Vodafone Stock Trading

Vodafone is a British multinational telecommunications firm that offers digital services domestically and abroad. Despite some recent challenges, many traders continue to view Vodafone stock as a good investment opportunity given its technological strengths and healthy dividend yield. This guide will cover the background of the company, how to buy or sell Vodafone stock and historical share prices. Our experts also explain how to start trading Vodafone shares with an online broker and the different investment vehicles available.

Top UK Brokers For Trading Vodafone Shares

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

-

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

-

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

Company Details

Vodafone Group PLC is one of the leading communications technology companies. It has an impressive 625 million customers worldwide, including 18 million in the UK, and a market capitalisation of just over £25 billion.

The company was established in 1981 as Racal Strategic Radio Ltd and was awarded the UK’s first cellular telephone license in 1982 before being renamed Vodafone in 1984. Since then, Vodafone has been involved in some major communication technology advances including the world’s first SMS message sent in 1992, the first 3G voice call in 2001 and most recently, the launch of 5G networking in Gatwick Airport.

Vodafone shares are traded on the London Stock Exchange (LSE) under the ticker symbol VOD. Additionally, shares can be traded as American Depositary Shares (ADSs) on the NASDAQ exchange.

The Indian subsidiary Vodafone Idea can be traded by UK investors on India’s National Stock Exchange (NSE) if they register a Demat account with a SEBI-registered brokerage.

Price Chart

Release Dates

Vodafone functions on an April to March fiscal year, and traders should take note of important dates on the company calendar as earnings reports often cause share price volatility.

Typically, financial trading analysts will publish predictions about the company’s performance before announcements are made. Market confidence in the firm may therefore swing, causing significant changes to the stock price.

For example, Vodafone will publish its Q1 financial results for the fiscal year 2024 on July 27th, 2023. Retail investors should keep an eye out for any indications of the company’s performance in the run-up to this announcement and should adjust their trading positions accordingly.

Investors should not underestimate the influence these reports have on a company’s share price, as was demonstrated in November 2022, when Vodafone reduced its profit predictions by 2% in a company statement. This saw the share value drop by 6% in the following days as shareholders became cautious about the apparent challenges facing Vodafone.

Share Price Influences

Market Expansion

Telecommunication is big business in every part of the world, so there are a wealth of markets that Vodafone could tap into. Look out for news of expansions to fresh regions and markets, as this could send the firm’s stock price higher.

Technology

New technologies that harness telecom networks could be a significant advantage for a company like Vodafone. At the same time, a new invention could also cut into the company’s existing services or make them obsolete – just think about the impact of the arrival of an innovation like WhatsApp.

As in any sector where technology plays a significant part, Vodafone investors should stay abreast of the latest tech products and developments.

Regulatory Changes

Vodafone is reliant on business in Europe – particularly Germany, the company’s largest market. In 2022, Vodafone reported a 0.5% drop in revenue from Germany due to broadband and TV regulation changes, the ‘Telecommunications Act’. This resulted in a loss of almost 80,000 customers thanks to the removal of automatic re-contracting policies.

It is important to keep up-to-date with news of similar regulations in any country where Vodafone has a significant presence.

Organisational Restructure

The company has announced that it is aiming to cut costs by up to €1 billion by 2026 to counteract poor performance across Europe. Vodafone has pledged to streamline its organisational structure and decentralise global operations, which in turn will lead to the loss of hundreds of jobs.

The latest chief executive Nick Read stepped down at the end of 2022, following an unsuccessful attempt to get the firm back on track. This did in fact lead to a 2p price rise in Vodafone stock. Though a restructuring will be welcomed by many investors, major changes may also prove unnerving to shareholders.

Dividend Yield

Vodafone remains one of the highest dividend yields in the telecommunications market averaging 8.9%. This is an exciting prospect that is likely to attract new investors, but it is not necessarily sustainable in the long run.

If Vodafone cuts dividend payouts, many investors will think about moving their money to alternative trading assets.

Share Price Highs & Lows

The Vodafone stock quote price has witnessed major volatility thanks to fierce competition in the telecommunications landscape and challenging economic conditions following the Covid-19 pandemic. Product price increases to combat these issues have impacted new customer uptake and existing customer retention.

In 2022, Vodafone stock value declined by a huge 28%, with a 38% decline in the last three years and an almost 60% loss over the last five-year period. This is significantly different from the performance of the FTSE 100 index overall, which grew by 3% in 2022.

As of 2023, Vodafone has a share price of around 92p with a 52-week range of between 83p and 141p.

Pros Of Vodafone Stock Trading

- High dividend yield

- Volatility can provide opportunities to traders with an appetite for risk

- Established brand with large market capitalisation and access to expansive trading markets

- Some see Vodafone stocks as good value after a severe drop in its share price in recent years

- Widely available to trade and invest using a large range of vehicles from diverse Vodafone brokers

Cons Of Vodafone Stock Trading

- Poor recent performance has led to drastic losses in share price

- Vodafone is at risk of regulations to telecom markets, particularly in Europe

- Trading volatility heightens risk

How To Trade Vodafone Stock

Purchase Shares

The simplest way for UK traders to invest in Vodafone stock is by purchasing shares directly through an online brokerage. You will need access to reliable Vodafone brokers that provide trading opportunities on the London Stock Exchange.

CFDs

CFDs (contracts for difference) are a popular way for retail traders to speculate on the price movement of Vodafone stocks and other trading assets. Retail investors can take long or short positions to profit from price movements in either direction, and can trade with leverage.

AvaTrade, for example, offers UK traders Vodafone CFDs with a maximum leverage of 1:5 and a maximum 1000-lot trade size.

Indices

Vodafone is listed on several UK indexes including the FTSE 100, FTSE 350, and FTSE 350 High Yield.

Indices are a basket of securities that can be traded as one asset using derivative products and index trackers. The Financial Times Stock Exchange 100 index (FTSE 100), for example, is an index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation, and it is frequently used as the basis for financial derivative products.

Trading FTSE indices enables shareholders to gain exposure to Vodafone alongside other companies, giving a level of protection against volatility.

ETFs

Another way to start trading Vodafone shares is via ETFs. An exchange-traded fund (ETF) is a financial product typically organised to reflect a specific market segment such as technology, real estate, or commodities.

Similar to indices, trading Vodafone stock via ETFs may protect against volatility. As one company struggles, another may boost overall profitability through strong performance.

The ETF with the largest weighting of Vodafone Plc is the iShares STOXX Europe 600 Telecommunications UCITS ETF.

Finding A Broker

The best brokers will allow you to trade Vodafone shares using at least one of the products listed above as well as alternative stocks and other assets. Spend some time comparing the important features we outline below:

- Minimum Deposit Requirement – For beginners, or those just starting out, a broker with a low minimum deposit may appeal as it allows them to limit their investment until they are comfortable with the trading basics. CMC Markets is one example of a reputable broker that has no minimum deposit requirement.

- Trading Fees – Charges may vary between trading brokers that offer Vodafone shares. Commission fees and wide spreads can quickly eat away at profits, particularly if you are planning on opening and closing positions regularly. Brokers often charge different fees according to the asset traded, so check how much it will cost to trade Vodafone – Admiral Markets, for instance, is a good option as it provides low commission fees of 0.1% when trading UK shares.

- Regulation – The best brokers for Vodafone stock trading will be authorised and regulated by a top-tier financial body such as the UK’s Financial Conduct Authority (FCA). You can confirm registration via the watchdog’s official website. Regulated trading brokers, particularly those overseen by the FCA, are considered the most secure and will provide safeguarding initiatives and capital protection for retail traders.

- Educational Resources – Particularly for beginners, access to educational content and training guides can be invaluable. The best Vodafone brokers, such as eToro, provide extensive user guides and learning materials on their websites. Brokers that offer Vodafone shares may provide tools to help you build a trading strategy and guidance on using their platform and app. Also look out for a demo account with simulated market conditions to practice investing in securities without risking personal capital.

How To Sign Up With A Broker

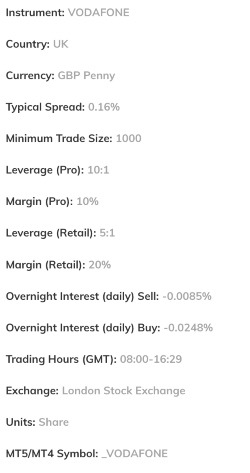

AvaTrade Conditions

Once you have established that a broker offers Vodafone stock trading with competitive fees and reliable tools, it’s time to sign up:

- Fill out the online registration form and enter/transfer your personal details

- Upload identity verification documents to comply with AML and KYC agent policies

- Once your new account request is approved, sign in to the client portal or trading platform

- Make a deposit to your live trading account

- Search for the Vodafone stock symbol (VOD) and start trading

How To Buy Vodafone Stock

- Log in to your broker’s trading platform (you may need to download software)

- Search for the stock symbol, VOD

- Select the asset and open a new order

- Complete order details including the number of shares to purchase, risk management parameters, and order type

- Submit the order

Bottom Line

Vodafone has seen some share price slumps over the past few years as the company has suffered more than its competition under difficult global market conditions. However, it is still a force to be reckoned with in the telecommunications sector and continues to attract investors thanks to its high dividend yield and potential for growth. The stock’s volatility may also attract day traders and others looking to profit from large price swings.

To start trading online today, head to our list of the best Vodafone brokers.

FAQ

Should I Buy Shares In Vodafone?

Although the Vodafone share price looks attractive, the jury is out on whether it will make a good investment in the mid-to-long term. High dividend yields are attractive for investors, but the company’s share price has dropped drastically over recent years. As with any stock, do your own research before putting money down.

Will Vodafone Shares Recover?

Vodafone has experienced challenges in the past few years, with organisational restructuring, growing debts, and changes to European regulations. Some analysts are concerned that Vodafone is spread too wide across the global market to maintain control. Having said that, the stock price has already dropped a significant amount, and the company is certainly big enough to bounce back if managed well.

Should I Buy, Sell Or Hold Vodafone Stock?

Before deciding on which stock to buy, sell or hold, you should spend some time doing your own research on historical price data. Review significant price rises or falls and the relevant reasoning for this. Use our guide to trading Vodafone stock to assess share price highs and lows, earnings releases, and more.

How Can I Buy Vodafone Shares?

The easiest way for UK traders to buy and sell Vodafone shares is via an online stockbroker. Simply open an account, make a deposit, and search for the stock symbol for Vodafone on the trading platform (VOD). Head to our list of the top Vodafone brokers to find a suitable trading firm.

Does Vodafone Stock Pay Dividends?

Yes, Vodafone shareholders are entitled to dividend payments. Payment months are usually February and August each year. Its dividend yield averages approximately 8.9%