Windsor Brokers Review 2025

|

|

Windsor Brokers is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Windsor Brokers |

| Windsor Brokers Facts & Figures |

|---|

Windsor Brokers is a multi-regulated broker offering CFD trading on diverse instruments via the MetaTrader 4 platform. This CySEC-regulated firm offers tight spreads from 0.2 and $8 round-turn commissions on its Zero account as well as a commission-free account with spreads from 1 pip. The broker provides very high leverage up to 1:1000 while also providing a reliable service with client funds insured up to 5 million euros. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, shares, commodities, treasuries |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC (Cyprus), IFSC (Belize), JSC (Jordan) |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, indices, commodities, bonds and cryptos with a maximum 1:1000 leverage available from the offshore branches and 1:30 from the CySEC-regulated entity. The broker's dealing desk assures fast execution, but traders should note the broker does not offer any ECN or STP trading. |

| Leverage | 1:30 (EU), 1:500 (Global) |

| FTSE Spread | N/A |

| GBPUSD Spread | 0.5 |

| Oil Spread | 0.03 |

| Stocks Spread | Variable |

| Forex | Trade 45+ forex pairs with lightning-fast execution and spreads from zero on majors. We were offered a tighter-than-average 0.5 spread on the GBP/USD pair and rated the powerful MetaTrader 4 platform. |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.5 |

| Assets | 44 |

| Stocks | With 104 global stocks including Apple, eBay and Ferrari, Windsor Brokers only has a small stock offering, but on the upside traders can also speculate on broad market movements with 14 index CFDs covering diverse regions. |

Windsor Brokers is an online brokerage that provides access to multiple markets, including shares, indices, commodities, and cryptos. This Windsor Brokers review will unpack the key information you need to know before opening an account, including average spreads, minimum deposits, withdrawals, and UK regulations.

Windsor Brokers offers a popular trading platform, alongside two account types and low fees. However, withdrawal charges and no FCA license means the brand is not the best pick for UK traders. See our ranking of the best alternatives.

Markets

Windsor Brokers has a broad range of supported instruments, extending from the FTSE 100 to oil. Its platform focuses on CFD trading, allowing investors to speculate on asset value – with leverage – without owning the underlying asset.

Available assets:

- Seven energy CFDs, including Brent Crude Oil and Natural Gas

- 19 CFD indices, including the S&P 500 and the Nasdaq 100

- Five crypto CFDs, including BTC/USD and ETH/USD

- 104 share CFDs, including Apple, Netflix and Alibaba

- Six commodity CFDs, including Wheat

- Nine metal CFDs, including XAU/USD

- Four treasury CFDs

- 45+ forex pairs

- Six ETF CFDs

Fees

As is the case with many online brokers, there are two main account types at Windsor Brokers: one with higher spreads and zero commission and one with low spreads and round turn commission of £8.

We recommend that high-volume traders opt for low spreads with commission charges as this can provide more certainty to their planning. Spread-based account fees are often more volatile and, if trading large amounts, this can affect the profitability of positions.

Unless traders are prepared to put down a £1,000 minimum deposit, they will have to choose the Prime account, which has variable spreads from 1.0 pips on majors. In practice, traders should expect spreads of around 1.5 pips on EUR/USD and 1.9 pips on GBP/USD. These are relatively high compared to other brokers.

Spreads on the ZERO account are more competitive. The typical spread for EUR/USD is 0.2 pips but traders may be able to find values from 0.0 pips during times of high liquidity.

Swap fees apply to those holding positions overnight. These vary according to interest rates and are used to account for leveraged positions.

Account Types

There are two main MT4 account types at Windsor Brokers: Prime Trading Account and ZERO Trading Account.

There is also the VIP ZERO account designed for high-net-worth individuals, which includes a dedicated personal account manager, one-to-one sessions with a technical analyst and a lower round-turn commission. To be eligible for the upgrade, clients must be ZERO account holders.

Prime Trading Account

- Spreads from 1.0 pips on major forex pairs

- Islamic/swap-free solution available

- Negative balance protection

- 1:1000 maximum leverage

- Personal account manager

- £50 minimum deposit

- Suitable for beginners

- Training provided

- Zero commission

ZERO Trading Account

- Spreads from 0.0 pips on major forex pairs

- No Islamic/swap-free account

- Negative balance protection

- 1:1000 maximum leverage

- £8 round turn commission

- Personal account manager

- £1,000 minimum deposit

- No training provided

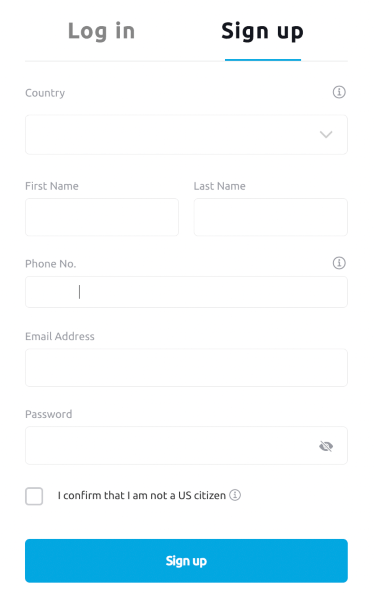

How To Register For An Account

- Click on Open Account at the top of the broker’s website

- Click Sign Up

- Enter the requested personal details and password

- Tick to confirm that you are not a US citizen

- Click Sign Up

- Complete the email verification request

Payment Methods

Deposits

Although the range of deposit methods is smaller than some other brokers, Windsor Brokers does offer some of the most popular methods, including Visa and Mastercard. UK investors should note that GBP is not one of the eligible currencies for a wire transfer.

Deposit options and their associated processing times and fees:

- Visa – same-day processing and no fees

- Mastercard – same-day processing and no fees

- WebMoney – same-day processing and a 0.8% fee

- Wire transfer – processing times and fees vary

Withdrawals

The withdrawal methods are the same as the deposit methods. However, when using Windsor Brokers, we were disappointed to see a £3 fee on Visa and Mastercard withdrawals, which was not incurred for deposits. The best brokers now offer free deposits and withdrawals to reduce non-trading costs for investors.

Withdrawals and their associated times and fees:

- Visa – same-day processing, £3/transaction

- Mastercard – same-day processing, £3/transaction

- WebMoney – same-day processing, 0.8% fee

- Wire transfer – GBP not accepted, processing times and fees vary

Note that credit card withdrawals must be withdrawn to the same credit card as the deposit if within six months. If outside the six months, the funds must be withdrawn to a bank account in the trader’s name.

How To Withdraw Funds From Windsor Brokers

- Log in to your customer portal

- Once in the user portal, select the relevant account under Live Accounts and click on Withdraw

- Select your preferred method and fill out the required information

Trading Platforms

Windsor Brokers only provides one trading platform: MetaTrader 4 (MT4). Although this does not give users much choice, MT4 is an industry-leading platform with a range of features to suit both novices and seasoned investors. These include:

- Nine timeframes

- 23 analytical objects

- 30 technical indicators

- Backtesting using historical data

- Algorithmic trading with expert advisors (EAs)

MT4 is available as a free download desktop platform on PC and Mac. There is also the WebTrader version, which can be accessed through a browser without having to download any software. A mobile app can be downloaded on iOS and Android. In addition, MT4 Multiterminal allows over 100 accounts to be managed at once from the same place.

We were disappointed not to see MetaTrader 5 (MT5) on offer, which many other brokers provide in addition to MT4.

How To Place A Trade

Market Watch Window

- Complete the MT4 login process

- Navigate to the Market Watch window

- Double-click on the relevant asset name to open the order window

- Enter the details of the order, including volume and, if necessary, a stop loss/take profit order

- Click Buy by Market or Sell by Market

One-Click Trading

- Complete the MT4 login process

- Click on Tools -> Options

- Click on the Trade tab

- Click on One Click Trading and press OK to activate

- Once activated, traders can then click on Buy or Sell directly from the chart and modify the volume as appropriate

A third way to open a position is to right-click on the chart and select Trading and then New Order to open the order window.

Windsor Brokers App

Windsor Brokers has its own mobile app on Apple (iOS) and Android (APK) devices. This application enables traders to see live prices, manage their accounts and make deposits and withdrawals.

However, to make trades on the go, investors should use the intuitive MT4 mobile and tablet app. It is one of the best trading apps around, with many of the same features as the desktop and web versions.

Leverage

Windsor Brokers Ltd, regulated by CySEC, offers leverage rates up to the standard 1:30 in line with EU limits. Traders can increase their leverage when investing through other entities up to 1:1000 on both the Prime and ZERO accounts.

The broker has dynamic leverage, meaning that the maximum leverage rate will generally decrease the more net open lots a client has.

Demo Account

Windsor Brokers, like most other brokers, provides a demo account that allows traders to test the markets and develop strategies using virtual money.

How To Open A Windsor Brokers Demo Account

- Click Try Demo at the top of the broker’s homepage

- Enter personal details and password

- Tick to confirm that you are not a US citizen

- Click Sign Up

- Under the Accounts section, click on the Demo tab

- Click New Demo Account

Is Windsor Brokers Regulated?

Windsor Brokers is not regulated by the FCA in the UK. This is a significant drawback vs competitors.

Several entities operate under the Windsor Brokers name and these each have different regulators and licenses:

- Windsor Brokers Ltd is regulated by CySEC

- Windsor Markets (Kenya) Limited is regulated by the Capital Markets Authority (CMA) in Kenya

- Windsor Brokers (BZ) Limited is regulated by the Financial Services Commission (FSC) in Belize

- Windsor Brokers International Ltd is regulated by the Financial Services Authority (FSA) in Seychelles

- Seldon Investments Ltd (Jordan) is regulated by the Jordan Securities Commission (JSC)

The CySEC is a regulatory body that is trusted by many traders and brokers across the industry. Other regulators, particularly those located offshore, may not provide the same level of protection for British investors or monitor the activities of online brokers as closely.

Windsor Brokers Bonuses

Promotions are not advertised on the European website of Windsor Brokers as the Cyprus Securities and Exchange Commission (CySEC) does not allow such offers. Other regulators take a more relaxed approach, which allows some of the other companies under the Windsor Brokers name to offer promotional content.

Promotions have included:

- Luxury electric car draw

- The Ultimate Forex Trading Challenge – withdrawable cash rewards for the top 10 traders monthly

- $30 free account/no deposit welcome bonus – trading credit available to new Prime account customers using either the USD, EUR, GBP or JPY base currencies

- Loyalty Programme – collect points based on trading volume and then redeem them for more investing power

Remember to check the broker’s terms and conditions if you decide to make use of these promotions. While using Windsor Brokers, we found fairly tough volume requirements have to be met before you can withdraw bonus credit.

Extra Tools & Features

We were impressed with the range of educational material available at Windsor Brokers. The only major feature missing is copy trading.

Much of the material is completely free (often only requiring registration) and includes:

- Webinars

- Video courses, including on forex trading

- Comprehensive financial glossary

- Ebooks

Although there are currently no upcoming webinars at Windsor Brokers, past ones can be viewed in the online library.

Both beginners and experienced traders can benefit from the market analysis section, which includes fundamental analysis-based articles covering topics such as the future direction of EUR/USD and oil price predictions. The published technical analysis trading ideas will also assist those seeking some inspiration for potentially profitable trades.

Other features include an economic calendar, market holidays calendar and various calculators, including a profit/loss calculator and margin calculator.

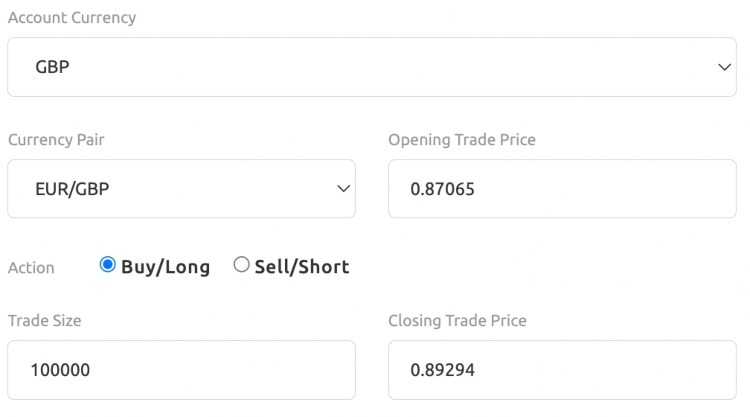

How To Calculate Net Profit/Loss

- Navigate to the menu on the right-hand side of the company’s homepage

- Click on Tools and then on Forex Calculators

- Check that the Profit Calculator is selected on the upper tab

- Enter the account currency, the currency pair, the opening/closing trade price, the trade size and whether it is a long or short position

- Click Calculate

Customer Service

The European-regulated side of Windsor Brokers has 24/5 multilingual customer support. Our experts found the following customer support options to be available:

- Live chat

- Email: support@windsorbrokers.eu

- Phone: +357 25 500 700

Although some brokers now offer 24/7 customer support, we were pleased to see that this company provides the three main contact options that we look for. In addition, the firm has social media accounts on Facebook, Twitter and Instagram.

We received fast responses when we used both email and live chat services. There is also an extensive FAQs section for more standard queries.

Company History & Overview

Windsor Brokers was founded back in 1988. It aims to facilitate retail investors’ access to the global financial markets.

It is a brokerage with a worldwide presence; it has offices in Belize, Jordan, Seychelles and Kenya, with multiple companies operating under its trading name. The CEO of Windsor Brokers Ltd is Johny Abuaitah.

The brand has also won several international awards, including Best Multi-Asset Broker at the Forex Expo Dubai 2022.

Security

Windsor Brokers provides insurance to all Windsor Brokers International Ltd clients. This is to protect client funds. The insurance is underwritten by Lloyds of London and the protection is up to EUR 5 million. There is no cost to the trader for this insurance.

Offshore entities can carry more risk as they may not be covered by official compensation funds for investors, like the Financial Services Compensation Scheme (FSCS) in the UK.

In terms of account and investing security, the broker has encryption and firewalls in place. The MetaTrader 4 platform also has its own security, with advanced encryption technology, one-time passwords and two-factor authentication (2FA).

Trading Hours

Trading hours vary according to the market being traded. Forex is generally Monday 00:05 to Friday 23:59 GMT with a daily break from 23:59 – 00:02 GMT. On the other hand, Apple stocks and many other US shares trade from 16:30 – 23:00 GMT.

The broker’s server’s time zone is GMT+3 in the summer and GMT+2 in the winter. Full details of opening hours for each market can be found on the Windsor Brokers website.

Should You Invest With Windsor Brokers?

Windsor Brokers has a good range of markets at competitive spreads with the ZERO account. Its educational and market analysis materials will also be welcome news to traders of all abilities. However, spreads on the Prime account are not as competitive, there are charges for payment card withdrawals and Windsor Brokers’ regulatory structure is quite complex, which may put traders off opening an account with the firm.

Ultimately, there are better alternatives for UK traders.

FAQ

Is Windsor Brokers Trustworthy?

Windsor Brokers has several international brokerage brands operating under the trading name. Windsor Brokers Ltd is regulated by CySEC, while its Kenya, Belize, Seychelles and Jordan-based firms are licensed and regulated by the local financial services authority.

However, British traders should note that the firm is not licensed by the FCA in the UK. This means traders will not get the same level of protection.

What Are The Average Forex Spreads With Windsor Brokers?

Windsor Brokers’ forex spreads vary with the account type. Prime account holders can access spreads from 1.0 pips on all major pairs, while ZERO account values can drop as low as 0.0 pips. On the downside, traders will need to deposit £1,000+ to access the low-spread account, which is expensive vs competitors.

Can I Invest In Crypto With Windsor Brokers?

Windsor Brokers offers cryptocurrency speculation via five CFD products that can be accessed directly from MetaTrader 4. These products include crypto-fiat pairs for the most popular DeFi tokens, including BTC/USD and ETH/USD.

Does Windsor Brokers Offer A Good Trading Platform?

Windsor Brokers offers the MetaTrader 4 platform and app. Clients can carry out technical analysis, open new trades and manage any open positions. MT4 is a well-regarded platform available at many of the top brokers.

Does Windsor Brokers Charge Commission?

Windsor Brokers charges commissions on positions from the ZERO Trading Account only. This can help high-volume traders plan for trading charges on large positions. The commission is £8 per round lot turn, which is fairly high vs some alternatives.

Article Sources

Top 3 Windsor Brokers Alternatives

These brokers are the most similar to Windsor Brokers:

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Windsor Brokers Feature Comparison

| Windsor Brokers | FXPrimus | Admiral Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 3.5 | 2.3 | 3.6 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, treasuries | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $100 | $15 | $100 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC (Cyprus), IFSC (Belize), JSC (Jordan) | CYSEC, MIFID, ICF, FCA, BaFin, VFSC | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:1000 | 1:30 (EU), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | Windsor Brokers Review |

FXPrimus Review |

Admiral Markets Review |

Swissquote Review |

Trading Instruments Comparison

| Windsor Brokers | FXPrimus | Admiral Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | No | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | Yes |

Windsor Brokers vs Other Brokers

Compare Windsor Brokers with any other broker by selecting the other broker below.

Popular Windsor Brokers comparisons: