Unidex Review 2025

|

|

Unidex is #80 in our rankings of crypto brokers. |

| Top 3 alternatives to Unidex |

| Unidex Facts & Figures |

|---|

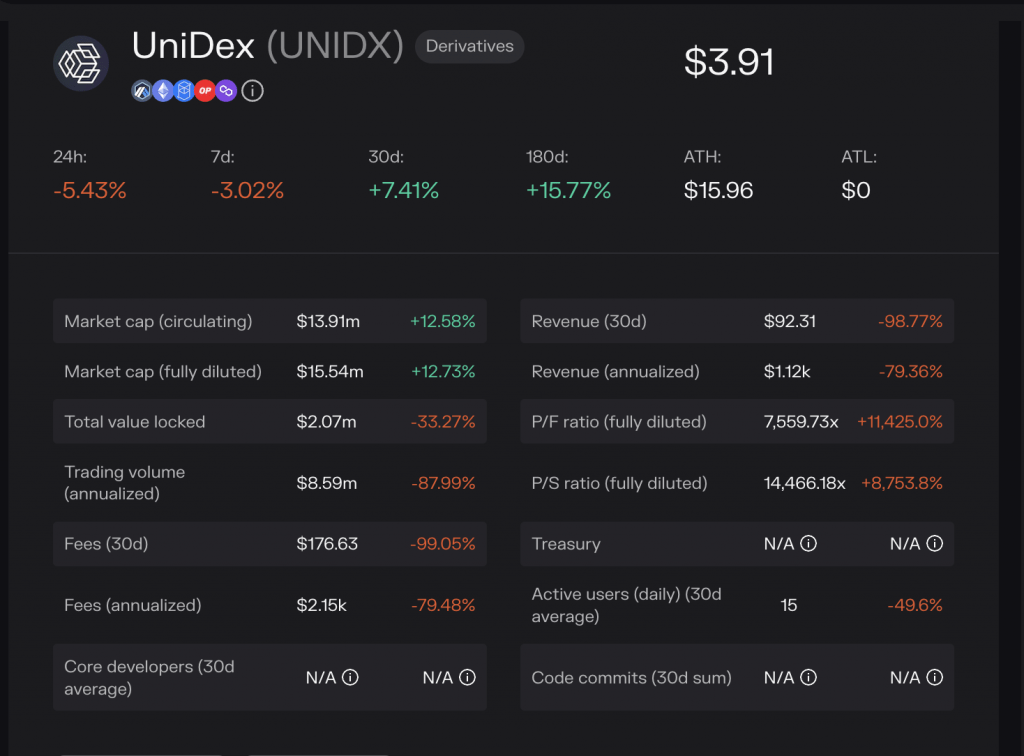

UniDex is an inclusive DeFi network, launched in 2021. The exchange supports several crypto trading activities including options aggregation, leveraged investments and cross-chain trading. UniDex uses 160+ liquidity partners to source the best pricing with $40+ billion in aggregated liquidity. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | $43 |

| Mobile Apps | iOS & Android |

| Min. Trade | $20 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Cryptocurrency | UniDex offers a huge range of popular and emerging DeFi tokens including Bitcoin, Ethereum and Litecoin. Traders can also invest in the brand's native token UNDX, and be compensated with fee rebates. Transaction fees are floating, typically fluctuating between $24 and $29. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

UniDex is a DeFi cryptocurrency exchange, offering a vast range of tokens as well as derivatives on its advanced proprietary platform. This review will cover the crypto products on offer, how to trade on the platform, trading fees, tools and security features to help you decide if trading with UniDex is a good choice.

Our Take

- UniDex uses an advanced aggregation engine to access some of the most competitive prices from 160+ liquidity sources

- The exchange offers a native token, UNIDX, and connects with a huge crypto ecosystem, including access to Uniswap

- Beginners will be disappointed with the lack of educational materials and demo trading opportunities

- The absence of regulatory oversight is a safety risk and traders may prefer an established crypto broker like FXCC

Crypto Tokens

UniDex offers a huge range of coins and assets, which includes ALPHA, BUSD, Bitcoin, and the exchange’s native token, UNIDX.

The exchange supports a wide range of protocols, so we were pleased to see that it can connect and interact with multiple blockchain networks and decentralised applications (dApps).

As such, the firm connects with some well-known lending markets and yield optimisers, including Uniswap, one of the largest decentralised exchanges (DEX) in the industry.

UniDex and Uniswap are not competitors but rather work together. For example, users can connect to Uniswap’s liquidity pools and trade assets available on Uniswap directly through the UniDex platform.

The way that UniDex works means it is set up as a multi-trade club, where users can trade almost anything they want over any DEX, CEX or chain. So, the number of tradeable instruments is always changing depending on those that are available on the DEX, CEX, or blockchains on UniDex’s roster.

UNIDX Native Token

We liked that there are also a limited number of forex pairs and commodities that can be traded on the exchange, for those who want to diversify. These are:

- EUR/USD

- GBP/USD

- JPY/USD

- AUD/USD

- CAD/USD

- CHF/USD

- Gold against USD

- Silver against USD

Fees

UniDex, and most decentralised exchanges, don’t have the same pricing structure as traditional brokers. Instead, the exchange charges a gas fee, which helps cover the costs of processing your transaction on the UniDex network.

Our team found that recent gas fees have fluctuated between $24 and $29. Half of the fee is given back to the trader in the form of digital tokens.

Part of the fee collected is used to buy and burn some of the circulating tokens from the market. This helps make those tokens more limited in supply, which can help prevent too much inflation or depreciation over time.

The gas fee at UniDex can vary depending on network conditions and congestion. Higher network congestion can result in higher gas fees, while lower congestion can lead to lower fees. Therefore, the actual gas price you pay for each transaction may vary depending on the specific circumstances at the time of the transaction. To review average gas fees, you can use sites like CoinGecko or EtherScan.

UniDex does charge Swap fees but the exact value depends on each trade. This unfortunately means that there are no Islamic-compatible accounts at the exchange.

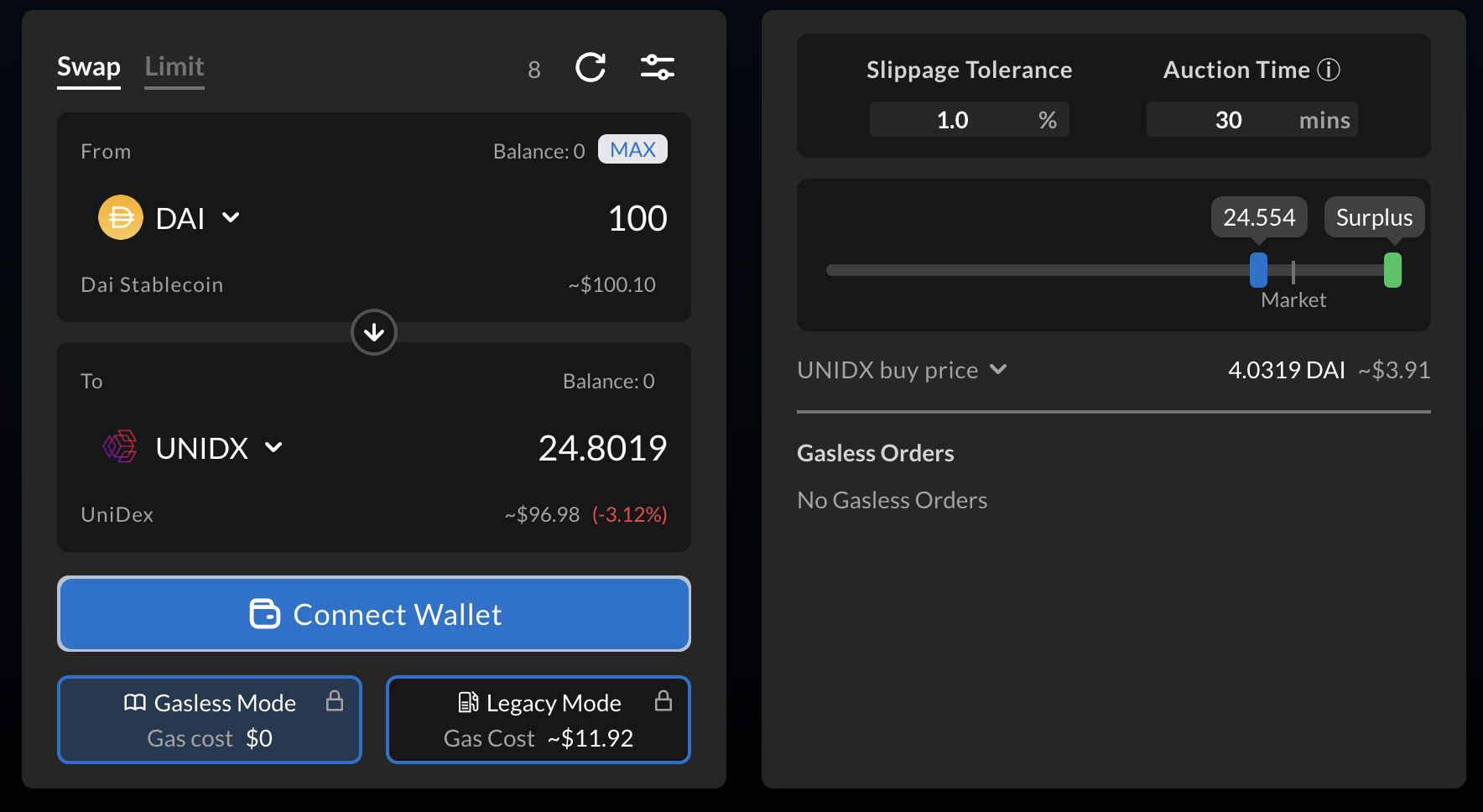

How To Trade With UniDex

Our team found that trading with UniDex is straightforward, with no need to register and login for an account. Below are the easy steps I followed to start trading at UniDex:

- At the top of the website page, press ‘Start Trading’

- Choose whether you wish to spot or margin/leverage trade

- Press the ‘Connect wallet’ button at the top right-hand side of the page

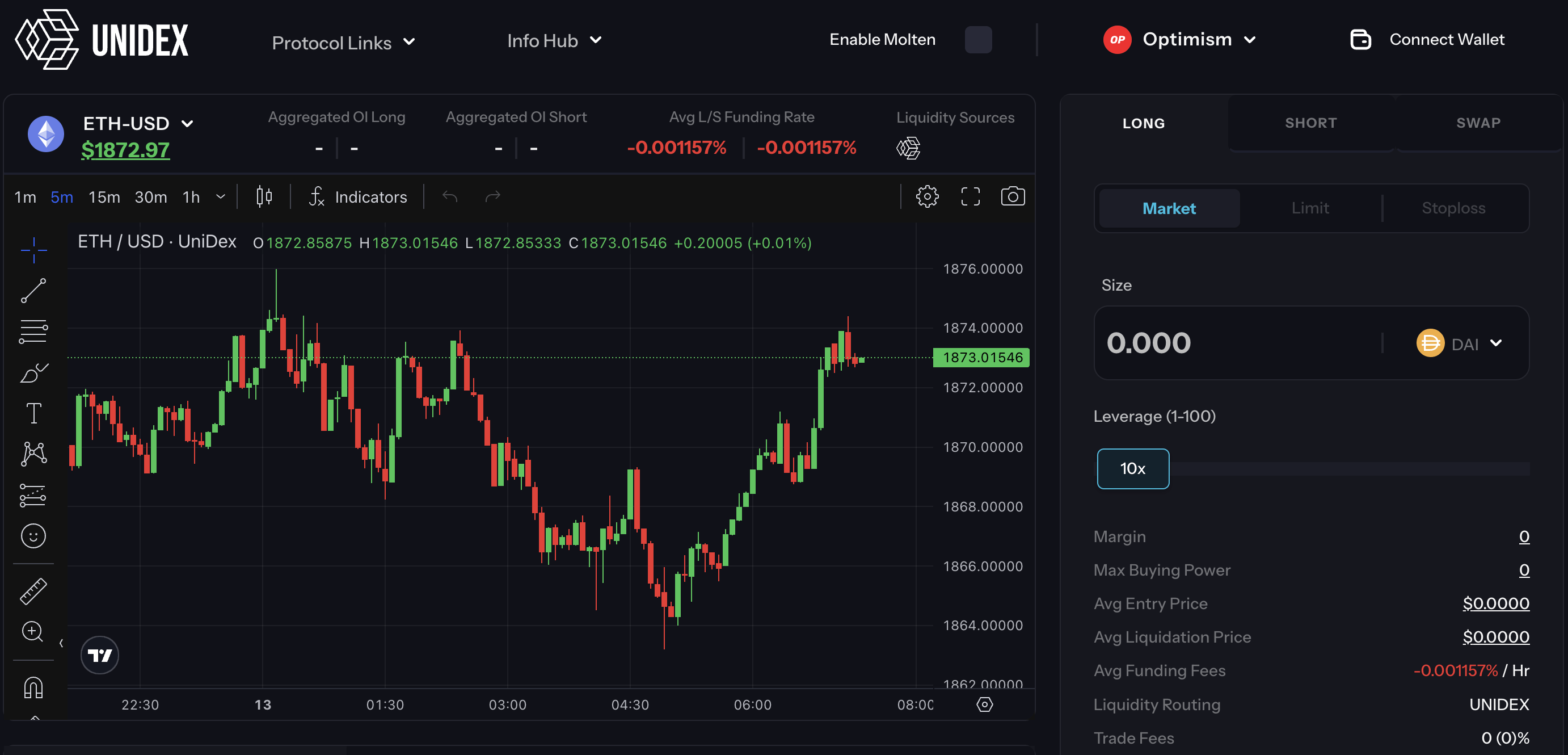

- You can then choose the conditions of the trade. For leveraged trading, you can choose to either go long, short, or a swap trade. Then enter the lot side, the amount of leverage (1-100), and any limit or stop-loss orders.

- For spot trading, simply choose the coin you are purchasing in and the coin you would like to purchase. You can also add limit orders. You can choose to make gasless trades or pay a gas fee on ‘legacy mode’ for more efficient trades. The approximate gas fee is shown before committing to a trade.

- Once your wallet is connected, you can continue to make trades via the Web Portal. There is no app available to download via APK, Windows, or iOS.

We were impressed that there are more than 200 different wallets at UniDex including SafeMoon, Bitcoin.com wallet, Braavos, and SafeStar. This makes the firm more accessible than many alternatives.

Trading Platform

UniDex offers user-friendly leverage and spot trading platforms available via a web browser only. We particularly liked the intuitive charting functions of the leverage platform, with 5 timeframes, 12 chart types and an impressive library of over 100 indicators.

Graphs are powered by respected analysis tool, TradingView, which we found stable and seamless when tested. There is also a decent range of drawing tools, ideal for mapping out various strategies.

Overall, we were impressed with the functionality of the UniDex platforms, though it would be nice to see them offered as an app for mobile and tablet use.

Leverage Trading

Demo Account

We were disappointed to see that UniDex does not offer a demo account. Most brokers offer a demo account with virtual funds to allow traders to practise trading before depositing real money. This would have been particularly useful for beginners who want to try before they buy.

With that said, you can still view and browse the platform directly from the website.

Regulation

Like most other crypto firms, UniDex is an unregulated exchange. Decentralised exchanges (DEXs) are built on blockchain technology and operate without a central authority controlling the platform. This means that traders do not receive the same financial protection as regulated brokers.

As such, we strongly recommend that prospective clients take extra care when trading with unregulated crypto exchanges as your funds may not be protected. Instead, it might be worth considering reputable firms that offers CFD crypto trading.

Bonus Schemes

UniDex does not offer any promotions or bonuses as of 2023.

Extra Tools & Features

Mirai Liquidity Engine

The Mirai Liquidity Engine is the backbone of UniDex. It is the software that allows the exchange to act like an API, communicating between all the protocols and aggregating all financial products.

The advanced engine even aggregates other aggregators, which ensures the system can lift the best prices and put the best routes on the table for users.

UniDexBot

We were impressed that UniDex supports automated trading via its UniDexBot service, like OKX. It works very similarly to other popular automated trading services, the only difference being you need to connect to your wallet instead of making an account.

Deposits need to be made into your connected wallets and fees differ between each wallet. You will have to use a MetaMask wallet or Fortmatic account, then choose a token, set the order details such as price and gas limit, and confirm the trade. After this, simply wait for the trade to be executed automatically.

We liked that this can be done even when you are not online, as the UniDexBot runs on a server. So, even if you group trades and set up multiple trades simultaneously, they can be executed automatically.

Customer Service

We scored the firm down after testing the customer service. Our team found that the UniDex website does have a ‘Contact Us’ section but the service is only available via email address: marketing@unidex.finance.com. Unfortunately, there is no contact number.

The exchange is also active on social media platforms such as Twitter, Discord, and Twitch.

Company Details & History

UniDex is a relatively new crypto trading platform that was developed in 2020 by a group of experienced traders. Led by founder Krunal Amin, UniDex aims to provide users with a platform for digital asset trading.

While specific details about the platform’s operations and physical address are limited, it primarily operates online, making its services accessible to users worldwide. It’s also reassuring to see details of the company’s employees on the website, which is uncommon at crypto exchanges.

UniDex announced plans for a rebranding initiative at the beginning of 2023, however, information regarding the rebranding is yet to be released.

Although UniDex is relatively new and not widely known, it has expanded its operations to serve users in multiple countries, including the UK, USA and Japan.

Should You Trade Crypto With UniDex?

UniDex has the building blocks to be a good DEX. It offers an intuitive user-friendly platform and a very wide selection of tradeable assets.

However, with the lack of regulation and public company information, traders may feel more comfortable with more well-established brands operating in the UK. See our list of the best crypto brokers for recommended alternatives.

FAQ

Is UniDex Legit And Safe?

UniDex is a legitimate trading platform, though its safety cannot be guaranteed due to its lack of regulatory oversight. This means clients do not receive any fund protection measures such as negative balance protection or access to compensation schemes. As such, we urge traders to consider the risks before opening an account with this firm.

Is UniDex A Good Crypto Exchange?

UniDex is a decent exchange compared to other similar brands. Traders can access a strong range of crypto assets and some promising trading opportunities on its intuitive platform. We also like that there are other traditional assets on offer, including forex and commodities, as well as automated trading tools.

On the downside, UniDex offers little in terms of education and operates with little to no regulatory oversight. This raises safety and security concerns.

What Is The Difference Between UniDex Vs Uniswap?

UniDex acts as a multi-trade club, allowing users to trade across various decentralized exchanges (DEXs), centralized exchanges (CEXs), and blockchain networks. While Uniswap is one of the supported protocols on UniDex, it is not the only one.

Is UniDex Good For Beginners?

UniDex is not the best option for beginners, compared to other alternatives. The brand’s products and platforms are quite complex, with comparably high fees, no demo account to practice in, and no educational resources on offer. Instead, consider well-known brands like FXCC and PrimeXBT that cater to novice traders.

What Is UNIDX?

UNIDX is the UniDex native token. It can be tracked in CoinGecko and can be traded on UniSwap and directly through UniDex.

Article Sources

Top 3 Unidex Alternatives

These brokers are the most similar to Unidex:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Unidex Feature Comparison

| Unidex | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $43 | $1,000 | $0 | $0 |

| Minimum Trade | $20 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Unidex Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Unidex | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Unidex vs Other Brokers

Compare Unidex with any other broker by selecting the other broker below.

Popular Unidex comparisons: