Best Brokers With Volatility Index 2026

When markets get shaky, some savvy traders look to volatility indexes for opportunity. Often called the “fear gauge,” these tools don’t just track uncertainty – they help you profit from it.

This guide to the best brokers with volatility indexes (VIX) will help you understand how volatility works and how to use it to your advantage in unpredictable times.

Top Brokers With Volatility Index Trading

-

Testing Pepperstone revealed that trading on MT5 achieved swift execution and minimal delay, even amid CPI or Fed-induced surges. Spreads averaged slightly below 2 points, and the Smart Trader Tools suite provided valuable volatility metrics. It's an excellent option for traders seeking accuracy during major news events.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

XTB simplifies volatility index trading with its sleek xStation platform, offering fast performance even during significant market shifts, alongside tight spreads starting from 0.1. VIX charts refresh instantly without delay, and the integrated sentiment gauge provides additional context. Perfect for traders seeking agility and insight during sharp volatility spikes.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Eightcap excels with its smooth integration of TradingView and MetaTrader, providing traders with sophisticated charting and automation tools. VIX trading proved highly responsive in tests, and the low-latency system ensures precise order execution. Ideal for strategy testing, it meets the need for accuracy during volatility spikes without platform delays or re-quotes.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

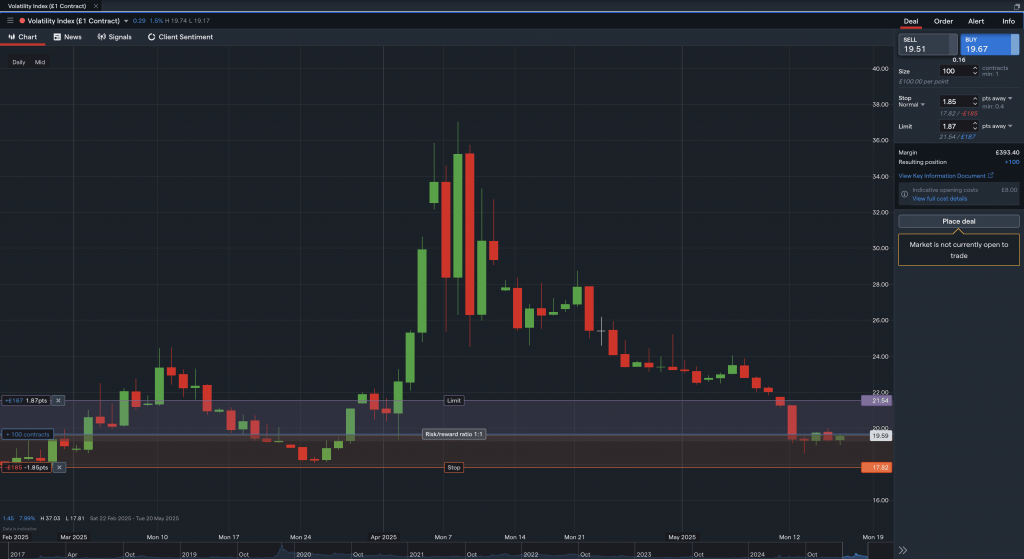

At IG, trading VIX CFDs on both proprietary and MT4 platforms yielded consistent execution with fixed spreads of approximately 0.35–0.40 index points, even amid market volatility. The platform's depth-of-market view and guaranteed stop options provided enhanced trade control. While there were occasional delays in extreme volatility, IG remains a reliable choice for daily VIX strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Testing Vantage by trading its VIX Futures CFD on MT4/MT5 showed rapid execution (around 0.1–0.2 seconds) and competitive spreads (about 0.4 points). Order slippage was rare, even during major futures rollovers. Access to market depth and futures data provided an advantage for precise VIX trade timing.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Plus500 VIX CFD execution is efficient with narrow spreads—approximately 0.23 index points—despite rapid sentiment changes. The proprietary platform’s +Insights sentiment overlay provided helpful context, and guaranteed stops enhanced risk management. However, limited liquidity during extreme spikes sometimes demonstrated constraints during sudden volatility.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

Spreadex, regulated by the FCA, provides spread betting across 10,000+ CFD instruments, including 60 forex pairs. Traders have the option to engage in short-term positions on sporting events as well. With a history exceeding 20 years, the company has earned numerous accolades.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30

Safety Comparison

Compare how safe the Best Brokers With Volatility Index 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Volatility Index 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Volatility Index 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| Spreadex | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Volatility Index 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Plus500 | ✔ | $100 | Variable | ||

| Spreadex | ✘ | £0 | £0.01 |

Advanced Trading Comparison

Do the Best Brokers With Volatility Index 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Volatility Index 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| Vantage FX | |||||||||

| Plus500 | |||||||||

| Spreadex |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- In 2025, Plus500 expanded its range of share CFDs to include emerging sectors such as quantum computing and AI. This update opened up trading opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The broker provides low-commission trading across varied markets, reducing extra fees and attracting seasoned traders.

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

Cons

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

- Educational resources are not as extensive as leading brokers such as eToro, which affects beginners' ability to learn quickly.

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- The broker provides a user-friendly custom charting platform and mobile application.

- Spreadex offers UK traders the chance to earn tax-free profits via spread betting.

- Traders can place wagers on sporting events directly through their brokerage accounts.

Cons

- There is no support for expert advisors or trading bots.

- The absence of a demo account may dishearten potential clients wishing to evaluate Spreadex's offerings.

- Third-party e-wallets are not permitted.

How Investing.co.uk Chose The Best VIX Brokers

To identify the top brokers for trading the VIX, we focused on platforms that not only offer access to volatility indexes but also deliver exceptional service for UK-based clients.

Using our in-depth broker database, we applied a custom scoring system built around 200+ data points, including VIX availability, execution speed, trading tools, FCA regulation, GBP accounts, and platform performance.

But we didn’t stop at the specs – our team ran hands-on tests under to see how each broker actually performs in the trading environment.

What Is A Volatility Index?

A volatility index measures market expectations of future price fluctuations – essentially tracking how much turbulence traders think is ahead.

The most well-known example is the CBOE Volatility Index (VIX), which reflects anticipated volatility in the S&P 500 over the next 30 days. When the VIX rises, it signals increased market anxiety. When it falls, investors are generally more confident.

Unlike traditional market indexes that track price levels, a volatility index measures market sentiment. This makes it a powerful tool for gauging market fear or complacency before major moves happen.

These indexes don’t forecast direction (up or down). Instead, they gauge the intensity of movement. That makes them valuable for traders looking to profit not just from market trends but also from how chaotic or calm the markets are expected to be.

Instruments based on volatility indexes – like ETFs, options, and CFDs – let you speculate on or hedge against market swings.

How Volatility Indexes Work

When traders anticipate big swings (up or down), they’re willing to pay more for options, which pushes the index higher. When markets are calm and stable, the index tends to drop.

These indexes are not directional indicators. A high reading doesn’t mean the market will fall – it simply means traders expect large movements, which could be in either direction.

Bullish and bearish traders use volatility indexes to gauge risk, prepare for price shocks, and manage exposure.

Even though the VIX is US-based, UK investors can benefit from understanding how these indexes operate.

Many global financial instruments, including UK stocks and indices like the FTSE 100, are influenced by US market sentiment. Additionally, UK traders often gain access to volatility-based products like VIX derivatives, CFDs on VIX 75, or volatility ETFs via brokers like CMC Markets and Pepperstone.

Knowing how volatility indexes are built can help you make informed decisions, whether hedging portfolios or speculating on market uncertainty.

Why Trade Volatility Indexes?

Volatility indexes allow you to profit from market turbulence rather than direction. Unlike traditional assets, which depend on whether prices go up or down, volatility trading focuses on the intensity of market movement.

This makes volatility indexes ideal for capitalising on times of uncertainty – whether markets are rallying, crashing, or simply bracing for impact.

In my experience trading the VIX and VIX 75, I’ve found that volatility spikes sharply during sudden market sell-offs or news shocks before prices fully react – capturing these moves early has often led to some of my most profitable trades.

One of the most significant advantages of trading volatility is hedging. Volatility tends to spike during events like interest rate decisions, geopolitical tensions, or major economic reports.

Instruments based on indexes like the VIX or VIX 75 can help protect a portfolio from unexpected moves. For example, you might use a VIX CFD to offset risk from long positions in equity markets.

Most Popular Volatility Indexes To Trade

If you’re looking to trade market sentiment rather than price direction, these are the top volatility indexes that attract the most attention from traders worldwide:

- VIX (CBOE Volatility Index): The most recognised volatility index globally, the VIX measures expected 30-day volatility of the S&P 500. Known as the market’s “fear gauge,” it’s widely used by traders and institutions to hedge or speculate during uncertain times. UK traders can access it through ETFs like VXX, as well as CFDs, options, and futures via brokers such as IG, CMC Markets, and City Index.

- VIX 75 (Volatility 75 Index): A synthetic volatility index designed for retail traders, VIX 75 is known for its extreme price movements and 24/7 trading availability. It’s popular among short-term speculators and high-risk traders. UK and international traders typically access it through Deriv and similar brokers offering synthetic indices.

- VXN (Nasdaq-100 Volatility Index): The VXN index tracks expected volatility in the tech-heavy Nasdaq-100. It’s a favourite for traders focused on technology and growth stocks, offering a targeted way to trade volatility in fast-moving sectors. It’s available via select brokers that support Nasdaq-linked volatility products.

- VDAX-NEW (Germany): As the key volatility index for Germany’s DAX 40, the VDAX-NEW provides insight into Eurozone market sentiment. It’s popular with UK and European traders looking to hedge or trade based on volatility in the EU’s largest economy. Access is typically via international brokers offering DAX-linked derivatives or CFDs.

- RVX (Russell 2000 Volatility Index): The RVX measures volatility expectations for the small-cap-focused Russell 2000 index. It’s popular with traders seeking exposure to more volatile segments of the US equity market. While mainly traded on institutional platforms, some retail brokers offer access through ETFs or CFD products.

Top broker for trading the VIX: Trading the VIX on XTB‘s xStation platform felt refreshingly straightforward during testing, even during high-volatility periods. I used CFDs to speculate on short-term spikes, particularly around US inflation data and Fed meetings, where VIX movements tend to be sharp and fast.

The platform’s layout makes it easy to monitor charts and set stop-losses quickly, which helps manage risk in a market that can turn within minutes. While XTB doesn’t offer direct access to VIX futures, the real-time pricing and built-in news feed gave me enough insight to act decisively.

Getting Started

Getting started with trading volatility indexes begins with choosing a reliable FCA-regulated broker that offers access to these unique markets.

Many popular brokers, including IG, CMC Markets, and City Index, provide trading on volatility indexes like the VIX through CFDs, options, or futures.

Brokers such as Pepperstone, IC Markets, and Vantage are also excellent options if you want tight spreads and fast execution. They offer robust platforms and competitive pricing.

Once you’ve selected a broker, open a trading account. Most VIX brokers we’ve tested, like XTB, Eightcap, and Plus500, offer user-friendly onboarding processes and demo accounts, which are perfect for beginners to practice without risking real money.

Starting with a demo account is essential to familiarise yourself with volatility index behaviour and the broker’s platform before moving to live trading.

After getting comfortable, fund your account and begin trading with careful risk management. Volatility indexes can be highly unpredictable, so it’s recommended to start with smaller positions and use stop-loss orders.

Platforms like Spreadex also provide educational resources and tools to help new traders understand volatility trading nuances and improve their strategies.

Trade the VIX Index on IG’s platform with intuitive tools and tight spreads

Bottom Line

Trading volatility indexes means speculating on market uncertainty instead of price direction. Popular indexes like the VIX and VIX 75 reflect expected market swings and often rise during turbulent times.

You can access these markets through instruments like CFDs, options, and futures offered by UK-regulated brokers. While volatility trading presents unique profit opportunities, it also involves higher risk and requires careful risk management.

Use our list of the best brokers with volatility index trading to get started.

FAQ

Is Volatility Trading Legit?

Yes, volatility trading is entirely legitimate. Retail and institutional traders use this recognised strategy to profit from or hedge against market uncertainty. When done through regulated brokers and with proper risk management, it’s a legal and valid form of trading.

Is Volatility Trading Suitable For Beginners?

Volatility trading can be risky for beginners due to sharp price swings and the use of leverage, which can lead to rapid losses.

However, with proper education, risk management, and starting on a demo account or low-risk instruments, beginners can gradually build experience. It’s best suited for those who take the time to learn the markets and start small.