XS Review 2025

|

|

XS is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to XS |

| XS Facts & Figures |

|---|

XS is an established forex and CFD broker based in Australia. Clients can access 1000+ assets on the popular MT4 and MT5 platforms. The firm holds several global licenses and is regulated by the ASIC, CySEC and Seychelles FSA. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Metals, Energies, Crypto, Futures |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, ASIC, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | With more than 1,100 CFDs spanning precious metals, stocks, crypto, forex, futures and indices, I’m pretty confident that there will be something for everyone at XS. Traders can also enjoy zero commissions on CFD trades plus a range of account types. |

| Leverage | 1:500 |

| FTSE Spread | From 0.7 (Standard) |

| GBPUSD Spread | From 0.7 (Standard) |

| Oil Spread | From 0.7 (Standard) |

| Stocks Spread | From 0.7 (Standard) |

| Forex | My tests have uncovered a decent range of 55 currency pairs at XS with spreads from 0.1 pips in the Pro accounts. Dedicated forex traders should also be pleased with the choice of MetaTrader platforms, which can facilitate complex forex strategies. |

| GBPUSD Spread | From 0.7 (Standard) |

| EURUSD Spread | From 0.7 (Standard) |

| GBPEUR Spread | From 0.7 (Standard) |

| Assets | 44 |

| Stocks | I’m a big fan of the 1,000+ company stocks available at XS, including huge companies like Amazon and Apple. That said, I would like to see additional stock market analysis tools on offer, which would align XS with some of the top brands I have reviewed. |

| Cryptocurrency | On the downside, I am disappointed to see such a mediocre variety of crypto products supported by XS, with only 6 cryptocurrencies available. With that said, I was able to access decent leverage rates up to 1:20. |

| Coins |

|

| Spreads | From 0.7 (Standard) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

XS.com is an online broker offering CFD trading on 1000+ instruments including forex, cryptos, indices and commodities via the industry-leading MT4 and MT5 platforms. This broker’s advantages include competitive spreads, flexible account options and mobile trading.

In this review, our team evaluate XS as an option for UK investors by diving into the broker’s key features from fee structure to platforms, regulation, safety and more.

Our Take

- As an offshore broker, XS provides trading opportunities with high leverage up to 1:500

- XS offers competitive accounts with raw spreads, zero commissions and no minimum deposit

- XS is not regulated in the UK, meaning traders will not have access to the safeguards available from FCA-authorised brokers

- This firm is not the transparent about its security measures and other information, which reduces its trust score and may put some traders off

Market Access

XS.com offers trading across a good range of forex, indices and commodities as well as 1000+ stocks from exchanges in the UK, US, Germany, France, Hong Kong and more, and we are confident most traders will find enough to satisfy them here.

This is a good range of markets that stands up well against the competition, even if it is not quite as diverse as some leading brokers like FxPro.

Crypto assets are also offered, though this is perhaps the weakest part of XS’s offering with just five tokens available. All assets are traded via CFDs.

- Energies – including oil and natural gas

- Metals – such as silver, gold, copper and platinum

- Forex – trade 55+ currency pairs 24/5, including majors and minors

- Commodities – trade popular commodities including cocoa, oil, coffee and sugar

- Crypto – trade 5+ of some of the biggest names in crypto including Bitcoin and Ethereum

- Indices – trade some of the most popular global indices such as NASDAQ, Dow Jones and FTSE

- Shares – trade shares on some of the world’s biggest companies including Apple, Amazon and Alibaba

Accounts

XS offers four account types, and we were impressed to find a fair pricing structure on all accounts, as well as no minimum deposit requirement in most. This means that newer or casual traders, who tend to favour zero-commission and micro-lot trading, will not be at a major disadvantage in the Standard account, since the spreads from 0.9 pips are still competitive.

With that said, we were unable to determine why the Classic and Plus accounts are necessary since they offer the same features as the Raw and Standard accounts, but with less competitive spreads.

- Standard – offers commission-free trading with spreads starting from 0.9 pips. There is no initial deposit requirement. One-click trading is supported, as are stop-out levels and micro lot trading. The Standard account is best suited to beginner and casual traders who make medium- or long-term trades.

- Raw – commission per lot is set at $3 ($6 per lot round turn) while spreads start from 0 pips. The initial deposit is $5,000 and all trading styles are supported. The RAW account is best suited to experienced traders who need tight, stable spreads for short-term and automated strategies.

- Classic – Commission-free trading with spreads from 1.4 pips and no initial deposit requirement. Micro-lot trading is also supported, as well as all trading styles and asset classes.

- Plus – Commission-free trading with spreads from 1.9 pips and no initial deposit requirement. Micro-lot trading is also supported, as well as all trading styles and asset classes.

How To Open A Trading Account

We found it quick and straightforward to open an XS trading account:

- Head to the broker’s website and select Register

- Complete the registration form

- Provide proof of ID and proof of address

- Wait up to one working day for the registration request to be processed

Clients can have up to five live trading accounts per platform. To open an additional account, visit the member’s portal.

Trading Fees

Fees vary between the two account types, but in general, we found them to be reasonable. Standard account holders can trade commission-free on spreads starting from 0.9 pips.

We were offered spreads on popular forex pairs GBP/USD and EUR/USD from 1.2 pips and 1.1 pips respectively, and we found this to be competitive for a more basic account type.

The Raw account, meanwhile, offers tight spreads from zero, as well as a competitive commission of $6 per round turn, rivalling top brands like IC Markets.

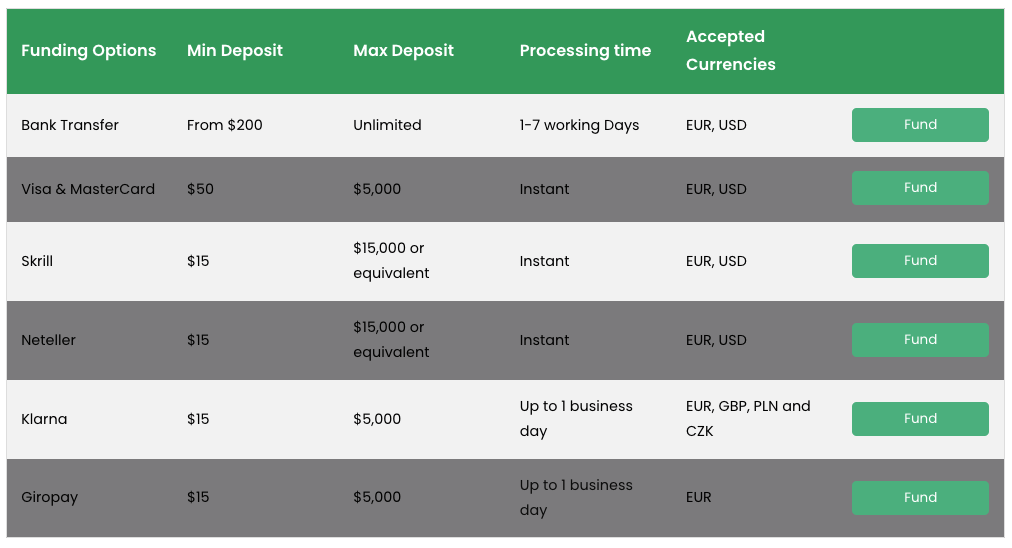

Funding Methods

We were impressed by the range of funding methods on offer from XS and are especially happy to see that the broker does not charge any deposit or withdrawal fees.

The payment methods available are some of the best we have seen with low barriers to entry and fast processing times. It is also great to see low deposits on all methods as this makes XS accessible for more traders.

It would have been good to see additional e-wallet or crypto payment options, but overall, this is a good, flexible range of payment methods that will satisfy most traders.

Deposits

Clients can choose between:

- Bank wire transfer – £200 minimum deposit; deposits take 1–7 working days to process; USD and EUR accepted

- Credit/debit card – £50 minimum deposit; deposits processed instantly; EUR and USD accepted

- eWallets – including Skrill and Neteller; have a minimum deposit of $15 and offer instant processing

- Klarna – £15 minimum deposit; deposits processed within one business day; GBP, EUR, PLN, CZK and USD are accepted

A bank wire transfer is the best option for larger deposits as there is no maximum. All other methods have a maximum of $5,000 or equivalent except transfers made via Skrill which has a maximum of $15,000 or equivalent.

Withdrawals

Options for withdrawing funds are flexible and minimums are generally relatively low which is good to see, though we do think the bank wire transfer limit could be lower. We would also like to see some of the caps raised, but what is on offer is in line with competitors.

- Bank Wire Transfer – processing time is one working day; $200 minimum withdrawal; GBP, EUR and USD accepted

- Credit/debit card – instant processing; $50 minimum withdrawal, $5,000 maximum; GBP, EUR and USD accepted

- eWallets – including Skrill and Neteller processing time is one working day; $50 minimum withdrawal, $2,500 maximum; GBP, EUR and USD accepted

XS Leverage

As an offshore broker, XS can offer UK traders higher leverage than those regulated by the FCA or European regulators. Many traders see this as an advantage and choose offshore brokers for this reason, though we always urge traders to act with caution when trading on margin. Generally, the 1:30 maximum allowed by UK and EU regulators is more than enough.

XS offers up to 1:500 leverage on major currency pairs, up to 1:200 on some minors and gold, 1:100 on major indices, silver and energies, 1:50 on minor indices and the remaining commodities, and 1:20 on crypto assets.

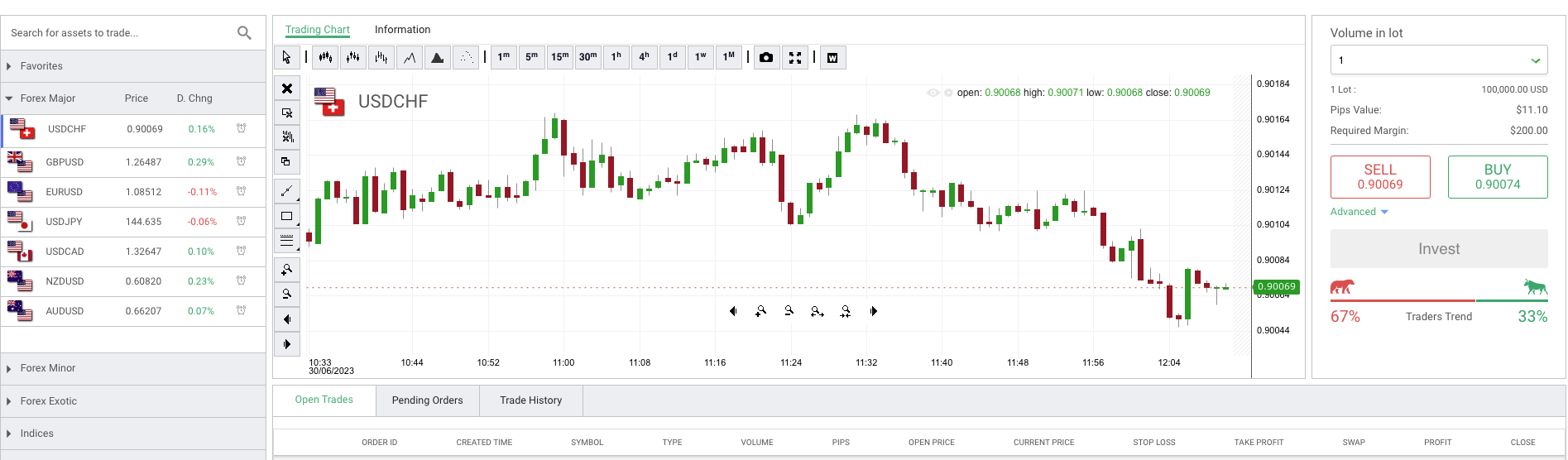

Trading Platforms

Our experts were pleased to see that both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available, as well as a WebTrader.

The MetaTrader platforms are among the best in the industry, and we are sure most traders will find them powerful and intuitive, regardless of their experience level.

The MT4 and MT5 platforms can be downloaded from the broker’s website and are compatible with most browsers and devices including iOS, Windows and Android.

MT4 and MT5 are popular for a reason. Both platforms are easy to navigate, accessible and intuitive. They also offer advanced charting, options for customisation and tools for analysis.

MT4

Highlights of MetaTrader 4 include:

- 3 chart types with 9 timeframes

- 50+ technical indicators

- Backtesting capabilities

- Real-time price quotes

- Expert Advisors (EAs)

- One-click trading

- MQL4-based

MT5

Highlights of MetaTrader 5 include:

- 3 chart types and 21 timeframes

- Backtesting capabilities

- 90 technical indicators

- Real-time price quotes

- Expert Advisors (EAs)

- 6 pending order types

- Economic calendar

- One-click trading

- VPS capabilities

- MQL5-based

Both platforms are available with the XS demo account.

WebTrader

A third option is the WebTrader, a sleek platform offering a great range of charting styles, features for analysis and indicators. These are available to view across nine timeframes.

We think this is a good offering that will appeal especially to newer traders as it makes it easier to start trading than the MetaTrader apps.

Both hedging and scalping are permitted on the WebTrader.

However, we were disappointed to see that copy trading was not supported. Due to the growth in demand for copy trading in recent years, this feels like an oversight and we hope to see this made available in the future.

XS WebTrader

How To Place A Trade

We found it straightforward to place a trade with XS. Simply:

- Select an instrument to trade. You can find the options in the dropdown on the side or in the favourites list

- Enter the trade volume in the New Order window located on the right-hand side

- Select Buy or Sell

- To add a stop loss or take profit level, click the Advanced icon

- Finally, select Invest to open the position

Mobile App

We were glad to find that XS offers clients the option to trade on the go through their proprietary mobile app, available on iOS or Android devices.

Since most of us have busy lifestyles and may need to respond to market events while away from our desktop systems, we see mobile apps as a requirement from a good broker.

XS’s app is well-reviewed and supports almost all trading functionality of the desktop version. It is easy to navigate and offers great flexibility. Features include one-click trading, custom alerts and watchlists.

Demo Account

XS offers a free demo account for all prospective clients, and we think this often-overlooked feature is another real bonus. It grants access to all platforms, a rare opportunity to get to grips with the platforms and broker before investing.

The demo account supports good functionality and offers an accurate simulation of real-market environments. We often recommend making use of a demo account no matter your skill or experience level.

How To Open A Demo Account

To access the demo account, you will first need to register with XS. To do so, head to the broker’s website and click Register. Once your account has been verified, you can open a demo account and start trading.

Regulation

UK investors should note XS is not regulated in the UK. For this reason, we recommend that anyone choosing to trade with XS researches the broker and alternatives carefully to inform themselves of all the risks.

When trading with an unregulated broker, the protection afforded to clients is minimal. You should be aware that your funds may not be insured if something goes wrong, and the financial ombudsman won’t be able to step in if you have a dispute with this broker.

XS is, however, regulated in other markets, and the oversight from ASIC and CySEC gives the broker a degree of credibility that isn’t always present in offshore brokers. It operates three subsidiaries:

- XS Ltd is authorized and regulated by the Financial Services Authority of Seychelles (FSA) with license number: SD089.

- XS Prime Ltd is authorized and regulated by the Australian Securities and Investments Commission (ASIC) with License Number: 374409.

- XS Markets Ltd is authorized and regulated by Cyprus Securities and Exchange Commission (CySEC) with License Number: 412/22.

Bonus Deals

XS does not offer promotions or welcome bonus offers. This is per standard regulatory requirements which stipulate that promotional offers and similar incentives may mislead customers. We do not expect this to change in the future.

Extra Tools & Features

Unfortunately, XS does not offer any additional tools, features or resources, and we found this disappointing to see at a time when so many brokers, such as IG Index and XM, offer great additional features. It is a real shortfall, especially for those new to trading who would benefit from educational resources.

We would hope to see this change as we know how useful it is for investors to be able to access information to grow and build on their knowledge and understanding.

Customer Service

XS.com advertises that it provides round-the-clock customer support, so our experts were disappointed to find no agents available over the weekend.

Help can be accessed through several channels including:

- Email: support@xs.com

- Phone: visit the Contact Us tab on the broker’s website and select ‘Request a Callback’

- Live Chat: available 24/7, select the chat icon in the bottom right corner

XS.com is also active on social media platforms including Facebook, Instagram, Twitter and LinkedIn.

Company History & Overview

XS is a trademark of the XS Group, a multinational corporation offering fintech services.

XS is regulated in multiple jurisdictions including Australia, Europe and the Seychelles. UK traders should note that it is not regulated in the United Kingdom by the Financial Conduct Authority.

When we tested XS.com, our experts found that the company shares very little in terms of its background, team or company ethos. It is unusual to see so little information shared and we feel this may be a cause for concern.

Security

We were disappointed to see that the broker does not publish any information regarding the security measures in place to protect client funds or data. Given the regulation in other markets, it is fair to assume that there are standard measures in place but for UK investors, this is insufficient.

Given the size of the broker, we would expect to see greater transparency. It is cause for concern that so little is volunteered.

Despite the lack of transparency, the primary security risk for British investors is the lack of regulation in the UK market. We always recommend trading with a regulated broker as clients are better protected should anything go wrong. Unregulated brokers carry significant risks.

Trading Hours

Trading hours will vary between assets. Any changes to standard trading hours will be reflected in the trading platform. To view a detailed breakdown, head to the trading portal and:

- Select an instrument from the list of symbols from the menu on the left

- From the menu above the chart, select the Information tab

- Scroll down to Trading Hours

Should You Trade With XS?

Our team liked many things about XS, including the MT4 and MT5 offerings, as well as the proprietary mobile trading app. The fee structure and account options were flexible and competitive, and the asset list is extensive enough to satisfy most traders. If you are willing to take the risk of trading with an offshore brokerage to access higher leverage, then XS is worth considering.

However, for UK investors, the lack of regulation is a serious concern. Although the broker is regulated in other jurisdictions by leading financial bodies, this will not protect UK investors. We also found the lack of transparency regarding general processes, company history and security to be worrying. For this reason, we think anyone considering XS should proceed with caution.

FAQ

Is XS Good For UK Traders?

We found XS is not be the best for UK traders compared to alternatives. The lack of FCA regulation is a key drawback, and with only one payment method supporting GBP deposits, traders may feel restricted. With that said, more experienced UK clients may appreciate the higher leverage limits and access to crypto trading.

Is XS A Legitimate Broker?

XS is well-regarded and we did not uncover any signs that its operations are not legitimate. However, to boost our trust score, we would like to see greater transparency from the broker regarding security, company history and ongoing operations. FCA oversight would also improve its rating.

Does XS Offer A Good Demo Account?

Yes, all prospective clients will have an opportunity to try before they buy with the XS demo account, which we found satisfactory. The demo account offers both MT4 and MT5 platforms as well as a good range of features.

Is XS Secure?

The firm’s security status is mixed. Despite being regulated by several leading authorities including the CySEC and ASIC, the broker is not yet by the FCA in the United Kingdom. This is something we hope the broker addresses in the future as we always recommend trading with a regulated broker where possible.

Which XS Account Is Best?

XS offers four account options, though we feel the only ones worth considering were the Standard account and the RAW account. The Standard account offers commission-free trading with spreads starting from 0.6 pips, and no initial deposit requirement, which is ideal for beginners. The Raw account, on the other hand, would work well for experienced traders or scalpers, with spreads from 0 pips and low commissions from $6 per round turn.

Article Sources

Top 3 XS Alternatives

These brokers are the most similar to XS:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

XS Feature Comparison

| XS | Swissquote | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 2.9 | 4 | 4.8 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Energies, Crypto, Futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $200 | $1,000 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, ASIC, FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | XS Review |

Swissquote Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| XS | Swissquote | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | Yes |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

XS vs Other Brokers

Compare XS with any other broker by selecting the other broker below.

Popular XS comparisons: