SuperForex Review 2025

|

|

SuperForex is #81 in our rankings of CFD brokers. |

| Top 3 alternatives to SuperForex |

| SuperForex Facts & Figures |

|---|

Established in 2013, SuperForex is an offshore CFD and forex broker offering highly leveraged trades on 400+ instruments via the popular MetaTrader 4 platform. The broker has gained clients in over 150 countries and is regulated by the Belize IFSC. With a range of STP/ECN account types, including swap-free, micro and zero spread, this broker continues to suit traders with different styles and setups. SuperForex also offers a range of welcome bonuses and trading contests. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Commodities |

| Bonus | 50% Welcome Deposit Bonus |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | IFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | SuperForex offers CFDs on a good range of assets, though it only really shines when it comes to forex, thanks to its very diverse list. On the other hand, the significant leverage available on most assets increases profit potential, though traders will need to watch out for spreads, which compare poorly to some competitors. |

| Leverage | 1:2000 |

| FTSE Spread | 6.0 (standard account) |

| GBPUSD Spread | 2.5 (standard account) |

| Oil Spread | 5.0 (standard account) |

| Stocks Spread | Variable |

| Forex | With 100+ currency pairs including all majors plus many minors and exotics tradeable on the MT4 platform with 1:2000 leverage, SuperForex lives up to its name as a great choice for forex traders. The ForexCopy system is also useful for newer traders. |

| GBPUSD Spread | 2.5 (standard account) |

| EURUSD Spread | 2.0 (standard account) |

| GBPEUR Spread | 2.5 (standard account) |

| Assets | 100+ |

| Stocks | SuperForex offers CFDs on a range of international stocks, with big names including Google, Disney and Apple as well as regional powerhouses such as Petrobras. This is not the widest range of stocks, but there is a diverse enough list to keep traders interested, especially beginners. |

| Cryptocurrency | SuperForex offers cryptocurrency CFDs on 11 popular tokens including Bitcoin, Dash, Solana and Polkadot. 1:10 leverage is available for crypto assets and although this is a fairly limited selection of digital assets, it covers the most important tokens. |

| Coins |

|

| Spreads | Floating or fixed |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

SuperForex is a global broker that specialises in forex, stocks, indices, commodities, ETFs and cryptocurrency investing. This 2025 review will provide further detail about SuperForex’s trading platform, user experience, fees, customer support and much more.

Company History & Overview

Established in 2013, SuperForex has become a broker that operates in over 150 countries. It is an offshore firm registered in Belize (the location of its headquarters is in Belize City) and regulated by the International Financial Services Commission (IFSC). The company claims to generate $100,000 total profit each day for its clients and it has won several awards, including the Best ECN Broker in Africa (2021).

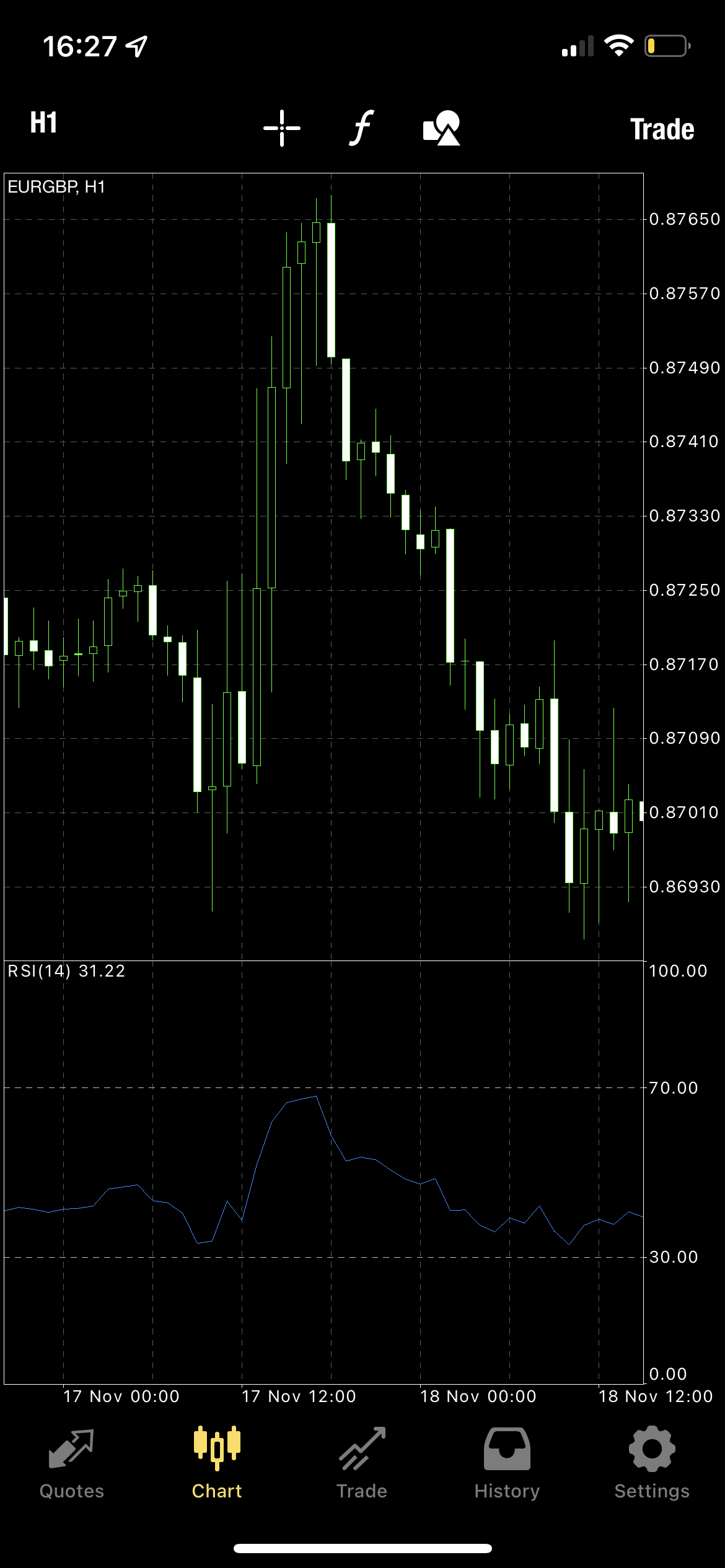

Trading Platform

There is only one trading platform available to download with SuperForex: MetaTrader 4 (MT4). This platform generally gets an excellent rating from investors and brokers around the world, providing them with advanced technical analysis tools and reliability. In addition to being available on Windows, macOS, iOS, Android, Linux and HUAWEI, our experts found the following critical features:

- Demo account

- Nine timeframes

- 39 graphic objects

- Real-time market prices

- One-second order execution

- Algorithmic trading with expert advisors (EAs)/bots

- 30 built-in technical indicators (more available on the MetaTrader market)

MetaTrader-4 iOS Platform

Markets

More than 300 trading instruments are offered by SuperForex, from the Nasdaq index to gold. Instruments on the STP Standard account are broken down as follows:

- 23 ETFs

- 80 forex pairs

- Nine commodities futures

- Nine metals including silver, gold and platinum

- 19 indices, including the FTSE, Nasdaq and Dow Jones

- 89 stock CFDs including Tesla, Apple and Amazon

21 cryptocurrency CFDs are also available on the Crypto account.

Fees

Spreads and commissions depend on your SuperForex account type. The ECN accounts generally have lower spreads and higher commissions than the STP accounts (although there is the No-Spread STP account). Spreads on the STP Standard account are fixed, whereas all ECN account types have floating spreads from 0.4 pips.

On the ECN Standard account, traders can expect spreads of 0.9 pips on EUR/USD and a commission of $9 per lot. On the STP Standard account, there is zero commission but the spread is 2.0 pips.

On the STP Crypto account, the BTC/USD spread is fixed at 75 pips and the commission is $0.75 per lot.

Swap rates may apply for positions held overnight. SuperForex has accounts in 40 base currencies, which should help avoid currency conversion fees for most clients.

Leverage

The highest leverage available on SuperForex is 1:3,000 with the Profi STP account. However, most accounts limit leverage to 1:1,000, which is still very high compared to European-regulated brokers. Crypto accounts restrict leverage to 1:10.

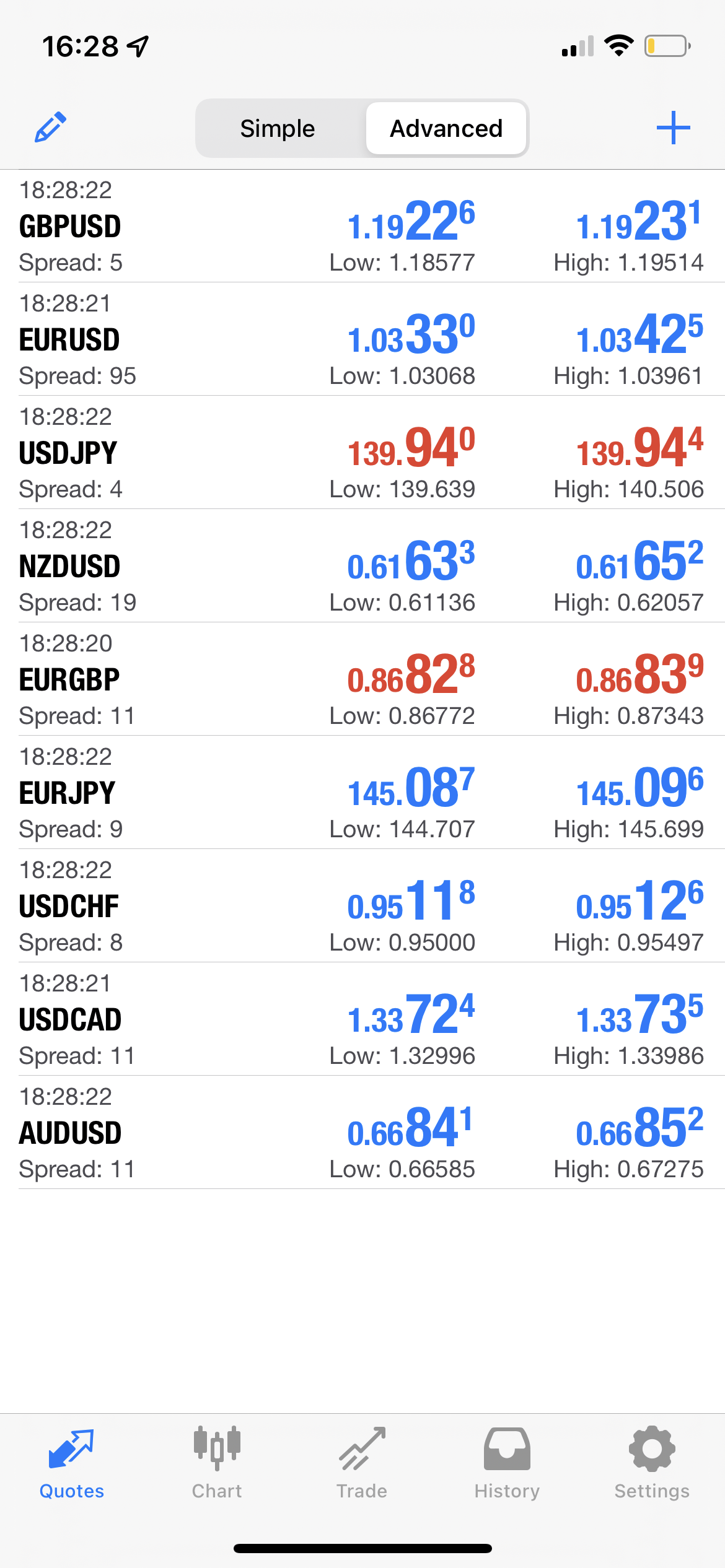

Mobile Trading

SuperForex has its own mobile app, although this is only available to download on Android (APK) and not iOS. This is unusual, although the broker’s mobile app only allows customers to undertake account management activities, such as deposits and withdrawals; it does not allow trading. To trade on a mobile device, customers will need to download the MT4 app, which is available on iOS and Android.

MetaTrader 4 Mobile

Payment Methods

Deposits

The minimum deposit on SuperForex is very low, sitting at just $1. There are also no deposit fees, although third-party bank charges may apply. Deposit methods are generally instant but bank wire transfers in GBP usually take 2-4 business days to process. While using this broker, we found the following deposit methods available:

- Credit/debit cards

- Bank wire transfer

- Cryptocurrencies, including BTC, LTC and USDT

- Electronic payments, including Skrill, Neteller and AstroPay

- SuperForex Money (transfer USD, MYR and IDR at a 7% discount)

Withdrawals

Most withdrawals at SuperForex incur a fee. For Visa and Mastercard, this is a hefty 3% plus $10 and a GBP bank transfer is even more, at 3% plus $35. Withdrawal times are also generally slower than deposits, although these vary depending on the method chosen. Crypto and electronic payments are often faster and most of them process in under four hours. Visa and Mastercard withdrawals generally take 2-4 business days to process.

Demo Account

When we used SuperForex, we found a free demo account available with a maximum leverage limit of 1:1,000. The demo account provides investors with many of the tools that a real account has but allows them to make decisions without risking their funds. Experienced traders may also want to use the demo account to explore a new trading strategy. Users can open a demo account (and a real account once comfortable) from the client login page.

Bonuses & Promotions

We undertook a review of the promotions available and found that, as an offshore broker, SuperForex offers many deposit and no-deposit bonuses that clients can claim, in addition to trading contests that essentially take place on a demo account. Ensure you check all the bonus terms and conditions as these vary depending on the particular promotion. Many of the promotions also contain conditions that state that your account must be in a certain currency or you may need to trade a minimum number of lots before a withdrawal of any profit is allowed. The following bonuses and promotions are currently offered by this broker:

- 300% Hot Bonus

- 60% Energy Bonus

- 50% welcome bonus on each deposit

- Easy Deposit Bonus – deposit as little as $1 and get 3000% extra, up to $750

- No-deposit bonus of $88 (for a $10 deposit, you can receive a second no-deposit bonus of $99)

- Gold Rush Competition and BitcoinMania (free to enter and do not require the use of your own funds)

Regulation

SuperForex is regulated by the International Financial Services Commission (IFSC) in Belize. The role of the IFSC is to regulate and supervise non-bank financial services providers. As an offshore regulator, traders will generally have less protection than with a broker regulated by the likes of the FCA or CySEC. That said, a firm regulated by an offshore body is usually better than a completely unregulated broker, as the IFSC will provide at least some oversight.

Account Types

In addition to the account types listed below, there are several packages on SuperForex that combine three account types and include various incentives. Minimum deposit requirements do apply to these and the lowest is $25.

STP Standard

- Forex Copy

- Fixed spreads

- £10,000 lot size

- £1 minimum deposit

- 1:1,000 maximum leverage

- Multiple base currencies including GBP

STP Swap-Free

- Forex Copy

- Fixed spreads

- £10,000 lot size

- £1 minimum deposit

- 1:1000 maximum leverage

- Multiple base currencies including GBP

STP No Spread

- Zero spreads

- $100,000 lot size

- $100 minimum deposit

- 1:1,000 maximum leverage

- Only USD and EUR base currencies

STP Micro Cent

- Fixed spreads

- 10,000 cents lot size

- $1 minimum deposit

- 1:1,000 maximum leverage

- Only USD, EUR and ZAR base currencies

Profi STP

- £100,000 lot size

- Spreads from 0.01 pips

- £500 minimum deposit

- 1:3,000 maximum leverage

- USD, EUR and GBP base currencies

STP Crypto

- Fixed spreads

- $100 minimum deposit

- 1:10 maximum leverage

- Only USD base currency

ECN Standard

- Floating spreads

- £100,000 lot size

- £50 minimum deposit

- 1:1,000 maximum leverage

- Multiple base currencies including GBP

ECN Standard-Mini

- £10,000 lot size

- Floating spreads

- £1 minimum deposit

- 1:1,000 maximum leverage

- Compatible with all bonuses

- Multiple base currencies including GBP

ECN Swap-Free

- Floating spreads

- £100,000 lot size

- £50 minimum deposit

- 1:1,000 maximum leverage

- Multiple base currencies including GBP

ECN Swap-Free Mini

- £10,000 lot size

- Floating spreads

- £1 minimum deposit

- 1:1,000 maximum leverage

- Multiple base currencies including GBP

ECN Crypto

- Floating spreads

- £100 minimum deposit

- 1:10 maximum leverage

- TTR, DOGE, LTC and BCH base currencies

How To Trade On SuperForex

1) Open An Account

Once you decide to sign up for SuperForex, you will need to choose an account type that aligns with your investing strategy and fill in the online registration form. Your name and address, as well as documentation to prove these, will also need to be provided as part of the account registration and verification process. Verification approval can take up to 48 hours.

2) Deposit Funds

Once verification is complete and you can sign in to SuperForex, you will need to deposit funds before you can begin investing. Minimum deposits depend on your account type but start from £1. Remember that bank wire transfers can take longer than credit and debit card deposits. You should also check out the bonuses available as some may be linked to the amount deposited.

3) Begin Trading

After funds have been deposited, you can proceed to open positions. Our experts recommend you aim to use a mixture of technical and fundamental analysis. MT4 has a range of indicators and chart types to analyse trends. SuperForex’s economic calendar will help prepare you for upcoming economic announcements that could impact the markets, thereby helping to protect your investments. Our opinion is that beginners should initially show restraint with margin and only leverage their positions once they become comfortable with their investing strategies.

Benefits Of SuperForex

- High leverage

- Low spread accounts

- MT4 trading platform

- Good customer support

- Excellent range of assets

- Negative balance protection

- Range of promotions and bonuses

Drawbacks Of SuperForex

- No MT5 trading platform

- Offshore regulated broker

- Some high withdrawal fees

- Complicated account structure

- Some accounts have high spreads

Additional Features

The SuperForex Membership Club is available to all customers with a real trading account (not a demo) who deposit at least £100. The club brings many benefits to its members, including lower spreads for a temporary period, access to a trading signals and analytics private Facebook group and 24/7 support.

There is also the Deposit Protection Program, which allows traders to claim back lost investment funds as a bonus. Various conditions apply, including that you must lose over 90% of your deposit and the insurance only lasts for a limited period, which depends on how much you deposit.

Clients on SuperForex that have spare margin can earn interest on this capital. The current annual interest rate is 5%, which is paid monthly.

The following features are also available to customers:

- Economic calendar

- Forex Copy (£10 deposit required)

- Seminars, lectures, webinars and training videos

- Economic news and video analysis of the forex market

- Pattern Graphix – assists traders in undertaking technical analysis

- Global training centres (albeit not in the UK) for in-person, group training

We were unable to find a profit and loss calculator on the SuperForex website.

Trading Hours

Trading hours depend on the market in question. Cryptocurrency is usually a 24/7 market, whereas forex is closed for most of the weekend and stock hours depend on the opening times of the exchange they trade upon.

Customer Support

Should you have a technical issue, general enquiry or wish to change your leverage, the following customer support contacts are available at SuperForex:

- Live Chat

- Phone: +442045771579

- Email: support@superforex.com

- WhatsApp and other instant messaging services

Live support is available 24/5. When we used the live chat feature, we received a helpful response within minutes.

SuperForex also has accounts on Facebook, Twitter, LinkedIn, Instagram, YouTube and Pinterest.

Security

Despite being an offshore broker, SuperForex has implemented several security features to protect client funds and personal data. Funds are held in segregated accounts, which means money belonging to the firm is never mixed with client money.

Regarding personal account security, traders can access the login history for their account and they will also receive email alerts from the broker if suspicious activity is detected. Device ID allows customers to create a list of trusted devices so that any device not on the list would not be allowed to login, even if they had your account details. The same can be done with IP addresses. When withdrawing money, clients will need to enter their withdrawal pin code.

Final Word On SuperForex

SuperForex has an excellent range of markets, low spreads and a good investing platform that suits traders of various abilities and lifestyles. Despite the firm being regulated offshore, it has implemented a good range of additional security features to reassure its clients and has successfully lasted many years and gained a huge number of clients. Moreover, SuperForex offers a wide range of promotional schemes, including a $88 no-deposit bonus, as well as several additional features and tools.

FAQ

Is SuperForex Legit Or A Scam?

This broker is likely legitimate as it is regulated by the IFSC. Although registered offshore, the fact that it has operated since 2013 in over 150 countries would suggest that it is not a scam.

Is SuperForex A Good Broker?

SuperForex provides access to low spreads, fast order execution and good customer support. On the other hand, the broker does charge high withdrawal fees for certain methods and is registered offshore.

Is SuperForex A Regulated Broker?

Yes. SuperForex is regulated by the International Financial Services Commission (IFSC), based in Belize.

Does SuperForex Have The Nasdaq Index?

Clients can invest in various indices, including the Nasdaq, Dow Jones and FTSE 100.

Does SuperForex Have An Islamic Account?

Yes. SuperForex provides swap-free accounts with both STP and ECN execution types.

Top 3 SuperForex Alternatives

These brokers are the most similar to SuperForex:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

SuperForex Feature Comparison

| SuperForex | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 2.6 | 4.8 | 4 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $1 | $0 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | IFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | 50% Welcome Deposit Bonus | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | SuperForex Review |

Pepperstone Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| SuperForex | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

SuperForex vs Other Brokers

Compare SuperForex with any other broker by selecting the other broker below.

Popular SuperForex comparisons: