Spreadex Review 2026

SpreadEX is an online trading broker that specialises in sports and financial spread betting. The firm also offers fixed-odds sports betting and CFD trading across a range of markets via a web-based platform and mobile application. This 2026 SpreadEX.com review will explore the different instrument options, demo account availability and any trading fees, withdrawal charges and promotions.

About SpreadEX

SpreadEX Ltd has provided spread betting services to UK and international clients since 1999 and has expanded to include CFD trading and a fixed-odds sportsbook. Regulated by the FCA and trusted by more than 60,000 investors, the platform offers speculation on live casino games, sports and financials.

The SpreadEX owner and CEO, Jonathan Hufford, has overseen the company’s growth around London and the UK with a dedicated head office address in St Albans. Through several high profile sponsorships, including with prominent British football clubs Burnley and Fulham, the brand is more popular than ever.

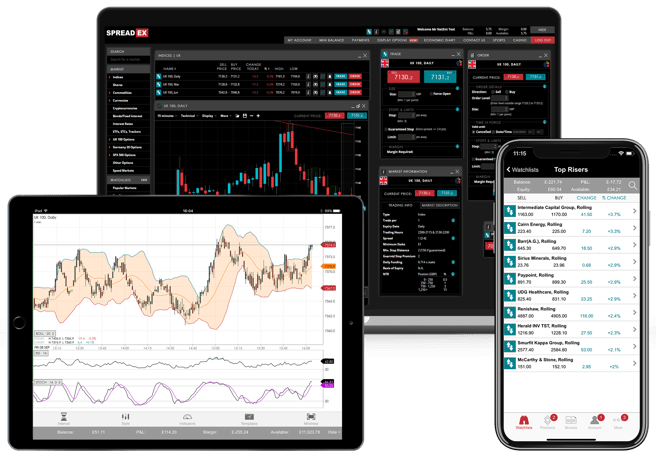

SpreadEx Mobile Platform

Markets

SpreadEX boasts more than 10,000 trading products from various financial areas, including forex, shares, commodity and cryptocurrency instruments. While the broker specialises in spread betting, a popular form of speculation in the UK due to its tax advantages, the platform also offers CFDs, options trading and a fixed-odds sports betting section.

Forex

The firm offers many options for FX currency traders, with both spread betting and CFDs available on more than 50 spot pairs and 11 futures markets. Major, minor and exotic pairs are all represented and spreads on popular pairs such as EUR/USD and AUD/USD start from 0.6 points.

Indices & ETFs

Indices and ETFs allow investors to speculate on the overall economic health of countries and specific market sectors like tech or energy. SpreadEX provides access to 35 spot and futures indices, such as the UK FTSE 100, US S&P 500 and US VIX 70, with spreads from 0.3 points. The broker also offers over 100 ETFs, including leveraged, inverse and short markets.

Cryptocurrency

SpreadEX offers five cryptocurrency markets to UK traders, though CFDs on these assets are unavailable. Those accessible are Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP). Spreads start at 140 points on Bitcoin and 1 point for Ripple.

Shares

SpreadEX facilitates spread betting, CFDs and options on over 1,000 global equities, including selected UK FTSE AIM assets. Speculation on the share price of specific UK, US and German stocks is also supported for extended (after-hours) trading.

Commodities

While many supported ETFs track commodity prices like wheat and oil, direct exposure to the commodities markets is also available through 15 assets. Clients can access futures markets on energies like Brent crude oil, soft commodities, such as coffee, and precious metals, including gold and silver. Spreads start from 0.4 points when trading gold.

Bonds & Interest Rates

14 total bond and interest rate markets are supported by the broker, with spreads starting at 2.0 points. These products allow investors to speculate on the future values of several global bonds and European and UK interest rates.

Sports & Events Betting

While this is a SpreadEX trading review rather than a sports review, it is worth mentioning the considerable selection of sports markets available with the broker. Whether you are a spread betting specialist or favour fixed-odds betting, the firm offers markets on many popular sporting events and politics.

Users can speculate on football, NFL, cricket, darts, rugby league, rugby union, F1, horse racing, golf, tennis and many more sports. Clients can also wager on politics, such as the outcome and seat allocation of UK general elections.

Leverage & Margin

Brokers with high leverage capabilities are often seen as preferable due to their enhanced profit potential. SpreadEX financials operate a complicated margin scheme, with available leverage applied through a tiered system where higher stake bets require additional margin levels.

For example, a £50 bet on an index requires a 0.1% margin, while a stake over £3,250 necessitates a 15% margin level. The specific margins for each asset class are different, so make sure you understand the requirements for each market before trading.

As standard, retail accounts are allocated a credit limit for use as margin. This amount is available to utilise on intraday trading, interest-free. SpreadEX offers higher credit facilities upon request, though additional income verification is required to obtain a credit limit of over £2,000.

Account Types

SpreadEX requires retail clients to open different account types for sports and financials speculation, though professional clients may use a single account to wager on both. Accounts are offered in five base currencies, including GBP, USD and EUR, though other currencies may be available upon request.

Unfortunately, the firm does not provide an Islamic account for swap-free trading, so those who cannot pay interest due to religious beliefs should look elsewhere.

Demo Account

Paper trading on a demo account is a great way to try new markets, explore trading strategies and familiarise oneself with new trading platforms. However, SpreadEX does not offer a demo account and requires all trading to use real funds.

Trading Platforms

SpreadEX uses a proprietary web trading platform that is accessible via desktop. Clients can login to the site for both trading and account management. The platform features lots of customisation options and allows users to place spread bets, options and CFD trades all from one place.

The web application features historical data of up to ten years for each asset, a solid range of indicators and drawing tools, user-defined price alerts and advanced order types, such as guaranteed stops. The platform is available via both the desktop and mobile sites, though mobile users may find the dedicated app easier to navigate and use.

SpreadEx Platform

Mobile App

In addition to the desktop site, the firm operates a mobile app for Android (APK) and Apple (iOS) devices. Clients can download the app to monitor and open positions on the go and manage their accounts from a phone or tablet. The software supports a range of charting features, built-in indicators and graphical analysis objects.

Trading Fees

SpreadEX charges no commissions on its spread betting service and most CFDs, though its share CFD and options markets are subject to additional fees. However, the broker does not levy fees on inactive accounts, nor are there any joining fees.

The broker also offers a rollover on its spread bets and CFDs, though it charges interest on rolled over positions. Roll charges vary from asset to asset and can be found on the website or trading platforms.

Deposit & Withdrawal Fees

There are no deposit or withdrawal fees for most transactions into and out of SpreadEx accounts. However, a debit card deposit of under £50 may incur a £1 charge, depending on your bank.

If withdrawal time is a priority, clients can make a same-day direct withdrawal using CHAPS for a £25 flat charge. All international bank transfers and non-GBP bank transfers are subject to additional charges.

Payment Methods

SpreadEX offers a limited number of payment options for deposits and withdrawals. Clients can choose between debit and credit card payments, bank transfers, written cheques or regular direct debits; e-wallets such as Neteller, PayPal and Skrill are not supported. Additionally, the broker does not support cryptocurrency deposit methods or crypto withdrawals.

There is no minimum deposit requirement with this broker, though there is a minimum withdrawal limit of £50. However, clients with under £50 in their account can withdraw their remaining balance.

SpreadEX does not state how long each deposit method will take to add funds but withdrawal times are quoted as 2-5 working days via card and within two working days for bank transfers. Those who wish to make a same-day direct withdrawal via CHAPS may do so for a £25 charge.

Security & Regulation

The protection of user information and funds is a priority for all legitimate brokers in an industry where scams are common. Unfortunately, while SpreadEX has a well-earned reputation as a secure and reliable broker, the financial login does not support the highest security measures, such as two-factor authentication (2FA).

The broker is regulated in the UK by the FCA, an effective and respected regulatory body. Client funds are held in segregated bank accounts and protected from insolvency by FCA client money rules.

Customer Support

The SpreadEX UK-based support team is available to contact between 08:00 and 17:30 GMT every day to help with problems or deal with complaints. Clients can contact the team by Freepost via the St Albans head office, live chat or its free UK landline phone contact number. The customer service team is available throughout the week, including weekends. Outside of working hours, enquiries made via the live chat system are logged and replied to via your given email address and details the following day.

The customer support provided by the broker is responsive and knowledgeable, able to help with simple requests like how to close your account and more complex ones, such as bonus terms and conditions, calculating profits and setting up a stop-loss order.

- Telephone Number: +44 (0)1727 895 000

Educational Content

The broker has created several tutorials available in its video training centre to provide prospective and new clients with additional information. Here, advanced tools such as guaranteed stops are explained, alongside the features of the SpreadEX trading platforms.

The company also operates a financial trading blog with daily market updates and in-depth analyses of specific, sectors such as finance and tech.

Promotions

Many offshore competitors entice new clients with promotions like a joining offer or risk-free bet or trade. However, SpreadEx is limited due to its rigorous regulation. For this reason, the broker cannot offer a sign-up promotion or an existing customer rebate bonus for financial speculation. Clients with the sports betting arm can take advantage of a welcome bonus and several existing account loyalty offers, though.

Additional Features

SpreadEX provides several additional features to help its clients make the most of market opportunities. For example, investors can keep up to date on upcoming news with the provided economic calendar, available on the website, mobile platform and web trading app.

Professional clients can access SpreadEX speed markets, though there is no API access to the platform for retail or professional traders.

Advantages Of SpreadEX

- UK-based

- Mobile app

- Sports betting

- FCA regulated

- 10,000+ assets

- Competitive fees

- Crypto & bond instruments

- Spread betting, CFDs & options trading

Disadvantages Of SpreadEX

- No demo account

- No Islamic account

- No e-wallet support

- On trading platform

- Complex margin scaling system

- No automated trading or API access

Trading Hours

The SpreadEX trading hours vary from asset to asset, with markets such as forex operating 24/5 while stock and indices follow their local exchange hours. This being said, on holidays like Christmas Day, opening hours may vary.

The broker supports out-of-hours speculation on selected assets and allows users to place market open orders.

SpreadEX clients can access their accounts without restriction through the login on the desktop site to monitor positions, scout for investment opportunities or make deposits and withdrawals.

SpreadEX Verdict

SpreadEX offers investors in the UK a tax-advantaged form of speculation through spread betting on over 10,000 financial markets. Despite solid regulation from the FCA and an impressive range of instruments, including options and CFDs, the broker is let down slightly by its limited withdrawal and deposit methods and singular trading platform. This aside, SpreadEX customer reviews are positive and the company is highly reputable, investors can trade in relative confidence on the platform.

FAQs

Does SpreadEX Offer A Mobile App?

Yes, SpreadEX offers a dedicated app for Android and iOS mobile devices. This has much of the functionality of the complete browser-based platform and is optimised for phones and tablets.

Does SpreadEX Offer Dividends?

For SpreadEX investors with a long position on an equity product, a dividend adjustment will be credited to their account when a dividend is paid. Conversely, those short will have a dividend adjustment debited from their account.

Is SpreadEX Any Good?

SpreadEX is a reputable and regulated broker offering options, equities, CFDs and spread betting on over 10,000 global markets.

Does SpreadEX Enforce A Minumum Bet?

While SpreadEX does have a minimum bet for each asset, these amounts can be as small as £0.20.

Is There A SpreadEX Maximum Payout?

SpreadEX Financials does not have a maximum payout for spread betting, options or CFDs.

How Does SpreadEx Work?

SpreadEx is split into financial trading and sports betting, each requiring a different account for retail clients. The firm’s web platform and mobile app are intuitive, so anyone with some experience in financial speculation or betting should be able to work it out fine without it being explained. For the rest, the broker has created several video tutorials designed for beginners, available on the website or trading platforms.

Top 3 Spreadex Alternatives

These brokers are the most similar to Spreadex:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- City Index - Founded in 1983, City Index is a prestigious broker, now under the Nasdaq-listed StoneX Group. It excels in forex, CFDs, and spread betting. With access to over 13,500 instruments, City Index provides a dynamic Web Trader platform, exceptional educational materials, and round-the-clock support five days a week, ensuring a thorough trading experience.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

Spreadex Feature Comparison

| Spreadex | IG | City Index | Swissquote | |

|---|---|---|---|---|

| Rating | 3.8 | 4.5 | 4.4 | 4 |

| Markets | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | £0 | $0 | $0 | $1,000 |

| Minimum Trade | £0.01 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, CySEC, MAS | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4 | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 |

| Visit | 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Spreadex Review |

IG Review |

City Index Review |

Swissquote Review |

Trading Instruments Comparison

| Spreadex | IG | City Index | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | Yes | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

Spreadex vs Other Brokers

Compare Spreadex with any other broker by selecting the other broker below.

Popular Spreadex comparisons:

|

|

Spreadex is #26 in our rankings of CFD brokers. |

| Top 3 alternatives to Spreadex |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting |

| Demo Account | No |

| Minimum Deposit | £0 |

| Minimum Trade | £0.01 |

| Regulated By | FCA |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Cheque, Credit Card, Debit Card, Mastercard, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | No |

| Signals Service | Autochartist |

| Islamic Account | No |

| Commodities | Cocoa, Coffee, Copper, Cotton, Gold, Natural Gas, Oil, Platinum, Silver |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.9 |

| CFD Oil Spread | 2.8 |

| CFD Stocks Spread | 0.15% |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 0.9 |

| Assets | 60+ |

| Crypto Coins | BCH, BTC, ETH, LTC, XRP |

| Crypto Spreads | 1 - 140 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |