Valutrades Review 2025

|

|

Valutrades is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Valutrades |

| Valutrades Facts & Figures |

|---|

Valutrades is an FCA-regulated broker offering ultra-low latency forex, index and commodity CFD trading with ECN pricing from 0 pips. Traders can choose between the MetaTrader 4 and MetaTrader 5 platforms and benefit from a range of blogs, webinars and calculators. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, commodities |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on forex, indices and commodities with leverage up to the FCA-sanctioned maximum of 1:30. The MetaTrader platforms will also serve technical traders and automated trading strategies. |

| Leverage | 1:500 |

| FTSE Spread | 0.7 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 0.018 |

| Stocks Spread | N/A |

| Forex | Trade 80+ major, minor and exotic forex pairs on true ECN accounts with spreads from zero, low commissions and deep liquidity from tier-one providers. The breadth of currencies and competitive pricing makes the broker a good pick for forex traders. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.1 |

| Assets | 80+ |

| Stocks | Speculate on stock market movements via CFDs on indices covering major global markets, including S&P 500 and FTSE 100. On the downside, there is no direct stock trading or share dealing which can be found at many alternatives. |

Valutrades is a UK-based ECN broker that offers trading opportunities on a wide selection of forex pairs and a few other assets with competitive pricing and a range of educational content. Our Valutrades.com review will cover the brand’s fees, trading platforms, funding options, extra features, and more. We also unpack our experience using Valutrades to help you get started, including how to sign up for an account and make a trade.

Our Take

- Valutrades is best for active forex traders looking for spreads from 0.0 pips and low commissions

- There are no restrictions on strategies with scalping, hedging and news trading permitted

- The broker is regulated by the FCA and offers a GBP trading account for UK clients

- The selection of non-forex assets is subpar and doesn’t match rival brokers

Market Access

Valutrades offers just three asset classes with 100+ instruments, and while this is far behind many competitors that offer thousands, we do feel the main offering, forex, is more than adequate with 80+ pairs. Besides these, you are restricted to trading indices and commodities trading, with no stocks or ETFs available.

- Commodities – UK and US oil as well as gold, silver, platinum, and palladium

- Index CFDs – 14 major global indices such as the FTSE 100, S&P 500 and DE 30

- Forex – 80+ major, minor, and exotic currency pairs including GBP/USD, GBP/JPY, and EUR/GBP

EUR/USD Market Data & Trading Conditions

Fees

When we used Valutrades, we were impressed by the tight spreads available, with raw pricing sourced directly from top-tier liquidity providers. We got a 0.1 pip spread on the GBP/USD and a 2.5 pip spread on UK Oil, which rivals many alternatives. As well as low spreads, a $3 commission applies per side, which is competitive.

We were also happy to find limited non-trading charges, with no inactivity fee for dormant accounts, free deposits and even VPS hosting.

You can also access three free withdrawals per month, and though requests after this will incur a 5% charge, this should be enough for most traders to affordably move their money.

Accounts

We like the simple model Valutrades uses for customer accounts, with all clients registered under one standard profile. The ECN Trading Account makes no distinction between traders of different funding levels, and the account’s features have been designed with all experience levels and strategy types in mind.

We found no trading restrictions, meaning you can invest with EAs, scalping, news trading, and more. We were also pleased to see GBP is an accepted base currency, meaning you can avoid sometimes costly conversion fees. There is no minimum deposit requirement, which is another feature that ranks the brand up.

Key account features:

- Spreads from 0 pips

- $3 commission fee per side

- No maximum number of open orders

- No limits on order distance from current market pricing

How To Open A Valutrades Account

I didn’t have any issues registering for an account. To sign up:

- Choose ‘Open Account’ under the Valutrades UK logo

- Complete the online application with your personal details, country of residence, tax information, email, and base currency

- Agree to the T&Cs and select ‘Next’

- Submit your current employment position (status, industry, income, net worth, and fund source)

- Declare your previous investment experience by answering the questions using the tickboxes

- Select ‘Finish’ to submit your application

Funding Methods

Deposits

We were impressed with the choice of funding methods available to UK traders and even more so by the guarantee of zero-fee deposits. As well as the standard bank wire transfer and credit/debit card funding options, clients can deposit in GBP using alternative methods such as Paysafe and Rapid Transfer.

We were pleased to see that the broker does not charge any deposit fees, and best of all, Valutrades will credit back any third-party banking charges if incurred.

All methods provide instant processing times, except for bank wire transfers which can take up to two days for funds to be available.

Deposit methods available to UK customers:

- Skrill

- Jeton

- Klarna

- Sticpay

- Neteller

- Paysafe Card

- Rapid Transfer

- Bank Wire Transfer

- VISA, Mastercard And Maestro Credit/Debit Card

How To Fund Your Account

I found the deposit process intuitive with a few straightforward steps to follow:

- Login to the client dashboard

- Select ‘My Funds’ from the side menu and then ‘Make A Deposit’

- Choose a payment method from the list by selecting the relevant icon

- Enter your bank account or e-wallet details and choose the amount to deposit

- Confirm the transaction

- You can view your transaction history and status by selecting ‘My Funds’ from the dashboard menu and then ‘Funding History’

Withdrawals

We think Valutrades offers fair terms for withdrawals that for most traders will be low-cost as well as speedy. The broker aims to approve withdrawal requests within 24 hours, though the time taken for funds to arrive back to the payment method will vary.

It is a shame to see that withdrawal fees will apply, but all customers are entitled to three free withdrawals per month, which should suffice. A 5% fee applies thereafter.

While using Valutrades, we also came across a minimum withdrawal limit of £50 which is a little steep, though comparable to other brokers.

Trading Platforms

Valutrades offers UK clients two trading platform options; MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and though we were disappointed to see no bespoke software offered by the brand, the MetaTrader terminals are among the best in class and provide everything you need to trade successfully.

Both platforms can be used as web traders or downloaded to desktop devices. We tested both options and found each to have connection stability and clear navigation.

MetaTrader 4

While we appreciate that the MetaTrader platforms are getting older and some traders prefer a more modern design, it is not difficult to understand why they have achieved their award-winning and market-leading status thanks to the advanced technical analysis features, and automated trading functions.

MT4 is the favoured platform for forex trading, though MT5 offers more features and functions, so we would recommend that for experienced traders. Other key differences between the platforms include:

- 30 indicators on MT4 vs 44 on MT5

- Four pending order types on MT4 vs six on MT5

- Nine timeframes available on MT4 vs 21 on MT5

- No Market Depth data on MT4, available on MT5

- No integrated economic calendar on MT4, available on MT5

- Single-threaded strategy backtesting on MT4 vs multiple threaded on MT5

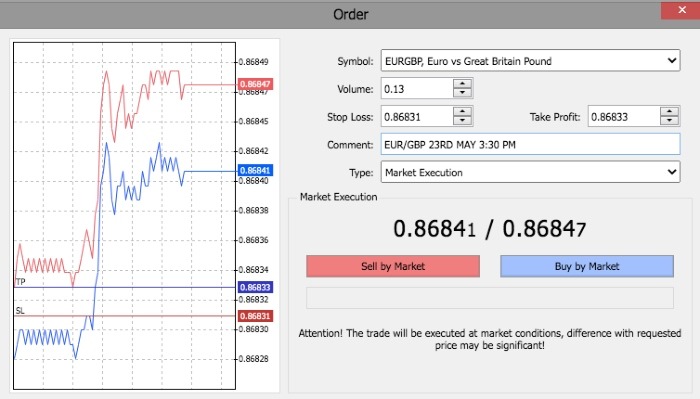

How To Place A Trade

It is easy for traders of all experience levels to open and close positions on the MetaTrader platforms. Both follow similar formats and provide a choice of trade initiation including the option to use one-click trading via charts.

To Enable One-Click Trading:

- Select ‘Options’ from the top menu

- Choose ‘One-Click Trading’ from the dropdown list

- Review and confirm the T&Cs using the tickbox

- Select ‘OK’

To Open A Position With One-Click Trading:

- Right-click on the chart and select ‘One Click Trading’ from the dropdown menu

- The new trading tool will be displayed in the top left of the chart screen

- Use the arrows to set the trade size

- Select ‘Buy’ or ‘Sell’ to confirm the order

Client Dashboard

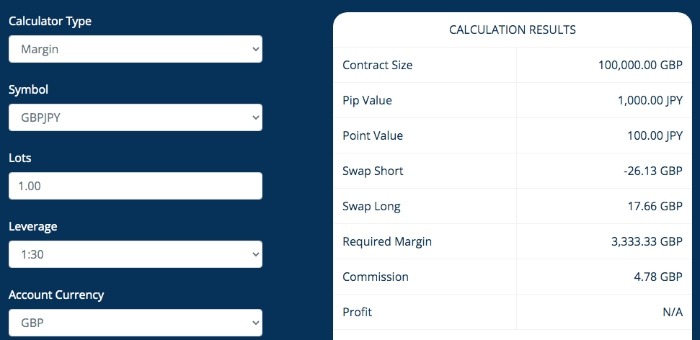

We particularly rated the Valutrades’ client dashboard and its prominent ‘Product Information’ tab, which provides an easy way to access important information quickly, including contract specifications, a trading calculator, and margin requirements.

The option to add two-factor authentication (2FA) to login to the client area is also good to see.

Valutrades App

Although Valutrades does not have its own app, the good news is that MT4 and MT5 both offer mobile apps for free download to iOS and Android devices and our experts found that these provide an excellent trading experience on the go.

The applications provide users access to all the advanced functions found on the desktop versions, and we found them easy to use, with simple navigation. Small-screen compatibility works well, and we were able to view charts and graphs with no compromises.

We also appreciate that the mobile platforms allow you to set alerts and notifications to stay up to date with price movements while away from your computer.

Leverage

Due to local regulations, Valutrades UK clients will be eligible to trade with a maximum leverage of 1:30:

- Major Forex Pairs – 1:30

- Minor Forex Pairs And Major Indices – 1:20

- Commodities And Minor Indices – 1:10

Greater margin trading opportunities are available for customers that are classified as ‘Professionals’. The requirements to qualify for this status are fairly standard across the market, with one being a savings or investment portfolio size of at least £500,000. Once satisfied, you can trade with much more generous leverage up to 1:500, though this is on a tiered model based on account equity:

- Account Equity Less Than £50,000 – 1:500

- Account Equity Between £50,000 And £100,000 – 1:200

- Account Equity More Than £100,000 – 1:100

Demo Account

A free demo account is available to new Valutrades clients, and we were happy to find that this allows you to choose the trading terminal and relevant server to practise investing with. And, since we found no limit to the amount of virtual funds you can use, you have full flexibility to practise as much as you need.

You can also use all the resources available to live traders including technical indicators and automated systems. GBP account base currency is available.

How To Open A Demo Account

I found the paper trading account registration easy to follow, and I was able to start trading in demo mode in just a few minutes.

- Click ‘Free Practise Account’ from the header of the broker’s website

- Select ‘Open Account’ under the Valutrades UK logo

- Complete the online application with your personal details, base currency, and virtual deposit value

- Use the tickbox to agree to be contacted by the brand

- Select ‘Login’. Redirection to the client portal will be completed

- Login details will be sent to your registered email address

- From the dashboard, select ‘Downloads’ from the side menu and choose the platform to open. Login with your registered credentials to start the practice session

UK Regulation

As Valutrades holds UK licensing and is incorporated as a limited liability company in England and Wales, we are confident that the brand operates with high levels of customer security.

Valutrades Limited is authorised and regulated by the Financial Conduct Authority (FCA), license number 586541. With this, you benefit from negative balance protection, segregated client funds in top-tier EU banks including Barclays and Lloyds, and access to the Financial Ombudsman Service (FOS) as an external complaints service.

Additionally, FCA regulation enables customers access to the Financial Services Compensation Scheme, with protection to the value of £85,000 in the event of insolvency.

We also felt confident in the brand’s security features, with a fully encrypted client area that protects your personal data and financial transmissions.

Valutrades Bonus

Valutrades is not permitted to offer any bonus rewards or financial incentives to UK traders due to regulations. This means you will not find any welcome bonuses or no-deposit payments when you sign up.

This is to be expected, but we were disappointed by the lack of a refer-a-friend scheme or trading rebates, which are often used in place of these bonus rewards.

Extra Tools & Features

Our experts found a complete online education centre with various materials and resources suitable for all experience levels and we feel this provides good value to Valutrades clients. We especially liked the selection of different learning styles catered to, with videos, blog posts, online webinars, and e-books.

All are classified usefully into beginner, intermediate, or advanced categories and the range covers major topics from integrating trading signals on the platform to avoiding the emotional pressures of investing.

Other tools include an economic calendar, a glossary of key terms, calculators and client sentiment data. As a Valurades customer, you also benefit from access to seven custom indicators that can be integrated into the MetaTrader terminals. This includes Hammer Pattern, RSI CCI Divergence, and Inside Outside Bars.

We were disappointed that Valutrades does not offer a copy trading tool, but you can find opportunities within the MetaTrader platforms.

On the plus side, you will find VPS server compatibility for 24/7 connectivity. Though we don’t think it is a requirement for beginners or those participating in casual trading, active traders can sign up with either Beeks Financial Cloud or Commercial Network Services. We also rate that this is free for customers who execute at least one new trade per month, as many brands charge to use a VPS.

Customer Service

We were impressed by Valutrades’ selection of customer service options, which include a UK-based telephone number, live chat, WhatsApp, email, or online contact form.

Support is only available during European and Asian market opening hours, which is plenty of cover, though for help outside of these times, you will need to source information from the FAQ page.

When we tested Valutrades and used the live chat service, we received a response almost instantly. We found it easier to speak to a human advisor rather than use the article search function.

Contact details:

- Telephone – 020 3141 0888

- Email – support@valutrades.sc

- Live Chat – Located bottom right corner of the website

- WhatsApp – Located bottom left corner of the website

- Online Contact Form – Available on the ‘Contact Us’ page

Company History

Valutrades was founded in 2012, originally under the trading name Monex Capital Markets. The brand operates via two entities; a UK-based subsidiary and an international group.

The firm provides services to over 5000 customers in 120+ countries, with a head office presence in London and the Seychelles. Some of the main team employees include Graeme Watkins (CEO) and Liam Bonfield (CFO).

Valutrades launched its own MT4 server in Equinix NY4 in 2014 and further trading hubs across the world to provide fast execution feeds and improved latency. The brokerage is a true ECN brand.

Trading Hours

Valutrades opening hours vary by instrument. Forex trading is available between 1 AM and 11:59 PM Monday to Friday with no daily break. UK oil commodities, on the other hand, are available between 3 AM and 11:59 PM and the FTSE 100 index between 1 AM and 12 AM. This information is available under the ‘Products’ page of the broker’s website and reflected in the trading terminals.

We were also pleased to find an updated economic calendar with details of market closures and upcoming holiday dates.

Should You Trade With Valutrades?

Although the product list is not expansive, Valutrades is mainly a forex broker and it does offer an excellent selection of 80+ currency pairs. We rated the trading tools and MT4/MT5 platform offerings, as well as the competitive fees, VPS hosting and custom indicators available for no extra cost. FCA regulation also adds to the brand’s credibility.

Overall, if you are an active trader who is satisfied with only trading forex, then Valutrades could be a good option.

FAQ

Is Valutrades UK Regulated?

Yes, Valutrades UK is authorised and regulated by the Financial Conduct Authority (FCA), license number 586541. We can confirm this registration is active.

Do Valutrades Have Low Trading Fees?

Valutrades operates as an ECN broker, meaning tight spreads and fast execution speeds. Spreads are offered from 0 pips, with a $3 commission charge per side. This is decent compared to many alternatives.

Is Valutrades Suitable For Beginners?

Valutrades has plenty of educational content available for beginners. This includes e-books, videos, and keyword glossaries. A demo account with an unlimited time limit is also provided to practise trading risk-free. The $0 minimum deposit also makes it a good pick for newer traders.

Does Valutrades Have A Mobile App?

Valutrades does not offer a proprietary mobile app. Having said that, you can download MT4 and MT5 to iOS and Android devices, and sync your account and trading activities to your portable device.

Can I Trade With Leverage At Valutrades?

Yes, Valutrades offers leverage up to 1:30. FCA regulations restrict margin trading to these levels to protect retail investors from excessive losses. With that said, users that qualify as pro traders can access leverage up to 1:500.

Article Sources

Top 3 Valutrades Alternatives

These brokers are the most similar to Valutrades:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Valutrades Feature Comparison

| Valutrades | Swissquote | INFINOX | IG Index | |

|---|---|---|---|---|

| Rating | 3.3 | 4 | 3.4 | 4.7 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Forex, CFDs, Indices, Shares, Commodities, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $1,000 | £1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, FSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SCB, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | 1:500 | 1:30 | 1:30 (UK), 1:200 (Global) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Valutrades Review |

Swissquote Review |

INFINOX Review |

IG Index Review |

Trading Instruments Comparison

| Valutrades | Swissquote | INFINOX | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Valutrades vs Other Brokers

Compare Valutrades with any other broker by selecting the other broker below.

Popular Valutrades comparisons: