SushiSwap Review 2025

|

|

SushiSwap is #83 in our rankings of crypto brokers. |

| Top 3 alternatives to SushiSwap |

| SushiSwap Facts & Figures |

|---|

SushiSwap is a DeFi cryptocurrency exchange launched in 2020. Through the Ethereum blockchain, SushiSwap has generated over $2.5 billion in trading volume through it's AMM framework. Traders can swap tokens, as well as create liquidity via yield farming. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | Yes |

| Min. Deposit | $30 |

| Mobile Apps | Not yet |

| Min. Trade | Variable |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | SushiSwap offers over 400 tokens to swap, with a good range of fiat and crypto deposits. With that said, this exchange is unregulated and funds may not be secure when compared to reputable crypto brokers. |

| Coins |

|

| Spreads | 0.30% fee |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

SushiSwap is one of the world’s most well-known decentralised exchanges (DEXs) operating an automated market maker system, allowing clients to trade without the need for intermediaries. In this review of SushiSwap, our team evaluate the ways you can trade, pricing, safety, investing tools and anything else UK clients should know before signing up.

Our Take

- SushiSwap offers a range of products for beginners and experienced DeFi investors, including crypto swapping and yield farming

- The exchange offers a good selection of UK-supported payment methods for fiat-to-crypto deposits, including bank transfer, Apple Pay and credit card

- SushiSwap does not offer crypto derivatives which is a drawback compared to popular crypto brokers

- The absence of FCA regulation and the hacking incident in 2023 raises serious security concerns. As such, we recommend considering more reputable crypto firms, such as FXCC

Crypto Trading

There are two ways to trade crypto through SushiSwap:

Swap

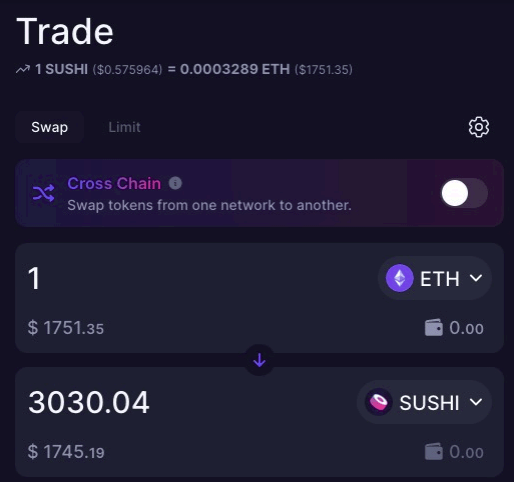

The Swap service is the main method for trading crypto via the SushiSwap DeFi exchange. Simply put, you are completing a transaction of one token for another, with around 50 cryptos to choose from, including Bitcoin.

We were also pleased to see that SushiSwap has implemented its SushiXSwap Crosschain AMM which helps clients to swap tokens across different blockchains when there is limited liquidity.

This is essentially a bridging service whereby clients can complete chain-agnostic trades securely while ensuring good trade value efficiency. This means that while you may receive fewer crypto from the trade, you can avoid higher network fees, which we appreciated.

At the time of writing, the Swap feature, which works akin to market execution, is the only way to submit trade orders. In the future, SushiSwap plans to introduce limit trades whereby orders are processed only once certain conditions are met. This will bring it in line with popular crypto brokers.

How To Make A Crypto Swap

I found making a swap trade easy, requiring just a few simple steps:

- Click ‘Swap’ on the website

- Set up the transaction by selecting the crypto you are selling and the crypto you are buying

- Input either the amount you wish to buy or the amount you wish to sell. SushiSwap will then calculate the corresponding crypto value

- Click on the gear icon to specify the slippage tolerance percentage. If the change in trade value exceeds this tolerance then the order is cancelled

- Confirm the order and wait for the trade to complete

Crypto Farming

DeFi trading, such as with SushiSwap, is reliant on there being sufficient liquidity in dedicated pools to complete the transaction. In other words, if you are buying ETH, you need there to be counterparties with ETH willing to trade with you. SushiSwap allows clients to take this position and be liquidity providers and earn rewards for doing so. This is called crypto, or yield, farming.

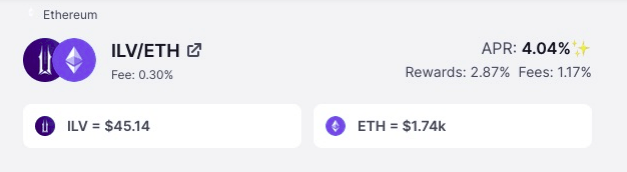

The main reason for clients to engage in DEX crypto farming is to generate passive returns. This is calculated on a per-pool basis whereby the APR is derived from the fees and reward percentage determined using algorithms.

At the time of writing, the Illuvium/Ethereum liquidity pool has an APR of 4.04%. This comes from a reward of 2.87% (equivalent to 263 SUSHI per day) and a fee percentage of 1.17%.

Note that the fee percentage is only paid out when you withdraw your funds (as this is accrued from the yield from fees paid by traders using the pool).

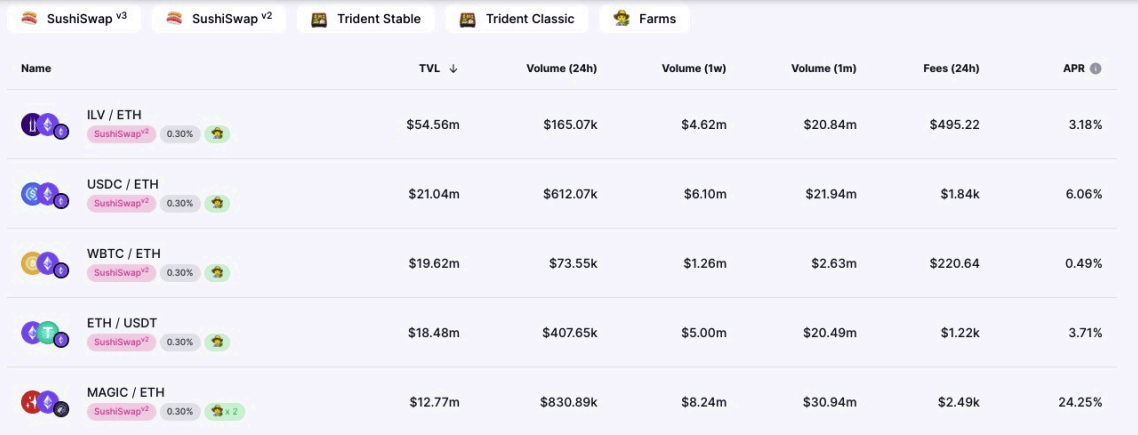

SushiSwap has more than 500 token pools to choose from, which is more than many competitors, and over half a billion USD locked as liquidity, so it can be hard to determine which pool you should deposit funds into. To help, you can sort the SushiSwap leaderboard by a range of factors including the total value locked (TVL), traded volume over the past 24 hours, week and month, the fees and APR.

Liquidity Pools

How To Start Crypto Farming

When testing the platform, I was able to set myself up in a crypto pool within a few minutes. To do so:

- Click ‘Swap’ on the website

- Click the ‘Create Position’ button

- Select the crypto network to provide liquidity for (such as Ethereum, Polygon and Fuse)

- Specify the token pair pool

- Choose the fee percentage from 0.01%, 0.05%, 0.3% and 1%

- Determine the crypto pair price range you want to provide liquidity for. This involves specifying the maximum and minimum value price

- Type in the amount of liquidity you wish to provide for the two tokens in terms of USD

- Connect your wallet and confirm the request

Accounts

Generally, DeFi platforms like SushiSwap do not adopt a model whereby clients must register for an account. Rather, they simply allow customers to conduct any trades by connecting their crypto wallet.

This is appealing as it means all clients have full access to the SushiSwap features and tools without the need to pay subscription fees.

However, I was disappointed to see that there is no SushiSwap demo account, so clients have no way to practise trading crypto in a risk-free way. And while this is fairly standard amongst decentralised exchanges, it is a drawback vs alternatives like FXCC.

Fees

DeFi platforms such as SushiSwap use a fee model involving taker fees. These are fees charged to the clients that submit a buy order and vary according to the crypto pair you trade. For example, at the time of writing, a trade of 5 ETH into SUSHI incurs a network fee of around $4.034. Whereas, converting 5 ETH into 1INCH comes with a charge of $8.436.

To determine how much you can expect to be charged for a transaction, fill out an order form on the website to see the estimated fees. This is free and we appreciated how quick and straightforward it is.

SushiSwap also charges for fiat-crypto transactions. The amount you are charged relates to the method, the onboarding service and the transaction size. For example, a GBP 90 to ETH transaction incurs a £4.55 for credit and debit card payments but only £2.41 if you use a Faster Payments transfer, which we thought was reasonable.

Automatically, SushiSwap will select the onboarding service which facilitates the transaction, offering the optimal conversion price. With that said, you can choose another service if desired.

Funding Methods

Deposits

SushiSwap is an entry-level exchange, which means you can purchase crypto using fiat currency such as GBP. We are pleased to see that GBP is supported as it means UK users can get started easily.

The available methods for British clients interested in purchasing cryptocurrency with fiat include the following:

- Apple Pay

- Google Pay

- GBP Bank Transfer

- Bank Wire Transfer

- Debit and Credit cards

- Faster Payment Service Bank Transfer

For all methods except bank transfers, the minimum deposit amount is £30, which is satisfactory as it provides a low barrier for entry for novices. Bank transfers, however, have a high minimum deposit limit of £150, so we recommend avoiding this.

Similarly, the maximum you can deposit for all methods excluding bank transfer is £9,000. The maximum bank transfer limit is £42,970.

How To Purchase Crypto Using Fiat

To make your first fiat-crypto transaction, follow these steps which I completed in just a couple of minutes:

- On the SushiSwap website, click on ‘Enter App’

- Select ‘Buy Crypto’ on the menu bar

- Choose the fiat currency you will use for the purchase and the crypto you wish to buy

- Specify either the amount of crypto you wish to buy or the amount you want to pay. SushiSwap will automatically calculate the conversion using the onramp service offering the best rate.

- Select the chosen payment method

- You will then be connected with the onboarding service to provide payment details and confirm the request

Crypto Wallets

If you have already purchased cryptocurrency, you can start trading by connecting your crypto wallet. The wallets supported by SushiSwap include the following.

- Ledger

- Injected

- MetaMask

- Gnosis Safe

- WalletConnect

- Coinbase Wallet

How To Connect Your Crypto Wallet To SushiSwap

I found the process to link my wallet very straightforward. Simply:

- Click the ‘Enter App’ button on the SushiSwap website

- Select ‘Connect Wallet’ on the top-right-hand side of the page

- Choose your wallet provider

- Scan the QR code in the pop-up window using your wallet app

Regulation

SushiSwap is not licensed by the Financial Conduct Authority (FCA) or any other regulatory body. However, this is expected since DEXs are not licensed by centralised authorities.

Still, we found that SushiSwap has experienced security problems in the past. One of the most notable was a smart contract bug exploit in April 2023 where hackers stole around $3.3 million worth of Ethereum.

While Jared Grey, the exchange’s head developer, said that a large proportion of the funds had been recovered, our experts have concerns over fund safety. As such, there are more secure options out there, such as PrimeXBT.

To help provide transparency and demonstrate the platform can be trusted, you can view SushiSwap’s GitHub with 94 repositories. Here you can read code on services and sections of the platform such as the SushiXSwap and Trident.

Trading Platform

Our team were disappointed to see that SushiSwap does not operate through a trading platform akin to brokers such as eToro. Instead, you invest by using the broker’s website accessed via your internet browser.

While this makes the buying and selling process very simple, it lacks the useful tools that you can expect with platforms such as MetaTrader 4 or MetaTrader 5. Most importantly, clients cannot conduct their own analysis to develop a strategy as there are no charts with indicators or signals used to investigate potential assets.

As a result, you will need to use third-party platforms such as TradingView to complete technical analysis if you plan on actively trading.

Mobile App

Our experts were also disappointed to see that there is no dedicated SushiSwap platform for mobile. This means if you want to trade crypto while away from your computer, you will need to use the web browser on your phone.

On a lighter note, we were pleased to see that SushiSwap has created a mobile-dedicated webpage version to help with the user experience.

Leverage

In the past, SushiSwap offered leveraged crypto trading through Kashi, its margin trading platform. However, at the end of 2022, the team announced this platform would be disabled and that clients should withdraw their funds. As a result, clients can no longer open leveraged trades through SushiSwap.

This is another drawback for short-term crypto traders who can use leverage at other firms like FXCC.

Bonus Schemes

SushiSwap offers regular promo schemes where investors can earn rewards. Common examples include competitions such as the Sushi x ThunderCore trading competition. This competition is free to join and those with the greatest trading volumes of eligible pairs during the open period will receive rewards.

For the person that trades the most (buys and sells), there is a prize pool of $1,000 worth of SUSHI and TT coins. Additionally, all participants that trade at least $100 worth will be entered into a prize draw where they can receive $100 if one of the 10 participants is selected.

Importantly, we do not choosing a broker based on promotions alone. Terms and conditions often have strict withdrawal conditions and other factors, such as security and market access, are more important.

Extra Tools & Features

Our experts felt that SushiSwap offers an adequate selection of added tools to support crypto trading. While the analytics and education sections can prove to be useful, we would have liked to see additional features, such as calculators, expert crypto insights or trend analysis.

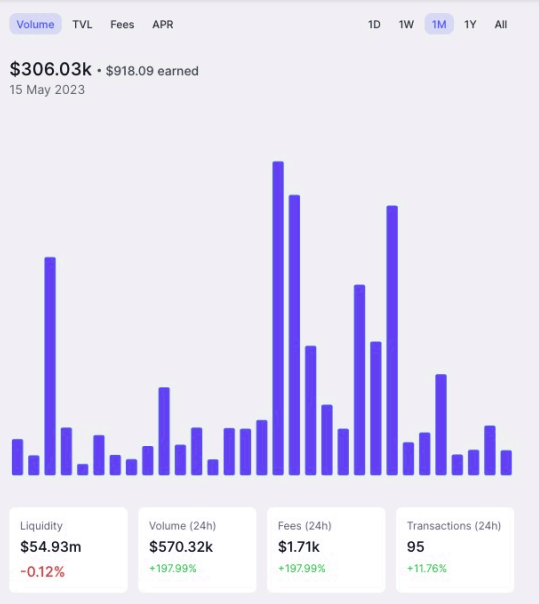

Analytics

We did appreciate that SushiSwap provides some analytics that tracks cryptocurrencies on the platform. For each token, you can see the TVL, liquidity, volume and fees generated and how each has changed over time. You can then filter your search of crypto pairs to show the assets that are best and worst performing in these categories.

Sushi Academy

We were also pleased to see that there is a detailed education section on the SushiSwap website under the name ‘Sushi Academy’. This is useful as it can be hard to understand blockchain terminology, making it difficult for novices looking to take advantage of price trends.

To remedy this, the Academy offers definitions and explanations for key details as well as guides on important topics such as what yield farming is and what smart contracts are.

Whether you are a novice, experienced investor or have technical knowledge of blockchains, this Academy should be one of your primary resources when trading with SushiSwap. This section includes tutorials suited to all knowledge levels and it is important you fully understand the market and the exchange before you start live trading.

Customer Service

We were disappointed with the customer support options with SushiSwap. Particularly, there are no direct contact options such as a live chat on the website, a phone hotline or an email address.

Instead, if you have any issues you must post on either the Discord server or the SushiSwap forum and chat with the community. Alternatively, you can contact the social media account on Twitter. This is a major drawback for newer users, especially when leading cryptocurrency brokers offer 24/5 or 24/7 customer support.

For DeFi news and discussion on SushiSwap updates, you can follow the exchange’s blog or the YouTube channel.

Company Details & History

SushiSwap is a decentralised crypto exchange that exists on the Ethereum blockchain. It was launched in 2020 by two developers under the pseudonyms Chef Nomi and 0xMaki.

One key objective for SushiSwap is to allow users to have a voice and input on the operations and the exchange’s features. This is done using the native token SUSHI whereby holders of the coin can vote in polls posted on the dedicated forum. The developer team then reviews the recent polls in regular videos on YouTube.

As a testament to how popular the exchange is, SushiSwap has generated over 100 million in trade volume through its automated market maker framework. This is in addition to over 500 million worth of USD value locked into the exchange’s yield farms.

Moreover, in 2021, SushiSwap’s native token SUSHI was added to the DeFi pulse index, an index used to track the leading protocols on the Ethereum network.

Should You Trade Crypto With SushiSwap?

SushiSwap offers an interesting DeFi platform for crypto trading, with accessible transaction methods for beginners, plus a decent learning Academy. Experienced traders will also appreciate the range of liquidity pools which offer passive income opportunities via yield farming.

However, there are no ways to test out SushiSwap before live trading and the lack of any regulatory oversight is always a safety concern with crypto exchanges. A more secure option would be a more reputable crypto broker.

FAQ

Is SushiSwap Safe?

SushiSwap is an unregulated decentralised exchange. As such, your funds are not protected in the same way as they are with FCA-regulated brokers. Like some other crypto exchanges, SushiSwap has also been a victim of a hacking incident, which makes it hard for us to give this exchange a high trust score.

Does SushiSwap Offer A Good Trading Platform?

SushiSwap does not offer any dedicated trading platforms such as desktop or mobile apps. You can only submit buy and sell orders or begin yield farming through the DeFi exchange’s website.

If you want to conduct any analysis into coins such as BTC, USDT or SUSHI against the USD, you will need to use third-party platforms such as TradingView.

If you wish to see token information such as price, market cap or supply, Coinbase is a good crypto trading resource.

Is SushiSwap Free?

No, SushiSwap is not free to use. Whether you are completing crypto-to-crypto trades or fiat-to-crypto trades, you will be charged transaction fees. The fees you are charged vary according to the trade you are making, and the coins involved. For fiat-to-crypto trades, you also need to account for the payment method and the onboarding service.

Which Wallets Does SushiSwap Support?

For crypto-to-crypto trades, SushiSwap requires clients to connect a crypto wallet, which is typical for DeFi exchanges. If you want to trade crypto, you have six options to choose from. These include Injected, MetaMask, Ledger, WalletConnect, Coinbase Wallet and Gnosis Safe.

Is SushiSwap Good For Beginners?

Unfortunately, there is no practice account available with SushiSwap which means beginners cannot test out crypto trading in a risk-free way. We recommend considering a reputable crypto broker such as FXCC, if you are looking for an excellent demo experience. With that said, SushiSwap does offer some good educational resources on the website which are aimed at novices.

Article Sources

Top 3 SushiSwap Alternatives

These brokers are the most similar to SushiSwap:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

SushiSwap Feature Comparison

| SushiSwap | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 1.8 | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $30 | $1,000 | $0 | $0 |

| Minimum Trade | Variable | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | SushiSwap Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| SushiSwap | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

SushiSwap vs Other Brokers

Compare SushiSwap with any other broker by selecting the other broker below.

Popular SushiSwap comparisons: