Triumph FX Review 2025

|

|

Triumph FX is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Triumph FX |

| Triumph FX Facts & Figures |

|---|

Triumph FX offers fixed and floating spread accounts with copy trading, MT4 downloads, and high leverage. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Commodities, Forex, Indices |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs with flexible leverage and multiple accounts and pricing models. |

| Leverage | 1:500 |

| FTSE Spread | NA |

| GBPUSD Spread | From 1.6 pips (Standard Account) |

| Oil Spread | From 1.6 pips (Standard Account) |

| Stocks Spread | NA |

| Forex | Trade currencies with a choice of fixed or floating spreads. |

| GBPUSD Spread | From 1.6 pips (Standard Account) |

| EURUSD Spread | From 1.6 pips (Standard Account) |

| GBPEUR Spread | From 1.6 pips (Standard Account) |

| Assets | 60 |

| Stocks | Trade popular stock indices with a choice of pricing models. |

Triumph FX (TFXI) is an offshore broker specialising in forex trading with competitive spreads and access to a selection of other assets. While our experts like some of the features offered by this broker, there are red flags concerning poor business practices as well as scams. This review will lay out Triumph FX’s fees, markets and features as well as help readers judge whether this is a safe broker to trade with.

Our Take

- Triumph FX could be good for experienced traders looking for low commissions and reasonable spreads

- The broker’s copy trading feature is beginner-friendly and a free demo account is available

- The weak regulatory oversight and lack of additional tools and research is a major drawback

- Negative press and historical scam reports are also concerning and will deter potential traders

Market Access

With a roster of just 100 tradeable assets, we felt that Triumph FX (TFXI) falls behind many competitors who offer clients access to thousands of markets.

While this broker focuses on forex and offers a decent selection of 40+ currency pairs, even this falls short of the 70+ offered by many reputable brokers, such as Plus500.

- Forex: 44 different types of forex pairs such as EUR/USD and GBP/CAD

- Energies: Both UK Brent Crude Oil and WTI Crude Oil CFDs can be traded

- Metals: You can trade gold and silver with Triumph FX, against the Euro and the US Dollar

- Cryptocurrencies: Triumph FX offers Bitcoin, Litecoin, Ethereum, Ripple, and Dash

- Indices: 14 indices including the STOXX Europe 50 Cash Index, UK 100 Cash Index, and S&P 500

Fees

We think Triumph FX’s pricing structure is generally competitive, although they are complicated by a large number of account types with different fees. Clients will be free of hidden charges or account maintenance fees and will instead pay their trading fees through commissions and the spread.

I was pleased to see that Triumph FX does not charge deposit fees and it is even better that the broker promises to reimburse up to the equivalent of $70 of intermediary bank charges for any deposit equal to or above $500. Traders are responsible for covering local bank charges themselves.

For withdrawals, intermediary bank charges are applicable and not reimbursed, and these can range from $25-75. These fees are quite high as many reputable brokers offer free deposits and withdrawals, including wire transfers, for example, XM and eToro.

Commissions & Spreads

The commission fees and spreads with TFXI depend on the type of account you have with the broker and I think this makes the pricing structure unnecessarily complex. The broker offers seven different types of accounts; Standard Fixed, Standard Variable, Premium, Platinum, VIP, Islamic Variable, and Islamic Platinum.

There are no commission charges on the Standard Fixed, Standard Variable, Islamic Variable, Islamic Platinum, or VIP account.

The Premium account has a commission of $6 per round turn, compared to a $3 per round turn commission for the Platinum account.

Spreads are tighter for Premium, (Islamic) Platinum, and VIP accounts – for example, the typical spread for EUR/USD on each platform is 0.6 pips, 0.6 pips, and 0.5 pips respectively. This is compared to a typical spread of 1.6 pips for EUR/USD on the Standard accounts and the Islamic Variable.

Accounts

We do not think Triumph FX’s seven different account types add much value to the brand. Having this many accounts does add some flexibility, with the choice between fixed and variable spreads at various tiers of accounts, but having this many accounts makes it complicated to assess what is on offer. However, I do like that two of the TFXI accounts are swap-free to cater to those of the Muslim faith:

Standard Fixed

- Swap Charges: Yes

- Referral Rebate: Yes

- Leverage: Up to 1:500

- Minimum Deposit: $100

- Community Trading: Yes

- Commission Per Lot: None

Standard Variable

- Swap Charges: Yes

- Referral Rebate: Yes

- Leverage: Up to 1:500

- Minimum Deposit: $100

- Community Trading: Yes

- Commission Per Lot: None

Islamic Variable

- Swap Charges: No

- Referral Rebate: Yes

- Leverage: Up to 1:500

- Minimum Deposit: $100

- Community Trading: Yes

- Commission Per Lot: None

Premium

- Swap Charges: Yes

- Referral Rebate: Yes

- Leverage: Up to 1:500

- Minimum Deposit: $500

- Community Trading: Yes

- Commission Per Lot: $6

Platinum

- Swap Charges: Yes

- Referral Rebate: Yes

- Leverage: Up to 1:500

- Minimum Deposit: $2,000

- Community Trading: No

- Commission Per Lot: $3

Islamic Platinum

- Swap Charges: No

- Referral Rebate: No

- Leverage: Up to 1:500

- Minimum Deposit: $2,000

- Community Trading: No

- Commission Per Lot: None

VIP

- Swap Charges: Yes

- Referral Rebate: No

- Leverage: Up to 1:500

- Minimum Deposit: $5,000

- Community Trading: Yes

- Commission Per Lot: None

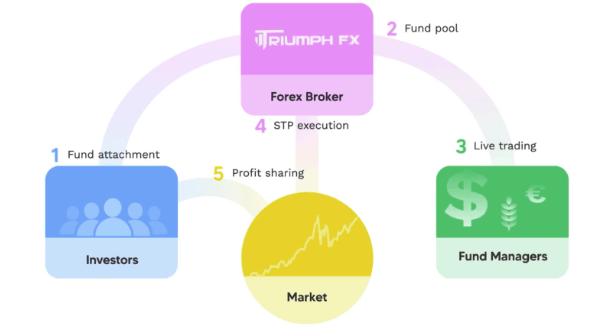

You can also register for a fund-managed account where professional traders make trading decisions for a cut of the profits. Only professional traders who have been invited to manage funded accounts can do this, which should provide some reassurance given the criteria traders must meet to qualify as pros.

To yield a profit when a fund manager does, investors will need to first stake TFX tokens (the Triumph FX cryptocurrency) for a minimum of 7 days. After this, investors can choose to attach funds to a customised crypto token (a crypto token customised by a fund manager, so any profit that is gained by the fund manager on this token is also made by you). CCT that is attached must be equal to or less than the amount of TFX tokens you originally staked.

Triumph FX promises clients decent interest of up to 24% on their staked tokens, and it is good to see that these are paid in USDT. Nevertheless, this system ties customers into the broker’s native cryptocurrency to access fund management services and could leave them exposed if the price of these tokens crashes.

Below is a diagram indicating the process of managed account – where you are the investor.

Managed Account

Community Trading

I was pleased to see community trading included with Triumph FX, as we think this is an excellent, beginner-friendly feature. It allows those with minimal trading experience to choose a real trader whose trading decisions they wish to copy.

With TFXI you can choose from a list of providers and copy their trading movements. 90% of any profit you make from using the community trading feature is yours, the remaining 10% is given to the provider.

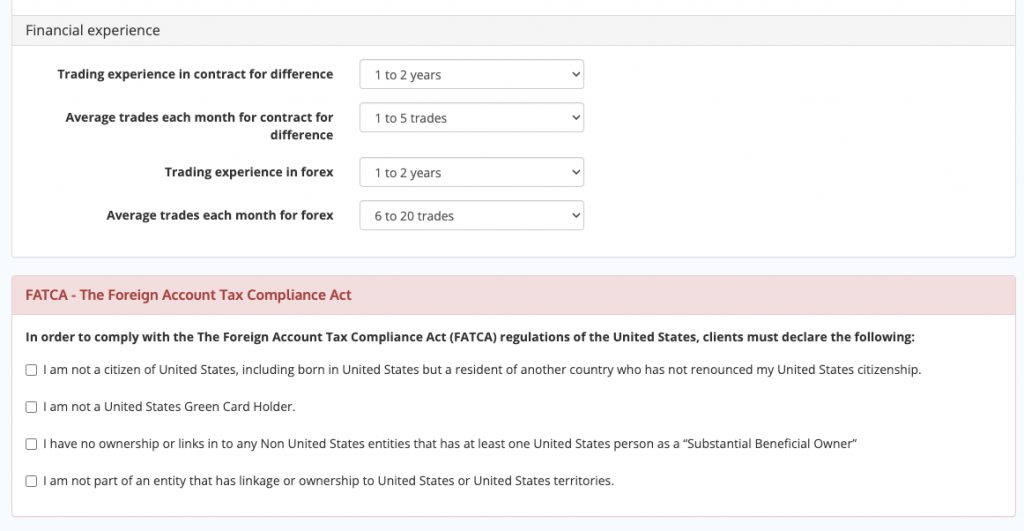

How To Register With Triumph FX

- Press the ‘Register’ button at the top, right side of the screen on the Triumph FX website

- Enter your first name, last name, nationality, phone number, and email address

- Provide passport, ID, proof of residence, financial/employment information and other necessary personal information to complete KYC verification and access a full account

- Confirm compliance with The Foreign Account Tax Compliance Act (FATCA) regulations of the United States (required for all applicants including UK residents)

- Input the ID of the account you were referred to if applicable

- Provide information on your trading experience and expected trading volume and deposit

- Wait for your details to be verified and approved. Login details upon approval will be sent to your email address

Registration Form

Funding Options

We are happy with the choice of payment method on Triumph FX, which allows users to make payments via bank wires, credit cards, cryptocurrencies, and e-wallet payments like Alipay. Minimum deposits depend on the account type and deposits take 2–3 working days from the day the funds left your bank account. Unfortunately this is fairly slow vs alternatives.

Sadly, Triumph FX only allows withdrawals via bank transfer, which I thought was a letdown. The withdrawal time of this method is generally slower than online methods at 2–5 working days. It is not difficult to find many other brokers that accept withdrawals via a lot more channels, for example, XM accepts withdrawals via bank transfer, Neteller, and Skrill.

How To Make Withdrawals On Triumph FX

- Login to your Traders Room account

- Press the ‘My Account’ button

- Click ‘Withdrawals’ then ‘New Withdrawal’

- Fill out withdrawal information, including bank address, bank country, SWIFT code, and reason for withdrawal

- You can also upload a file for approval should you need to

- Complete the withdrawal

Trading Platforms

TFXI uses MetaTrader 4, and while this is an excellent platform with a huge following, we prefer to see brokers offer more than one platform option. We would have liked to see a bespoke terminal or additional third-party platforms to increase the choice available to Triumph FX traders.

The MT4 platform offers traders the ability to personalise various aspects, such as chart layouts, indicators, and trading templates, according to their preferences.

Moreover, MT4 supports automated trading through the utilisation of Expert Advisors (EAs), enabling traders to automate their strategies and streamline their trading processes. It also provides the valuable functionality of back-testing strategies using historical data directly within the platforms.

Triumph FX App

Triumph FX offers a mobile app available for both Apple iOS and Android users and our tests found it to be a convenient and flexible way for traders to manage their portfolios.

The Triumph FX app allows traders to quickly check their account balance and status, but also provides access to the MT4 platform, allowing traders to monitor their positions and stay connected to the market while on the go.

Although the app does not support the execution of new trades, it offers a view of open positions, enabling TFXI traders to stay informed about their investments. It also allows them to close their open positions, which is extremely useful since it means they can quickly react to market conditions as they occur.

Additionally, the app features a user-friendly client portal. This portal allows traders to perform various account-related functions, including making internal transfers between multiple accounts. This process enhances the management of funds and simplifies account administration.

Leverage

The maximum leverage TFXI offers is 1:500 for all accounts, although it does recommend beginner traders limit their leverage to 1:50. This is because higher leverage comes with a higher risk of loss.

Demo Account

I was happy to find that Triumph FX allows users to test out the MT4 platform and practise their trading strategies via a demo account with all the same features as live trading.

How To Open A Demo Account

The easiest way to open a demo account with TFXI is to go onto the homepage of the website, scroll down, and press ‘Try Demo’.

- Press ‘Try Demo’

- Enter your name, email, phone number, and country of residence

- Choose the leverage for your forex and the initial demo deposit of up to 1,000,000 in paper funds

- You will be emailed login details (account number and password) to use either on the WebTrader (just select TriumphFX-demo as the server), or when you download MT4

Is Triumph FX Regulated?

Triumph FX operates under the regulation of the Financial Services Authority (FSA) of Seychelles, with license number SD080. Registered as a securities dealer under Triumph Int (SC) Ltd, it is important to note that it is not regulated by the Financial Conduct Authority (FCA), which is the renowned regulatory body in the United Kingdom. The FSA of Seychelles oversees Triumph FX’’s operations and grants them a license number.

While the regulatory framework in Seychelles may not hold the same level of reputation and stringency as that of the FCA, it still provides a certain level of security to traders. The FSA of Seychelles aims to ensure fair and transparent financial practices within the jurisdiction.

TFXI does this by offering traders negative balance protection, providing the FSA with an audited financial statement annually, and keeping client and company funds in segregated and secured bank accounts.

Bonus Deals

TFXI offers several bonus and reward schemes, which we are sure will appear attractive to many investors. The LOR scheme allows traders to gain 100 points for every lot traded, and the broker sometimes offers ‘early bird’ or similar promotions that increase the points per lot trades. Points allow traders to redeem gifts ranging from deposit bonuses to electronics.

Extra Tools & Features

Having tested Triumph FX’s extra features, I feel there is not much on offer to satisfy active traders. The educational content covers fairly basic topics, and the blog has some nice points but does not stand out compared to the top brokers.

YouTube

The Triumph FX YouTube account has a range of educational videos which are clear and well-formatted, covering topics including guides to using the platform for technical analysis.

The videos are well produced, but the educational content tends to be fairly basic, answering questions like ‘What Is Forex?’ or ‘What Is GDP?’. The ‘Educational Series V’ seems to be the most valuable, explaining some basic strategies such as how to use news, trend lines, or the price action strategy.

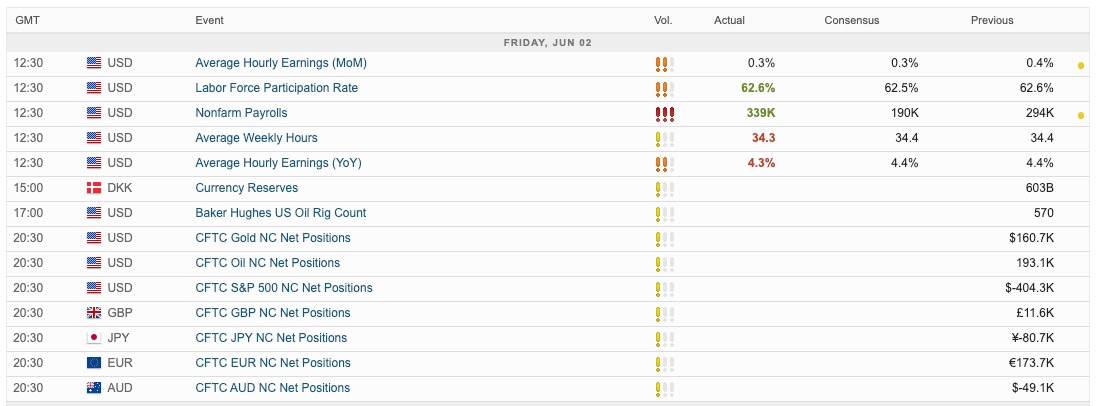

Calendar

TFXI offers an economic calendar which covers all upcoming political events and release dates for macroeconomic data such as GDP reports and unemployment statistics.

Economic Calendar

Blog

The website has a ‘Market Analysis’ section run mostly by an author under the name ‘Dean’, and TFXI. Dean uploads motivational tips and some detailed explanatory blog posts about drivers of exchange rate swings, the impact of AI on forex, and monthly wrap-ups.

The monthly wrap-ups are the most useful as they offer insightful information on some of the most significant events influencing financial markets. They cover crucial aspects such as notable price movements and provide a comprehensive analysis of the reasons behind them.

Customer Service

We were not impressed with Triumph FX’s customer service, which we found to be slower than other brokers. They are only available via email or ‘Support Ticket’, with no live chat or contact number, making it very difficult to get a quick response in the case of an urgent question.

There are two email addresses to contact:

- For applications: application@tfxi.com

- For support when logging in: support@tfxi.com

Support Tickets are essentially emails but they are sent from the Trading Room. They can take from 2–3 business days to process.

Company History

TriumphFX (TFXI) has a complex history that raises concerns about its credibility and practices. The broker has been in operation for over a decade, but around August 2022, clients started to experience withdrawal issues. Suspicions also emerged that TriumphFX might be involved in a multi-level marketing (MLM) or Ponzi scheme. Numerous clients reported unresponsiveness from customer services and said they had been locked out of their accounts.

Additionally, there are reports online stating that a director of Triumph FX is Singaporean Leong Koon Wah, who was reportedly charged for his involvement in a Ponzi scheme centred around a brand named ‘Singliword’ in Malaysia in 2018.

The charge sheet noted that Leong was the director of a financial company called Triumph Global, which press reports state was integral to the Ponzi scheme he was charged over. This site had the same ‘TFXI.com’ web address as Triumph FX, which is suspected to be the same company under a new brand name. It is also noteworthy that the company TFXI trades under, Triumph International Ltd., was reportedly de-registered by the Vanuatu Financial Services Commission in 2021.

While we could not uncover more detailed information on the outcome of Leong’s charges, we do feel the press reports present a red flag and we therefore advise traders to be cautious. Besides the risk that TFXI is associated with scammers, users on forums have also complained about slow server performance and frequent server downtimes, leading to difficulties in executing trades and managing their accounts effectively.

Should You Trade With Triumph FX?

Triumph FX offers an acceptable range of products and uses a reliable trading platform in MT4, but we urge traders to be very careful about investing money in this brand due to the questions raised by press reports of historical scams. In any case, there are excellent brokers with very positive reputations on the market, and many of these offer a wider selection of tradeable assets with better trading terms, plus far better customer services and extra features. As a result, this brand doesn’t really offer anything to entice traders.

FAQ

Is TFXI Legit?

There has been no confirmation on allegations of Triumph FX being a scam. Some clients say they have had a safe and positive experience with the broker, whilst others say the opposite. However, it does not seem wise to take the risk when there are excellent brokers with strong reputations such eToro, Pepperstone, and XM.

What Is TFXI Vs Triumph FX?

TFXI is the same as Triumph FX. The first is just an acronym for the full broker’s name.

Can I Participate In Copy Trading With TFXI?

Yes, Triumph FX offer community and copy trading. Providers of copy trading take 10% of the profits from the users who copy their trades.

How Do I Withdraw Money From TFXI?

Unfortunately, Triumph FX only offers withdrawals via bank transfer, which can take 2 – 5 days to process. After logging in to your client portal, go to ‘Withdrawals’ and then complete the withdrawal information, including bank details, SWIFT code and reason for your withdrawal. Note that if you encounter any withdrawal problems, the only available methods of contact are via email or support ticket.

Are There Any Withdrawal Fees For Triumph FX?

Yes, there are intermediary bank fees when withdrawing with TFXI, as they only accept wire and bank transfers for withdrawals. These range from $20-75.

Article Sources

Straits Times News Report – Fraudulent Trading Scheme

Triumph FX FSA Seychelles License

Top 3 Triumph FX Alternatives

These brokers are the most similar to Triumph FX:

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Triumph FX Feature Comparison

| Triumph FX | IronFX | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 1.8 | 3.8 | 4 | 4 |

| Markets | CFDs, Commodities, Forex, Indices | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $100 | $100 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA | CySEC, FCA, FSCA, BMA / Bermuda | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | Triumph FX Review |

IronFX Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| Triumph FX | IronFX | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | No | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | Yes |

Triumph FX vs Other Brokers

Compare Triumph FX with any other broker by selecting the other broker below.

Popular Triumph FX comparisons: