TP Global FX Review 2025

|

|

TP Global FX is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to TP Global FX |

| TP Global FX Facts & Figures |

|---|

TP Global FX is an offshore broker with a strong focus on education and technical analysis tools. It offers STP pricing and up to 1:500 leverage on 50+ forex pairs and a smaller range of stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers additional services including copy trading and an informative daily blog. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA, VFSC, CAMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | TP Global FX clients can trade CFDs on forex as well as around 12 stocks, 12 indices, five cryptocurrencies and commodities including gold, silver oil and gas. CFDs trade with up to 1:500 leverage on the hugely popular and reliable MT4 and MT5 platforms. |

| Leverage | 1:500 |

| FTSE Spread | Not offered |

| GBPUSD Spread | From 0.2 pips |

| Oil Spread | From 0.2 pips |

| Stocks Spread | From 0.2 points |

| Forex | TP Global FX offers trading on 50+ forex pairs with a good selection of minors and exotics as well as the majors. The broker offers fast 30ms execution speeds with a Straight-Through Processing system. Very tight spreads starting from 0.2 are available on pro accounts, while standard commission-free account spreads start from 1.2. |

| GBPUSD Spread | From 0.2 pips |

| EURUSD Spread | From 0.2 pips |

| GBPEUR Spread | From 0.2 pips |

| Assets | 50+ |

| Stocks | TP Global FX offers trading on leading indices such as the Dow Jones, alongside major company shares such Tesla and Facebook. Spreads are also impressive and start from 0.2 points. |

| Cryptocurrency | TP Global FX offers CFDs on five cryptocurrencies paired with USD. Spreads are lower than many alternatives and users can trade crypto 24/7 without interruption. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

TP Global FX is a straight-through processing CFD and forex broker that offers a wide range of instruments to UK retail traders, as well as access to many speculative features like daily financial analysis and copy trading. In this 2025 broker review, we will cover what TP Global FX is, the platforms on offer, how to place a trade, additional features, fees, trust ratings, and much more.

TP Global FX boasts access to MT4 & MT5 for speculation upon a range of instruments, including cryptocurrencies, at low fees. A free demo account and proprietary mobile app are also available. However, there have been several allegations of blocked and ignored withdrawal requests.

Company History & Overview

TP Global FX is an online brokerage firm founded in 2016 with a main physical office in Lagos, Nigeria. The company offers a wide range of tradable assets, giving clients access to forex, indices, cryptocurrencies and many more speculative products.

TP has a focus on helping clients invest and learn through its educational resources, enabling investors to speculate with ease from anywhere through mobile apps and its bespoke copy-trading solution.

The firm operates through three entities (TP GLOBAL FX, TP Global Fx Africa and TP Global Services Limited), with offshore regulation in St. Vincent and the Grenadines, CAMA (Nigeria) and VFSC (Vanuatu).

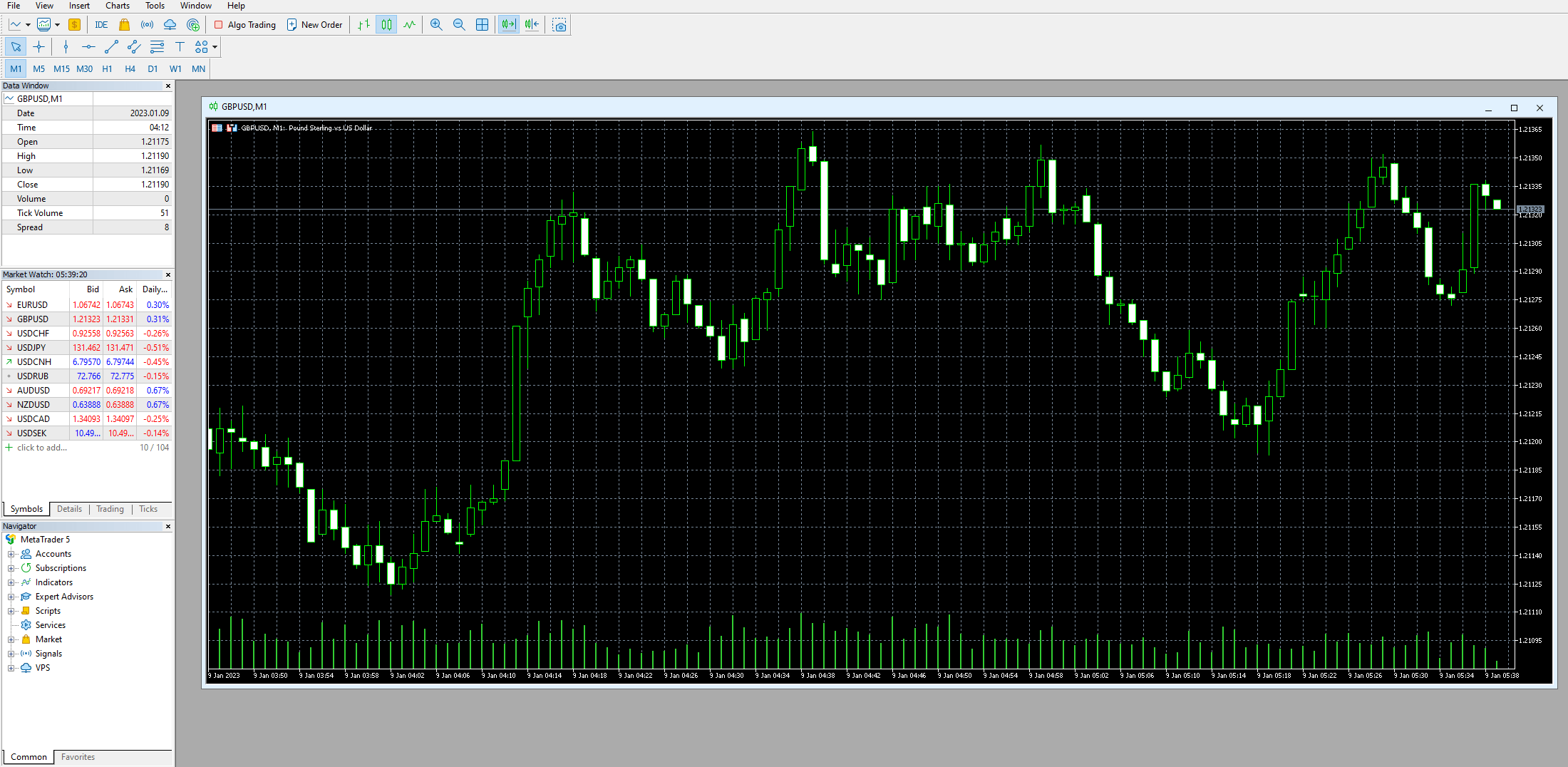

Platforms

TP Global FX offers two highly popular and widely used desktop trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These tools are the most popular trading platforms for online retail traders.

Both MT4 and MT5 come with deep technical analysis tools, automation properties, mobile app support and impressive customisability. You can download these trading platforms for free directly from TP Global FX’s website or use their webtrader functionality.

MetaTrader 4 Vs. MetaTrader 5 – Which Platform To Pick?

When we used MT4 and MT5, our experts found them both to be advanced platforms that provide powerful tools for experienced traders to take advantage of, alongside intuitive interfaces and basic layouts to retain beginner accessibility.

Key features include:

- Built-in indicators – moving averages, candlesticks, Bollinger bands etc.

- Programmable automation via MQL4 and MQL5 expert advisors (EAs)

- Integrated trading signals

- Deep market data

- Copy trading

- 2FA

However, the two TP Global FX platforms come with several differences. At its core, MT5 boasts more base features than MT4, including a greater number of accessible markets, technical indicators, timeframes, pending order types, graphical objects and concurrent charts. However, by writing plugins using the MQL4 and MQL5 languages, you can enhance the suite of tools that each platform offers.

Those less experienced with the platforms and that have not delved into the more advanced plugin creation may want to use MT5 over MT4 thanks to the greater quantity of features out-the-box. However, thanks to its longer active life, MT4 may have a greater range of sophisticated, specific tools on the MetaQuotes marketplace.

MetaTrader 5

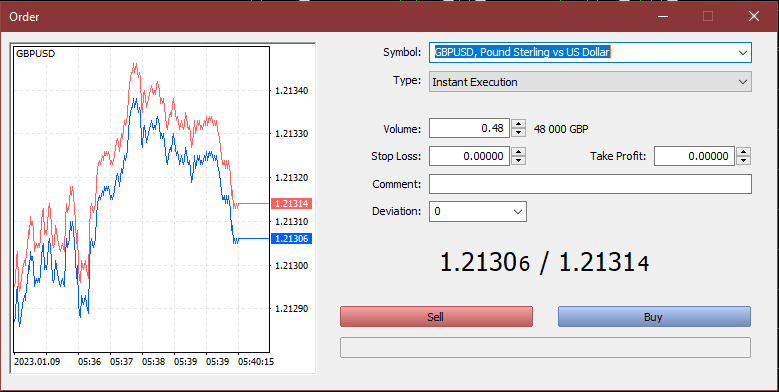

How To Place A Trade On MT4 & MT5

Placing a trade on TP Global FX with either MetaTrader 4 or MetaTrader 5 is straightforward:

- Choose which instrument you would like to trade from the drop-down list

- Click on New Order, this will open a separate window that shows the parameters of the trade

- Select the type of order desired (market execution or pending order)

- Input the volume you wish to trade

- You can then optionally set a stop-loss and/or take-profit order. These will automatically close the position if certain conditions are met

- Choose your fill policy (e.g. fill or kill)

- Finally, click on either Buy or Sell

MT5 Order Screen

Markets & Instruments

TP Global FX offers over 200 tradable CFDs in a range of financial markets. This is a somewhat limited roster compared to most alternative companies, although the cryptocurrency offering is competitive amongst forex brokers.

- Metals – 3 products, namely gold, silver and platinum

- Indices – 12+ indices, including the FTSE 100, NASDAQ and Dow Jones

- Stocks – 12+ equities, including major companies like Facebook, Tesla and Apple

- Forex – 40+ forex pairs, including six majors, more than 20 minors and a handful of exotics

- Commodities – 14 commodity assets, including hard and soft commodities, such as natural gas, wheat, coffee and sugar

- Cryptocurrencies – 35+ crypto pairs, including BTC/USD (Bitcoin), DOGE/USD (Dogecoin) and ETH/USD (Ethereum)

Margin Rates & Leverage

With TP Global FX’s limited regulation, it can offer attractive leverage rates, reaching a maximum of 1:500 for all account types. Clients do have the option to lower the maximum leverage rate available to them when opening their accounts. All accounts have a stop-out level of 40%.

This access to high leverage compared to FCA-regulated brokers allows confident traders to maximise their earning potential.

Mobile App Review

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) each have a mobile app available on both the Apple iOS App Store and Android APK Google Play Store. The mobile apps allow traders to track price action, perform technical analysis using indicators and place trades.

The mobile apps come with most of the functionality of the base desktop packages, though they lack some of the more sophisticated features, such as EA creation and MQL manipulation.

TPG Trader

TP Global FX also offers its own, bespoke mobile trading platform called TPG Trader. This mobile application is available for free download on both the Apple App Store and Google Play. The platform aims to be more intuitive and easier to use than the MT4 and MT5 mobile alternatives while retaining as much sophistication and advanced functionality as possible.

TP Global FX Payment Methods

TP Global FX has limited deposit and withdrawal methods for UK-based traders. The key supported options are bank wire transfers, BTC and FairPay.

The broker does not charge deposit fees for any payment methods. However, any costs associated with the methods may still be charged (e.g. Bitcoin gas fees). Moreover, deposits can only be made using USD, so there may be conversion charges implemented.

Bank wire transfers can take between five and seven working days to process. BTC payments are blockchain-dependent but typically take between 12 and 24 hours. FairPay typically processes within 24 hours. Minimum deposits apply, varying with the account type.

Withdrawals will be processed on the same day if the request is submitted before 10:00 GMT. Otherwise, the withdrawal time is extended by one business day. For bank wire transfers, fees will be charged on withdrawal requests of less than £1,000.

Demo Account

TP Global FX offers demo paper trading accounts to new and existing clients. We recommend that traders get to grips with investing and practise using the platform through a demo account before opening a live account and risking hard-earned money.

Demo accounts also allow more adept traders to test strategies and develop effective indicators before investing in real assets.

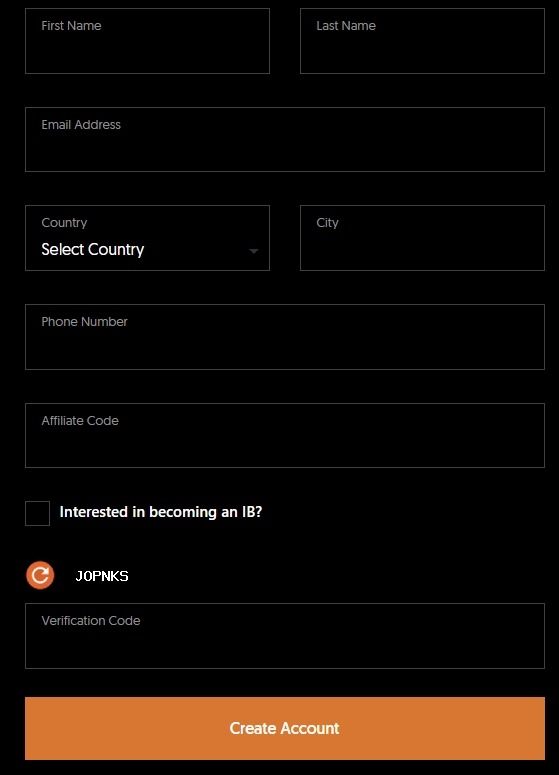

How To Open A TP Global FX Demo Account

To open a demo account, head to the broker’s website and register for an account. Choose the Demo Account option, fill in your contact details and the company will send you an email with your login details to input into your MetaTrader platform. Once you have done so, you will be able to open positions, practise investing and explore the platform with no risk to your money.

UK Regulation

The three entities that comprise TP Global FX: TP Global Services Limited, TP GLOBAL FX and TP Global Fx Africa Limited all hold licence details and are registered with St. Vincent and the Grenadines, VFSC (Vanuatu) and CAMA (Nigeria) respectively.

As such, the broker is not under any strict regulation, meaning there is greater risk trading with this broker than those regulated by more reputable regulators, such as the UK’s Financial Conduct Authority (FCA).

Deals & Promotions

TP Global FX often runs Traders of the week and Traders of the month competitions. Winners are rewarded with cash prizes that can be as high as £500 for the weekly competitions and £1,200 for the monthly ones. All that is required to enter is a live account with a minimum of £500 balance and to sign up for the competition. Only trades performed on MetaTrader 4 are eligible.

There are no other promotions or bonus deals offered by the firm, which is disappointing to see from a company not regulated by a stringent body, as deposit and welcome bonuses are a key selling point of many offshore brokers.

TP Global FX Extra Features

Education & Research

TP Global FX provides investors with an up-to-date blog that consists of daily analysis reports on a wide range of tradable instruments. The posts compile information from several sources, including Reuters, to provide detailed analyses of assets in the current socioeconomic climate. The blog is broken down into Daily Analysis Reports and Fundamental News.

Premium Analytics are also offered with TP Global FX’s Trading Central feature. This is a trading tool that provides useful information and tools, including an economic calendar, alpha generation and a newsletter.

Copy Trading

TP Global FX also offers copy trading. This is a social trading service that allows clients to view and copy other investors’ portfolios and positions in real-time.

Those with less time or experience may find this trading method more accessible, allowing them to invest their money without having to spend time analysing each asset to create a balanced and effective portfolio.

Account Types & Fees

TP Global FX offers three different account types: Standard, Pro and Institutional. Each tier has its own minimum deposit limit and fee structure.

- Standard – £50 minimum deposit, spreads from 1.2 pips and no commission

- Professional – £500 minimum deposit, spreads from 0.2 pips and £15 commission per lot

- Institutional – £25,000 minimum deposit, spreads from 0.2 pips and £8 commissions per lot

The fee structures offered by this broker are generally on par with its competition.

All account types come with leverage rates of up to 1:500, swap-free/Islamic account alternatives, 100% margin call limits and 40% stop-out levels.

How To Open A TP Global FX Live Account

Opening a TP Global FX account is quick and simple, taking just a few minutes.

- At the top of this review, click the Visit button

- Next, you will need to fill in the required personal information (name, address, email address, etc.)

- You will then need to provide KYC-compatible documents (government ID, proof of address)

- Once this is verified, your account will open and you can deposit money via one of the supported methods

Registration Form

Trading Hours

Trading hours are dependent on the asset type being traded. Cryptocurrencies are available 24/7 as they are not on a localised market. Other assets, like indices, can only be traded when their respective markets are open.

Customer Service

The broker has several customer support avenues that traders can use if they come across a problem, including an online contact form on the company website and the following:

- 24/5 Email Address: support@tpglobalfx.com

- Mail Address: 45, Labaiwa Road, Oke-aregba Abeokuta Ogun State, Nigeria

TP Global FX is also on a range of social media platforms (Facebook, LinkedIn, Twitter, Instagram & YouTube) @tpglobalfx

Client Safety

TP Global FX follows lax regulation, thus making it riskier to deposit with than regulated brokers. There is no guarantee of fund protection, negative balance protection or fund insurance.

It should be noted that some recent user reviews have also been negative, mentioning that withdrawal requests have not been responded to in over three months.

Should You Trade With TP Global FX?

TP Global FX offers a moderate range of assets at reasonable spreads and commission rates, all on the most popular trading platforms for online retail investing. The frequent trading contests, sophisticated educational resources and high leverage rates make this broker attractive to new investors looking to jump into trading.

However, being virtually unregulated, as well as providing limited security information and suffering claims of withdrawal request problems means UK traders should take a careful approach to money management. Experienced investors willing to take the risk could make use of TP Global FX’s daily analysis tools, low spreads and access to the MetaTrader platforms to turn a profit, despite the additional risk.

FAQ

Is TP Global FX A Safe Broker?

TP Global FX is not regulated by any major regulatory bodies, meaning the firm has no obligation to provide safety features that are expected of FCA-regulated brokers. As such, services like negative balance protection and fund segregation may not be provided. Trading with this broker is, therefore, riskier than most others.

What Platforms Does TP Global FX Offer?

TP Global FX offers the MetaTrader 4 and MetaTrader 5 platforms for desktop trading. The company also offers MT4 and MT5 mobile applications, as well as a bespoke TPG Trader mobile trading platform.

Is TP Global FX Good For New Traders?

TP Global FX boasts a wide range of assets, a couple of different trading platforms and a host of informational blog posts to help traders build their portfolios. Those new to financial speculation might find this overwhelming as there are no beginner-friendly educational resources available. The investing platforms are targeted at more experienced clients looking to apply technical analysis.

However, the broker does have a copy-trading service that novices may find useful as this allows one to look at and/or copy other investors’ portfolios.

Should UK Traders Open An Account With TP Global FX?

While TP Global FX deposit options are limited for UK traders, there are no deposit fees, allowing for cheap account funding. Furthermore, being less regulated, clients have access to higher leverage rates than is standard. Access to 24/7 crypto assets also makes trading times flexible for UK traders.

However, deposits can only be placed in USD and the unregulated environment adds a lot of risk to trading with this broker.

How Do I Open An Account With TP Global FX?

To open a TP Global FX account, click on the Visit button on this TP Global FX review. Fill out the online form, input personal information and provide proof of identification details when required (e.g. government ID). Once this has all been verified, your account will be opened automatically.

Top 3 TP Global FX Alternatives

These brokers are the most similar to TP Global FX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

TP Global FX Feature Comparison

| TP Global FX | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.9 | 4.8 | 4.8 | 4.7 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $200 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA, VFSC, CAMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | TP Global FX Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| TP Global FX | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

TP Global FX vs Other Brokers

Compare TP Global FX with any other broker by selecting the other broker below.

Popular TP Global FX comparisons: