Uphold Review 2025

|

|

Uphold is #6 in our rankings of crypto brokers. |

| Top 3 alternatives to Uphold |

| Uphold Facts & Figures |

|---|

Uphold is a digital asset platform offering a range of services, from crypto trading and staking to payment cards that provides rewards and easy multi-currency payments. The company was established in 2015 and has enabled $4+ billion in transactions. Uphold is now active in 180+ countries and deals in 200+ crypto and fiat currencies. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | $1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Automated crypto trading bots |

| Islamic Account | No |

| Commodities |

|

| Cryptocurrency | You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet. |

| Coins |

|

| Spreads | Up to 1.5% |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | Yes |

| Auto Market Maker | No |

Uphold is a digital asset trading platform and exchange that allows investors to speculate on the DeFi markets with altcoins, stablecoins and fiat money. The broker also offers staking pools, where investors can earn a steady yield on their uninvested cryptocurrencies. This 2025 broker review of Uphold will explore its trading platform, markets, fees and more. Find out whether to sign up with Uphold.

Company History & Overview

Despite only being launched in 2015, Uphold already has over 10 million users and serves more than 184 countries, which shows it has become a sizeable force in the crypto trading industry. To emphasise the point, the platform’s current daily transaction volume is over £28 billion.

Simon McLoughlin is the CEO and other senior employees can be found on the website. Uphold Europe Ltd’s headquarters are based in London.

The firm is regulated by the Financial Conduct Authority (FCA) but does not receive the same protections as the more traditional brokers. Our experts go into more detail on that further on.

Trading Platform

There is only one investment platform available on Uphold. It is a basic in-house software package that is simple and intuitive but lacks the advanced features and technical analysis tools that more experienced traders may decide is a necessary prerequisite.

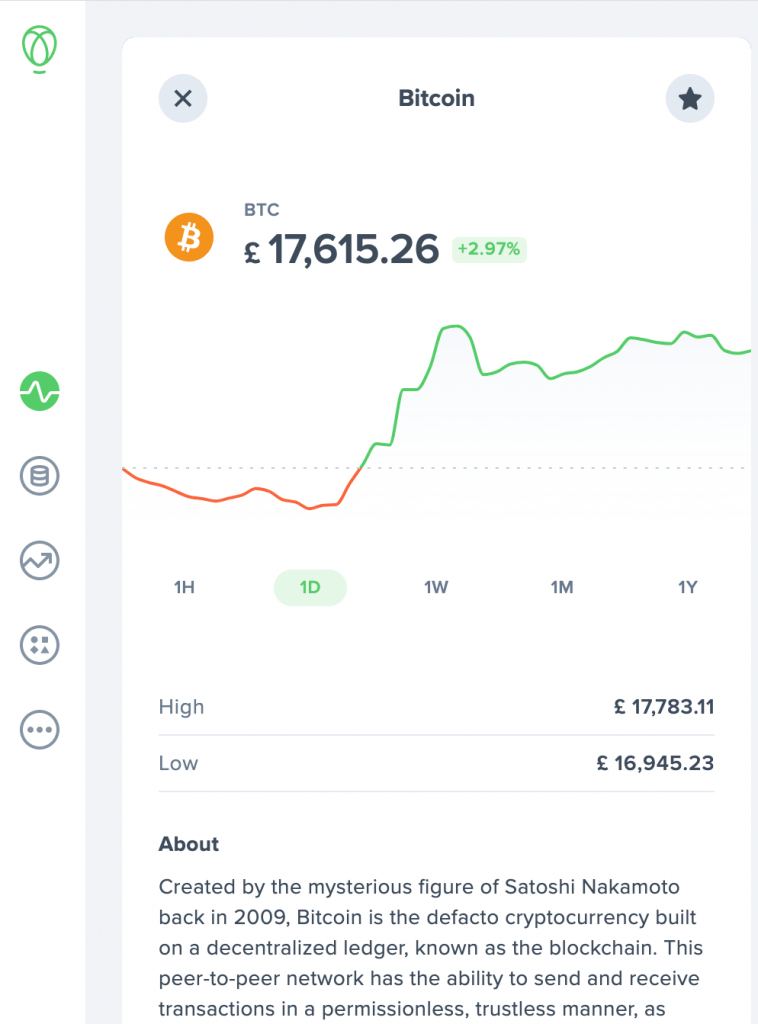

Uphold Trading Platform

Trades can be opened in a single click and there are two main order types, in addition to standard repeat and limit orders. Repeat orders do exactly what they say: repeat the same order at set intervals for a given length of time. These orders are typically used as part of a dollar-cost averaging strategy.

Limit orders allow you to buy or sell an asset at a specified price or better. This means that you do not have to invest as much time actively monitoring the market.

Uphold lets its clients place up to 50 limit orders using the same amount of capital. For example, if you put £1,000 on each of BTC, XRP and ETH (all as linked limit orders) and you only had £1,000 capital in total, if the limit order for BTC was satisfied first the others would automatically fail.

Markets

Uphold is perfect for those wanting access to the more obscure altcoins in addition to the major cryptocurrencies like Bitcoin and Ethereum. There are over 160 cryptocurrencies and stablecoins, as well as three national currencies (GBP, EUR and USD). Examples of the cryptocurrencies and tokens available for trading are as follows:

- BTC

- XRP

- ETH

- ADA

- DOT

- UNI

- AAVE

The Uphold trading platform does not offer stock trading, commodities or NFTs to UK customers.

Staking

Staking pools are common in proof-of-stake blockchains, where investors can lend their funds to other users and earn rewards. Investors on Uphold can earn up to 25% by staking crypto, although the crypto market is very volatile and these rates are highly exposed to changes in supply and demand. Slashing penalties are an inherent risk with staking that investors also need to be mindful of. The staking rewards are credited weekly on a Thursday.

Fees

There is zero commission when trading crypto pairs on Uphold, although there is a buy-sell spread, charged in USD. For Bitcoin, the buy spread is 0.85% and the sell spread is 1%. For altcoins, spreads are generally higher. For example, the NEM buy and sell spreads are both 1.25%. Fiat currencies on the other hand have smaller spreads. GBP has a buy-and-sell spread of 0.2%, charged in USD.

Peer-to-peer (P2P) transactions are free if over $100, though the above conversion fees apply if transferring fiat money and you want the recipient to get crypto. P2P transactions involving a transfer from one crypto to another will constitute two separate transactions (one from the original crypto to fiat money and one from fiat money to the new crypto).

A $0.99 fee is charged on transactions between assets where the amount is below $100. There are three exceptions: transactions made using the Uphold Debit Card, an exchange of BAT from a Brave Browser-linked account to fiat or an automated transaction (recurring or limit orders).

Note that some deposit and withdrawal methods have a fee attached (explained in more detail further on) and network fees may be applicable for crypto withdrawals, which are passed on to the Uphold client.

When staking, there is usually a 15% fee on any rewards but a current promotion has waived this fee for a temporary period.

Uphold Leverage

There is no leverage or margin trading on Uphold, meaning investors are unable to gain additional exposure for a given amount of capital. That said, the ability to implement up to 50 limit orders simultaneously with a given amount of capital is an innovative way of making your money go further (although this is not classed as trading on the margin).

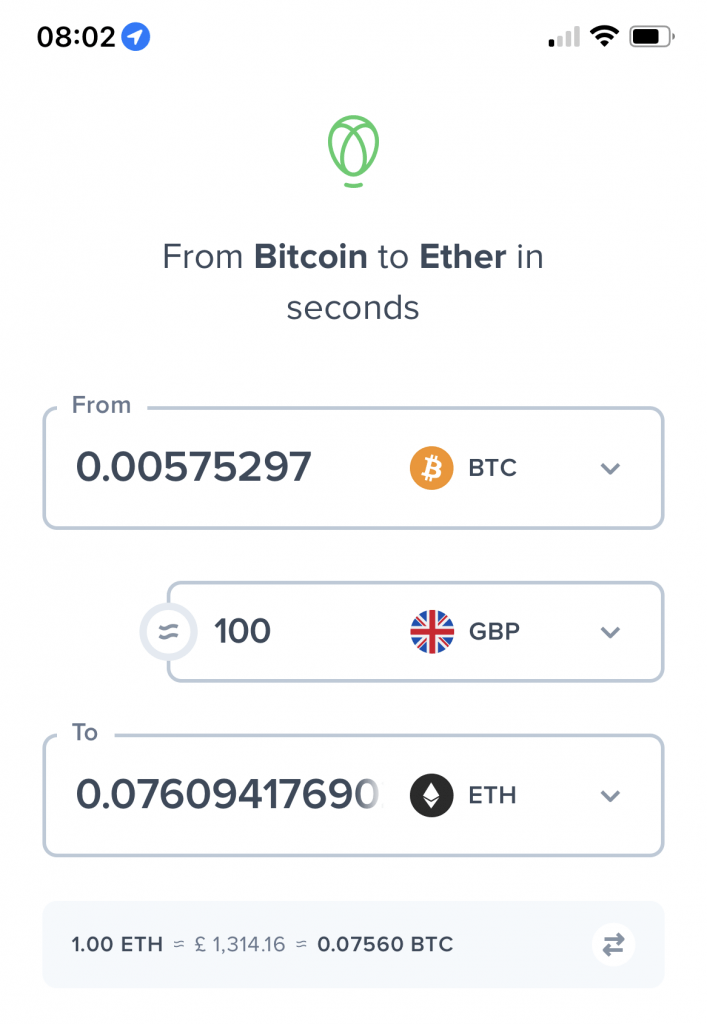

Mobile Trading

Uphold offers a mobile app that is available on Apple (iOS) and Android (APK) devices. A review of the app found that it has all the main tools available on the web platform, including the ability to make trades, monitor the market and transfer funds from wallets. Like the web platform, the mobile app is intuitive and perfect for beginners or those who enjoy trading on the go.

Payment Methods

Deposits

The following deposit options are available to Uphold customers:

- Apple Pay – 2.49% fee per deposit. £10 minimum deposit and £500 per day or £10,000 per month maximum limits

- Google Pay – 2.49% fee per deposit. £10 minimum deposit and £500 per day or £10,000 per month maximum limits

- Debit Card – 2.49% fee per deposit. £10 minimum deposit for non-US customers, as well as a £500 per day and £10,000 per month maximum deposit

- Crypto Wallet – no fees or minimum deposit

- Bank Transfer – no fees or minimum deposit

Note that credit cards are not supported in the UK or Europe.

Withdrawals

Withdrawals are free when making a UK bank transfer (£10 minimum and £25,000 maximum withdrawal). For crypto withdrawals, there are usually fees (or network fees that are passed on) and minimum withdrawal amounts:

- LTC – 0.003 LTC withdrawal fee and 0.25 LTC minimum withdrawal

- BTG – 0.0003 BTG withdrawal fee and 0.0001 BTG minimum withdrawal

- BTC – 0.0003 BTC withdrawal fee and 0.00001 BTC minimum withdrawal

- BCH – 0.0003 BCH withdrawal fee and 0.00001 BCH minimum withdrawal

Those trading on Uphold are not subject to any limits on crypto withdrawals. Processing times vary, particularly when withdrawing crypto as efficiency is dependent on blockchain traffic.

Uphold Demo Account

Although there is no official demo account, the Sandbox Environment can be used to test strategies using virtual BTC funds. However, the Sandbox Environment is mainly designed for testing applications built on top of the Uphold platform. Applications can be connected using an API.

Bonuses & Promotions

The only promotion currently advertised on Uphold is a 0% staking commission. This is a lucrative offer as the usual staking reward fee is a hefty 15%.

Regulation

Our team found the crypto exchange to be regulated by the FCA as an EMD Agent of an Electronic Money Issuer. Although the FCA is a reputable regulatory authority trusted by brokerages and trading platforms around the world, it is important to note that Uphold’s regulatory status does not bring with it protection under the UK Financial Services Compensation Scheme or the UK Financial Ombudsman Service.

Account Types

Only individual and business account types are available on Uphold. Retail traders, therefore, do not get a choice of account type, although this does keep things simple and makes the fee structure less complex. The key difference between an individual and a business account is that the fees charged depend on the volume traded for a business account.

How To Invest On Uphold

1) Open An Account

A trading account can be opened with Uphold in fewer than three minutes. In addition to some personal details, investors will need to provide basic financial information, such as salary and type of employment. Your email address will also need to be verified by clicking a link sent to it. Once complete, your login details should be ready to use to sign in.

2) Complete Verification

Before you can deposit funds and begin trading, investors will need to verify their identity. This involves providing your address, a valid form of a photo ID and a selfie.

3) Deposit Funds

The next step is to deposit funds, which can be done using a debit card, Apple Pay, Google Pay, bank transfer or a crypto wallet. Payment methods can be added on both the mobile app and web platform. Clients will also need to decide what type of wallet they wish to store their cryptocurrency in (hot or cold). There are many external providers but a review of Uphold’s own wallets found that they have options for multiple cryptos (including Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash). Around 90% of the firm’s crypto is held in cold storage and Uphold stores the security keys.

4) Open A Position Or Stake Crypto

Trading can be done in just a few clicks. Although there are limited advanced technical analysis features (important for short-term strategies like day trading and swing trading), the newsletter and blog both provide useful insight into the market. Make use of limit orders and, if appropriate, repeat orders. Although this is not fully automated trading through a bot, it does reduce the input required from the investor. Those wanting to invest less time in the markets or who have uninvested crypto may want to stake their tokens and earn a steady interest.

Benefits Of Uphold

When we used Uphold, we found several key advantages:

- FCA-regulated

- Zero commission

- Intuitive platform

- High staking yields

- Simple sign-up process

- Good staking commission bonus

Drawbacks Of Uphold

While using Uphold, our experts also found several disadvantages:

- No FSCS protection

- Customer support is limited

- Spreads can be high on altcoins

- Limited technical analysis tools

Additional Features

Investors seeking market insight and analysis should sign-up for Uphold’s daily newsletter. Whether you are unable to allocate the time needed to keep checking the market or you are afraid you may have missed something, the newsletter is a good way around these problems.

The website’s blog section covers topics such as the Ethereum merge and there is also a separate news section, which pulls content from other media outlets. Beginners may find the ‘cryptionary’ useful, which is essentially a glossary of trading terms related to the world of cryptocurrency.

Investors implementing a dollar-cost averaging strategy will find a calculator available on the exchange’s website that shows how much your crypto holdings would have grown (or shrunk) in a given period – all you have to do is enter the size of your deposits and the time intervals. It can also help show the potential of this strategy to new investors.

Trading Hours

The crypto market is open 24/7. One of its main strengths is that it is decentralised and not controlled by any particular institution or government. A natural result of this is that there are no opening or closing times on Uphold for UK or international customers.

Customer Support

Technical issues like if trading has been halted or any general enquiries about the platform can require human assistance. Unfortunately, customer support at Uphold is limited. There is no contact number, live chat or email. The only way for clients to get in touch with the broker is through an online contact form. The FAQs partly compensate for this.

Security

Uphold never lends out your money and has a current reserve status of 102.2%. That said, customer funds are not protected by the FSCS, meaning investor deposits could be at risk in the event of insolvency.

The trading platform has adopted a range of measures to protect against malicious attacks including encryption, the 24/7 Uphold Securities Operation Centre and routine security audits. The bug bounty program can reward investors for identifying a vulnerability in the system, thereby incentivising users to make reports so that the platform’s security is strengthened.

2-factor authentication can be activated for personal account security. For card transactions, Uphold is certified to PCI/DSS requirements to ensure payments are completed safely.

Should You Trade With Uphold?

Although the spreads at Uphold are not insignificant, zero commission on crypto investing will certainly appeal to many clients, as will the high potential staking rewards on offer. However, the strongest aspect of this firm is its simplicity and the ease with which you can trade almost ‘anything to anything’ within the world of cryptocurrencies.

FAQ

Is Uphold A Trading Platform?

Yes. Uphold is a cryptocurrency trading platform with its approach being that investors should be able to trade ‘anything to anything’.

Is XRP Still Trading On Uphold?

Yes. XRP is available with the Uphold exchange for investors to buy and sell.

What Is An Altcoin On Uphold?

Altcoin is a combination of the words ‘alternative’ and ‘coin’. The term is usually used to refer to all cryptocurrencies that are not Bitcoin.

Is Uphold A Brokerage Account?

Uphold is a trading platform that can also be classed as an exchange or a firm that offers broker services. It allows users to trade and invest in cryptocurrencies and DeFi products.

Which Is Better For Uphold: A Cold Wallet Or A Hot Wallet?

Both cold and hot wallets have their pros and cons. The main benefit of a cold wallet is its security as the funds are stored offline. While hot wallets are less secure, they are usually more easily accessible.

Top 3 Uphold Alternatives

These brokers are the most similar to Uphold:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

Uphold Feature Comparison

| Uphold | Swissquote | IG Index | eToro | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 4.7 | 3.5 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs |

| Minimum Deposit | $0 | $1,000 | $0 | $50 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | $10 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4 | - |

| Leverage | - | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

51% of retail CFD accounts lose money. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. |

|

| Review | Uphold Review |

Swissquote Review |

IG Index Review |

eToro Review |

Trading Instruments Comparison

| Uphold | Swissquote | IG Index | eToro | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

Uphold vs Other Brokers

Compare Uphold with any other broker by selecting the other broker below.

Popular Uphold comparisons: