Tiger.Trade Review 2025

|

|

Tiger.Trade is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Tiger.Trade |

| Tiger.Trade Facts & Figures |

|---|

Tiger.Trade is a Swiss DeFi broker with nearly 200,000 clients and a competitive range of features, trading conditions and tools. The FINMA-regulated firm provides 24/7 customer support and access to several proprietary platforms. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, Forex, Cryptos, Futures, Options |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FINMA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Yes (copy trading) |

| Islamic Account | No |

| Forex | Tiger.Trade clients can use the company's Windows and MacOS copy trading platforms to speculate on a range of currency pairs. On the downside, the 10% commission rate is higher than some alternatives. |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Stocks | Tiger.Trade is integrated with a range of financial services companies and networks to provide clients with access to stocks and futures from the NYSE, NASDAQ, CME, ICE, CBOT, COMEX, NYMEX, MOEX, SPBEX and EUREX exchanges. |

| Cryptocurrency | Tiger.Trade is primarily a crypto broker, linking with Binance and six other exchanges to offer a wide array of cryptocurrency tokens at market prices with a software charge of $400pa (or $1,500 for lifetime access). |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Tiger.Trade is a Swiss-regulated trading platform and broker that gives traders a way to access cryptocurrencies, forex, indices and shares from companies around the world. The Tiger.Trade platform works on Windows and macOS computers and connects to numerous exchanges and terminals to find trading counterparties. This review will explore the broker’s account types, fees, proprietary software and everything UK clients need to know before signing up.

Our Take

- Tiger.Trade offers an innovative service that allows users to combine trading on various exchanges on one trading terminal

- The software will suit crypto traders with a decent amount of technical know-how

- The platform is not the most user-friendly as it requires quite complex steps to connect to different exchanges

- A high subscription fee is required to trade non-crypto assets, and the broker’s terminal has limited functionality on non-Windows devices

- Tiger.Trade is not FCA-regulated so UK traders should be cautious

Market Access

Tiger.Trade is not a typical broker, but instead provides a trading platform through which traders can access various exchanges. This is fairly unique and we found that it provides a very powerful service by allowing traders to connect to multiple exchanges with a decent range of assets through a single trading platform.

On the downside, since it foregoes the usual functions of an online broker, it could prove quite complex for casual traders and beginners. Also, while the stocks and crypto offering is strong, there are no commodities and a narrow range of indices.

Through the exchanges linked with Tiger.Trade, you can trade derivatives including futures and options in the following markets:

- Forex: More than 40 fiat-to-fiat currency pairs including seven GBP pairs

- Indices: Three indices including the IMOEX, MOEX 10 and RTSI

- Stocks: Around 3,000 stocks from companies listed on exchanges such as the NYSE and NASDAQ

- Crypto: Over 2,200 cryptocurrency pairs including Bitcoin from five exchanges including Binance and OKX

Accounts

Our experts were not impressed by the account types available. The broker adopts a licensing model that provides access to different markets for a fee. There is a free account type, but it is restricted to crypto trading only. If you want to trade on other markets such as forex and stocks, you need to pay extra.

We have pulled out the key differences between the accounts below.

Crypto

- Free to access

- Comes with a 14-day demo account

- Trade on cryptocurrency only

Full

- Base cost of $55 per month or $1,500 for a lifetime subscription. Discounts available for three-month or yearly subscriptions

- Complete access to all features

- Trading on crypto, stocks and shares, forex and futures

- Backtesting on historical data

History Player

- $15 per month subscription cost

- No live trading supported

- Paper trading on stocks and shares, forex and futures in addition to cryptocurrency

- Backtesting on historical data only

How To Open A Tiger.Trade Account

I didn’t encounter any problems signing up for a live account. Simply follow these steps:

- Download the Tiger.Trade mobile or desktop app

- Open the app and click ‘Create An Account’

- Input your email address and request a password

- Select your desired license

- Choose the exchanges and platforms you want to connect to

- Select the connection account type (e.g. spot vs margin trading)

- Connect your wallet using the API settings and set up a proxy server if desired

- Begin trading

Since Tiger.Trade requires extra steps of connecting various exchanges to the platform, we recommend checking the instructions on the official website for help with the process.

Funding Methods

Deposits

We found the payment system a little too limited in choice and complex for most casual traders. You do not deposit or store funds with Tiger.Trade. Instead, after registering an account, you deposit funds with the relevant exchange directly using a crypto wallet, which you need to connect to your chosen exchange via the platform’s API.

As a result, if you want to invest using Tiger.Trade, you will need to acquire a cryptocurrency wallet and purchase crypto using an entry-level exchange. This is a shame as our experts would have liked to see support for bank wire transfers or debit/credit cards. It means that traders are forced to undertake the risk and effort of investing in crypto in order to trade.

To deposit funds with your exchange, you first need to complete the ‘Know Your Customer’ verification steps and enable two-factor authentication. The 2FA process requires clients to input a code from the Google Authenticator App, which helps to prevent others from gaining access to their account without permission.

How To Make A Deposit To Tiger Trade’s Exchange

I thought the transfer process was relatively smooth after completing the KYC process and enabling multi-factor authentication:

- On the main account dashboard, go to the ‘Deposit’ section

- Choose the cryptocurrency and blockchain you will use to transfer funds

- Tiger.Trade will then give you the wallet address to send your funds to

Withdrawals

Similarly, you can only withdraw funds from the Tiger.Trade exchange via a crypto transfer. The process is simple as you click the ‘withdraw’ button on your account, choose the cryptocurrency and blockchain and then confirm the request using two-factor authentication.

Fees

The main fees for Tiger.Trade relates to your account type and license, but we found that it is relatively expensive to access the brand’s full services. The basic account type is free but offers crypto trading only.

Additionally, if you want to backtest to prepare for trading, you will need to pay $15 per month for the History Player account. However, you cannot invest with live capital in real-time with this license, and we think $180 per year is a lot to pay for what is essentially a demo platform.

To access all available markets, you must purchase the Full license, costing $55 per month. Alternatively, you can pay $124 for three months, $399 for 12 months, or $1,500 for lifetime access. However, this does not cover the History Player service, so an additional $15 monthly will be required for that. Our tip is to check the website for special offers, as Tiger.Trade frequently offers discounts.

We do like that there is no inactivity fee for Tiger.Trade and so you do not need to worry about being charged for lack of trading. Additionally, as Tiger.Trade does not handle any deposits or withdrawals, the broker does not charge any payment fees.

However, there are commissions charged by the Tiger.Trade crypto broker. For spot trading with Binance, there is a 0.1% for both the maker and taker. For futures of COIN-M crypto pairs, the maker fee is 0.01% and the taker fee is 0.05%. For USD-M crypto pair futures, the maker fee is 0.02% and the taker fee is 0.04%.

Fortunately, Tiger traders can reduce the total commissions they pay trading by between 25% and 30%, depending on their volume of monthly trades. At $45,000,001, the volume needed to gain a 30% reduction is steep, so we are happy to see that all traders qualify for the 25% reduction.

Trading Platform

Tiger.Trade provides its own proprietary platform rather than any third-party options, and you will use this to connect with exchanges and execute trades.

While the platform itself is well-made and comes with many features to support your trading, we would have liked to see clients given the choice of using others also. For example, MetaTrader 4, MetaTrader 5 or TradingView.

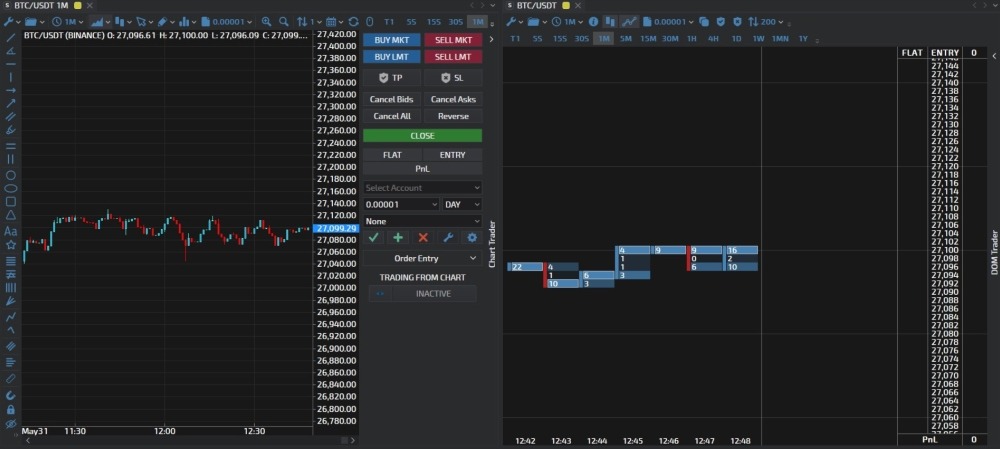

While using the Tiger.Trade platform, we found the following useful features:

- Over 70 technical indicators and drawing patterns that can be overlaid on the chart

- 14 built-in time frames from one tick up to one year. There is also the option to create your own time frames

- A highly customisable workspace facilitating easy reviews of your portfolio, past orders, alerts, and PnL

- Depth of market data

- One-click trading

Tiger.Trade offers its platform on both Windows and Mac computers, but currently the Mac version only functions with crypto exchanges.

How To Use The Tiger.Trade Software

I appreciated the simplicity of the trading process. To make a trade:

- Select your asset from the search bar

- Open the ‘Trading’ tab

- Specify the trade information such as volume

- If necessary, specify additional parameters such as take profit or stop loss orders

- Choose the trade type from market execution, limit, stop or stop limit

- If you open a limit, stop or stop limit order, you will need to input the strike price

- Click ‘Buy’ or ‘Sell’ to confirm the trade

- Alternatively, you can quickly trade using the depth of market data by clicking on the blue (to buy) or red (to sell) boxes next to a price

Copy Trading

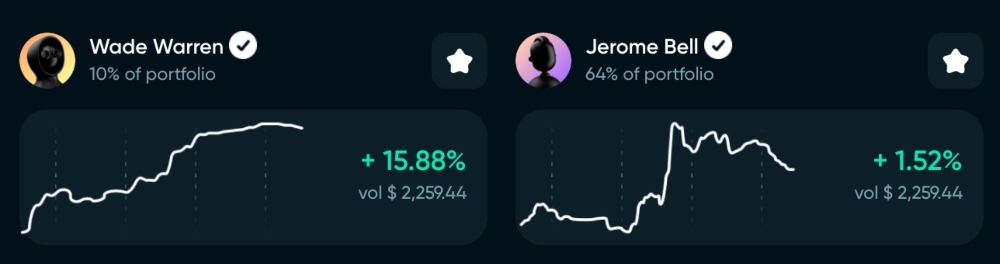

I was very pleased with the copy trading service, which I think is one of the best features of Tiger.Trade.

Copy trading allows clients to follow the trades made by experts and experienced investors. Then, whenever the expert makes a trade, you will copy their order automatically without needing to confirm any requests. To begin copy trading, there is a reasonable minimum deposit limit of $100.

Traders must satisfy certain requirements to qualify for certified ‘expert’ status, including having at least six months of trading history, over 20% annual profit and proof of trading high liquidity assets. The only requirement for uncertified traders is to have a proven history. Regardless of certification, traders cannot execute any scalping or high-frequency trading strategies.

To choose who to copy, you can see a leaderboard showing a quick overview of PnL over recent history, total trading volume and whether they are certified or uncertified. Clicking on a profile shows more detail such as the percentage of profitable trades, recent positions and links to their social pages.

While we do like the copy trading feature, we were disappointed that it was limited to cryptocurrency trading on the Binance app only. There was no option to follow traders in other markets or on different exchanges.

Mobile App

There is a Tiger.Trade mobile app for Android and Apple (iPhone and iPad) from Google Play and the Apple App Store, but it is restricted to the copy trading service only. We think this is a big disadvantage – most brokers and exchanges offer fully functional mobile apps these days, and the powerful MT4 or MT5 mobile apps are also extremely common among brokers that support these third-party platforms.

The copy trading app is available for download for iOS and Android devices with links on Tiger.Trade’s site.

Leverage

We rate the margin trading opportunities available from the broker, which allows clients to make leveraged trades on a selection of cryptocurrency pairs. The maximum leverage varies depending on which pair you are trading, with most restricted to 1:20, and less volatile pairs like ETH/BTC and ETH/USDT offering higher amounts up to 1:100.

While this amount of leverage is far lower than the amount offered by many offshore brokers on assets like forex, it is quite high for cryptos, which are particularly volatile assets.

It is good to see traders afforded the opportunity to boost their trading power to this extent on popular crypto pairs, though we do advise caution as this also magnifies risk.

Demo Account

We were happy to see that Tiger.Trade offers a free demo account to all clients, but with only a 14-day licence available, we feel there is insufficient time to properly learn how the platform works prior to trading with real capital.

When compared to IG Index where there is no limit on paper trading accounts, this is disappointing.

How To Open A Tiger.Trade Demo Account

I didn’t have any problems registering for a demo account. It only took me a couple of minutes by following these steps:

- Download and install the Tiger.Trade desktop trading platform app and sign up for an account

- After being allocated login details, select a free demo license

- Create connections with crypto exchanges or trading terminals

- Choose your account type (e.g. spot vs margin trading) and provide API settings. You also have the option of setting up a proxy server

UK Regulation

Tiger.Trade does not hold a license with the Financial Conduct Authority, which is generally a sign for inexperienced traders to keep their distance.

I would have preferred if the broker was authorised by the FCA as UK-based clients would receive high-level protections such as through the Financial Services Compensation Scheme.

Tiger.Trade does claim to be regulated by ARIF Self-Regulating Organisation in Switzerland. However, our research could not verify this as the broker’s name did not appear on the members list on the regulator’s website.

Bonus Deals

While there are no promotions with Tiger.Trade, you can receive a discount on the ‘Full’ account type by purchasing more than one month at a time. If you buy a three-month subscription, you can save around 25% and with an annual subscription, you save 39%. There is also the option to buy a lifetime subscription for the equivalent of 28 monthly payments. However, we recommend thinking carefully about this option, since there is no guarantee that this relatively young company will be around that long.

The Tiger.Trade broker also offers a discount according to trade volume from the past month whereby the more you trade, the greater the discount on commission. If you trade anything up to 550,000 USDT, you receive a 25% discount. This increases in 0.5% steps up to 30% for a trading volume of over 45,000,000 USDT per month.

Extra Tools & Features

Our experts were sorry to see a lack of extra tools and features to support Tiger.Trade clients. There is no education section or market insights from experts, and even basic tools like an economic calendar or suite of calculators were missing.

We were disappointed by the lack of these features, which are offered by most brokers. CMC Markets, for example, has an extensive learning centre with webinars, tutorials, training guides and market analysis.

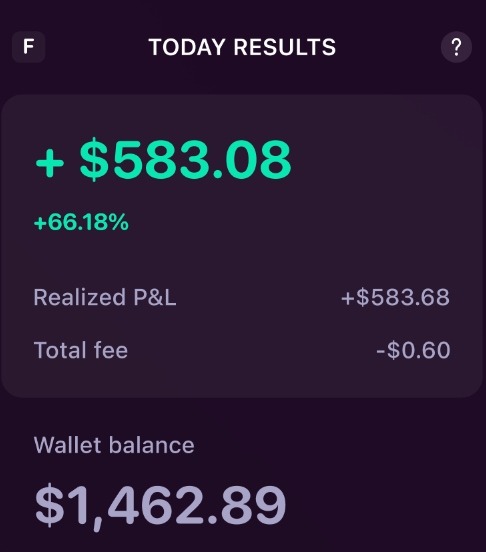

With that said, we did rate the daily insights into your gains and losses:

Customer Service

I was not happy with the customer support at Tiger.Trade, which has neither a live online chat nor a phone hotline. This means there is no reliable way to reach the company if you have an urgent query, and the only avenues to reach them are via email or social media. From our experience, the team is fairly responsive, getting back to us about two hours after we emailed them.

To seek help with Tiger.Trade, you have the following options:

- Email copytrading.support@tiger.trade for copy trading-specific

- Email support@tiger.trade for all other topics

- Contact the team at their social media pages on Facebook, Twitter, Telegram, Discord or YouTube

Company Details

Tiger Trade Capital AG was launched in 2015 and has grown its customer base to around 180,000 since then. Additionally, the broker has enlisted the MMA star Conor McGregor as a brand ambassador.

Tiger.Trade is based in Zug, Switzerland and claims that it is regulated by the Swiss Association Romande des Intermédiaires Financiers (or ARIF). However, it is worth reiterating that our experts could not verify this license upon checking.

Trading Hours

Tiger.Trade supports investing in crypto 24/7 without breaks. Other markets, however, will vary. For example, the New York Stock Exchange is open between 2:30 pm and 9 pm GMT Monday to Friday.

Should You Invest With Tiger.Trade?

Tiger.Trade is an innovative platform that offers access to an excellent range of exchanges through a single terminal, and we think its services will suit serious cryptocurrency traders, though it may prove too complex for more casual traders.

While it does not offer either MetaTrader 4 or MetaTrader 5, the proprietary platform is of high quality with many customisable chart settings and several tools for technical analysis.

However, the way Tiger.Trade’s services work on stock, forex and other markets is less effective. Fees on these assets are also less transparent. Moreover, Tiger.Trade is not regulated by the FCA, which means UK clients may receive limited legal and account protections.

For these reasons, you should take care if you choose to register with Tiger.Trade.

FAQ

What Is Tiger.Trade?

Tiger.Trade is a broker that facilitates derivative and spot trading of cryptocurrencies, shares, indices and forex. Clients can strategise and execute trades through the broker’s proprietary app, which connects with exchanges and terminals such as Binance.

Is Tiger.Trade Good Or Bad?

Tiger.Trade has both benefits and drawbacks. It is a good option for crypto traders as it provides connections with a range of exchanges including Binance, OKX and BitMEX on just one platform. Additionally, clients can trade on shares, indices and forex, but must pay a subscription fee to do so.

On the downside, it is not regulated by the FCA, some trading charges are opaque and the brand is not established in online trading circles. As such, it is worthwhile opening a demo account to test the platform that can download for Mac or PC to build some experience first.

Is Tiger.Trade Safe And Reliable?

Tiger.Trade is a legit broker that mandates a KYC process and two-factor authentication so clients can ensure their funds are kept secure. However, it is not FCA-regulated, so you should be careful before handing over your money.

Is Tiger.Trade Free?

Tiger.Trade offers a free account that is limited to cryptocurrency trading only. Additionally, you can download the app on your Macbook or Windows PC for free.

If you are interested in trading on other markets such as stocks and shares you will need a full trading account, which costs $55 per month.

Does Tiger.Trade Offer A Trial?

Yes, Tiger.Trade offers a 14-day demo account for free which provides you with an opportunity to test out the broker’s platform. It is also a good way to test out any changes for the new software version from recent updates you have needed to download.

Note that this is limited to personal trading only. You cannot use a demo account to test out the Tiger.Trade copy trading service.

How Do You Open A Tiger.Trade Account?

To register with Tiger.Trade, you first need to go to the broker’s web page and download the app onto your device. After installing, input an email to request login details. Then, sign in and begin setting up using the available licenses to different exchanges and terminals. Once you have completed the setup, you may be asked to complete a ‘KYC’ process and enable 2FA before trading with live capital.

Article Sources

ARIF Register (No Result For Tiger.Trade)

Top 3 Tiger.Trade Alternatives

These brokers are the most similar to Tiger.Trade:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Tiger.Trade Feature Comparison

| Tiger.Trade | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.3 | 4.7 |

| Markets | Stocks, Forex, Cryptos, Futures, Options | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $100 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Tiger.Trade Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Tiger.Trade | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Tiger.Trade vs Other Brokers

Compare Tiger.Trade with any other broker by selecting the other broker below.

Popular Tiger.Trade comparisons: