Nasdaq Nordic

Nasdaq Nordic brokers offer trading on securities from a range of Scandinavian and Baltic countries and eight different stock exchanges. The Nordic and Baltic markets are home to global companies, including Volvo and pharmaceutical giant Novo Nordisk A/S. This tutorial will list the best Nasdaq Nordic & Baltics brokers. It will also provide a guide to the Nasdaq Nordic, with information on its affiliate stock exchanges, trading days and hours, and the largest listed companies.

Nasdaq Nordic Brokers UK

-

eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Choosing Nasdaq Nordic & Baltic Brokers

Nasdaq Nordic brokers provide the platform and tools to execute trades on associated stock exchanges. Access to market data, trading fees and products vary among brands, so it’s important to consider your strategy requirements. Key factors to consider include:

Instruments

Multiple financial products are available to Nasdaq Nordic retail investors. Top-ranking brokers may provide stocks, indices, bonds, futures, and ETFs. Popular instruments associated with the Nasdaq Nordic exchange include electricity or power futures contracts and sustainable or green bonds.

Index funds such as the Nasdaq OMX Nordic 40 or the Nasdaq OMX Nordic 120 are also popular for long-term investment strategies. Traders who wish to speculate on short-term price movements could look for Nasdaq Nordic brokers that offer contracts for difference (CFDs).

Fees

Nasdaq Nordic brokers usually levy fees through trading commissions and spreads. Additional costs can come in the form of inactivity fees, deposit and withdrawal fees, and charges for using specific tools or features.

Additionally, since the Nasdaq Nordic exchanges are denominated in their respective countries’ currencies, UK traders may need to pay currency conversion fees when they purchase stocks and when they divest.

Besides that, there may be specific charges for trading with a Nasdaq Nordic stock exchange such as clearing charges. Interactive Brokers clients will incur a 0.035% exchange fee and £7 clearing charge per trade when investing on the Riga Stock Exchange, for example.

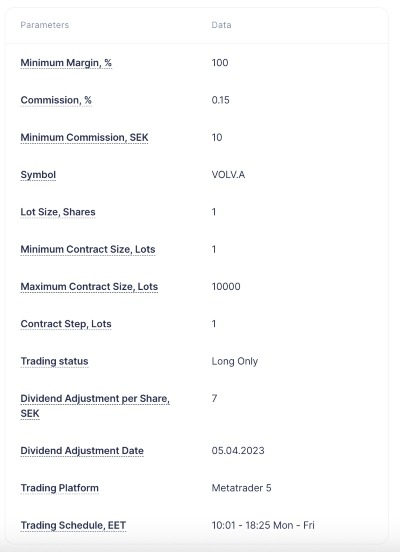

The best brands will have transparent pricing structures, making it easier to compare. Admiral Markets, for instance, offers one free trade per day to invest in European stocks from a GBP-denominated account. After this, a 0.15% commission fee applies per trade.

Minimum deposit requirements can also make a big difference, particularly for beginners. Skilling imposes a £100 initial deposit for all new customers, which is relatively competitive among Nasdaq Nordic brokers.

Trading Platform

Traders need a reliable and responsive platform. Some offer proprietary software – Interactive Brokers and its bespoke Trader Workstation is a good example. Many brokerages also offer third-party software such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), either as the main platform or as additional options.

There is no ‘best’ platform to use when trading the Nasdaq Nordic exchange – the choice often comes down to personal preference. Most traders look for platforms that offer flexible, real-time and historical data and charts, a customisable interface, mobile app compatibility and their preferred order routing style.

Tools & Additional Features

Look for Nasdaq Nordic brokers that offer useful additional tools such as demo accounts, copy trading and access to educational resources. For more experienced investors, you may want to consider access to algorithm-based investing.

Admiral Markets is a good option on this front with a wealth of learning materials alongside market analytics, a trading podcast, a sentiment heat map, live financial news, and an integrated economic calendar. Customers can also access Trading Central for market insights and technical analysis.

Regulatory Status

The best Nasdaq Nordic and Baltic brokers for UK investors will hold a license with the Financial Conduct Authority (FCA) or the Cyprus Securities & Exchange Commission (CySEC).

These regulatory bodies are in place to protect retail traders by imposing various safety measures, from segregated accounts and negative balance protection to compensation schemes in case of broker insolvency.

Customer Support

The best Nasdaq Nordic brokers offer quick and responsive customer service options if any issues arise. It is especially useful to have live chat and telephone contact with human representatives during trading hours, if not 24/7.

Top-ranking brokers also offer a wealth of automated support on their websites, including FAQ sections, step-by-step user guides and access to community forums.

What Is The Nasdaq Nordic?

The Nasdaq Nordic is the name of the organisation that operates stock exchanges across Scandinavia and the Baltic region. These exchanges have been operating under the Nasdaq Nordic Group name since 2008.

The Nasdaq Nordic exchanges are divided between the Nordic Market and the Baltic Market. The first includes the Stockholm, Helsinki, Copenhagen, and Iceland stock exchanges and the second constitutes the Vilnius, Tallinn, and Riga exchanges. Investors can trade various products on subsidiary exchanges including company stocks, ETFs, warrants, and bonds.

Founded as a futures exchange in the 1980s, the Nasdaq Nordic as we know it today was originally named OM AB and provided options contracts only. Further acquisitions saw several name changes and ownership before Nasdaq bid $3.7 billion for the purchase of the exchange, which it then renamed to the Nasdaq OMX Group.

The legal structure consists of a board of directors for each exchange, a trading surveillance function, and a clearing branch.

History

Key milestones in the history of the Nasdaq Nordic and its subsidiaries:

- 1808 – Copenhagen Securities Exchange begins trading

- 1863 – Stockholm Securities Exchange established

- 1912 – Helsinki Securities Exchange founded

- 1994 – Stockholm Stock Exchange becomes the first exchange to accept online members in Europe

- 1996 – Tallinn Stock Exchange begins trading

- 1998 – Stockholm and Copenhagen stock exchanges join forces in the NOREX Alliance partnership with a mirrored system for equity investments

- 2004 – Joint trading terminal implemented across all Nordic stock exchanges

- 2006 – Launch of the OMX Nordic Exchange, incorporating the Helsinki, Copenhagen, and Stockholm regions

- 2007 – Nasdaq acquires OMX, bringing together the Nasdaq OMX Group

- 2010 – Nasdaq OMX launches the Genium INET trading terminal across all markets

Markets

There are two markets on the Nasdaq Nordic; a main market for the largest companies, and a growth market that acts as a stepping stone for up-and-coming listings.

Main Market

Main market Nasdaq Nordic company listings are accepted from Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Stockholm, and Nasdaq Iceland.

Over 650 firms are currently traded on this market, including some of the largest and best-known brands such as H&M, AstraZeneca, Volvo, and Danske Bank.

Companies are categorised by market capitalisation; Large, Mid, and Small Cap. Trading members must comply with a stringent rulebook and high standards of data reporting, transparency, and accountability to be listed on the main market.

Growth Market

The Nasdaq First North Growth Market is home to approximately 200 listed firms. It runs alongside the main market, though offers more lenient listing requirements and rules for acceptance.

The growth market is designed for SMEs to improve their business development whilst raising capital, increasing visibility, and achieving the credibility of being a listed firm.

Some of the newest introductions to the member list include BrainCool, RanLOS, Ortoma, and Agtira.

Indices

Several indices track the performance of the Nordic and Baltic exchanges, and some Nasdaq Nordic brokers offer trading on these indices.

Nasdaq OMX Nordic 40

The OMX Nordic 40 index tracks the 40 largest and most actively traded company stocks on the Nasdaq Nordic.

Created in 2006, the market-cap-weighted index is reviewed bi-annually and re-weighted according to company size.

The company listings include Ericsson B, Telia Company, Nokia Oyj, and Volvo B.

Nasdaq OMX Nordic 120

The OMX Nordic 120 index is made up of 120 of the largest and most traded company stocks listed on the Nasdaq OMX Stockholm, Nasdaq OMX Helsinki and Nasdaq OMX Copenhagen exchanges. It is a free-floating market-cap-weighted index.

In 2023, the largest industry weighting was healthcare at 27%, followed by industrials at 24% and financial at 17% respectively.

Nasdaq OMX Baltic 10

The OMX Baltic 10 index is a regional stock market index comprising 10 high-liquidity organisations.

The companies on the index are fixed between annual revisions, with a maximum weight of 15% for any individual stock.

Listed firms can be from the Riga Stock Exchange, Vilnius Stock Exchange, and Tallinn Stock Exchange only.

Other Indices

Some Nasdaq Nordic brokers may also provide trading opportunities on:

- OMX Baltic Benchmark – Tracks the most traded and largest company stocks represented on the Nasdaq Baltic Market

- OMX Baltic All-Share – This index monitors all stocks listed on the Main and Secondary markets of the Baltic exchanges, except for firms with single shareholders with more than 90% of the stockholding

The individual stock exchanges within the Nasdaq Nordics Group also offer bespoke indices. These include Copenhagen 25, Stockholm 30, and Helsinki 25.

Admiral Markets – Volvo Conditions

Major Stocks

The biggest company stocks by turnover listed on the Nasdaq Nordic include:

- Novo Nordisk B (Nasdaq OMX Copenhagen)

- Volvo B (Nasdaq OMX Stockholm)

- A. P. Moller Maersk A/S (Nasdaq OMX Copenhagen)

- Arion banki hf (Nasdaq OMX Iceland)

- Evolution AB (Nasdaq OMX Stockholm)

- Assa Abloy AB (Nasdaq OMX Stockholm)

- DSV (Nasdaq OMX Copenhagen)

- Vestas Wind Systems (Nasdaq OMX Copenhagen)

- Marel (Nasdaq OMX Iceland)

- Trelleborg AB (Nasdaq OMX Stockholm)

The top Nasdaq OMX Nordic brokers will provide information on company listings including annual financial reports, statistics, dividends reference data, and press release news.

Listing Requirements

Applicants to list on the Nasdaq Nordic must undergo a rigorous application process and ongoing oversight.

Requirements for entry include publishing annual financial reports for at least three years before a listing request and a forecasted IPO market value of shares of at least €1 million.

The Nasdaq Nordic ‘Member Rule Book’ includes common trading rules for all exchanges and detailed specifications for individual exchanges such as the buy-in procedure and cancellation guidelines.

Trading Hours

The Nasdaq Nordic’s trading hours vary between exchanges and products; Helsinki equities trade from 10am to 6:30pm (GMT+3), for example, while Nasdaq OMX Nordic derivatives trading hours for the Copenhagen market are 9am to 4:55pm (GMT+2).

The Copenhagen, Iceland, and Stockholm stock exchanges also offer extended trading hours.

Trading hours for some of the major players:

Stockholm Stock Exchange (GMT+2)

- ETFs Trading – 9am to 5:25pm

- Equities Trading – 9am to 5:30pm

- Derivatives Trading – 9am to 5:25pm

Helsinki Stock Exchange (GMT+3)

- ETFs Trading – 10am to 6:25pm

- Equities Trading – 10am to 6:30pm

- Derivatives Trading – 10am to 6:25pm

Copenhagen Stock Exchange (GMT+2)

- ETFs Trading – 9am to 4:55pm

- Equities Trading – 9am to 5pm

- Derivatives Trading – 9am to 4:55pm

The best Nasdaq Nordic brokers publish full trading calendars, including opening times, public holidays, and any closure notices by market.

Member Initiatives

Nasdaq is committed to environmental, social and governance (ESG) standards, and through participation in ESG reporting by listed companies is voluntary, the organisation encourages listed firms to follow the reporting guide and upload relevant information to the data portal.

The Nasdaq Nordic Foundation was founded in 2005 to support the financial markets in Denmark, Finland, and Sweden with research and ESG initiatives.

Market Regulation

Nasdaq Nordic main market listings must comply with the rules and regulations of the EU’s Markets in Financial Instruments Directive (MiFID).

The objective of the regulatory framework is to promote transparency, improve investor protection and increase resilience across the EU’s financial markets.

Bottom Line On The Nasdaq Nordic

Nasdaq Nordic brokers provide a gateway for UK traders to access major European markets and some leading large-cap firms. The top brokers offer competitive fees as well as all the tools and other features needed to analyse Nordic and Baltic price movements.

FAQ

What Stock Exchanges Are Part Of The Nasdaq Nordic Group?

There are eight individual stock exchanges included in the Nasdaq Nordic exchange. Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Stockholm, and Nasdaq Iceland are categorised under the Main Market. Other exchanges include the Riga Stock Exchange, Tallinn Stock Exchange, and the Armenian Stock Exchange.

What Is The Difference Between The Nasdaq Nordic Main Market And Growth Market?

The Nasdaq Nordic Main Market is home to more than 650 large, mid, and small-cap companies that comply with rigorous rules. Firms must be listed on the Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Stockholm, or Nasdaq Iceland only.

The Growth Market is suitable for newer organisations looking to raise capital and achieve the recognition of being a listed company. Many firms progress from the Growth Market to the Main Market once the minimum requirements are met.

How Can I Trade On The Nasdaq Nordic Stock Exchange?

Nasdaq Nordic brokers may offer a range of investment opportunities including company stocks, ETFs, futures, bonds, and warrants. Retail trading platforms also typically provide leveraged contracts for difference (CFDs), to facilitate short-term trading strategies.

When Can I Trade On The Nasdaq Nordic?

Nasdaq Nordic trading times vary between the individual exchanges and instruments. Note that while Iceland and Finland, for example, have different trading hours, they are also in different time zones, as are many of the Nasdaq Nordic exchanges.

Nasdaq Nordic brokers typically publish a calendar of key dates and holiday closures by region to help traders get to grips with the various exchanges.

How Do I Compare Nasdaq Nordic Brokers?

The best Nasdaq Nordic brokers provide competitive trading fees, access to a responsive customer service team, and a choice of powerful and intuitive platforms and financial tools. Also look for reliable regulatory oversight from a body like the Financial Conduct Authority in the UK.