Tickmill Review 2025

|

|

Tickmill is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to Tickmill |

| Tickmill Facts & Figures |

|---|

Tickmill is a global broker authorized by trusted regulators including the CySEC and the FCA. Over 660,000 traders have opened an account with the firm with more than 530 million trades executed. Advanced trading tools, educational content and low fees make this broker stand out from competitors. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, commodities, bonds |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, FSA, LFSA, SC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Speculate on the price movement of 500+ instruments including forex, stocks, commodities and crypto with a low minimum deposit of $100. You can go long or short with leverage in line with regulatory requirements. |

| Leverage | 1:500 |

| FTSE Spread | 0.9 |

| GBPUSD Spread | 0.3 |

| Oil Spread | 0.4 |

| Stocks Spread | N/A |

| Forex | Trade 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD, with spreads as low as 0 pips and ultra-fast execution speeds. |

| GBPUSD Spread | 0.3 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 62 |

| Stocks | Trade 500+ CFD stocks and ETFs with leverage up to 1:20 and no commission. You can also speculate on popular indices from major economies, including the US, EU and UK. |

Tickmill is an award-winning, global brokerage, with competitive CFD, options and futures offerings. It specialises in forex, stock, indices, commodities, bonds and cryptocurrency markets, providing access to raw spreads. This 2025 UK broker review will look at Tickmill’s trading platforms, account fees, customer support and more to help investors decide whether to sign-up.

Company History & Overview

Established in 2014, Tickmill is the trading name of Tickmill UK Ltd, which has its headquarters and registered office in London. It is a member of the Tickmill Group, which is a conglomerate of companies – including Tickmill Europe Ltd – with offices around the world. The company is a large broker, with more than 270,000 clients and 200 employees globally. This firm also received an award for Best Forex Spreads 2022 at the Ultimate Fintech Awards.

Tickmill UK Ltd is regulated by the UK’s Financial Conduct Authority (FCA), though the firm’s other subsidiaries are under the jurisdiction of leading overseas regulators, such as CySEC.

Trading Platforms

Clients have a choice between the industry-leading MetaTrader 4 and 5 (MT4 and MT5) platforms, in addition to several others, including TradingView. All of these platforms have earned recognition and respect throughout the investing world, each available through Tickmill for download on PC or browser-based use.

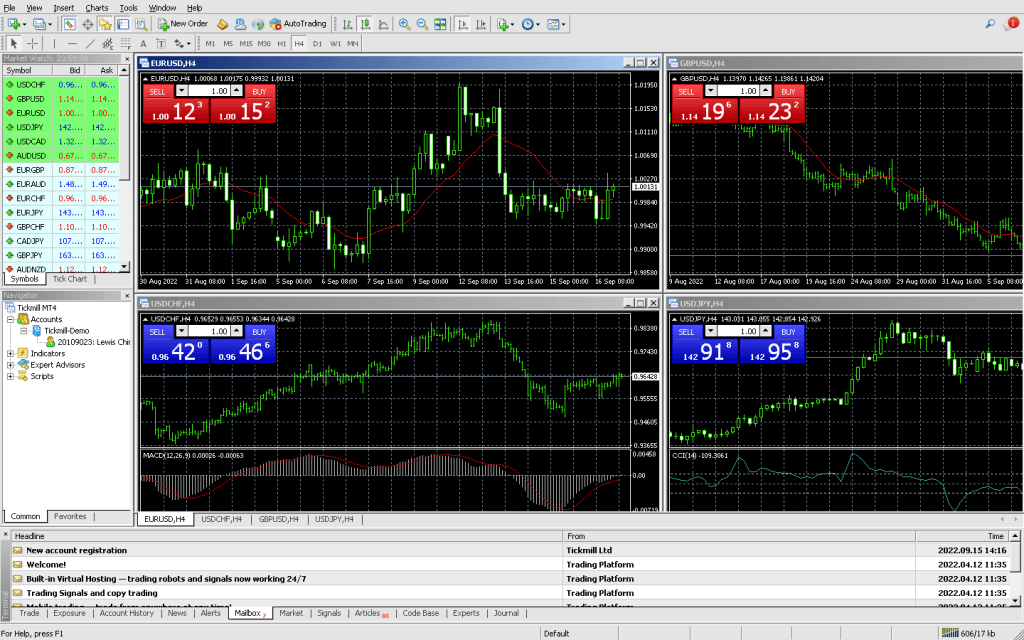

MT4

- Nine time frames

- WebTrader support

- Algorithmic trading

- 30 technical indicators

- Four pending order types

- Windows, macOS, Android (APK) and iOS

- CFDs on forex, indices, commodities, bonds and cryptocurrencies

MetaTrader 4

MT5

- 21 time frames

- WebTrader support

- Algorithmic trading

- Six pending order types

- 38 integrated indicators

- Built-in economic calendar

- Windows, macOS, Android and iOS

- CFDs on forex, indices, stocks, commodities, bonds and cryptocurrencies

CQG

- RSS news feed

- Real-time data

- Web-based option

- Numerous chart styles

- Optimised for the futures market

- Over 90 technical indicators and tools

- Also available with QTrader, Integrated Client (IC) and on mobile

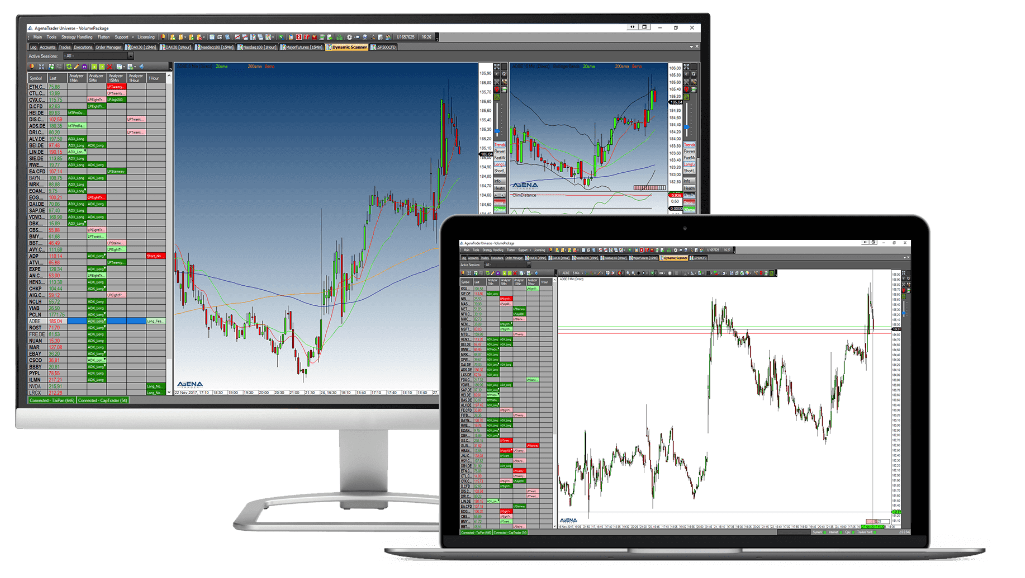

AgenaTrader Mercury

- 150 indicators

- Multiple timeframes

- Connect with other traders

- Direct market access to the Chicago Mercantile Exchange (CME)

- Order templates so you can save order structures for future transactions

AgenaTrader Mercury

TradingView

- 12 chart types

- Custom time intervals

- Integrated with Tickmill

- Up to eight charts per tab

- Strategy backtesting using historical data

- Over 100,000 community-built indicators

Markets

Tickmill clients can invest using CFDs, options and futures, although spread betting is not supported. In total, there are over 180 instruments. The forex and CFD markets can be broken down as follows:

- 14+ indices

- Stock CFDs

- Four bonds

- 62 forex pairs

- Commodities (including Brent/WTI oil and five metals)

- Eight cryptocurrency CFDs including Bitcoin and Ripple (pegged to the USD)

Please note that cryptocurrency CFDs are only available to professional clients (who are generally high-net-worth individuals or those with prior financial experience).

Those wishing to trade futures rather than CFDs can invest in stock indices, forex, metals and energies across seven globally-regulated exchanges, including the CME and CBOT. Options contracts are also available through the CME exchange.

Fees

Spreads as low as 0.0 pips are available on Tickmill, though they are variable and so will fluctuate depending on market liquidity and volatility. The account type will also impact the spread rates and commissions charged. Our review team found that the typical spread for EUR/GBP is 0.4 pips and 0.3 pips for GBP/USD. These are low when compared with average spreads at other brokers but access to the tightest spreads will incur a commission. For indices, the UK100 (FTSE 100) has a typical spread of 0.9, while others like the US 30 sit around 2.5. Expect spreads of around 1.9 for the Nasdaq 100 (a.k.a the NAS100). Gold spreads (XAU/USD) are typically as low as 0.1.

For raw spreads on Tickmill’s CFD and forex accounts, the commission will be two units of the base currency per side per 100,000/one lot traded (or one unit of the base currency with the VIP level). For example, suppose an investor with a Pro account opens a £100,000 position on EUR/GBP and then closes it. The commission will be £2 per side, so the total will be £4.

Those holding positions overnight will also be subject to swap rates. These can be either positive or negative depending on the interbank rate and the particular asset you are buying or selling.

Commission on futures (with the futures account) is £0.85 for a micro contract and £1.30 for a standard contract. For a micro options contract, the commission is also £1.30 (although this excludes exchange and NFA fees).

Note that Tickmill accepts EUR, GBP, USD and PLN as base currencies. Investors depositing money into their trading account in a currency that is not one of these may incur currency conversion charges from their bank.

Leverage

Margin rates vary depending on the asset in question and whether the investor is a retail or professional/Tickmill Prime client. As is common for UK and European brokers due to restrictions put in place by regulators, retail clients can expect maximum leverage on forex of up to 1:30 and up to 1:20 on stocks.

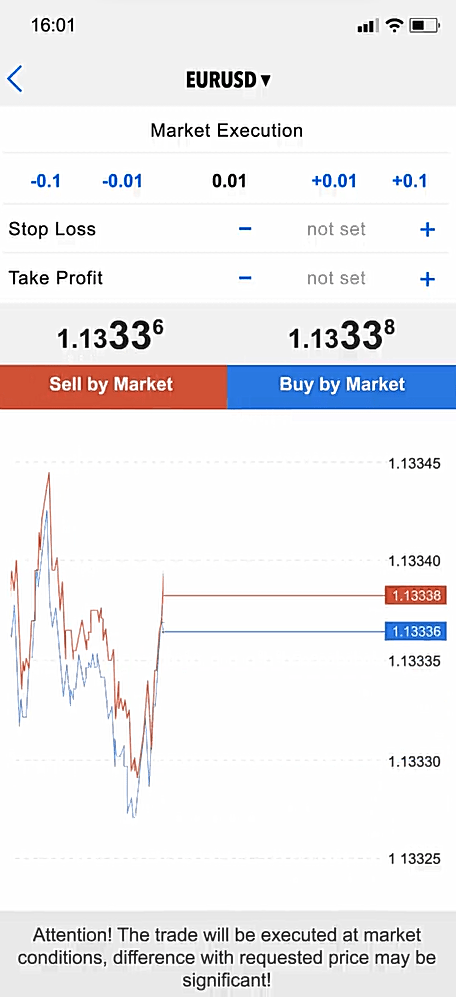

Mobile Trading

The broker has its own mobile app so investors can manage their accounts on the go. This is available for download on both iOS and Android (APK). Note that trading platforms such as MetaTrader 4 and 5 also have mobile apps, which can be downloaded from the App Store and Google Play.

MetaTrader 5 Mobile

Payment Methods

Deposits

The minimum deposit is £100. This ranks pretty poorly compared to other brokers, many of whom now offer minimum deposits as low as £10. There are generally no fees charged by Tickmill on deposits, although bank transfers must be over £5,000 for fee-free funding. All deposit methods are instant, apart from a bank transfer, which processes within one working day.

The full list of deposit options is as follows:

- Skrill

- PayPal

- Dotpay

- Neteller

- SOFORT

- Paysafecard

- Bank transfer

- Visa/Mastercard

- Rapid Transfer by Skrill

Withdrawals

Our experts studied Tickmill withdrawals and found that the minimum withdrawal is £25. All deposit methods are available for withdrawals, except Paysafecard. The processing time for all methods is within one working day.

Demo Account

Tickmill has a free demo account available for UK traders. Investors can choose between a forex/CFD demo account (either on the MT4 or MT5 platform) or a futures demo account. In addition, clients can select their level as they would for a live account. That is to say, Classic, Pro and VIP demo accounts are all available. Unlike with other brokers’ demo accounts, there is not a specified sum of virtual money – instead, you can choose the quantity of virtual funds you start with.

Bonuses & Promotions

Although Tickmill does allow customers to claim a £30 no deposit free welcome bonus to those in certain jurisdictions, this is not available to investors in the UK. No other promotions or rebates are featured on this broker’s official UK website. This may be due to the FCA clamping down on broker advertisements of high-risk investment products. We would always urge caution in this area; although some brokers will offer schemes of over £100, they may not always make the bonus withdrawal terms and conditions easy to understand or achieve.

UK Regulation

Tickmill UK Ltd is regulated by the FCA. The FCA aims to protect consumers, enhance market integrity and promote competition. It is a robust regulatory body that helps reassure traders that their interests will be better protected than with an offshore and unregulated broker. The broker is also a member of the Financial Services Compensation Scheme (FSCS), which can award compensation to eligible clients up to £85,000 if the firm is unable to meet its obligations.

Account Types

Tickmill has three forex and CFD account types, along with a futures account. In short, the Pro account is for raw spreads plus commission, the Classic account is zero commission with wider spreads and the VIP account offers raw spreads and low commission but a high minimum balance requirement.

Pro Account

- Spreads from 0.0 pips

- Islamic account available

- Minimum deposit of £100

- Commission at £2 per side per 100,000 units

Classic Account

- Zero commission

- Spreads from 1.6 pips

- Islamic account available

- Minimum deposit of £100

VIP Account

- Spreads from 0.0 pips

- Islamic account available

- Commission at £1 per side per 100,000

- Minimum balance of £50,000

Futures Account

- Commission from £0.85

- Minimum deposit of £1,000

How To Get Started With Tickmill

1) Register For An Account

The first step is sign-up/registration. The registration page can be accessed by clicking on the ‘Create Account’ button on the homepage. Signing up involves choosing your account type (whether that be the forex/CFD Pro, Classic, VIP or Futures account), entering your personal details and financial experience and uploading verification documents such as photo ID and proof of address. Although this takes longer than opening a demo account, it can still be done in a matter of minutes. Note that there can be delays with Tickmill approving your account if, for example, they need to carry out further checks.

2) Deposit Funds

Once your account has been approved and you can login, the next step is to deposit funds. Deposits are made inside the “Client Area”. Your base currency will need to be one of the designated base currencies. For those in the UK, this will usually be GBP. An appropriate deposit method will need to be chosen and investors should remember that they will be liable for bank transfer fees if the deposit is under £5,000.

3) Choose A Market

Keep in mind that your choice of market will likely have an impact on spreads and leverage. For example, forex majors will generally have tighter spreads and higher maximum leverage than exotic pairs (mainly because exotics are more volatile). We recommend that investors choose a market they are familiar with and endeavour to understand the factors influencing prices in that market.

For example, those investing in gold should be aware that its reputation as a safe haven asset means investors often buy it in times of economic uncertainty. If you are someone new to all financial markets, make use of Tickmill’s educational material and demo account first.

4) Open, Monitor & Close Your position

Knowing when to enter the market is often the trickiest decision that investors face. There are many unknowns and it is often a case of managing risk. Luckily, the tools available on trading platforms like MT4 and MT5 mean that clients can benefit from signals and algorithmic trading strategies. Features like these can mean decisions are based more on rationality than emotion.

It may also be a good idea to backtest your chosen strategy (whether it is hedging, scalping or swing trading) using historical market data. Monitor your positions closely and keep up-to-date with financial news and Tickmill’s economic calendar. Sophisticated investors will often have their positions close automatically once the price reaches a certain level or moves a particular number of pips away from their starting position.

Benefits Of Tickmill

- ECN broker

- No requotes

- Raw spreads

- Fast trade execution

- Regulated by the FCA

- Zero commission accounts

- Negative balance protection

- Most payment methods are free

- Excellent choice of trading platforms

Drawbacks Of Tickmill

- No promotions or bonuses

- High minimum deposit

- Low leverage rates

Additional Features

There is a wealth of educational material on Tickmill, including free webinars in multiple languages, seminars, eBooks and video tutorials (covering topics such as how to build a custom dashboard on the CQG platform). In addition, the Acuity Trading Tool is useful to gain a picture of market sentiment. It scans through millions of news articles and data releases to do this. Insight can also be gained from the broker’s blog, which offers free access to various articles that analyse market conditions.

More experienced traders running expert advisors (EAs) and algorithmic strategies whilst offline will benefit from the broker’s Virtual Private Server (VPS), which is offered through BeeksFX. Although not free, clients can get a 20% discount on all VPS packages.

There is also free access to Autochartist, which scans vast amounts of data to identify potentially profitable investing opportunities. Autochartist is an external analysis tool used by many online brokers.

A trading margin and pip calculator is available so investors can easily work out the required leverage and the swap rates for a particular forex pair.

Trading Hours

Trading hours depend on the market in question. Those seeking maximum flexibility should look to the crypto market, which runs 24On, on the other haGold nd, is Monday-Friday 01:02-23:57 GMT and the forex market is closed across most of the weekend.

Customer Support

If at any point you have a Tickmill technical issue or an ‘invalid account’ problem with MetaTrader, the broker offers excellent customer support in 16 languages. The support team is available Monday-Friday, 07:00 – 20:00 GMT. In addition to an extensive FAQs section, the customer support team can be contacted by phone, email or using an online contact form. Email response times on business days are within 24 hours. The broker also has social media profiles on Facebook, Twitter, LinkedIn, YouTube, Instagram and Telegram.

- Email Address: support@tickmill.co.uk

- Phone Number: +44 203 608 6100

Safety

In addition to being regulated by the FCA, this firm holds client funds in segregated accounts (meaning that client funds are separate from the company’s funds) in top-tier banks. This mitigates risk should the company encounter financial difficulties. Tickmill UK Ltd also adheres to data protection law as set by the Information Commissioner’s Office (ICO) and is registered with this organisation. As part of its objective to protect client data, it uses industry-standard encryption algorithms. Moreover, negative balance protection is available for all retail investors. For these reasons, we would give this broker a relatively high security rating.

Tickmill Verdict

Tickmill is an award-winning CFD, futures and options broker that offers a range of accounts with low spreads or zero commissions. Its excellent customer support and wealth of educational material make the firm an attractive choice for investors. Moreover, the firm supports Islamic traders and boasts a wide range of trading platforms. Those interested can sign-up using the button on this page.

FAQ

What Does Tickmill’s No Requotes Policy Mean?

Some brokers give requotes when the price has moved during the time between the order being made and executed. When this happens, clients accept or reject the new price, which can delay execution times or result in unfavourable pricing. Tickmill does not give requotes, meaning the order will automatically be executed at the previously available price.

Can I Run An Expert Advisor 24/7 With Tickmill?

Yes. Tickmill clients receive a discount on a VPS, which means expert advisors and other forms of algorithmic trading can be run continuously whilst offline.

How Does Tickmill Make Money With Zero Commission?

Traders can get zero commission with the Classic account, although this Tickmill account comes with higher spreads (at least 1.6 pips). The broker generates revenue from these spreads.

Are Cryptocurrencies Available For All Traders On Tickmill?

No. Only professional traders have access to cryptocurrency derivatives in the UK. To be classed as a professional trader, you must meet certain criteria concerning your equity value and experience.

What Do I Do If I Forgot My Tickmill Password?

This can be reset easily from the login page. There is no need to contact customer support directly in the first instance.

Do I Need To Download Software From Tickmill To Access MetaTrader 4 & 5?

Not necessarily. While a desktop version is available that requires a software download, the browser-based options on offer do not. This means investors can get trading quicker.

Top 3 Tickmill Alternatives

These brokers are the most similar to Tickmill:

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Tickmill Feature Comparison

| Tickmill | Vantage FX | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 3.3 | 4.7 | 4 | 4 |

| Markets | Forex, CFDs, indices, commodities, bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $100 | $50 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, FSA, LFSA, SC | FCA, ASIC, FSCA, VFSC | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | ||||

| Review | Tickmill Review |

Vantage FX Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| Tickmill | Vantage FX | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Tickmill vs Other Brokers

Compare Tickmill with any other broker by selecting the other broker below.

Popular Tickmill comparisons: