Best Brokers For Low Spreads 2026

Spreads are the difference between the buy and sell price of a security, such as a forex pair. Top brokers will offer low or tight spreads, but they may charge additional commissions. Conversely, wider spreads can reduce your profit margins if you’re trading in large volumes.

That’s why we’ve tested, compared and ranked the brokers with the lowest spreads.

Brokers With The Lowest Spreads

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

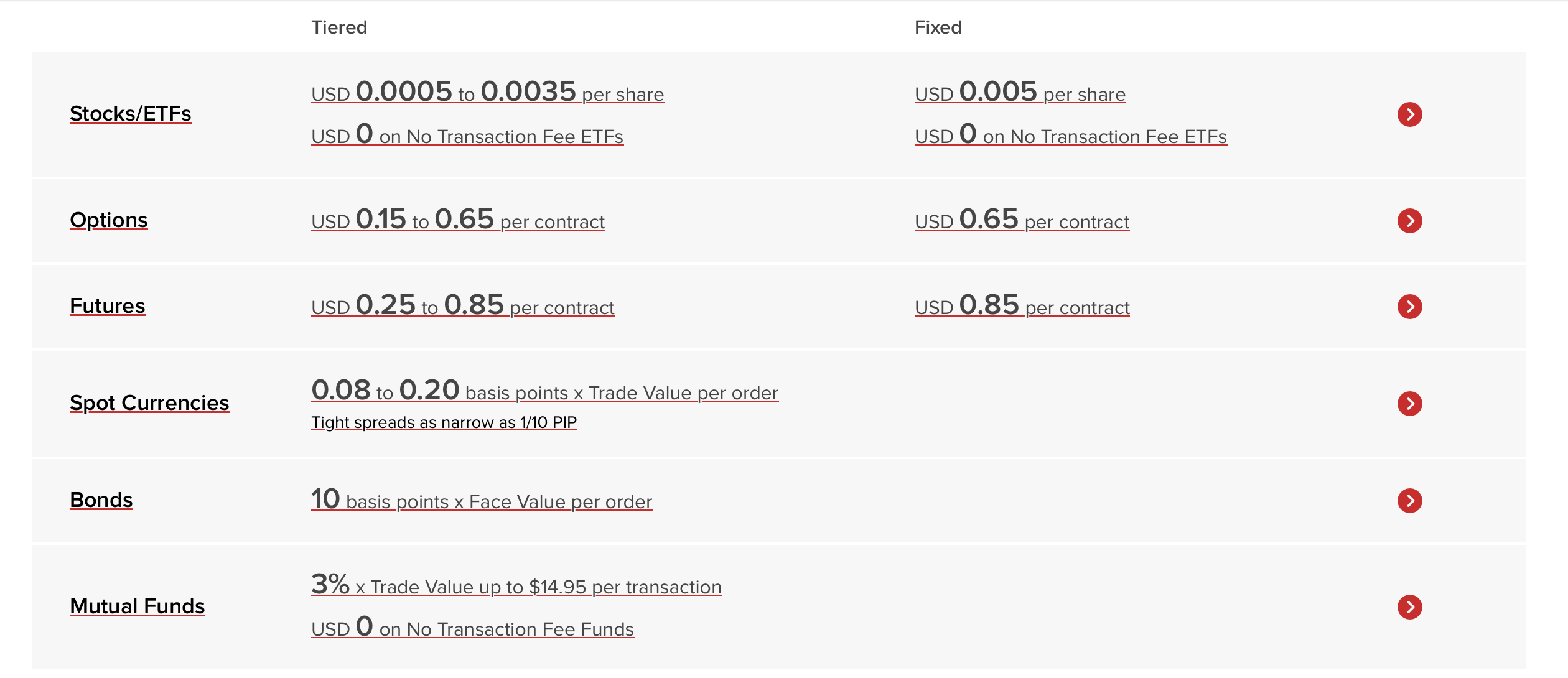

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Founded in 2008 and based in Israel, Plus500 is a leading brokerage with over 25 million registered traders across more than 50 countries. It focuses on CFD trading, offering a user-friendly proprietary platform and mobile app. The company provides competitive spreads and does not impose commissions or charges for deposits or withdrawals. Plus500 stands out as a highly trusted broker, licensed by respected authorities such as the FCA, ASIC, and CySEC.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Brokers For Low Spreads 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Low Spreads 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Low Spreads 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ |

Beginners Comparison

Are the Best Brokers For Low Spreads 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Plus500 | ✔ | $100 | Variable | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers For Low Spreads 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Low Spreads 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Plus500 | |||||||||

| CMC Markets | |||||||||

| Vantage FX | |||||||||

| XTB |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

Cons

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- Plus500 offers a dedicated WebTrader platform tailored specifically for CFD trading. It features a user-friendly and streamlined interface.

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

- In 2025, Plus500 expanded its range of share CFDs to include emerging sectors such as quantum computing and AI. This update opened up trading opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

Cons

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

- Algorithmic trading and scalping are not available, potentially deterring certain traders.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

- CMC provides competitive pricing with narrow spreads and low trading fees, except for stock CFDs. The Alpha and Price+ programmes offer additional benefits for active traders, including discounts on spreads of up to 40%.

- We've upgraded the 'Assets & Markets' rating due to frequent product enhancements in early 2025. These include extended trading hours for US stocks and the introduction of new share CFDs.

Cons

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

- The CMC Markets app provides a comprehensive trading package; however, its design and user experience lag behind market leaders such as eToro.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage addresses the needs of passive investors through user-friendly social trading on ZuluTrade and Myfxbook.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

How Investing.co.uk Chose The Brokers With The Lowest Spreads

We reviewed brokers that advertise consistently low spreads across major instruments, including forex, indices, and commodities. Our team tested each platform in live or demo environments to record typical spreads under different market conditions.

We then ranked the brokers by overall ratings, combining our hands-on results with verified data points such as average spread levels and execution quality, to highlight the best choices for traders seeking the lowest-cost trading conditions.

What To Look For Beyond Low Spreads

It’s not enough to have tight spreads – our experts have found over decades of trading that any broker worth signing up with needs to perform well in the following areas:

Regulation & Trust

Regardless of the spread a broker charges, you should ensure that it’s trustworthy before risking a penny of your funds with it.

Regulation by a trusted organisation like the UK’s Financial Conduct Authority (FCA) provides a huge amount of credibility to brokers, which need to meet strict requirements to be granted a license.

If you opt to trade with an offshore firm that’s not regulated by the FCA, you can still get an idea of its credentials by checking which, if any, other bodies have granted it a license.

You should also check that the broker has been in operation for a significant period of time and check reviews from existing clients to gauge the user experience.

- Pepperstone has maintained an excellent reputation as a reliable broker since 2010, with licenses from top regulators including the FCA and tight spreads from 0 pips on major FX pairs from its Razor account and from 0.9 pips on its commission-free Standard account, as well as competitive spreads on other products like indices at 1 pip.

Competitive Spreads Across Assets

You need to research the spreads on specific assets you want to trade, because there’s a great deal of variation among different brokers on many assets.

Compare the spreads being offered by the broker against the average spread of the asset you wish to trade. For example, let’s say you want to trade the GBP/USD pair, and the industry-wide average spread is 1.7 pips.

If Pepperstone, for instance, offers an average spread of 0.38 pips on this currency pairing, this would be a very positive sign in this broker’s favour, whereas you would likely ignore a broker that offers a 2-pip average on this pair.

Brokers often advertise their minimum spread, which is often as low as 0 pips, but it’s more useful to check the average spread. Likewise, most brokers advertise their spread on very high liquidity instruments, like EUR/USD, which tend to have lower spreads.For the most accurate assessment of fees, you need to check and compare spreads on the specific assets you want to trade, as these will often be a very different story.

- IC Markets has been a favoured broker by our experts for years because it provides clear and transparent information on the pricing of its many asset classes, including a 0.1-pip average spread on the EUR/USD pair via its ECN account, 0.23 average on gold, and 0.38-pip average on the SP500 index.

Commissions

Brokers often charge commissions on top of tight spreads, so you need to factor these in when you choose your low-spread broker.

Competitive commissions along with brokers that offer low spreads are best for reducing the overall cost of trading. Note, commissions are usually a fixed charge per trade or a variable fee based on trading volumes.

- FXCC is a regulated broker that has broken the mould since it was established in 2010 with tight floating spreads from 0 pips and absolutely no commissions on its hybrid ECN/STP account.

Additional Fees

To compensate for low spreads, brokers can also charge additional fees, such as overnight financing rates, withdrawal fees and currency conversion costs, so you need to take these into account when you compare brokers.

You should also look into hidden fees like inactivity charges, which usually kick in after an account remains idle with no trading activity for several months. These are charged monthly and will quickly chip away at your trading funds if you are an infrequent trader.

- Eightcap is a reliable broker with tight spreads across its forex, shares, commodities, index and crypto instruments and with no added fees from deposits, withdrawals or account inactivity.

Market Access

If you are interested in trading in international markets such as the US or Europe, or specific asset classes such as cryptocurrencies, indices or commodities, ensure that your broker provides access to them.

To trade Nasdaq stocks, for instance, you need to choose UK brokers with very low spreads that offer access to that market, such as eToro.

Nowadays, most low-spread brokers offer a decent selection of forex pairs, plus stocks, indices, commodities and ETFs, so you should be able to find the instruments you want by shopping around.

Interactive Brokers is transparent about pricing across its huge range of assets

- Interactive Brokers remains among the leading brokers in the UK for market access, with an unmatched breadth of 1 million+ instruments from across the globe, including stocks, forex, indices, ETFs, bonds, options and more.

What Is A Spread In Trading?

Spreads are a key way that brokers generate profit. They are the difference between the ask price (sell) and bid price (buy) of an asset. The bid price can be taken as the demand for an asset, while the ask quote can be seen as the supply.

The bid price is usually just above the market value of the asset, and the ask price is normally just below. The difference between the underlying value and the bid/ask price is profit for the broker.

Particularly with high volume trading, wide spreads usually mean that it takes longer for traders to make a profit. This is because the risk of trading the asset is higher due to the volatility in price.

Example

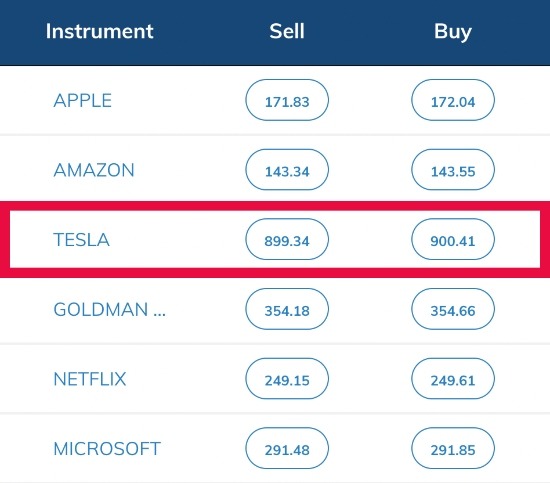

The difference between the ask and bid quote is measured in percentage in points (or pips).

So, if the ask price of Tesla is 899.34 and the bid price is 900.41, the spread is 1.07 points/pips.

AvaTrade Spreads

Types Of Spreads

- Fixed: These are spreads that remain the same regardless of changes in the market. Fixed spread brokers help traders calculate their potential profit before trading, and can also save traders’ money in markets that have a lot of price fluctuation. However, for stable markets, fixed spreads are not always helpful and can sometimes even cut into profits due to their unchanging position.

- Variable/Floating: The opposite of fixed spreads, variable spreads change with market conditions. When prices are less volatile and markets are more liquid, brokers will offer tighter spreads. When prices are more volatile and the markets are less liquid, the spread will be wider.

What Affects The Spread?

- Volatility: The volatility of an asset’s price creates confusion between buyers and sellers on what the actual underlying price should be. This instability causes bigger spreads. Traders can expect to see wider spreads on cryptocurrency and volatile forex pairs, whereas brokers with low spreads will typically offer the best price quotes on stable assets like gold.

- Liquidity: Assets in more liquid markets tend to have tighter spreads. This is because they can be more easily bought and sold, which means that online brokers are more confident in the price.

ECN Brokers & Raw Spreads

Electronic Communication Network (ECN) is a term used to describe the way that a broker manages and processes client orders. It is a Non-Desk Dealing (NDD) type of broker, meaning that the brokerage does not act as the counterparty to customers’ positions. Importantly, this also means more competitive spreads for traders.

Dealing desk brokers take the opposing side to traders, which means that they usually fix the bid and ask price to be profitable for themselves. This can often lead to spreads being wider and can create a conflict of interest as the brokerage profits from traders’ losses.

ECN brokers behave as the intermediary between traders and liquidity providers. This eliminates the conflict of interest. Liquidity providers then bid to trade with the investor, resulting in more competitive spreads.

Because of these benefits, ECN brokers often charge higher fees, for example, increased commission on each trade made and/or a higher minimum deposit amount.

Pros Of Using A Low Spread Broker

- Trading in high volumes can have a lower overall cost

- If commissions are not too high, low spreads can help traders to improve profit margins

Cons Of Using A Low Spread Broker

- It may not be beneficial to those who trade in low volumes, such as beginners

- ECN brokers often charge higher commissions for low spreads

Bottom Line

Brokers with low spreads are helpful for active traders seeking to cut costs. Spreads are one of the most common ways that trading platforms generate revenue, so it is useful to understand how to compare providers.

As a trader, you should look for the tightest spread possible to maximise your profit margins. However, brokers with the lowest spreads often charge additional commission fees, so it is important to paint a full picture of trading costs before opening an account.

See our list of the lowest spread brokers to find the right provider for your needs.

FAQ

How Do I Know A Broker With Low Spreads Is Not A Scam?

Check to see if the broker is FCA-approved in the UK. The Financial Conduct Authority enforces regulations that help ensure the safety of traders’ funds. You can check the broker’s licensing details on the official FCA register. The best-regulated investing firms also publish regulatory information on their websites.

How Do I Know If A Spread Is Good?

To ensure that your broker is offering competitive spreads, it is a good idea to compare their spreads with other online brokers. The lower the spread, the better, though also take into account any additional fees, such as commissions and overnight/rollover charges. Our spread comparison table can help you.