Tradeview Review 2025

|

|

Tradeview is #32 in our rankings of CFD brokers. |

| Top 3 alternatives to Tradeview |

| Tradeview Facts & Figures |

|---|

Tradeview is an offshore forex and CFD broker based in the Cayman Islands and regulated by CIMA. Traders can access over 5000 instruments with a minimum deposit of $100. There are several third-party platforms on offer, including MetaTrader 4 (MT4) and cTrader. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | Credit / Debit Car, Neteller, Skrill, Cryptocurrencies, Bank Wire, Bitpay, Accentpay, Payretailers, Sticpay, Fasapay, Advcash, TransferMate, Bitwallet, Uphold and JPay |

| Min. Trade | 0.01 Lots |

| Regulated By | CIMA, MFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | My tests uncovered around 100 CFD products covering forex, indices, commodities and cryptos. Leverage is available up to 1:400 and it’s good to see that scalping, hedging and EA strategies are permitted. |

| Leverage | 1:400 (CIMA), 1:30 (MFSA) |

| FTSE Spread | N/A |

| GBPUSD Spread | 0.6 |

| Oil Spread | 0.5 |

| Stocks Spread | Variable |

| Forex | I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading. |

| GBPUSD Spread | 0.6 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.7 |

| Assets | 60 |

| Stocks | I was also pleased to find over 5000 stocks and options available to trade on several platforms, as well as 9 stock indices. Active traders can also enjoy flexible commission plans, superior low-latency DMA and a dedicated customer support line. |

| Cryptocurrency | I found 5 crypto products at Tradeview: BTCUSD, ETHUSD, LTCUSD, XRPUSD and BTCJPY. Whilst this isn’t the widest range, beginners should have enough opportunities to explore the market. Plus, with STP/ECN execution, traders should be able to access relatively competitive prices. |

| Coins |

|

| Spreads | From $0.09 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Tradeview is an online broker that offers CFD trading and equity investing on some of the most popular trading platforms. The company is split into two arms: Tradeview Stocks and Tradeview Forex, both of which are reviewed below.

Our team tested the broker, alongside hundreds of competitors, to analyse its pros and cons for UK traders. Find out if they recommend opening an account.

Our Take

- The firm boasts more than 5,000 instruments, encompassing CFDs, futures and DMA equities

- Tradeview offers a competitive range of accessible, advanced trading platforms, including MetaTrader 5 and Sterling Trader Pro

- Our team recommend the broker for active traders with diverse portfolios and advanced strategies that combine an array of securities and derivatives

- We found Tradeview’s customer service, regulation and security measures to fall behind those of the best UK brokers

Market Access

We rate the wide range of assets offered by Tradeview, covering most of the instruments that UK retail traders look for. Furthermore, the inclusion of real stocks and futures rather than just CFD products that track the underlying securities makes this broker competitive from a long-term trading perspective.

Tradeview Forex offers a competitive 80 CFD products across a decent range of markets, including cryptos and indices.

- Forex – 60 pairs, including majors, minors and exotics

- Indices – Nine major equity indices from the US, Europe, Asia and Australasia

- Metals – Three metals products, comprising gold and silver against the USD and gold against the EUR

- Energies – Brent crude oil, WTI crude oil and US natural gas CFDs

- Cryptocurrencies – Four DeFi tokens, consisting of Bitcoin, Ethereum, Ripple and Litecoin against the USD, as well as Bitcoin against the JPY

More than 5,000 stocks are also available to invest in directly on major US exchanges through Tradeview Stocks. Clients have access to popular assets like Apple, Microsoft and Starbucks, as well as ETFs on popular exchanges like the NASDAQ 100 and S&P 500. Clients can also gain access to futures contracts on grains, metals, securities, energies, currencies, interest rates, softs, meats, dairy and renewable fuels.

Fees

The fee structure applicable to Tradeview clients varies depending on the account type chosen.

Tradeview Forex

For Tradeview Forex, the broker’s CFD trading entity, four different fee structures are present, one for each of the X Leverage, Innovative Liquidity Connector (ILC), cTrader and CurreneX accounts.

All account types charge spreads on tradable assets, with the size of these spreads differing by account type.

For the X Leverage account, the trading fees are all rolled into the spreads, with no commission charges to consider. This makes the pricing easier to understand, with the fees all calculated as part of the buying and selling prices.

The ILC account type features the lowest spreads due to its no-markup ECN pricing. This means that clients get direct pricing from liquidity providers, allowing for ultra-tight spreads. However, this comes at the cost of having to pay a commission for each position. This charge comes to £1.90 per lot per side.

We think this is a competitive fee structure, with most brokers charging around £3 commission per lot per side. The cTrader account works similarly to the ILC account, also having tighter spreads and charging £1.90 per lot per side.

The CurreneX account is made for high-volume forex traders, charging a commission of £20 per million USD of investments.

When we used the broker, we found typical spreads for popular assets to be:

- BTC/USD – 72.0 pips

- GBP/USD – 0.4 pips

- FTSE 100 – 9.0 pips

- Crude Oil – 2.0 pips

Tradeview Stocks

Tradeview Stocks charges different fees and commissions depending on the trading platform chosen.

- MetaTrader 5: Software Fee: Free & Minimum Commission: £0.008 per share

- Lightspeed: Software Fee: £180 & Minimum Commission: £0.004 per share

- Sterling: Software Fee: £180 & Minimum Commission: £0.004 per share

- Takion: Software Fee: £190 & Minimum Commission: £0.004 per share

- DAS: Software Fee: £140 & Minimum Commission: £0.004 per share

Other charges include:

- Regulatory Fees: Passed through at prevailing rates

- Margin Interest: 750bps above Fed Funds

- Back-Office Clearing: £0.015 per order

- Short Margin Interest: Variable

- Routing: Varies by destination

Active traders also gain benefits, including flexible commission plans, lowering the total charges paid, and maximising profits.

Accounts

There are several different account types available to traders for the Tradeview Forex and Tradeview Stocks entities.

Tradeview Forex

We found that each of Tradeview Forex’s account types has two key differentiating factors. These are the trading platform available and the fee structure implemented. The fee structure of each account was covered in our fees section above.

Prospective clients can open individual, joint or corporate account types under the X Leverage or ILC account types. Each account type can be opened with access to any one of MetaTrader 4, MetaTrader 5 or cTrader and both accounts support multiple base currencies, including GBP, USD, EUR and JPY.

Leverage rates of up to 1:100 are available with ILC accounts, rising to 1:400 for X Leverage accounts. The minimum trade size for ILC accounts is 0.1 lot, while X Leverage accounts can go as low as 0.01 lot.

Our team appreciated that hedging, scalping and automated trading strategies are all allowed on both account types.

ILC accounts have a minimum deposit of £780 and X Leverage accounts have a minimum deposit of £78, which makes X Leverage accounts much more accessible to less experienced investors.

Any client with an account value over £2,000 gets a dedicated account manager, whatever their account.

We think that the X Leverage account is better suited to newer traders looking for a simpler fee structure and easier entry to trading. The ILC, on the other hand, account is designed for experienced traders that can afford the larger minimum deposit and take advantage of more predictable, commission-based pricing.

Tradeview Stocks

TradeView Stocks allows all clients to open real equity trading accounts, though there is only one type on offer. All accounts have access to the five trading platforms below.

- Takion

- Lightspeed

- DAS Trader

- MetaTrader 5

- Sterling Trader

TradeView Stocks clients can also decide to open a futures trading account or an API/FIX integrated platform. These account options mainly differ in fees and available assets. The equity accounts do not provide access to the CFDs offered by the ILC or X Leverage account, only supporting real equity products are available.

Tradeview also offers PAM/MAM accounts for reduced workload and swap-free Islamic accounts for Sharia-compliant investing, available upon request.

Overall, our experts were impressed with the account options offered. The different fee structures allow all investors to find an account that minimises costs for their styles and goals.

We particularly like that the X Leverage accounts provide a simpler cost structure, making it more suitable for newer traders, while the ILC account is better for experienced and high-volume traders looking to optimise throughput on a much larger scale.

How To Open A Tradeview Account

I thought the account opening process was fairly straightforward, taking a similar time to most alternatives. To get started:

- Go to the Tradeview Markets website (Forex or Stocks)

- Click the Open Live Account button

- Choose your desired account type (Individual, Corporate, Joint)

- Input which platform and base currency you would like for your account

- Fill out the account holder information form, inputting details like your name, age, nationality, address, etc

- You will also need to provide your banking information, employment information, trading experience, etc

- Finally, you will need to provide government identification (ID card, driver’s license, passport, etc.) and proof of address (bank statement, utility bill, certificate of residence, etc.)

- After signing up, you can submit the application to be processed and approved

- Once approved, you will be able to go into the client portal, deposit funds, download the trading platform and start investing

Funding Options

Tradeview offers a huge range of funding methods to suit as many traders as possible. None of these funding methods charges any fees from the broker’s side, though our experts found that third-party costs may be incurred.

From testing the firm, credit card and alternative funding methods are typically processed during the same business day, while bank wire transfers usually take 1-2 business days. This data carries across to both Tradeview deposits and withdrawals

Funding methods that are most suitable to UK clients include, though many more methods can be used for alternative currencies:

- Transfermate – GBP, USD, EUR, JPY, AUD, CHF, CAD, MXN, CNY

- Sticpay – GBP, USD, CAD, EUR, AUD, JPY, CNY

- Currencycloud – GBP, USD, JPY, CHF, EUR

- BMO – GBP, USD, CAD, JPY, EUR

- Uphold – GBP, USD, JPY, EUR

- Credit Card – GBP, USD, EUR

- Skrill – GBP, USD, JPY, EUR

- Bitpay – BTC, USD

This wide range of funding methods and supported currencies ensures that many traders will be able to easily deposit and withdraw from this broker. We really like how accessible this makes the broker to UK investors.

Regulation

Tradeview Forex and Tradeview Stocks comprise many global entities, each regulated by different local authorities and financial watchdogs:

- TVM Global Ltd. – Labuan Financial Services Authority – Reg. LL15870

- Tradeview Ltd. – the Cayman Islands Monetary Authority (CIMA) – Ref. 585163

- iLC Brokers Ltd. – Mauritius Financial Service Commission – Lic. #GB20025800

- Tradeview Europe Ltd. – Malta Financial Services Authority (MFSA) – Reg. C93990

- Tradeview Financial Markets S.A.C. – National Superintendence of Public Registries – No. 13089531

UK traders are likely to be investing with the European entity regulated by the MFSA. Unfortunately, our experts highlight that this regulator is not the most reputable, linked with scandals and weak regulation over the years.

The MFSA is much less stringent than the FCA, which oversees many of the best UK brokerages, such as AvaTrade and CMC Markets.

Despite this, we have found that the broker does segregate client funds from operating funds, store capital at tier 1 banks, implement competitive data centre security, provide negative balance protection and perform regular audits and reports.

While negative balance protection will usually stop leveraged positions from sending a user into debt with their broker, with this firm, it is not a guarantee and you may not succeed in closing positions quickly enough if a heavily leveraged position abruptly loses too much value.

Trading Platforms

We were impressed to see that Tradeview Forex and Stocks offer a very competitive range of powerful trading platforms. Many brokers limit their selection to just one off-the-shelf variant or a simple, proprietary solution with limited functionality.

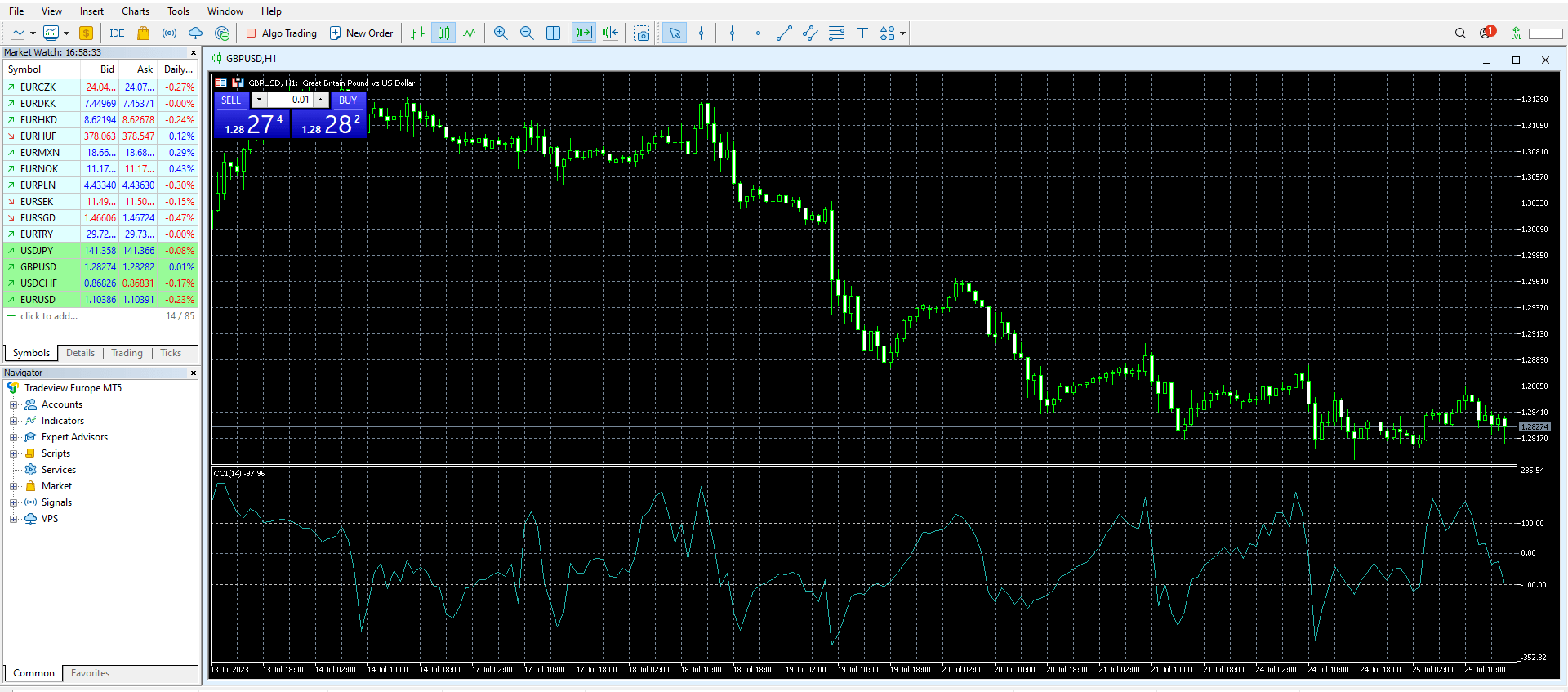

MetaTrader

MetaTrader 4 and MetaTrader 5 are two of the most popular online trading platforms for retail investors and forex brokers. Both are sophisticated platforms with high levels of customisability and advanced functionality.

When we used the platforms, we found that both have lots of sophisticated technical analysis tools, several time frames, the capability to develop automated trading strategies via Expert Advisors and a myriad online resources to learn from.

The best features for us include:

- API access

- One-click trading

- VPS compatibility

- Mobile trading applications

- Online indicator marketplace

- Nine and 21 time frames, respectively

- Four and six order types, respectively

- 31 and 44 graphical objects, respectively

- Automated trading through Expert Advisors

- 30 and 38 built-in technical indicators, respectively

- MQL4 and MQL5 programming languages, respectively

MetaTrader 4 and MetaTrader 5 are both available as desktop applications, browser-based web traders and mobile applications. Clients can download the MetaQuotes platforms from the Tradeview Markets website.

The mobile applications are available on the iOS App Store and Android Google Play Store.

MetaTrader 5

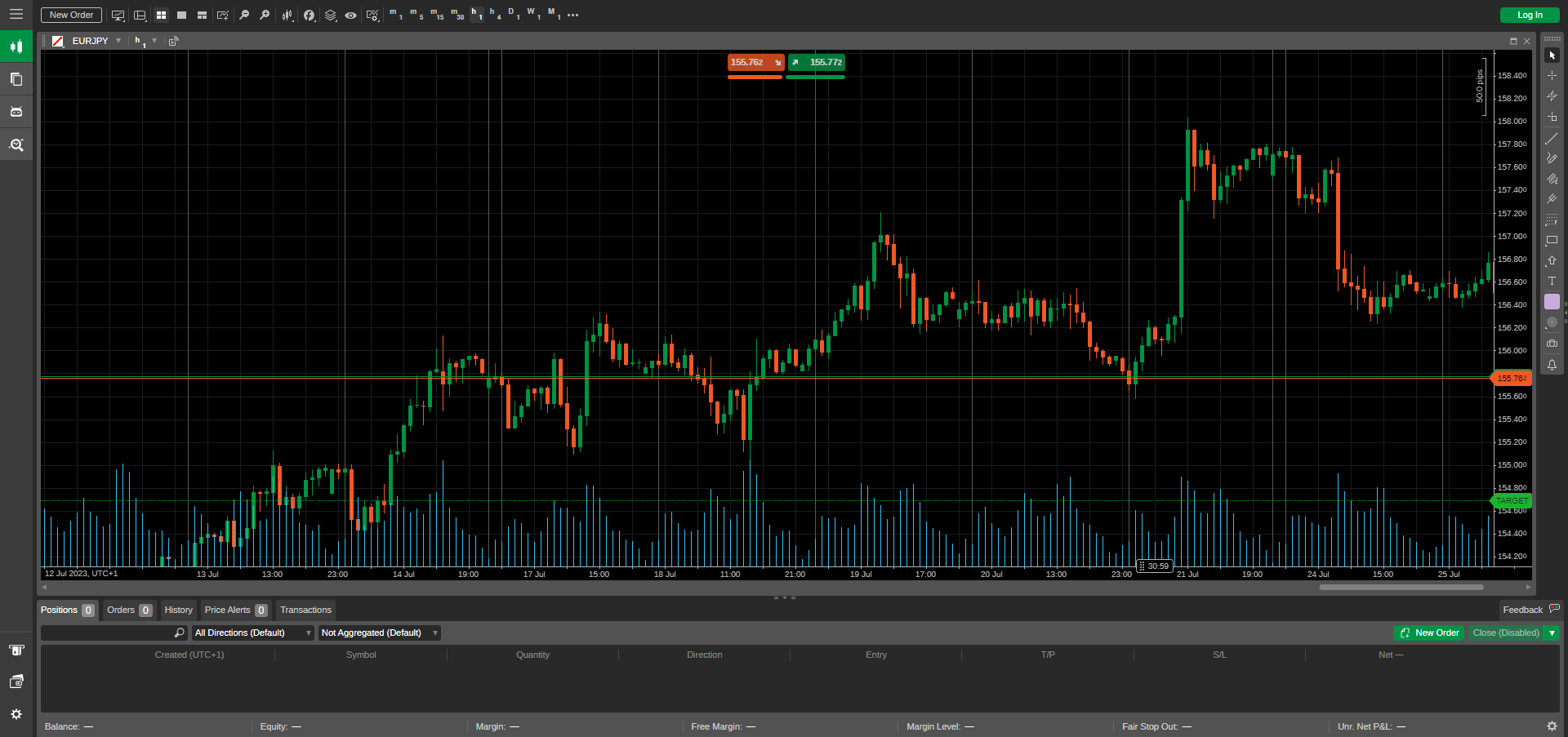

cTrader

cTrader is a popular online trading platform, competing with the likes of MT4 and MT5 amongst many online brokerages and UK traders.

We found the platform to have a sleek modern design and provide a huge range of tools with which to implement a vast array of strategies.

The stand-out functionality for us includes:

- 54 timeframes

- Six chart types

- Integrated copy trading

- Automated trading bots

- Mobile trading application

- 70+ built-in technical indicators

We think that cTrader is a great platform for new traders or those looking for something different from the MetaTrader packages. Clients can download cTrader directly from the Tradeview website, access the webtrader or download the mobile application to trade on the go.

cTrader

Sterling Trader Pro

Sterling Trader Pro is a powerful, professional-grade trading platform that is popular amongst high-net-worth and pro traders.

The platform features advanced charting capabilities, including 90+ configurable charts and studies, real-time scanning tools, custom trading alerts, volatility calculations, exchange alerts and configurable hotkeys.

This platform’s features make it ideal for investing in real equities, with a strong combination of technical features and customisability.

Lightspeed

Lightspeed is an efficient and effective platform built to handle and execute trades as quickly as possible. The software comes with over 100 order types, lots of built-in risk management features, detailed reporting capabilities, hotkeys, professional design and customisability.

High-volume and active traders will find the Lightspeed platform useful for its incredibly quick execution and customisable hotkeys, speeding up the investing process, allowing more time for strategy development and taking advantage of small-window opportunities.

Takion

Takion is a powerful equities trading platform built with advanced code and smart order routing. The platform comes with many key features, such as advanced charting, custom orders, API support for plugins, algorithmic trading and hotkeys.

The platform describes itself as the “best-in-class solution” when it comes to professional equity trading and our team of experts has found little to disagree with this.

The platform is designed for highly active and experienced traders that can make the most of its vast possibilities, advanced technological capabilities and sophisticated extensibility.

DAS Pro

Direct Access Software Pro is a powerful platform for direct market access (DMA) speculation. The platform comes with news integration, 40+ technical indicators and studies, customisable alerts, detailed watch lists, drawing tools, MAC compatibility and an accessible design.

The platform is designed for universal use, attracting both beginner and advanced traders. However, in terms of features, it does fall flat compared to some of the other options, steering away some more technically advanced traders.

CurreneX

This platform is built for high-volume CFD traders and financial speculators with at least £20,000 to meet the minimum deposit limit required to access the platform.

CurreneX features advanced charting tools, 31+ technical tools, 13 line studies, liquidity from over 60 banks, sophisticated order management and reporting tools and high reliability.

Overall, our experts were impressed with the wide range of advanced, capable trading platforms offered by Tradeview, providing a competitive balance of accessibility and capability. On the CFD front, the most popular retail platforms in the industry are included, providing great choices for all investors. The equity trading platforms supported by the firm are also some of the most popular among professional online traders.

However, we would have preferred to see free access to these software packages, rather than subscription costs.

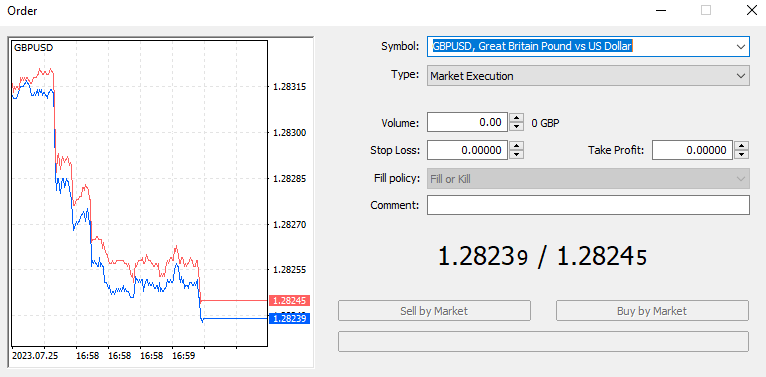

How To Place A Trade On MT5

- Login to your chosen trading platform

- Choose the asset you would like to chart

- Perform technical and fundamental analysis to find the best time to trade

- Click on the New Order button

- Fill in the details of your position within the order window (volume, stop loss, take profit, order type, etc.)

- Press Buy by Market or Sell by Market to choose the direction of your prediction and open your trade position

MetaTrader 5 Order Window

Mobile App

Many of the platforms offered also have their own mobile applications. MetaTrader 4, 5 and cTrader all have apps that can be downloaded for free directly from the iOS App Store or Android Google Play Store.

The mobile versions have many of the same features as the desktop applications, allowing investors to chart assets, perform technical analysis, set up alerts, keep up with news and place trades.

However, advanced features like programmable autotraders and algorithm development, are not available without the full desktop clients.

Leverage

Tradeview Forex and Tradeview Stocks each offer highly leveraged trading, with rates that compare well to alternative brokers like XM or eToro.

Maximum limits vary with the asset class in question. For example, forex pairs can generally be traded with rates up to 1:200, although the X Leverage account can reach up to 1:400.

Futures products support rates between 1:20 and 1:66, while equities and ETFs vary greatly up to a maximum limit of 1:10.

Demo Account

We were pleased that Tradeview clients can open demo accounts for all of the available trading platforms. This is great to see as it makes choosing a platform to stick with much easier. Many other brokers will limit their demo accounts to one account type, one platform or a maximum time limit.

Our experts recommend that traders open demo accounts for all of the platforms they are interested in. This will allow you to practice investing with each and become accustomed to their tools, features, cost structures, benefits and drawbacks before committing any real capital.

Clients can choose the platforms, base currency, account type and starting balance when setting up a demo account with Tradeview. Demo accounts can be opened from within the client portal in the same way that live accounts can.

Bonus Deals

Our experts found evidence that Tradeview has previously offered bonus promotions and financial incentives like deposit bonuses, though no such deals are currently available to UK clients. That being said, the broker could decide to implement new offers in the future.

Importantly, it is often the sign of a more legitimate, customer-focused broker to restrict incentives and promotions.

Extra Tools & Features

When we used Tradeview, we found that the broker offers a fairly competitive range of additional tools to its clients, comprising an upcoming educational Academy, Surf’s Up! break downs and TradeGATEHub news.

Upon release, the Tradeview Academy will provide online courses and videos to new investors, teaching and developing client trading skills and knowledge. The curriculum is built by established, experienced speculators and will be delivered in a format that will suit each user’s own pace, allowing anyone to take part. Of course, we haven’t been able to pass a verdict on this as it wasn’t available at the time of writing.

The Surf’s Up! offering is a collection of online articles covering a wide range of topics. The service aims to keep users up to date with what is happening in the financial world, with daily update articles covering key topics. Weaved amongst these are guides covering a variety of investing topics, such as core strategies or how to use stop significant losses.

The TradeGATEHub is a large community investing platform upon which clients can interact socially to share knowledge and investment ideas. The service is free and provides several educational and research features to Tradeview clients. These include real-time news releases, institutional analysis and educational lectures and speeches.

Company Details & History

Tradeview has been in the online investing industry since 2004 when it was founded by Timothy Furey.

The broker was originally a division of the Rosenthal Collins Group before breaking off in 2009 and establishing an independent location in the Cayman Islands in 2012.

The firm was internationally recognised in 2014 and became known as Tradeview Markets in 2015. The broker integrated client access to the CurreneX, cTrader, MT4 and MT5 platforms in the same year.

Tradeview Markets released its ILC account in 2016 and followed up with US equity trading in 2019. The broker then went on to sponsor the social trading solution TradeGATEHub in 2020. In 2021, the European branch was established in Malta, providing service to European customers, including UK investors.

Customer Service

We were pleased to see that Tradeview’s customer support team can be contacted 24/5 GMT via email and telephone. However, there are no UK-specific phone numbers, which other major competitors like Plus500 and IG Index offer 24/7.

- Email Address – support@tradeview.eu

- Telephone Contact Support – +356 2031 1017

Our experts contacted Tradeview’s support team twice at two different times during the day to test the response time. Contacting the team during the business day yielded a quicker email response, arriving within an hour. However, contacting out of hours saw a longer delay of four hours.

We think that both these responses were fairly slow as many other firms respond within a couple of minutes, some even offer a live chat window on their website to gain immediate access to a customer support agent.

Trading Hours

Tradeview clients can access the markets and place orders between Sunday 21:00 and Friday 20:55 GMT. However, some asset classes and products will have more restricted availability, depending on their underlying markets. Forex pairs, indices and commodities are available for the entire trading period (Sunday through Friday).

Should You Trade With Tradeview Markets?

We think that Tradeview Forex & Tradeview Stocks together offer a very large range of assets, an impressive number of top-tier trading platforms, competitive fees, vast funding options and both derivatives and real equity investing.

However, would like to point out that the broker falls short in terms of its regulation, client safety features and customer support, especially from a UK perspective. The lack of proper negative balance protection and access to a compensation scheme also make the broker a less attractive option, especially given its higher-than-average leverage rates.

Overall, our team would suggest this broker is suitable for high-net-worth, active investors with a portfolio and strategy that require a large variety of derivatives and equity products. However, the firm’s key selling points can be found at top UK brokers, alongside top-tier FCA regulation, negative balance protection and UK-focused customer support.

FAQ

Is Tradeview A Scam?

Our team does not believe that Tradeview is a scam. Despite its fairly weak UK regulation, the broker is still overseen by multiple regulatory bodies across the world, ensuring that some reasonable levels of guidance and rules are in place.

Furthermore, the firm has maintained its position as a competitive brokerage and taken on lots of professional-grade clients over the years, something that would be difficult to keep up with were it a scam.

Is Tradeview A Good Broker For UK Investors?

Tradeview provides traders with a huge range of assets, trading platforms and tools to successfully implement sophisticated strategies. Furthermore, the massive number of funding methods and generally competitive fees make this broker accessible and straightforward to trade with.

However, we almost always push UK investors to consider FCA-authorised brokers, as these companies are regulated by a trusted local authority, which helps protect British retail traders.

Can UK Traders Invest With Tradeview?

Tradeview Markets accepts UK traders, with GBP available as a base currency with most of the trading platforms provided. Furthermore, there are a large number of funding methods available with GBP, making this broker accessible to UK traders.

That being said, I would prefer to see a UK-specific phone number that British clients can use to quickly arrange English-speaking support.

Can You Make Money Trading With Tradeview?

Tradeview Markets features a massive range of assets, low fees, free funding methods, powerful trading platforms and a host of tools to help its clients implement strategies and keep costs low.

However, there is no guarantee you will turn a profit, and many clients will lose money. With that in mind, take a sensible approach to risk management.

Is Tradeview Good For Beginners?

The broker is on the way to implementing a large-scale online trading academy for beginners to sign up to. The goal of this is to provide all the training needed for a new trader to confidently invest. Unfortunately, this service has not yet been released, making the educational resources available rather limited for beginners.

Article Sources

CIMA Regulation – Reference Number 585163

MFSA Regulation – Registration Code C 93990

Top 3 Tradeview Alternatives

These brokers are the most similar to Tradeview:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Tradeview Feature Comparison

| Tradeview | Pepperstone | Admiral Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4.8 | 3.6 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $0 | $100 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CIMA, MFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:400 (CIMA), 1:30 (MFSA) | 1:30 (Retail), 1:500 (Pro) | 1:30 (EU), 1:500 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Tradeview Review |

Pepperstone Review |

Admiral Markets Review |

FP Markets Review |

Trading Instruments Comparison

| Tradeview | Pepperstone | Admiral Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Tradeview vs Other Brokers

Compare Tradeview with any other broker by selecting the other broker below.

Popular Tradeview comparisons: