Trade.com Review 2025

|

|

Trade.com is #40 in our rankings of CFD brokers. |

| Top 3 alternatives to Trade.com |

| Trade.com Facts & Figures |

|---|

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, ETFs, Bonds, Cryptos, Warrants, IPOs, Futures, Mutual Funds, Fixed Income, Options |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, FSC, FSCA, FINRA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (MT4 & MT5) |

| Islamic Account | No |

| Commodities |

|

| CFDs | Access over 2,000 CFDs across diverse markets including indices, commodities and bonds. There is also premium daily analysis and strategy resources for savvy traders. |

| Leverage | 1:30 (EU), 1:300 (Global) |

| FTSE Spread | 1.4 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 2.0 |

| Stocks Spread | Variable |

| Forex | As well as a competitive selection of 55+ forex pairs, traders can access high leverage up to 1:300. You can also enjoy advanced analysis from Trading Central with easy integration into MetaTrader 4. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 1.6 |

| Assets | 55+ |

| Stocks | Trade US, European and Asian markets with thousands of equities and competitive spreads. You can also take advantage of DMA pricing on the broker's MT5 platform, as well as IPOs. |

| Cryptocurrency | Over 10 of the most popular cryptos are available with leverage of 1:2. With just a $100 minimum deposit, traders can benefit from advanced crypto analysis tools. |

| Coins |

|

| Spreads | Raw spread + 0.5% commission |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Spreadbetting | Start leveraged spread betting on 1,000 assets at Trade.com. Spread bets are available 24 hours a day with access to rising and falling markets, plus no stamp duty or capital gains taxes. |

Trade.com is a leading multi-asset brokerage offering over 100,000 tradable assets to its clients. The company’s strategic expansion, MetaTrader support and wide range of assets have resulted in an active investor population well into the thousands. This page outlines our expert team’s reviews and explores the broker’s platform choices, account types, trading fees and demo account support. Read on to find out whether you should register with Trade.com today and start building your portfolio.

Trade.com Headlines

Whilst Trade.com’s headquarters are in Cyprus, this premier broker’s growth has resulted in a multi-licensed group. The firm established the Trade Capital UK brand in 2022 on top of Livemarkets Ltd as part of its expansion into the UK markets. The London-based operation is authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA).

The multi-faceted brokerage boasts an impressive and dedicated multilingual team, providing support and guidance to more than 100,000 customers in 120 markets.

Trading Platforms

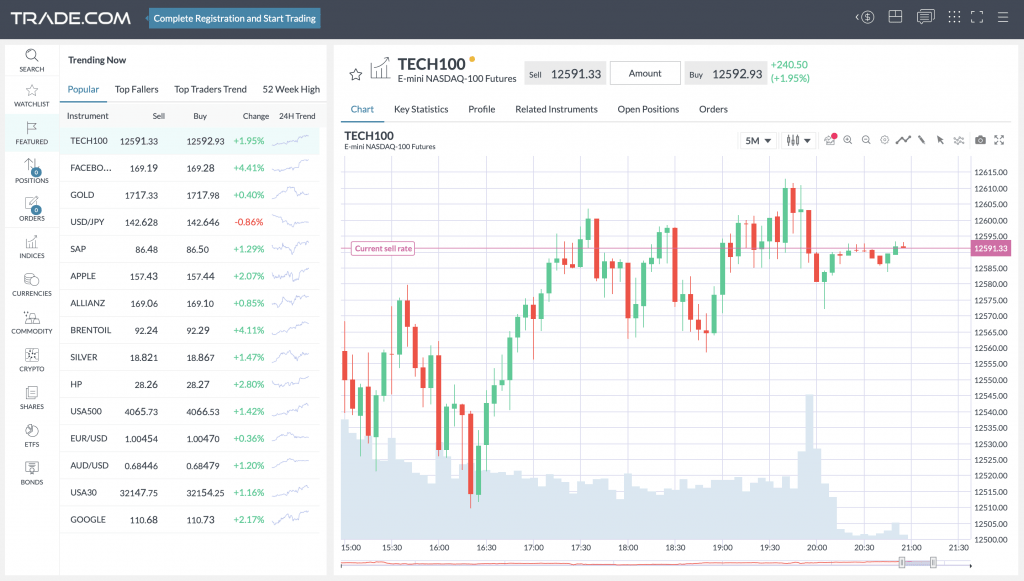

Trade.com offers three platform options: the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) toolsets, plus the broker’s exclusive solution, Trade.com WebTrader.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most well-established and secure platforms available. It provides a sophisticated solution for access to the global markets and is suitable for investors of all skill levels. Trade.com offers access to the MT4 platform, which is available on both desktop and mobile devices. The platform presents traders with over 350 tradeable assets to explore, analyse and speculate upon in real-time.

Notably, Trade.com provides invaluable and immediate online support for all clients seeking advice or tips about the tools and capabilities of the platform.

The key features of MT4 include:

- Nine timeframes

- One-click trading

- Real-time charting

- 24 graphical objects

- 30 built-in technical indicators

- Automated trading via MQL4

- User marketplace with myriad indicators & analysis tools

MetaTrader 5 (MT5)

MetaTrader 5 is a more advanced efficient upgrade for MT4, with a more modern and easy-to-use interface. This platform can support a wider range of assets and features a slicker automation language, MQL5. Moreover, there are additional in-built features, including timeframes, indicators, graphical objects and charting data.

The key features of MT5 include:

- 21 timeframes

- One-click trading

- 38 built-in indicators

- 3D optimisation graphs

- Advanced portfolio reports

- Automated trading via MQL5

- Multi-threaded strategy optimisation

- 20x operational efficiency improvement

- Independent protocol exchange capability

Trade.com WebTrader

The broker’s proprietary WebTrader platform is a browser-based toolset that uses an award-winning architecture to provide exclusive investment opportunities. When using Trade.com’s the WebTrader, we found it easy to navigate, intuitive and favourable towards customisation.

The key features of the WebTrader platform include:

- Multi-chart windows

- Live customer support

- In-platform price alerts

- Over 2,100 instruments

- Secure management tools

- One-touch account switching

Trade.com WebTrader

Assets

Trade.com boasts an extensive instrument list for UK clients, comprising over 2,100 CFD assets:

- Bonds – available in sterling, yen, euro & dollar

- Forex – 55+ currency pairs, including major, minor and exotics

- Indices – 26 global exchanges including the FTSE 100

- Commodities – soft and hard products, including Gold and Brent Oil

- ETFs – commodity, sector/industry, financial market ETFs and more

- Stocks – 2,000+ companies, including over 250 popular shares, such as Barclays PLC and ITV PLC.

24-hour access to spread betting products is also available on over 1,000 assets across forex, commodities & stocks. These have the added benefit of exemption from capital gains tax, though they provide less speculative flexibility.

Moreover, UK clients can access direct market access (DMA) products from a wide range of global exchanges. These instruments are purchased directly from the underlying exchange. These products cover the following markets and instrument classes:

- ETFs

- Stocks

- Options

- Warrants

- Mutual funds

- Fixed incomes

- Futures & FOPs

Spreads & Commissions

Trade.com offers an attractive speculation service, with zero commission when executing most trades. However, there are varying levels of commissions charged for stock CFD positions, depending on your account type. Our team of experts has found that the average trading fees on offer are less favourable than with some competitors.

The broker also imposes other common fees on its clients. These are variable overnight swap charges, which can be found in real-time through any of the trading platforms and inactivity fees for accounts that remain dormant for more than 90 days. Such accounts are initially charged £25 per month, though this is dropped to $100 annually if the account is not used for more than 12 months.

Leverage

Trade.com offers the maximum 1:30 leverage cap on major and minor forex pairs, though this is dropped to 1:20 for exotics and most minor pairs. Most commodities, such as oil and natural gas, can be leveraged at a rate of 1:10, though gold sits alongside indices with a maximum available rate of 1:20. All equity CFDs (stocks and ETFs) are limited to 1:5.

Mobile Apps

When we used Trade.com we found all three of the platforms offered have mobile compatibility and are available to download on Android (APK) and Apple (iOS) devices. These apps allow all clients to trade and manage their portfolios and accounts via a mobile or tablet device, wherever an internet connection is available. We found the apps to be responsive and successful in allowing users to assess the financial markets, whilst providing a secure trading environment.

Payment Methods

Trade.com investment accounts can be funded and emptied via a competitive range of methods:

- Credit and debit cards

- Bank wire transfer

- Przelewy24

- Multibanco

- Safecharge

- Safetypay

- MyBank

- Neteller

- Giropay

- Trustly

- PayPal

- iDEAL

- Sofort

- Skrill

- Epay

- EPS

All third-party charges on deposits and withdrawals are covered by Trade.com, resulting in free transactions. The broker also levies a 2% conversion fee, where required.

Demo Account

Trade.com offers a zero-risk demo trading account to allow prospective clients to experience and practise investing. These accounts are a great way to test the waters of different instruments or trial a brokerage without committing and risking live capital.

Regulation & Licensing

Trade.com is regulated in the UK by the Financial Conduct Authority (FCA), although the firm holds many other licenses for operation elsewhere in the world, demonstrating its dedication to transparency.

The FCA is one of the more rigorous regulatory agencies out there, requiring strict adherence to an array of regulations and rules designed to ensure the safety of retail investors. These include the segregation of company and retail funds and a brokerage subscription to the Financial Services Compensation Scheme (FSCS), which protects its clients for up to £85,000 in the event of malpractice or insolvency.

Additional Features

There is a competitive range of extra features and tools offered to Trade.com clients, beyond the standard economic calendars. The company boasts a suite of technical analysis and research services.

A dedicated Resource Centre provides up-to-date reports on financial news from around the globe, analysed and highlighted to support the firm’s clients. The Trading Central market analysis tool is available to clients holding Gold or higher accounts. This software package provides leading investment research and technical analysis, covering trends, pricing and market history, to aid users in opportunity identification.

Account Types

Trade.com offers several CFD account types, each tier offering additional features and reduced fees. Every variant includes desktop and mobile investing, 24-hour customer service and daily market analysis reviews. Clients can upgrade their accounts once they achieve the required account size, though the firm may revert any account to the Silver tier after periods of inactivity.

Silver

- Daily analysis reviews

- 24-hour customer service

- Gold spreads around 0.6 pips

- Minimum account size of £100

- 0.2% + £10 commission on shares

- GBP/USD spreads around 1.9 pips

Gold

- Trading Central

- 24-hour customer service

- Dedicated account manager

- 0.16% commission on shares

- Gold spreads around 0.5 pips

- “Premium” daily analysis reviews

- Minimum account size of $10,000

- GBP/USD spreads around 1.4 pips

Platinum

- Trading Central

- Dedicated account manager

- 0.10% commission on shares

- Gold spreads around 0.4 pips

- “Premium” daily analysis reviews

- Minimum account size of $50,000

- GBP/USD spreads around 1.0 pips

- 24-hour “premium” customer service

Exclusive

- Trading Central

- Dedicated account manager

- 0.08% commission on shares

- Gold spreads around 0.3 pips

- “Premium” daily analysis reviews

- GBP/USD spreads around 0.8 pips

- Minimum account size of $100,000

- 24-hour “premium” customer service

Those looking to speculate using investment products sold by global exchanges themselves can open a Trade.com DMA account. These provide access to the full range of DMA assets outlined above, including options, futures and warrants.

Investors that meet the required level of experience outlined by the FCA can open a professional account. Elective professional traders must meet two of the following criteria:

- Financial portfolio exceeding £500,000

- Placed at least 10 separate 1 lot trades in the past year

- Work or have worked within the financial sector for at least one year

Professional Trade.com accounts offer leverage rates of up to 1:300 on all assets and more sophisticated account management and analysis services. However, opening such an account waives participation in the FSCS.

Benefits Of Trade.com

- Regulated by the FCA and other reputable bodies

- Demo account

- Range of payment methods

- Access to industry-recognised MT4 and MT5 as well as their proprietary platform, WebTrader

- 24-hour customer service

- Access to numerous major, minor and exotic Forex pairs with competitive spreads

- Simple account opening process

- Low minimum deposit of $100

- Copy trading tools

Drawbacks Of Trade.com

- No crypto trading

- No promotional offers or deals

- Lack of educational material

- Inactivity and overnight fees

- Asset management isn’t offered to UK clients

- Spreads can be high for smaller account types

Guide To Getting Started With Trade.com

Our experts have outlined a step-by-step guide to begin investing with Trade.com.

1. Create An Account

To engage with the markets through Trade.com, navigate to the banner at the top of the webpage and click on ‘Open Account’. After entering your email address and creating a password, you will be prompted to complete your registration. This process will include providing the broker with personal, tax and financial information and any relevant trading experience, as well as the completion of a compliance quiz.

2. Deposit Funds

Upon registering your account, you can add funds using any of the supported payment methods outlined above. Your initial deposits must exceed the minimum limit for your desired account type before you can continue.

3. Open A Trade

If you wish to use one of the MetaTrader platforms, navigate to the relevant page on the broker’s site to download the software for free. Otherwise, go to the online Trade.com WebTrader page.

Log in to your demo or live account to begin investing. On the left-hand panel of the WebTrader platform, select your desired asset to bring up its price chart. Above this, click the buy or sell button as desired, type the number of units you would like to trade, specify the order type, select the desired characteristics and place the order.

4. Close Your Position

When you are ready to close your position, do so through the open positions section of the platform. You will then see the outcome of the trade enter or leave your account.

Trading Hours

The Trade.com brokerage is open 24/5, Sunday through Friday. However, individual instrument trading hours vary. The forex markets follow that same hours as the broker, though equities follow the active hours of the exchanges that list them.

Customer Support

Trade.com provides a range of customer service contact methods. There is a useful live chat window that can be found in the bottom-right corner of the site or an email enquiry form on the Contact Us page. Alternatively, contact the broker directly via email any time between Sunday 22:00 GMT to Friday 22:00 GMT.

- Email Address: support@trade.com

Trade.com Verdict

Trade.com holds a strong reputation for its suite of investment services, covering CFDs, options, warrants, futures and equities. Our experts found the proprietary platform user-friendly, offering a plethora of advanced tools for market analysis. Alternatively, traders can make use of the more widespread MT4 and MT5 platforms. Create a Trade.com account and login today to gain access to thousands of attractive trading instruments, plus a team of dedicated workers there to aid your success in growing your portfolio.

FAQ

Is Trade.com A Trustworthy Broker?

We found Trade.com to hold a valid license from the FCA for the sale of its UK investment products. Moreover, the firm is transparent regarding its fee structure and business model.

Does Trade.com offer an API?

Trade.com does not appear to offer a dedicated API service to connect to external trading platforms.

Is Trade.com A Good Broker For beginners?

Whilst Trade.com does not provide an extensive range of educational material, a lot of its services are geared towards less experienced investors. These include intuitive proprietary software packages, multilingual customer service team and high-level security measures in line with FCA regulations. The website is also very clean and easy to navigate, with definitions and examples to explain most terms.

What Assets Can I Invest In With Trade.com?

Trade.com offers a wide range of trading products. These include CFDs on forex, commodities, indices and equities, as well as direct market access to options, warrants, futures, FOPs, stocks and ETFs.

Is Trade.com Regulated?

The FCA regulates and oversees the activities of Trade.com’s UK branch. However, oversees subsidiaries are also licensed and regulated by stringent international agencies.

Top 3 Trade.com Alternatives

These brokers are the most similar to Trade.com:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Trade.com Feature Comparison

| Trade.com | IG Index | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.7 | 4.7 | 4 | 4.8 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, ETFs, Bonds, Cryptos, Warrants, IPOs, Futures, Mutual Funds, Fixed Income, Options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $100 | $0 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, FSC, FSCA, FINRA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (EU), 1:300 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 78.60% of retail CFD accounts lose money. |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

|

| Review | Trade.com Review |

IG Index Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| Trade.com | IG Index | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Trade.com vs Other Brokers

Compare Trade.com with any other broker by selecting the other broker below.

Popular Trade.com comparisons: