TIOmarkets Review 2025

|

|

TIOmarkets is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to TIOmarkets |

| TIOmarkets Facts & Figures |

|---|

TIO Markets is a global forex and CFD brokerage with both an offshore and UK-regulated branch. The broker has a strong customer focus, with 24/7 telephone and live chat customer service. Traders can access a range of accounts with competitive spreads from 0.4 pips. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Unfortunately, I do feel that the broker's mediocre range of 300 CFDs will be quite restricting for most traders. It certainly doesn't compare to many other brands I review. Plus, the absence of crypto, ETF and soft commodity CFDs is a further setback. |

| Leverage | 1:30 |

| FTSE Spread | 20 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 0.02 |

| Stocks Spread | Variable |

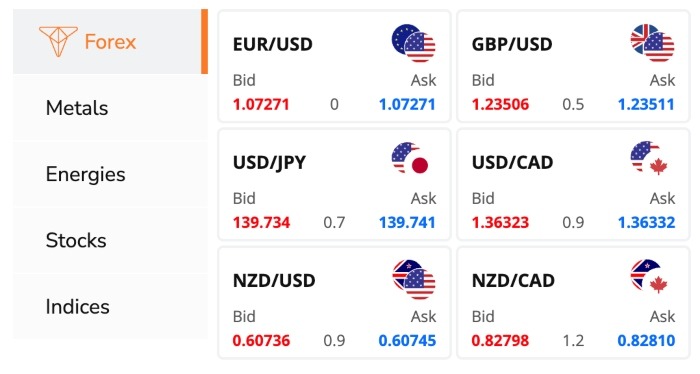

| Forex | My tests uncovered an average selection of 46 forex pairs, including major, minor and exotic currency combinations. That said, access to both the MT4 and MT5 platforms is a major bonus for forex strategists looking for market-leading software. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.6 |

| Assets | 45+ |

| Stocks | Overall, I find TIO Markets' selection of 200+ stocks and 11 indexes quite underwhelming compared to alternative brands. If you're just looking to trade major company shares like Amazon, Lloyds Bank and BMW, then this may be sufficient. |

TIOmarkets is an FCA-regulated broker, offering forex, stocks, and commodities. The brokerage offers several account types and powerful trading platforms, including MT4. This review will cover everything our experts found using TIOmarkets, including trading fees, regulatory compliance, additional tools and more.

Our Take

- TIOmarkets is a good choice for experienced traders who can benefit from tight spreads and low commissions with the VIP accounts

- The broker scores highly for its platform offering and UK regulatory status, which are good signs that the brand is trustworthy

- Education, market analysis and copy trading features are lacking compared to popular alternatives and may deter beginners

- The suite of tradable instruments is reasonable but does not compete with leading brokers in the UK

Markets

TIOmarkets has an average range of assets, with over 300 tradeable products. The selection is not as vast as top brands such as CMC Markets or IG Index, however we are confident that most traders will have enough to build a diverse portfolio.

When testing the platform, we found:

- Forex: 46 different types of forex pairs including majors, minors, and exotics such as EUR/USD and EUR/HUF

- Stocks: More than 200 international stocks including Amazon, BMW and Lloyds Bank

- Commodities: 9 popular precious metals and energies including gold, silver and crude oil

- Indices: 11 popular global indices including FTSE 100 and NASDAQ

We also liked that spread betting is offered as well as CFDs. The former allows UK traders to bet on short-term price movements with no tax on profits.

TIOmarkets Fees

Our experts found that fees were competitive, with spreads starting from 0.6 pips in the broker’s Standard account.

While using TIOmarkets, I was offered 0.9 pips on the GBP/USD, which is in line with popular brokers such as Plus500. VIP clients who deposit 3,000 USD or GBP equivalent will enjoy tighter spreads from 0.2 pips.

Commissions in the Standard account come in at $5 per round turn, which I think is reasonable compared to similar brands. VIP account holders also get commissions as low as $2 per round turn, though you will need to deposit 1,000 USD or GBP equivalent.

I was disappointed to see that there is a monthly account inactivity fee if an account has been left dormant for more than 3 months, and even more disappointed that the broker is not forthcoming about the amount.

Another drawback for me is that if you withdraw from your TIO Markets wallet without ever having placed a trade, you will pay $25 (via bank wire) or 5% (via credit cards and e-wallets).

Accounts

You can choose from three main account types at TIOmarkets: Standard, VIP and VIP Black. There are also PAMM accounts and Islamic accounts available upon request.

Overall, we found the accounts to be fairly competitive, offering lower trading costs as you move up the tiers. VIP Black clients, for example, gain access to a private consultation and inner circle webinars, though the minimum deposit requirement for this account is $3,000, which will put it out of reach for most beginners.

We were particularly pleased to see that hedging and scalping strategies are permitted in all accounts, ensuring that all trading styles are catered to.

Our team have highlighted the key differences between the accounts below:

Standard

Best for beginner traders

- Leverage: 1:30

- Spreads: From 0.6 pips

- Minimum Deposit: $10

- Commission Per Lot: $5

- Minimum Trade Volume: 0.01 lots

VIP

Best for intermediate traders

- Leverage: 1:30

- Spreads: From 0.4 pips

- Commission Per Lot: $2

- Minimum Deposit: $1000

- Minimum Trade Volume: 0.01 lots

VIP Black

Best for advanced traders

- Leverage: 1:30

- Spreads: From 0.2 pips

- Commission Per Lot: $0

- Minimum Deposit: $3000

- Minimum Trade Volume: 0.01 lots

How To Register With TIOmarkets

I didn’t have any issues signing up for a TIOmarkets account – the sign-up process is intuitive:

- Open the application form

- Enter your basic information and select ‘Next’

- Add your phone number and set a password

- Verify your email address

- Complete the KYC verification, including address and passport number

- Complete financial information and trading experience

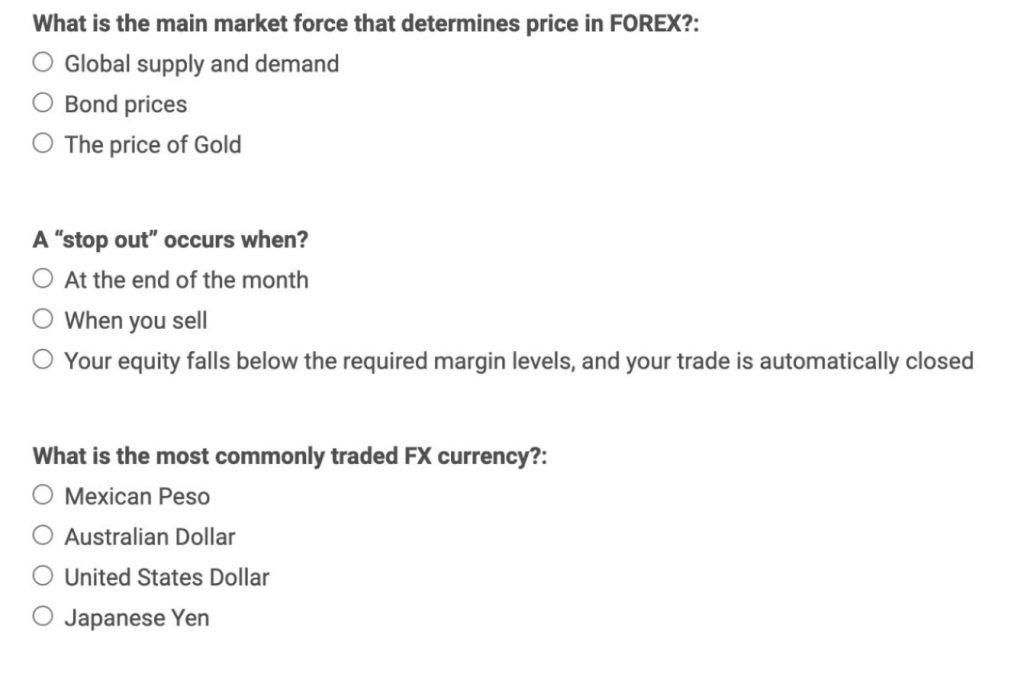

- Complete a questionnaire to test your competency in trading

- Wait for your account to be approved

Trading Questionnaire

Payment Methods

Our team found a good range of payment methods at TIOmarkets, including bank wire, credit cards and popular e-wallets such as Skrill and Neteller.

Deposits

I was pleased to see there are no deposit fees for all deposit methods, however, this only applies if you deposit more than the minimum deposit amount of $50 (or currency equivalent).

Bank wire transfers can take up to 5 working days to process, which is typical for bank transfers. To get started quickly, I recommend opting for deposits via credit cards or e-wallets which take up to 1 working day to process, though they are normally processed immediately.

Deposits are fee-free, however, some fees do apply if you have deposited into the account but have not traded, or if you wish to withdraw less than the minimum of $10.

Withdrawals

For withdrawals, TIO Markets only offers bank wire transfers and credit cards, which is limited compared to other brokers, for example, eToro accepts withdrawals via credit/debit card, bank transfer, PayPal, Neteller, Skrill, Trustly, and iDEAL.

With that said, I was happy to see that there are no withdrawal fees, which sets the broker apart from some rivals.

Again, bank wire transfers can take up to 5 working days to process, whilst credit cards and e-wallets can take up to 1 working day.

How To Make A Withdrawal

- Log in to the client portal

- Press the ‘Withdrawal’ button

- Enter the withdrawal amount and currency

- Select the withdrawal method

- Complete the request

Trading Platforms

I was glad to see that TIOmarkets offers some of the most popular platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both are available to download from the broker’s website or they can be accessed directly from a web browser.

MT4 and MT5 are widely reputed for their excellent customisable features including chart layouts, indicators, and trading templates. We also like that they both support automated trading using Expert Advisors (EAs), with backtesting functionality and access to full historical data.

MT5 has more additional features for multi-asset trading, whereas MT4 is particularly popular amongst forex traders. Some of the key features that differentiate the two platforms are:

MetaTrader 4

- Advanced technical analysis with 30 indicators and 31 graphical objects

- 4 flexible order types and 4 execution modes

- Single-threaded strategy tester

- Access to 175 instruments

- 9 chart time frames

MT4 Technical Indicators

MetaTrader 5

- Even more technical tools with 38 indicators and 44 drawing objects

- 6 pending order types and 6 execution modes

- Embedded MQL5 community chat

- Multi-threaded strategy tester

- Access to 263 instruments

- 21 chart timeframes

- Economic calendar

TIOmarkets App

It is good to see that both the MT4 and MT5 platforms are available as mobile apps with TIOmarkets. These are available to download from the App Store or Google Play for iOS and Android users, respectively.

Our team is always impressed with the MetaTrader apps’ functionality and power. Virtually all of the features that you see on the desktop platforms are also available in the mobile applications, so trading whilst on the go is comparable to trading at home.

For example, while using TIOmarkets, I was able to access a full set of trade orders and execution types, comprehensive real-time quotes and complete trading history.

You also get full access to technical analysis on mobile-adapted interactive charts. Understandably, many active day traders will still prefer to take advantage of the large screen of the desktop software when performing technical analysis.

Leverage

As we expected from an FCA-regulated broker, maximum leverage ratios are 1:30 for major forex. This falls in line with the regulator’s guidelines on protecting retail investors from accumulating large losses from highly leveraged trades.

With that said, our team always recommend applying appropriate risk management tools.

Demo Account

I was pleased to see that TIOmarkets offers a demo account for both the MT4 and MT5 platforms.

A demo account allows you to test out the broker’s platforms and practice trading strategies without depositing any real capital. As such, the funds included in the paper trading account can be customised as per your requirements, however, I did find it a little frustrating that you have to request top-ups from the broker.

On the upside, the demo account will not expire unless it has been left inactive for over 30 days, which is reasonable.

How To Open A Demo Account

- Log in to the TIOmarkets client portal

- Select ‘Open Demo Account’ and enter your basic information

- Choose the platform and confirm

- Check your email for the demo login details

- Download MT4 or MT5 and sign in to begin demo trading

UK Regulation

We are satisfied that TIOmarkets operates under authorisation from the Financial Conduct Authority (FCA), with license number 488900. The FCA is one of the most reputable industry regulators, ensuring that firms adhere to the fair treatment of customers and their funds.

Traders should receive the following benefits under the FCA’s rules:

- Client money protection: TIOmarkets must ensure client money is held in separate accounts and adequately protected.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Brokers are required to have robust AML and KYC procedures to prevent money laundering and terrorism financing. This includes verifying the identity of clients, monitoring transactions, and reporting suspicious activities.

- Negative balance protection: TIOmarkets must ensure that client accounts never fall below zero.

Extra Tools

I was pleased to see that TIOmarkets offers technical analysis and insights from Trading Central. The trusted third-party charting tool provides in-depth analysis of the markets, investment insights and market news. With that said, it is a shame that only clients of the VIP and VIP Black accounts can access Trading Central for free.

We also found some other practical tools, including an economic calendar for tracking daily economic events and forex calculators to determine pip values, trade margins, and more.

Overall, the selection is decent but could be improved with the addition of social investing features and a copy trading platform. Market leaders in this area include AvaTrade and eToro.

Education & Research

Overall, I found the broker’s selection of educational resources disappointing. There is a section on live webinars, though the last webinar was hosted in September 2022. Traders can find more up-to-date webinars and trading courses at IC Markets or Pepperstone, for example.

TIOmarkets’ blog section is a little better, with more regular market updates and in-depth trading insights, though this doesn’t particularly stand out against competitors.

It is a shame there isn’t more to offer in terms of analysis, such as expert-led video market reports or trading ideas with technical analysis demos.

Customer Service

We liked the 24/7 customer service offered by TIOmarkets, though it could be improved in some areas. The broker is available mainly via live chat or email.

To contact someone on the phone, you have to request a callback as no telephone number is publicly available. With that said, an international telephone number is provided in the broker’s email responses, though it may be subject to call charges for UK clients.

- Telephone:+357 2425 9325

- Email address: support@tiomarkets.com

- Live chat: Located in the bottom right corner of the website

When I tested the live chat function, I received a helpful response within 1 minute in line with other top brands. For emails, I received responses within 1 hour, which again is decent.

Company Details

TIO Markets Limited is a forex, CFD and spread betting brokerage headquartered in the offshore jurisdiction of St. Vincent and the Grenadines, although its UK branch is registered in London.

TIO Markets UK Limited is registered under company number 06592025. The CEO is Simon Quirke.

Bonuses & Promotions

When we used TIOmarkets, we weren’t offered any trading competitions, ‘welcome bonus’ deals or ‘no deposit’ bonus promotions, which is in line with the FCA’s restrictions on trading incentives. The plus side here is that traders are not subject to any unrealistic bonus conditions.

Trading Hours

Trading hours vary depending on the asset traded, as per the relevant global exchange.

For example, due to overlapping forex market exchanges, you can trade currency pairs around the clock. At TIOmarkets, you can trade EUR/USD Monday to Thursday from 12:05 am to 11:58 pm, and Friday from 12:05 am to 11:55 pm (GMT).

You can also check specific trading hours for all markets on the MT4 or MT5 platforms.

Should You Trade With TIOmarkets?

TIOmarkets could be a good option for traders with a decent starting capital, with competitive spreads in the VIP accounts. Alternatively, new traders can benefit from zero commissions in the Standard account with free deposits.

Yet whilst we were impressed with the broker’s powerful platforms and fast customer support, the lack of additional trading tools and educational resources is a letdown. The selection of assets is also fairly narrow compared to leading alternatives.

FAQ

Is TIOmarkets Safe?

TIO Markets UK Ltd is FCA-regulated and is therefore likely to be relatively safe. Other user reviews are also generally positive and there have been no reports of the broker being a scam.

Do TIOmarkets Offer Swap Free Accounts?

Yes, TIOmarkets does offer swap-free accounts for Muslim traders. However, it’s bearing in mind that the commission for swap-free accounts is higher to cover the swap fees that the broker absorbs per trade. This will differ on the account type and the size of the trade.

Can I Participate In Social Trading With TIOmarkets?

Are There Any Deposit Fees For TIOmarkets?

We were pleased to see that TIOmarkets do not charge any deposit fees, however, all payment methods have a minimum deposit requirement of $50.

Does TIOmarkets Allow Hedging?

Yes, the MT4 and MT5 trading platforms have a ‘hedging’ option as a default. TIOmarkets does not have any major restrictions on trading strategies.

Article Sources

Top 3 TIOmarkets Alternatives

These brokers are the most similar to TIOmarkets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

TIOmarkets Feature Comparison

| TIOmarkets | Swissquote | Admiral Markets | IG Index | |

|---|---|---|---|---|

| Rating | 2.9 | 4 | 3.6 | 4.7 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $50 | $1,000 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4 |

| Leverage | 1:30 | 1:30 | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | TIOmarkets Review |

Swissquote Review |

Admiral Markets Review |

IG Index Review |

Trading Instruments Comparison

| TIOmarkets | Swissquote | Admiral Markets | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

TIOmarkets vs Other Brokers

Compare TIOmarkets with any other broker by selecting the other broker below.

Popular TIOmarkets comparisons: