Switch Markets Review 2025

|

|

Switch Markets is #64 in our rankings of CFD brokers. |

| Top 3 alternatives to Switch Markets |

| Switch Markets Facts & Figures |

|---|

Switch Markets is a multi-asset CFD brokerage, regulated by ASIC and SVGFSA. The new brand offers trading on the MT4 and MT5 platforms and leverage up to 1:500. The broker boasts over 2000+ instruments, with some additional tools including copy trading services and free VPS hosting. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, ETFs, Cryptos, Futures, Commodities |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes - Equinix |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Switch Markets offers 180+ CFD instruments with 1:500 leverage and fast order execution speeds of <76 ms. I find commissions are also fairly competitive, coming in at $7 per round turn for Pro account holders. |

| Leverage | 1:500 |

| FTSE Spread | 1.2 |

| GBPUSD Spread | 0.5 |

| Oil Spread | 2.0 |

| Stocks Spread | Variable |

| Forex | I think the range of 60+ major, minor and exotic currency pairs is fairly competitive, especially with spreads from 0 pips in the Pro account. Experienced traders can also access high leverage up to 1:500 in the popular MT4 platform. |

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.6 |

| Assets | 60+ |

| Stocks | That said, I find the range of just 86 shares products is very limited compared to most other brands. The good news is that spreads are pretty competitive, coming in at around 0.11 for the Twitter (X) stock. |

| Cryptocurrency | There's only 6 crypto CFDs available at Switch Markets, though I was pleased to see leverage of 1:3 available. I like that you can also benefit from BTC, ETH, XRP, USDT and USDTRC20 deposit options. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Switch Markets is a regulated CFD broker that offers UK investors access to the MT4 and MT5 platforms for online trading. The broker boasts well over 2000 markets, a wide range of additional resources, including a free VPS, and leverage up to 1:500. In this 2025 review, we will cover whether UK traders should invest with Switch Markets, the fee structure provided, account types available, instruments offered, its trading platform, security and more.

Our Take

- Switch Markets offers a good range of payment options with GBP support for UK traders

- The broker stands out for its education services and trading tools including 10+ calculators and a free VPS

- FCA authorisation is lacking for UK traders, lowering the firm’s trust and safety score

- Fees on popular instruments are higher than many alternatives

Market Access

Switch Markets gives traders access to over 2000 CFD instruments, including forex, indices, shares, commodities and cryptocurrencies.

We rate the breadth of tradable assets offered by Switch Markets highly. Many of the most popular instruments are supported, including the FTSE, gold and major forex pairs.

This market depth has also been added to over time, so expect more markets to be added as the firm advances.

- Forex – 65 forex pairs are available, including EUR/USD, GBP/CHF and AUD/NZD

- Indices – 26 indices are tradable, including the FTSE 100, CAC 40, DAX 40 and S&P 500

- Equities – You can trade 1829 US & European shares and ETFs, including Twitter, Tesla, Amazon and Exxon Mobil

- Commodities – 15 commodities: Gold/USD, Gold/EUR, Silver/USD, Brent Crude Oil (BRENT and BRN.XX), WTI Crude Oil, Crude Oil and Natural Gas

- Digital Currencies – 41 popular crypto coin CFDs: Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Ripple (XRD), Dash (DASH) and Bitcoin Cash (BCH)

Fees

The fee structure offered by Switch Markets varies depending on the account type but is generally quite high, especially compared to the more competitive online brokers. The Standard account has average-to-high spreads, while the Pro account balances raw spreads against expensive commission charges.

The Standard Regular account has no commission for all assets bar shares but has higher spreads, starting from 1.4 pips. The EUR/USD average spread is 1.5 pips, which is reasonable but not the lowest.

The Pro Regular account has a commission of £5.60 for all assets bar shares but has lower spreads, starting from 0.0 pips. The EUR/USD average spread is 0.1 pips, which is decent.

CFDs on shares all have associated commissions, with American shares charging £0.15 per round turn and European stocks charging 2% of the share price.

Swap rates are also charged, varying by asset. These overnight fees are charged every trading day at midnight, with Wednesdays typically higher.

We were pleased to see that deposit methods are free, though digital currencies have a charge of 0.8%. Most withdrawal methods charge no fees, though cryptos have a flat network fee dependent on the currency (0.0005 BTC, 0.0035 ETH, 0.02 XRP, 25 USDT & 2.50 USDTRC20). External fees, such as Neteller’s currency conversion fee of 3.99% may still apply to deposits and withdrawals.

Accounts

There are two main account types offered by Switch Markets, the Standard and Pro accounts. Our experts found that a Sharia-compliant Islamic account version for each type is also available.

The Standard and Pro accounts are very similar in terms of their features, with the only difference being the fee structure for trading (zero commission and higher spreads versus fixed commission and lower spreads). Ultimately, the fee structure will be the determinant of which account you choose to open.

We have unpacked the features shared by the accounts below.

- Minimum deposit of £40

- Leverage rates up to 1:500

- Micro lot trading available

- Islamic alternatives offered

- Credit bonus of up to £4,000

- Free Virtual Private Server (VPS)

- Automated trading via Expert Advisors

- GBP, USD, EUR, AUD, CAD, NZD, SGD, CHF & PLN base currencies

The halal Islamic accounts have no swap fees and allow traders to hold positions for five days. We were pleased to see that Switch Markets allows clients to access all 2000+ tradable assets with their Islamic accounts, whereas some firms limit the tradable assets on swap-free accounts.

Overall, the account types offered by Switch Markets are quite good. The profiles all offer the full range of tradable assets and features with the only difference being in the fee structure. This means traders will not miss out by choosing one account over another. Furthermore, we were impressed with the offering of full-feature Islamic accounts.

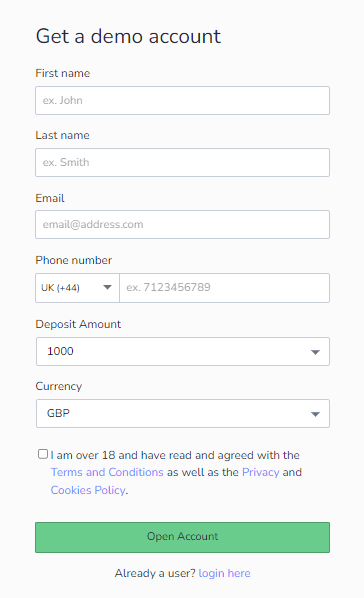

How To Register For A Switch Markets Account

I thought the account opening process is intuitive. To sign up:

- Go to the Getting Started bar at the top of the broker’s website

- Select Start Trading Today

- Fill in the form with your details

- Click Open Account

- Download the platform and get trading

Funding Methods

Overall, we rate the selection of payment methods offered by Switch Markets. This includes 13 different funding options, with six directly available in GBP. This makes the brand versatile for UK traders looking to add capital or withdraw profits.

The payment methods all carry 0% fees, apart from digital currency transfers, which charge 0.8% for deposits and a flat network fee for withdrawals.

- Visa

- Mastercard

- Bank Wire

- Digital Currencies

- Neteller

- Skrill

Trading Platforms

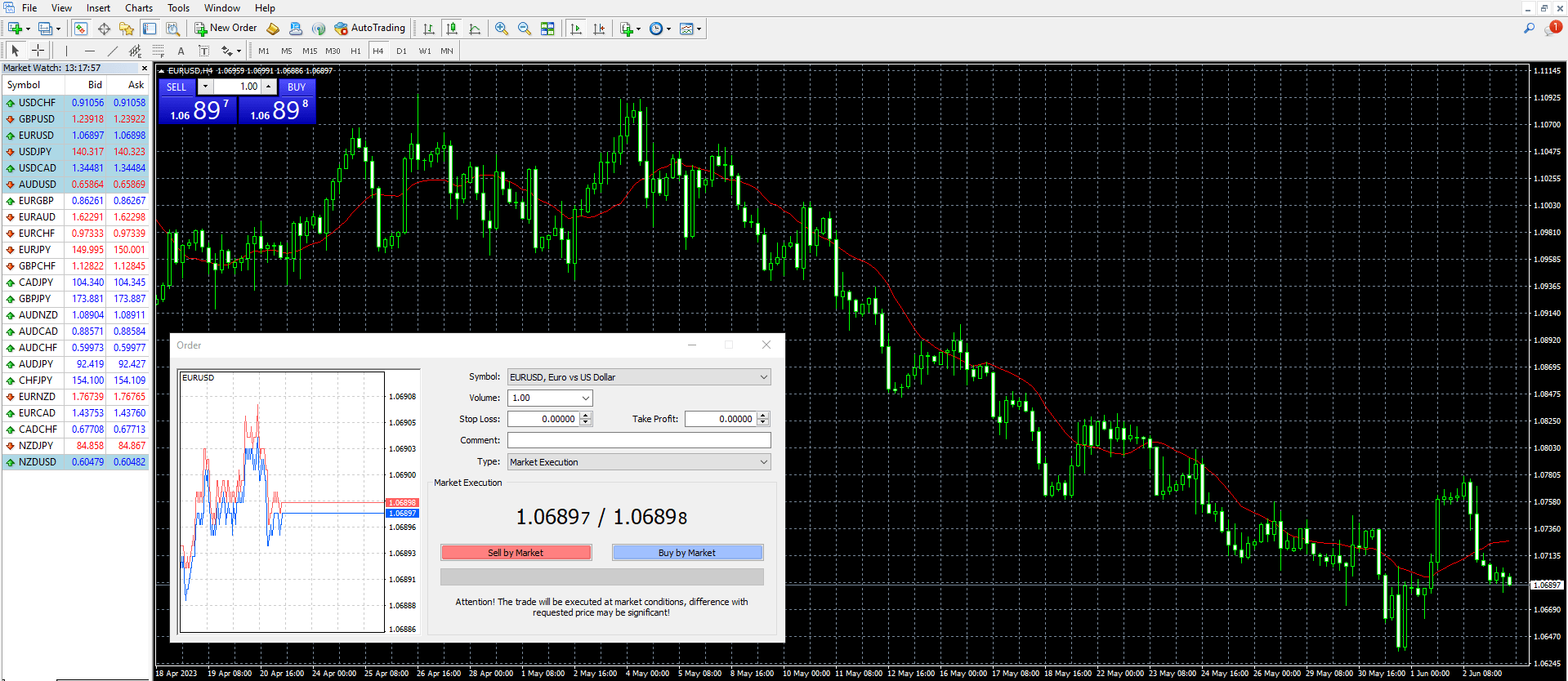

While using Switch Markets, we were pleased to see the popular MetaTrader 4 (MT4) platform. This is a powerful, customisable and user-friendly software package with a range of advanced built-in tools and features. It is one of the most widely-used online trading platforms, with a huge range of guides and resources online for newer traders.

Standout features for me include:

- Nine timeframes

- 31 graphical objects

- 30 technical indicators

- Four pending order types

- Compatible with plug-ins

- Mobile trading app available

- Automated trading through Expert Advisors

- Programmable through the MQL4 programming language

The MT4 platform is available to download for free from the Switch Markets website, on the Apple iOS App Store, on the Android Google Play Store and available through the web application.

This platform has set the standard for online trading tools with its sophisticated features that make it perfect for building and implementing advanced strategies.

Yet while we are happy that this platform is offered, most top brokers offer a variety of platforms for investors of different styles, goals and experience levels. We would have preferred to see other platforms also available, like MetaTrader 5, TradingView and cTrader.

How To Place An Order

The process of placing a trade is straightforward:

- Download MT4 and login to your Switch Markets account with the details sent to your email address

- Choose which asset you would like to trade

- Click the New Order button

- Fill in the details of your order symbol, volume, stop loss, take profit

- When you are ready, choose the Sell by market or Buy by market button to place your order

MetaTrader 4

Switch Markets App

The MetaTrader 4 platform offers a mobile app that is available on iOS and Android devices. The application is free to download from the devices’ respective app stores.

This mobile platform provides many of the same features as the desktop application, including asset charting, market updates, technical analysis tools, and market orders.

On the downside, the mobile app does not facilitate plug-ins but we found it to still be a great way to trade away from a desktop. It features a sleek design with an intuitive interface and an impressive range of technical analysis features.

MetaTrader 4 Mobile App

Leverage Rates

Switch Markets offers high leverage. The rates offered are much higher than those offered by UK-regulated brokers.

The maximum leverage rates at the firm vary amongst assets but the largest of each category is given below.

- Forex – up to 1:500

- Indices – up to 1:200

- Shares – up to 1:20

- Commodities – up to 1:50

- Digital Currencies – up to 1:3

Leverage allows you to invest with greater buying power than the capital you put in. As a result, potential profits increase by a factor of the leverage rate but so do potential losses. As such, do not risk more than you can afford to lose.

Demo Account

We were happy with Switch Markets’ demo account offering. The broker offers free demo support with no time limits across all its account types, including Islamic options.

Investors can open a demo account by simply signing up for one on the broker’s website. The details for the demo account are then sent to your email address, allowing you to log into either the MT4 or MT5 account.

You can also log into the demo account through the mobile app or on the web trader rather than the desktop app.

Is Switch Markets Regulated?

Switch Markets is fairly well regulated, though there is room for improvement. The broker is made up of two different entities: Switch Markets International PTE Ltd and Switch Markets Pty Ltd Australia. Switch Markets International PTE Ltd is an authorised representative of Royal ETP LLC.

Switch Markets is regulated by the Australian Securities & Investments Commission (ASIC), a top financial regulator, under ACN 640 033 727 and ABN 73 640 033 727. Royal ETP LLC is registered with St. Vincent & the Grenadines Financial Services Authority (FSA) under registration number 149.

The ASIC is a trusted regulatory body that ensures the broker’s financial practices are up to scratch. The regulator enforces the segregation of client funds, KYC procedures, risk disclosure, a lack of conflict of interest and periodic audits and reports.

However, unlike the UK’s FCA, the ASIC does not enforce a compensation scheme like the FSCS. Also, British traders won’t get the same legal protections from regulators in other countries, so this is a notable drawback.

Bonus Deals

If you choose to register with the SVG FSA licensed entity, you gain access to a 100% credit bonus of up to £4,000. Bonuses like this are restricted by the ASIC but allowed with the SVG license.

Importantly, the credit bonus can only be used for trading and cannot be withdrawn. However, profits produced from the credit bonus can be withdrawn. The bonus is only available to new customers that deposit at least £80.

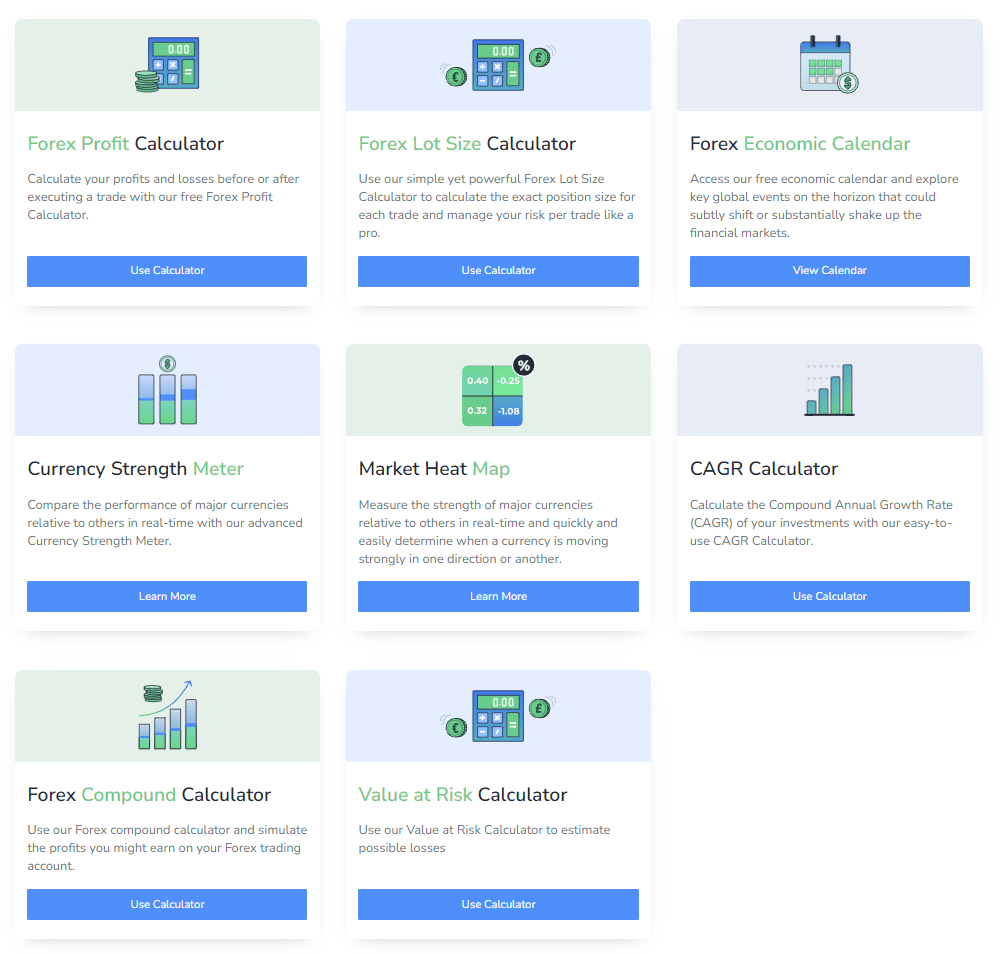

Extra Tools & Features

Overall, we were impressed by the additional resources and services offered by Switch Markets. When we used the broker, we found more than ten calculators and tools, alongside currency strength meters and a free VPS.

Supported calculators and graphical tools include:

- Pip Calculator

- CAGR Calculator

- Market Heat Map

- Lot Size Calculator

- Economic Calendar

- Expert Advisor Tools

- Pivot Point Calculator

- Forex Swap Calculator

- Forex Profit Calculator

- Value At Risk Calculator

- Forex Margin Calculator

- Currency Strength Meter

- Forex Compound Calculator

Additional features include the VPS, a library of “forex cheat sheets” and market analysis.

The VPS is available upon request as soon as your live account gets approved. You can then trade with a very fast 1ms execution hosted in LD4 London.

The “forex cheat sheets” are essentially educational guides on a range of different topics. These include understanding types of forex charts, MT4 shortcuts, moving average analysis, Fibonacci retracement, using the stochastic indicator and more.

Market analysis articles are also offered, providing information on economic events as well as more general information on market trends. Video guides are also available.

A free HowToTrade.com membership is also offered with membership. This partnership allows traders to jump into the HowToTrade courses, including online trading lessons, live streams, progress tracking, quizzes and more.

Switch Markets Calculator Summary

Customer Service

Our experts found that Switch Markets offers responsive, effective customer service, which can be contacted via a range of methods.

On the website, you can find a chatbot at the screen’s lower-right for any questions; this is available 24/7. The Contact Us page also has a form that can be filled out with your name, email address, phone number and message, with the support team later responding to your message.

There is also a QR code to be used to contact the support team through WhatsApp. Furthermore, there are FAQs available on the page to answer common questions.

- Email Address: support@switchmarkets.com

- Phone Number: +44 1902 943 383

Finally, you can contact the team through social media, including on Facebook, Instagram and Twitter under the handle @switchmarkets.

Company History & Overview

Switch Markets was founded in 2019 as an OTC online broker to provide competitive trading conditions, plentiful resources and strong support, something we think it has been successful at.

The firm is regulated by the ASIC and registered by the SVG FSA, providing global retail brokerage services.

To accomplish its goal the broker is partnered with HowToTrade and ForexVPS to provide education resources and a free VPS tool to all clients for free.

Security

We are pleased to see that the broker provides a strong level of security. This includes segregating clients’ funds, no conflict of interest within trades, required KYC procedures, regular audits and reports and full risk disclosure.

Furthermore, the MetaTrader 4 and MetaTrader 5 trading platforms are secure with encryption on all orders to protect your funds and assets.

There is also an additional facility to add two-factor authentication via the user cabinet.

Trading Hours

Trading hours vary by asset, with different open and close times each day. For example, forex markets are open from 21:00 to 20:59 the next day, Sunday to Friday, GMT. Commodities vary by asset, with Brent Crude Oil available from 00:00 to 20:59 every day from Monday to Friday, GMT.

Indices vary greatly depending on their underlying markets, with the FTSE 100 tradable from 07:00 to 20:00, Monday to Friday, GMT. Shares also vary, with Amazon stocks being available from 13:30 to 20:00, Monday to Friday, GMT.

Digital currencies are disappointingly tradable from 21:00 Sunday to 20:59 Friday, GMT. We would have liked to see direct access to the crypto markets 24/7, as the decentralised nature of the markets means that it never closes.

Should You Invest With Switch Markets?

Switch Markets is a regulated CFD broker that offers a decent range of assets and a huge amount of additional resources to support traders. We found that the broker uses the MetaTrader 4 and MetaTrader 5 platforms, and offers free VPS services, allowing for high-speed execution and complex strategy implementations.

Furthermore, we like that UK investors can deposit funds easily due to the wide variety of GBP transfer options. There is the ability to use HowToTrade.com to gain substantial trading education with Switch Markets picking up the first year costs.

However, Switch Markets has relatively high trading fees across the board and there is no access to an investor’s compensation scheme.

Ultimately, for UK traders, Switch Markets is an okay choice if you are looking for lots of educational material and a free VPS, though there are better alternatives with lower fees, robust FCA regulation and more instruments.

FAQ

Is Switch Markets Legit?

Switch Markets is regulated by the ASIC, a top financial regulator. This ensures that the broker implements several safety features that our experts consider desirable for client security. On the downside, the company is not regulated by the UK’s FCA.

Does Switch Markets Offer A Good Platform?

Switch Markets offers the popular MetaTrader 4 platform. This software package comes with a range of useful technical tools and customisable features, making it great for implementing complex trading strategies. It is particularly good for automated strategies through its Expert Advisor (EA) function.

Is Switch Markets A Good Broker For UK Traders?

UK traders can invest with Switch Markets and the broker allows GBP as a base currency for all of its account types, offering a range of deposit and withdrawal methods. On the negative side, fees are higher than alternatives and there is no FCA authorisation, which may deter UK traders.

Does Switch Markets Have A Reliable App?

The MT4 platform offered by Switch Markets can be accessed through its mobile application available on iOS and Android devices. The app lets traders track markets, perform technical analysis and place trades through its intuitive user interface, though it does lack some of the features of the desktop client.

Does Switch Markets Offer A No Deposit Bonus?

The broker does not offer a no-deposit bonus but those registered with the SVG entity will have access to a 100% credit bonus upon their first deposit (over £40 and under £4,000). The broker will essentially match your deposit with credit, giving you double the buying power. While you cannot withdraw this credit, you can use it to trade more and withdraw any profits.

Article Sources

Switch Markets SVG FSA Licence – Registration Number 149

Top 3 Switch Markets Alternatives

These brokers are the most similar to Switch Markets:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Switch Markets Feature Comparison

| Switch Markets | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.8 | 4.8 | 4 | 4.8 |

| Markets | CFDs, Forex, Stocks, ETFs, Cryptos, Futures, Commodities | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $50 | $200 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Switch Markets Review |

IC Markets Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| Switch Markets | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Switch Markets vs Other Brokers

Compare Switch Markets with any other broker by selecting the other broker below.

Popular Switch Markets comparisons: