The Bullish Gartley Strategy

The Bullish Gartley Strategy is based on the retracement strategies that were outlined by H.M. Gartley in his 1935 book. There are two versions of this strategy: bullish and bearish. In today’s article, we will talk about the bullish component of this strategy.

Top UK Forex Brokers

-

Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

-

CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

-

Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

-

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

-

FxPro offers 70+ currency pairs but no minors and stands out with its ultra-fast execution speeds and tight spreads averaging 0.45 pips on EUR/USD. Forex traders can also build test and deploy short-term trading strategies on the industry-leading MT4 software, with expert advisors (EAs) for algo trading.

-

IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

-

FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

-

City Index is one of the most trusted forex brokers, providing an above-average selection of 80+ currency pairs alongside tight spreads from 0.7 pips, trading alerts, and terrific insights into FX markets, with 99.99% of trades successfully executed.

-

Markets.com offers 43 major, minor and exotic currency pairs. The range is around the industry average, though spreads are fairly competitive, starting from 0.6 pips for EUR/USD. There’s also an excellent range of tools and education, including forex calculators and trading videos.

-

Axi’s 70+ currency pairs is its strongest market offering and beats out rivals like AvaTrade, which offers only 50+. Combine this with an elevated MT4 offering through the NextGen add-on, and Axi remains an excellent broker for forex traders.

-

OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad for fresh insights.

-

Errante traders can access 50+ forex pairs with leverage up to 1:500 (location dependant). The broker offers fast execution and tight spreads, especially to clients with VIP and Tailor-Made accounts.

-

Kwakol Markets offers a wider range of forex pairs than most competitors, with 90+ assets available. Users get fast execution speeds and competitive spreads through the ECN model. On the negative side, not all currency pairs are available on MT4.

-

Coinexx offers an excellent selection of 70+ major, minor and exotics currency pairs, presenting diverse opportunities with a forex calculator to aid trading decisions. It’s also one of a select few brokers to support forex trading on the ActTrader platform, alongside MT4 and MT5.

-

Ingot Brokers offers forex trading on a modest suite of 30+ currency pairs with raw spreads on the MT5 platform. There are also no restrictions on short-term trading strategies, including hedging, scalping and the use of Expert Advisors (EAs).

-

Trade a small selection of 25 major and minor pairs. Spreads from zero on the pro account, micro-lot trading, and very high leverage make up for the limited range of currencies. The MetaTrader software is also a well-regarded platform for forex trading.

-

Go long or short on over 50 currency pairs with spreads from 0.6 pips on EUR/USD. Traders can access interactive tools on the forex industry’s most popular software, MetaTrader 4, with customizable charts, one-click trading and Expert Advisors (EAs) for algo trading.

-

World Forex offers CFD and digital contract trading on 53 forex pairs, including EUR/USD and GBP/EUR. High leverage is available for CFDs, which can be accessed with competitive spreads on certain account types.

-

Trade 45+ major, minor and exotic pairs with deep liquidity and low latency. The ultra-tight spreads from 0.01 pips on raw accounts, competitive $7 or lower round-turn commissions and high leverage up to 1:500 will suit scalpers, who can trade without limits.

-

Scope Markets offers 40+ major, minor and exotic currency pairs. Although the range is average, experienced traders can access very high leverage up to 1:2000. Additionally, the broker’s proprietary terminal delivers advanced analysis tools, including a live forex heatmap.

-

Trade 50+ forex pairs, including popular major, minor and exotic pairs. This is a decent selection, but traders will have a choice between the attractive MT4, MT5 or IRESS platforms and regulatory cover from ASIC. The VPS will also suit automated forex trading strategis.

-

Anzo Capital offers 45+ forex pairs including majors, minors and exotics with fast execution and spreads starting from zero. High leverage up to 1:1000 is available with a margin call at 80% and a stop out level at 50%.

-

I think the range of 60+ major, minor and exotic currency pairs is fairly competitive, especially with spreads from 0 pips in the Pro account. Experienced traders can also access high leverage up to 1:500 in the popular MT4 platform.

-

Rock Global clients can access 50+ currency pairs via CFDs with leverage up to 1:500, world class liquidity and fast execution on the MT4 or TWS platforms. The tight spreads from 0.9 with no commission are a particularly attractive feature.

-

VT Markets offers an average selection of 40+ forex pairs with up to 1:500 leverage. Forex spreads in the ECN account are highly competitive, starting from 0.0 pips, although the 1.2-pip minimum quotes in the Standard account are a little higher than the likes of Pepperstone or IC Markets.

-

Binary and OTC options can be purchased on 40+ currency pairs, with 55+ currency pairs available if you deposit $1000. Typical payouts are reasonable at 81% and the $1 minimum trade makes the broker accessible to new forex traders. There is also access to the MT4 and MT5 platforms for experienced forex traders.

-

Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular trading strategies.

-

xChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies.

-

PU Prime clients can trade 40+ forex pairs via the MT4 and MT5 platforms with dynamic leverage up to 1:500. Spreads start from near zero on Prime accounts, which also charge a $7 commission per lot, and a zero-commission Standard account with wider spreads is also available.

-

With 100+ currency pairs including all majors plus many minors and exotics tradeable on the MT4 platform with 1:2000 leverage, SuperForex lives up to its name as a great choice for forex traders. The ForexCopy system is also useful for newer traders.

-

AdroFx's strongest offering is its 60+ currency pairs, which can be traded with very high leverage up to 1:500. The broker also offers competitive forex spreads starting from 0.4 pips and charges no commission. Additionally, traders have access to MetaTrader 4, which was built for forex trading and offers excellent support for technical analysis and algo trading.

-

Start trading on dozens of currencies at RoboMarkets with powerful analysis tools and pattern recognition technology. 35+ currency pairs are available with tight spreads from 0 pips and rapid market execution. You can also utilise the broker's forex news alerts and economic calendar.

-

M4Markets offers 45+ currencies with zero pip spreads. The low latency and 30-millisecond execution speeds makes the broker a decent choice for forex traders. Additionally, there are no restrictions on trading strategies, including scalping.

-

MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted.

-

I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading.

-

Global Prime traders can access 48 forex pairs including majors, minors and exotics with tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Forex is traded via the leading MT4 platform, micro lots are available and latency is low via a New York-based server.

-

Trade Nation offers over 30 of the most popular forex pairs with variable spreads. Traders can access a slick proprietary platform or MetaTrader 4, with real-time forex market updates and insights via 'Smart News'.

-

As well as a competitive selection of 55+ forex pairs, traders can access high leverage up to 1:300. You can also enjoy advanced analysis from Trading Central with easy integration into MetaTrader 4.

-

Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders.

-

4xCube offers 60+ currency pairs with competitive trading conditions. We like that all trading strategies are permitted including scalping and hedging.

-

ActivTrades offers its lowest fees in the forex department, with excellent spreads on majors like the EUR/USD from 0.5 pips and zero commissions, keeping pricing simple. Improvements to the ActivTrades platform, alongside access to the industry-leading MetaTrader 4, also give traders the tools they need to navigate the FX market confidently.

-

BlackBull offers 64 currency pairs with excellent pricing through its ECN accounts, with the Standard commission-free spread starting from 0.8 pips. BlackBull also ensures its rapid execution carries through to MT4, which still stands as the industry’s most popular platform with active forex traders.

-

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

-

Swissquote offers compelling conditions for active forex traders, with an extensive range of 80+ currency pairs, plus ultra-fast execution speeds averaging 9ms and access to the industry’s favorite MT4 software.

-

SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online.

-

EagleFX facilitates short-term trading on over 50 major, minor and exotic currency pairs with competitive spreads as low as 0.1 pips, plus the industry-leading MT4 platform, which delivers a host of charting tools for traders, including 9 timeframes and over 30 indicators.

-

FXDD continues to offer a leading selection of 90+ currency pairs with ECN pricing. Spreads are decent, coming in at 0.4 pips for EUR/USD during testing. That said, these quotes aren’t as narrow as top competitors like Pepperstone.

-

Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service.

-

FXTrading clients can access 70+ forex pairs with high leverage up to 1:500, fast execution averaging 80ms, excellent liquidity and spreads from zero. A good selection of minors and exotics are available as well as all the majors. New users can start trading forex in 4 easy steps.

-

With over 190 forex spot pairs, EZ Invest outperforms many rivals in terms of access to the currency markets. Users can also choose between desktop software, a webtrader plus a solid mobile app. On the negative side, spreads aren't the tightest on entry accounts.

-

FXGiants offers a strong suite of 70 currency pairs, spanning major, minor and exotics. Forex can be traded through CFDs, offering long and short opportunities with leverage.

-

Trade 50+ forex pairs via the MetaTrader 4 and MetaTrader 5 platforms with leverage up to 1:500, immediate execution, deep liquidity and tight spreads.

-

Fortrade offers 60+ currency pairs including a good selection of majors, minors and exotics. Trading takes place via MT4 or Fortrade's proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips.

-

FP Markets stands out as an excellent option for forex traders, boasting a selection of over 70 currency pairs covering a wide range of currencies, especially since expanding its choice of exotics. With average spreads of just 0.1 on the EUR/USD in its Raw account, the broker provides competitive pricing for traders.

-

IronFX continues to offer a strong selection of 80 currency pairs. You can trade through the market-leading MT4 platform with a range of forex market research tools. That said, commission charges in the zero-spread accounts are high, starting from $13.50 per lot.

-

Trade 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from, and traders will benefit from fast execution and support from extra features including a pip calculator. The MetaTrader 4 software was also designed for online forex trading.

-

NordFX offers a modest range of 30+ major and minor forex pairs. Disappointingly, there are no exotic pairs, though traders do benefit from tight spreads from 0.0 pips and low commissions from 0.0035% per side. It also provides insightful weekly forecasts covering key forex assets like EUR/USD.

-

HYCM offers 40+ forex pairs, with most available to trade on either the MT4 or MT5 platform. The maximum leverage on offer is 1:30 in accordance with regulations, and tight spreads start from 0.2 on the Raw account and from 1.2 on the commission-free Classic account.

-

Established in 2005, FXOpen is a multi-regulated broker that has attracted over 1 million traders. Designed for active trading, it provides access to a growing selection of more than 700 markets and supports high-frequency trading, scalping, and all forms of algorithmic trading using expert advisors (EAs).

-

Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies.

-

Hantec Markets offers a limited range of 30+ forex pairs – less than most top brands, including Pepperstone with 100+. That said, market execution is rapid based on tests, and spreads are competitive starting at just 0.2 pips. This, combined with access to the popular MT4 platform with 30+ technical indicators, ensures a relatively complete trading experience for short-term currency traders.

-

Speculate on popular currency pairs with flexible leverage up to 1:500 and zero-pip spreads in the GO Plus account. Commission-free trading is available with micro, mini and standard forex contract sizes.

-

ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours. Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators - ideal for complex forex strategies.

-

OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds.

-

FXTM stands out with a strong selection of over 60 currency pairs, surpassing many competitors like AvaTrade. It also stands out with its six currency indices for traders aiming to diversify their forex portfolios, while the ECN account offers ultra-competitive spreads starting at 0 pips on majors, along with low commissions of just $3.50 per lot.

-

easyMarkets offers 60+ major and minor currency pairs but no exotics. Forex traders will appreciate the access to the industry’s leading software MT4, paired with the broker’s fixed spreads from 0.7 pips on EUR/USD, offering a degree of price certainty.

-

Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

-

FXCM offers an average range of 40+ currency pairs, although there are no commissions and spreads are competitive from 0.78 pips for EUR/USD. The broker also offers 3 forex baskets covering USD, Yen and emerging markets benchmarks.

-

InstaForex's range of 100+ currency pairs is among the largest we have seen. ECN spreads are also available from 0.0 pips with zero commissions. Minimum deposits start from $1 making the broker accessible for beginners. You can also access market-leading forex analysis and insights.

-

Trade 200 CFD forex pairs with DMA pricing and tight spreads, ultra low latency and high leverage up to 1:1000. The range of forex pairs available and pricing model are among the most attractive in the African market.

-

Capital.com offer a long list of forex CFD pairs for trading. All have competitive spreads. The firm also ensures negative balance protection

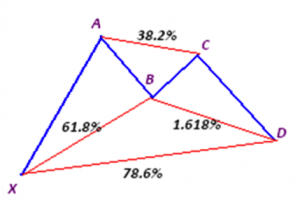

The bullish Gartley pattern is a complex chart pattern that aims to use points of downward price retracement as a way of identifying a possible upward price reversal point. The bullish Gartley pattern is a bullish reversal chart pattern.

As is seen from the simplified sketch above, the bullish Gartley pattern resembles an inverted “W”. The pattern should be able to show an XABCD formation as shown above if correctly traced. The pattern is traced by connecting the points with trend lines as follows:

– It starts with a bullish move from point X to a point A.

– There is a short retracement from point A to point B.

– The uptrend resumes again to point C. Point C is not usually on the same level as point A).

– There is a downward move from point C to point D. This completes the bullish Gartley.

If a trader can correctly trace the bullish Gartley pattern on the charts, he can cash in on the full reversal that is sure to occur from the point D.

Rules for the Bullish Gartley Strategy

Central to the use of this strategy is the identification of the bullish Gartley pattern from the currency chart. There are rules that must be followed in order to identify a true bullish Gartley pattern, as it is very easy to get caught out by many fake outs or fake patterns that resemble a bullish Gartley but which are really something else.

These rules have to do with being able to detect a true XABCD pattern and are listed below:

1) The price move that is represented by the AB line must be a 61.8% retracement of the price movement represented by the XA line. The dotted line XB should therefore show the 61.8% reading (please refer to the diagram above).

2) The next move following AB is the resumption of the uptrend. This is represented by the line BC. The BC price movement should be an upward retracement of between 61.8% and 78.6% from the price movement AB. In other words, point C must be below point A on a horizontal plane. If point C is at the same horizontal plane as point A or even above point A, the chart pattern rule for the bullish Gartley is invalidated.

3) Next in line is the downward price retracement from point C, represented by the line CD. CD must be 127% to 161.8% retracement from line BC. This means that point D MUST be below point B, but remain above or at the same horizontal plane as point X.

It is only when the rules above have been clearly obeyed that a true bullish Gartley pattern has formed and we can truly say that the trader has a good basis for going long at point D.

Traders should be very alert to pattern failures. It is best to practice the identification of this pattern on a demo account before attempting it on a live account.

Indicators

This strategy uses a single indicator which is a customized indicator that helps the trader to plot the XABCD lines. This indicator is known as the . Once you have downloaded this indicator, attach it to the Indicators folder of your MT4 trading client, then attach it to the chart when you open your MT4 platform and it will automatically plot the lines as shown in the chart above. Click here to download the indicator.

Time Frames

This strategy can be used on any time frame and for any currency pair.

Setting Stop Loss and Profit Target

There are no hard and fast rules for setting the stop loss targets and the profit targets. For the stop loss, the key is in identifying when the point D has been reached so as not to get stopped out if prices are still retracing. Once the point D has been clearly identified, the stop loss can be set at a set number of pips beyond it, taking into cognisance the time frame used in doing the trade analysis. For instance, it is unrealistic to set a 40 pip stop loss if the analysis was done on a daily chart, seeing the wide difference in pips between the key points.

Profit targets will depend on using technical parameters like support/resistance levels, candlestick reversal points or even news trades that may counter the trade.