Stryk (Formerly BUX X) Review 2025

|

|

Stryk (Formerly BUX X) is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Stryk (Formerly BUX X) |

| Stryk (Formerly BUX X) Facts & Figures |

|---|

Stryk is a user-focused CFD brokerage with a sleek mobile trading platform and social investing features. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, ETFs |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $10 |

| Regulated By | FCA, CySEC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Islamic Account | No |

| CFDs | Styrk is a mobile CFD broker with a wide range of assets and an easy-to-use, accessible trading platform. |

| Leverage | 1:5 |

| FTSE Spread | From 0.2% |

| GBPUSD Spread | 1.2 |

| Oil Spread | From 0.25% |

| Stocks Spread | From 0.2% |

| Forex | Stryk supports forex trading in 36 major, minor and exotic currency pairs through its bespoke mobile trading platform. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.0 |

| Assets | 36 |

| Stocks | Stryk has trading on stocks CFDs from major UK, US and European stock markets. |

Stryk, formerly BUX X, is an online broker with an intuitive mobile app and social investing functionality. In this review, our UK team share their findings after evaluating the broker. We unpack Stryk’s product portfolio, trading fees, customer support and FCA regulation.

Our Take

- Stryk is a good option if you want to trade stock CFDs on a UK-regulated and beginner-friendly mobile app

- Authorisation from the FCA is a reassuring sign for us that the brokerage is legitimate and trustworthy

- The selection of US and EU equities where you can earn dividends is especially strong

- We found the social trading features useful for sharing tips and investment ideas

- Stryk trails the best brokers when it comes to education and customer support

- Seasoned traders may also be disappointed by the lack of desktop platform support and advanced analysis tools

Markets & Instruments

With over 800 CFDs, Stryk offers a decent range of global markets, especially in terms of equities. It also offers a good selection of metals, energies and soft commodities, particularly in terms of futures.

On the downside, its coverage of the forex market is limited. With just 23 currency pairs, brokers like eToro and AvaTrade are a better option for serious forex traders.

You can trade:

- Four interest rate futures

- Stocks, including EU and US shares

- Three metals, consisting of gold, silver and platinum

- Ten futures, including Brent Crude oil, cocoa and white sugar

- 13 indices, including the FTSE 100, S&P 500 and Nasdaq 100

- 23 forex pairs, including GBP/USD, EUR/GBP and EUR/USD

- Five cryptos, including Bitcoin/USD, Ethereum/USD and Ripple/USD

- ETFs/ETCs

Fees

We liked the fee simple fee structure. There are no spreads to consider; a single price is quoted, which is the mid-price between the bid and ask prices.

The broker charges a commission, which depends on the instrument and the total value of the position. However, the fee structure is tiered so the more you invest, the lower your fees are, which we found to be an effective incentive to ramp up volumes with the firm.

Stryk charged me a 0.3% fee each way on stock CFD positions worth between £0 and £50, though this fell to 0.2% for positions above £5,000. Minimum charges of £1 apply for Italian stock investments and 50p for all others, which is reasonable given the lack of spreads.

Other products have varying commission rates, up to a maximum of 0.6% (minimum 50p) for the US volatility index (VIX 75) for position sizes under £50,000. Forex assets have average commissions of 0.10% for low-volume positions, though this drops to a competitive 0.05% once enough volume is reached.

We found that Stryk also charges overnight swap fees or financing fees for leveraged positions held overnight. Our experience was that most assets have the alternative reference rates (ARRs) added to (or subtracted from for short positions) a fixed daily spread of 0.0139% or 0.0137% for GBP-denominated assets.

On the negative side, I was disappointed to see that inactivity fees of £5 per month apply to accounts that have been dormant for 90 days. This is defined by Stryk as not opening or closing positions, not opening the app and not holding any open positions.

Note that the broker will not automatically deduct tax payments from any profits so you may need to declare your earnings using the relevant tax form.

Accounts

There is only one live account at Stryk, formerly BUX X. We liked this as it keeps the structure simple and there are already incentives in place for high-volume traders through the tiered fee structure.

How To Sign Up For A Live Account

The first step is registering for a demo account, before following the instructions below. Importantly, I found the process quick and straightforward through the mobile app.

- Tap the wallet icon

- Select CASH

- Select FUND YOUR ACCOUNT

- Upload your ID document, enter your personal details and answer the on-screen questions

Payment Methods

Deposits

I think the minimum deposit at Stryk is reasonable at £50, though some brokers like CMC Markets and OANDA have no minimum deposit.

We were pleased to see that all deposit methods are free, although clients depositing or withdrawing using a non-EUR bank account may incur fees from their own financial institutions.

Available deposit methods, alongside their processing times, are given below.

- iDEAL – instant

- SOFORT – instant

- Visa/Mastercard – instant

- Bank Wire Transfer – 3-5 days

Withdrawals

Only Visa/Mastercard and bank transfers can be used to withdraw money from a Stryk account. We liked that there are no fees charged by the broker for withdrawals, something few brokers do, although banks may charge third-party fees for wire transfers.

The processing times are 1-3 working days for Visa/Mastercard withdrawals and 3-5 working days for bank transfers. Withdrawal requests made after 12:30 GMT will be processed the following working day.

I was happy to find that users with no open positions can withdraw their full account value.

How To Make A Deposit Or Withdrawal

- Click on the Wallet icon at the bottom of the app

- Click CASH

- Select either DEPOSIT or WITHDRAW

UK Regulation

We were reassured to see that Stryk is regulated by the Financial Conduct Authority (FCA) for traders in the UK.

The FCA is a trusted regulatory authority that helps ensure brokerages are governed soundly and that British investors are protected. This is a metric we deem key to the credibility and trustworthiness of any brokerage.

Trading Platform

Stryk is a mobile-only trading platform, meaning it does not have a browser or desktop-based equivalent. Whilst this means all the resources that the broker has to offer are invested in that one proprietary app, those looking to invest on their PC, Mac or via an API will be disappointed.

On the positive side, the mobile app is clearly designed with simplicity in mind, making it a good option for new investors. I found it easy to navigate around the application and the trade order process was clear and intuitive, reducing the risk of making mistakes. I also found an in-app Trading Coach that assisted me with becoming accustomed to the platform.

One downside I noted of the Stryk app’s simplicity is that it lacks the advanced analysis features and evaluation tools that experienced traders may wish to use. Investors wanting to undertake more in-depth technical analysis would benefit more from access to a trading platform like MetaTrader 4 or MetaTrader 5.

The mobile trading app is available for free on iOS and Android devices.

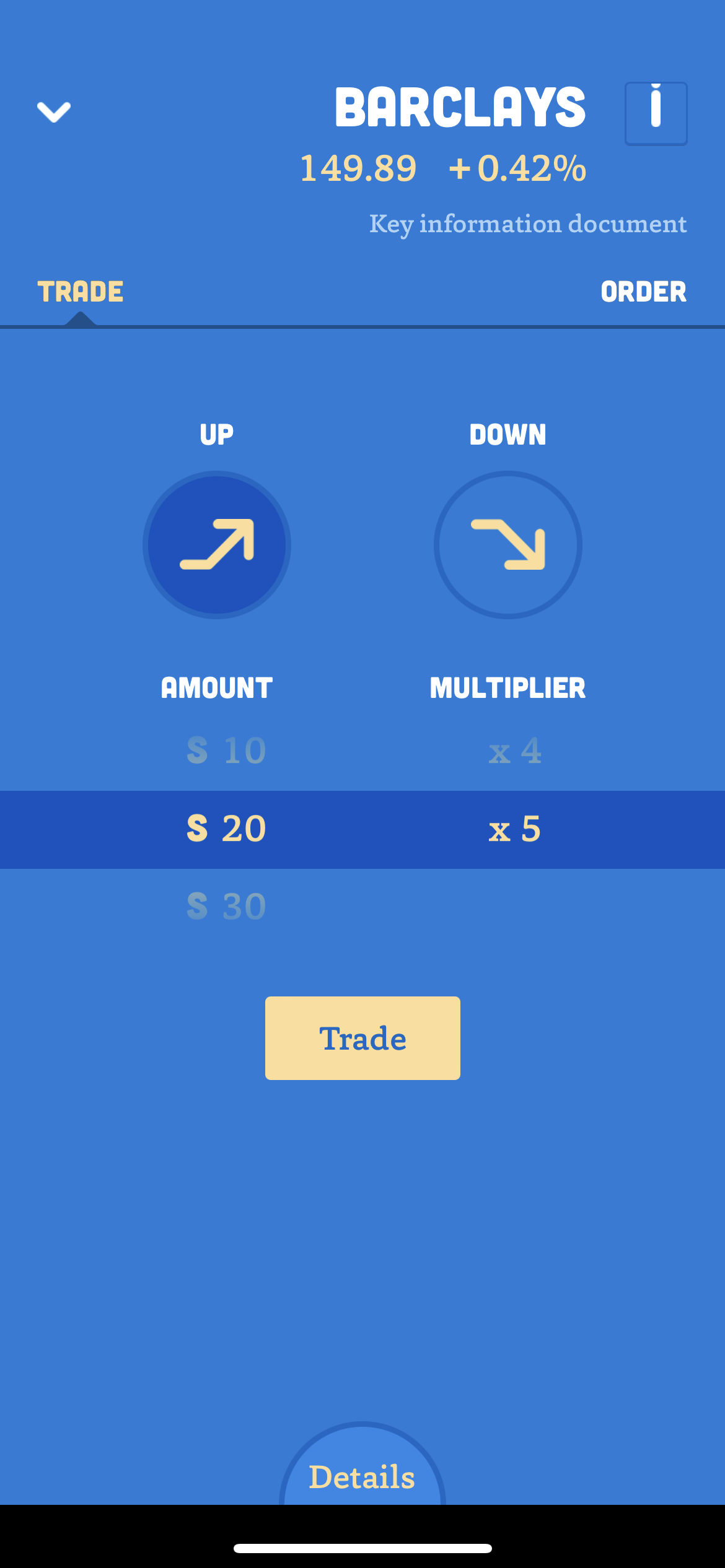

How To Make A Trade

It only takes a few steps and a couple of minutes to place a trade on the Styrk app:

- Select an asset

- Ensure Trade is selected in the top-left of the screen

- Choose whether you want to trade Up or Down, the investment amount and the multiplier

- Limit and stop orders can also be set within the position details screen

- Click Trade

Stryk App Order Screen

Leverage

Leverage, referred to on the Stryk app as the multiplier, is available to all investors.

Margin trading is subject to strict ESMA regulations and maximum leverage ratios vary depending on the instrument. For example, rates of up to 1:30 are available for forex pairs, while stocks are capped at 1:5. The FTSE 100 and other indices have a maximum rate of 1:20. Higher leverage rates are available to those who qualify as professional clients.

I was reassured to see that negative balance protection is in place. This is an important regulatory measure that ensures you cannot lose more than is in your account if a severe market swing occurs on a leveraged position.

To supplement this protection, I found that the broker will close your worst positions when your account value drops below 50% of the initial invested amount to bring the margin back up to 50%.

Demo Account

Free demo accounts are standard now at most brokers to enable investors to get familiar with trading platforms and practise their strategies.

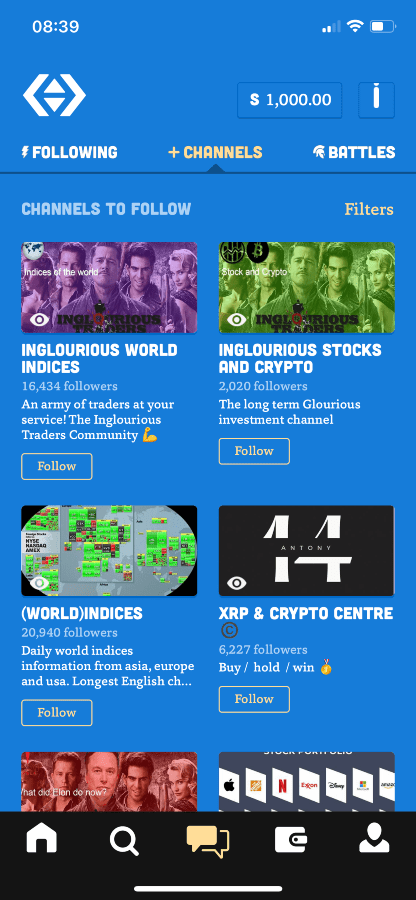

However, our experts were particularly impressed with the Stryk, formerly BUX X, demo account as it gives a realistic experience of all the features on offer. This includes several of the social trading features, with demo users able to follow different Channels. Access to market analysis is also available.

That said, the live account does provide full access to the social trading features whereas the demo account does not.

How To Open A Stryk Demo Account

- Download the app

- Register with your email address (verification required) or Google/Apple account

- Choose a username

Bonuses & Promotions

ESMA and the FCA have imposed strict restrictions on European and UK brokers offering monetary rewards linked to the trading of CFDs. This explains why Stryk does not have a promotional deal to incentivise new users.

We don’t think this is a significant drawback – bonuses can encourage overtrading and bad habits.

Extra Tools & Features

I think Stryk performs well with its social trading features. The broker names this dedicated section of its app the Community and it allows investors to share positions and discuss market news in various Channels and Groups.

Investors can also battle in short-term trading competitions with other users and follow star traders, the best-performing investors each week, for inspiration.

Stryk Channels

Education & Research

The broker has its own Channel named Stryk Brief, which includes daily market news, updates and other broker-developed content.

I also found that the app and website contain educational articles and regular market insights, although our experts pointed out that the educational resources are not as strong as those available elsewhere.

Some of the best brokers I have seen in this category, such as AvaTrade and FP Markets, offer a wide array of video tutorials, webinars and other training material.

Company History & Overview

Stryk has been rebranded from BUX X. Its UK trading name is BUX Financial Services Limited, which is regulated by the FCA and is registered in England and Wales.

We liked that the company has a physical office in London with UK contact details, providing a dedicated and personalised experience to British clients.

Stryk is the UK arm of BUX, which is a European company established in 2014 with headquarters in Amsterdam. It is available in many countries across Europe and is, therefore, an established outfit when compared to many other platforms.

In addition to Stryk, the entity also owns the BUX Trading App, formerly BUX markets.

Customer Service

Stryk has UK contact details for its London office, as well as an online live chat feature.

Unfortunately, when I tested the live chat feature, I did not receive a prompt response. This is a concern as traders may find themselves needing prompt answers from the customer support team if they encounter any technical issues whilst their money is at risk.

To get in contact:

- Live chat

- Phone number – 020 3326 2131

- Email address – support.uk@strykapp.com

Trading Hours

Opening hours vary depending on the market in question. Check on the app before you begin investing to see whether a particular market or asset is open. For example, the London Stock Exchange is open from 08:00 to 16:30 Monday to Friday.

Safety

Stryk, previously BUX X, claims to be routinely tested by third-party security experts. It also uses 3D Secure technology for Visa/Mastercard payment methods.

One feature we liked, which is designed to help protect traders in the market by encouraging diversification, is that investors are not allowed to put all their money into a single position if their account values are above £425.

Should You Trade With Stryk?

I think Stryk is a good choice for rookie traders thanks to its intuitive mobile platform, simple account and fee structure and comprehensive demo account.

However, seasoned investors may be put off by the lack of advanced trading tools, despite the tiered cost structure.

FAQ

Is Stryk Legit?

Stryk is a legitimate broker that is regulated by the FCA and registered in England and Wales. Our experts have confirmed that it is part of the BUX Financial Services entity, which operates in many countries across Europe.

Is Stryk Good Or Bad?

We liked Stryk’s simple fee and account structures, as well as its social trading features. However, I think its educational resources could be stronger and its customer support was disappointing.

Is Stryk Regulated?

Yes – Stryk is regulated in the UK by the Financial Conduct Authority (FCA) under licence number 184333.

Is Stryk Suitable For Beginners?

I would recommend Stryk to beginner investors thanks to its low minimum deposit, clear and simple cost structure and extensive social trading features, which take much of the time out of online trading.

Article Sources

Top 3 Stryk (Formerly BUX X) Alternatives

These brokers are the most similar to Stryk (Formerly BUX X):

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Stryk (Formerly BUX X) Feature Comparison

| Stryk (Formerly BUX X) | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 2.4 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, ETFs | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | $10 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:5 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Stryk (Formerly BUX X) Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Stryk (Formerly BUX X) | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Stryk (Formerly BUX X) vs Other Brokers

Compare Stryk (Formerly BUX X) with any other broker by selecting the other broker below.

Popular Stryk (Formerly BUX X) comparisons: