London Stock Exchange

The London Stock Exchange (LSE) is the primary stock exchange in the UK, with just under 2000 companies from over 100 countries listed. The best brokers with access to the London Stock Exchange offer trading on the share prices of listed stocks, plus associated indices like the FTSE 100 and FTSE 250. This review ranks the top London Stock Exchange brokers with expert ratings and comparisons.

Best London Stock Exchange Brokers in the UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Safety Comparison

Compare how safe the London Stock Exchange are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the London Stock Exchange support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the London Stock Exchange at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ |

Beginners Comparison

Are the London Stock Exchange good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots |

Advanced Trading Comparison

Do the London Stock Exchange offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the London Stock Exchange.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| IG | |||||||||

| eToro | |||||||||

| Vantage FX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- eToro secured second place in DayTrading.com's 'Best Crypto Broker' for 2025, offering a vast selection of tokens, dependable service, and competitive fees.

- In 2025, eToro enhanced its trading experience by incorporating insights from over 10 million Stocktwits users, enabling better assessment of market sentiment.

Cons

- The only significant contact option, besides the in-platform live chat, is limited.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Choosing London Stock Exchange Brokers

Online brokers are the intermediary through which you trade assets on the exchange. Fortunately, as one of the world’s oldest and leading exchanges, there is a long list of London Stock Exchange brokers to choose from. When comparing trading firms, consider:

Fees

Research both trading and non-trading fees when comparing London Stock Exchange brokers. These include commission charges and in-built spreads, which will negate a portion of your profit per trade. These can also include non-trading fees such as inactivity charges, overnight rollover fees, or charges for making deposits and withdrawals.

Importantly, look for London Stock Exchange brokers with a transparent fee structure and competitive costs. Pepperstone, for example, offers CFDs on UK shares with a 0.10% commission per side with a minimum of 10 GBP. Alternatively, spread betting on London Stock Exchange shares comes with a 0.10% spread markup.

Note, it is normally cheaper for British investors to trade through UK-based brokers that use GBP as a base currency, so no conversion fees are necessary.

Vehicles

A key question for investors comparing London Stock Exchange brokers is how they want to trade. Whether you are a buy-and-hold investor or a day trader, you will need a brokerage that provides the right trading vehicle. Popular options include:

- Stocks – The direct purchase and sale of stocks will typically suit longer-term investors. Traders will own a piece of the company and can receive dividend payments and voting rights.

- CFDs – Contracts for difference allow traders to speculate on stock price movements without actually buying or selling the underlying securities. Leverage also enables investors to take much larger positions than their current cash would allow.

- Spread Betting – A similar derivative to CFDs and also popular among retail traders, particularly in the UK where profits from this type of trade are tax-exempt.

- ETFs – Longer-term LSE investors may choose exchange-traded funds, which bundle together a range of securities listed on the London Stock Exchange. Popular examples include ETFs that track the FTSE 100, giving the trader exposure to the biggest companies on the exchange. However, traders can find ETFs with a diverse range of features, including sector-specific funds.

- Binary Options – Some retail traders opt for binary options to make a straightforward bet on a stock. The timeframe and potential profit/loss are determined before the contract begins, and all the trader needs to do is predict whether the asset’s price will rise or fall.

Platform

The platform is the terminal through which investors analyse chart data and execute trades. The best London Stock Exchange brokers will offer industry-recognised platforms such as MetaTrader 4 and MetaTrader 5 or provide proprietary technology.

Look out for a range of analysis features, customisable charts, and useful tools to create the best conditions for successful investing. You should also consider access to a mobile app if you want to keep up with investments on the go.

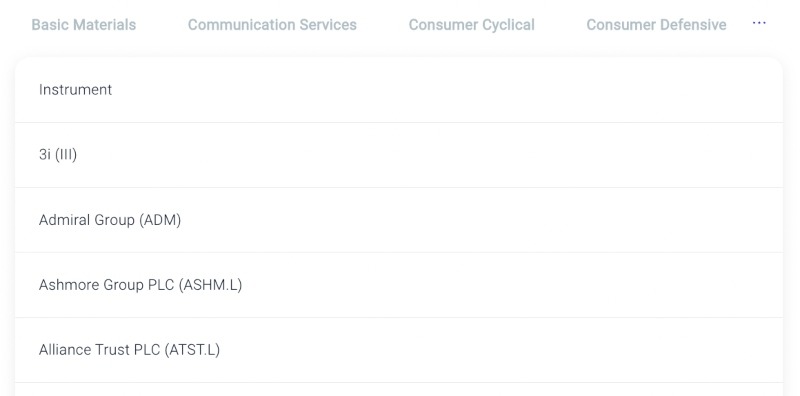

eToro, for example, provides an intuitive web-based, multi-asset platform alongside a sleek mobile app. Retail investors can create custom watchlists, access expert research analysis and view portfolio performance within one interface.

eToro UK Stock Trading Platform

Market Execution

Traditionally, London Stock Exchange brokers request individual security prices from market makers, known as Retail Service Providers (RSPs). However, this is changing and some of the best London Stock Exchange brokers now offer Direct Market Access (DMA). This permits retail investors to access the same pricing and order book execution model as provided to institutional investors.

IG Index, for example, provides its customers with access to free market depth data from the LSE and direct trading on the exchange’s order book. Note, a £3 fee applies for UK shares if three or more orders are executed per month.

Regulation

One of the most important factors to consider when comparing London Stock Exchange brokers is their regulatory status. Oversight from reputable financial regulators such as the UK’s Financial Conduct Authority (FCA) will ensure that your personal information and finances are better protected against fraud, scams, or misconduct.

You may not be covered by any compensation schemes, have access to negative balance protection or have your funds held segregated from a broker’s money if you choose an unregulated broker or one with more lenient supervision.

Customer Support

Customer service quality and access are important when choosing between London Stock Exchange brokers, especially for beginners. Access to a customer support team during trading hours will be helpful if you have any urgent platform queries or need withdrawal guidance.

Many of the top brokers with access to the London Stock Exchange provide 24/5 help, though Pepperstone ranks even higher with a 24/7 toll-free telephone contact number.

Live Chart

What Is The London Stock Exchange?

Established in 1698, the London Stock Exchange (LSE) was one of the first official stock exchanges in the world. In 2007, the LSE merged with the Milan Stock Exchange (the Borsa Italiana), creating the multinational stock exchange operator, the London Stock Exchange Group (LSEG). Today, LSEG is ranked the eighth-largest stock exchange globally, and the second-largest stock exchange in Europe. The stock exchange is physically located in the city of London, with headquarters in Paternoster Square.

London is Europe’s largest capital market, providing companies with access to some of the world’s deepest and most liquid capital pools. The LSE also offers a range of equity, fixed-income, and exchange-traded products available to retail investors via London Stock Exchange brokers.

Some of the largest companies listed on the LSE include Unilever, Shell, and HSBC. The company also owns several financial subsidiaries including Refinitiv, LSEG Technology, and FTSE Russell.

History

Below we outline the key dates in the formation of the London Stock Exchange:

- 1698 – John Castaing publishes a list of commodity, currency, and stock prices at Johnathon’s Coffee House

- 1773 – A more formal trading establishment is formed with a dealing room, known as ‘New Jonathan’s’

- 1840 – The telegraph machine is implemented by the exchange with NYSE prices available in London within 20 minutes

- 1872 – The ticker tape machine is introduced, followed by the telephone in 1880 for faster price information transmissions

- 1970 – The introduction of the Market Price Display System gives London Stock Exchange brokers access to real-time prices of securities

- 1984 – The Financial Times Stock Exchange 100 (FTSE 100) is launched, an index of the 100 biggest organisations by market cap

- 1986 – A computerised trading floor replaces the old physical processing technique, known as the ‘Big Bang’

- 1995 – The Alternative Investment Market (AIM) launches with 10 companies originally listed for access to investor capital

- 2007 – The London Stock Exchange merges with the Italian Stock Exchange Borsa Italiana, creating the London Stock Exchange Group (LSEG)

- 2019 – A relationship between the Shanghai Stock Exchange is established with London-listed firms able to issue CDRs in Shanghai and Shanghai companies approved to issue GDRs in London

Markets

The London Stock Exchange consists of four markets; the Main Market, AIM, High Growth Segment, and Premium Main Market. Each market has different capital-raising requirements and admission needs.

- Standard Main Market – The core European listing standards for international organisations. It is typically reserved for larger, more established companies as it has strict listing requirements for entry

- Premium Main Market – Companies need to pass even higher listing criteria to gain a place in the top-tier market

- High Growth Segment – A market designed for innovative and high-growth organisations looking to increase business visibility with potential customers and the investor community

- Alternative Investment Market (AIM) – The LSE market for small and medium-sized growth companies. Today, the number of AIM-traded stocks represents 3500+ global organisations taking advantage of the opportunity to raise equity capital

Indices

Several well-known indices are available at the best London Stock Exchange brokers and they can also form the basis of ETFs that track the price of multiple securities. The most popular and widely traded is the FTSE 100, though brokers with access to the London Stock Exchange may also offer some of the below.

- FTSE 100 – The Financial Times Stock Exchange (FTSE) 100 index is a market-capitalisation weighted index of UK blue chip companies, comprising the top 100 firms trading on the LSE.

- FTSE 250 – A market-capitalisation-weighted index consisting of the 101st to the 350th largest companies listed on the London Stock Exchange. Although not as well known, the index includes some major companies including Cineworld Group, Greggs, National Express, and Royal Mail.

- FTSE 350 – A market-capitalisation-weighted index combining FTSE 100 and FTSE 250 firms.

- FTSE SmallCap – An index made up of small market capitalisation organisations consisting of the 351st to the 619th largest-listed companies on the main market exchange.

- FTSE All-Share – A market-capitalisation weighted index comprising the FTSE 350 and the FTSE SmallCap index.

Largest Stocks

Below are the five largest companies listed on the London Stock Exchange with their ticker symbols and market cap as of 2023:

- AstraZeneca – Ticker symbol AZN, market cap of approx £175 million

- Shell – Ticker symbol SHEL, market cap of approx £165 million

- Unilever – Ticker symbol ULVR, market cap of approx £105 million

- HSBC – Ticker symbol HSBA, market cap of approx £100 million

- BP – Ticker symbol BP, market cap of approx £85 million

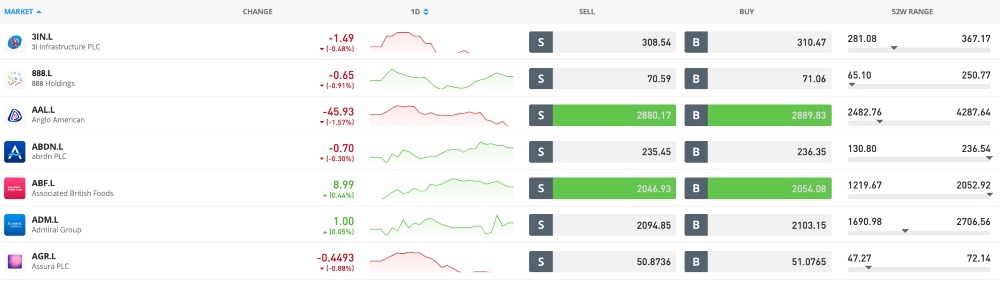

The top London Stock Exchange brokers, including Pepperstone, also split out UK shares by sector:

Pepperstone UK Shares

Trading Hours

The London Stock Exchange standard operating hours are from 8am to 4:30pm (GMT) Monday to Friday. Note, a daily market closure applies between 12pm and 12:02pm (GMT). Interestingly, the LSE has some of the longest opening hours in the world, with a standard 8 hours and 28 minutes of trading time per day.

Some London Stock Exchange brokers also support extended hours, with a pre-trading session from 5:05am to 7:50am (GMT) and a post-trading session from 4:40pm to 5:15pm (GMT). During these hours assets will typically see less liquidity but increased volatility. As a result, there are often wide price swings.

Should You Invest In The London Stock Exchange?

A London Stock Exchange listing maximises access to long-term capital and liquidity, helping companies attract a range of domestic and overseas investors. But should you trade assets listed on the London Stock Exchange?

Trading UK shares may offer retail investors a way to create returns faster than depositing money in a standard banking account with annual interest payments. The FTSE All-Share Index, for example, provided an average annual return of 6.4% for investors between 1993 and 2018.

Additionally, some LSE stocks provide dividend payouts on a quarterly or annual basis. You can withdraw these dividends to supplement your income or reinvest them. This compounds your gains, which may exceed those made from interest in a standard savings account.

Points To Consider

- Portfolio Management – In today’s world, individuals have many options regarding the management of their invested funds. London Stock Exchange brokers may offer a range of solutions, such as fully managed profiles, robo-advisors, and self-managed accounts.

- Investment Capital – How much you invest in London Stock Exchange products will depend on your personal circumstances. Your budget and expected returns timeframe will influence how much to put on the line. When making long-term investments, some suggest a minimum timeline of three years. Active traders usually open and close positions more quickly – in some cases within minutes. Whatever your approach, ensure that you don’t stake too much capital on a single trade, and keep some cash in reserve to help you claw back any losses.

- Research – The best London Stock Exchange brokers will provide live news streams with information relevant to listed companies. This, alongside educational content and expert analysis, can help you make forecasts on price movements and execute trades more accurately.

- Practise – If you are new to trading, or exploring a new platform, it is worth spending time in demo mode before putting your capital at risk in a live environment. Many London Stock Exchange brokers provide demo accounts free of charge, with profiles funded with virtual money.

Bottom Line On London Stock Exchange Brokers

London Stock Exchange brokers provide investment opportunities on some of the largest publicly-traded companies. When comparing firms look for low fees, stable platforms and apps, analyst insights, responsive customer support, and oversight from a trusted regulator like the FCA.

Alternatively, choose from our list of the best London Stock Exchange brokers.

FAQ

Can I Trade On The London Stock Exchange Through Online Brokers?

Yes, brokers with access to the London Stock Exchange provide a gateway to the UK financial market through an online terminal or investing app. Typically you can open an account free of charge, with just a few registration requirements. Look out for competitive fees, FCA oversight, and a reliable platform with suitable analysis tools.

Is There A London Stock Exchange Broker Directory?

There is a list of London Stock Exchange brokers on the official LSE website split into service levels; execution-only, advisory, and discretionary. Alternatively, choose from our rankings of the best brokers with access to the London Stock Exchange for UK retail traders.

Can I Trade Stocks From The London Stock Exchange?

Yes, you can invest in individually listed stocks or trade indices such as the FTSE 100. Stockbrokers including Pepperstone and Interactive Brokers offer opportunities on the London Stock Exchange with competitive derivatives and user-friendly tools.

Which Is The Best London Stock Exchange Broker?

There is no ‘best’ London Stock Exchange broker, often this comes down to personal preference and strategy needs. Our experts recommend you compare fees, mobile apps, payment methods, customer support, FCA regulation, platform functionality and execution model.

What Are The Trading Hours On The London Stock Exchange?

LSE trading hours are from 8am to 4:30pm (GMT) Monday to Friday. Some London Stock Exchange brokers may provide extended hours with a pre-trading session from 5:05am to 7:50am (GMT) and a post-trading session from 4:40pm to 5:15pm (GMT).