XBTFX Review 2025

|

|

XBTFX is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to XBTFX |

| XBTFX Facts & Figures |

|---|

XBTFX is a fintech broker offering trading opportunities on 200+ instruments via the powerful MT4, MT5 or cTrader terminals. The low minimum deposit, copy trading services and competitive trading fees makes it an appealing brand for traders of all strategy types. The broker has a decent client base of 10,000. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | I found a fairly decent range of 200+ CFDs across 5 asset classes on the MT4, MT5 or cTrader terminals. I particularly like the copy trading solutions, STP execution and the fact that you can get started with just $10. |

| Leverage | 1:500 |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | XBTFX offers a large list of 70+ major, minor and exotic currency pairs such as EUR/USD or GBP/JPY. I find spreads very competitive starting from 0.01 pips and leverage up to 1:500 for experienced investors. |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 79 |

| Stocks | My tests uncovered a small but diverse selection of 200+ stocks listed on US, European and Asian exchanges with leverage up to 1:5. Commissions are also industry-standard, at $0.10 per US share. |

| Cryptocurrency | There's an excellent range of 70+ cryptocurrency vs USD pairs such as BTC/USD, ETH/USD and XRP/USD with leverage up to 1:25. My tests also found competitive commission fees of 0.075%. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

XBTFX is an online CFD broker offering a range of assets, three powerful trading platforms, and low minimum deposits. In this review, we find out if UK traders should trade with XBTFX, uncovering the available markets, trading tools, typical fees, UK regulations and more.

Our Take

- XBTFX could be worth exploring for those looking to deposit, withdraw and trade in cryptos

- Beginners can take advantage of MAM accounts and copy trading

- The lack of FCA regulatory oversight and educational resources is concerning

- UK traders may feel limited by the non-GBP trading accounts

Market Access

XBTFX offers over 300 instruments across 5 asset classes. Our experts found the range decent, covering the bases for most investors looking to diversify their portfolios.

On the negative side, it doesn’t match the extensive breadth of assets at top firms like IG Index and CMC Markets.

- Forex: Over 70 forex pairs can be traded, including GBP/USD, EUR/CAD and CHF/JPY

- Crypto: 90+ crypto coins available, including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP)

- Commodities & Metals: Clients can access over 15 commodities, including Brent crude oil, natural gas, plus spot gold and silver contracts

- Indices: 12 indices are on offer, including the FTSE 100, Nasdaq 100, S&P 500 and DAX 30

- Shares: Over 200 shares from USA, European and Asian markets are available, including Amazon, Netflix and Lenovo

XBTFX Fees

XBTFX offers three different fee structures depending on the chosen account type.

For example, while the ECN account has higher commission fees, lower expected spreads offset this. When we used XBTFX, we were offered spreads starting from 0.01 pips for EUR/USD, while the Standard account offers a 1 pip spread for the same pair. I found these competitive when compared to top brands like IC Markets, for example.

Commissions are also competitive. For instance, the ECN account charges a typical $7 (£5.50) per round trade.

Standard Account

- Forex, Commodities & Indices: Zero commission

- Shares: GBP 0.08/USD 0.10 (US), 0.45% (EU/Asia)

- Cryptocurrency: Zero commission

ECN Account

- Forex, Commodities, Indices: GBP 2.80/USD 3.50 per lot side

- Shares: GBP 0.08/USD 0.10 (US), 0.45% (EU/Asia)

- Cryptocurrency: 0.075% per lot side

Islamic Account

- Forex, Commodities & Indices: Zero commission

- Shares: GBP 0.08/USD 0.10 (US), 0.45% (EU/Asia)

- Cryptocurrency: 0.15% per lot side

Other Fees

I was pleased to see that all account types have zero deposit fees. Withdrawal fees are also zero for non-ETH or ERC20 tokens.

The foreign exchange fee charged by XBTFX is typically between 2-4% depending on the market conditions.

We also found overnight swap fees in the Standard and ECN accounts depending on the asset and market conditions. However, Islamic accounts are swap-free.

Account Types

XBTFX offers three main account types: Standard, ECN and Islamic. Professional traders can also request a corporate account.

All account types require a $10 (£8) minimum deposit, which is excellent and accessible for beginners. Leverage is available up to 1:500 and micro lot trading is also permitted, catering to all investment styles. Algo traders will also be pleased to see that Expert Advisors (EAs) are supported.

Traders should note that while all assets can be traded via micro-lots on the ECN and Islamic accounts, the Standard account only permits micro-lot trading with the 76 available currency pairs.

PAMM and MAM accounts are also on offer for traders looking for a hands-off approach to online investing. These accounts essentially designate a fund manager to several accounts.

Funding Methods

XBTFX only accepts deposits and withdrawals in cryptocurrency, which may be a significant drawback for some traders requiring accessible and flexible funding methods. We hope to see GBP, USD or EUR transfers offered via bank cards or e-wallets in the future.

The good news is that crypto transfers are generally very fast, typically processed within minutes or up to 24 hours, depending on the blockchain confirmation time.

We appreciated the wide range of crypto funding methods:

- Dai

- Tron

- USDP

- Tether

- Ripple

- Bitcoin

- Litecoin

- Cardano

- Dogecoin

- Ethereum

- USD Coin

- Bitcoin Cash

- Binance Coin

- Stellar Lumen

Trading Platforms

While using XBTFX, I was impressed to find three of the world’s leading trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader.

Investors will be spoilt for choice, with a range of excellent tools available on each platform. The platforms are also highly versatile, accessible via web browsers, mobile apps and desktop programs.

Note that while the MT5 and cTrader platforms support all account types, the MT4 platform only supports ECN USD accounts. All crypto deposits are transferred into a USD wallet for trading on this platform.

MT5 supports USD, BTC, ETH, USDT, DAI and XRP, whilst cTrader supports USD, BTC, ETH, USDT, and CRP.

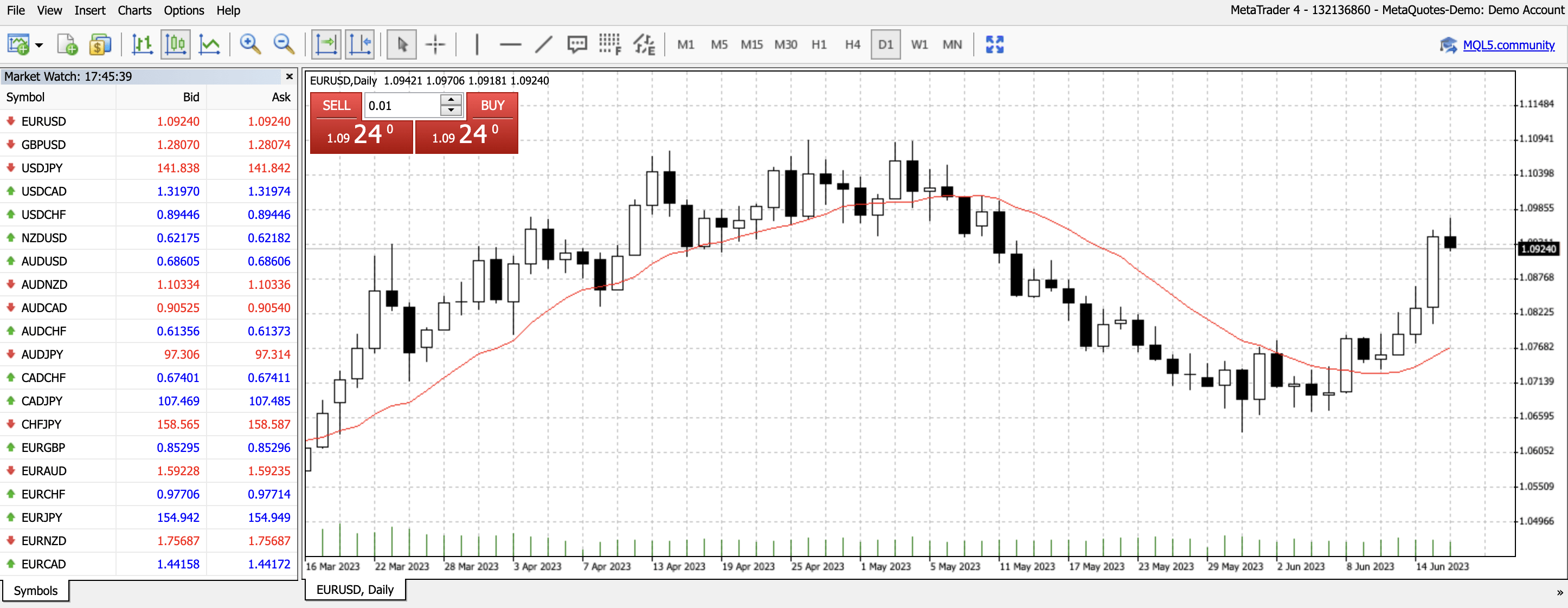

MetaTrader 4

The MT4 platform is a flexible, feature-rich platform with high customizability and a host of built-in tools. I found the platform is sophisticated enough for experienced traders to implement complex strategies while still being user-friendly for newer traders.

With that said, we are disappointed that only one XBTFX account type is available for this platform.

Features include:

- 30 technical indicators and 31 graphical objects

- Automated trading through Expert Advisors

- MQL4 programming language

- 4 pending order types

- 9 timeframes

MetaTrader 4

MetaTrader 5

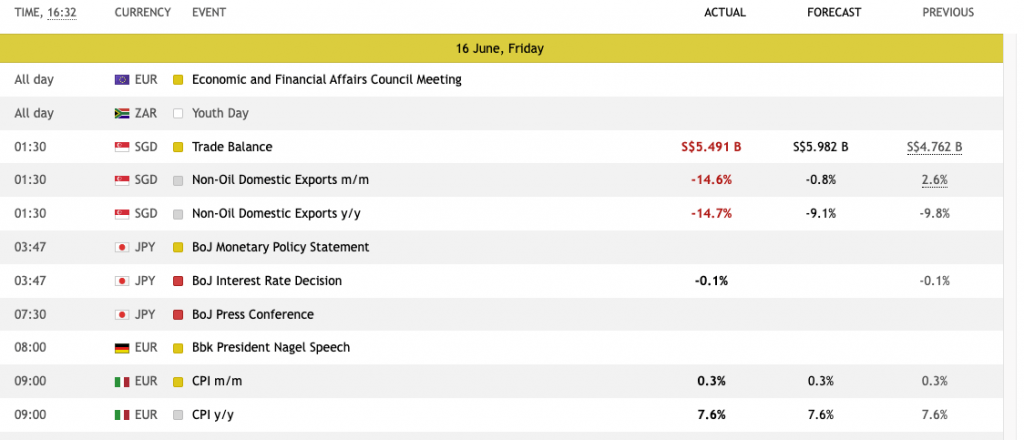

The MT5 platform is an updated take on the MetaTrader 4 program, providing a greater number of tools and features out of the box than MT4. The platform also has a huge online community, providing guides, plug-ins and Expert Advisors to install into the platform.

I like that the platform still adopts a similar layout to MetaTrader 4 and is highly adaptable, supporting all account types and base currencies.

Furthermore, I was happy to see that copy trading is available on MT5, which is an excellent addition for beginners at XBTFX.

Features include:

- 38 technical indicators and 44 graphical objects

- Automated trading through Expert Advisors

- MQL5 programming language

- Integrated economic calendar

- 6 pending order types

- Strategy tester

- 21 timeframes

MT5 Economic Calendar

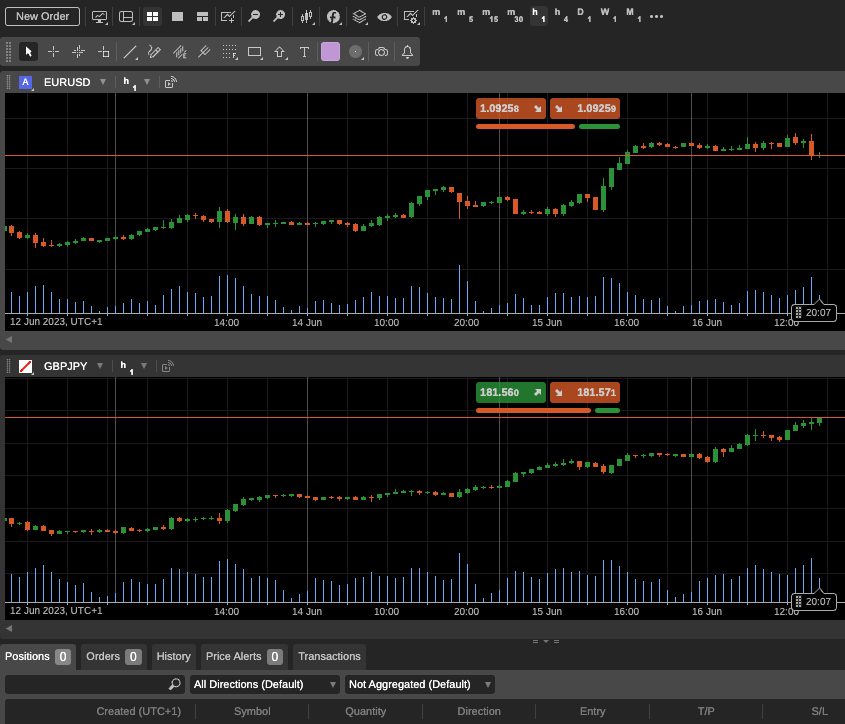

cTrader

cTrader is an advanced, yet user-friendly trading platform boasting a sleek design which I find a little more modern and attractive than the MetaTrader terminals.

The platform is also a strong contender in terms of its highly intuitive interface, its robust programming language and the vast suite of technical tools available.

With that said, the range of plug-ins, guides and additional tools is much smaller than that of the MetaTrader platforms.

Features include:

- Over 70 technical indicators

- C# programming language

- Copy trading available

- Automated bots

- 54 timeframes

- 9 chart types

cTrader

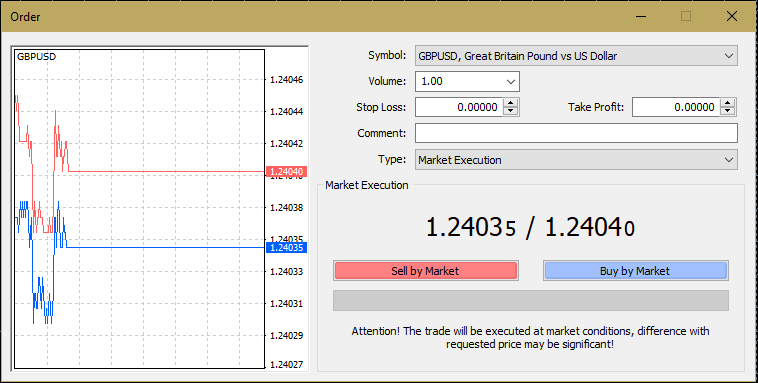

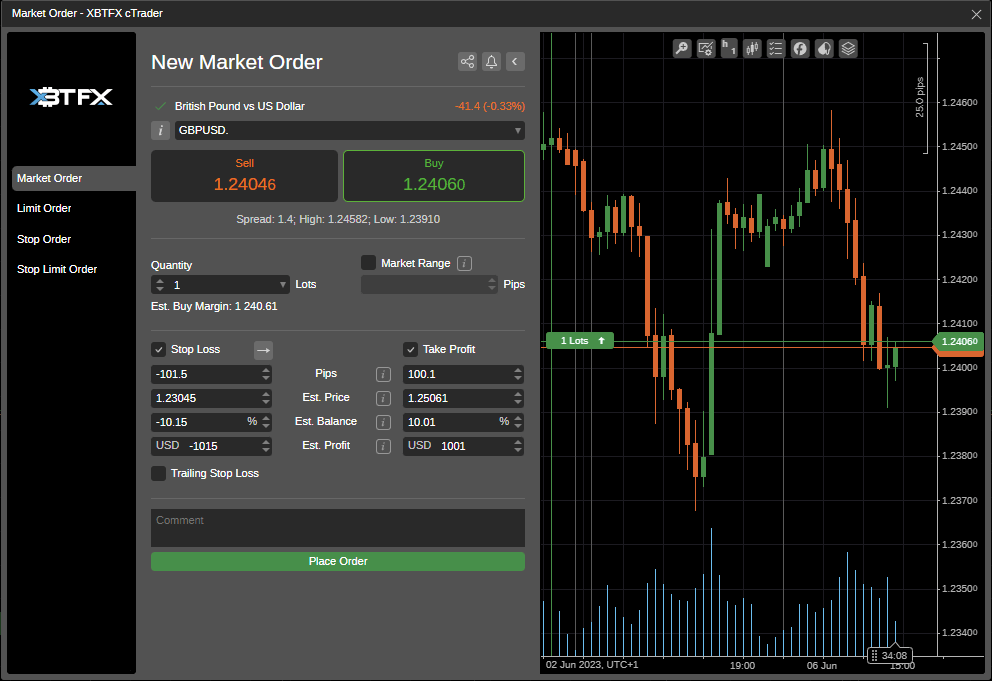

How To Place A Trade

You shouldn’t have any issues making a trade at XBTFX:

- Log into the XBTFX client portal and choose which platform you would like to trade on

- Open a trading account (live or demo) on your chosen platform

- Download the platform from the client portal (or app store), install and log in

- Choose which asset you would like to trade

- When you are ready to trade, click the “New Order” button at the top

- Fill in the details of your order (symbol, volume, stop loss, take profit, execution type)

- Choose to “Buy” or “Sell” to complete the order

MetaTrader 4 New Order

cTrader New Order

Mobile App

All three trading platforms offered are also available as mobile apps for Android and Apple iOS devices at XBTFX. Investors can track and monitor assets, perform technical analysis, and place orders from anywhere.

All the apps offer many of the key features present within their desktop counterparts, except certain indicators or tools. For example, custom indicators and robots are only available in the cTrader desktop application.

Nonetheless, the MT4, MT5 and cTrader mobile interfaces are all very well optimised, with efficient chart functions such as ‘zoom and scroll’ and one-tap trading. I also liked that you can set mobile push alerts to keep updated with global events whilst on the go.

Leverage

XBTFX offers leveraged trading on all its tradable assets. Leverage allows you to increase your buying power while investing a smaller amount. This is a great way to maximise your profits but also invites huge losses. As such, appropriate risk management parameters are advised.

Maximum leverage limits are as follows:

- Shares: 1:5

- Forex: 1:500

- Indices: 1:50

- Metals: 1:100

- Commodities: 1:20

- Crypto Majors: 1:25

- Crypto Extended: 1:5

The stop-out for all assets is at a 50% margin level.

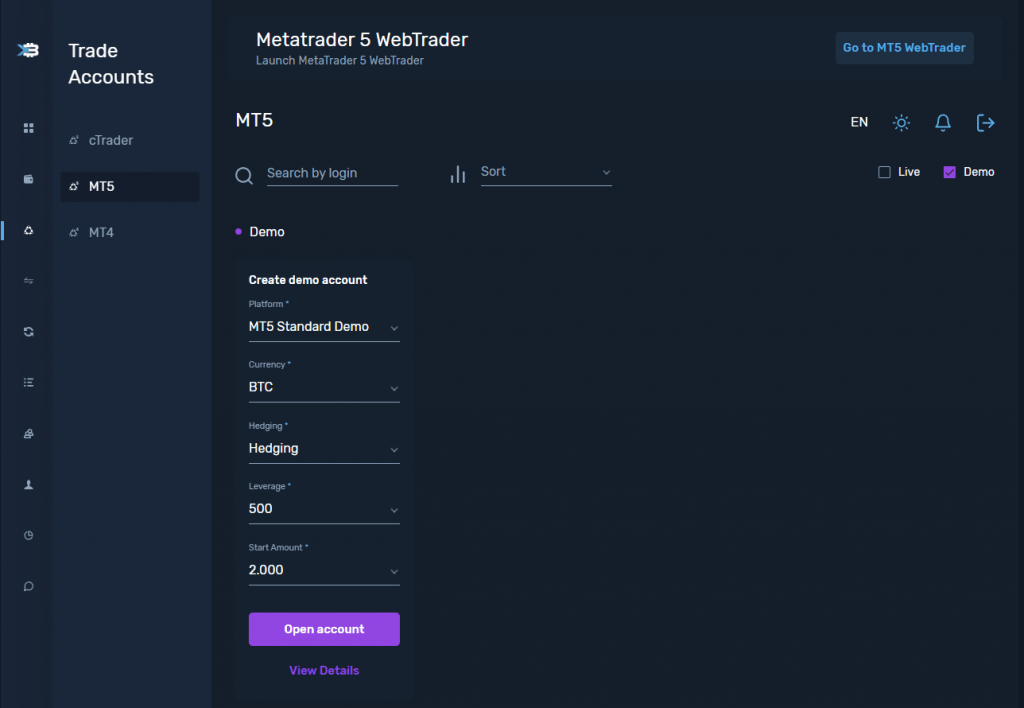

Demo Account

XBTFX offers demo accounts on all its trading platforms straight from the client portal. Demo accounts are great tools for testing out trading strategies on the available platforms.

How To Open A Demo Account

It only took me a couple of minutes to sign up for a paper trading account:

- Follow the broker’s standard registration process from the website

- Log into the XBTFX client portal

- Go to the “Trade Accounts” tab

- Choose which platform you would like to trade

- Scroll to the Demo form

- Enter the details of your demo account in the “Create Demo Account” window

- Click “Open Account”

- You will then be shown and sent your demo account login details

- Go to the trading platform and log in

XBTFX Regulation

XBTFX LLC is an incorporated firm licensed in Antigua and Barbuda. With that said, the firm is unregulated and client funds are therefore relatively unprotected. With no regulatory body overseeing the financial management of the firm, traders should consider the risks before signing up.

The firm does claim to have safety procedures in place for the protection of clients’ funds. These include storing funds in cold storage, an anti-money laundering policy, a ‘know your customer’ (KYC) policy, IP address checks, and an automated watchlist.

For those who want peace of mind, there are plenty of alternative brokers which are regulated by reputable bodies such as the UK’s Financial Conduct Authority (FCA).

Bonuses Deals

While XBTFX does not offer any no-deposit bonuses or competitions, the broker does have a referral scheme where traders can earn up to 30% of the revenue of their referrals.

- 1 – 5 traders referred nets a 10% payout

- 6 – 9 traders referred nets a 20% payout

- 10+ traders referred nets a 30% payout

Since there are no regulatory restrictions imposed on XBTFX, we strongly recommend reading the terms and conditions before signing up.

Extra Tools & Features

XBTFX’s educational resources in the ‘Learn’ section cover a few topics including the basics of technical analysis, the impact of psychology, understanding harmonics trading and an introduction to MQL5.

With that said, the section is quite disappointing. There are some outdated news articles, opinion pieces and basic tutorials with YouTube videos, though the selection is small when compared to the likes of Forex.com, for example.

I was also disappointed to see that some popular tools, such as forex calculators, are not provided.

Customer Service

XBTFX offers several contact methods, including email, telephone and live chat. However, when I tested the live chat feature, I received a response over 1 hour later. This is rather poor and puts the broker at a disadvantage compared to leading brands.

We did find a 24/7 help desk service in the client portal, though replies can take up to 24 hours.

- Support email: support@xbtfx.io

- Telephone contact number: +44 203 807 9081 (2:00 pm – 10:00 pm GMT)

- Registered address: Hodges Bay, P.O. Box 1348, St. John’s, Antigua

- Physical address: Ezharh Yosif 9, Burgas, 8000, Bulgaria

You can also follow the broker on Facebook, Twitter and Reddit.

Company History & Overview

Founded in 2019, XBTFX LLC is a company incorporated in Antigua and Barbuda and is based in Bulgaria.

The firm currently has over 9,000 clients and generated a yearly volume of over $10 billion (£8 billion). The firm claims to have never lost a coin and provided an execution speed of under 10 milliseconds on average.

The broker aims to provide a dynamic and powerful trading experience and is intending to obtain a brokerage license in the future.

Security

While unregulated, XBTFX claims to use several security measures to protect traders.

Firstly, we were pleased to see that the majority of client funds are kept in cold storage. Furthermore, all withdrawals are reviewed by staff members rather than through AI.

We also noted that the firm is partnered with CloudFlare to protect the site from DDoS attacks. Furthermore, the client site is separate to limit cross-access, and the broker’s platforms are hosted in LD4 Equinix.

Full encryption is used to protect passwords and other user details, all being stored on secure servers.

Clients can also put other security tools into place, such as two-factor authentication (2FA), anti-phishing tools, a wallet address whitelist and device management features.

Trading Hours

Individual trading hours vary between asset classes. However, general trading hours at XBTFX are between 9:00 pm Sunday to 9:00 pm Friday (GMT).

There is a 10-minute system restart time at 9:00 pm every day, except for Sunday which has an 8:00 pm restart time (GMT).

Liquidity bridge servers also restart for up to 10 minutes at 9:06 pm every day except Sunday which restarts at 8:00 pm (GMT).

MT4 and 5 also have a restart for up to 1 minute at midnight, every night.

Should You Trade With XBTFX?

XBTFX.io offers a decent range of assets, several account types and access to some of the most popular trading platforms. The broker also offers competitive fees, as well as PAMM, MAM and copy trading suitable for novice investors.

However, in this review we were disappointed by the lack of funding methods, all being crypto payments with no fiat transfers available. The lack of UK regulation is also a key drawback.

FAQ

Can UK Traders Invest With XBTFX?

UK investors can sign up and trade with XBTFX, however, there are no GBP deposit or withdrawal options, with all transfers supported in cryptocurrency only. In addition, USD is the only fiat base currency available, so UK traders will need to consider currency conversion fees.

Is XBTFX A Trustworthy Broker?

XBTFX is an offshore, unregulated brokerage that does not offer the same protections as FCA-regulated brokers. However, the company does take fund security seriously, with measures including cold storage and CloudFlare server protection. There have also been no recent scam reports, though traders are advised to do their own due diligence before signing up.

Does XBTFX Offer Low Trading Fees?

Yes, we found the fees at XBTFX competitive. The broker offers a raw spread ECN account for those looking for 0 pip spreads and low commissions from $3.50 per side. Alternatively, the Standard account offers zero commissions with spreads from 1 pip, comparable with top brands like Pepperstone.

Is XBTFX Good For Beginners?

XBTFX is a solid choice for beginners. The broker offers accessible minimum deposits of $10 and free demo accounts on any of the three available trading platforms. However, all deposits must be made in cryptocurrencies, so the true minimum deposit amount can vary slightly depending on market conditions.

Which XBTFX Trading Platform Is Best?

The broker’s MT4, MT5 and cTrader platforms are powerful and feature-rich, allowing traders to implement complex strategies, from scalping to auto trading. The MT4 platform is best for those looking to trade with the USD base currency ECN account. MT5 is a multi-asset terminal aimed at more experienced investors, whilst cTrader is a top choice for coders and algo traders.

Article Sources

Top 3 XBTFX Alternatives

These brokers are the most similar to XBTFX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

XBTFX Feature Comparison

| XBTFX | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 2 | 4.8 | 4 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $10 | $0 | $1,000 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | XBTFX Review |

Pepperstone Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| XBTFX | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

XBTFX vs Other Brokers

Compare XBTFX with any other broker by selecting the other broker below.

Popular XBTFX comparisons: