Unicorn Forex Review 2025

|

|

Unicorn Forex is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Unicorn Forex |

| Unicorn Forex Facts & Figures |

|---|

Unicorn Forex Broker is an offshore multi-asset broker and prop trading firm. The broker offers several account types with very high leverage up to 1:1000 on the MetaTrader 5 platform. Traders can also access prop trading accounts, plus MAM, PAMM and copy trading opportunities. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | You can access a fairly wide range of CFDs covering forex, indices, stocks, commodities and cryptos with a choice of account types. There’s also flexible leverage rates and access to copy trading solutions for those looking to follow other strategists. |

| Leverage | 1:1000 |

| FTSE Spread | From 1.6 Pips (Standard Account) |

| GBPUSD Spread | From 1.6 Pips (Standard Account) |

| Oil Spread | From 1.6 Pips (Standard Account) |

| Stocks Spread | From 1.6 Pips (Standard Account) |

| Forex | There’s around 100 currencies to trade on STP and ECN accounts, which is a competitive selection compared to other brands. Spreads are the lowest in the ECN Pro account, though this requires a minimum deposit of $1000. There are no additional forex market analysis tools or educational resources. |

| GBPUSD Spread | From 1.6 Pips (Standard Account) |

| EURUSD Spread | From 1.6 Pips (Standard Account) |

| GBPEUR Spread | From 1.6 Pips (Standard Account) |

| Assets | 100 |

| Stocks | Testing uncovered a decent range of US, European and Asian stocks, as well as popular indices. The MetaTrader 5 terminal is an excellent platform for stock trading since it integrates powerful analysis tools. However, the broker provides no additional stock market analysis like other competitors. |

| Cryptocurrency | 300 crypto instruments are supported at Unicorn Forex Broker which are available via spot and futures contracts. You can get started with $10 and pay zero commissions on crypto trades. There are also various crypto deposit methods available with no fees. |

| Coins |

|

| Spreads | From 1.6 Pips (Standard Account) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Unicorn Forex provides CFD trading on currencies, stocks, indices, commodities and cryptos for investors from the UK and around the world. The firm boasts a variety of STP and ECN accounts, alongside copy trading and PAMM/MAM accounts to suit traders and investors of varying abilities and goals. This review of Unicorn Forex will assess the broker’s trading platforms, fees, accounts and more.

Our Take

- Unicorn Forex will appeal to traders looking for high leverage on a wide range of cryptos

- A prop trading program is also available to investors that can demonstrate their skills

- Unicorn Forex has a disappointing lack of education and guidance for less experienced clients

- The broker offers leverage up to 1:1500 on the MetaTrader 5 platform and mobile app

Market Access

We think that Unicorn Forex offers a competitive and extensive selection of trading instruments, covering cryptocurrencies, indices, commodities and more. Our experts found more than 1,4o0 trading symbols and 300 cryptocurrency products on offer. Some of the more popular instruments include:

- 10 Indices: Including the FTSE 100 and S&P 500

- 71 Forex Pairs: Including EUR/USD, GBP/USD and EUR/GBP

- 7 Metal Pairs: Including gold (XAU/USD, XAU/EUR and XAU/AUD)

Other assets include stocks, energies like Brent crude oil and cryptos. We were pleased with the broad range of assets, particularly the number of cryptos, which is impressive relative to other brokers. Clients should find it easy to diversify their portfolios and spread risk across various markets and countries.

Fees

When we used the firm, we found that fees at Unicorn Forex, including spreads and commission, depend on the account type in question. With the Standard account, spreads start from what we think is a decent 1.6 pips, with no commission or swap fees on forex and metals. This were particularly pleased with the lack of swap fees on currencies and metals as this is something our experts do not see very often.

The tightest spreads are on the ECN PRO account, which start from 0.0 pips. However, this account has a commission of £4.50 per lot and, with a £800 minimum deposit, it will be less accessible to novices.

Overall, we found spreads at Unicorn Forex to be generally in line with other brokers. While there are no deposit fees, withdrawal fees apply to most transaction methods. In addition, a 5% charge may be placed on withdrawals if an investor deposits and then makes no transactions or has a low trading volume.

Unicorn Forex Accounts

We have found that Unicorn Forex offers an impressive range of account types, catering to many forms of investing and demonstrating the firm’s intention to provide a competitive service to all clients. However, we feel that the minimum deposit limits on most of these are fairly high, restricting access for lower-net-worth investors.

Standard

- £8 minimum deposit

- Up to 1:1,000 leverage

- Floating spreads from 1.6 pips

- No swap fees or commissions on forex and metals

- Up to £1,600 bonus (20% for the initial deposit and 15% for subsequent deposits)

ECN

- £80 minimum deposit

- Maximum leverage is 1:500

- Floating spreads from 0.8 pips

- Commission from £3.70 per lot

- Up to £1,600 bonus (20% for the initial deposit and 15% for subsequent deposits)

ECN PRO

- £800 minimum deposit

- Maximum leverage is 1:200

- Floating spreads from 0.0 pips

- Commission from £4.50 per lot

- Up to £1,600 bonus (20% for the initial deposit and 15% for subsequent deposits)

PAMM

We were happy to see PAMM accounts offered by Unicorn Forex (also known as percentage allocation money management accounts), which involve investors allocating funds to a money manager that makes trades on the investor’s behalf. The money manager retains full control of the positions. A performance fee is usually paid to the money manager and investors receive a share of any profits or losses.

- No bonus

- £80 minimum deposit

- Maximum leverage is 1:300

- Floating spreads from 0.8 pips

- Commission from £4.50 per lot

MAM

MAM accounts (also known as multi-account manager accounts) are similar to PAMM accounts but investors can set parameters and risk preferences for the money manager to follow.

- No bonus

- £80 minimum deposit

- Maximum leverage is 1:300

- Floating spreads from 0.8 pips

- Commission from £4.50 per lot

Copy Trading

We think copy trading at Unicorn Forex gives investors the most control over their funds (compared to PAMM and MAM accounts) as they have the option to amend and close positions, whilst still benefitting from the experience of others.

- No bonus

- £80 minimum deposit

- Maximum leverage is 1:300

- Floating spreads from 0.8 pips

- Commission from £4.50 per lot

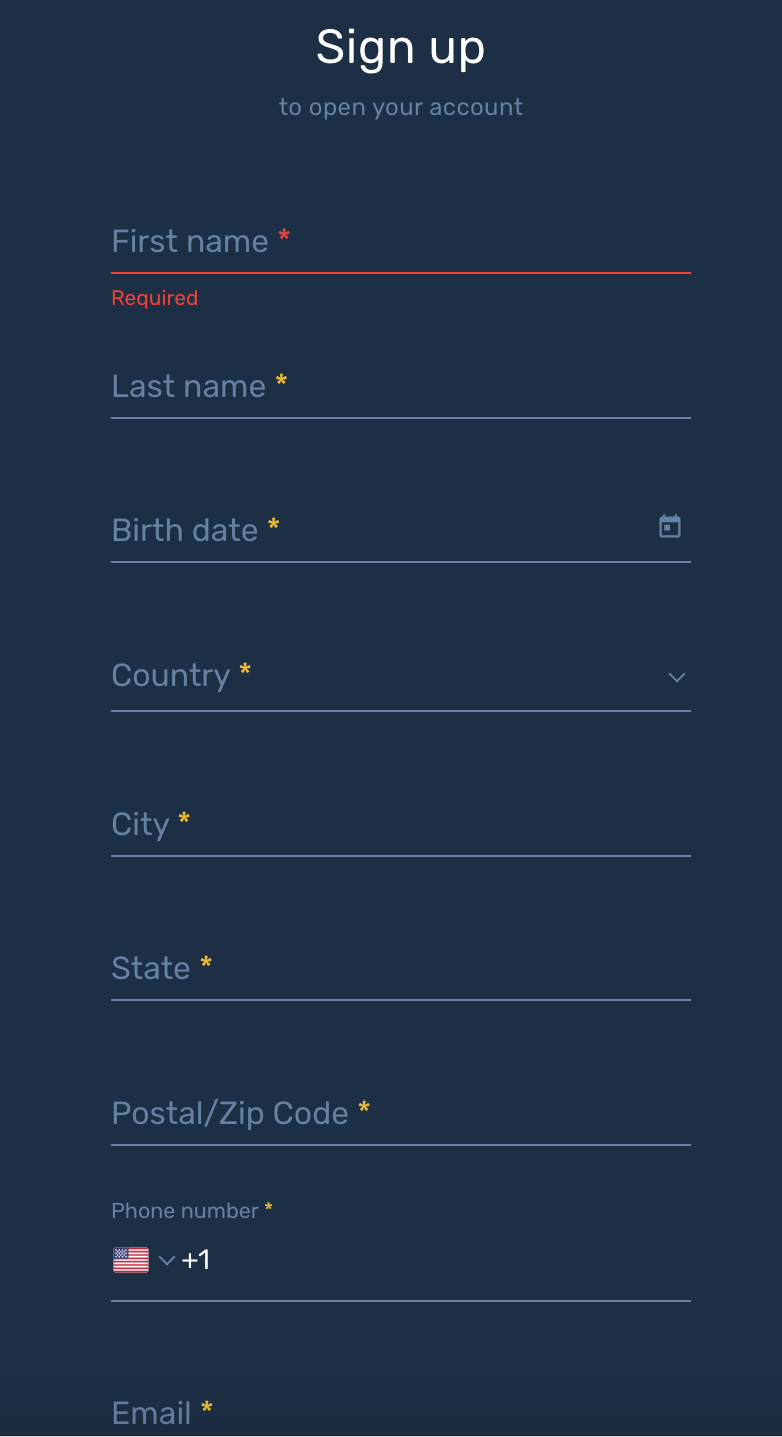

How To Register For An Account

- Click on Open Account

- Enter your details

- Click Continue

- Enter the verification code that is sent to your email address

- Sign in using your login details to access the client portal

Unicorn Forex Registration Form

Funding Methods

Deposits

Our experts found that there are a lot of deposit methods supported by the firm, which is great to see. There are also no deposit fees at Unicorn Forex, though this is fairly standard. Deposit methods are generally instant apart from Western Union, which has a 24-hour processing time and crypto deposits are also dependent on blockchain capacity.

We were happy to see that GBP is an accepted currency for wire transfers, Western Union, Neteller and PayPal.

- NEO

- Dash

- Tether

- PayPal

- Bitcoin

- Litecoin

- Neteller

- Monero

- Ethereum

- Web Money

- Bitcoin Cash

- Binance Coin

- Wire Transfer

- Perfect Money

- Western Union

How To Deposit With Unicorn Forex

- Login to your account

- Click on Funds

- Click on Deposit

- Select the deposit method (and the amount, if requested at this stage) and click Proceed

- Follow the on-screen instructions to complete the deposit (customers may be taken to a third-party website)

Withdrawals

While using Unicorn Forex, we were disappointed to see that several withdrawal methods impose fees. Withdrawal requests are processed on working days Monday-Friday. The processing times of withdrawal methods listed below are 6-48 working hours, although wire transfers are instant. These are relatively quick processing times, although the overall withdrawal time may be dependent on your bank (or the blockchain if using crypto).

We have listed the main withdrawal methods for UK traders and their associated fees below:

- Tether (£5 fee)

- PayPal (2% fee)

- Web Money (2% fee)

- Western Union (5% fee)

- Perfect Money (0.5% fee)

- Neteller (No fee)

- Wire Transfer (No fee)

Regulation

Unicorn Forex (UNFXB Ltd) is regulated by the Financial Services Authority of Saint Vincent and the Grenadines. Offshore regulators like this usually provide fewer protections to investors, such as investor compensation schemes, so traders should understand the risk of choosing such a broker.

However, UNFXB Ltd is owned and operated by UNFXB PTY Ltd, which is itself regulated by more reputable organisations like ASIC and the Canadian NFA.

Trading Platform

We found that MetaTrader 5 (MT5) is offered as the only trading platform by Unicorn Forex. It is one of the best and most popular platforms in the industry, with an excellent range of technical and fundamental analysis features that suit both beginners and more seasoned traders. However, our experts would have preferred to see some alternatives to allow for different styles and approaches to online investing.

In addition to the desktop version, which is available on Windows and Mac, investors can trade through their browsers using the Web Trader. This avoids the need for any software downloads and has most of the same analysis capabilities as the desktop client. Leading features of the platform include:

- 21 timeframes

- 100+ indicators

- Direct access to news

- 60+ technical analysis tools

- Seven order execution modes

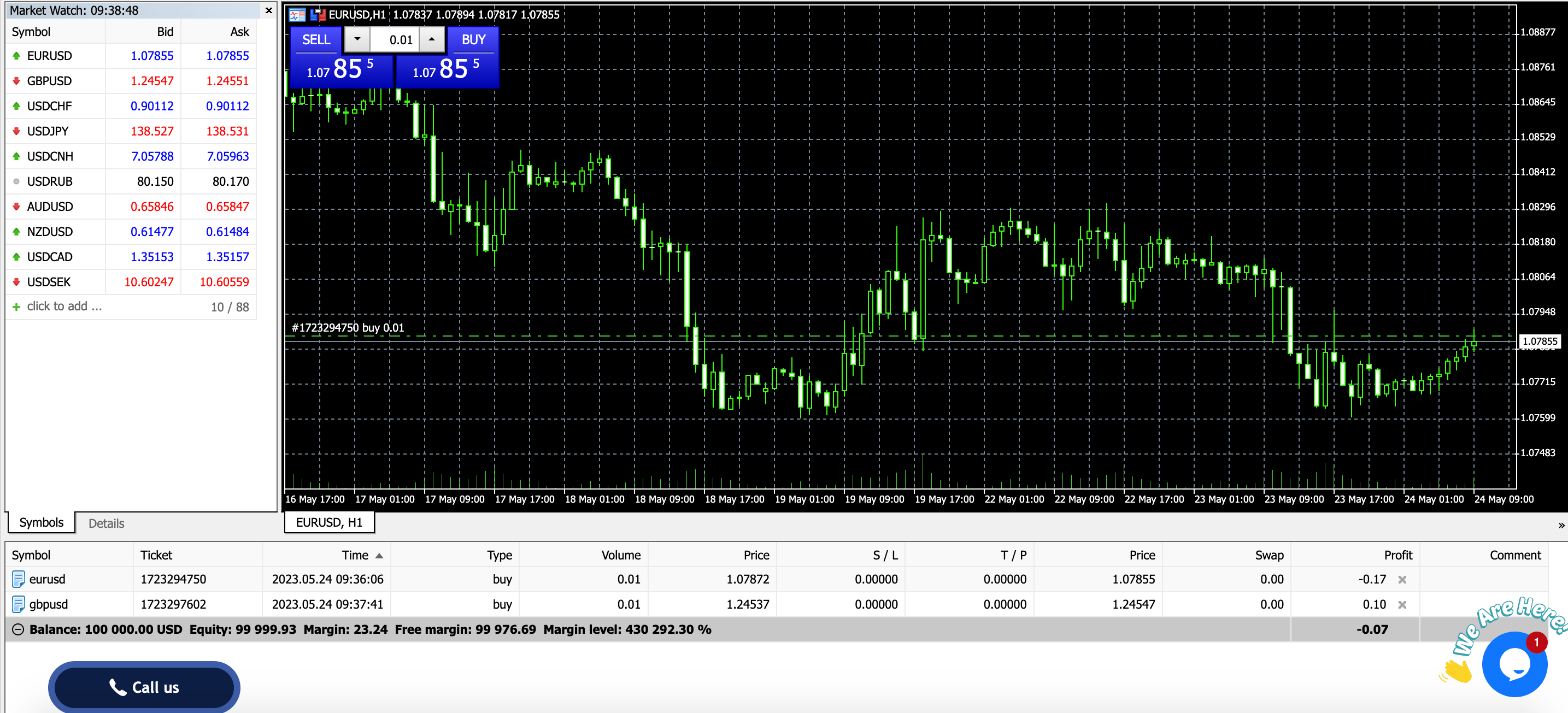

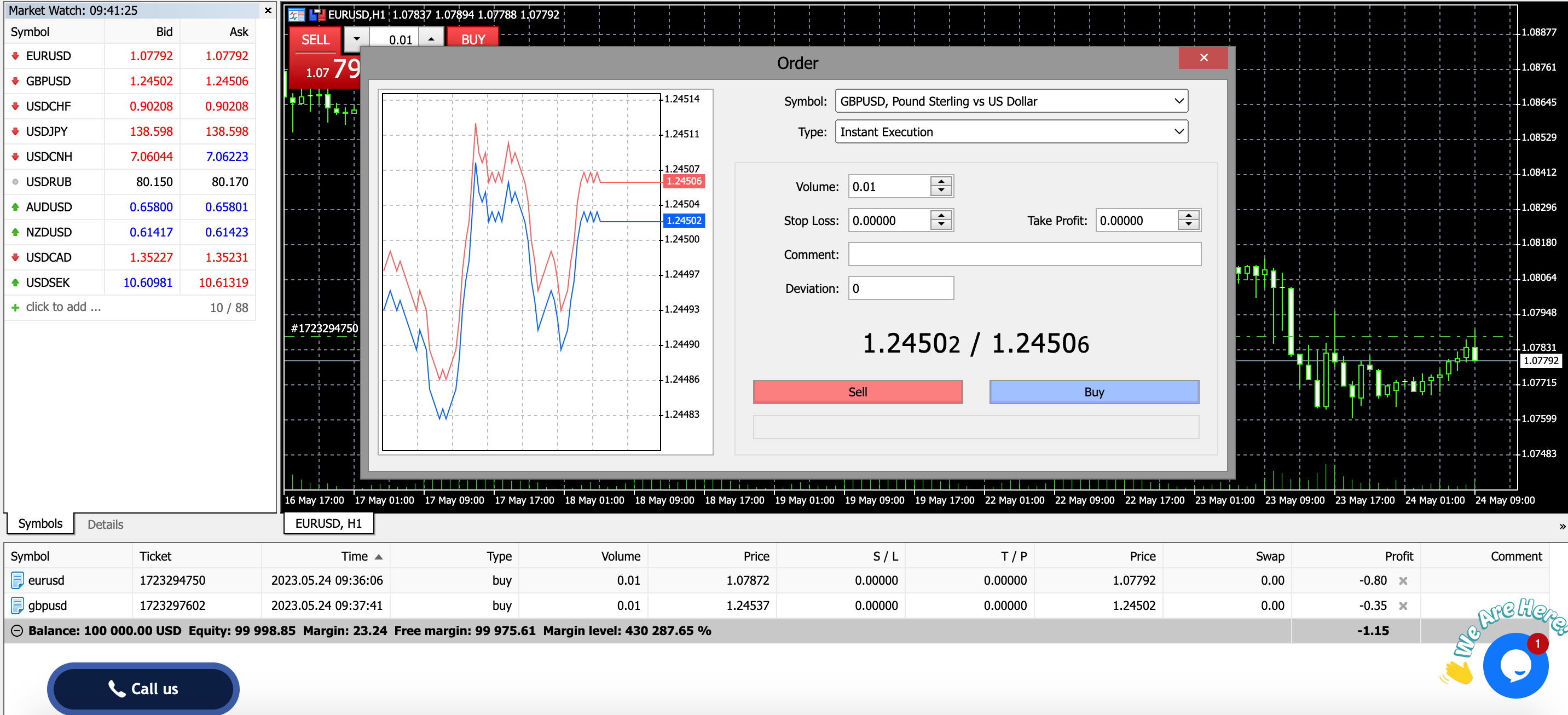

MetaTrader 5

How To Place An Order On MT5

- Right-click on the instrument’s symbol (the list of instruments is on the left)

- Click New Order

- Complete the details including volume and, if necessary, stop loss/take profit

- Press Buy or Sell to complete the order

MT5 Order Placement

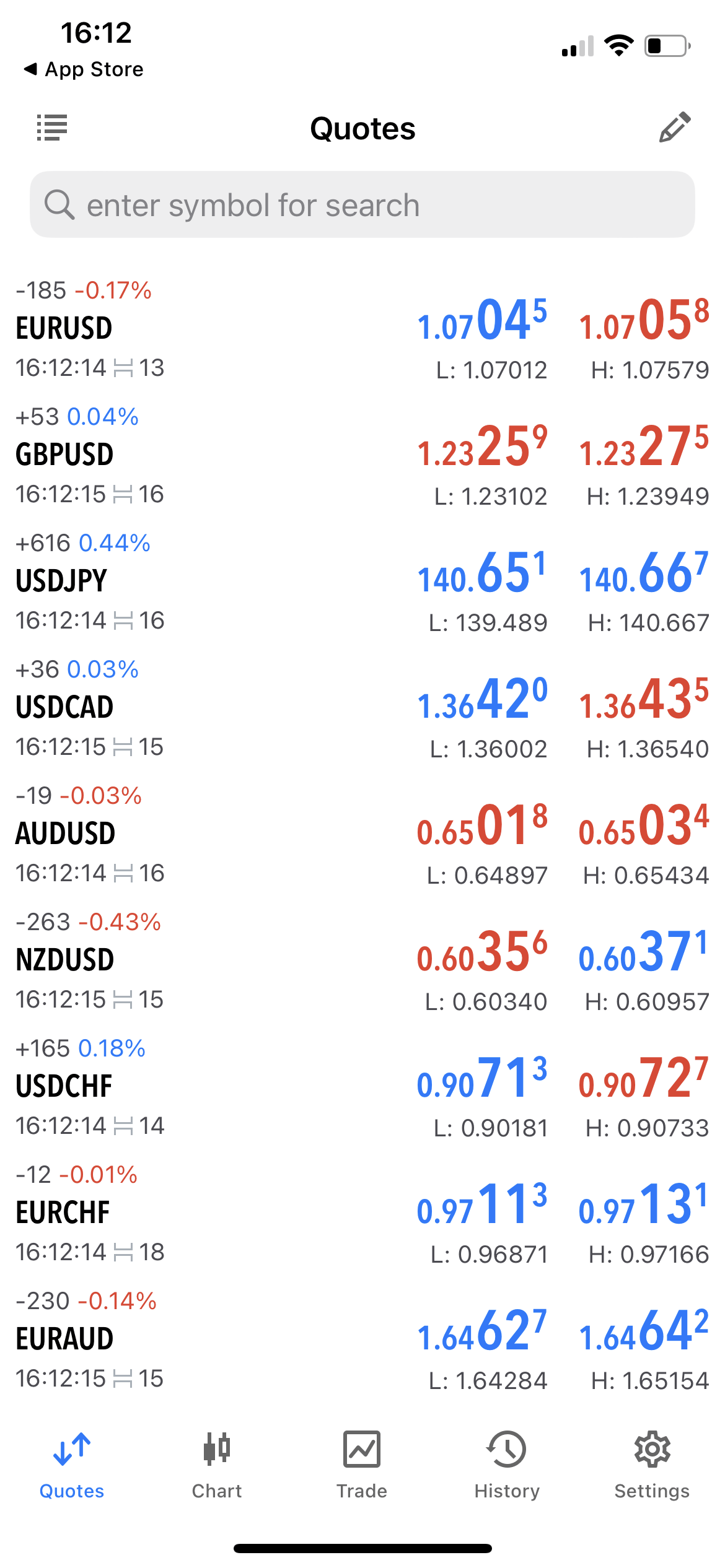

Mobile App

Although Unicorn Forex does not have a proprietary mobile app, we have found the MT5 app (available on iOS and Android) to be more than sufficient for any on-the-move analysis, account management and position placement. This application contains similar features to the desktop version, though with limitations in terms of technical analysis and automation.

Analysing charts can be more difficult on a mobile screen compared to a computer, though our experts believe most investors, whether beginners or veterans, will find the MT5 mobile app to be intuitive and effective.

MT5 Mobile App

Leverage

We found a competitive maximum leverage rate available at Unicorn Forex Broker of 1:1,500, though this is disappointingly only available on the ECN account. This is a maximum limit and individual markets will often have their maximum leverage ratios. For cryptos, for example, the maximum leverage rate is usually 1:10.

We think these rates are very competitive as UK brokers are typically required to limit leverage rates to 1:30 for the most liquid forex pairs, with other instruments capped much lower than this.

Investors should remember that high leverage ratios carry significant risk, although the broker provides negative balance protection.

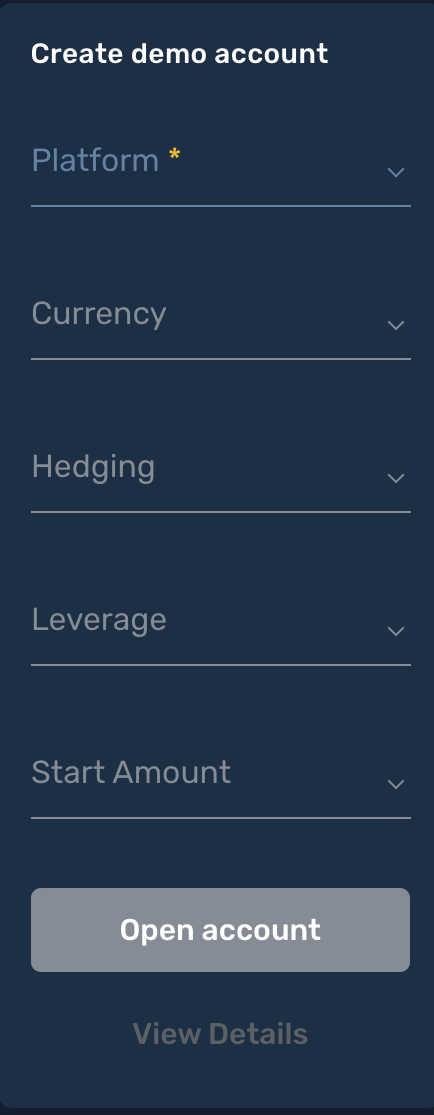

Demo Account

When we used Unicorn Forex, we found an effective demo account offered with the MT5 platform and it only takes a minute or two to sign up through the client portal. Investors can choose their starting account capital, which ranges from £100 to £5,000.

Most reputable brokers have demo accounts these days but they are a key feature for traders of all abilities. Paper trading accounts are helpful for beginners to understand how to make profitable trades. They are also used by more experienced investors to test and refine their strategies.

How To Open A Demo Account

- Login to your account

- Click on Platforms

- Click on MT5

- Fill in the details under Demo

- Click Open Account

Demo Account Registration Form

Unicorn Forex Bonuses

We were glad to see that Unicorn Forex takes advantage of its freedom to offer promotions, which comes with being an offshore-regulated broker. Therefore, it has a current deposit bonus promotion of 20% for the initial deposit and 15% for subsequent deposits, up to a maximum of £1,600.

Recent promotions, some of which are more generous than those at other brokers, have included a 30% deposit bonus for new customers, a £120 no deposit bonus and a lottery promotion.

Remember always to check the terms and conditions carefully as there are often restrictions on the withdrawal of bonus funds.

Extra Tools & Features

When we tested Unicorn Forex, we were disappointed with the lack of educational material. The best brokers have a wealth of learning resources, including video tutorials and webinars, to help investors expand their knowledge. However, this was noticeably missing from this broker’s website, although this is partly compensated by daily market analysis articles with a focus on major forex pairs that provide useful insight into current market events.

Investors that are consistently profitable, and can demonstrate this, may benefit from the broker’s prop trading scheme. This is designed for those in need of extra capital who can show that they are talented investors. In this scheme, additional capital is provided to the trader once they have evidenced their profitability. Profits are then shared between the trader and capital provider. When using the broker’s capital, up to 80% of the profits can be withdrawn.

Unicorn Forex also has an investment fund that traders may wish to contribute to instead of or in addition to the standard markets.

How To Sign Up For A Prop Trading Account

- Register for a live account

- Complete KYC procedures

- Open a prop trading account and pay the fee

- Complete the two-step programme or the one-step 30-day programme

- If successful, you will have access to a prop trading account with a specified amount of capital

Company Background

Our experts discovered that Unicorn Forex is one of the subsidiaries of Unicorn Brokers Holding, which was established in 2016. This is a global no-dealing desk (NDD) broker that offers its services to traders around the world. The company has also won awards in other countries, including ‘Best New Brokerage for Spreads (Turkey)’ at the Global Brands Magazine Awards 2021.

Although we have found limited information relating to the senior management of the brokerage, UNFXB Ltd is regulated in Saint Vincent and the Grenadines by the Financial Services Authority of that same jurisdiction.

The company that owns UNFXB Ltd holds regulatory licenses with the Australian Securities and Investments Commission (ASIC) and the Canadian National Futures Association (NFA).

Customer Service

When we tested Unicorn Forex, we found that it has a range of customer support options including:

- Live Chat

- Telegram

- Callback Request Form

- Email: support@unfxb.com

- Phone: +44 800 5200 072

There are support offices in Australia, Saint Vincent and the Grenadines, Canada and Cyprus. Our experts tested the live chat feature and received a response within three minutes, which is faster than many alternatives.

Trading Hours

Trading hours at Unicorn Forex Broker depend on the market in question, as is the case for most DMA brokers.

Forex is usually available 24/5 Monday-Friday, whereas the hours of other markets like stocks will usually be restricted according to the opening times of the local stock exchange.

Security

While assessing the security of the firm, we were pleased to see that segregated bank accounts are used by Unicorn Forex to ensure that client deposits are kept separate from funds belonging to the firm. This reduces the risk of financial loss if the firm becomes insolvent. However, the offshore status of this broker does mean regulatory oversight will likely not be as robust.

Two-factor authentication (2FA) is also available to enhance account security, although this is not the default. KYC verification is mandatory to make deposits and withdrawals.

MetaTrader 5 is trusted by investors and brokers around the world. It provides a secure trading terminal, for example by ensuring that the exchange of data between the trading platform and the server is encrypted based on 128-bit keys.

Should You Trade With Unicorn Forex?

Unicorn Forex provides a wealth of crypto and CFD instruments on the respected MetaTrader 5 platform. Its offshore status increases the risk for investors, although this also means access to higher leverage rates and more bonuses.

Our biggest disappointment with Unicorn Forex is the lack of educational resources, although those that do not require these may find the broker meets their requirements at a reasonable cost.

Overall, we think that those looking for more trustworthy regulation and guidance for getting started should turn to an FCA-regulated broker with much more accessible services.

FAQ

Is Unicorn Forex Legit?

This broker holds a regulatory license with the Financial Services Authority of Saint Vincent and the Grenadines. The company that owns Unicorn Forex has licenses with ASIC and the Canadian NFA.

Is Unicorn Forex Good?

Unicorn Forex has several good aspects, including a wide range of instruments, reasonable spreads and a low minimum deposit. However, it is held back by its lack of educational material and an offshore regulatory license.

Is Unicorn Forex Accessible To Beginners?

Unicorn Forex has a free demo account and a low minimum deposit of £8, making it accessible to many new traders. However, some novices will be put off by the lack of learning resources.

Are The Fees At Unicorn Forex Competitive?

Spreads on the ECN PRO account start from 0.0 pips and so are very competitive, though this account has a high £800 minimum deposit. Spreads and commissions on other account types are similar to what should be expected elsewhere.

Are There Free Withdrawal Methods At Unicorn Forex?

Yes, the main withdrawal methods for UK traders with no fees are Neteller and wire transfers.

Article Sources

SVG FSA Registration – entity number 2433

Top 3 Unicorn Forex Alternatives

These brokers are the most similar to Unicorn Forex:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Unicorn Forex Feature Comparison

| Unicorn Forex | FP Markets | Vantage FX | IC Markets | |

|---|---|---|---|---|

| Rating | 1.5 | 4 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $10 | $40 | $50 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | ASIC, CySEC, FSA, CMA | FCA, ASIC, FSCA, VFSC | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (UK), 1:500 (Global) | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | ||||

| Review | Unicorn Forex Review |

FP Markets Review |

Vantage FX Review |

IC Markets Review |

Trading Instruments Comparison

| Unicorn Forex | FP Markets | Vantage FX | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Unicorn Forex vs Other Brokers

Compare Unicorn Forex with any other broker by selecting the other broker below.