in a range of financial markets.

Background: CFD Trading

A CFD, or contract for difference, is a derivative contract that stipulates an agreement between the buyer and seller to exchange the difference between the current price of an asset and the value at the time the contract expires. So if BP’s share price increases after a CFD is purchased, the trader can make a profit from the exchange.

CFDs essentially allow traders to make predictions about price fluctuations without actually owning the underlying asset. CFDs are also normally leveraged, meaning only a small deposit is needed to open a position.

Leveraging provides the potential for much higher profits, but there is also a risk of greater losses. As a result, UK-regulated CFD brokers limit retail leverage to 1:30 and offer negative balance protection, ensuring traders can’t lose more than their account balance.

CFD Trading Software

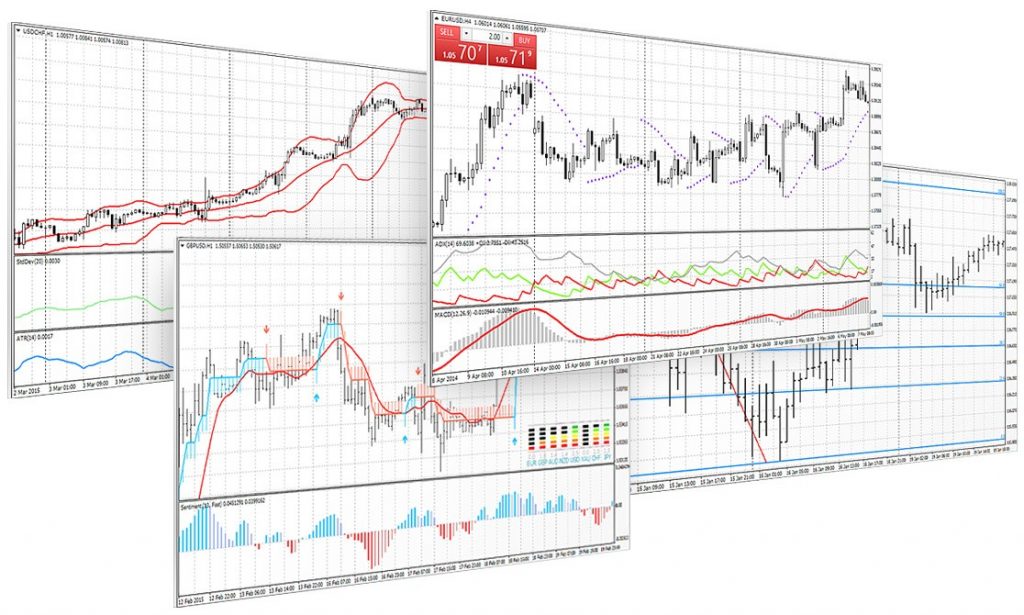

CFD trading software is essentially a platform or application that allows investors to trade on the financial markets using the internet. On the best platforms, users can scan the markets for potential opportunities, and then execute buy and sell orders with the click of a button. Platforms often include charts and graphs that provide historical and real-time price data, alongside live quotes.

With that said, CFD trading software can come in all shapes and sizes. While some comprehensive trading platforms offer a one-stop shop for managing trading portfolios, other tools specialise in a particular function. For example, some software packages provide advanced technical analysis tools and pattern recognition technology. Other applications focus on developing and deploying automated trading algorithms.

Which software package you download will ultimately depend on your financial goals, trading style and budget.

Types of Applications

When it comes to CFD trading software, there are several popular types of applications:

- Computer software – This is where you download software to your computer. This kind of trading platform is often the most reliable and the fastest as it is less reliant on your web browser. However, downloadable software may come with hardware requirements and isn’t a good option if you trade on the go.

- Web-based platforms – This kind of platform is gaining popularity with modern traders. Platforms can be opened and used via an internet browser, and the data is normally stored in the cloud, offering flexibility in return for a stable internet connection. Browser-based solutions are a particularly good option for beginners getting started with CFDs.

- Mobile apps – Again, these are gaining popularity as they facilitate CFD trading from any location. On the downside, mobile or tablet applications typically offer reduced functionality versus their desktop counterparts. As a result, mobile apps are often best for keeping tabs on open orders as opposed to conducting in-depth technical analysis.

Best CFD Trading Software 2025

Below is a review of the best CFD trading platforms available today.

MetaTrader 4

MT4 is the platform offered by most CFD brokers because it provides a good range of analysis tools alongside a selection of instant and pending orders. In fact, MetaTrader 4 offers 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders and a trailing stop. Users also benefit from 30 integrated indicators, over 2,000 custom indicators, plus 700 paid options.

MT4 also has a user-friendly and customisable interface, so it’s perfect for both beginner and advanced traders. In addition, its expert advisors feature allows for automated trading, so you can open and close trades according to pre-programmed rules.

MetaTrader 4

AvaTrade is one of the best CFD brokers that offers the MetaTrader 4 software.

MetaTrader 5

MT5 is another of the most popular platforms for trading CFDs, also developed by the creators of MT4. It is more advanced than MT4, with sophisticated charts, indicators and tools available.

Users benefit from separate accounting of orders and trades, support for all types of orders and execution modes, plus a Market Depth feature. 38 technical indicators are available, alongside 44 analytical objects, 21 timeframes, 1-minute history and an unlimited number of charts. MT5 also supports algorithmic trading.

This platform is a good option for experienced CFD traders looking for a step up from the MT4 software.

MetaTrader 5

Pepperstone is one of the top-rated CFD brokers that offer MetaTrader 5.

ProRealTime

ProRealTime is designed for automation and technical analysis. This is an advanced CFD trading software that is great for experienced traders looking for powerful market analysis tools.

The platform offers more than 100 technical indicators, market scanning, automated trend detection, plus tick and volume analysis. The software also offers real-time news, strategy backtesting, a scalping mode, plus 4 order book display modes.

Clients can choose from a free end-of-day subscription or a real-time solution. Some brokers also offer the terminal as part of their CFD trading package.

ProRealTime

IG is one of the best CFD brokerages that offer access to ProRealTime.

eToro CopyTrader

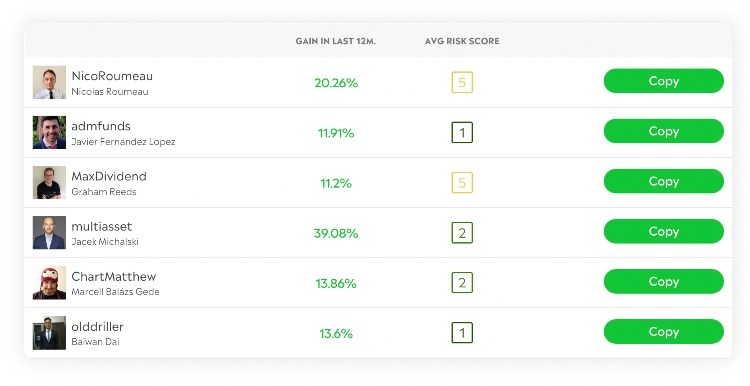

eToro offers CFD trading software that allows you to learn from and follow successful traders. Copy trading has become increasingly popular in recent years, offering access to a large community of experienced investors.

The platform hosts thousands of traders, and users can mirror their strategies and positions with ease, choosing a master trader that is aligned to their financial goals and risk appetite.

The firm’s leaderboard shows traders’ average gain over the last 12 months and applies a standardised risk score. There are also no management fees, making it popular with CFD beginners.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro CopyTrader

Platform & Software Comparison

There are some features that nearly all platforms provide, which are essential to basic CFD trading, but the availability of more advanced tools can vary between providers, as will the costs for using said features.

So, there is a lot to think about for investors seeking a platform to trade CFDs, especially for beginners getting started. To help you find the right application for your needs, here are some questions to ask yourself:

What Markets Are You Looking To Speculate On?

Platforms offer varying access to underlying markets and assets. Do you want to trade forex pairs with the GBP? Perhaps you want to speculate on FTSE-listed stocks like Diageo or BAE Systems. Alternatively, do you want to trade CFDs on major cryptocurrencies such as Bitcoin?

Note, if you’re not sure which markets you want to trade on, sign up with a software provider that offers access to a wide range of underlying assets.

What Functions Do You Need?

Brokers sometimes charge more for advanced features, so if you don’t need a virtual private server or AI-powered market scanners then you could save yourself money by choosing a beginner-friendly platform.

Software packages like MetaTrader 4 and MetaTrader 5 offer a good balance of features while being relatively straightforward to get to grips with.

What Are You Willing To Spend?

Some CFD trading software is free, for example, the standard platform your online broker will provide, while advanced tools and functionality may come at an extra cost.

Decide what your budget is and remember that you will need to pay off all overheads, including software subscriptions, before you make a profit from CFD trading.

It’s also worth considering the following:

- Leverage – Much of the popularity that CFDs have gained is because they can be traded with leverage. Does the provider offer leverage up to 1:30 on the assets you’re interested in? What are the margin requirements and stop-out levels? It is also worth keeping in mind that CFDs are a high-risk instrument, and if you are new to investing then leveraged trading can lead to large losses.

- Ease of Use – A good trading platform, whether you’re a beginner or expert trader, should be easy to use and navigate. Look for a platform with an intuitive and slick design. Also check for customisation options so you can build a view that works for you.

- Access – The best CFD trading platforms offer broad market access, including stocks and shares, major indices, currency pairs, hard and soft commodities, plus cryptos. It’s also worth noting that a diverse portfolio can help spread risk.

- Features – CFD trading software comes with different features. Which tools will bolster your trading experience? Do you need forex heat maps or machine learning-powered market scanners? Do you want to build your own robot for automated trading? If you want to carry out detailed technical analysis then maybe you need a stand-alone charting package.

Bottom Line On CFD Trading Software

CFD trading software connects investors with popular financial markets. Platforms and applications vary in functionality, from offering technical and fundamental analysis alongside trade execution, to niche products that specialise in automated investing.

A useful tip is to check if a software provider or brokerage offers a free demo account so you can try a tool before opening a live account or spending money.

To get started trading CFDs today, use our list of leading brokers and software providers.

FAQ

What Is CFD Trading Software?

CFD trading software is used by traders to analyse the financial markets and make buy and sell decisions. Most top brokers offer comprehensive trading software via a desktop platform or downloadable mobile app. Standard software packages are usually free when you open a live CFD trading account.

What Is The Best CFD Trading Platform?

How Do I Compare CFD Trading Software?

The best way to begin choosing CFD trading software is to get clear on what you need from a platform or application. Do you need advanced charting? Do you want access to the latest financial news and economic releases? Perhaps you want to copy the trades of more experienced investors. Use our guide to choosing CFD trading software to find the right package for your requirements.

What Is The Best CFD Trading Platform For Beginners?

If you are a beginner trader looking for the perfect CFD platform, then one of the best options is MetaTrader 4 (MT4). Available across the world at most leading brokers, this platform offers user-friendly analysis features, instant and pending orders, automated trading, live signals, and more.