City Index Review 2025

City Index is an award-winning financial broker based and regulated in the UK. The firm has built up a trustworthy reputation over its 35 years of operation offering forex, spread betting, CFDs, options and even metal bullion investing. This 2025 broker review explores significant features like leverage rates, supported markets, opening times, fees and CFD commissions. Read on to learn whether City Index could provide you with the investing edge you need.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

About City Index

City Index Limited was founded in 1983 as a spread betting service for UK clients and has expanded significantly in its almost 40-year history. Now, the firm offers many more instruments, including CFDs and forex pairs to over 125,000 clients. The broker has also grown from its London address to operate additional office locations in Sydney and Singapore, bolstering its global presence.

The acquisition of City Index by NASDAQ-listed StoneX Group in July 2020 has had little impact on the policies and running of the broker since it was announced. The firm will retain its FCA regulation and the entire range of 13,500+ markets and services.

Asset Types

City Index is far from a standard forex and CFD broker and surpasses many competitors in its diverse range of financial products.

CFDs

CFD trading is one of the most popular forms of financial speculation due to its high leverage capabilities and lack of underlying asset delivery. Popular CFD markets include forex, commodities and indices. The instrument is also often used for hedging other positions.

The minimum trade size for City Index CFDs is one contract and all markets other than share CFDs are commission-free. Most assets operate with a variable spread.

Spread Betting

Spread betting is similar to CFD trading in that no underlying assets transfer ownership. However, unlike CFDs, spread bets are classed as gambling in the UK, so profits are not liable to capital gains tax. With City Index, spread betting and CFD markets have the same spread, so neither instrument has a cost advantage over the other.

Spread betting on the City Index platform can be utilised for indices, shares, commodities, bonds, interest rates and forex trading. It is also compatible with spot and futures markets. The minimum bet size is 50p per point and spread betting has no commission charges on any assets.

Metal Bullion

The final asset type offered by City Index is its precious metal investing service. Clients can purchase metal bullion like gold or silver bars and rare coins through a collaboration with CoinInvest. Historically, these assets have provided a haven for wealth through turbulent economic periods. As a result, many experts believe that diversification into precious metals is an essential part of any portfolio.

Markets

City Index offers over 13,500 global assets, spanning a range of markets and countries:

Forex

The broker provides a wide selection of major, minor and exotic pairs, as well as several currency futures (forwards) markets. Of the 84 currency pairs, the most competitive spreads are on the majors. For example, EUR/USD has a minimum spread of 0.5 pips, though the average value is 0.9. As per FCA leverage regulations, the available margin ranges from 1:30 for major pairs to 1:10 for exotics.

Indices

A firm favourite for CFD and spread betting is index investing, with the instruments functioning as an accessible way to speculate on the overall health of a specific country or market. City Index supports 21 global spot and futures index markets, including the Australia 200, Germany 40 (DAX) and UK FTSE 100.

Spreads start from 0.3 points, while leverage ranges from 1:20 to 1:10 depending on the specific market.

Stocks

City Index excels in its equity investing department, with over 4,500 stocks from markets in the US, UK, Europe and Asia. Moreover, several ETFs are offered for speculating on the share prices of a group of companies.

A small commission fee applies when using CFDs to speculate on equity prices. This stands at 0.08% on UK and European shares (£10 minimum) and 1.8% on US stocks ($10 minimum). Spread betting is commission-free. Leverage rates of 1:5 are available on shares.

Commodities

Commodities provide an alternative vehicle for investment, with inflation and global supply and demand primarily affecting value. City Index provides fuel, metal and soft commodities markets in both spot and futures form, including UK Crude oil, cotton, gold and platinum. 25 commodities are available in total.

Gold markets start from 0.3 pips, while crude oil has a minimum spread of 1.5 pips, all with zero commission. The maximum margin on gold is 1:20 and all other commodities can trade up to 1:10.

Leverage

FCA regulation restricts the broker from offering competitive, predatory leverage rates. While this measure helps protect clients from substantial losses, the lessened risk comes at the cost of reduced potential for profits.

The maximum leverage levels are as follows:

- 1:30 for major forex pairs

- 1:20 on minor forex pairs, major indices and gold

- 1:10 for exotic currency pairs, minor indices and other commodities

- 1:5 on shares, bonds and interest rates markets

City Index enforces a margin call on orders once margin levels fall below 50%, as per regulations. Investors are alerted when margin levels reach 80% to give them ample time to provide more capital or close their position.

Note, leverage up to 1:400 is available for traders that qualify for ‘Professional’ status.

Trading Platforms

There are two trading platforms to choose from for City Index clients and several mobile app offerings for on-the-go access to the markets.

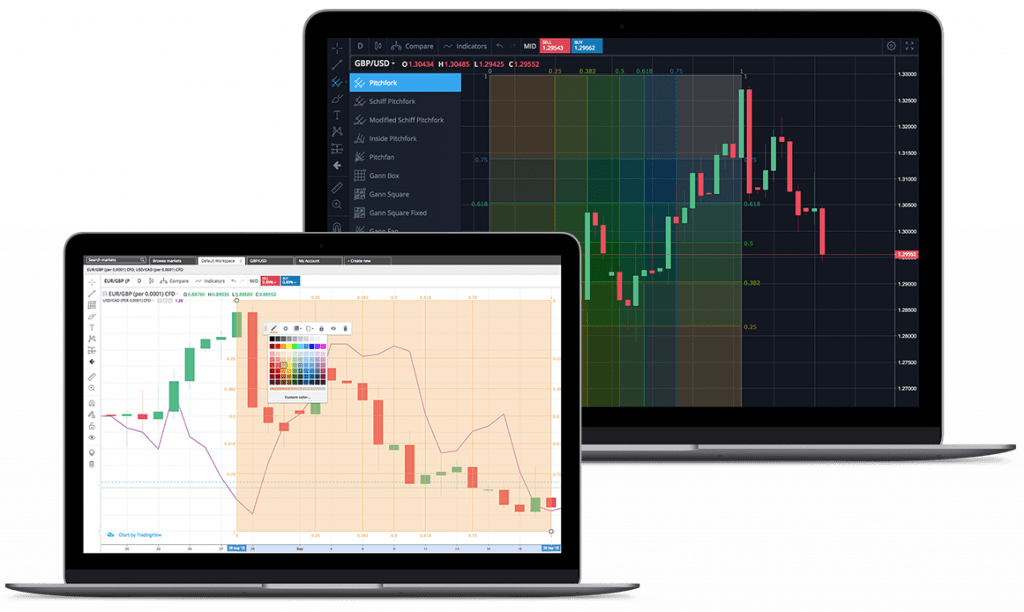

City Index Web Trader

For those that like a sleek, trimmed-down interface and lots of easy to use functionality, the City Index Web Trader platform may be the way to go. This free browser-based solution provides access to the full range of markets through a fast and reliable software package that does not require a download.

Built with a focus on its user-friendly interface, the Web Trader is fully customisable and features custom indicators, price alerts and precision drawing tools for comprehensive technical analysis. Advanced order tools, such as the trailing stop loss, take profit and guaranteed stop loss, can be defined by points, profit/loss or total price level to ensure that users can manage their trades efficiently.

City Index Web Trader

To experience the Web Trader platform before committing to the full service, clients can open a demo account and practice CFD, options and spread betting risk-free.

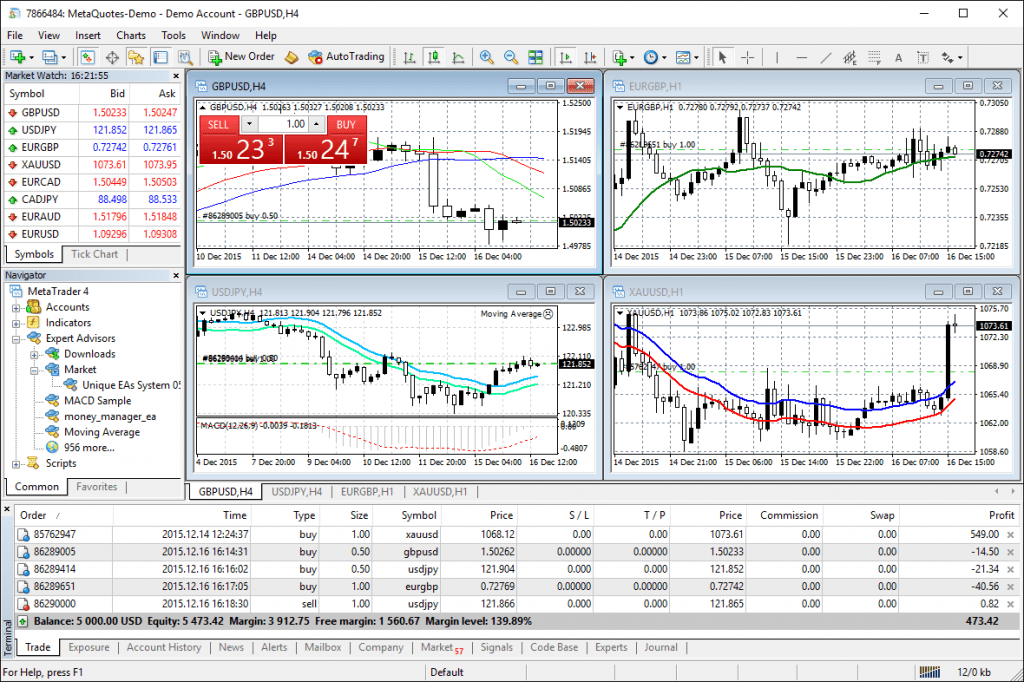

MetaTrader 4

MetaTrader 4 is a popular forex and CFD trading platform that will be familiar to experienced investors. To use the platform, users must download the MT4 desktop standalone application, though this is available on Windows PC, Mac and Linux.

Geared towards more experienced City Index clients, the MT4 platform boasts advanced tools, such as automated trading and backtesting capabilities using significant historical data. In addition, programmers can utilise the open API to create custom indicators and expert advisors or replicate the positions of top traders through the integrated copy trading facility.

MetaTrader 4

As with Web Trader, MetaTrader 4 is available with a risk-free demo account for practice trading. Alternatively, the platform can also be accessed by the MT4 mobile app for iOS or APK devices.

City Index Mobile App

In addition to the MT4 app, City Index has developed its own proprietary Android and iPhone app. The mobile application retains many of the features of the Web Trader platform, with over 60 built-in and customisable indicators. Clients can set custom price alerts, create asset watchlists and monitor the data feed in real-time on live price charts powered by TradingView.

City Index Mobile App

Trading platform reviews of the City Index mobile app are primarily positive, with most clients reporting no or few problems. However, some investors bemoan the lack of a volume indicator.

Account Types

City Index provides several options to open an account: clients can open a spread betting account, CFD account or one that supports both instruments. In addition, a free practice account to help new clients learn how to trade through market experience is available for all account types.

Importantly, live accounts are split between Standard, DMA and Professional trading solutions. Joint accounts and Corporate accounts are also available. In addition, City Index offers a self-invested personal pension (SIPP) account for UK investors who wish to speculate with their pension funds, though this is only available upon request.

Fees

Excessive fees levied on earnings are a significant consideration for investors when choosing a broker. Prospective clients will be pleased to hear that City Index has very low trading fees and does not charge commissions on most markets, except stock CFDs. This is because, as a market maker, the firm will often generate funds from speculating against clients, which may put off some traders.

Account charges are limited to a monthly inactivity fee for users that do not place a trade for 12 months. This fee stands at £12 per month but does not apply to accounts with a zero balance.

When maintaining CFD positions past market hours, overnight charges may apply. The broker’s financing charge stands at SONIA plus 2.5% for long trades or minus 2.5% for short positions.

Payment Methods

City Index provides clients with several options to fund their accounts: bank transfer, PayPal, debit card and credit card. Notably, there are no crypto funding methods.

The minimum deposit requirement is £100. Profits must be withdrawn to the original funding source and there is a minimum withdrawal limit of £100. It can take up to five days to withdraw funds to a card, while bank transfers are usually completed within two working days.

Safety & Regulation

As an FCA regulated broker, City Index users have access to the financial services compensation scheme, which protects funds for up to £85,000 in the event of platform liquidation. Additionally, client funds are held in segregated bank accounts and not used to hedge positions.

Disappointingly, login is not protected by two-factor authentication for the UK brokerage, even though the Singapore sister platform supports 2FA. A separate login is used for MT4, which adds an extra layer of protection for account access.

Educational Content

The City Index trading academy is full of useful resources to help new clients learn how to invest. With sections on how to use the trading platforms, fundamental market analysis and technical analysis, the website area looks to arm traders with the necessary information to make informed speculative decisions. Whether you want to learn how to implement a trailing stop loss or how to use the news to make price predictions, webinars, seminars and written content are on hand.

While some clients may feel uneasy about receiving training from a market maker that profits from client losses, there is nothing to suggest that the information and tutorials on the website are not entirely accurate.

Customer Support

Knowing that a broker is available to help with problems or complaints goes a long way to reassure investors of the legitimacy of a platform. To this end, City Index provides several avenues for customers to receive help.

The first port of call for queries and issues is the help and support section. Here, traders can find FAQs with solutions to issues like platforms not working, login problems, account funding information and more. Clients with a forgotten username or password can also reset their login using their email.

Users can contact City Index via its UK-based phone hotline or live chat facility for problems that require additional guidance. Live chat operates 24/5 alongside the forex markets, whilst the helpline is available during UK office hours.

- Telephone Number: 0800 060 8609

Advantages

- Copy trading

- Spot trading

- FCA regulated

- Hedging permitted

- Multiple platforms

- Market & instant execution

- Established and reputable

- Negative balance protection

- TradingView & Trading Central

- No deposit or withdrawal charges

- Wide range of markets and asset classes

- Cash rebates of up to $7.50 per 1M traded (rebates available to Professional Clients only)

Disadvantages

- Limited leverage rates

- No crypto trading

- No MetaTrader 5

Additional Features

To help keep clients up to date with current financial market news, City Index provides an economic calendar and a regular newsletter with market updates for the day ahead. Moreover, the platform’s SMART signals service constantly monitors the data feed from thousands of assets to identify momentum-based trading opportunities.

The broker also runs a Performance Analytics solution which helps clients monitor and analyse their trading performance. The tool offers insights into psychological factors, short vs long trades, price patterns and more.

Trading Hours

Investing is available on the City Index platform 24/5, as per the forex markets. However, trading hours for shares and indices may be limited to their local market hours, depending on the specific asset. Pre-market and after-hours trading is also available on a selection of US stocks.

Note, holidays may cause a deviation from standard trading hours. Also, clients can access their accounts and funds at all hours.

City Index Verdict

With a range of assets that dwarves many of its competitors and strong FCA regulation, the City Index forex, CFD, options and spread betting broker receives a very positive review. With over 35 years of experience in the field, investors may be inclined to trust City Index over less established brands and the variety of instrument types, trading platforms and extra features provide a good service for any type of client. However, the firm’s market maker execution model may put off some traders that prefer brokers that do not profit from their losses.

FAQs

Is City Index A Good Broker?

City Index excels in its range of instruments and assets and clients can feel secure due to its FCA regulation.

Does City Index Offer A Spread Betting Demo Account?

Prospective customers can open a risk-free practice account to trial CFD speculation or spread betting with no money on the line.

Is There A City Index Forum?

Unfortunately, City Index does not have a help forum. However, there is a well-stocked FAQ section and a trading academy with a wealth of educational content.

Is City Index Sign Up Difficult?

To open an account with City Index, traders may need to provide documents to verify their identity and financial status. Other than this, signing up is a straightforward process.

Is There A City Index No Deposit Bonus?

There are no welcome bonus offers available from City Index due to its FCA regulation.

Top 3 City Index Alternatives

These brokers are the most similar to City Index:

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- CMC Markets - Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

City Index Feature Comparison

| City Index | IG | CMC Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 4.4 | 4.5 | 4.7 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $0 | $0 | $0 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, CySEC, MAS | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | 5% Cashback On Investments | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4 | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 |

| Visit | 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

67% of retail CFD accounts lose money. |

||

| Review | City Index Review |

IG Review |

CMC Markets Review |

Swissquote Review |

Trading Instruments Comparison

| City Index | IG | CMC Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | Yes | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

City Index vs Other Brokers

Compare City Index with any other broker by selecting the other broker below.

Popular City Index comparisons:

|

|

City Index is #30 in our rankings of CFD brokers. |

| Top 3 alternatives to City Index |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, CySEC, MAS |

| Trading Platforms | MT4 |

| Leverage | 1:30 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, Maestro, Mastercard, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | SMART Signals |

| Islamic Account | No |

| Commodities | Cannabis, Coffee, Copper, Cotton, Gold, Iron, Lean Hogs, Livestock, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 1.1 |

| CFD Oil Spread | 1.5 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 1.1 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 1.0 |

| Assets | 84 |

| Currency Indices | USD |