Rolls-Royce Stock Trading

Rolls-Royce is a multinational engineering company that specialises in power and propulsion systems. The company’s stock is publicly traded on the London Stock Exchange (LSE) and is a fixture on the FTSE 100, regularly ranking in or near the UK’s top 50 companies. This Rolls-Royce stock trading guide will explain the most important things you need to know to invest in the organisation, from the factors determining the company’s stock price to the steps you need to take to start buying shares. Our experts have also reviewed and ranked the best Rolls-Royce brokers for UK traders:

Top UK Brokers For Trading Rolls-Royce Shares

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

-

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

-

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

Company Background

Rolls-Royce was founded in England in 1906 by Charles Rolls and Henry Royce, and has since become one of the world’s leading producers of aircraft engines, marine propulsion systems, and energy products.

Throughout its history, Rolls-Royce has been at the forefront of innovation and has made significant contributions to the development of the aviation and marine industries. Today, Rolls-Royce is a multinational corporation with operations in more than 50 countries, employing more than 50,000 people globally. Despite facing challenges in recent years, such as the downturn in the aviation industry following the Covid-19 pandemic, Rolls-Royce remains a leading player in its markets and is well-positioned for future growth.

Rolls-Royce Holdings plc is publicly traded on the London Stock Exchange (LSE) under the ticker or trading symbol “RR”, or “RLLCF” for preferred shares with fixed dividends. The company was listed on the LSE in 1987. It is also traded under the stock symbol for Rolls-Royce, “RYCEY” on the OTC market in the United States.

Rolls-Royce has a reputation around the world as a prestige company, not least for its role in producing some classic automobile designs and engines for advanced military aircraft. However, the company has had a difficult recent history, posting its largest-ever pre-tax loss of £4.6 billion in 2017.

In January 2023, the company’s new CEO, Tufan Erganbilgic, described Rolls-Royce as a ‘burning platform’ with an ‘unsustainable’ performance that would require a major shakeup to remedy.

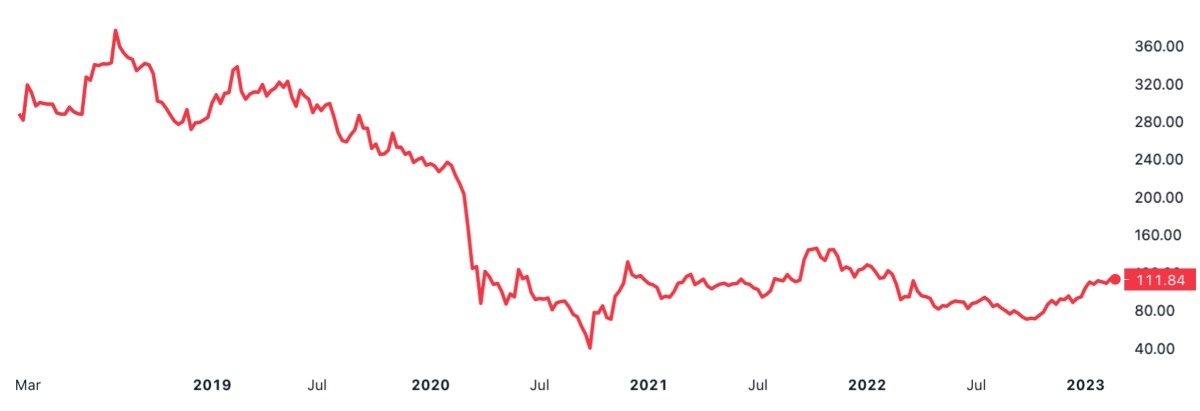

Price Chart

Share Price Influences

To start trading Rolls-Royce stock, you need to understand the key factors that can influence its share price:

- Performance: The financial performance of Rolls-Royce, including its revenues, profit margins, and earnings per share, can have a significant impact on the share price. If the company is performing well, its shares are likely to be in demand, and the share price may increase. Conversely, if the company is underperforming, its share price may decrease. For instance, in the five years to 2023, the Rolls-Royce share price fell 89%.

- Market sentiment: This refers to the overall mood of the market and can be influenced by economic news, geopolitical events, and other factors. If the market is bullish in general, there will tend to be more upward pressure on Rolls-Royce stocks. But it’s important to tune into the sentiment in the specific sectors that Rolls-Royce operates in to get an accurate view of where the price is headed, i.e. aircraft engines and marine propulsion systems.

- Competition: The performance of Rolls-Royce’s competitors can also influence the company’s share price. A company that is performing well in relation to its peers is more attractive to investors, who might steer clear of firms that are lagging behind the competition. The firm’s chief competitors are Pratt & Whitney, Bombardier, and B/E Aerospace.

- Industry trends: The trends and developments in the aviation, defence, marine, and energy industries can also have an impact on the company’s share price. If any of these industries are experiencing growth, the share price is likely to perform well, attracting investors looking to start Rolls-Royce stock trading.

- Regulatory changes: Changes in government regulations and policies can also have an impact on the share price of Rolls-Royce. New trade policies or environmental regulations can affect the company’s financial performance and, in turn, its share price.

Highs & Lows

- Financial crisis impact: During the 2008 financial crisis, the share price of Rolls-Royce experienced high volatility and decreased significantly, falling from around 190 to below 100. However, the company’s strong financial performance and market position helped it recover relatively quickly from the crisis.

- Expansion into new markets: Rolls-Royce has expanded into new markets, such as the marine and energy industries, and this has been reflected in the company’s stock price. Historically, the share price of Rolls-Royce has generally performed well, reflecting the company’s broad portfolio of products and services and its strong market position, though recent years are an exception.

- COVID-19 impact: In 2020, the Covid-19 pandemic had a significant impact on the aviation industry and, as a result, the share price of Rolls-Royce experienced a notable decline, reaching 67.32 on 6 November 2020.

- Recent concerns: The company has faced challenges in recent years, such as operational issues and concerns about the sustainability of its business model, which have contributed to downward pressure on its stock price. As a result, its stock price over the last five years is significantly below the value it enjoyed in the previous 10 years.

Rolls Royce Price Chart – 5 Years

Company Releases

The best brokers that offer Rolls-Royce stock trading offer insights into the famous UK engineering company. However, investors should also keep an eye out for several releases by Rolls-Royce that can impact its stock price:

- Financial results: If the company reports strong revenue growth or improved profit margins, its shares are likely to be in demand, and its share price may increase. The full-year results are typically released in February or March each year, while half-year results come out in August or September.

- Strategic updates: Rolls-Royce regularly releases updates on its strategic plans, including its plans for expanding into new markets, developing new products, and improving its financial performance. These updates can provide investors with important insights into the company’s prospects.

- Major contracts: Rolls-Royce has a strong reputation for engineering and is a major supplier to the aviation, defence, marine, and energy industries. When the company announces a major contract, it can have a positive impact on the company’s share price, as investors become more optimistic about the company’s prospects.

- Management changes: Changes in the company’s senior management can have an impact on the company’s share price. The appointment of Erganbilgic, for example, and his expected shakeup of the company may lead to a significant rally.

- ESG initiatives: In recent years, ESG has become an increasingly important factor for investors, and companies are under pressure to demonstrate their commitment to sustainability and corporate responsibility. When Rolls-Royce announces ESG initiatives, such as new sustainability goals or investments in clean energy, it tends to have a positive impact on the company’s share price.

Key forecasted dates are as follows:

- Half-yearly results: Aug 2023

- Annual general meeting: May 2023

- Annual report: Mar 2023

How To Trade Rolls-Royce Stock

Choose An Instrument

The key ways for the retail market to start investing in or trading Rolls-Royce stock are directly buying shares in the company, gaining exposure through an ETF or similar fund, and trading derivatives such as CFDs (Contracts for Difference). Each approach has its advantages and disadvantages, and the best option for you will depend on your Rolls-Royce stock trading goals and risk tolerance.

Rolls-Royce Shares

Directly buying shares in Rolls-Royce involves purchasing ownership of a portion of the company. When you own shares, you have a stake in the company’s success and can benefit from any increase in its share price.

To buy shares, you need to open a brokerage account, fund it, and place an order. You can then hold the shares for as long as you wish and benefit from dividend payments or sell them when you want to make a profit or cut your losses.

If you are signing up with a broker to buy Rolls-Royce shares, it may be worth looking for a brokerage that deals in fractional shares. This type of Rolls-Royce stock trading broker allows you to invest smaller amounts of capital in a stock than the price of a single share, making for a more flexible investing experience if you have less capital.

ETFs

Many retail investors favour exchange-traded funds (ETFs) because they provide exposure to a range of different companies, mitigating some of the risks involved in investing in a single company. For example, an aerospace ETF might include shares in Rolls-Royce and several of its competitors, allowing the investor varied exposure to the aerospace sector in general and balancing out if a single company performs poorly.

ETFs make good long-term investments and are often available in ISA stocks & shares accounts, though they can also be used as instruments for shorter-term trading.

CFDs

Contracts for difference, or CFDs, are popular among retail traders as they are a simple way of speculating on the price movement of Rolls-Royce stock and other assets without having to own them.

With CFDs, the trader bets on which way the price of an asset will move, and if correct, earns profits in the proportion to the extent of the price movement – if the CFD starts at £100 and the price moves to £110, the trader earns a £10 profit (minus any fees). Naturally, if the price moves in the wrong direction the trader will make a loss.

One advantage of CFDs is the ability to trade them with leverage, allowing retail traders to significantly boost the trading power of a relatively small sum of capital.

Ultimately, the instrument you choose will depend on your investment goals, risk tolerance and experience level, therefore there is no ‘best’ instrument for trading Rolls-Royce stock. Stocks are often a good idea if you are looking for a hands-off, longer-term investment, while day traders often prefer CFDs.

Choose A Broker

To start trading Rolls-Royce stock, you need to open a brokerage account that allows you to buy and sell shares and other securities. Many Rolls-Royce brokers offer easy-to-use platforms, such as MetaTrader 4, and competitive trading conditions.

When choosing brokers, consider factors such as spreads and commissions, trader security, customer support, investment vehicles, app compatibility, and oversight from a trusted regulator like the UK’s FCA.

Alternatively, sign up with one of our top-rated Rolls-Royce brokers.

Fund Your Account

Once you have opened a brokerage account, you will need to fund it. This can typically be done through a bank transfer, credit or debit card, or by a range of e-wallet options. Deposit methods will vary between Rolls-Royce brokers, so be sure to check the list before creating your account.

Also check for any transfer fees and processing times. With that said, the best Rolls-Royce brokers offer instant and fee-free payments.

Place On Order

Once your brokerage account is funded, you can search for Rolls-Royce stock by typing in its ticker symbol, RR, to the appropriate place on your trading platform. On MT4, this is in the Market Watch widget.

You should familiarise yourself with the Rolls-Royce stock trading platform and check the real-time information about the share price, volume, and other key metrics.

When you are ready to buy Rolls-Royce stock, place an order through your broker’s platform or app. There are two main types of orders you can use when buying stocks: a market order and a limit order. A market order is an order to buy or sell a stock at the current market price, while a limit order is an order to buy or sell a stock at a specific price.

Trading Hours

Rolls-Royce Holdings is listed on the London Stock Exchange (LSE), which trades from 8:00 am to 4:30 pm GMT, Monday through Friday.

Hours may be subject to change due to market holidays or other factors. Additionally, hours may vary depending on the broker or platform you use to start trading Rolls-Royce stock.

Bottom Line On Trading Rolls-Royce Stock

Buying and selling Rolls-Royce stock is a straightforward process and can be a good investment opportunity, particularly for those with experience in monitoring the aerospace and defence industries. However, it’s important to do your research and understand the risks involved so that your funds remain well protected. It’s also important to choose a reputable online broker that offers competitive trading fees, a range of investment products, and strong customer support. By comparing the conditions offered by different Rolls-Royce brokers, you can make an informed decision and choose a trading platform that best meets your needs and investment goals.

Use our table of the best Rolls-Royce brokers to start trading.

FAQ

How Can I Buy Rolls-Royce Stock?

To buy Rolls-Royce stock, you need to open a brokerage account with a stockbroker or an online trading platform. Once you have opened an account and funded it, you can place a trade to buy Rolls-Royce stock. Our trading tutorial ranks the top Rolls-Royce brokers in 2025.

How Do I Sell Rolls-Royce Shares?

To sell Rolls-Royce stock, you simply place a sell order through your trading account. You can do this at any time, subject to market conditions and any applicable brokerage fees.

How Much Is It To Buy Rolls-Royce Shares?

The price of Rolls-Royce stock is influenced by a variety of factors, including the company’s financial performance, the strength of the aerospace and defence industry, the general state of the stock market, plus economic and political conditions. Importantly, the top Rolls-Royce brokers offer real-time price quotes on their trading platform and investing app.

How Do I Choose The Right Broker To Buy Or Sell Rolls-Royce Stock?

When choosing a broker to buy or sell Rolls-Royce stock, it’s important to consider the fees, platform features, and customer service offered by each brokerage. Also look for oversight from a trusted regulator, like the UK’s Financial Conduct Authority.

Before choosing between Rolls-Royce brokers, it’s also worth considering your investment goals and risk tolerance. Do you want to buy and hold onto shares for dividend payments? Alternatively, do you want to start day trading Rolls-Royce stock using leveraged CFDs?

Should You Buy Rolls-Royce Stock?

Investing in Rolls-Royce shares, like any other stock, carries risk. The stock market can be volatile, and the price of Rolls-Royce shares can fluctuate widely. For example, its share price fell almost 90% in the five years to 2023.

With that said, for traders with a long-term investment horizon and a diversified portfolio, investing in Rolls-Royce stock could be a sensible decision. The company also brought in a new CEO, Tufan Erganbilgic, to improve the firm’s prospects.

What Is The Stock Symbol For Rolls Royce?

The most commonly used stock symbols for Rolls Royce at online brokers are RR, RYCEY and RLLCF. There are different stock tickers to reflect the different classes of shares and associated rights and dividends that the owner/holder may get. For example, RLLCF is the preferred US stock, traded over the counter, while RYCEY is the sponsored ADR, also known as American Depository Scheme. RYCEY is essentially the US equivalent of RR.