VALR Review 2025

|

|

VALR is #80 in our rankings of crypto brokers. |

| Top 3 alternatives to VALR |

| VALR Facts & Figures |

|---|

VALR is an unregulated South-African cryptocurrency exchange, founded in 2019. Clients can access over 60 crypto assets with opportunities to earn staking and market making rewards. The broker also offers a QR code payment service. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | Variable |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

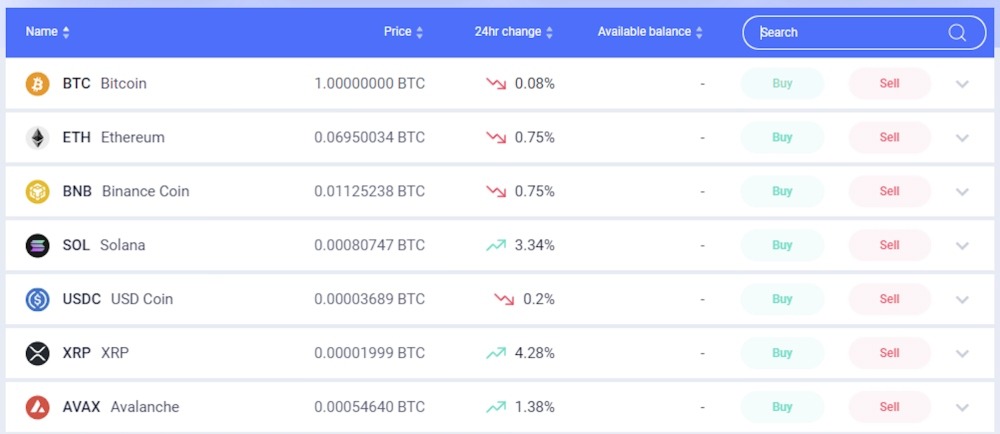

| Cryptocurrency | VALR offers 60+ crypto assets including Bitcoin, Tether and Shiba Inu, though the selection is not as wide as other firms. However, traders can earn 0.01% in rewards as market makers. |

| Coins |

|

| Spreads | 0.75% buy/sell per trade |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

VALR is a cryptocurrency exchange that provides access to 60+ crypto assets including Bitcoin, Ethereum and Ripple. The brokerage offers some good features including a sophisticated platform with TradingView charts and a simplified terminal for beginners, though the lack of deposit methods and relatively small range of tokens may put traders off.

This review will cover VALR’s fee structure, account types, trading platform, security, regulation, and everything else UK traders should know before opening an account.

Our Take

- VALR offers excellent trading software including charts from TradingView

- Active traders benefit from relatively low commissions and bonus deals

- The suite of crypto tokens is limited compared to rivals that offer hundreds of digital assets

- UK investors need to pay a conversion fee if they deposit in GBP

- Leveraged trading is only available if you meet certain criteria

Market Access

VALR is a pure cryptocurrency exchange and supports trading in crypto tokens only. The exchange offers 60 tokens, and while this is a fair amount, it is far less than the offering from established firms like OKX. This means VALR isn’t the best pick for traders looking to speculate on new and emerging coins.

VALR’s asset list includes the most popular cryptos like Bitcoin (BTC), Ethereum (ETH), Cardano (ADA) and Ripple (XRP), as well as altcoins such as Solana, Augur and Dai.

Fees

VALR’s pricing structure is reasonable, though traders who are more familiar with CFD and forex brokers may need to adapt. The brand charges commissions per order and also a maker-taker fee. The maker-taker fee charges a premium to ‘takers’ who remove liquidity from the market with market orders, while rewarding the ‘makers’ who provide liquidity through limit orders.

- Simple Buy/Sell orders have a 0.1% fee for crypto-to-crypto pairs, a 0.75% fee for ZAR to BTC, ETH, XRP, SOL or USDC pairs, and 0.85% for ZAR to other coins

- Exchange Buy/Sell orders charge 0.1% for takers and pay 0.01% to makers (profit)

- Auto-Buy has a 0.75% fee per trade

- The exchange does not charge any maintenance, management, or monthly fees

Importantly, trading fees can be reduced through the VALR referral system. Signing up with a referral will reduce your fees by 10%. Referring one sign-up will reduce your fees by 15%. Referring two or more sign-ups will also reduce your referrals’ trading fees by 10%.

We were disappointed to find that although fiat and crypto deposits are free, withdrawals have a variable crypto fee and a flat 50 USDC (USD stablecoin ~ £40) fiat fee. Also, only ZAR and ZMW fiat currencies can be used for non-crypto transfers.

On a lighter note, transfers through VALR’s e-wallet app, VALR Pay, are free to phone numbers, email addresses, or when receiving payments. This applies to both fiat and crypto transfers.

VALR Accounts

Unlike many brokers, VALR does not offer a choice of account types with differing trading terms, though users will choose between the trading method with Simple Buy/Sell, Exchange Buy/Sell, and Auto-Buy services available. We feel that this is a reasonably useful and intuitive system.

- The Simple Buy/Sell network is designed for beginners or those looking to invest in cryptocurrencies quickly and easily

- The Exchange Buy/Sell platform is a more advanced terminal with more features for tracking and choosing cryptos to trade

- The Auto-Buy method provides an easy way to buy crypto by transferring funds into your account

How To Set Up An Account

I appreciated the quick and easy joining process at VALR. To sign up with the broker:

- Enter your sign-up details (email address, password) in the client portal or login via Gmail/Apple ID

- Go to your email address and verify the email

- Sign in to your VALR account using the email address and password

- You will now be asked to verify your identity

- Input all of the details (residential address, etc.)

- Provide ID and a live snapshot to prove your identity

- With this complete, you will be able to deposit and start trading

Finance Options

When we used VALR, we felt that UK traders were left at a disadvantage, as the broker does not support direct transfers using GBP or other popular currencies (like USD or EUR), making deposits and withdrawals limiting. VALR only accepts crypto, ZAR (South African Rand) and ZMW (Zambian Kwacha) transfers.

Traders can transfer cryptocurrencies to their VALR wallet from other crypto wallets. Many popular coins can be transferred, with a full list available on the ‘Wallets’ page in the client portal.

There is a minimum withdrawal for each coin that usually equals three times the withdrawal fee quoted when you try to withdraw a coin. Withdrawal fees are based on the current network fees required to make transactions.

Fiat ZAR and ZMW can also be used to deposit from bank accounts and credit/debit cards. ZMW can also be transferred using MTN MoMo or Airtel Money. We were pleased to see that there is no minimum withdrawal amount for fiat transfers.

How To Deposit Crypto With VALR

I have listed the steps to transfer crypto after testing VALR:

- Ensure the coin is supported (on the ‘Wallets’ page)

- Find the crypto you want to deposit on the ‘Wallets’ page and click ‘Deposit’

- Copy the address or scan the QR code

- Use this address as the sending address (withdrawal address) in your external crypto wallet

- Send the funds from the external wallet

How To Withdraw Crypto

The process to withdraw cryptocurrencies from the broker is also fairly straightforward:

- Find the relevant crypto on the ‘Wallets’ page and click ‘Withdraw’

- Fill in the destination address and the amount you want to withdraw

- Authorise the transaction by following the instructions in the authorisation email sent to your email address

- Enter your one-time pin

- Confirm the withdrawal from VALR

Note, ID verification may be required.

Trading Platforms

VALR offers two platforms, Simple Buy/Sell and Exchange Buy/Sell. We think these two bespoke platforms will satisfy beginner and experienced traders respectively. The features of each platform suit their target markets well.

Unlike traditional brokers, crypto exchanges typically offer proprietary software rather than popular trading platforms like MetaTrader 4, though the addition of TradingView charts makes up for this.

Charting Views

The Simple Buy/Sell is exactly that, simple. Charts provide 3 months’ worth of data to help you plan trades. Cryptos can be filtered by price, 24hr change, and available balance.

The Exchange Buy/Sell is a more complex and powerful platform that uses TradingView charting with 9 different timeframes and over 100 technical indicators. The exchange window also gives more sophisticated order options, including limits, stop limits, market orders, fill or kill, good till cancelled, and immediate or cancel. Traders can also switch to subaccounts and trade on margin. As a result, we would recommend this platform for seasoned crypto traders.

VALR App

VALR offers a free mobile app on both Apple iOS and Android mobile devices.

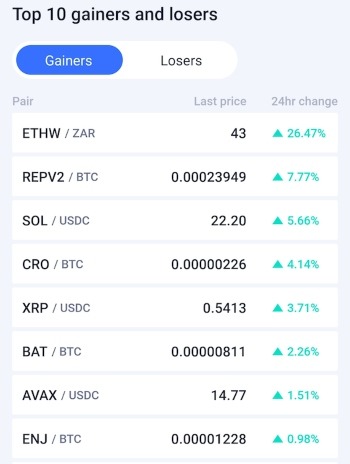

I found the design of the application sleek and intuitive. You can use the ‘Home’ tab to quickly check the movers of the day, place buy and sell orders easily on the Markets tab, perform more complicated analysis and place sophisticated orders on the Exchange tab.

Overall, I rate the VALR app for its ease-of-use, powerful tools and accessibility.

App

Leverage

VALR only offers leveraged trading to select customers who are registered as corporate or business traders and have capital/annual income of over ZAR 1,000,000 (approx £40,000).

Fulfilling these conditions allows you to open a sub-account where leveraged trading is enabled. A maximum of 2x leverage can be used for trades, and interest is charged on debt hourly.

Margin requirements are as follows:

- Initial – 50%

- Maintenance – 10%

- Auto-close – 3%

Demo Account

While using VALR, we were disappointed to find there is no demo account.

Although the same is true of many other crypto exchanges, these useful features are available from some crypto brokers and are a good option for traders who want to gain experience in crypto markets without risking real funds.

Regulation

Like other crypto exchanges, VALR is unregulated. While this is in line with the state of the industry, we urge traders to practice caution when investing in cryptos online. Your capital is at risk and there may be limited recourse options available should you run into issues.

Despite this, VALR implements some safety features commonly enforced upon regulated brokers. These include local and international Know Your Customer, Anti-Money Laundering and Counter-Terrorism Financing checks.

Bonus Deals

We were glad to see that VALR offers a few bonuses and competitions, as well as a referral scheme. The competitions can be found through the blog on the official website, with cash rewards and prizes available.

A referral scheme is also offered, providing cost benefits to traders. Signing up with a referral provides the trader with a 10% rebate on their trading fees. Referring one sign-up will provide a 15% rebate on trading fees, and two or more sign-ups will provide their referrers with an additional 10% rebate each.

It is worth noting that rebates are capped at ZAR 1,500 (£60).

Extra Tools & Features

VALR offers little in the way of extra features, and we think this is a big letdown. Many rivals come packed with educational content and other useful tools, and crypto exchanges particularly are known for providing innovative features like NFT marketplaces through DeFi functionality.

Educational tools are limited to FAQs, general information, and a blog. We were disappointed by the overall lack of educational facilities. The blog is kept up to date but only covers generalised stories occurring in the crypto world. Other crypto exchanges, like Coinbase, provide educational resources with incentives, promoting the learning of cryptocurrencies.

Other, standard features are also offered, like price alerts, a wallet address book, an audit trail, a portfolio tracker, and insights into the biggest risers and fallers.

Customer Service

We were not impressed by the lack of support avenues offered by VALR, which only provides a support centre with general FAQs, a chatbot and a help@valr.com email address.

The broker does have active social media accounts, namely Twitter, Facebook, Instagram, and LinkedIn, with the handle @VALRdotcom.

Unfortunately, this is all that is provided. There is no physical address displayed, and no contact phone number to call.

Company Details & History

VALR Pty Ltd. is a global cryptocurrency exchange with its office based in Johannesburg, South Africa, and was founded in 2018. The firm became fully operational in 2021 and has since gained over 100,000 active users.

The CEO and joint founder Farzam Ehsani says the company aims to provide frictionless trading to people across borders, allowing traders to buy, sell and store crypto assets safely and securely.

Security

Despite being unregulated, we were reassured to find that VALR has several safety features to support account and fund security.

The firm implements various guidelines to ensure safe onboarding, including facial recognition checks that are used by many major financial services companies during KYC processes.

The exchange also uses encryption to ensure all personal data and transactions are kept secure. Furthermore, two-factor authentication (2FA) is required across the platform to ensure transactions are secure. When signing into a new device, the exchange asks for a pin to log in. This is sent to your registered email address.

VALR implements both cold storage and hot wallet storage system to provide safety to clients’ assets. The exchange is also partnered with a leading blockchain platform, Bittrex, to ensure funds are fully safe and reserved.

Trading Hours

As VALR is a decentralised cryptocurrency exchange, it is available 24/7, 365 days per year. This will be welcome news to active crypto traders.

Should You Trade With VALR?

VALR presents itself as a sleek, intuitive crypto exchange with a range of digital assets and a choice between simple and sophisticated trading platforms. The exchange also offers a transparent fee structure and strong security features, making it enticing.

However, UK traders will be disappointed by the lack of GBP funding options, a relatively small number of tradeable assets, a poor range of additional features, and a lack of margin trading.

Overall, the strong platforms, user-friendly design, and clear fee structure are attractive, but many traders will prefer to sign up with another exchange or a crypto broker instead.

FAQ

Is VALR Safe?

VALR, like most crypto exchanges, is unregulated. This significantly lowers the firm’s safety and security score.

With that said, the exchange does implement several security features, such as 2FCA, plus KYC and AML checks.

Is VALR A Broker Or An Exchange?

VALR is not a cryptocurrency broker but rather an exchange. Traders can use the exchange to trade directly with other investors, buying and selling their own crypto coins.

What Platform Does VALR Offer?

VALR offers two trading platforms, Simple Buy/Sell and Exchange Buy/Sell. The simple platform is designed for traders looking to quickly place orders, while the exchange platform gives experienced traders access to the popular charting platform TradingView.

Is VALR Available In The UK?

VALR is headquartered in South Africa but accepts clients worldwide. UK traders can trade crypto with VALR. The exchange is decentralised, unlike regular brokers, meaning that assets are tradable from anywhere 24/7, 365 days per year.

Does VALR Have Registration Fees?

VALR does not have any sign-up fees, nor any management or monthly fees. Like many brokers, VALR only charges users when trading and with some transfer payments.

Article Sources

Top 3 VALR Alternatives

These brokers are the most similar to VALR:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

VALR Feature Comparison

| VALR | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| Rating | 2.2 | 4.3 | 4 | 4.7 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | Variable | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4, MT5 | MT4 |

| Leverage | - | 1:50 | 1:30 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | VALR Review |

Interactive Brokers Review |

Swissquote Review |

IG Index Review |

Trading Instruments Comparison

| VALR | Interactive Brokers | Swissquote | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | No | Yes | Yes |

VALR vs Other Brokers

Compare VALR with any other broker by selecting the other broker below.

Popular VALR comparisons: