StormGain Review 2025

|

|

StormGain is #81 in our rankings of crypto brokers. |

| Top 3 alternatives to StormGain |

| StormGain Facts & Figures |

|---|

StormGain is a comprehensive crypto platform that allows clients to trade crypto derivatives, store them in a wallet, mine new tokens and access DeFi capabilities such as staking. The focus is on trading crypto futures, which takes place through proprietary software with integreated trading signals and a suite of educational software. The platform also supports trading on 'tokenized assets' – smart contracts based on gold and silver price movements – and crypto options. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Cryptocurrency |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $10 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| Cryptocurrency | StormGain is a crypto platform that allows clients to trade crypto derivatives, store them in a wallet, mine new tokens and access DeFi capabilities such as staking. The focus is on trading crypto futures, which takes place through proprietary software with integreated trading signals and a suite of educational software. The platform also supports trading on 'tokenized assets' – smart contracts based on gold and silver price movements – and crypto options. |

| Coins |

|

| Crypto Lending | No |

| Crypto Mining | Yes |

| Crypto Staking | Yes |

| Auto Market Maker | No |

StormGain is a crypto trading broker well known for its sleeve partnership with Newcastle United (NUFC). The comprehensive platform, which is available on desktop devices and as a mobile app, offers a cloud mining tool, a loyalty scheme, plus promo codes for new users. Our review explores the crypto broker’s services for UK traders, looking at fees and withdrawals while exploring whether StormGain is a safe and legitimate platform.

About StormGain

StormGain was founded in 2019 and is registered in Saint Vincent and the Grenadines. The broker was originally geared towards UK traders but has now expanded to more than 100 countries with over 120,000 clients.

The company is not yet regulated, however it is a member of the Blockchain Association, which regulates companies who trade digital assets. CoinMarketCap also lists StormGain as the #1 interest rate provider for crypto traders.

The company prides itself on being a crypto trading platform for everyone and its user-friendly interface and video education features make it an attractive broker for beginners.

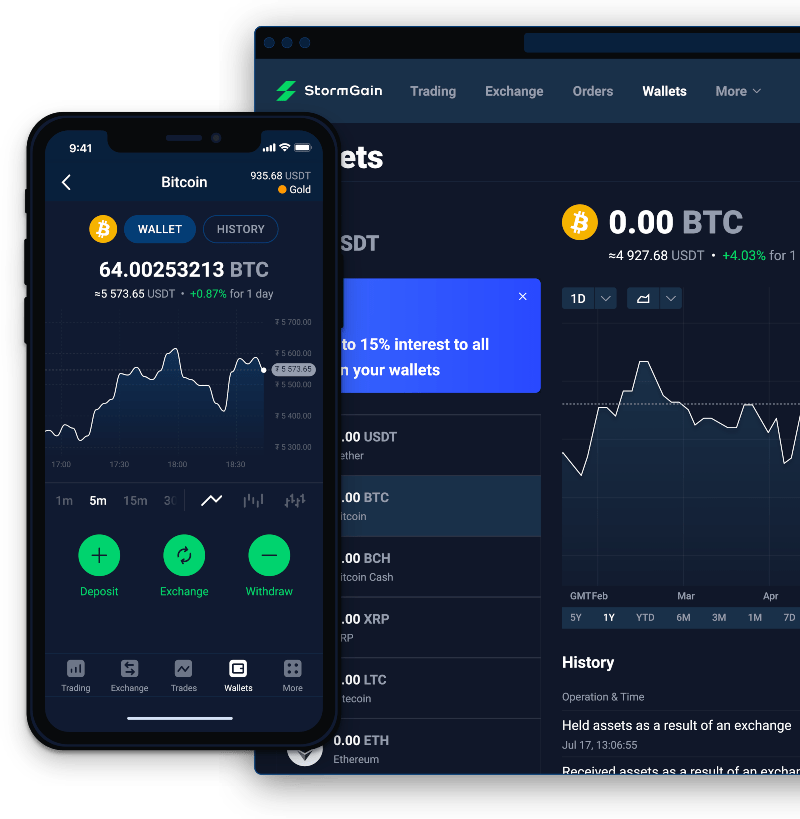

StormGain Web Terminal

Registration for StormGain only requires an email address and phone number making it a simple and straightforward process without the hassle of a KYC check. If you’re interested in browsing StormGain’s margin trading and investing features before registering, the desktop platform is directly accessible from the website.

On the web platform, traders can take advantage of a number of features:

- Full-screen mode with a variety of charting tools

- User-friendly and customisable dashboard

- Over 40 technical indicators

- Access to trading signals

- In-platform live chat

- Video education

- 9 time-frames

Web platform

You can also use their public API to access market data without the need for authentication.

Assets

There are over 50 cryptocurrency futures contracts users can trade as well as 3 crypto indices plus 6 stocks and commodities – including Tesla, Apple, Google, and Amazon. The range of assets is impressive and will meet the needs of most active crypto traders.

Crypto products

Users can buy and hold Bitcoin, Litecoin, Ethereum, Ripple, Bitcoin Cash and Tether in their StormGain wallet as well as easily transferring cryptocurrency from their personal wallets. To ensure exchange rates remain stable, all transactions on StormGain are carried out in the stablecoin Tether (USDT) which is tied to the U.S. dollar. Tether’s liquidity means that the cash-out process is quicker and easier than with other cryptos.

Fees

StormGain’s business model operates under a no gain, no fee policy vs the likes of Binance and Coinbase, who charge spreads and trading commissions. StormGain simply takes a 10% profit share of successful positions.

There is commission on exchange services, which may be necessary if you do not already own Tether. Commission rates are either 0.095% or 0.25%, depending on the currency.

UK Leverage

StormGain offers some of the highest leverage options on the market with a multiplier of up to 1:300 available on BTC/USDT and up to 1:100 on LTC/USDT, BCH/USDT and ETH/USDT. With multipliers this high, there are opportunities to maximise profits – even with minimal capital. However, this also increases the risk of losses.

Mobile Trading

The StormGain mobile app is available on iOS or Android (APK) devices as a free download from the App Store or Google Play. The application offers a comprehensive range of features making the exchange, storage and trading of cryptos possible 24/7 at the touch of a button.

On the StormGain app, users can make use of all the same features as the desktop platform, including trading signals, technical analysis tools and a cloud mining feature which we will cover in more detail later in this review.

StormGain app

Deposits

The minimum deposit on StormGain is 50 USDT which is equivalent to £40. Using a Visa or Mastercard credit or debit card, clients can easily buy cryptocurrency on the platform with a 5% or $10 deposit commission, whichever is higher. There are no commission fees on crypto deposits.

Note, StormGain does not accept PayPal.

Withdrawals

The withdrawal of fiat currency is not possible with StormGain, but aside from this, it is a quick and easy process, with funds generally being deposited to your account within 30 minutes. StormGain charges a 0.1% fee for all express withdrawals.

Users can withdraw USDT, ETH, DAI and USDC with no restrictions, while minimum withdrawal amounts vary for other currencies. Users are advised to check StormGain’s website for the latest information on withdrawal restrictions.

Demo Account

Users automatically receive access to both real and demo accounts upon registering for StormGain. The demo account offers beginners the opportunity to practice trading and develop strategies risk-free with access to 50,000 USDT in virtual funds, equivalent to roughly £35,000.

Users can easily switch to the live account by clicking on ‘account management’ and selecting the ‘demo account’ in the dropdown menu.

Regulation Review

StormGain is not yet regulated. However, the company is a member of the Blockchain Association, and its innovative service has garnered many positive accolades such as being listed by The European as the Cryptocurrency Trading and Exchange Platform of The Year.

With that said, the lack of regulatory oversight does mean limited legal options should the broker behave inappropriately. As a result, we recommend trading with caution.

Additional Features

StormGain’s Cloud Miner tool, which is available on both the desktop and mobile platforms, is a unique selling point and is free to use. The miner is hosted on remote cloud servers, which means no expensive mining equipment is required and battery and CPU drainage is avoided.

Once you have made an account, go to the dedicated Bitcoin Miner page and hit the ‘Activate’ button. After 4 hours you will have received your first mining reward and once you have made 10 USDT, you can deposit this to your account and start trading.

StormGain also offers various risk management tools, including:

- Stop losses

- Take profits

- Mobile alerts

- Regular crypto forecasts

Live Accounts

Unlike some competitors, registration at StormGain does not require a lengthy KYC process and is possible with only an email address and phone number. There are 5 account types available, with a user’s status being defined by account balance size and trading volume:

- Standard – Account balance less than 499 USDT and no trading volume

- Gold – Account balance greater than 499 USDT and a trading volume greater than 150,000 USDT

- Platinum – Account balance greater than 1,499 USDT and a trading volume greater than 750,000 USDT

- Diamond – Account balance greater than 4,999 USDT and a trading volume greater than 2,250,000 USDT

- VIP – Account balance greater than 49,999 USDT and a trading volume greater than 7,500,000 USDT

Bonuses & Promos

StormGain’s loyalty scheme offers a range of benefits, for example, deposit bonuses from 5% for Gold members up to 20% for VIP members and interest on deposits from 3% for Gold members up to 12% for VIP members. StormGain also offers a referral scheme where you can gain 17% of funds withdrawn from crypto miner by your referrals while your referral will receive 3 USDT for registering.

There are currently no deals for new members, however a promo code for 25 USDT has previously been offered, so it is worth keeping an eye on the broker’s website for any future contests or competitions.

Pros

Highlights of opening a StormGain account include:

- High leverage

- Interest on deposits

- No gain, no fee policy

- Free cloud mining tool

- Hassle-free registration

- Loyalty and referral scheme

- Video education freely available

- User-friendly and customisable interface

Cons

Downsides of opening a StormGain account include:

- StormGain does not support the withdrawal of fiat currency

- Transactions must be carried out with Tether

- Currently unregulated

Opening Hours

The cryptocurrency trading market never closes and the StormGain platform is accessible 24/7 via the desktop and mobile application. This is good news for active traders looking for access to crypto markets on the weekends.

Contact Details

You can get in touch with StormGain via several channels:

- Telephone – +248 467 19 57

- Email – support@stormgain.com

- Telegram – Link provided at the bottom of the broker’s homepage

If you have technical queries, or simply want to find out more about how StormGain works, an extensive database of FAQs is available on the company website. There are several well-explained tutorials available both on the video education section of their website as well as regular reviews, price predictions and trading strategies posted to their blog forum.

Note, due to the rapid growth of their client base, customer support from live agents is only provided to users with funded accounts.

Security

StormGain provides cold wallets which are inaccessible to hackers and a 2-Factor Authentication (2FA) login system with SMS or Google Authenticator to protect accounts. Even with these safety measures, crypto trading is notoriously volatile so make sure you take steps to manage risk.

Should You Trade With StormGain?

StormGain provides an innovative service with competitive exchange and commission rates. The platform’s user-friendly interface and video education make it an ideal starting point for beginners interested in cryptocurrency trading. The cloud mining tool and high multipliers also make it an attractive option for more experienced investors.

FAQ

Is StormGain Legit?

StormGain is currently unregulated but it is a member of the Blockchain Association within the Financial Commission and has many positive user reviews. The platform was also well known as the Newcastle United (NUFC) sponsor during the 2019/20 season.

What Do I Need To Start Trading On StormGain?

To register, you only need an e-mail address and phone number. Choose between the desktop or mobile version and begin trading in seconds.

How Much Capital Do I Need To Trade With StormGain?

The minimum deposit on StormGain is 50 USDT, equivalent to £40. Trades are restricted to a minimum of 10 USDT.

What Leverage Does StormGain Offer?

On StormGain, you can trade with a multiplier up to 1:300 on BTC/USDT and up to 1:100 on LTC/USDT, BCH/USDT and ETH/USDT. Most other pairs allow a multiplier up to 1:50.

Do I Have To Install Any Software To Mine Bitcoin On StormGain?

With StormGain, you can mine Bitcoin for free using your phone or computer. Mining happens on remote cloud servers which means no specialised equipment is required and it will not drain your battery or CPU. All users who have an account can mine Bitcoin and trade it on the platform.

Top 3 StormGain Alternatives

These brokers are the most similar to StormGain:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

StormGain Feature Comparison

| StormGain | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.9 | 4.8 | 4.8 | 4.7 |

| Markets | Cryptocurrency | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | $10 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | MT4, MT5, cTrader | - | MT4 |

| Leverage | - | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | StormGain Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| StormGain | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | Yes | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

StormGain vs Other Brokers

Compare StormGain with any other broker by selecting the other broker below.

Popular StormGain comparisons: