TradeZero Review 2025

|

|

TradeZero is #115 in our rankings of UK brokers. |

| Top 3 alternatives to TradeZero |

| TradeZero Facts & Figures |

|---|

TradeZero is a stock and ETF broker established in the Bahamas in 2015. Though the global entity is regulated offshore, the US subsidiary is overseen by FINRA with SIPC registration. The powerful proprietary trading software makes it a popular choice for active traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs, Options |

| Demo Account | No |

| Min. Deposit | $200 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | SCB, FINRA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Stocks | TradeZero supports short-term stock trading on 100+ shares listed on the Nasdaq and NYSE. There is no commission for limit orders with a stock price of at least $1 while leverage up to 1:6 is available for accounts with $2,499+. |

TradeZero is a DMA broker that provides UK investors with equities, warrants and options on major US exchanges. This 2025 review will cover how to open an account and login to the client portal, funding options for international clients, trading hours, fees and more. We also share our verdict on trading with TradeZero.

Our Take

- TradeZero is best for investors looking for commission-free stock trading on US markets

- A choice of powerful in-house platforms is available, alongside an iOS and Android-friendly mobile app

- We did not appreciate the demo account fees, deposit and withdrawal charges, or the hefty OTC market data subscriptions

- The lack of FCA authorisation may deter UK investors looking for robust account and regulatory protection

Market Access

The TradeZero product list is quite limited, with just a small list of US stocks, ETFs and warrants. You can also invest in options with short selling. There are no crypto assets, including Bitcoin, nor any commodities, forex or index products.

As a result, TradeZero is geared towards investors looking to speculate on US markets only. Users looking for a greater breadth of asset classes, as well as US equities, may want to consider a brand like CMC Markets.

Fees

We appreciated the simplicity of the broker’s pricing model, offering either paid orders or free orders. Options trading is not included in this format.

Importantly, commissions are low and minimum requirements are reasonable. We outline the conditions of both models below:

Free Orders

- Limit orders must not create an immediate match

- Orders must be 200 shares or more and greater than $1

- Instruments must be listed on the NASDAQ, AMEX, or NYSEX

Paid Orders

- Orders must be less than 200 shares

- Trades of less than 200 shares will incur a £0.80 fee

- Applicable to all stocks, warrants and ETFs listed on the NASDAQ, AMEX or NYSEX

- Equities less than $1 will incur a £0.004 fee per share with a £0.80 minimum and £6.40 maximum

Options

- $0.59 per contract

- $0.055 OCC fee per contract

- $0.0295 ORF fee per contract

We also found that US regulatory fees apply when trading with ValuTrades, including an SEC and SIPC fee. This is standard in the industry and not associated solely with TradeZero.

It is also worth noting that variable market rate overnight fees will apply to positions held past the closing of the trading day.

Non-Trading Fees

Similar to trading fees, TradeZero is transparent with its non-trading charges. We were pleased to see no inactivity fee, a cost that is still applied by many brokers.

Disappointingly, TradeZero charges users for deposits and withdrawals. This, on top of a monthly charge to use the trading platform, holds the broker back vs competitors.

You can expect to pay:

- Withdrawals – £40 per transaction

- OTC Markets Level 1 Data – £4 per month

- OTC Markets Level 2 Data – £12 per month

- Deposits – £20 per transaction (free for initial deposits over £40)

- ZeroPro & Zero Web Trading Platform Access – £48 per month

TradeZero Accounts

TradeZero does not offer any variation in account types, though our experts found that some account features are restricted based on equity balance. This includes the maximum margin rate for those depositing more than $2,000 and pattern day trading permissions with an account balance of at least £400.

Ultimately, we found it quite complicated with the varying minimum limits and account balance requirements to unlock specific benefits. With that said, Platinum account status can be unlocked for individuals with a maintained account balance of £20,000 or more.

How To Open A TradeZero Live Account

I found it straightforward to open a live TradeZero account, although the registration process is lengthy. It took me over ten minutes to complete all the requirements.

- Open the account application form

- Add your email address and choose the product you want to trade from the menu drop-down

- Create a password and select Continue

- Complete your details on the following page including name, phone number, and address

- Add the verification code sent to your registered phone number on the application screen and select Verify

- Complete your employment status on the next page and select Continue

- Add your date of birth and AML proof of identity document information and select Continue

- Confirm industry connections by using the Yes or No tick boxes

- Review your financial details in the following screen and add your bank account details. Click Continue

- Confirm your risk tolerance and trading goals

- Add your previous investment experience and knowledge

- Review the client agreement and confirm your acknowledgement by ticking the Yes box

- Upload a copy of your identity verification document and proof of address

- Draw and print your signature and select Finish to confirm the application

- Your account details will be sent to your registered email address once approved

Funding Methods

It is a shame that TradeZero only accepts bank wire transfer deposits. We were disappointed by the lack of credit and debit card options or e-wallet solutions, such as PayPal, especially as these provide much quicker processing times.

Another major disadvantage we found while using TradeZero is the £20 fee to fund your account, though this is waived for first-time deposits over £400. An expensive £40 withdrawal fee also applies, regardless of the value.

The broker has a minimum deposit requirement of £160, which isn’t as low as brands like eToro (£50), but it is better than firm’s such as IG Index (£250).

How To Fund Your Account

- Sign in to the TradeZero client dashboard

- Select Wires from the top menu to access TradeZero bank details

- Use these details to initiate a transfer via your online banking

UK Regulation

TradeZero is registered as a Firm Dealing in Securities with the Securities Commission of the Bahamas, license number SIA-F151. The brand was incorporated on the list in April 2015 and our experts confirm that this license is still active.

Though we were pleased to see relevant registration, this financial watchdog does not provide the level of protection and financial safeguarding for UK traders that would be offered by FCA-regulated firms. You may not benefit from negative balance protection or have access to FSCS compensation in the case of business malpractice. These factors drop the brokerage ranking considerably for us.

Having said that, client funds are held segregated from business money in clearing accounts with SIPC firms, so clients are somewhat protected.

Trading Platforms

There are three platform options: ZeroPro, ZeroWeb and ZeroFree. When we used TradeZero, we found that all terminals offer stable conditions for speculation, with a range of tools and features with which to execute investments. On the downside, and unlike the majority of broker-dealers, TradeZero charges a monthly fee for customers to invest on the ZeroPro and ZeroWeb terminals.

We recommend the ZeroPro terminal for active investors, particularly those looking for the most advanced tool selections. We think the interface is complex, with a lot of technical data and details, creating a slightly confusing user-navigation. ZeroPro is also compatible with Windows devices only; there is no Mac download option.

We found the ZeroWeb platform slightly easier to use, while still offering some of the top-tier features of the Pro terminal, including real-time charting, indicators and live news streams. This online-only platform can be used via all major browsers, including Google Chrome and Safari.

ZeroFree is our vote as the most suitable platform for beginners. It is a slightly scaled-back version of the other two terminals, though it still accepts several order types and boasts advanced charting facilities, technical indicators and level 1 data feeds.

We have outlined the key features of each platform below.

ZeroPro

- Dynamic live news stream

- Level 2 market depth data

- 10 concurrent chart types within one window

- Five order expirations: Day, GTC, GTX, IOC, and FOK

- Custom watchlist functionality with visual and audio alerts

- Nine order types, including market, limit, market-on-open and limit-on-close

- Fully customisable ProCharts visuals with 70+ technical indicators and drawing tools

- Real-time portfolio performance data, including P&L, live equity status and order history

ZeroWeb

All of the above features plus:

- Up to five custom watchlists

- Customisable hotkey controls

- Six concurrent chart types within one window

- Compatible with all browsers and operating systems, including tablets and phones

ZeroFree

- Level 1 market depth data

- Dynamic live news stream

- Intraday and daily tick-by-tick charting with line-drawing tools

- Scan and borrow stocks for shorting via the Market Locate tool

- HTML5 trading tool compatible with all browsers and operating systems, including tablets and phones

How To Place A Trade On ZeroPro

I thought the process of choosing an instrument and placing a trade was intuitive:

- Login to the ZeroPro terminal

- Use the quick launch menu to open the Level 2 order screen

- Use the dropdown menu in the upper-left corner to search for an instrument

- Complete the trade details in the lower section of the window (price, trade volume, order type and route)

- Select Buy to go long or Sell to go short

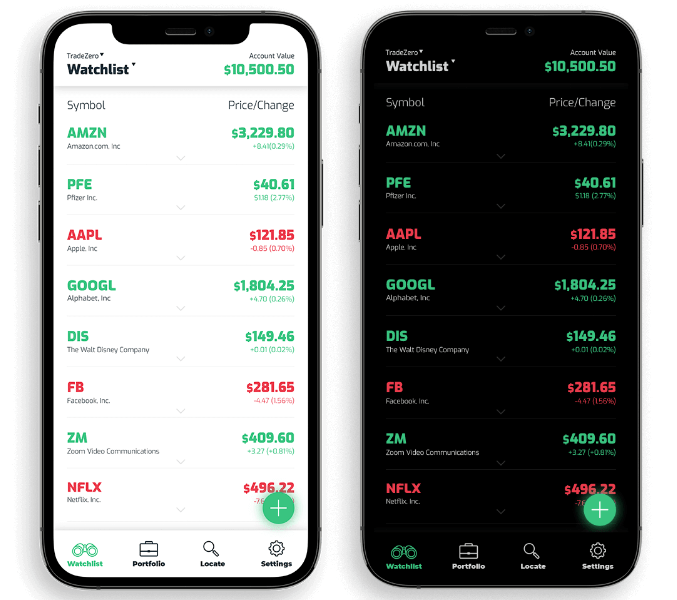

Mobile App

ZeroMobile is the broker’s proprietary mobile app, designed for investors to stay up to date while on the go. We liked the stability of the terminal and found it to combine the best features of the ZeroPro and ZeroWeb terminals in a portable design.

The application provides a simple-to-use menu design at the bottom of the screen with a clear stock search navigation tool. You can view Benzinga’s real-time news and events, track and close orders, review portfolio performance, add and monitor your personalised watchlists and review level 2 market data, all from within the app.

The application is available for free download to iOS and Android (APK) devices.

ZeroMobile App

TradeZero Leverage

TradeZero uses an unusual tier-based leverage system that we found provides limited additional buying power. Beginners or those with limited access to equity (less than £400) will be restricted to no-margin trade opportunities. This increases up to 1:6 for those with more than £2,000. Overnight positions are granted a 1:2 limit.

Fortunately, margin account requirements are simple; all positions will be closed if they fall below $99 equity.

Demo Account

While using TradeZero, we found that real-time trading conditions are not provided for free on the demo account. This is a shame and means that UK investors cannot practise adapting to real price shifts and market circumstances. All streamed data in practice mode is delayed by 15 minutes. On a more positive note, it was good to see that there is an unlimited time limit and £100,000 in virtual funds.

To access a practice account with real-time data and fast execution speed, you will need to opt-in for a paid demo subscription for £50 per month on the ZeroPro platform or £12 per month on the ZeroFree platform. This is far from competitive, with very few brands requesting money to access a demo profile.

How To Open A Demo Account

- Select Free Demo from the bottom of the broker’s homepage

- Complete the application form in the window pop-out (email, name and password creation)

- Select Submit

- A unique username will be sent to your registered email address

- Follow the download instructions displayed in the email to access the platform

- Login to the terminal and start practising technical analysis, risk management and order placement

Demo Registration Form

Bonuses

TradeZero does not offer any standard deposit rewards or financial incentives. However, the brand does offer free stock trades for eligible positions:

- Stock value must be greater than $1 and listed on the NASDAQ, NYSE or AMEX exchanges

- Eligible orders must be at least 200 shares and one penny below the ask price when purchasing for long limit orders

- Eligible orders must be at least 200 shares and one penny above the bid price when purchasing for short limit orders

Refer A Friend

A refer-a-friend scheme is also available and conditions are competitive, although we found that rewards are tiered based on your referral’s deposit amount. You can earn at least £16 for each new account opened with a deposit of at least £500.

However, it is worth noting that when we reviewed the terms and conditions, we found that deposited funds must remain active and equal to the funded value for at least six months.

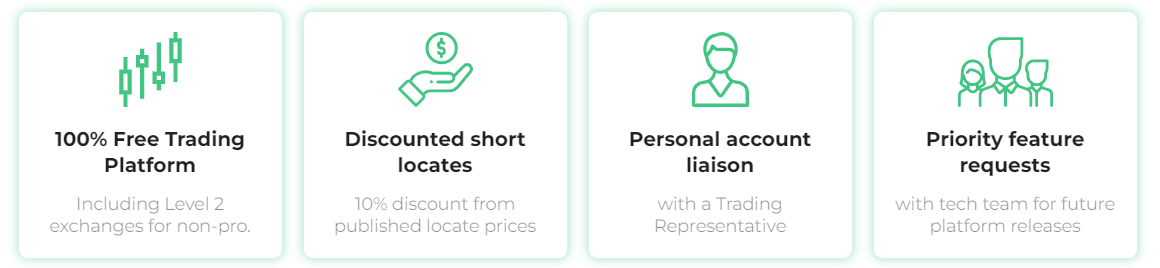

Platinum Account

Accountholders with an extensive £20,000 balance are eligible for premium services and fee discounts. This includes access to a personal account manager, a 10% discount on stock short locates and no trading platform fees.

While these benefits are good, they are not the best we have seen, so perhaps do not stretch your account balance for this sole reason.

TradeZero Platinum Account Benefits

Extra Tools & Features

We were pleased to see that TradeZero offers some learning content with enough to get started, though this is not as extensive as other brands. Information is published in small article formats, which we prefer to the lengthy and wordy materials sometimes found on alternative websites.

However, we didn’t appreciate that you cannot filter between topics or by experience level, which makes it difficult to determine the most relevant information for your strategy. It would also be good to see some integrated educational videos and diagrams introduced to aid with discussion points.

We also found platform-specific training videos, which demonstrate several key features, including how to apply custom price alerts, how to amend chart colours and how to add indicators to graphs.

Our experts were positive about the bitesize news blog forum, which is updated with daily top stories and economic dates. This is useful for staying in the loop of potential stock price shifts and potential upcoming volatility.

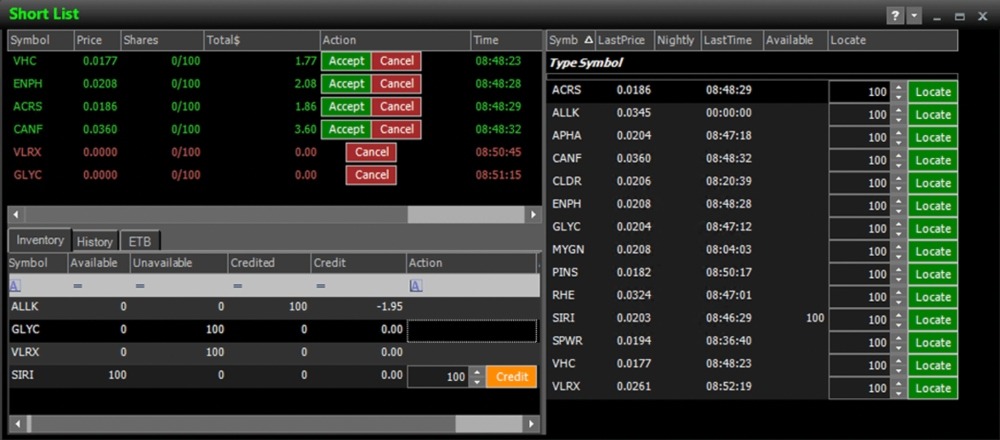

Locates

We liked the advantage that all TradeZero customers can benefit from being able to sell back short locates that are not needed. The broker has developed a specialised short-selling feature to reduce your costs. Essentially, these shares will be offered to other clients seeking locates in the same security.

To initiate, you will need to indicate the locate shares available to other users by selecting the Credit icon next to the relevant stock symbol. These products will be locked immediately when marked for credit and become available for other customers.

Company Background

TradeZero was founded in the Bahamas in 2015. The broker-dealer is registered with the Securities Commission of the Bahamas, with headquarters in Nassau.

UK investors can benefit from commission-free stock trading and advanced trading platforms. The brand also operates US and Canadian entities for residents of these countries, alongside the global subsidiary in which UK traders will be registered.

The broker has been recognised with the Benzinga Global Fintech Award for Best Brokerage for Short Selling in 2020 and 2021.

Customer Service

TradeZero support is available 24/7, which is good to see. It is worth noting that only the live chat function offers weekend support; telephone and email customer service options are only available during the week.

We were disappointed to discover that there is no UK phone number and lines operate following EST business hours, which are 12:00 to 21:00. This means that you will not have any telephone contact options during UK morning trading.

On a lighter note, when we tested the live chat function, we were reassured by the fast response times and information provided. You must provide your email address and name first but you will receive a reply within the chat screen.

- Phone: +1 954 944 3885

- Email: support@tradezero.co

- Live Chat: Icon in the lower-right corner of the broker’s website

- Headquarters Address: 436 West Bay Street, Cable Beach, Nassau, Bahamas

Security

TradeZero offers fairly standard security measures. These include Secure Sockets Layer (SSL) encryption of all web traffic, alongside encrypted platform data and account details.

Client funds are also held securely in segregated bank accounts, ensuring that they cannot be used for business purposes.

Trading Hours

TradeZero opening hours are determined by the US exchanges and markets. Market orders are accepted between 09:30 and 16:00 EST (GMT – 4).

We were pleased to see that the broker offers both pre and post-market trading opportunities, meaning you can trade from 04:00 to 20:00 EST. This is a larger investing window compared to alternative firms, though you may experience significant volatility outside of standard trading hours due to reduced activity.

You should note that all leveraged accounts cannot hold more than a 1:2 margin after 15:45 EST.

Should You Invest With TradeZero?

TradeZero provides non-US citizens with access to local markets via a suite of advanced, proprietary terminals. We like several of the tools that these platforms offer, alongside several interesting features of the broker, such as short-selling locates and free trades.

However, we were disappointed by some of the charges, with costly platform, demo account and funding charges, alongside limited UK regulation, low leverage limits and very few non-stock assets.

FAQ

Is TradeZero A Good Broker?

Our TradeZero international review concludes that TradeZero is a fairly average choice for UK investors. The technology is competitive, as is the 24/7 customer support and free trading opportunities.

Having said that, our experts has found that international clients are restricted to offshore regulatory oversight, which does not provide the protection that you would find from an FCA-regulated brand. There are also some expensive platform fees and funding costs, alongside limited demo account accessibility.

Does TradeZero Offer After-Hours Trading?

Yes, premarket and post-market trading hours are available at TradeZero, meaning the investing window is open from 04:00 to 20:00 EST.

Does TradeZero Accept A Wide Selection Of Order Types?

Yes, TradeZero supports nine order types, which is more than the MetaTrader platforms. These include Market Limit, Stop Market, Stop Limit, Market On Open, Limit On Open, Market On Close, Limit On Close and Range.

Does TradeZero Have A Mobile App?

Yes, TradeZero offers a proprietary mobile application named ZeroMobile. The app is easy to use and provides all the advanced features of the ZeroPro and ZeroWeb terminals. You can download it to iOS and Android devices for no fee.

Is TradeZero Regulated?

TradeZero is registered as a Firm Dealing in Securities with the Securities Commission of the Bahamas (SCB). However, it is not authorised by the Financial Conduct Authority (FCA), which is a drawback for UK traders.

Article Sources

Securities Commission Registration (page 16)

Top 3 TradeZero Alternatives

These brokers are the most similar to TradeZero:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

TradeZero Feature Comparison

| TradeZero | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 2.6 | 4 | 4.3 | 4.7 |

| Markets | Stocks, ETFs, Options | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $200 | $1,000 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | SCB, FINRA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | TradeZero Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| TradeZero | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

TradeZero vs Other Brokers

Compare TradeZero with any other broker by selecting the other broker below.

Popular TradeZero comparisons: