Online Trading For Beginners

Online trading allows individuals to speculate on popular financial markets, including stocks, forex and commodities. Users can place trades through UK-regulated platforms and apps, requiring just an internet connection. This guide to online trading explains the basics, from the different products and services to tips and strategies for beginners.

What Is Online Trading?

Online trading provides straightforward and low-cost access to global markets.

Historically, if an individual wanted to buy a FTSE-listed stock, they had to ring a brokerage who would manually put in the request. The firm would communicate the price, agree on the details with both parties, and place an order on the stock exchange. This was time-consuming and relatively expensive.

Today, online trading platforms allow users to quickly buy and sell financial products through the internet, reducing the role of the intermediary. Traders can analyse financial markets, place trades and manage their accounts from a computer or mobile device.

Market participants such as hedge funds, banks and retail traders mainly trade online for two reasons: speculation and hedging.

- Speculation is used by retail traders to predict the movement of various assets, such as stocks, forex, and commodities. A key attraction is that speculating is suitable for short-term trading strategies. Correct market forecasts can see traders generate profits over a short period.

- Hedging is widely used by banks and institutions to hedge against risk exposure. It is generally done by trading assets that move or pay out inversely to each other. Retail traders can also employ hedging techniques to offset any losses, in case their other positions decline.

Top 3 UK Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Best UK Brokers and Trading Platforms

Ways To Trade Online

Online trading gives you exposure to the financial markets by, either investing in stocks for instance, or trading derivative products such as CFDs, spread bets, and futures.

Popular investment vehicles include:

Contracts for Difference (CFDs)

A CFD is an agreement between a buyer and seller to exchange the difference in the opening and closing prices of an underlying asset.

CFDs are leveraged derivatives, meaning they are traded on margin. Leverage trading allows you to open a larger position while only putting down a small percentage of the total value as a deposit.

CFDs are available across a range of online trading assets, including forex, commodities, stocks, indices and cryptocurrencies.

Top CFD brokers in the UK include Pepperstone, XTB and CMC Markets.

Spread Bets

Spread betting involves tracking the value of the underlying asset by betting a certain amount of capital per point of price change (the ‘stake’). For every point in the right direction, you earn profit. Conversely, every point that moves against you is a loss.

Spread bets give you exposure to a market without taking ownership of the asset. They can also be leveraged.

In the UK, online trading with spread bets are considered tax efficient, as they are exempt from both capital gains tax (CGT) and stamp duty.

Leading spread betting brokers in the UK include AvaTrade and City Index.

Futures

Futures contracts allow you to buy or sell securities or commodities for a set time and price in the future. Typically, futures are used for hedging purposes or to speculate on prices prior to expiration.

Futures are traded on futures exchanges such as the Chicago Mercantile Exchange (CME) and are offered at several UK online trading brokers including IC Markets and Forex.com.

Often, brokers will offer CFDs or spread bets on futures contracts, which means you can speculate on the price of a future without taking ownership of the asset. You can trade index futures, such as the E-Mini S&P 500, or commodity futures such as oil or gold.

Binary Options

Binary options are derivative products offering two possible outcomes of a ‘yes’ or ‘no’ proposition. If the binary option expires ‘in the money’, the trader will receive a payout; if the option expires ‘out of the money’, the trader loses the entire investment in the trade.

All binary options have an expiry time, generally ranging from 30 seconds to 1 hour, making them a popular choice for short-term traders.

Investors should note that regulated UK brokers are prohibited from providing binary options to retail clients, due to the high level of risk involved. As such, UK investors will need to sign up with offshore binary options brokers.

Share Dealing

Share dealing, or stock trading, involves the buying and selling of a company’s shares, such as Amazon (AMZN) or Twitter (TWTR). Investors aim to build a portfolio to either make a profit from successful investments or earn income from dividends.

Share dealing is generally a long-term trading strategy where you hold your investments in a ‘stocks and shares account’, such as an ISA. Typical products to invest in include publicly listed companies, ETFs and Investment Trusts.

In the UK, there are two main stock exchanges on which you can buy and sell shares: the London Stock Exchange (LSE) and the Alternative Investment Market (AIM).

Popular share dealing brokers in the UK include IG Index.

Key Markets

These online trading vehicles give you access to a range of international markets:

- Forex – Forex involves the buying and selling of national currencies, available in spot and derivatives markets. Some of the most traded currency pairs include EUR/USD, USD/JPY and GBP/USD.

- Commodities – Investors can trade commodities such as raw materials, and agricultural or mining products. Popular commodities include gold, oil, coffee and sugar.

- Stocks – Stocks represent the shares in the ownership of a company such as Tesla (TSLA) or Meta Platforms Inc (META). The London Stock Exchange (LSE) lists 3,000+ companies, ranging from small businesses to large multinationals.

- Exchange Traded Funds (ETFs) – ETFs are baskets of securities traded on stock exchanges. These can be a collection of bonds, stocks, commodities or indices. Popular ETFs include the Vanguard S&P 500 ETF and the ProShares UltraPro QQQ.

- Indices – Indices track the performance of a group of assets on an exchange. For example, the FTSE 100 tracks the largest 100 blue-chip companies on the London Stock Exchange. The NASDAQ (US Tech) tracks the 100 largest non-financial companies in the US.

- Cryptocurrencies – Cryptocurrencies are digital currencies where transactions are verified on a decentralised exchange. Top assets include Bitcoin, Ethereum and Tether.

Online Trading Vs Long Term Investing

Whilst the end goal might be the same, the main difference between the two approaches is the timeframe in which trades are executed.

Online trading typically refers to any strategy that involves buying and selling assets within minutes, hours or days. Popular techniques include day trading, scalping, and swing trading. These fast-paced strategies are attractive among traders who enjoy making forecasts on short-term price movements.

Investing generally refers to buy-and-hold approaches where trading securities, for example, spans months or years. These strategies focus mainly on the long-term performance of assets, rather than daily swings in price, for instance. Long-term investing platforms, such as Interactive Investor, also usually offer a slightly different suite of products, such as ISAs and SIPPs.

How To Open An Online Trading Account

The sign up process varies between online brokers, however it typically involves:

- Choose a broker – Using our tips below, make a top 5 or 10 list of the best online trading platforms and apps that suit your requirements. Consider trading conditions, asset availability and the broker’s overall reputation. Alternatively, choose from our list of best online brokers, collated by experts.

- Complete an application form – When you apply, the broker will typically request basic contact information and ask you to create login details. Some platforms may send a short quiz or questionnaire on the individual’s perception towards online trading to help determine their requirements and risk appetite. ID verification and proof of address will also normally be required.

- Make a deposit and start trading – Once registered, you are free to log in and browse your new trading account and platform. You will need to fund your account with one of the supported payment methods, taking into account any minimum deposit requirements. Once the funds are available in your account balance you can start trading online.

How To Compare Online Brokers In The UK

With hundreds of online brokers available to UK traders, there are several key areas to assess firms in:

Assets & Markets

The financial markets you want to speculate on and the vehicle you use to do so are key considerations.

Top-rated online brokers provide access to UK, US and global stocks and indices, major, minor and exotic forex pairs, plus hard and soft commodities like gold. Offshore firms may also provide online trading on cryptocurrency, though UK traders will receive limited legal protections.

The vehicles you can use to speculate on markets also vary between online brokers. CFDs, spread betting and binary options are particularly popular with short-term traders.

Less common assets and markets include futures, options, bonds, and ETFs.

Fees

A quick review of the broker’s pricing model will determine what spreads you can expect for popular assets, as well as any commissions on trades.

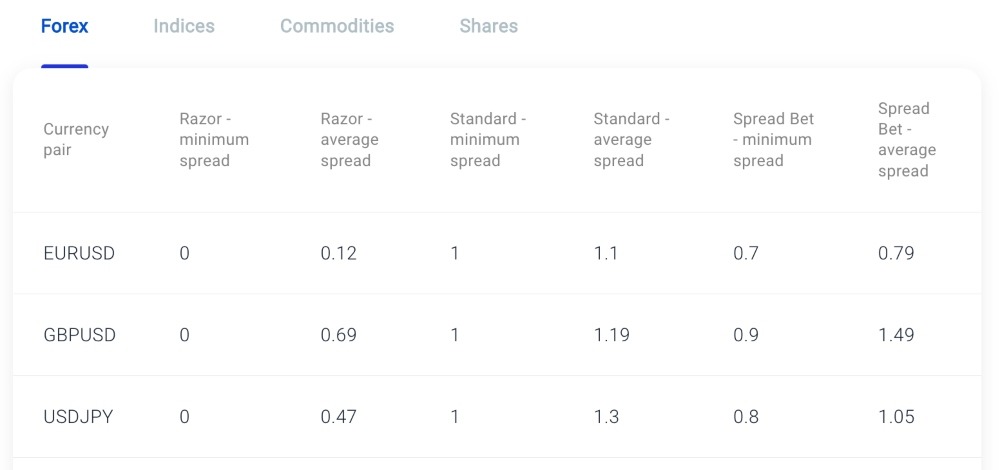

Competitive online brokers will offer tight spreads from 0.0 pips with deep liquidity. Commissions are also often charged on CFD trades. Pepperstone, for example, has a 1.19 average spread (Standard) on the GBP/USD or a 0.69 average spread (Razor) plus a £2.25 commission per standard lot per side.

There may also be other fees to look out for, including swap rates, deposit and withdrawal fees, plus inactivity charges.

To make sure you are trading with an affordable broker, see our list of brokers with the lowest fees.

Pepperstone Spreads

Account Types

Most online trading brokers will offer a choice of accounts depending on your experience level or the execution system, such as ECN and STP.

Some firms also offer Islamic accounts for Muslim traders and professional accounts for experienced investors.

Key things to look for are the minimum deposit and profiles denominated in GBP. Beginners may also want to check that micro-lot trading is available.

Platforms & Apps

The broker’s platform and/or mobile trading apps will be the hub of your online trading activity, so it should be intuitive, user-friendly, and offer the features you need for technical and fundamental analysis. Also consider the platform charting tools that you require when doing your comparison.

Many online brokers today offer MetaTrader 4 and MetaTrader 5, as well as their own proprietary online trading solutions. These are typically available via desktop software, web browsers and mobile apps, downloadable on iOS and Android devices. This allows you to trade on the go anywhere with an internet connection.

Payment Methods

UK brokers offer a selection of well-known payment methods, as well as options to fund your account in various currencies, including GBP.

Popular payment methods include wire transfers, debit cards, and e-wallets such as PayPal, Neteller and Skrill.

Also check for any transaction fees and payment timelines. Deposits are usually processed instantly, though account verification may be required first. Note that there may also be a minimum deposit requirement, which can vary. For example, AvaTrade requires an initial $100, whilst XTB lets you start online trading with no minimum deposit.

UK Regulation

For British traders, we recommend using brokers licensed by the Financial Conduct Authority (FCA). Regulated online trading brokers offer the highest level of financial protection, including negative balance protection and compensation up to £85,000 under the Financial Services Compensation Scheme (FSCS).

Look out for the FCA logo or the Firm Reference Number (FRN) at the bottom of the online trading brokerage’s website to verify their legitimacy.

Education & Tools

Top-class brokers provide free trading resources suited to all levels. This might include copy trading, signals, analyst insights, integrated economic calendars, and access to online analytical tools such as TradingView.

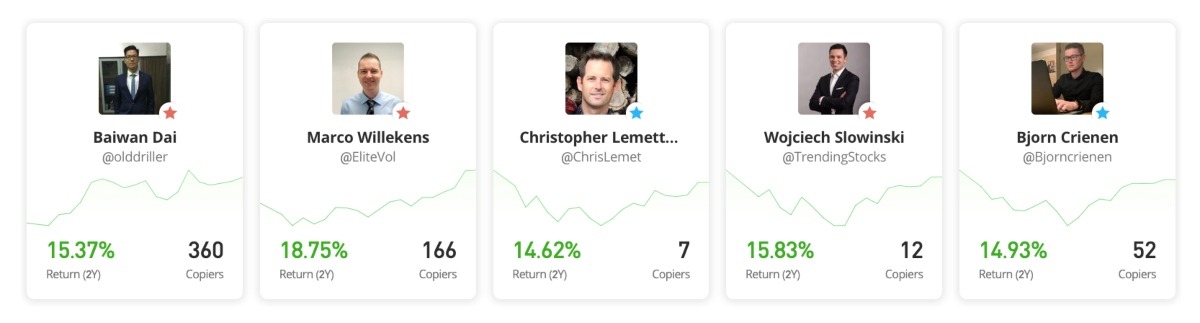

Copy trading, in particular, is proving popular with UK investors, offering a hands-off approach to online trading whereby individuals mirror the strategies of profitable traders.

eToro Copy Traders

Other useful resources include online trading academies, forex forums and discussion groups, video tutorials for beginners, e-books and access to news channels.

Customer Support

Accessible and responsive customer support is useful, particularly for newer traders. The best online brokers will offer advice and support via live chat, ideally handled by humans rather than robots. A telephone helpline, email address, and social media assistance are also usually provided.

Also check the opening hours. Top-rated online trading brokers in the UK, such as CMC Markets, offer 24/5 or 24/7 assistance.

Trading Hours

Most brokers facilitate online trading when the respective market is open, for example, from 08:00 to 16:30 Monday to Friday on the London Stock Exchange. You should also make note of any market holidays when exchanges are closed, which can be found on their respective websites.

Other markets such as forex run around the clock. Some online trading platforms also offer out-of-hours and weekend trading. For instance, IG Index offers extended hours on USA and German stocks, as well as weekend trading, so you can trade 24/7.

Is Online Trading Regulated In The UK?

Online trading is regulated by the Financial Conduct Authority (FCA) in the UK. The financial body imposes various regulations on platforms to support the financial safety and security of their clients. Measures include:

- Negative balance protection, to prevent retail trading accounts from falling into negative equity.

- Reimbursements up to £85,000 under the Financial Services Compensation Scheme (FSCS) if the company goes into liquidation.

- Restricting the sale of CFDs to retail clients, as per European Securities and Market Authority (ESMA) guidelines. This includes limiting leverage to 1:30, automatically closing out positions that fall to 50% of a margin requirement, and ceasing any trading incentives, games or bonuses.

Traders should note that some unregulated brokers operate scams. These firms often disguise themselves as trustworthy services that offer ‘guaranteed profits’ and target investors who are new to online trading.

Tip: Before you register with an online broker, run its license number and trading name on the FCA register. Also look out for red flags, including advertising of forex and stock trading with ‘guaranteed’ high returns alongside zero commission.

Is Online Trading Taxable In The UK?

Whether your profits are taxed in the UK depends on what type of trader you are, which products you are trading and your personal circumstances. Spread betting, for example, is generally tax-free in the UK, however, profits from CFDs may be liable for capital gains tax (CGT).

To determine your taxable status, the UK tax office, His Majesty’s Revenue & Customs (HMRC), will need to assess whether you are an amateur trader (who may not be liable to pay any tax) or if you are a full-time investor (who may be liable to income, capital gains or corporation tax).

In addition, HMRC will consider other factors including your salary bracket, the frequency and duration of your trades, whether you employ people who contribute to your profits, and whether you are a limited company or self-employed.

If you are unsure how your online trading activity may be treated from a tax perspective, it is best to seek advice from HMRC directly or a professional tax advisor.

Pros & Cons Of Online Trading

Online trading has gained traction in recent years, with a range of brokers and products available. But what are the benefits and risks of online trading?

Pros

- Round-the-clock opportunities – Thanks to the time difference between the main economic centres in the UK, US, Europe, and Asia, many markets are open 24/5. Some platforms even offer weekend trading and after-hours sessions.

- High liquidity and favourable spreads – A highly liquid market creates tighter spreads and allows online traders to easily enter and exit trades at competitive prices.

- Leverage can multiply profits – Leveraged trading on products like CFDs and spread bets allows traders to multiply their position size without a large deposit. This essentially involves borrowing money to increase trading power and potential profits. In the UK, leverage at regulated brokers is limited to between 1:2 and 1:30, depending on the volatility of the asset.

- Regulatory oversight – Online brokers with a UK trade license are required to provide various financial protections. The FCA can also intervene if consumers are being manipulated or exploited. With that said, online trading is still risky.

- Opportunities to learn – Online trading provides opportunities to educate yourself in fast-paced financial markets, so you don’t need a university degree to learn. The best brokers offer access to forex, stock, and commodity training, free trading tools, education and social trading apps.

- Low entry requirements – Leading brokers require a small amount of capital to open an account. This makes trading online attractive for beginners. A starting deposit of less than £200 is competitive, but some firms even have no minimum payment.

Cons

Importantly, online trading can be an intensive, high-risk activity. As such, traders should consider the disadvantages of online trading:

- Volatility is a double-edged sword – Whilst price swings can provide opportunities to profit, these opportunities can be laced with risk. If appropriate risk management tools are not in place, money can be lost as quickly as it can be made.

- Time-consuming – Online trading can be a daunting undertaking, particularly for beginners who must start their education from scratch. Learning about the evolving forex and stock markets, for example, whilst also studying the technicalities of trading takes time and patience.

- Risk of scams – Unfortunately, the online trading market attracts scammers looking to take advantage of new traders. To help avoid untrustworthy firms, our experts recommend trading with a reputable and FCA-licensed broker in the UK.

Tools & Resources

Strategies

Online trading requires a robust strategy, even if you are a novice looking to trade casually.

For a slower pace, you could try swing trading, where trades are typically held over days. This strategy requires you to identify a potential trend before it happens, to profit from price swings. This approach is suitable for those who don’t have a lot of time to monitor trades during the day but can still dedicate some time to fundamental and technical analysis.

Day trading, on the other hand, is more involved with traders opening and closing positions within the same day. With this short-term trading technique, you will need a good grasp of technical analysis and daily price action. Be mindful, though, that day trading is time-consuming and markets can be unpredictable, especially in the immediate term.

Another short-term trading technique is scalping. A scalping strategy seeks to profit from small price movements through a high volume of forex trades, for example. Scalpers will often hold positions for a matter of seconds. The aim is to accumulate a small number of pips from each position which amasses into larger returns over time.

Charts & Tools

Whatever online trading strategy you choose, you will normally need a good understanding of chart patterns.

Charts allow you to analyse, monitor and execute trades within your online CFD, forex and stock trading platform and are available in a range of time intervals, from 1 minute to 1 month.

The best online trading graphs are intuitive and come with various drawing tools and technical indicators to help you map out trends. For example, a 200-day simple moving average (SMA) can be used to analyse long-term market trends, whilst the relative strength index (RSI) can help track momentum over a short-term timeline.

Some brokers also offer additional tools such as advanced market data, signals and scanners to help you keep abreast of the latest news and events, plus free and paid online trading apps, economic calendars, automated bots and trading journals.

Research

You can find information on how to make money with forex and stock markets through a simple Google search, but the top online trading platforms already offer free resources through their sites.

Depending on your learning style and objectives, there is something for beginners and experts alike, including:

- PDFs and free step-by-step guides

- Practical online trading courses led by professional traders and industry experts

- Easy-to-digest trading academy or 101 crash course-style videos on YouTube channels

- Official publications, research papers, and popular e-books such as ‘Online Trading for Dummies’ by Grayson D. Roze and Lita Epstein, or ‘7 Winning Strategies For Trading Forex’ by Grace Cheng

Demo Trading

Demo accounts give you the tools you need to practice online trading with zero investment. These simulator profiles allow you to refine a trading strategy by offering you the same quotes and conditions that you would experience in a live account.

These are available with any good online broker and will include a sum of virtual funds that you can play around with, risk-free. They may also include some added benefits, such as access to learning apps, market insights, and other trading tools.

Risk Management

With appropriate risk management tools in place, traders have some control over the impact of a negative market event.

Some analysts recommend that you never risk more than 1%-2% of your total capital per trade. This will ensure that you can survive any losing streaks and drawdowns. Another approach is the 3:1 reward-to-risk ratio, which allows you to potentially make 3 times what you are risking.

To avoid getting caught in a losing position, you can also implement a stop loss. This is a predetermined exit point for a losing trade, which automatically cuts your losses before the financial detriment becomes substantial. A take-profit order works in a similar way but to lock in profits.

5 Tips For Beginners

Online trading requires consistency, patience and a rational mindset. If you are new to trading online, we have pulled together 5 top tips to keep in mind:

- Don’t expect instant wealth – Online trading is not a guaranteed quick source of daily income. It will take time to develop your knowledge and confidence.

- Utilise a demo account – The best way to learn online trading first-hand is to practice in a demo account or app, where you have the opportunity to trade without putting down a deposit.

- Understand your limits before starting – Ask yourself how much you are willing and able to risk per trade. Consider the leverage ratio that you are comfortable with and set reasonable risk management parameters.

- Don’t let emotion impede your judgement – Irrational trading can have expensive consequences. If things don’t go your way in the market, stick to your plan and don’t attempt to claw back your profits by placing impulsive trades.

- Choose the right broker – Every trader is different, so choose an online trading broker that caters to your needs, whether that is a wide range of assets or copy trading.

Bottom Line On Online Trading

In this online trading tutorial, we have covered all the basics, plus shared our tips for choosing the best broker depending on your needs. Whether you are interested in forex or stocks, keep in mind the types of trading features that you require, from a stable platform to signals and low fees. Also look for FCA-regulated brokerages – these offer the best protection for British traders.

FAQ

What Is The Definition Of Online Trading?

Online trading refers to the buying and selling of assets in financial markets. This includes currencies, commodities, stocks, and cryptos such as Bitcoin. Trades are facilitated through online platforms which are provided by retail brokers who act as intermediaries. Individuals can either directly buy or sell securities or speculate on prices using derivatives.

What Is The Best Online Trading Platform?

The best online trading app depends on the features you require. You may be a beginner looking to start with a low initial investment or a professional requiring advanced trading tools and market data.

In the UK, popular online forex and stock trading platforms include Pepperstone, XTB, and CMC Markets. These brands are all FCA-regulated with competitive fees and a breadth of trading assets and markets.

Is Online Trading Profitable?

Online trading can be profitable, but earning money is not possible without financial investment and risk. In addition, highly volatile markets can be hard to predict in the short term and lead to losses. Ultimately, online trading requires a healthy risk appetite and there are no guarantees.

Is Online Trading Safe?

British traders can increase the safety of online trading activities by signing up with FCA-regulated brokers. UK-authorised firms enforce various protection rules to safeguard accounts, from restrictions on the use of misleading incentives to limits on retail leverage.

However, this does not mean that you are completely safe from scams or fraudsters claiming to be legit firms. Be vigilant when you use any online trading app, platform or service and check for company reviews before signing up.

Is Online Trading Easy?

Online trading is not easy and even experienced traders lose money. It takes commitment and patience to learn the tricks of the trade. To make your learning experience easier, you can find online trading courses for beginners at top brokers.

Which Is The Best Online Trading App For Extended Hours Trading?

You can enjoy pre-session and post-session trading hours at popular online brokers including CMC Markets, IG Index, and City Index. Typical stock market trading sessions in the US run until 4 pm (US time) but with after-hours sessions, traders can open positions until 8 pm (US time).

Is Online Trading Halal Or Haram?

Some brokers offer Islamic accounts which remove standard interest payments. However, this may be compensated for in other areas, such as higher trading fees. If you have any questions or concerns about whether your chosen online trading account is halal or haram, seek advice from a religious scholar.

Article Sources

Online Trading Masterclass – Alpha Bull Traders (2019)

Mastering The Market Cycle – Howard Marks (2018)

Trading For Dummies – Lita Epstein & Grayson Rose (2017)

Trading For A Living – Alexander Elder (1993)