24-Hour Trading

Trading was once the domain of professionals and institutions operating on set hours in specific geographic locations, but today, the worldwide web, internet-based brokers and cryptocurrencies allow individual investors to make trades 24/7, 365 days a year.

24-hour trading is a godsend for many private traders, as it allows them to trade in their own time, regardless of their duties during normal working hours (though not all assets and markets will be available around the clock). Forex, cryptos and other assets that are available will likely require specific strategies tailored to the time of day.

This guide will provide examples and strategies to help beginners understand the meaning of 24-hour trading markets. We have also reviewed and listed the top brokers and trading apps in the UK with 24 hour trading below.

24 Hour Trading Platforms & Brokers

-

PrimeXBT offers forex trading on over 50 majors, minors and exotics with margin opportunities and zero commissions. The forex platform is fast, reliable and feature-rich based on our latest tests with 3 charts, 10 timeframes, and 91 technical studies - ideal for active trading strategies.

Crypto Coins

- BTC

- LTC

- ETH

- XRP

- EOS

- ADA

- DOT

- SOL

- UNI

- LINK

- DOGE

- BNB

- ICP

- SAND

- more

GBPUSD Spread EURUSD Spread GBPEUR Spread Variable 0.1 Variable Total Assets FCA Regulated Platforms 45+ No Own -

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

Crypto Coins

- BTC

- BCH

- DOT

- DSH

- EMC

- EOS

- ETH

- LNK

- LTC

- NMC

- PPC

- XLM

- XRP

- ADA

- BNB

- DOG

- UNI

- XTZ

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.23 0.02 0.27 Total Assets FCA Regulated Platforms 75 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower -

XTB provides access to 70+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

Crypto Coins

- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IQCent traders can access CFDs or binary options on 45+ forex pairs. CFD spreads start from 0.3 pips and binary options payouts are decent up to 95%. This is competitive compared to Pocket Option, for example, offering forex payouts up to only 81%.

Crypto Coins

- BTC

- ETH

- LTC

- ETC

- DOGE

- MATIC

- QNT

- SOL

- XRP

- USDT

- XMR

- BNB

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.8 0.3 0.8 Total Assets FCA Regulated Platforms 49 No Online Platform, TradingView -

BlackBull offers 64 currency pairs with excellent pricing through its ECN accounts, with the Standard commission-free spread starting from 0.8 pips. BlackBull also ensures its rapid execution carries through to MT4, which still stands as the industry’s most popular platform with active forex traders.

Crypto Coins

- BTC

- ETH

- XRP

- LTC

- ADA

- POLY

- XFET

- XINJ

- XNAKA

- XAX

- XCOTI

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.3 0.8 Total Assets FCA Regulated Platforms 64 No BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist -

InstaTrade offers a huge selection of around 100 currency pairs. It provides spreads starting at 0.0 on majors, plus integrated forex analysis in the web platform, featuring signals, plus technical and fundamental summaries. Additionally, InstaTrade offers educational modules covering forex basics for beginners, including margin trading and risk management.

Crypto Coins

- BTC

- ETH

- XRP

- LTC

- SOL

- UNI

- DOGE

- BCH

- FIL

- ADA

- DOT

- LINK

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.2 0.0 2.8 Total Assets FCA Regulated Platforms 65 No InstaTrade Gear, MT4 -

IC Trading delivers remarkably narrow forex spreads across 60+ currency pairs, particularly on key forex assets like EUR/USD. This renders it an outstanding choice for forex traders in pursuit of superior pricing with top-tier execution speeds. High-volume traders also stand to gain significant advantages, with rebates reaching up to $2.50 per forex lot.

Crypto Coins

- BTC

- ETH

- DSH

- LTC

- BCH

- XRP

- EOS

- EMC

- NMC

- PPC

- DOT

- XLM

- LINK

- DOGE

- XTZ

- UNI

- ADA

- BNB

- AVAX

- LUNA

- MATIC

- GLMR

- KSM

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.2 0.1 0.3 Total Assets FCA Regulated Platforms 60+ No MT4, MT5, cTrader, AutoChartist, TradingCentral -

Plexytrade presents major, minor, and exotic forex pairs for trading, with leverage reaching 1:2000 and raw spreads starting from 0.0 - an enticing proposition for advanced traders seeking gains from minor price shifts. However, the downside lies in the limited selection, with only 41 currency pairs available, significantly fewer than the 100+ forex assets at IG.

Crypto Coins

- BTC

- ETH

- LTC

- SOL

- XRP

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.8 0.7 1.1 Total Assets FCA Regulated Platforms 40+ No MT4, MT5 -

RedMars strongest investment category is forex with more than 50 currency pairs, from majors to minors and exotics. Spreads start from 0.0 pips, catering to active currency traders, and leverage can reach 1:500. However, there are no forex heatmaps or research tools to support aspiring forex traders.

Crypto Coins

- BTC

- ETH

- LTC

- XRP

- XLM

- DOT

- ZEC

- XMR

- QTM

- NEO

- EOS

- BCH

- DSH

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.7 0.7 1.1 Total Assets FCA Regulated Platforms 50+ No MT5 -

UnitedPips supports trading on over 40 major, minor and exotic currency pairs. To help inform trading decisions, it offers daily market analysis with fundamental and technical insights into prominent currency pairs like AUD/USD and EUR/USD.

Crypto Coins

- BTC

- ETH

- LTC

- XRP

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 0.7 1.1 Total Assets FCA Regulated Platforms 40+ No UniTrader

24-Hour Trading Markets

A wide range of popular trading brokers and websites has made it possible to trade a diverse list of assets 24 hours a day. These include:

- Foreign Exchange – Forex markets are open 24 hours a day, 5 days a week. Many popular brokers such as Pepperstone, Vantage FX, and IC Markets are available to UK traders.

- Crypto – Cryptocurrency markets never close, so you can make trades at any time of day, any day of the year. This includes crypto-based financial products, such as Spectre.ai’s digital contracts, as well as standard cryptocurrency markets.

- Synthetic Markets – Some trading brokers, such as Deriv, offer 24/7 trading on synthetic markets – proprietary, simulated markets based on real-world assets.

- OTC Trading – Another popular 24-hour product offered by companies such as binary options broker Pocket Option is OTC markets, which allow trades on a variety of securities, commodity and other assets during times when the ordinary market is closed. OTC trading takes place with a counterparty, rather than on an exchange, allowing brokers to offer it outside ordinary trading hours.

- Standard Markets – With 24/7 trading becoming more commonplace, some of the traditional markets have extended their hours to allow trading nearly round the clock. The CBOE’s options exchange, for example, allows trades on S&P 500 Index and other indices nearly 24 hours a day, 5 days a week.

Each of these methods of 24-hour trading has its own characteristics which traders should familiarise themselves with, and which we will explore in the next section.

24-Hour Forex Trading

Forex is the classic 24-hour trading instrument for a simple reason: no matter what time of day it is, there will be a currency market open somewhere in the world, whether that is in Japan or New York.

The forex trading day begins in the morning in Asia and Australasia, with the Sydney session closing at 6 am and the Tokyo market running between midnight and 9 am, UK time. The focus then switches to London, with the UK forex session open between 8 am and 4 pm BST. Finally, the New York session kicks off at British noon until 9 pm, at which point the Sydney session opens once more.

The Forex Trading Day (BST):

- Sydney: 9 pm – 6 am

- Tokyo: 12 am – 9 am

- London: 8 am – 4 pm

- New York: 12 pm – 9 pm

As a result, you will find there are three main sessions for forex trading over the course of a UK day:

- The overnight Asia-Pacific session coinciding with Sydney and Tokyo markets

- The European session that runs from British morning to afternoon

- The US session from 12 pm – 9 pm BST

This is important because certain currency pairs will trade more actively during different sessions. The GBP/USD pair will have a far higher volume during the European through US sessions, while you can expect the USD/JPY pair to be more active during the Asia-Pacific session.

Moreover, trading volume and volatility are not distributed evenly over the course of a trading day, and you can expect a much more active environment at certain times of the day. Generally, the first hours after London opens tend to have a high trading volume, which then slows during late morning until the New York market opens at midday. The overlapping hours between the British, European and US markets tend to be busy for forex trades, particularly for the GBP/USD and EUR/USD pairs.

Similar dynamics will exist for different currency pairs depending on their geographical location and the opening hours of their local forex market. It is a good idea to learn the most active markets and pairs during the 24-hour trading period you intend to be executing orders.

24-Hour Cryptocurrency Trading

Crypto markets remain open for trading 24/7 because they work on decentralised blockchain ledgers – anyone can execute a transaction on the blockchain any time they like.

Nevertheless, cryptos are still likely to mirror some of the dynamics of traditional assets, and particularly the 24-hour aspect of forex markets.

This is because individuals and institutions involved in cryptocurrency trading in different geographical regions are still likely to do their trading at roughly the same times during a standard working day. When the European and US markets wind down for the day, the Asian market gets started.

Each session will have its own pattern regarding 24-hour trading volumes and volatility, and the best play on a given market may well depend on gauging how that asset will react to the price movements of the previous session.

As a result, crypto traders should familiarise themselves with the market dynamics during the hours they trade and use that knowledge when analysing price movements and setting up trades.

Bear in mind that while many prefer to trade during periods with high trading volume driving price movements, this can cause be expensive on crypto markets where certain trades require “gas fees” – the network fee paid per transaction, which can quickly climb to hundreds of dollars during periods with high volume.

Synthetic Products

Popular brokers including Deriv have developed proprietary synthetic markets, which are designed to simulate the price movements experienced in a real market. There are no real, underlying assets at play on a synthetic market – instead, the price movements are generated algorithmically by the synthetic index brokers, meaning they can be traded at any time, 24/7.

While many traders feel synthetic markets are too random to trade on, since they are completely divorced from real-world events, some traders do say it is possible to consistently profit from them using standard technical analysis methods.

Traders who are only available to place trades at a specific time might enjoy synthetic markets since they can choose to trade with different volatility levels than those available to them on the real markets. Besides that, synthetic markets can be attractive as they give traders a chance to use instruments like CFDs at any time of day.

OTC Products

Some of the best binary options brokers, like Pocket Option, let traders speculate on the price of forex, securities and indices during standard trading hours, but also provide an over-the-counter (OTC) version of many assets that can be traded around the clock.

It is not always clear what influences price movements of the OTC assets, which differ from the actual market price, and some traders complain that the price movements are too random to consistently make profitable trades. However, Pocket Option says OTC quotes are provided directly by international banks, liquidity providers and market makers, and the payout is generally considerably higher than exchange-traded assets. Algorithmic strategies can also be used.

Standard Markets

Standard financial markets are becoming more flexible about trading times as online investing becomes ever more popular. Some exchanges now allow after-market or pre-market trading, in some cases allowing customers to trade certain securities and indices 24 hours per day.

- The CBOE launched a 24/5 global trading service in November 2021, allowing the trade of S&P 500 Index (SPX) and Volatility Index (VIX) options nearly 24 hours per day.

- Some trading brokers offer an ever-growing list of securities that can be traded 24 hours a day, 5 days a week.

- Popular brokers such as IG, City Index and CMC Markets support 24-hour trades on indices 5 or more days per week.

24-Hour Trading Strategies

With such a wide range of products, assets and markets available to trade day and night, the scope of strategies that could be used in 24-hour trading is nearly endless.

One of the most important things to consider is the time you make your trade and the phase the market is in. Since traders often seek out 24-hour trading because of time constraints preventing them from trading during their local market’s normal opening hours, this can be an especially important point.

The following list provides traders with a “24-hour trading clock”, showing major exchanges’ trading hours in the British time zone:

Exchange Trading Hours (GMT)

- London Stock Exchange (LSE): 08:00–16:30

- Euronext: 08:00–16:30

- Nasdaq: 14:30–21:00

- New York Stock Exchange (NYSE): 14:30–21:00

- Australian Securities Exchange (ASX): 00:00–06:00

- Tokyo Stock Exchange (TSE): 00:00–06:00

- Shanghai Stock Exchange (SSX): 01:30–07:00

- Shenzhen Stock Exchange (SZSE): 01:30–07:00

Here are some features to note about different market phases for 24-hour trading:

Market Open

The first period after the market opens tends to be busy as a flurry of buy and sell orders come in at once. This is a good time for strategies that aim to take advantage of price moving out of a range, such as breakout or straddle strategies.

End-Of-Day Trading

Some traders prefer the final period before the market closes as they feel that as the market winds down there is less random noise and, with lower trading volumes, there could be gaps in the market or other opportunities to exploit. Prices of market data and other tools also tend to be cheaper during this period.

After-Hours & Pre-Market Trading

When you trade securities, indices and commodities outside normal trading hours, you will face completely different market conditions due to the lower volume and liquidity as far fewer people are making trades. This heightens risk, and it can also lead to a much wider spread than during normal hours.

Finally, watch out for after-hours news events that may cause a sudden spike in volume and thus an extreme price movement.

Trading Orders & Automated Trading

While the specific hours you are able to devote to trading may be limited, that doesn’t necessarily mean you can only make trades during those hours.

Many traders use after-hours to study assets’ fundamentals and plan their trades for the following day. These trades may be scheduled by placing an order that will automatically be filled when the asset reaches a specified price level.

Alternatively, automated trading bots can be programmed to trade according to user-defined parameters throughout the day without the trader being present at all.

Comparing 24-Hour Trading Brokers

As there is such a diverse variety of products, markets and styles for trading 24 hours, the broker you choose will depend on your specific needs.

Forex Brokers

Since the forex markets have traditionally worked 24/5, there is a wide selection of forex brokers available to UK traders.

For most traders, the most important things to look out for when selecting a forex broker are the spread, pricing structure for additional fees, and regulation.

Brokers like CMC Markets are FCA-regulated brokers and trusted by large customer bases, and they are also known for their competitive spreads and pricing structures. Some other reputable brokers such as Pepperstone offer a range of assets to trade, including forex but also indices, commodities and shares.

Binary Options Brokers

Many binary options brokers offer trading on 24-hour markets such as forex and crypto, and some like Pocket Option allow traders to speculate both on stock or commodities markets during opening hours and to make 24/7 trades on OTC or synthetic markets.

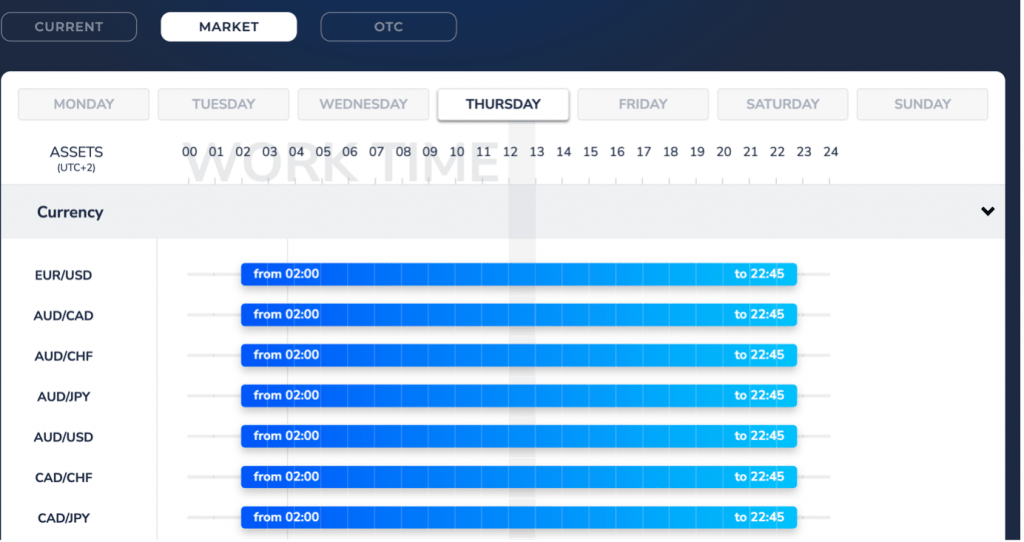

It should be easy to find the trading schedule for different assets offered by the broker, as can be seen from the screenshot from Pocket Option below.

Pocket Option Trading Schedule

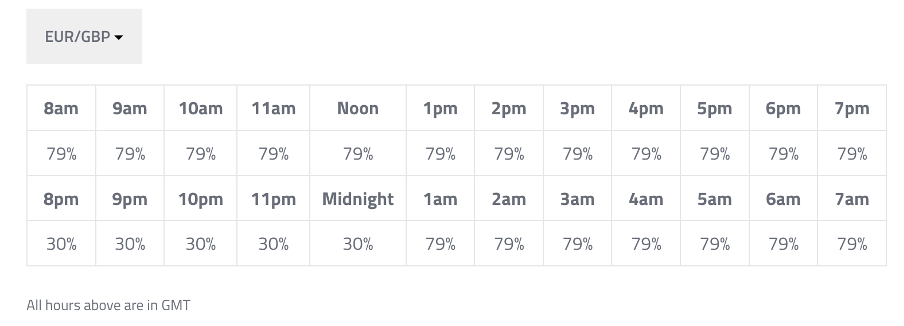

Another thing to keep in mind when trading binary options is that the payout levels are likely to change depending on the time of day it is. Try to access a chart showing the payouts you can expect at different times of the day, as with the below page from the digital contracts broker Spectre.ai:

Spectre.ai Payouts

Trading Platforms

Another consideration when choosing your 24-hour trading broker is its support for different trading platforms. This can be especially important for traders with time constraints, as it will be easier to research, set up and execute scheduled trades using a more powerful platform, not to mention support for automated trading bots and algorithms.

While many 24/7 brokers get traders on board their proprietary platforms when they sign up, you may wish to look for one that supports third-party software, such as MetaTrader’s MT4 or MT5, if you are familiar with these platforms.

Bottom Line On 24-Hour Trading

It is not easy fitting a trading side-hustle into your daily routine if you already work full-time, but fortunately there are many ways to access lucrative markets, 24/7. Traders can either choose a stock exchange that is open and busy during the period they can trade, or go for a 24-hour asset class like forex and crypto or a product such as binary options that is available round the clock. Trading orders and automated robots provide other options for traders who want to deal with a specific asset during hours they would otherwise be unavailable.

Use our list of the best brokers with 24-hour trading to get started.

FAQ

What Can I Trade 24 Hours A Day?

No matter what time you are awake and free to log into your trading account, you can be sure profitable markets are available. Forex markets are open 24/5 and cryptocurrencies can be traded 24/7, though you will still need to take into account the prevailing market conditions at the specific times you trade.

Trading volumes for cryptocurrency will tend to rise and fall to the same schedule as other major markets, but you can check Coinbase, Binance or your chosen exchange for the 24-hour data on bitcoin, ether, dogecoin or whichever crypto asset you prefer.

Otherwise, traders can access certain stocks and indices 24 hours a day from some brokers, or they could try trading a synthetic market.

Are Any Stock Exchanges Open 24/7?

Stock exchanges usually operate on a schedule according to the standard working day in their geographic location, but there are still some ways to trade stocks round the clock. Some brokers, including Interactive Brokers and Charles Schwab allow traders to access a selection of assets including SPX-listed stocks during extended pre-market and after-market hours, in some cases allowing 24-hour trading.

Where Can I Trade 24 Hours?

Thanks to the internet, traders around the world should be able to access some form of 24-hour trading as long as they have a connection. With the right broker, you will be able to trade cryptocurrencies 24/7, forex 24/5, and you will be able to access after-hours trading on selected indices such as VIX and other assets including SPY and other ETFs, stocks and commodities.

Can I Trade Stocks 24 Hours A Day?

It is possible to trade some stocks effectively 24 hours a day with certain brokers. However, bear in mind that the market dynamics will be very different during after- and pre-market hours, as volumes will be much lower.

Is Forex Open 24-Hour?

Forex markets are generally open 24 hours per day throughout the 5 days of the working week. With a good trading platform or trading app, anyone can trade the currency pairs of their choice, at any time of the day.

What Is The Best Time For A 24-Hour Trader To Execute Trades?

If you are available and able to trade 24 hours a day, whether that is because you have a free schedule and are willing to lose sleep to execute a trade or because you have mastered automated trading, you will have the advantage of being able to pick and choose the asset and market time you wish to trade.

The best time to trade depends on the context, with certain assets and markets tending to be busier during specific times in the day. In forex, the busiest periods tend to be when two exchanges from a particular currency pair are both working at the same time. So, the GBP/USD pair will have a higher trading volume at around midday UK time, when exchanges in London and New York are both active.

Volumes of other assets such as cryptocurrencies will also tend to ebb and flow as different time zones join the market or finish trading for the day. However, keep in mind that a major news event – and in particular, an unexpected one – will often drive up the trading volume during irregular hours.