Deriv.com Review 2025

|

|

Deriv.com is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Deriv.com |

| Deriv.com Facts & Figures |

|---|

Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Demo Account | Yes |

| Min. Deposit | $5 |

| Mobile Apps | iOS & Android |

| Trading App |

Deriv excels with its straightforward app design, enhanced in 2025 with streamlined position management and clearer contract details, alongside its diverse trading opportunities, from traditional markets to custom indices that simulate real-world markets and offer 24-hour trading, including on weekends. The in-app chat assistance, which can’t be found at many alternatives, is also fast and reliable, providing an important layer of support for new users. These all helped Deriv secure DayTrading.com’s ‘Best Trading App’ award in 2025. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, DBots |

| Signals Service | DMT5 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Since broadening its range of CFDs in 2023, Deriv now offers trading on rising and falling prices across hundreds of global financial markets. This includes the firm’s exclusive synthetic indices which imitate real markets but run around the clock for additional trading opportunities. |

| Leverage | 1:1000 |

| FTSE Spread | 1.28 |

| GBPUSD Spread | 1.4 |

| Oil Spread | 0.02 |

| Stocks Spread | 0.59 (Apple) |

| Forex | Deriv has expanded its range of currency pairs, now enabling clients to go long or short on a over 40 major, minor and exotic currency pairs. Spreads on EUR/USD are also competitive at 0.44 pips, especially since being slashed in 2021, while forex CFDs are available via MT5 and multipliers on the broker's beginner-friendly DTrader. |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 1.4 |

| GBPEUR Spread | 1.0 |

| Assets | 40+ |

| Stocks | You can speculate on big stocks like IBM, Netflix and BMW, along with equity indices like the S&P 500. Deriv also offers extended hours trading up to 18 hours a day on shares, which will serve more experienced traders looking to tap into more dynamic stock market opportunities. |

| Cryptocurrency | Deriv.com continues to offer a strong selection of 30+ crypto pairs - more than double the range offered at competitor, IQ Cent. 1:2 leverage on crypto is also available allowing traders to magnify potential returns, and there are zero commissions, catering to aspiring traders looking for simple pricing. |

| Coins |

|

| Spreads | From 0.5 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Deriv is a leading online broker, developed by Binary.com. The broker specialises in trading forex, commodities, stocks and synthetic indices via 3 user-friendly platforms; DMT5, DTrader and DBot. Our Deriv.com review will explore the real account options, market range, leverage, regulation and more. Find out whether to open a Deriv trading account today.

About Deriv

Deriv, launched in 2020, evolved from the established Binary.com. The group was founded in 1999 under the trading name Regent Markets. The rebranding follows 20+ years of providing trading services with a focus on innovation.

Binary.com is well established in the market, averaging 65 million trades a month with total transactions over £8 billion. The entities now employ over 400 people across multiple global locations, including its Malta head office.

Trading Platforms

Deriv offers 3 trading platforms, suitable for a variety of trading styles and client experience. All platform options are available for PC download or as a web terminal via major browsers.

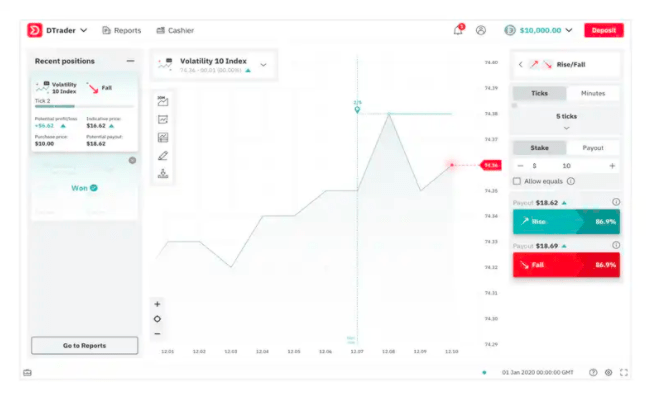

DTrader

Trade forex, indices, commodities and synthetic indices with:

- Multiple trade types

- Customisable charts

- Position size from £0.35

- Trading duration from 1 second

- Suite of technical indicators and widgets

DTrader

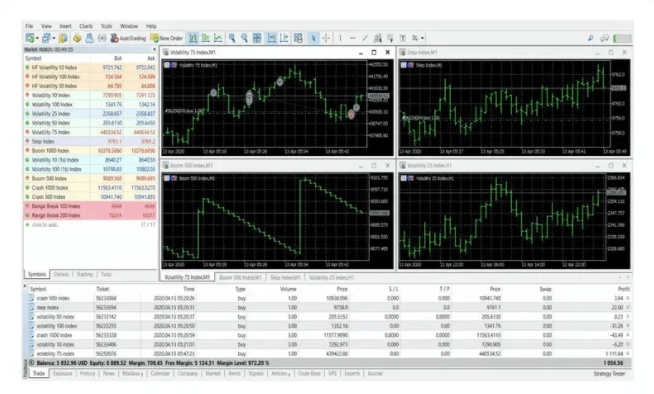

DMT5 (Deriv MetaTrader 5)

Trade forex, stocks, synthetic indices and commodities with:

- Exclusive order types

- A customisable interface

- Simultaneous trade windows

- Range of trade sizes up to 30 lots

- Dozens of technical indicators & drawing tools

MetaTrader 5

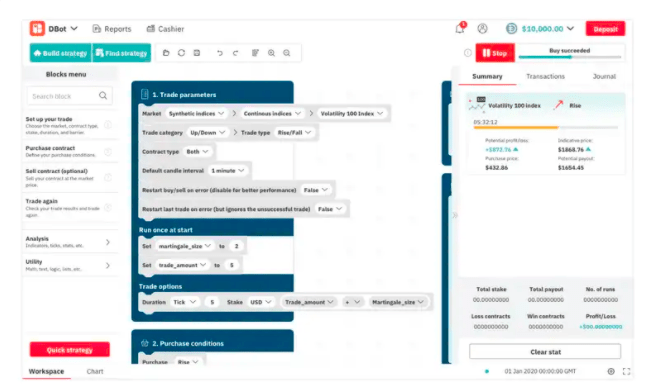

DBot

Web-based strategy builder with automated trading across 50+ assets:

- Pre-built strategies

- Build your own trading bot

- Guides and tutorials available within the platform

- Deriv Telegram group available for performance notifications

- No coding required – easy to configure with pre-built blocks and indicators

DBot

Clients are also able to access Binary.com’s proprietary platform SmartTrader via Deriv. You can use existing login details. SmartTrader is an easy-to-use online platform specifically for new traders. Features include multiple trade types and expiry times. The user-friendly interface makes it a great option for beginners looking to learn more about the financial markets.

Products

Deriv offers retail clients trading opportunities in 100+ assets across the following markets:

- 5 commodities – metals and energy

- 45+ forex pairs – majors, minors and exotics

- Stock indices – Asian, European and US stocks including Nasdaq

- Synthetic indices – randomly generated indices, based on real-world conditions and markets

Assets can be traded via:

- Options trading – take straightforward positions on the direction of markets

- Margin trading – take larger position sizes with borrowed capital for greater returns

- Multipliers – trade on leverage and maximise profit potential by taking multiple positions

Trading Fees

Deriv Group Ltd does not charge trading commissions on any transactions. Instrument prices for CFD trading are quoted directly from liquidity providers with tight spreads starting from 0.5 pips.

The broker does charge swap rates for positions held overnight. An inactivity fee of £25 or equivalent is applied to dormant accounts after 12 months. It should also be noted that during periods of high volatility, spreads and multiplier trades may be offered at unfavourable prices vs usual market conditions.

Leverage Review

Deriv.com offers leverage up to 1:30 in the UK, in line with ESMA regulations:

- 1:2 for cryptos

- 1:5 for equities

- 1:10 for commodities

- 1:20 for minor currencies, gold and major indices

- 1:30 for major forex pairs

Mobile Trading

Deriv supports mobile trading through the MT5 app, available as a free download on iOS and Android devices. Simply login to MT5 with your account details for full access to the broker’s suite of products. Clients can undertake comprehensive price analysis using customisable charts, one-click trading and expert advisors. Pending orders are also available alongside free deposits and secure withdrawals. The MT5 app receives positive reviews from Deriv.com traders.

Deposits

Deriv does not charge a fee for real account deposits. Supported payment methods include:

- Bank wire transfer – minimum deposit from £10, processing times vary from instant to 1 working day

- E-wallets – including Skrill, Neteller and WebMoney. Minimum deposit from £5, instant processing

- Credit/debit card – including Visa and Mastercard. Minimum deposit £10, instant processing

- Cryptocurrency – varying minimum deposits, funds available once blockchain approved

Deriv’s retail clients can also manage funds through a payment agent.

Withdrawals

Withdrawals are processed within one working day and there are no fees charged by the broker. E-wallets offer the lowest payments starting from £5 or currency equivalent. Bank wire transfers provide the largest withdrawals up to £100,000.

Note you may need to submit identity documents as part of Deriv’s standard verification checks.

Demo Account

Deriv Limited offers a demo account on all trading platforms including MT5 with a simple sign-up via email. This is a good way to become familiar with the trading platforms and to test strategies risk-free. These accounts are available across all markets with unlimited virtual funds.

Note demo accounts may be closed after 30 days of inactivity.

Deriv.com Bonuses

At the time of writing, Deriv did not offer any promotions to new or existing clients in the UK, this includes no deposit welcome bonuses and vouchers. This is aligned with the UK’s regulations that restrict trading incentives for retail traders.

Regulation Review

Deriv Europe Limited, with headquarters in Malta, is licensed by the Malta Financial Services Authority to provide trading services within the European Union. The broker also follows limited regulation from the Financial Conduct Authority (FCA) in the UK.

The FCA is a highly regarded regulatory institution in the financial markets. Licensing conditions usually mean traders can be assured of stringent protocols including negative balance protection, segregated client funds and FSCS protection.

Additional Features

The Deriv group offers limited additional trading features. There is no education platform, live news bulletins or economic calendar. Instead, resources are limited to trading calculators. External blogs and peer-to-peer community websites are highlighted as additional features, however these are not kept updated.

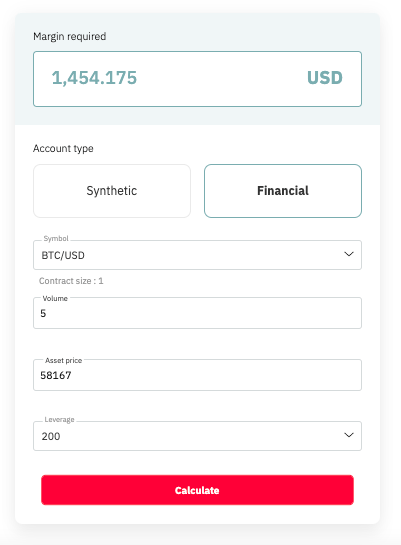

Margin Calculator

Trading Accounts

UK clients are subject to Deriv Europe trading directions. Account types include:

- Synthetic – suitable for CFD trading

- Financial STP – suitable for forex pairs and cryptocurrency trading

- Financial – suitable for forex, commodities and cryptocurrency trading

The account registration process is in line with most online brokers, requiring users to submit identity documents and proof of residence. All accounts accept GBP, USD and EUR as base currencies.

Benefits

- Synthetic indices

- Free demo account

- Negative balance protection

- Various trading platform options

- Low minimum deposit requirements

- Several deposit and withdrawal payment methods

Drawbacks

- Lack of customer support

- Limited additional features & education tools

Trading Hours

Deriv follows standard market operating hours, including 24/5 trading on some instruments, such as forex. Synthetic indices are available for trading 24/7. Head to Deriv.com for a breakdown of working hours by instrument.

Customer Support

Deriv’s English speaking customer support team is available 24/7:

- Ask the community – self-service portal, peer-to-peer between broker clients

- Help centre – comprehensive FAQ portal covering topics such as server issues, opening a new financial account and platform help

There is the notable absence of a live chat-bot via the website home page and no phone numbers or email. We would expect these to become available as the broker develops.

Client Safety

The security protocols offered by Deriv are fairly standard within the industry. This includes personal information protection via SSL encryption on both PC and mobile applications. Real account login access is username and password protected. The broker also supports trading limits and self-exclusion parameters.

Should You Trade With Deriv?

Deriv offers opportunities for traders of all abilities to invest across multiple asset classes. UK traders should feel relatively assured by the FCA regulation, though the extent of the licensing could be reviewed. We were particularly pleased with the various platform options and interesting trading products, including synthetic indices. Overall, we’re comfortable recommending Deriv.com to our readers.

FAQ

What Trading Platforms Does Deriv Offer?

The broker offers 3 trading platforms for real accounts; DMT5, DBot and DTrader. These offer an excellent all-round trading environment for retail investing. Note Deriv does not support a MetaTrader 4 (MT4) download for trading activities or as a demo account. See our list of MT4 brokers here.

Does Deriv Support Volatility 75 Index Trading?

Yes, Deriv offers trading on VIX 75 alongside other synthetic volatility indices. Volatility 75 looks at the speculated price change of the S&P 500 index. These indices offer an exciting trading option not found at most online brokers and are a positive in our broker review.

What Is The Difference Between Deriv.com Vs Binary.com?

Deriv is the rebranded platform of Binary.com. The new platform was established in 2020. Deriv will eventually replace Binary.com and you can use your original login details on the new website. The latest platform has been well received by UK traders.

What Is The Deriv Peer-To-Peer App?

The Deriv peer-to-peer app is a mobile APK solution for clients to make deposits and withdrawals to their real accounts and review credits. The user-friendly and free-to-download app is a useful extra for active traders and isn’t something offered by many retail brokers.

Does Deriv Accept Bitcoin Deposits?

Yes. To deposit into a real account with Bitcoin, log into Deriv and deposit BTC in the cashier section. Paste your BTC wallet account address into your blockchain wallet. Funds will be available once processed and confirmed.

Top 3 Deriv.com Alternatives

These brokers are the most similar to Deriv.com:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Deriv.com Feature Comparison

| Deriv.com | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.6 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $5 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5, cTrader | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Deriv.com Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Deriv.com | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | Yes | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Deriv.com vs Other Brokers

Compare Deriv.com with any other broker by selecting the other broker below.

Popular Deriv.com comparisons: